Professional Documents

Culture Documents

+2 Accountancy CA - Orukkam 2023-Hsscommerce

Uploaded by

sinanmp0973Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

+2 Accountancy CA - Orukkam 2023-Hsscommerce

Uploaded by

sinanmp0973Copyright:

Available Formats

Downloaded from hsscommerce.blogspot.

com

പ്ലസ് ടു കൊമേഴ്സ്

പഠനപിന്തുണാ സഹായി

ഒരുക്കം ആലപ്പുഴ

2022 - 2023

അക്കൗണ്ടൻസി

Prepared by

1. Sreekumar P.R, T.D.H.S.S, Thuravoor, Alappuzha

2. Harikumar.A, V.V.H.S.S, Thamarakulam, Alappuzha

3. Jagan.H, Govt. HSS, Kidangara, Alappuzha

4. Muhammed Hafeeze V.A, Lajanathul Muhammadiya HSS, Alappuzha

5. Hari.L, Govt. HSS, Kayamkulam, Alappuzha

6. Ajith P.S, SNM Govt. BHSS, Cherthala, Alappuzha

Coverdesign, Page layout | H a r i k u m a r. A , M a v e l i k a r a

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

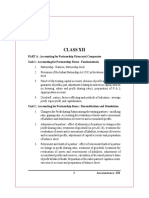

PART – A

ACCOUNTANCY

Chapter - 1

Accounting for Partnership – Basic Concepts

Partnership Deed

Features of Partnership Document containing rules and regulations of

1. No. of persons – Minimum-2, Maximum-50 a firm

Contents of Deed

2. Agreement – Oral / Written

1. Name of the firm

3. Profit sharing – Agreed ratio / Equally

2. Name and address of partners

4. Liability – Unlimited

3. Nature of business

5. Partnership business must be Lawful

4. Place of business

5. Profit sharing ratio

Rules applicable in the absence of Partnership agreement

If partnership deed is silent, then the following provisions of the Indian Partnership Act, 1932

will become applicable :

1. Profit sharing ratio Equally

2. Interest on Capital Not admissible

3. Interest on Drawings Not to be charged

4. Interest on Loans/Advances 6% p.a

5. Remuneration Not admissible

Question

Ajmal and Bilal are partners in a firm. The firm did not have any partnership deed. Specify

how the following situations are treated :

(a) Sharing of profit and losses.

(b) Interest on advance given by Bilal to the firm

Answer (a) Profits and losses shared equally.

(b) 6% interest is given to Bilal’s loan.

Question : What are the two methods of maintaining Capital Accounts of partners ? Give any

four differences between these two methods.

Plus Two Accountancy+2 Accountancy Page No. 1

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

Answer : There are two methods by which the capital accounts of partners can be

maintained. They are :

(1) Fixed capital method and

(2) Fluctuating capital method

Distinction between Fixed and Fluctuating Capital Method

Basis of distinction Fixed Capital Account Fluctuating Capital Account

(1) Number of Two accounts - Capital account and

One account - Capital account.

accounts Current account .

All adjustments are made in the All adjustments are made in the

(2) Adjustments

current account. capital account.

The capital account balance remain

The balance of the capital account

(3) Fixed balance unchanged unless there is addition

fluctuates from year to year.

to or withdrawal of capital.

The capital accounts always show a The capital account may sometimes

(4) Credit balance

credit balance. show a debit balance.

Format of Partner’s Capital Account (Fluctuating Capital Method)

Partner’s Capital Account

Dr. Cr.

J. Amount J. Amount

Date Particulars Date Particulars

F. ₹ F. ₹

Drawings xxx Balance b/d xxx

Interest on drawings xxx Bank (fresh capital xxx

Profit and Loss introduced)

Appropriation A/c xxx Salaries xxx

(share of loss) Interest on capital xxx

Balance c/d xxx Profit and Loss

Appropriation A/c xxx

(share of profit)

xxxx xxxx

====== =======

Question

Anilkumar and Prakash are partners sharing profits and losses in the ratio of 2 : 1. on 1 st

April, 2021 their capitals were ₹ 5,00,000 and ₹ 3,00,000 respectively. Prepare the capital

accounts of the partners on 31st March 2022 under fluctuating capital method.

Plus Two Accountancy+2 Accountancy Page No. 2

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

Particulars Anilkumar (₹) Prakash (₹)

Interest on capital 8% 8%

Drawings during the year 10,000 8,000

Interest on drawings 1,000 800

Salary 7,000 -

Commission - 5,000

Profit for the year after making all the adjustments was ₹ 24,000

Answer

Capital Account

Dr. Cr.

Anilkum

J. Anilkumar Prakash J. Prakash

Date Particulars Date Particulars ar

F ₹ ₹ F ₹

₹

Drawings 10,000 8,000 Balance b/d 5.00,000 3,00,000

Interest on Interest on Capital 40,000 24,000

drawings 1,000 800 Salary 7,000 -

Commission - 5,000

P&L

Balance c/d 5,52,000 3,28,200 Appropriation 16,000 8,000

A/c

----------- ------------- ------------ -------------

5,63,000 3,37,000 5,63,000 3,37,000

======= ======= ======= =======

Profit and Loss Appropriation Account

Format of Profit and Loss Appropriation Account

Profit and Loss Appropriation Account

Dr. Cr.

Amount Amount

Particulars Particulars

₹ ₹

Profit and Loss A/c xxx Profit and Loss A/c xxx

(If there is loss) (If there is profit)

Interest on Capital xxx Interest on Drawings xxx

Plus Two Accountancy+2 Accountancy Page No. 3

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

Salary to Partner xxx Partner’s Capital xxx

Commission to Partner xxx (distribution of loss)

Interest on Partner’s Loan xxx

Partner’s Capital Accounts xxx

(distribution of profit)

xxxx xxxx

======= ========

Question

Dasan and Vijayan are partners. Dasan’s capital is ₹10,000 and Vijayan’s capital is ₹ 6,000.

Interest is payable at 6% p.a. Vijayan is entitled to a salary of ₹300 per month. Profit for the

current year before interest and salary to Vijayan is ₹.8,000. Divide the profit between Dasan

and Vijayan.

Answer

Profit and Loss Appropriation A/c

Dr. Cr.

Particulars ₹ Particulars ₹

Interest on capital : Profit and Loss A/c 8,000

Dasan 600 (Net profit transferred)

Vijayan 360

------- 960

Salary to Vijayan 3,600

(Rs.300 x 12)

Capital Accounts :

Dasan 1,720

Vijayan 1,720

--------- 3,440

8,000 8,000

========= =========

Interest on capital

Question

Harilal is a partner in a firm. On 1 st January 2022, his capital account balance was ₹2,20,000.

As per partnership agreement a partner is entitled to 6% interest per annum on his capital.

Harilal introduced additional capital ₹80,000 on 01-07-2022 and withdrew ₹50,000 on 1-10-

2022. Calculate the interest on capital for the year ending 31st December 2022.

Plus Two Accountancy+2 Accountancy Page No. 4

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

Answer

Interest on capital

6 6

For ₹2,20,000 = ₹2,20,000 x x = ₹6,600

100 12

6 3

For ₹3,00,000 = ₹3,00,000 x x = ₹4,500

100 12

6 3

For ₹2,50,000 = ₹2,50,000 x x = ₹3,750

12 12

-----------

Total interest on capital = ₹14,850

=======

Interest on Drawings

Question

Binoy withdrew the following amounts from his firm, for personal use during the year ending

March 31, 2022. Calculate interest on drawings by product method, if the rate of interest to

be charged is 7 per cent per annum..

