Professional Documents

Culture Documents

BCom Financial Accounting Study Material Notes Branch Accounts PDF

Uploaded by

simran32366Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BCom Financial Accounting Study Material Notes Branch Accounts PDF

Uploaded by

simran32366Copyright:

Available Formats

Royalty Accounts ll

l 5.1

L

E

S

S

O

N

6

Branch Accounts

Introduction

As a business grows, it may open branches in different towns and cities within country or

outside country in order to market its product over a large territory and, thus, increase its

profits. A branch may be defined as a section of an enterprise, geographically separated from

the rest of the business, controlled by a Head Office and generally carrying on the same

activities as of the enterprise. For example, Bata Shoe Co. has branches in various cities all

over the country. The same example holds good for a commercial bank also.

Meaning of Branch

The term ‘Branch Accounts’ refer to record of transaction of branches, whether relating

to deal with Head Office or with outsiders or deal between different branches in the books of

Head office. In order to exercise greater control over the branches, it is necessary to ascertain

profit or loss made by such branches separately. For this purpose, a proper accounting system

is to be adopted for recording business transactions between Head Office and Branches. The

accounting system to be adopted for the branch depends upon the size and nature of branch

and the degree of control required by the Head Office. Thus, branches can be broadly

classified into two categories for the purpose of recording transactions in the books of

accounts i.e.

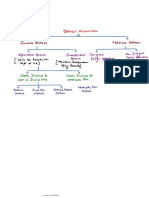

Branches

Home Branches Foreign Branches

Dependent Branches Independent Branches

Home Branches

A. Dependent Branches : Dependent branches are those branches which are bot

keeping their own separate set of books of accounts. The relation between head office and

branch is just like agency, therefore, these are also known as agency branches. The following

are the salient features of such a branch :

(i) These branches generally depend upon the head office for supply of goods. However,

the branch may be allowed to make purchases from the local parties.

(ii) All expenses of the branch are directly paid by the head office.

(iii) In order to meet the petty expenses of the branch, e.g., conveyance expenses,

entertainment expenses etc., may be provided with the petty cash from the head

office.

PDF Created with deskPDF PDF Writer - Trial :: http://www.docudesk.com

5.2 lll Financial Accounting

(iv) Normally branches receiving goods from head office selling for cash only but also

selling on credit if it is authorised by the head office.

(v) Cash received from branch from its debtors or on account of cash sales is daily

remitted to head office or deposited into a bank account opened in the name of the

head office.

(vi) Such branches maintain certain memorandum records only such as cash book,

debtors account and stock registers.

Accounting procedure : In case of a dependent branch, the head office may keep

accounts of the branch according to the following methods :

1. Debtors or Direct Method

2. Final Accounts Method

3. Stock and Debtors Method

Debtors or Direct Method

Under this method, head office opens one account for one branch. This account is called

Branch Account. The object of this account is to disclose branch profit or loss. This branch

account is a nominal account. The head office maintains this account in its books. Normally

this method is followed in case of branches of small size. On the basis of nature and size of

branch, the dependent branch can be divided into three parts for the purpose of recording

transactions in the books :

(a) Branch receiving goods from head office at cost price and making cash sales

only : These branches receive goods from head office at cost price, sell for cash only and remit

the cash collected to the head office. All expenses of the branch are directly paid by the head

office. These branches do bot make its own set of books. To find out the profit or loss of these

branches, the following accounting entries are passed in the books of the head office :

1. When the opening balances of assets at the branch :

Branch A/c Dr.

To Opening Stock A/c

To Opening Petty Cash A/c

To Opening Balance of Other Assets

(For opening balances at the branch)

2. For opening Creditors and outstanding

Opening Creditors A/c Dr.

Outstanding Liabilities A/c Dr.

To Branch A/c

(Being opening balance of liabilities at the Branch)

3. For goods supplied by the Head office to the branch:

Branch A/c Dr.

To Goods Supplied to Branch A/c

(For goods supplied to branch)

4. For expenses at the branch met by the head office :

Branch A/c Dr.

To Cash or Bank A/c

(For amount sent to branch for expenses)

5. For goods returned by the branch to the Head Office :

Goods Supplied to Branch A/c

To Branch A/c

(For goods returned by Branch)

PDF Created with deskPDF PDF Writer - Trial :: http://www.docudesk.com

Royalty Accounts ll

l 5.3

6. For amount sent to branch for petty expenses :

Branch A/c Dr.

To Cash A/c

(For amount sent to branch for petty expenses)

7. For remittances received from branch :

Cash A/c Dr.

To Branch A/c

(For cash received from branch)

8. When the closing balances of assets at the branch :

Closing Stock A/c Dr.

Closing Petty Cash A/c Dr.

Closing Balances of Other Assets Dr.

To Branch A/c

(For closing balances at the branch)

9. For loss at the branch (if debit side is bigger)

General Profit & Loss A/c Dr.

To Branch A/c

(For loss transferred to general profit and loss A/c)

10. For transfer of balance in goods to supplied to branch Account :

Goods Supplied to Branch A/c Dr.

To Trading A/c

(For balance in goods supplied to branch A/c transferred to trading A/c)

Branch Account in the books of Head Office

If branch account is to be prepared on the basis of above mentioned entries, it will appear

as follows :

In the books of Head Office

Branch Account

Particular Amount Particular Amount

Dr. Cr.

To Balance b/d ByBalance b/d—

Stock — Creditors —

Petty cash — Outstanding exp. — —

Furniture — ByCash—

Prepaid — Cash sales —

Debtors — — Cash from Debtor — —

To Goods sent to Bank A/c — By Goods Return to H.O. —

To Cash A/c— By Balance c/d

Rent — Stock —

Salaries — Petty Cash —

Other exp. — — Furniture —

To Balance c/d— Prepaid Exp. —

Creditors — Debtors — —

Outstanding exp. — —

To General P&L —

Total Total

PDF Created with deskPDF PDF Writer - Trial :: http://www.docudesk.com

5.4 lll Financial Accounting

Particular Illustration Questionry

1. Making cash sales only by Branch 1, 2 1, 2, 3

2. Making both cash and credit sales by Branch 3, 4 4, 5, 6

3. When goods are supplied to branch by H.O. at invoice price 5, 6, 7, 8, 9 7, 8, 9, 10, 11, 12, 13, 14,

15, 16

4. Memorandum stock account 10, 11 17, 18, 19, 20, 21

5. Final account method 12, 13 22, 23, 24, 25, 26

6. Stock and Debtors method 14, 15, 16, 17 27, 28, 29, 30, 31, 32, 33,

34

7. Wholesale branch system 18, 19 35, 36, 37

8. Independent Branch 20, 21, 22 38, 39, 40, 41

9. Special entries 23, 24, 25 42, 43, 44, 45

10. Foreign Branch 26, 27 46, 47, 48, 49

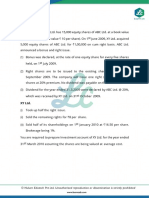

Illustration 1.

Hindustan Ltd. has a branch at Bhopal. Branch has to remit daily cash receipts to the

head office and all expenses of the branch are paid by the Head Office directly. Following are

the transactions between Head office and branch for the year ended 31st March, 2016 :

`

Stock at Branch on 1 Aril 2015 6,000

Goods supplied to Branch during the year 1,20,000

Cash sent to Branch for :

Rent 1,100

Salaries 9,000

Insurance 300

Goods returned by branch 3,000

Cash sent to Branch for Petty expenses 500

Cash received from the branch during the year 1,20,000

Cash sent by branch on 29 March 2016 5,000

Stock at Branch on 31st March 2016 10,000

Balance of Petty Cash on 31st March 2016 50

Outstanding Rent on 31st March 2016 100

Give Journal entries and show the Branch Account in the books of Head Office.

Solution. Books of Head Office

Journal

Date Particulars L.F. Amount Amount

Dr. Cr.