Date Amount

₹

April 1, 2021 16,000

June 30, 2021 15,000

October 31, 2021 10,000

December 31, 2021 14,000

March 1, 2022 11,000

Tips to solve the question

➢ To get the amount of product, multiply the amount of drawings with the period for

which they are withdrawn .

➢ Such multiplied amounts recorded in the ‘ Product’ column.

➢ Find the amount of interest by applying the formula

Rate 1

Interest = Sum of Products x x

100 12

Plus Two Accountancy+2 Accountancy Page No. 5

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

Answer

Statement Showing Calculation of Interest on Drawings

Date Amount Time Period Product

₹ ₹

April 1, 2021 16,000 12 months 1,92,000

June 30, 2021 15,000 9 months 1,35,000

October 31, 2021 10,000 5 months 50,000

December 31, 2021 14,000 3 months 42,000

March 1, 2022 11,000 1 month 11,000

Total 4,30,000

===========

1 7 1

Interest = Sum of Products x Rate x =Rs.4,30,000 x x

12 100 12

= ₹2,508

Choose the correct answer

1. Features of Partnership includes

(a) Agreement (b) Profit sharing

(c) Unlimited liability (d) All of these

Answer : All of these

2. Interest on capital of partners under Fixed capital method is credited to

(a) Capital A/c (b) Interest A/c

(c) Current A/c (d) Drawings A/c

Answer : Current A/c

3. In the absence of Partnership deed, Partners are eligible to get which among the

following :

(a) Remuneration (b) Interest on capital @ 6% p.m

(c) Interest on Loan @ 6% p.a (d) Salary

Answer : Interest on Loan @ 6% p.a

4. Interest on capital is calculated on the basis of

(a) Closing capital (b) Opening capital

(c) Average capital (d) Both (a) and (c)

Answer : Opening capital

5. .................. account shows how profit is distributed among partners

(a) Profit & Loss Account (b) Profit & Loss Appropriation A/c

(c) Partners Capital A/c (d) Partners Current A/c

Answer : Profit & Loss Appropriation A/c

Plus Two Accountancy+2 Accountancy Page No. 6

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

Chapter – 2

Reconstitution of a Partnership Firm -Admission of a partner

Factors affecting Goodwill Accounting adjustments at the time of admission

of a partner

1. Nature of business

2. Location of business 1. Calculation of New ratio and Sacrificing ratio

3. Efficiency of Management 2. Treatment of goodwill

4. Market Situation 3. Revaluation of Assets and Liabilities

5. Special advantages 4. Treatment of Reserves, Undistributed profits or losses

5. Adjustment of Capital A/c

Question : What are the two rights acquired by a partner at the time of admission to a firm?

Answer : (1) Right to share assets of the firm

(2) Right to share profits of firm

Question : What do you mean by goodwill ?

Answer : Goodwill is the value of the reputation of a firm in respect of the profits

expected in future over and above the normal profits.

Question : What do you mean by Sacrificing ratio ?

Answer : The ratio in which the old partners agree to sacrifice their share of profit in favour

of the incoming partner is called Sacrificing ratio.

Sacrificing ratio = Old ratio – New ratio

Question : What is Super profit ?

Answer : Super profit is the excess of actual average profit over normal return on capital

Question : What is Revaluation A/c ?

Answer : Revaluation A/c is prepared to find out the profit or loss on revaluation of assets

and reassessment of liabilities.

Methods of valuation of Goodwill

1.Average Profit Method

Question

The profit for the five years of a firm are as follows – year 2018 ₹4,00,000; year 2019

₹3,98,000; year 2020 ₹4,50,000; year 2021 ₹4,45,000 and year 2022 ₹5,00,000. calculate

goodwill of the firm on the basis of 4 years purchase of 5 years average profits.

Steps to solve the question

Total Profit

1. Calculate average profit ( )

No . of years

2. Calculate the amount of goodwill (Average Profits x No. of years purchased)

Plus Two Accountancy+2 Accountancy Page No. 7

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

Answer

Profit

Year

(₹)

2018 4,00,000

2019 3,98,000

2020 4,50,000

2021 4,45,000

2022 5,00,000

Total 21,93,000

Total Profit 21,93,000

Average Profit = = = ₹4,38,600

No . of years 5

Goodwill = Average Profits x No. of years purchased

= ₹4,38,600 x 4 = ₹17,54,400

2 Super Profit Method

Question

The books of a business showed that the capital employed on December 31, 2022, ₹5,00,000

and the profits for the last five years were : 2018 - ₹40,000; 2019 - ₹50,000; 2020 - ₹55,000 ;

2021 - ₹70,000 and 2022 - ₹85,000. you are required to find out the value of goodwill based

on 3 years purchase of the super profits of the business, given that the normal rate of return

is 10%.

Answer

Average Profits

Year Profit

(₹)

2018 40,000

2019 50,000

2020 55,000

2021 70,000

2022 85,000

Total 3,00,000

Average Profits = ₹3,00,000/5 = ₹60,000

Capital Employed x Normal Rate of Return

Normal Profits =

100

5,00,000 x 10

= = ₹50,000

100

Super Profit = Average Profit – Normal Profit

= ₹60,000- ₹50,000 = ₹10,000

Goodwill = Super profit x No. of years purchase

= ₹10,000 x 3 = ₹30,000

Plus Two Accountancy+2 Accountancy Page No. 8

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

3. Capitalisation Method

Question

A partnership firm has earned an average profit of Rs. 50000 during the last few years. Find

out the value of goodwill by capitalisation method, given that the assets of the business are

Rs.350000 and its external liabilities are Rs.190000. The normal rate of return is 20%.

Answer

Goodwill = Capitalised value of average profits - Net Assets

Capitalised value of average profits = Average profitx100/rate = ₹50000x100/20 = ₹250000

Net Assets = Total assets – External liabilities = ₹350000 – ₹190000 = ₹160000

Goodwill = ₹250000 - ₹160000 = ₹90000

Revaluation A/c

Tips for preparing Revaluation Account

1. Increase in the value of asset(Gain) – Credited to Revaluation A/c

2. Decrease in the value of asset(Loss) – Debited to Revaluation A/c

3. Increase in the value of liabilities(Loss)- Debited to Revaluation A/c

4. Decrease in the value of liabilities(Gain) – Credited to Revaluation A/c.

5. Unrecorded assets(Gain) – Credited to Revaluation A/c

6. Unrecorded Liabilities (Loss) – Debited to Revaluation A/c

In short,all gains must be credited to revaluation a/c and all losses must be debited to revaluation a/c

Question

Given below is the Balance Sheet of Anu and Binu who were sharing Profits and Losses in the

ratio of 3 : 2 as on 31st December, 2022

Balance sheet as on 31st December, 2022

Liabilities Amount Assets Amount

₹ ₹

Sundry creditors 27,500 Cash 12,000

Bills payable 12,000 Debtors 27,000

Outstanding expense 2,500 Stock 15,000

Capital : Furniture 20,000

Anu 50,000 Plant and Machinery 58,000

Binu 40,000

---------- 90,000

------------------- ---------------------

1,32,000 1,32,000

========== ===========

Vinu is admitted as a partner on the date of Balance Sheet on the following terms :

(a) Vinu will bring ₹30,000 as capital and ₹12,000 for his share of goodwill for 1/4 share in

profits.

(b) Plant and Machinery is depreciated by ₹8,000.

(c) Stock is found overvalued by ₹3,000.

(d) A provision for doubtful debts is to be created at 10% on debtors.

Plus Two Accountancy+2 Accountancy Page No. 9

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

(e) Creditors were unrecorded to the extent of ₹1,000.

Prepare Revaluation Account, Partners Capital Account and the new Balance Sheet

after the admission of Vinu.

Answer Revaluation A/c

Particulars Amount Particulars Amount

₹ ₹

Plant and Machinery 8,000

Stock 3,000 Capital Accounts :

Provision for debts 2,700 Anu 8,820

Unrecorded Creditors 1,000 Binu 5,880

------------- 14,700

----------------- -----------------

14,700 14,700

========= =========

Partner’s Capital A/c

Date Particulars J Anu Binu Vinu Date Particulars J Anu Binu Vinu

F F

Revaluation 8,820 5,880 - Balance b/d 50,000 40,000 -

(Loss) Cash 30,000

Balance c/d 48,380 38,920 30,000 Goodwill 7,200 4,800

---------- ---------- ---------- ---------- ---------- ------------

57,200 44,800 30,000 57,200 44,800 30,000

===== ===== ====== ===== ====== ======

Balance sheet

Amount Amount

Liabilities Assets

₹ ₹

Sundry Creditors 28,500 Cash 54,000

Bills Payable 12,000 Debtors 27,000

Outstanding Expenses 2,500 Less : Provisions 2,700

Capital Accounts : ---------- 24,300

Anu 48,380 Stock 12,000

Binu 38,920 Furniture 20,000

Vinu 30,000 Plant & Machinery 50,000

----------- 1,17,300

-------------------- -------------------

1,60,300 1,60,300

=========== ===========

+2 Accountancy

Plus Two Accountancy Page No. 10

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

Choose the correct answer

1. Which of the following event lead to reconstitution of a partnership firm

(a) Admission of a partner (b) Retirement of a partner

(c) Death of a partner (d) All of these

Answer : All of these

2. Sacrificing Ratio = ................... - New Ratio

(a) Gaining Ratio (b) Capital Ratio

(c) Old Ratio (d) Profit Ratio

Answer : Old Ratio

3. Which of the following is debited to the Revaluation A/c, at the time of reconstitution of a

partnership firm

(a) Unrecorded Assets (b) Increase in Assets

(c) Unrecorded Liabilities (d) Decrease in Liabilities

Answer : Unrecorded Liabilities

4. On admission, the debit balance of Profit and Loss account shown in the Balance sheet of the

firm indicates

(a) Undistributed Profit (b) Reserve

(c) Undistributed Loss (d) Revaluation Loss

Answer : Undistributed Loss

Chapter – 3

Reconstitution of a Partnership Firm -Retirement and Death of a

partner

Accounting adjustments at the time of Retirement

1. Calculation of New ratio and Gaining ratio

2. Revaluation of Assets and Liabilities

3. Treatment of Reserves, Undistributed profits or losses

4. Treatment of Goodwill

5. Calculation of total amount due to Retiring Partner

6. Settlement of amount due to Retiring partner

7. Adjustment of Capital A/c

Gaining Ratio : Gaining ratio is the ratio in which continuing partners decide to share

the outgoing partners share of profit.

Gaining Ratio = New ratio – Old ratio

+2 Accountancy

Plus Two Accountancy Page No. 11

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

Treatment of Undistributed Profits and Losses

The journal entries for recording accumulated profits and losses are:

i. For Accumulated profits :

Reserves/Profit and Loss Account Dr

To All Partner’s Capital Accounts

ii. For Accumulated Losses

All Partner’s Capital Accounts Dr

To Profit and Loss Account

Question

‘M’, ‘N’ and ‘O’ are equal partners. M decides to retire from the firm. On the date of his retirement

the Balance Sheet of the firm showed the following :

(a) Profit and Loss Account (Dr.) ₹12,000.

(b) General Reserve ₹ 48,000.

Pass necessary journal entries to record the above.

Answer Journal

Date Particulars J.F. Debit Credit

₹ ₹

(a) M’s Capital Account Dr. 4,000

N’s Capital Account Dr. 4,000

O’s Capital Account Dr. 4,000

To Profit and Loss A/c 12,000

(Accumulated loss distributed to partners

equally)

General Reserve A/c Dr. 48,000

(b) To M’s Capital A/c 16,000

To N’s Capital A/c 16,000

To O’s Capital A/c 16,000

(Reserves transferred to all partners in old ratio)

Revaluation Account

Question

Pranav, Pinki and Prasad are partners sharing P & L in the ratio of 3:2:1. Their balance sheet as on

31.12.2017 stood as follows :

Liabilities Amount Assets Amount

₹ ₹

Creditors 50,000 Cash in hand 20,000

Trade payable 20,000 Debtors 45,000

+2 Accountancy

Plus Two Accountancy Page No. 12

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

Reserves & Surplus 2,000 Less : Provisions 5,000

Capital A/c : --------- 40,000

Pranav 40,000 Inventories 30,000

Pinki 50,000 Plant & Machinery 42,000

Prasad 30,000 Goodwill 10,000

Furniture 50,000

--------------- ---------------

1,92,000 1,92,000

======== =========

Pranav retires and the following is agreed upon :

1. Provision for doubtful debts is not required.

2. Depreciation :

Furniture @ 5%.

Plant & Machinery @ 10%.

3. Creditors will be written off by ₹ 5,000.

Prepare Revaluation A/c.

Answer

Revaluation A/c

Dr. Cr.

Particulars Amount Particulars Amount

₹ ₹

Plant and Machinery 4,200 Creditors 5,000

Furniture 2,500 Provision for bad debts 5,000

Capital Accounts :

Pranav 1,650

Pinki 1,100

Prasad 550

---------- 3,300

------------ --------------

10,000 10,000

======= ========

Preparation of Partner’s Loan Account

Question

Anish, Manish and Sudheesh are partners in a firm. Sudheesh retires from the firm. On the date of

retirement of Sudheesh, ₹ 50,000 become due to him. Anish and Manish promise to pay the amount

in five equal instalments at the end of every year together with interest @ 10% p.a Prepare Loan

account of Sudheesh.

+2 Accountancy

Plus Two Accountancy Page No. 13

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

Answer :

Sudheesh’s Loan A/c

Dr. Cr.