` `

Bohpal Branch A/c Dr. 6,000

To Opening Stock at Branch A/c 6,000

(For opening balance of branch stock)

Bhopal Branch A/c Dr. 1,20,000

To Goods Supplied to Branch A/c 1,20,000

(For goods supplied to branch)

Bhopal Branch A/c Dr. 10,400

10,400

To Cash A/c

(For goods purchased for cash)

PDF Created with deskPDF PDF Writer - Trial :: http://www.docudesk.com

Royalty Accounts ll l 5.5

Goods Supplied to Branch A/c Dr. 3,000

To Bhopal Branch A/c 3,000

(For goods returned by branch)

Bhopal Branch A/c Dr. 500

To Cash A/c 500

(For amount sent to branch for petty expenses)

Cash A/c Dr. 1,20,000

To Bhopal Branch A/c 1,20,000

(For cash received from Branch)

Cash in Transit A/cDr. 5,000

To Bhopal Branch A/c 5,000

(For cash sent by branch still in transit)

Closing Stock at Branch A/c Dr. 10,000

Closing Petty Cash at Branch A/c Dr. 50

To Bhopal Branch A/c 10,050

(For closing balance of branch)

Bhopal Branch A/c Dr. 100

To Outstanding Rent A/c 100

(For rent due to branch)

Bhopal Branch A/c Dr. 1,050

To General Profit & Loss A/c 1,050

(For profit transferred to general profit & loss account)

Goods Supplied to Branch A/c Dr. 1,17,000

To Trading A/c 1,17,000

(For balance of goods supplied to branch A/c transferred to trading A/c

i.e. ` 1,20,000 – ` 3,000)

Bhopal Branch Account

(`) (`)

To Balance b/d ByGoods Supplied to Branch A/c

Stock 6000 (Goods returned by branch) 3,000

To Goods Supplied to Branch A/c 1,20,000 ByCash A/c 1,20,000

To Cash A/c (expenses) 10,400 ByCash in transit A/c 5,000

To Cash A/c (petty expenses) 500 ByBalance c/d

To Outstanding Rent A/c 100 Stock 10,000

To General Profit & Loss A/c 1,050 Petty Cash 50 10,050

(Bal. fig.)

1,38,050 1,38,050

Illustration 2.

Sincere Brothers of Delhi opened a branch at Kanpur on 1 April 2014. From the following

figures, prepare Kanpur Branch Account in the books of Sincere Brothers of the year ending

March. 31, 2015 and 2016.

PDF Created with deskPDF PDF Writer - Trial :: http://www.docudesk.com

5.6 lll Financial Accounting

2015 2016

` `

Goods sent to Kanpur Branch 1,00,000 1,20,000

Expenses paid by the Head Office–

Rent 1,200 1,200

Salaries 6,000 6,000

Advertisement 600 800

Cash sales at Branch 1,20,000 1,65,000

Remittance received from the branch — 1,60,500

Remittance made on March 30, still in transit — 4,000

Expenses paid by the branch

Cartage 200 250

300 400

Petty Expenses

Stock on March 31 20,000 30,000

Petty cash in hand on March 31 200 —

Solution. Kanpur Branch Account

for the year 2014-15

` `

To Goods sent to Branch A/c 1,00,000 By Bank A/c (Remittances received) 1,19,3001

To Bank A/c : ` By Balance c/d (31-03-2015)

Rent 1,200 Stock 20,000 2

Salaries 6,000 Petty Cash 200 8

Advertisement 600 7,800

To General Profit & Loss A/c 31,700

1,39,500 1,39,500

Kanpur Branch Account

for the year 2015-16

` `

To Balance b/d : (1-4-2015) By Bank A/c (Remittances received) 1,60,500

Stock 20,000 2 By Balance c/d (31-03-2016)

Petty Cash 200 2 Cash in Transit 4,000

To Goods sent to branch A/c 1,20,000 Stock 30,000

To Bank A/c : ` Petty Cash in hand 50 3

Rent 1,200

Salaries 6,000

Advertisement 800 8,000

To General Profit & Loss A/c 46,350

1,94,550 1,94,550

Note : 1. Remittances received from the branch is calculated as follows :

`

Cash sales (2014-15) 1,20,000

Less : (i) Expenses paid by the branch `

(Cartage ` 200 + Petty expenses ` 300) 500

(ii) Petty Cash in hand 200 700

PDF Created with deskPDF PDF Writer - Trial :: http://www.docudesk.com

Royalty Accounts ll l 5.7

1,19,300

2. Since amounts are closing balances of 2014-15 hence these become the opening

balances of 2015-16.

3. Petty cash in hand is ascertained as follows`:

Cash sales for 2014-15 1,65,000

Less : (i) Cash received 1,60,500

(ii) Cash in Transit 4,000 1,64,500

Balance of Cash with Branch 500

Add : Opening Petty Cash in hand 200

700

Less : Expenses paid by the branch (cartage ` 250

+ Petty exp. ` 400) 650

Petty cash in hand on 31-03-2016 50

4. Petty expenses paid by branch will not be recorded in the debit of branch account.

(B) Branch receiving goods from head office at cost price and making both cash

and credits sales : If branch is authorised to sale goods cash as well as credit, the following

entries are also included in respect of credit sales in addition to the above entries discussed

earlier :

(i) Opening balance of debtors

(ii) Cash received from debtors

(iii) Closing balance of debtors

For the above items, the following journal entries are made by the H.O. :

(i) Branch A/c Dr.

To Branch Debtors A/c

(For opening balance of debtors)

(ii) Cash A/c Dr.

To Branch A/c

(For cash received from debtors)

(iii) Branch Debtors A/cDr.

To Branch A/c

(For closing balance of debtors)

Posting in Branch Account : The posting of above entries in branch account is as

following :

Branch Account

To opening Balance of Debtors .......... By Cash received from Debtors ...........

By Closing Balance of Debtors ...........

The effect of posting of three items in branch account is that net sale are automatically

credited. In other words, sales returns, discount and allowances allowed, bad debts have

already been deducted from sales. Hence no entry is required to be passed by the head office

in branch account in respect of the following :

(i) Goods sold on credit

(ii) Goods returned by debtors

(iii) Discount allowed to debtors

(iv) Bad debts written off

(v) Allowance allowed to debtors

PDF Created with deskPDF PDF Writer - Trial :: http://www.docudesk.com

5.8 lll Financial Accounting

It is to be remembered that above given five items must be shown in Branch Debtors A/c.

Missing Item

Under direct method, it is necessary to know three items for recording–opening balance

of debtors, cash received form the debtors and closing balance of debtors. If any item of these

is not given in the question, it is a missing figure. This can be calculated by preparing branch

debtors account. The format of branch debtors account is as follows :

Branch Debtors Account

(`) (`)

To Balance b/d (Opening balance of debtors ByCash received from Debtors

either given or balancing figure) … (either given or balancing figure) …

To Credit Sales … ByDiscount Allowed …

ByAllowance Allowed …

ByBad Debts A/c …

BySales Returns A/c …

ByB/R A/c …

ByBalance c/d (Closing balance of debtors,

either given or balancing figure) …

Goods in Transit

Sometimes goods sent by the head office to the branch, though entered in the books of the

head office but might not have reached the branch before the date of closing of the accounts.

It is known as ‘Goods-in-Transit’. The head office will have to make the following entry :

Goods in Transit A/c Dr.

To Branch A/c

(For goods in transit)

It should be remembered that if goods received from head office ` 15,000 is given instead

goods sent by head office and also given goods-in-transit ` 5,000 in the question, it will be

recorded in the branch account as follows :

Branch Account

` `

To Goods Supplied to Branch A/c By Goods in Transit 5,000

(` 15,000 − ` 5,000) 20,000

Illustration 3. (When closing debtors are missing) :

Modern Ltd. has a branch at Agra. All cash received by the branch is daily remitted to

the Head Office and all expenses are paid by the Head Office. Prepare Branch Account in the

books of Head Office from the following particulars as on 31st March 2016 :

`

Opening Stock 10,000

Opening Debtors 5,000

Goods received by Branch from Head Office 50,000

Cash Sales 42,500

Credit Sales 36,300

Cash received from Debtors 30,000

PDF Created with deskPDF PDF Writer - Trial :: http://www.docudesk.com

Royalty Accounts lll 5.9

Bad Debts 400

Discount Allowed 720

Goods returned by Customers 800

Cheques sent to Branch for :

Salaries 7,500

Other expenses 3,200

Closing Stock 15,000

Goods in Transit as on 31st March 2016 4,000

Agra Branch Account

` `

To Opening Balances : By Cash A/c (Cash received from

branch) :

Stock 10,000 Cash sales 42,500

Debtors 5,000 Amount received from debtors 30,000 72,500

To Goods Supplied to Branch A/c 54,000 By Closing Balances :

To Bank A/c (expenses) 10,700 Stock 15,000

To General Profit & Loss A/c (Bal. fig.) 21,180 By Goods in Transit 4,000

1,00,880 1,00,880

Note : 1. Goods supplied by head office to branch : `

Goods received by Branch 50,000

Add : Goods in Transit 4,000

54,000

Note : 2.