J. Amount J. Amount

Date particulars Date Particulars

F. ₹ F. ₹

Bank 15,000 Sudheesh’s Capital A/c 50,000

Balance c/d 40,000 Interest 5,000

------------ -----------

55,000 55,000

Bank 14,000 Balance b/d 40,000

Balance c/d 30,000 Interest 4,000

------------ -----------

44,000 44,000

13,000 30,000

Bank Balance b/d

20,000 3,000

Balance c/d Interest

------------ -----------

33,000 33,000

Bank 12,000 Balance b/d 20,000

Balance c/d 10,000 Interest 2,000

------------ -----------

22,000 22,000

Balance b/d 10,000

Bank 11,000 Interest 1,000

------------ ------------

11,000 11,000

Choose the correct answer

1. The ratio in which the continuing partners acquire share from the retiring partner is called

(a) Capital Ratio (b) Sacrificing Ratio

(c) Gaining Ratio (d) Solvency Ratio

Answer : Gaining Ratio

2. New Ratio - Old Ratio = ...................

(a) Gaining Ratio (b) Capital Ratio

(c) Sacrificing Ratio (d) Liquidity Ratio

Answer : Gaining Ratio

+2 Accountancy

Plus Two Accountancy Page No. 14

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

3. At the time of retirement, which ratio is used to transfer Reserve account balance to all partners

capital account

(a) Old ratio (b) New ratio

(c) sacrificing ratio (d) Gaining ratio

Answer : Old ratio

4. At the time of retirement, accumulated profits / losses are to be shared by using

(a) Capital ratio (b) New ratio

(c) Gaining ratio (d) Old ratio

Answer : Old ratio

5. Revaluation profit at the time of retirement of a partner is credited to which of the following

account

(a) Retiring partners capital account (b) Remaining partners capital account

(c) All partners capital account (d) Continuing partners capital account

Answer : All partners capital account

6. Gaining ratio is calculated at the time of

(a) admission of a partner (b) death of a partner

(c) dissolution of firm (d) retirement and death of a partner

Answer : retirement and death of a partner

7. The amount due to the deceased partner is transferred to ......................... A/c

(a) Continuing Partners Capital (b) Executors Loan

(c) New partners Loan (d) Remaining partners Capital

Answer : Executors Loan

Chapter – 4

DISSOLUTION OF FIRM

Modes of Dissolution

1. Dissolution by Agreement

2. Compulsory dissolution

3. Dissolution on the happening of Contingencies

4. Dissolution by Notice

5. Dissolution by Court

+2 Accountancy

Plus Two Accountancy Page No. 15

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

Difference between Dissolution of Partnership and Dissolution of Firm

Basis Dissolution of Partnership Dissolution of Firm

1. Termination of

Business is not terminated Business of the firm is terminated

business

2. Settlement of assets Assets and liabilities are revalued Assets are sold and liabilities are paid-

and liabilities and new balance sheet is prepared. off.

3. Economic Economic relationship between Economic relationship between the

relationship the partners continues. partners comes to an end.

The books of account are not

4. Closure of books The books of account are closed.

closed.

Difference between Revaluation Account and Realisation Account

Sl.

Revaluation A/c Realisation A/c

No.

It is prepared at the time of admission, retirement and It is prepared at the time of dissolution

1

death of a partner of a partnership firm

It is prepared to find out profit or loss

2 It is prepared to find out profit or loss on revaluation

on realisation

It records increase or decrease in the value of assets It records the value of assets and

3

and liabilities liabilities at their book value

Format of Realisation Account

J. Amount J. Amount

Date Particulars Date Particulars

F. ₹ F. ₹

Assets (Book value) xxx

Cash (Liabilities paid) xxx Outside liabilities xxx

Partners (Book value)

Capital/Current A/c xxx Cash (Assets realised) xxx

(Liabilities discharged by Partners Capital /

partner) Current A/c xxx

Cash (Realisation xxx Assets taken over by

expense paid) partner xxx

Partners

Capital/Current A/c xxx

(Profit on realisation

shared) xxxx xxxx

====== =======

+2 Accountancy

Plus Two Accountancy Page No. 16

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

Question : A, B & C were partners sharing profit and losses in the ratio of 5:3:2.

Their Balance Sheet as on 31st March 2022 was as follows :

Balance Sheet of A, B & C as on 31st March 2022

Amount Amount

Liabilities Assets

(₹) (₹)

Creditors 15,000 Buildings 1,78,000

Bills payable 15,000 Machinery 20,000

Bank Loan 1,00,000 Stock 65,000

Provident Fund 60,000 Bills receivables 72,000

A’s husband’s loan 65,000 Furniture 65,000

General Reserve 45,000 Cash at Bank 35,000

Capitals :

A 35,000

B 45,000

C 55,000

--------- 1,35,000

------------------- ------------------

4,35,000 4,35,000

========== ==========

The firm was dissolved on that date.

Prepare realization account with the following information :

(1) Building realized for ₹ 1,20,000 ; Bills receivables realized for ₹ 70,000 ; Stock

realized for ₹ 40,000 and Machinery sold for ₹ 33,000 and furniture ₹60,000.

(2) Bank loan was settled for ₹ 70,000 ; Creditors and bills payable were settled at

10% discount.

(3) Realisation expenses ₹ 1,500.

Answer

Realisation A/c

Amount Amount

Particulars Particulars

₹ ₹

Buildings 1,78,000 Creditors 15,000

Machinery 20,000 Bills Payable 15,000

Stock 65,000 Bank loan 1,00,000

Bills Receivables 72,000 Provident Fund 60,000

Furniture 65,000 A’s Husband’s loan 65,000

Bank A/c Bank

Bank loan 70,000 Building 1,20,000

Creditors 13,500 Bills Receivable 70,000

+2 Accountancy

Plus Two Accountancy Page No. 17

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

Bills Payable 13,500 Stock 40,000

------------- 97,000 Machinery 33,000

Bank (Provident Fund) 60,000 Furniture 60,000

Bank (Realisation expenses) 1,500 ---------- 3,23,000

Bank (A’s husband’s loan) 65,000 Partner’s Capital :

A 22,750

B 13,650

C 9,100

----------- 45,500

--------------- ------------------

6,23,500 6,23,500

========== ==========

Question

Adithyan and Theertha are partners of Aswani Traders in the ratio of 2 : 3. Their

Balance Sheet as on 31-12-2022 stood as follows :

Balance Sheet as on 31-12-2022

Amount Amount

Liabilities Assets

₹ ₹

Capital A/c : Land & Buildings 40,000

Adithyan ₹ 50,000 Furniture 20,000

Theertha ₹ 30,000 Stock 40,000

------------ 80,000

Sundry Creditors 20,000

1,00,000 1,00,000

========== =========

Prepare the realisation account on the assumption that the firm dissolved on the

above date by considering the following :

1.Land & Buildings realised ₹ 60,000.

2.Furniture sold for ₹ 20,000.

3.Stock taken over by Adithyan ₹ 15,000.

Answer

Realisation A/c

Dr. Cr.