First of all before solving the question, the student should prepare Branch Debtors A/c, to

find out missing figure, (if any) viz :

(`) (`)

To Balance b/d (Opening Debtors) 5,000 ByCash received from Debtors 30,000

To Credit Sales 36,300 ByBad debts 400

By Discount allowed 720

BySales Return 800

By Balance c/d (closing debtors being the 9,380

balancing figure)

41,300 41,300

3. Only 3 items will be shown in Branch Account in repeat a debtors which are as

follows :

(a) Opening balance of debtors : It will be shown on the debit side of branch account.

(b) Cash received from debtors : It will be shown on the credit side of the branch

account.

(c) Closing balance of debtors : It will be shown on the credit side of the branch account

and remaining items i.e. credit sales, bad debts, discount, sales returns will not be

shown in branch account.

If branch is used Imprest System for Petty Expenses

Under this system, a fixed amount is advanced to the branch for petty expenses at the

beginning of the period. The branch submits its accounts at the end of the period and the head

office after auditing its accounts, gives a new advance equivalent to the amount spent by the

PDF Created with deskPDF PDF Writer - Trial :: http://www.docudesk.com

5.10 lll Financial Accounting

branch during the period. Thus in the beginning of each period, the branch has a same fixed

balance. suppose a branch gets ` 300 from the H.O. to be spent during the specified period. At

the end of the period, its total expenditure amounts to ` 240. According to the imprest system,

branch will be rembursed by ` 240. So his imprest money will again become ` 300. The

amount, so advanced to branch is termed as ‘imprest’ and therefore it is konwn as imprest

system of petty cash.

Illustration 4.

M/s Janta Prakashan invoice goods to their various branches at cost. All the expenses or

petty expenses are paid by the H.O. Petty expenses are paid by the branches, which are

allowed to maintain petty cash balance of ` 500. on imprest system. From the details

regarding Patna branch, prepare Branch Account to calculate profit :

`

Petty Cash on 1st April 2015 500

Debtors on 31st March 2016 4,000

Goods sent to branch during the year 14,000

Goods returned by branch 1,600

Goods returned by the customers 300

Cash sales 8,600

Credit Sales 12,000

Cash remitted to Head Office 22,600

Allowances to Customers 80

Stock on 1st April 2015 4,000

Bad Debts 3,200

Expenses paid by the H.O. 140

Rent from 1st April 2015 to 30th April 2016 2,600

Insurance to 30th June 2016 3,600

Salaries and Wages 5,600

Expenses paid by the Branch 400

Solution. Patna Branch Account

` ` ` `

To Balance b/d : By Bank A/c

Petty Cash 500 Cash Sales 8,600

Stock 4,000 Cash received from Debtors 14,000 22,600

Debtors1 6,520 By Balance c/d :

To Goods sent to Branch A/c 14,000 Petty Cash 500 3

Less : Goods returned by Stock 32,000

Branch 1,600 12,400 Debtors 4,000

To Bank A/c : Rent prepaid (2,600 × 1 / 13 ) 200

Rent 2,600 Insurance prepaid (3,600 × 3 / 12) 900

Insurance 3,600 By General Profit & Loss A/c (Loss) 4,220

Salaries & wages 5,600 11,800

To Bank A/c (petty expenses) 400 3

35,620 35,620

Note : 1. Calculation of opening debtors is as under :

PDF Created with deskPDF PDF Writer - Trial :: http://www.docudesk.com

Royalty Accounts ll

l 5.11

Branch Debtors Account

` `

To Balance b/d (1-4-2015) By Cash A/c 14,000 2

(Balancing figure) 6,520 By Bad Debts A/c 140

To Credit Sales 12,000 By Allowances A/c 80

By Sales Returns 300

By Balance c/d (31-3-2016) 4,000

18,520 18,520

2. Cash received from debtors is calculated as follows :

`

Total Cash remitted to H.O. 22,600

Less : Cash sales 8,600

balance of cash received from Debtors 14,000

3. Since imprest system is adopted for petty expenses by the branch, hence expenses

made by the Branch ` 400 will be sent by the head office.

4. Normally, insurance is paid for one year. Thus, it will be assumed that insurance

has been paid from 1st July 2015 to 30th June 2016. Therefore prepaid insurance

will be for three months from 1st April 2016 to 30th June 2016.

(C) When goods are supplied to branch by head office at invoice or selling price :

Sometimes goods are sent to branch by the head office at a price higher than cost price.

For example, if cost of goods is ` 8,000 and goods are invoiced at a profit of 20% on cost, the

perform invoice will show the value of goods at ` 9,600. The following are the advantages of

invoicing goods at invoice price :

(i) It is possible to maintain secrecy about the actual cost and profits, from branches

personnel.

(ii) The branch can be directed to sell the goods at the invoice price only or more.

(iii) control over stock with the branch becomes slightly easier.

When goods are invoiced at invoice price, question will be attempted in the same manner

as discussed under cost price method but opening stock, goods supplied to branch, goods

returned by branch and closing stock are to be shown at invoice price and not at cost price.

While calculating the branch profit or loss, adjustment entries are required to be made in

the branch Account for profit included in the above mentioned items so the branch account

shows true profit or loss. Hence, the following adjustment entries are to be passed for inflated

price, i.e., difference between invoice price and cost price :

1. For inflated price in the value of opening stock :

Stock suspense A/c Dr.

To Branch A/c

2. For inflated price in the value of goods sent to branch :

Goods Supplied to Branch A/c Dr.

To Branch A/c

3. Goods returned by branch is to be deducted from goods sent to branch.

Hence, it is not required any adjustment entry.

4. For inflated price in the value of closing stock :

Branch A/c Dr.

To stock Suspense A/c

PDF Created with deskPDF PDF Writer - Trial :: http://www.docudesk.com

5.12 lll Financial Accounting

The above entries are made in such condition, when head office keeps its account under

direct method. For calculation of inflated price, the following formula is used :

1. If head office includes profit at cost price,

Rate

Profit = Invoice price ×

100

For example if head office includes profit at 10% on cost, inflated price will be calculated

by applying : invoice price × 10/110.

2. If head office includes profit at invoice price,

Rate

Profit = Invoice Price ×

100

For example, if head office includes profit at 20% on invoice price or selling price, inflated

price will be calculated by applying : invoice price × 20/100.

Illustration 5.

National Advertising Co. has a branch at Jaipur. Goods are invoiced to the branch at cost

plus 25%. branch keeps its own sales Ledger and deposits all cash received daily to the Head

Office Account in a local bank. all branch expenses are to be paid by Head Office. Prepare

Branch Account as on 31st March 2015 from the following :

`

Stock on 1st April 2015 5,000

Stock on 31st March 2016 6,000

Goods Supplied to Branch during the year 66,600

Goods returned by Branch 2,600

Total Sales 95,000

Cash Sales 35,000

Debtors on 1st April 2015 7,000

Debtors 31st March 2016 10,000

Discount to Debtors 1,200

Rent & Taxes 5,500

Sundry Expenses 1,400

Goods in transit as on 31st March 2016 3,000

Furniture purchased by H.O. for the branch 10,000

Write off 10% Depreciation on the Furniture.

Solution. Branch Debtors Account

` `

To Balance b/d : By Cash A/c :

Opening Debtors (1-4-2015) 7,000 Received from Debtors (balancing figure) 55,800

To Credit Sales (` 95,000 − ` 35,000) 60,000 By Discount A/c 1,200

By Balance c/d :

Closing Debtors (31-3-16) 10,000

67,000 67,000

PDF Created with deskPDF PDF Writer - Trial :: http://www.docudesk.com

Royalty Accounts ll

l 5.1

L

E

S

S

O

N

6

Branch Accounts

Introduction

As a business grows, it may open branches in different towns and cities within country or

outside country in order to market its product over a large territory and, thus, increase its

profits. A branch may be defined as a section of an enterprise, geographically separated from

the rest of the business, controlled by a Head Office and generally carrying on the same

activities as of the enterprise. For example, Bata Shoe Co. has branches in various cities all

over the country. The same example holds good for a commercial bank also.

Meaning of Branch

The term ‘Branch Accounts’ refer to record of transaction of branches, whether relating

to deal with Head Office or with outsiders or deal between different branches in the books of

Head office. In order to exercise greater control over the branches, it is necessary to ascertain

profit or loss made by such branches separately. For this purpose, a proper accounting system

is to be adopted for recording business transactions between Head Office and Branches. The

accounting system to be adopted for the branch depends upon the size and nature of branch

and the degree of control required by the Head Office. Thus, branches can be broadly

classified into two categories for the purpose of recording transactions in the books of

accounts i.e.

Branches

Home Branches Foreign Branches

Dependent Branches Independent Branches

Home Branches

A. Dependent Branches : Dependent branches are those branches which are bot

keeping their own separate set of books of accounts. The relation between head office and

branch is just like agency, therefore, these are also known as agency branches. The following

are the salient features of such a branch :

(i) These branches generally depend upon the head office for supply of goods. However,

the branch may be allowed to make purchases from the local parties.

(ii) All expenses of the branch are directly paid by the head office.

(iii) In order to meet the petty expenses of the branch, e.g., conveyance expenses,

entertainment expenses etc., may be provided with the petty cash from the head

office.

PDF Created with deskPDF PDF Writer - Trial :: http://www.docudesk.com

5.14 lll Financial Accounting

Remittances made to Head Office :

Cash Sales 2,650

Cash collected from Debtors 21,000

Goods returned by branch at invoice price 400

Balances at the end :

Stock at invoice price 13,000

Debtors at the end 2,000

Petty Cash 25

Solution.

(a) When goods are shown at cost price :

Chennai Branch Account

` ` ` `

To Balance b/d : By Cash A/c :

Stock (` 11,000 − ` 1,833) 9,167 Sales 2,650

Debtors 1,700 Debtors 21,000 23,650

Petty Cash 100 By Balance c/d :

To Goods Supplied to Branch 20,000 Stock (` 13,000 − ` 2,167) 10,833

Less : Goods returned by Branch 400 Debtors 2,000

(` 19,600 − ` 3,267) 16,333 Petty Cash 25

To Bank A/c :

Rent 600

Wages 200

Salary, etc 900 1,700

To General Profit & Loss A/c 7,508

36,508 36,508

(b) When goods are shown at invoice price :

Chennai Branch Account

` ` ` `

To Balance b/d : By Cash A/c :

Stock 11,000 Cash Sales 2,650

Debtors 1,700 Collected from Debtors 21,000 23,650

Petty Cash 100 By Balance c/d :

To Goods Supplied to Branch A/c 20,000 Stock 13,000

Less : Returned by Branch 400 19,600 Debtors 2,000

To Bank A/c : Petty Cash 25

Rent 600 By Stock Suspense A/c

Wages 200 (20/120 of ` 11,000) 1,833

Salary, etc 900 By Goods supplied to Branch A/c

To Stock Suspense A/c (20/120 of ` 19,600) 3,267

(20/120 of ` 13,000) 2,167

To General Profit & Loss A/c 7,508

43,775 43,775

Note : Petty expenses made by branch is not shown in the debit side of branch account because

such expenses have already been deducted from the closing balance of petty cash. Thus

opening balance of petty cash ` 100 and closing balance of petty cash ` 25 will be shown

in the debit and credit side of branch account respectively.

PDF Created with deskPDF PDF Writer - Trial :: http://www.docudesk.com

Royalty Accounts ll

l 5.15

Illustration 7.

Akash Chapal Strores has an old established branch at Lucknow. Goods are invoiced to

the branch at 20% profit on invoice price, the branch having instructed to send all cash daily

to the head office. All expenses are paid by the head office except expenses which are met by

the branch manager. From the following particulars, you are required to draw up the Branch

Account as it would appear in the books of Akash Chappal Stores, Kanpur :

`

Stock on 1st April 2015 at invoice price 15,000

Sundry Debtors on 1st April 2015 9,000

Cash in hand on 1st April 2015 400

Office Furniture on 1st April 2015 1,200

Goods invoiced from the Head Office (Invoice Price) 80,000

Goods returned to Head Office 1,000

Goods returned by Debtors 480

Cash received from Debtors 30,000

Cash Sales 50,000

Credit Sales 30,000

Discount allowed to Debtors 300

Expenses paid by the Head Office :

`

Rent 1,200

Salary 2,400

Stationery & Printing 300

Petty Expenses paid by the Branch Manager 3,900

Stock on 31st March 2016 at invoice price 280

Depreciation to be provided on office furniture at 10% per annum 14,000

Solution.

While attempting a question, first of all debtors account should be prepared to find out

missing figure. i. e. closing debtors.

Branch Debtors Account

` `

To Balance b/d : Debtors (1-4-15) 9,000 By Cash A/c (received from debtors) 30,000

To Credit Sales 30,000 By Sales returns 480

By Discount A/c 300

By Balance c/d : Debtors (31-3-16)

(balancing figure) 8,220

39,000 39,000

Lucknow Branch Account

` ` ` `

To Balance b/d (1-4-15) By Cash A/c :

Stock 15,000 Sales 50,000

Debtors 9,000 Debtors 30,000 80,000

Petty Cash 400 By Goods Supplied to Branch A/c

Furniture 1,200 (20/100 of ` 79,000) 15,800

To Goods Supplied to Branch A/c 80,000 By Stock Suspense A/c

Less : Goods returned by Branch 1,000 79,000 (20/100 of ` 15,000) 3,000

PDF Created with deskPDF PDF Writer - Trial :: http://www.docudesk.com

5.16 lll Financial Accounting

To Bank A/c : By Balance c/d (31-3-16)

Rent 1,200 Stock 14,000

Salary 2,400 Debtors 8,220

Stationery & Printing 300 3,900 Petty Cash (` 400 − ` 280) 1201

To Stock Suspense A/c Furniture (` 1,200 − ` 120) 1,080

(20/100 of ` 14,000) 2,800

To General Profit & Loss A/c 10,920

1,22,220 1,22,220

Note :

1. If the payment of petty expenses are made by the branch itself, it is not shown on

the debit side of branch account but it should be deducted from petty cash.

2. If goods are invoiced to the branch at 20% profit on invoice price, inflated price will

be found out by applying 20/100.

Accounting Treatment of Liabilities

As opening balances of assets are shown on the debit side of branch account and closing

balances are shown on the credit side of branch account. On the contrary, opening balances of

liabilities are shown on the credit side of branch account and closing balances of liabilities are

shown on the debit side of branch account.

Illustration 8.

U.P. Industries Ltd. have a head office and many retail branches which are supplied

goods from the head office at 20% profit on sale price. Accounts are kept at head office from

which all expenses (except petty expenses) are paid. Such petty expenses are paid by

branches which are allowed to maintain petty cash balance of ` 1,500 on imprest system.

From the following balances, as shown by the books, prepare branch account :

Balances on 1 April, 2015

Petty cash in hand at branch 1,500 Bad-debts written off 200

Stock in hand at branch 30,000 Purchases by branch on permission of H.O. :

Debtors at branch 5,000 Cash purchase 10,800

Creditors at branch 1,000 Credit purchases 10,000

Furniture at branch 9,000 Cash paid to Creditors 8,500

Prepaid Rent (up June 30, 2015) 420 Payment made by H.O. :

Transaction for the year ended 31st March, 2016 Rent for year (paid on 1-7-2015) 1,800

Goods received by the branch from H.O. 1,24,000 Salaries 2,400

Loss in transit at invoice 1,000 Insurance paid for the year ending 30th

Cash sales at branch 1,00,600 June, 2015 440

Credit sale at branch 40,000 Payment of Petey expenses made by branch 200

Allowances to Debtors 400 Balances of Stock at cost on 31st March,

Cash received from Debtors 38,000 2016 35,000

Write off depreciation on furniture at the rate of 10%.

Solution. Branch Account

` ` ` `

To Balance b/d By Balance b/d :

Petty cash 1,500 Creditors 1,000

Stock 30,000 Stock Reserve (30,000 × 20 / 100 ) 6,000 7,000

Debtors 5,000 By Cash A/c :

PDF Created with deskPDF PDF Writer - Trial :: http://www.docudesk.com

Royalty Accounts ll l 5.17

Furniture 9,000 Cash sales 1,00,600

Prepaid Rent 420 Cash received for debtors 38,000

To Goods sent to Branch (1,24,000 + 1,000 ) 1,25,000 By Balance c/d

To Cash A/c : Petty Cash (1,500 − 200 + 200 ) 1,500 1,500

Rent 1,800 Stock at invoice price 43,750 43,750

(35,000 + 8, 750 )

Salary 2,400 Debtors1 6,400 6,400

Insurance 440 4,640 Furniture (9,000 − 900 ) 8,100 8,100

To Cash A/c (petty exp.) 200 Prepaid Rent 450 450

To Cash A/c : Prepaid Insurance 110 60,310

Cash purchases 10,800 By Goods sent to branch (1,25,000 × 20 / 100 ) 25,000

Payment to creditors 8,500 19,300

To Balance c/d

Creditors 2 2,500

Stock Reserve (43, 750 × 20 / 100 ) 8,750

To General Profit & Loss A/c 24,600

2,30,910 2,30,910

Notes :

1. Branch Debtors Account

` `

To Balance b/d 5,000 By Allowances 400

To Credit Sales 40,000 By Cash A/c 38,000

By Bad Debts 200

By Balance c/d (balancing figure) 6,400

45,000 45,000

2. Branch Creditors Account

` `

To Cash A/c 8,500 By Balance b/d 1,000

To Balance c/d (balancing figure) 2,500 By Purchases 10,000

11,000 11,000

3. As petty cash is maintained on imprest system, amount spent by branch must have

been re-imbursed by head office.