Amount Amount

Particulars Particulars

₹ ₹

Land and Building 40,000 Sundry Creditors 20,000

Furniture 20,000 Cash(Land & Buildings) 60,000

+2 Accountancy

Plus Two Accountancy Page No. 18

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

Stock 40,000 Cash (Furniture) 20,000

Cash (Creditors) 20,000 Adithyan’s Capital A/c(Stock) 15,000

Partner’s Capital A/c :

(Realisation Loss)

Adithyan 2,000

Theertha 3,000

-------- 5,000

------------------ ---------------

1,20,000 1,20,000

========== =========

Choose the correct answer

1. Which of the following is prepared at the time of dissolution of a Firm

(a) Revaluation A/c (b) Realisation A/c

(c) P/L Appropriation A/c (d) Profit & Loss A/c

Answer : Realisation A/c

2. When the business of a firm becomes illegal, it will lead to

(a) Dissolution by Agreement (b) Compulsory Dissolution

(c) Dissolution by Notice (d) Dissolution by Court

Answer : Compulsory dissolution

3. Which of the following account is not closed and transferred to Realisation account at the time

of dissolution of firm

(a) Stock A/c (b) Cash A/c

(c) Creditors A/c (d) Goodwill A/c

Answer : Cash A/c

4. The business of a partnership firm is terminated at the time of

(a) Retirement of Partner (b) Death of Partner

(c) Dissolution of Firm (d) Dissolution of Partnership

Answer : Dissolution of Firm

5. At the time of dissolution of firm, if a partner takes over an asset it should be

(a) Debited in Realisation account (b) Credited in Revaluation account

(c) Debited in Partners capital account (d) Credited in Partners capital account

Answer : Debited in Partners capital account

+2 Accountancy

Plus Two Accountancy Page No. 19

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

PART – B

COMPUTERISED ACCOUNTING

Chapter – 1

OVERVIEW OF COMPUTERISED ACCOUNTING SYSTEM

Features of CAS

1.Simple and Integrated : Computerised Accounting System integrates all the

business operations.

2.Accuracy : CAS is designed to be accurate to the minutest detail.

3.Speed : Statements and reports can be generated instantly.

4.Scalability : Computer software can manage huge volume of data.

5.Reliability : The financial statements prepared through CAS are highly reliable.

Components of CAS

1. Procedure

2. Data

3. Users/People/Live-ware

4. Hardware

5. Software

Types of Codes

1) Sequential Codes : Numbers and letters or both of them are assigned in a

consecutive order.

Eg: CM001 – Excel Company Limited

CM002 – Premium Company Limited

2) Block Codes : A range of numbers are used for codification

Eg : 1000 – 1999 : Televisions

2000 – 2999 : Mobile Phones

3) Mnemonic Codes : Mnemonic code consists of alphabets or abbreviations as

symbols to codify a piece of information.

Eg: Railway station codes

MVLK for Mavelikara, CNGR for Chengannur, HAD for Harippad etc...

+2 Accountancy

Plus Two Accountancy Page No. 20

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

Security features of CAS

(a) Password security : Password is the key or code to allow access to the system

and data.

(b) Data audit : This security enables to know, who and what changes have been

made in the original data.

(c) Data vault : Vaulting will save data in encrypted form to ensure its security.

Merits of CAS

1. Timely generation of reports

2. Saves time and money

3. Transparency and reliability

4. Accurate and updated information

Demerits of CAS

1. Heavy cost of installation

2. Threat from hackers

3. Chances of data loss due to various reasons

4. Extensive use of computer may lead to health problems

Choose the correct answer

1. Find the odd one

(a) Data (b) User (c) Employee (d) Hardware

Answer : Employee

2. In a retail business shop, a code number range from 2501 to 2599 is assigned to the

product Bath soaps. This coding is an example for

(a) Sequential Codes (b) Block Codes

(c) Mnemonic Codes (d) Numeric Codes

Answer : Block Codes

3. BST1 – Plus One Business Studies, BST2 – Plus Two Business Studies are examples

for ..................... type of code

(a) Block code (b) Book Code (c) Mnemonic code (d) Sequential code

Answer : Sequential code

4. Identify the type of coding used in the following case

CA for Current Assets

FA for Fixed Assets

(a) Sequential code (b) Block code

(c) Mnemonic code (d) Fluctuating code

Answer : Mnemonic code

5. The sub system of Accounting Information System, which deals with the payment

of salary/wages to employees

(a) Cash & Bank (b) Payroll accounting (c) Budget (d) Final accounts

Answer : Payroll Accounting

+2 Accountancy

Plus Two Accountancy Page No. 21

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

Chapter – 2

SPREADSHEET

Examples for Spreadsheet

LibreOffice Calc, MS Office Excel etc.. are examples of Spreadsheet Softwares.

Features of LibreOffice Calc

1. Easy calculations

2. What-if calculations

3. Serves as a database

4. Arranging data

5. Dynamic Charts

Components of LibreOffice Calc spreadsheet

1. Rows : Rows are numbered numerically from top to bottom.

2. Columns : Columns are referred by alpha character from left to right.

3. Range : A cell range is a collection of selected cells.

Naming Ranges

Naming a range means giving name to a specific range of cells.

Steps in Naming a range

1. Select the range which is to be named

2. Go to Data menu -->Define Range

3. Enter the name of range in the window appeared. Click on Add button and then

click OK button.

SPREADSHEET OPERATIONS

1. To start a new work book

Applications --> Office --> LibreOffice Calc

2. To save a worksheet

File --> Save

3. To close a worksheet

File --> Close

4. To add a new worksheet in the workbook

Click on the + sign near to Sheet tab

5. To delete a worksheet

Select the sheet to be deleted. Then select Delete Sheet option available

under Sheet menu.

6. To rename a worksheet

Select the sheet to be renamed. Then select Rename Sheet under Sheet

menu.

+2 Accountancy

Plus Two Accountancy Page No. 22

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

Types of data entered in a cell

Three types of data are entered in a cell

1. VALUE : Numerical data is called a value.

2. LABEL : The text data is called Label.

3. FORMULA : Formula means a mathematical calculation on a set of cells.

CELL REFERENCES

Relative Cell Reference

It means when the formula is copied, it changes to reflect the new location.

Absolute Cell Reference

Absolute cell reference is used to keep a cell reference constant. It consists

of column letter and row number surrounded by dollar sign ($).

Mixed Cell Reference

Mixed cell reference is a combination of Relative and Absolute cell

references.

Useful Functions in Spreadsheet

1. DATE AND TIME FUNCTIONS

2. STATISTICAL FUNCTIONS

3. LOGICAL FUNCTIONS

4. MATHEMATICAL FUNCTIONS

5. TEXT FUNCTIONS

1. Date and Time Functions

(i) Today - This function returns the current computer system date in the cell.

TODAY is a function without arguments.

Synax: =Today( )

(ii) Now – NOW function returns current computer system time also with the date.

NOW is also a function without arguments.

Synax: =Now( )

(iii) DAY - This function returns the day of a date represented by a number. The

day is given as an integer ranging from 1 to 31.

Syntax : =Day(“date”)

(iv) Month – This function returns the month of a given date. It ranges from 1 to

12.

Synax: =Month(“Date”)

+2 Accountancy

Plus Two Accountancy Page No. 23

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

(v) Year – This function returns the year from the date.

Syntax : =Year(“Date”)

(vi) Date – This function returns a date, when the year, month and day parameters

are given as integer separated by commas.

Syntax : =Date(Year,Month,Day)

2. Statistical Functions

(i) COUNT: This function will count cells that contains numbers, dates and time.

Syntax : =COUNT(Value1, Value2.....)

(ii) COUNTA : This function will counts the number of cells that contains any type of

data. That is it counts the cells that are not empty in a range.

Syntax : =COUNTA(Value1, Value2.....)

(iii) COUNTBLANK : This function counts the number of cells which are empty in a range

Syntax : =COUNTBLANK(Range)

(IV) COUNTIF : This function is used to count the number of cells that meet a criteria.

Syntax : =COUNTIF(Range,Criteria)

3. Logical Functions

(i) IF : This function returns one value if the condition is true, and another value if

the condition is false.

Syntax : =IF(Test,Then_Value,Otherwise_Value)

Example : =IF(C2>=40,”Passed”,”Failed”)

(ii) NestedIF : We can include several IF conditions in one formula. Such multiple

IF statements are called NESTEDIF.

Syntax : =IF(Test_1,ThenValue_1,IF(Test_2,ThenValue_2,IF(.....)))

(iii) AND : It checks more than one condition at the same time and returns TRUE if

all conditions are satisfied. Otherwise it returns FALSE.

Syntax : =AND(Logical Value1,Logical Value2,...)

(iv) OR : OR function is used to compare two values.

Syntax: =OR(Logical Value1, Logical Value2,.....)

4. Mathematical Functions

(i) SUM : This function adds together a supplied set of number or numbers given

in a range.

Syntax : =SUM(number1,number2,........) or =SUM(Range)

+2 Accountancy

Plus Two Accountancy Page No. 24

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

(ii) SUMIF : This function adds all numbers in a range of cells, only if it meets given

criteria.

Syntax : =SUMIF(range,”criteria”,sum_range)

(iii) ROUND : Round function rounds a number to a specified number of digits.

Syntax : =ROUND(Number,Count)

(iv) ROUNDUP : Roundup function rounds a number up away from zero, without

considering the value next to the rounding digit.

Syntax : =ROUNDUP(Number,Count)

(v) ROUNDDOWN : Roundup function rounds a number down towards zero.

Syntax : =ROUNDDOWN(Number,Count)

5.TEXT Functions

(i) TEXT : This function converts number into text.

Syntax : =TEXT(Number,Format)

(ii) CONCATENATE : This function combines several text strings of different cells

into one string.

Syntax : =CONCATENATE(“Text1”,”Text2”,.........”Text30”)

Data Validation

This feature imposes restrictions on the type of data entered into a cell. Data

validation helps to ensure the data is correct and useful.

Data validation option is available at Data Menu --> Validity

Conditional Formatting

Conditional formatting allows us to change the appearance of a cell, based on

certain conditions. This function helps to highlight relevant cells.

Conditional Formatting option is available at Format Menu --> Conditional

Pivot Table

A pivot table allows to extract the significance from a large, detailed data set.

Pivot table is useful if we have long rows or columns that hold values and to track

the sums of and easily compare to one another.

Pivot Table option is available at Data Menu --> Pivot Table

Uses of Pivot Table

● Pivot Table summarises data from a large dataset.

● Filtering and sorting data possible.

● Helps to present concise and attractive reports.

+2 Accountancy

Plus Two Accountancy Page No. 25

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

Choose the correct answer

1. LibreOffice Calc is a ........................................ software

(a) DBMS (b) Presentation (c) Spreadsheet (d) Video editing

Answer : Spreadsheet

2. Which function available in LibreOffice Calc displays the current computer system

data?

(a) DATE (b) NOW

(c) YEAR (d) TODAY

Answer : TODAY

3. Pre-defined formula in Spreadsheet is called

(a) Label (b) Function (c) Value (d) Formatting

Answer : Function

4. Intersection of a column and row in Spreadsheet is called

(a) Cell (b) Range

(c) Label (d) Value

Answer : Cell

5. Which of the following function is used to calculate depreciation under Fixed

instalment method ?

(a) PMT (b) DB (c) SLN (d) COUNT

Answer : SLN

6. In a formula, cell reference is given as $A$24. This type of cell reference is

(a) Relative (b) Absolute (c) Mixed (d) None of these

Answer : Absolute

7. Find the odd one

(a) DATE (b) NOW (c) TEXT (d) YEAR

Answer : TEXT

Chapter – 3

USE OF SPREADSHEET IN BUSINESS APPLICATION

PAYROLL ACCOUNTING

Payroll accounting is the function of calculating and distributing wages, salaries

and other allowances to employees

Components of Payroll

1. Earnings

Earnings include the following:

(a) Basic Pay (BP)

(b) Dearness Allowance (DA)

(c) House Rent Allowance (HRA)

(d) Transport Allowance (TA)

+2 Accountancy

Plus Two Accountancy Page No. 26

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

(e) City Compensatory Allowance (CCA)

(f) Other Allowances

Gross Pay = BP+DA+HRA+TA+CCA+Other Allowances

2. Deductions

Deductions includes:

(a) Professional Tax (PT)

(b) Provident Fund (PF)

(c) Tax Deduction at Source (TDS)

(d) Recovery of Loan

(e) State Life Insurance (SLI)

(f) Other deductions

Net Pay = Gross pay – Total deductions

ASSET ACCOUNTING

Records relating to assets are to be maintained from the acquisition of assets to till

its disposal. It mainly involves computation of depreciation

Methods for calculating Depreciation

1. Straight Line Method (Fixed instalment Method)

In this method, depreciation is calculated on the basis of original cost of the asset.

In LibreOffice Calc, SLN Function is used to find depreciation under Straight Line

Method

Syntax : =SLN(Cost,Salvage,Life)

Cost – Acquisition cost

Salvage – Scrap value

Life – Total life period of asset

2. Diminishing Balance Method (Written Down Value Method)

In this method, depreciation is calculated on the basis of opening balance of the

asset each year.

In LibreOffice Calc, DB function is used for calculating depreciation under this

method

Syntax : =DB(Cost,Salvage,Life,Period,Month)

Cost – Acquisition cost

Salvage – Scrap value

Life – Total life period of asset

Period – Period (Year) for which depreciation is to be calculated

Month – Number of months in first year

+2 Accountancy

Plus Two Accountancy Page No. 27

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

Loan Repayment Schedule

EMI (Equated Monthly Instalment) : Equated Monthly Instalment is a fixed

amount payable by a borrower to a lender at a specified date of each calender

month. EMI of a loan is determined by factors like Principal amount (Amount

borrowed), Rate of interest, Period of loan etc...

PMT Function in Calc spreadsheet is used to calculate periodic instalments of a

loan.

Syntax =PMT(Rate,Nper,PV,FV,Type)

Rate – Rate of interest

Nper – The total number of periods in which loan is to be repaid

PV – Present Value (i.e the Loan amount)

FV – Future value (Optional). The value at the end after final payment (0).

Type - Whether payment is made at the beginning (value=1)or at the end (value=0).