4. Loss of goods in transit will not be recorded in Branch Account under direct method

but goods sent by the Head Office ` 1,25,000 will be shown in branch account.

Purchase of asset by branch

If any asset is purchased by the branch with the permission of head office, it will be

shown on the credit side of branch account because amount paid for the purchase of asset will

be deducted from remittance to head office.

Purchase of asset by head office

If any asset is purchased by head office. Itself, it is debited to the debit side of branch

account and closing balance of asset is shown on the credit side of branch account.

PDF Created with deskPDF PDF Writer - Trial :: http://www.docudesk.com

5.18 lll Financial Accounting

Illustration 9.

Raghunath Co. had a branch at Lucknow. Goods are invoiced to the branch at cost plus

25%. Branch is instructed to deposit cash every day in the head office account in the bank. All

expenses are paid by cheque by the head office except petty cash expenses which are paid by

the branch manager. From the following particulars, prepare Branch Account in the books of

Head Office :

`

Stock on 1st April 2015 2,500

Stock on 31st March 2016 3,000

Sundry Debtors on 1st April 2015 1,400

Sundry Debtors on 31st March 2016 1,800

Cash Sales for the year 10,800

Credit Sales for the year 7,000

Cash remitted to the Head Office 15,000

Machinery purchased by the branch 1,200

Goods invoiced from the Head Office 18,200

Expenses paid by the branch 120

Expenses paid by the Head Office 1,640

Head Office sent cash to purchases safe for the branch 1,300

Solution. Lucknow Branch Account

` `

To Balance b/d (1-4-15) By Cash A/c (remitted) 15,000

Stock 2,500 By Balance c/d (31-3-16)

Sundry Debtors 1,400 Stock 3,000

To Goods Supplied to branch 18,200 Sundry Debtors 1,800

To Bank A/c (expenses) 1,640 Machinery* 1,200

To Bank A/c (safe) 1,300 Safe* 1,300

To Stock Suspense A/c (3,000 × 25 / 125) 600 Cash in hand 1,080 2

To General Profit & Loss A/c 1,880 By Stock Suspense A/c (2,500 × 25 / 125) 500

By Goods Supplied to Branch A/c 3,640

27,520 27,520

Note : (1) Cash received from debtors is found out as follows :

Branch Debtors Account

` `

To Balance b/d (1-4-2015) 1,400 By Cash received (balancing figure) 6,600

To Credit Sales 7,000 By Balance c/d (31-3-16) 1,800

8,400 8,400

(2) Cash in hand on 31-3-2016 will be calculated by preparing Cash Account :

Cash Account

` `

To Cash Sales 10,800 By Cash sent to H.O. 15,000

To H.O. A/c By Machinery purchased by branch 1,200

(Cash received to purchase safe) 1,300 By Petty Expenses 120

To Debtors A/c By Safe A/c 1,300

(Cash received from Debtors) 6,6001 By Balance c/d on 31-3-16 (Bal. fig.) 1,080

18,700 18,700

PDF Created with deskPDF PDF Writer - Trial :: http://www.docudesk.com

Royalty Accounts ll

l 5.19

Note : Machinery purchased by branch and petty expenses paid by branch will not appear in the

debit side of branch account, because cash has been reduced to this extent.

Memorandum Branch Stock Account

Memorandum branch stock Account is prepared to find out the missing figure in respect

of closing stock or spoiled goods lost, if any. The word memorandum is used before this

account because the principles of double entry system are not followed. This account is

debited with those items which increase the stock and credited with those items which

decrease the stock and all items are always shown at invoice price. Format of this account is

as follows :

Memorandum Stock Account

` `

To Balance b/d (opening stock) By Sales (cash & credit)

To Goods Supplied to Branch By Goods Returned by Branch

To Sales Returns By Wastage of goods

To Goods received from other Branch By Loss of goods–Pilferage

By Balance c/d (closing stock)

(balancing figure)

If both the sides of this account are equal, it means no missing figure but if debit side

exceeds credit side, difference will represent the figure of closing stock or spoiled goods. If

closing stock is given in the question, the difference will be treated as the value of spoiled

goods otherwise closing stock.

If branch account is prepared, only closing stock will be shown in branch account and not

spoiled goods because the closing stock itself reduces on account of it. In case insurance

company admits claim in respect of spoiled stock and the amount received by the branch, the

amount will be shown on the credit side of the branch account.

Accounting treatment of spoil goods under indirect method : On one hard, it will be shown

on the credit side of branch stock account or branch trading account and on other hand, it will

be shown on the debit side of profit and loss account.

Illustration 10.

Varanasi Traders has a branch at Lucknow. Goods are invoiced to the branch at Cost

1

+33 % . From the following particulars, prepare Lucknow Branch Account in the books of

3

Head Office.

Table

Furniture has to be depreciated 20%. No depreciation is to be charged for new furniture

bought during the period.

Table

Illustration 11.

Snow White Ltd. has one branch at Kanpur and other at Agra. Prepare Agra. Prepare

Agra Branch Account from the following particulars related to Agra Branch :

Table

Goods are supplied to branch at cost plus 20%. All expenses of the branch are met by

Head Office and branch sends all cash received to Head Office. Also prepare a Branch Trading

and Profit and Loss Account.

PDF Created with deskPDF PDF Writer - Trial :: http://www.docudesk.com

5.20 lll Financial Accounting

Solution :

Before preparing branch account first of all branch debtors account and memorandum

branch stock account are to be prepared to find out closing debtors and closing stock.

Table

Final Accounts Method

Under this method (i) Branch Trading and Profit and Loss Account, and (ii) Branch

Account are prepared. Branch Trading and Profit and Loss Account is prepared as but more

items will be shown which are clear from the following performa :

Table

• If these items are given at invoice price, they are to be shown at cost price. In

other words, inflated price will be deducted from invoice price and

remaining amount is to be shown in Trading Account.

Illustration 12.

Mr. ‘A’ of Mumbai has a branch at Delhi. Goods are invoiced to the Branch at cost plus

20%. The expenses of the Branch are paid from Mumbai and the branch keeps a Sales Journal

and the debtors ledger only. From the information supplied by the Branch, prepare Trading

and Profit & Loss Account of the Branch for the year ending 31st March, 2016 and show the

account of the Branch as it would appear in the books of the Head Office :

Table

Note : (1) Calculation of Opening Debtors

Table

(2) Net profit shown by profit and loss account and by branch account will always be

same.

Illustration 13.

Amar Nath Bros., Chennai has a branch at Kolkata. All goods required for sale at

Kolkata are supplied from Chennai at cost plus 25% and all cash received at branch is banked

daily in head office account opened in a Bank at Kolkata. From the following particulars, give

the Branch Account, Branch Debtor’s Account, Branch Trading & Profit and Loss Account :

Note :

1. Cash received from debtors is ascertained by preparing Debtors Account.

2. Only good debtors are recorded in Branch Account.

3. Reserve for Doubtful Debts has no relation with the Debtors Account. Hence not

taken in Branch Debtors Account.

Table

Stock and Debtors system

When the head office is interested in maintaining a better stock control at the branch,

stock and debtors method is used. Under this method, the head office maintains a number of

accounts for keeping a record of branch transactions in place of one Branch Account. A brief

description of each of these accounts is given below :

1. Branch stock account : This account is maintained at the invoice price. Therefore all

figures relating to opening stock, goods sent to branch, goods returned by customers to branch

are shown on its debit side and all figures relating to cash sales, credit sales, value of spoiled

goods, goods returned to head office and closing stock are shown on its credit side.

Both the sides of the branch account should be equal but, if unequal, it tells about

shortage or surplus of stock or closing stock at the branch. If the debit side is bigger, there is a

PDF Created with deskPDF PDF Writer - Trial :: http://www.docudesk.com

Royalty Accounts ll

l 5.21

shortage and if the credit side is bigger, there is surplus. The amount of surplus or shortage is

transferred to branch profit and loss account.

It is to be remembered that branch stock account is prepared at invoice price.

2. Branch adjustment account : This account is prepared with a view to ascertain the

gross profit of the branch. all loadings (or inflated price) in the goods are recorded in this

account. Therefore it is credited with the stock reserve on opening stock, loading on goods sent

to branch and it is debited with the loading on shortage in stock, spoilage, pilferage, theft, loss

by fire, loss-in-transit and stock reserve on closing stock. At the end, balance of this account is

transferred to branch profit and loss account. The following adjustment entries is made by the

difference between invoice price and cost price :

Table

The balance of this account will show profit or loss.

3. Branch Expenses Account : Branch expenses account records all branch expenses

in cash. In addition, this account is also debited with the items like bad debts. Discount

allowed, depreciation. Finally, the balance in this account is transferred to branch adjustment

account and, thereby closed :

table

4. Preparation of Branch Account : On the basis of above mentioned accounts, if

branch account has to be prepared, profit or loss shown by this account will be same as shown

by branch profit and loss account.

Illustration 14.

Unity Ltd. Mumbai invoice goods to their Branch at Lucknow at 50% above cost and pays

all branch expenses except petty expenses which are met by the Branch. From the following

particulars prepare all the Branch Accounts on Stock and Debtors system in the Head Office

books :

Table

Illustration 15.

A Company has its branch at Lucknow. All expenses are paid by Head Office and Goods

1

are invoiced to the branch at cost plus 33 %. From the following particulars for the year

3

ended 31st March 2016 ascertain the profit by stock and debtors system :

Table

Credit Side of Branch Stock Account exceeds Debit side

It branch sells goods more than invoice price, in such case credit side of branch stock

account (which is mentioned at invoice price) will be bigger. The difference being gross profit

will be transferred to profit & loss account.

Illustration 16.

Delhi Traders Ltd. sends goods to its Fazabad branch at cost plus 25%. From the

following particulars, you are required to show the Branch Stock Account, Branch

Adjustment Account and Branch Expenses Account in the Head Office books :

Table

Illustration 17.

Kumar Textiles Ltd. with its Head Office at Delhi, invoice goods to its branch at

Amritsar, at 20% less than the list price which is cost plus 100% with instructions that cash

sales were to be made at invoice price and credit sales as catalogue price (i.e. list price).

table

PDF Created with deskPDF PDF Writer - Trial :: http://www.docudesk.com

5.22 lll Financial Accounting

From the above particulars available from the branch prepare Branch Stock Account,

Branch Adjustment Account, Branch Expenses Account and Branch Debtors Account for the

year ending 31st March 2016.

Table

Note : Excess of list price over invoice price has been shown. This is done to prepare Stock

Account at invoice price so that shortage or surplus may be correctly calculated.

Wholesale Branch system

Meaning

sometimes, head office opens its own retail branches and sells goods through them in

addition to selling goods through wholesalers. The head office invoices the goods to the

wholesalers at wholesale price while branches sell goods to the consumer at retail price. Since

retail price is more than the whole sale price, hence more profit is earned on sales through its

own branch but the entire profit can not be treated as branch’s profit. However, the branch’s

profit will be equal to the difference between wholesale price and retail price and remaining

profit, i. e., wholesale price-cost price will be treated as earned by head office. For example, if

the cost price of an article is ` 100, its wholesale price is ` 120 and consumer price ` 125. In

such case, the branch profit is ` 25 (` 125 – ` 100). However the head office earns only ` 5 (`

125 – ` 120) by opening the branch because the profit of ` 20 can be earned by it directly

selling to the wholesalers.

Accounting treatment

The head office invoices the goods to the branch at wholesale price and not at cost price.

In other words, the wholesale price is the cost price to the branch. A problem arises in such

case, if a portion of the goods supplied to the branch, remains unsold at the end of accounting

year while the profit on these goods is included in the gross profit shown by head office

trading account. This profit is known as unrealized profit and this profit is transferred to

stock reserve account for calculating correct profit. The following entry is made in the books of

H.O.

Tabel

Above entry is reversed in next year because these goods will be sold out in the next year

and profit will be realized.

Illustration 18.

Sulabh Ltd. has a retail branch at Kanpur. Goods are sold to customers at cost plus

100%. The wholesale price is cost plus 80%. Goods are invoiced to Kanpur Branch at

wholesale price. From the following particulars, find out the profit made at Head Office and

Branch for the year 2015-16.

Table

Sales at Head Office are made only on wholesale basis and that at Branch only to

consumers. Stock at Branch is valued at wholesale price.

Solution.

Cost price, say = ` 100; Consumer price = ` 200; Wholesale price = ` 180.

Table

Note : 1. Calculation of unrealised profit :

If wholesale price is ` 180 then actual profit = 80

80

If wholesale price is ` 1 then actual profit =

180

PDF Created with deskPDF PDF Writer - Trial :: http://www.docudesk.com

Royalty Accounts ll

l 5.23

80

If wholesale price of branch stock is ` 9,000 then actual profit = × 9, 000

180

= ` 4,000

2. It is to be remembered that the wholesale price is the cost price to the branch while

branch sells goods at retail price i.e. more than wholesale price.

Illustration 19.

A head office fixes selling price for its goods at 200% of the cost. Goods are sent to the

branch at 25% less than the selling price and to other dealers at 20% less than the selling

price. Calculate the profit at the head office and at the branch separately from the following

information :

Table

Solution.

Cost price, Say = 100

Selling price = 200

Branch price = 150

Dealer’s price = 160

Table

Note : 1. Calculation of Gross Profit :

Branch :

(i) Gross Profit on goods sold by branch : 92,000 × 50 / 200 = ` 23,000.

(ii) Unrealised profit against opening branch stock = 7,200 × 50 / 150 = ` 2,400.

(iii) Unrealised profit against closing branch stock = 5,700 × 50 / 150 = ` 1,900.

Independent Branches Or Branches Keeping complete Books

Meaning

A branch is said to be independent when it maintains a separate set of books of accounts

and keeps a full system of accounting. In other words, the branch carries on business as an

independent unit, records all the transactions in its own books, extracts its own Trial Balance

and prepares its own Trading and Profit and Loss Account. A copy of the Trial Balance so

prepared will be forwarded to the head office and the head office will incorporate the same in

its books of accounts so that a consolidated Profit and Loss Account and a Balance Sheet can

be prepared for the business as a whole. Independent branches generally do not depend upon

the head office for supplies of goods and for meeting the expenses and they are not required to

remit their collections to the head office daily as in the case of dependent branches. However,

periodical transfer of goods and remittance of money may take place between the head office

and the branch.

Incorporation Entries in the Books of Head Office

The head office maintains a Branch Account in its books to which the goods sent to

branch is debited and cash received from branch is credited. It is like any other personal

account and the balance will show the amount due from/due to branch. At the end of

accounting year, the branch prepares its own Trial Balance and sends a copy of its Trial

Balance to the head office for its incorporation in the head office books. The head office will

incorporate the same in its books of accounts so that a consolidated Trial balance can be

prepared from which the final accounts of whole the business can be prepared easily. Entries

make in the books of head office with the help of Branch Trial Balance is known as

incorporation of branch trial balance and these entries are called ‘Incorporation Entries’. The

PDF Created with deskPDF PDF Writer - Trial :: http://www.docudesk.com

5.24 lll Financial Accounting

following are the three methods for incorporation of branch trial balance either of which may

be adopted :

(i) First method : Under this method, all items relating to Trading and Profit and loss

Account are incorporated in the head office books besides incorporation of branch assets and

liabilities. for this purpose, the final accounts are prepared in the usual way n the books of the

head office and then the following incorporation entries are passed in the books of head Office.

(a) Incorporation Entries from Branch Trading Account

1. For incorporation items debitable to Branch Trading Account

(except gross profit) :

table

2. For incorporating items creditable to Branch Trading Account

(except gross loss) :

Table

3. For Branch’s Gross Profit :

Table

4. For Branch’s Gross Loss :

Table

(b) Incorporation Entries from Branch Profit & Loss A/c

5. For incorporating items debitable to Branch Profit and Loss Account

(except net profit) :

Table

6. For incorporating items creditable to Branch Profit and Loss Account

(except net loss) :

Table

7. For branch’s net profit :

Table

8. For branch’s net loss :

Table

(c) Incorporation entries from Balance Sheet

9. For incorporation of branch assets :

Table

10. For incorporation of branch liabilities :

table

Note : Before making incorporation entries, branchs trading and profit & loss account and

balance sheet should be prepared from which incorporation entries can be passed easily.