Choose the correct answer

1. Which one of the following is a deduction in the calculation of NET PAY in payroll

(a) HRA (b) PF (c) DA (d) BP

Answer : PF

2. Which among the following is not an element of gross pay or total earnings

(a) DA (b) HRA (c) TDS (d) TA

Answer : TDS

3. PMT function is used for calculating

(a) Payroll (b) Depreciation (c) Loan repayment instalment (d) Professional Tax

Answer : Loan repayment instalment

4. Which function is used in LibreOffice Calc to calculate EMI of a loan

(a) NPV (b) PMT

(c) COUNT (d) FV

Answer : PMT

5. The argument ‘Nper’ used in the function PMT indicates

(a) New percentage (b) Loan amount

(c) Rate of interest (d) Number of repayment period

Answer : No. of repayment period

Chapter – 4

GRAPH AND CHART FOR BUSINESS DATA

+2 Accountancy

Plus Two Accountancy Page No. 28

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

TYPES OF CHART

1. Column chart : A Column chart is used for comparison of data items for a

specified time period. In the column chart, categories are displayed horizontally

and values vertically.

2. Pie chart : The pie chart contains only one data series. A series of data in a

pie chart is displayed as a percentage of the total.

3. Line chart : Line Chart is used to display data changes (trends) at regular

intervals

4. Bar chart : The bar chart is similar to the column chart, with the difference

that the data series are displayed horizontally and not vertically.

5. Area chart : Area chart is used to highlight the proportion of individual items

over total items.

6. Donut chart : Donut chart displays in rings. Each ring represents a data

series

7. Radar chart : This chart has separate axis for each category. Value of each

data point is plotted on corresponding axis.

8. Scatter chart : In this type of chart, both axes displays values. It is also

known as XY Chart

STEPS TO CREATE CHART

1. Open LibreOffice Calc spreadsheet

2. Enter the given data into spreadsheet

3. Select the cells containing data on the basis of which chart is to be prepared

4. To plot the chart in spreadsheet, select Chart option from Insert menu

5. Select Chart type and click on Finish button

ELEMENTS OF CHART

1. Chart Area : All elements within the outer border.

2. Plot Area : The area bounded by X axis and Y axis. It have its own border.

3. Chart Floor : It is the lower area on which data points are placed.

4. Data points : A symbol that represents the date. It may be columns, bars,

lines etc..

5. Data series : It is a collection of data points

6. Legend : It is an indicator of a piece of information in the chart.

7. Chart Title : Heading at top of the chart

8. X Axis – Horizontal axis in a chart

9. Y Axis – Vertical axis in a chart

10. Grid lines – Vertical and horizontal lines that appear in a chart

ADVANTAGES OF CHART

1. Visually appealing

2. Quick analysis and interpretation of data within a little time

+2 Accountancy

Plus Two Accountancy Page No. 29

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

3. To know the trends easily

4. A large volume of information can be exhibited through charts easily

Choose the correct answer

1. The chart used to display trends over a period of time is

(a) Pie chart (b) Radar chart (c) Line chart (d) Area chart

Answer : Line chart

2. Which among the following chart displays data in rings

(a) Bar chart (b) Column chart (c) Area chart (d) Donut chart

Answer : Donut chart

3. The identifier of a piece of information shown in a chart is called

(a) Plot area (b) Data series (c) Legend (d) Grid lines

Answer : legend

4. ............ chart is similar to Column chart with the difference that the data series are

displayed horizontally.

(a) Line chart (b) Bar chart

(c) Pie chart (d) Area chart

Answer : Bar chart

5. .......... chart contains only one data series

(a) Line chart (b) Bar chart

(c) Pie chart (d) Area chart

Answer : Pie chart

Chapter – 5

ACCOUNTING SOFTWARE PACKAGE - GNUKHATA

GNUKhata accounting software is developed by Digital Freedom Foundation (DFF –

a public charitable trust) in association with International Centre for Free and Open

Source Software (ICFOSS).

FEATURES OF GNUKhata

1. Free and Open Source accounting software.

2. Based on Double Entry book keeping.

3. Ledgers, Profit and Loss A/c, Balance Sheet etc... can be generated.

4. Facility for attaching source document with Voucher entry.

5. Can be used by both Profit making and Non-Profit making Organisations.

+2 Accountancy

Plus Two Accountancy Page No. 30

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

SYSTEM GENERATED (Default) LEDGER ACCOUNTS

In GNUKhata, there are four system generated ledger accounts.

Sl. No. Name of Account Group Sub Group

1 Closing Stock Current Assets Inventory

2 Opening Stock Direct Expenses None

3 Stock at the beginning Current Assets Inventory

4 Profit and Loss Account Direct Income None

Steps in Ledger creation

Step 1: GNUKhata → Master → Create Account

Step 2: Select Group to which account belongs

Step 3 : Select sub-group, if any to which the account belongs

Step 4 : Enter the name of account

Step 5 : Click on Save button to save the ledger.

Profit & Loss Account – Groups and Sub Groups

Group Sub-Group Ledger

Sales, Purchase

Direct Income None

Return

Wages, Power,

Freight, Import duty,

Direct Expense None

Octroi, Purchases,

Sales Return

Rent Received,

Indirect Income None Interest Received,

Commission received

Salary, Rent,

Insurance, Office

Indirect Expense None expenses, Electricity

Charges, Audit fee,

Depreciation

+2 Accountancy

Plus Two Accountancy Page No. 31

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

Balance sheet – Groups and Sub-groups

Group Sub-Group Ledger

Capital A/c

Partner's Capital A/c

Capital None

Share Capital A/c

Capital Fund

Bank Bank A/c

Cash in Hand

Cash Cash A/c

Petty cash A/c

Current Assets Closing Stock

Inventory

(System generated)

Short term loans

Loans & Advances

Prepaid expenses

Sundry Debtors Debtors A/c

Provision for Bad

debts

Provisions

Provision for Income

Tax

Current Liability

Sundry Creditors for Outstanding

Expenses Expenses

Sundry Creditors for All Suppliers

Purchases /Creditors A/c

Building A/c

Building Office Building A/c

Factory Building A/c

Furniture A/c

Furniture

Office Furniture A/c

Fixed Assets Land A/c

Land Land & Building A/c

Premises A/c

Machinery A/c

Plant & Machinery Plant A/c

Plant & Machinery A/c

Investment in Bank Fixed deposits in bank

Deposits

Investments Investment in Shares

Investment in Shares

Investment in

& Debentures

Debentures

+2 Accountancy

Plus Two Accountancy Page No. 32

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

Loans (Asset) None Long term Loans

Bank Loan

Secured

Other Secured Loans

Loans (Liability)

Loan from Partners

Unsecured

Loan from Manager

Miscellaneous Preliminary Expenses

None

Expenses (Asset)

General Reserves

Reserves None Reserves & Surplus

Retained Earnings

Types of Vouchers and its use

FUNCTION

KEYS/

VOUCHER TYPE USE OF VOUCHER

SHORTCUT

KEYS

RECEIPT For recording Cash or Cheque received F4

PAYMENT For recording payments by Cash or Cheque F5

SALES For recording Cash and Credit Sales F6

PURCHASE For recording Cash and Credit purchase of goods F7

CONTRA For recording Deposits to bank or Withdrawals from bank F8

For recording credit purchase of assets, rectification/

JOURNAL F9

adjustment entries

SALES RETURN For recording return of goods by customer Ctrl + 1

PURCHASE

RETURN

For recording return of goods to supplier Ctrl + 2

CREDIT NOTE For recording reduction in price charged to a customer Ctrl + 3

DEBIT NOTE For recording reduction in price given by a supplier Ctrl + 4

+2 Accountancy

Plus Two Accountancy Page No. 33

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

Steps in Voucher Entry

(i) Select appropriate voucher from Voucher menu

(ii) Enter Voucher number and Date

(iii) Select Debit account name and enter Debit amount

(iv) Select Credit account name and enter Credit amount

(v) Save the Voucher

REPORTS

Report menu is used to view reports such as Ledger, Trial balance, Balance

Sheet, Profit & Loss A/c, List of accounts etc...