(ii) Second method : Under this method, only one item i.e. net profit or net loss is

incorporated in place of all items of branch trading and profit and loss account in the books of

H.O. whereas incorporation of balance sheet is done in same manner as done in first method.

However, this method is suitable when final accounts are prepared by the branch itself and a

copy of final accounts instead of trial balance is sent to head office. The following

incorporation entries are passed in the books of H.O. :

1. For incorporating branch net profit :

Table

2. For incorporating branch’s net loss :

Table

3. For incorporating branch’s assets :

PDF Created with deskPDF PDF Writer - Trial :: http://www.docudesk.com

Royalty Accounts ll

l 5.25

Table

4. For incorporating branch’s liabilities :

Table

(iii) Third method : Under this method, on one hand, all debit balances of branch trial

balance and on other hand, all credit balances of trial balance are incorporated and for this

the incorporation entries are passed in the books of H.O. :

Table

Note : Balance of head office account is also mentioned in branch trial balance under above

mentioned three methods but incorporation entries will not be made of this balance

because this balance has already been shown as balance of branch account by H.O.

After posting of the above incorporation entries in branch account, shown in the books of

H.O., branch account will be automatically closed. In other words, both sides of branch

account must be equal.

Table

Stock on 31st March 2016 was ` 2,300. Find out the Surat Branch Profit and draft

journal entries necessary to incorporate the Surat Branch assets and liabilities in the

Mumbai Head Office books. Prepare also the Surat Branch Account in the Mumbai office

ledger. (Agra, Rohilkhand)

Solution.

Table

In Transit Items

When both branch and head office trial balance are given in the question, the balance

shown by the head office account in the branch trial balance and the balance as shown by the

branch account in the head office trial balance normally tally. However, it may not be so, then

the following accounts of branch trial balance must be reconciled with the accounts of head

office trial balance :

Table

1. Goods-in-transit : When the head office may have sent goods to the branches, these

goods may have not been received by the end of the accounting year by the branch. It is called

as goods-in-transit. Thus, goods-in-transit is an asset to the head office.

2. Cash-in-Transit : When the branch may have sent cash to the head office, the

amount may have not been received by the head office by the end of te accounting period. If is

called as cash-in-transit. Thus, cash-in-transit is an asset to the branch.

Adjustment entries are required for reconciliation of the difference on account of above

facts. These entries may either be passed by the head office or the branch but not in both of

them, as follows :

Table

At the end Stock in hand was valued at ` 2,700. The Branch Account in the Head Office

books on 31st March, 1999 stood at `460 (Debit balance). On 28th March, 2016 the Head

Office forwarded goods to the value of ` 2,500 to the Branch where they were received on 3rd

April 2016. similarly a cash remittance of ` 1,200 by Branch on 20th march, 2016 was

received by the Head Office on 1st April 2016.

You are required to submit the Journal entries necessary to incorporate the above figures

and also showing the result of trading at Branch separately in the Head Office Books and to

give the Kolkata Branch Account appearing finally in the Mumbai Head Office Books.

Table

PDF Created with deskPDF PDF Writer - Trial :: http://www.docudesk.com

5.26 lll Financial Accounting

Illustration 22.

The following are the trial balances of New Delhi Head Office and its Bareilly Branch for

the year ending 31st March 2016.

Table

Fixed assets are to be depreciated at 10%. Stock on 31st March 2016 ` 7,500 and H.O. `

1,500. The difference in Current Accounts is due to goods in transit and cash in transit.

Prepare Branch Final Accounts and incorporate them in the books of Head Office. Also

prepare other accounts and show the consolidated Balance Sheet.

Table

Note : Goods-in-Transit and Cash-in-Transit are calculated as follows :

Table

Special Transactions and Their Entries

As transactions took place between H.O. and Branch during the whole year. Entries of

some important transactions in the books of both are given below :

Table

Inter-Branch Transactions

In case of inter-branch transactions, H.O. is debited or credited in place of each other

branch assuming all the pertainting entries are to be made through H.O. account. If

transactions are took place between branches themselves which are controled by the same

H.O., these transactions are called as inter-branch transactions. These transactions are

recorded as follows :

Table

Special Entries

Illustration 23.

Show what entries would be passed by Head Office and Rangoon Branch to record the

following transactions in their books on 31st March 2016.

(a) Goods amounting to ` 500 transferred from Calcutta branch to Rangoon Branch

under instructions from H.O.

(b) Depreciation of Rangoon Branch Fixed Assets ` 1,000, when such accounts are

opened in the Head Office books.

(c) A remittance of ` 3,000 made by the Rangoon branch to head Office on 26th March

2016 and received by the Head Office on 4th April 2016.

(d) Goods amounting to ` 5,000 sent by Head Office to Rangoon Branch on 20th march

2016 and received by the latter on 15th April 2016.

table

Illustration 24.

Soni Traders Ltd. have their head office at Calcutta and Branches ‘A’ and ‘B’ each

branches keeping a complete set of books for recording daily transactions. All fixed assets

accounts are, however, maintained only in the Head Office books. The branches do not keep

Current Accounts with each other, the entries for any direct transactions between them being

recorded as if affecting the Current Accounts between Head Office and each Branch

concerned. Journalise the following transactions in the books of Head Office as well as in the

books of Branch ‘A’ :

(i) The purchase of a writing desk for ` 500 by Branch ‘A’ paid for by cheque by the

Branch.

PDF Created with deskPDF PDF Writer - Trial :: http://www.docudesk.com

Royalty Accounts ll

l 5.27

(ii) The transfer at cost of stocks from Head Office to Branch ‘A’; the cost of the goods

being ` 25,000

(iii) The transfer from Branch ‘A’ to Branch ‘B’ of the account of a customer Mr. X

amounting to ` 1,400 on Mr. X shifting his business from ‘A’ to ‘B’.

(iv) ` 10,000 remitted by branch ‘A’ to the Head Office by bank transfer as instructed by

the Head Office.

(v) Branch ‘A’ is charged with ` 2,000 for administrative expenses rendered by H.O.

during the year, as per agreement.

Table

Note : 1. The account relating to the fixed asset is generally maintained by head office. If an asset

is purchased by the branch, an asset account is transferred to the head office books.

Illustration 25. (Special Entries)

A kolkata firm whose accounting year ends on 31st March 2016 has two branches, one at

Agra and other at Varanasi. The branches kept a complete set of books. On 31st march 2016

the Agra and varanasi Branch Accounts in the Kolkata books showed debit balance of `

30,450 and ` 45,000 respectively before taking the following information into account :

1. Goods valued ` 2,000 were transferred from Agra branch to Varanasi branch under

instruction from Head Office.

2. The Agra branch collected ` 2,500 from an Agra customer of the Head Office.

3. The Varanasi Branch paid ` 5,000 for certain goods purchased by the Head Office in

Varanasi.

4. ` 5,000 remitted by the Agra Branch to Calcutta on 29th March 2016 were received

on 3rd April 2016. But the advice of remittance is received on 31st March 2016.

5. The Varanasi Branch received on behalf of the head Office ` 1,500 dividend from

Varanasi Company.

6. For the year 1998, the Agra Branch showed a net loss of ` 1,250 and the Varanasi

Branch a net profit of ` 5,400.

Pass journal entries to record above matters in the Head Office books and then write up

the two Branch Accounts therein.

Table

Note : Entry no. 4 should not be recorded in the books but the advice of remittance received on

March 31, 2016, due that reasen his entry has been recorded.

Table

Foreign Branch

a foreign branch is nothing but an independent branch and located outside country. It

maintains its accounts in a foreign currency because all transactions are made in the currency

of that country. Trial balance is prepared form the foreign branch books and send to the head

office for incorporating in its books. The head office has to convert the trial balance received

into currency of its own currency before incorporating the trial balance in its books of

accounts, because of the facts that the foreign branch trail balance will be in the currencies of

the country in which the branch is operating. After that branch trial balance is incorporated

as usual in the books of the head office to prepare the final accounts.

Conversion of Foreign Branch Trail Balance

The method of conversion depends on whether the exchange rate involved is fixed or

fluctuating, which are discussed as follows :

PDF Created with deskPDF PDF Writer - Trial :: http://www.docudesk.com

5.28 lll Financial Accounting

1. Fixed rate of exchange : Where the rate of exchange the countries of the head office

and that the branch is fairly constant, a fixed rate may be adopted for conversion of branch

balances. In such a case, all the balances in the branch books are converted at the fixed rate

with the exception of :

(a) Remittance by branch which are converted at the actual rates at which they are

affected; and

(b) The Head Office Account, which is converted at the rupee (or head office currency)

equivalent appearing in the Branch Account in the head office books.

2. Fluctuating rate of exchange : When there is a violent fluctuation in the rate of

exchange, the head office and branch will adopt a standard rate for conversion and all items

in the Trial Balance will be converted at the standard rate which can be one of following three

types :

(a) Opening Rate

(b) Closing Rate

(c) Average Rate

The above rules for conversion in the circumstances may be laid down as follows :

1. Fixed assets : At the rate prevailing when purchased, or at the actual cost of

remittance sent and used for the acquisition. It is known as opening rate. When, however,

capital expenditure is spread over a period, the average rate for that period may be adopted.

These assets are : building, land, machinery, furniture etc.

2. Fixed liabilities : At the rate when incurred, but if there has been a permanent fall

in exchange which will necessitate a large amount of rupee being required when the liabilities

come to be redeemed a reserve should be built up gradually in the head office books to meet

such increased liabilities. These are converted at rate applicable when incurred. Normally

these liabilities are created in the beginning. Thus, it should be converted into opening rate.

For examples, debentures or long term liabilities etc.

3. Current (floating) assets and current liabilities : These are converted at the rete

prevailing on the date of balance sheet. Since balance sheet is prepared at the end of

accounting year, hence these assets and liabilities should be converted at the closing rate.

Current assets includes cash, debtors, B/R investment, closing stock etc. and current

liabilities includes creditors, bills payable, bank overdraft, etc.

4. Opening and closing stock : Which should be converted at the opening and closing

rates respectively.

5. Depreciation : Which should be converted at the rate of conversion of the relevant

assets.

6. Provision for bad and doubtful debts : Which should be converted at the same rate

as that applicable to debtors, i.e., closing rate.

7. revenue items : At the average rate for the period over which they have accrued

except int eh case of opening and closing stocks, depreciation and reserve for bad debts.

Examples of revenue items are : salary, rent, interest, purchases, sales, etc.

8. Remittances by branch : Remittances to and from head office should be converted at

actual proceeds. Therefor no calculation is required for conversion.

9. Head office account : The Head Office account should be converted at the figure

standing in the branch account in the head office books. therefore, no calculation is required

for conversion.

Table

PDF Created with deskPDF PDF Writer - Trial :: http://www.docudesk.com

Royalty Accounts ll

l 5.29

Difference in Exchange Account : After conversion of foreign branch trial balance,

both sides of converted trail balance may not tally, hence the difference will arise solely by

reason of variation in exchange rates adopted for converting various balances. The difference

is called as difference in exchange or exchange suspense. For recalculation of converted trial

balance, the difference is transferred to difference in exchange account or exchange suspense

account, Normally, this account is shown in balance sheet. On the assets side, if it shows debit

balance or on the liabilities side if it shows a credit balance.

Note : Thus, first of all, the head office has to convert the branch trial balance into currency of its

own country before incorporation work and after that branch final accounts are prepared.

Illustration 26.

On 31st March 2016 the following balances appeared in the books of Delhi Branch of an

English firm having its Head Office in London.

Table

Stock on 31st March 2016 was ` 32,500. Branch Account in the London Books showed a

debit balance of £ 2,680 on 31st March 2016 and furniture appeared in the Head Office books

at £ 350.

The rate of exchange on 31-3-2015 was ` 14 and on 31-3-2016 ` 13. The average rate for

the year 2015-16 was ` 12.

Prepare in the H.O. books the Profit and Loss Account and the Balance Sheet of the

Branch.

Table

Illustration 27.

M/s Hinderson & Co. London has a branch in Calcutta. The following was the Head

Office trial balance as on 31 March, 2016.

Table

The assets and liabilities of the Calcutta Branch on 31st March, 2016 were as follows :

Table

The authorised share capital of the company is £ 1,50,000 in £ 1 share. On 31st March,

2016 there was cash in transit from Calcutta to London amounting to ` 24,000.

Prepare the combined Balance Sheet of company as on 31st March, 2016 taking the

rupee at 0.075 £.

Table

Note : 1. Adjustment of cash-in-transit will be made by branch, therefore, this will be the capital of

branch and H.O. A/c balance will increase by ` 5,37,520 to ` 5,61,520. In the books of

H.O. ` 5,61,520 has been changed in £ 41,520.

Table

2. The Aligarh Wax Ltd. invoices goods to its various branches at cost and the branches

sell on credit as well as for cash. From the following details relating to Meerut

Branch, show the Branch Debtors’ Account and Branch Account in the Head Office

books :

table

Objective Type Questions

(a) Select best alternate :

1. Branch account under debtors system is :

(a) Real Accounts (b) Personal Account

(c) Nominal Accounts (d) All these

PDF Created with deskPDF PDF Writer - Trial :: http://www.docudesk.com

5.30 lll Financial Accounting

2. Total Sales ` 3,00,000, Cash Sales ` 2,00,000, Cash received from debtors `

12,000, Bad Debts ` 3,000, Sales Return ` 20,000. Debtors will be :

(a) ` 1,00,000 (b) ` 80,000

(c) ` 65,000 (d) ` 85,000

3. The Head Office sent ` 10,000 to its branch for the purchase of furniture. The

Branch purchased the furniture. How these items are to be dealt with in the

Branch Account ?

(a) Debit side (b) Credit side

(c) Not in any side (d) In debit and credit sides

4. Branch Adjustment Account is in the nature of :

(a) Real A/c (b) Nominal A/c

(c) Personal A/c

5. By what rate the balance of head office account is converted in foreign

branch :

(a) Opening Rate (b) Closing Rate

(c) Average Rate (d) None of these

6. In case of foreign branch, the amount of creditors is convered :

(a) at closing rate (b) at average rate

(c) at opening rate (d) None of the above

7. Branch Adjustment Account is prepared :

(a) By Dependent Branch (b) By head office of dependent branch

(c) By head office of independent branch

8. Goods have been transferred from Agra Branch to Bareilly Branch under

instructions from Head Office. What shall be the entry for this transaction

in the books of head office :

(a) Dr. Bareilly Branch; Cr. goods Sent to Branch A/c

(b) Dr. Goods received from Agra branch; Cr. Agra Branch A/c

(c) Dr. Bareilly Branch A/c; Cr. Agra Branch A/c

(d) None of these

9. Agra branch collected some amount from a customer of H.O. at Agra. What

shall be the entry for this transaction in the books of Agra Branch ?

(a) Dr. Cash A/c; Cr. customer’s A/c (b) Dr. Cash A/c; Cr. H.O. A/c

(c) Dr. H.O. A/c; Cr. Customers A/c (d) Dr. Customer’s A/c; Cr. H.O. A/c

10. Agra Branch sent ` 1,000 to H.O. on 29-12-2000 which was received by H.O.

on 3-1-2001 but the intimation received on 31-12-2000. What shall be the

entry in the books of H.O. on 31st December) :

(a) Dr. Cash A/c; Cr. Agra Branch A/c

(b) Dr. Agra Branch A/c; Cr. Cash A/c

(c) Dr. Cash in Transit A/c; Cr. Agra Branch

(d) None of these

11. When branch ‘A’ sends goods to branch ‘B’, in the books of branch ‘A’ debit is

given to :

(a) Head office account (b) Branch ‘B’ account

(c) Sales return account (d) Purchase return account

PDF Created with deskPDF PDF Writer - Trial :: http://www.docudesk.com

Royalty Accounts ll

l 5.31

12. The cash and credit sales of a branch are ` 5,000 and ` 10,000 respectively.

The amount collected from debtors is ` 10,000. Under debtors system the

amount credited to branch account will be :

(a) ` 20,000 (b) ` 15,000 (c) ` 25,000 (d) ` 10,000

13. Goods are sent to the branch at 20% margin on selling price, when branch

stock discloses a surplus of ` 2,000 the amount to be credited to branch

adjustment account will be :

(a) ` 2,000 (b) `400 (c) `333 (d) 1,600

14. Goods sent by the head office to the branch but not received by the branch

before the close of financial year are credited by head office to :

(a) Branch Account (b) Trading account

(c) Goods sent to branch account (d) Goods in transit account

15. Depreciation on branch assets under debtors system is :

(a) Not shown separately in branch account

(b) Shown in branch account

(c) Not accounted

(d) Shown in the profit and loss account of H.O.

16. Stock reserve in relation to closing stock appears :

(a) On the debit side of branch account

(b) On the credit side of branch account

(c) On the debit side of profit and loss account

(d) On the credit side of the profit and loss account

17. In foreign branch fixed assets shall be converted at :

(a) Opening rate

(b) Average rate