Steps to display Trial Balance

GNUKhata → Report → Trial Balance → Set date → View

Steps to display Profit & Loss A/c

GNUKhata → Report → Profit & Loss Account → Set date → View

Steps to display Balance Sheet

GNUKhata → Report → Balance Sheet → Set date → View

Steps to display Ledger A/c

GNUKhata → Report → Ledger → Select Account → Set date → View

Choose the correct answer

1. Which of the following is not a system generated ledger account in GNUKhata

(a) Opening Stock (b) Closing Stock (c) Cash (d) Profit & Loss A/c

Answer : Cash

2. Which of the following vouchers is used to make rectification entries

(a) Receipt (b) Payment (c) Journal (d) Sales

Answer : Journal

3. In GNUKhata accounting software, Office Furniture A/c comes under ......... Group.

(a) Fixed Assets (b) Current Assets (c) Loans(Asset) (d) Investments

Answer : Fixed Assets

4.Which of the following is a system generated ledger account in GNUKhata.

(a) Opening Stock (b) Stock at the beginning

(c) Closing Stock (d) All of these

Answer : All of these

5. Deposits to Bank are recorded by using ............ type of voucher.

(a) Payment (b) Receipt

(c) Contra (d) Journal

Answer : Contra

+2 Accountancy

Plus Two Accountancy Page No. 34

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

Chapter – 6

Database Management System

DATABASE

A database is an organised collection of data. Data is always organised in data table

consisting of rows and columns.

DATABASE MANAGEMENT SYSTEM (DBMS)

It is a software application that allows the creation, storage, updation of databases.

Examples for DBMS Software

MS Access, LibreOffice Base, Oracle, MY SQL

COMPONENTS OF DBMS

Database Management system consists of Data, hardware, software and users.

1. Data: Data means facts. It is the raw material for information i.e processed data are

called information.

2. Hardware: Hardware consists of input/output devices, memory, processors etc.

3. Software: It operates the hardware and interacts with users. With the help of hardware

we store data into hard disk, update it, edit it and retrieve it.

4. Users: Users are the persons who seek the information from the database.

LibreOffice Base

It is one of the popularly used Database Management System (DBMS) to create, store and

manage database. The default extension of LibreOffice Base files is.odb.

LibreOffice Base components/ objects

1. Tables – Table is used for data storage. It consists of data logically arranged in rows

and columns

2. Queries –It is used to extract , append and modify data from a database.

SQL( Structured Query Language) is most widely used language to handle queries

3. Forms - It allows the user for entering data to a database file. The interface allows the

user to input , retrieve and manipulate data.

4. Reports - This is used to create various reports by using the data from tables and

queries. It is used to present selected set of contents in a format.

Creating Table in Design View

Steps

1. Click the object Tables from Database panel.

2. Click Create Table in Design View in Tasks area

3. Enter Field Name, Field Type, Filed Properties

+2 Accountancy

Plus Two Accountancy Page No. 35

COMMERCE RESOURCE BLOG

Downloaded from hsscommerce.blogspot.com

ORUKKAM 2022-2023

ORUKKAM 2022-23 _ ALAPPUZHA

4. Set primary key

5. Save the table by giving a suitable name.

Choose the correct answer

1. Which of the following is used to retrieve information from a database

(a) Tables (b) Queries (c) Forms (d) Reports

Answer : Queries

2. SQL indicates

(a) Structured Query Language (b) Secured Question Language

(c) Standard Queue Language (d) Smart Query Language

Answer : Structured Query Language

3. Which among the following is used to extract, append and modify data from

database.

(a) Table (b) Forms (c) Queries (d) Reports

Answer : Queries

4. ............. helps to present the information stored in database in the required format.

(a) Table (b) Queries

(c) Forms (d) Reports

Answer : Reports

5. The field that uniquely identifies each record is called

(a) Foreign key (b) Normal key

(c) Primary key (d) Sub key

Answer : Primary key

വിജയാശംസകൾ

+2 Accountancy

Plus Two Accountancy Page No. 36

COMMERCE RESOURCE BLOG

You might also like

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- Study Material CH.-1 Fundamentals of Partnership 2023-24Document28 pagesStudy Material CH.-1 Fundamentals of Partnership 2023-24vsy9926No ratings yet

- UntitledDocument22 pagesUntitledAayush TareNo ratings yet

- Chapter 6: Appropriation of Profits: Rohit AgarwalDocument4 pagesChapter 6: Appropriation of Profits: Rohit AgarwalbcomNo ratings yet

- 780 MS Financial Accounting XIIDocument9 pages780 MS Financial Accounting XIIAjay YadavNo ratings yet

- Unit V PartnershipDocument11 pagesUnit V PartnershipMUDITSAHANINo ratings yet

- Accounting For Partnership Firms - Fundamentals 2021Document183 pagesAccounting For Partnership Firms - Fundamentals 2021JPS J100% (1)

- Class Xii Summer Holiday Homework All MergedDocument97 pagesClass Xii Summer Holiday Homework All MergedRevathi KalyanasundaramNo ratings yet

- ACCOUNTANCY (CA) Answer Key Kerala +2 Annual Exam March 2020Document7 pagesACCOUNTANCY (CA) Answer Key Kerala +2 Annual Exam March 2020soumyabibin573No ratings yet

- Partnership Formation Partnership AccountingDocument14 pagesPartnership Formation Partnership AccountingJesseca JosafatNo ratings yet

- Retiremnet of A Partner - Ashiq MohammedDocument22 pagesRetiremnet of A Partner - Ashiq MohammedAshiq MohammedNo ratings yet

- 12 Accounts Imp Ch1Document22 pages12 Accounts Imp Ch1Tushar Tyagi100% (1)

- Chapterwise Theory Accounts by Sunil Panda - 240227 - 171656Document191 pagesChapterwise Theory Accounts by Sunil Panda - 240227 - 171656kawaljeetsingh121666No ratings yet

- Study MaterialDocument187 pagesStudy MaterialTanisha Tibrewal100% (1)

- Accounting 12Document140 pagesAccounting 12sainimanish170gmailc0% (2)

- Dissolution of PartnershipDocument17 pagesDissolution of PartnershipJASKARANNo ratings yet

- Chapters 1 and 2Document36 pagesChapters 1 and 2Qing ShiNo ratings yet

- FOW 9 - PA - Notes Session 2Document15 pagesFOW 9 - PA - Notes Session 223006022No ratings yet

- Fin Reporting and FSA-fund Flow Statment 6th Sem by VS (Vinay Shaw0 For MorningDocument12 pagesFin Reporting and FSA-fund Flow Statment 6th Sem by VS (Vinay Shaw0 For MorningSarfraz AhmedNo ratings yet

- ACC Assignment Questions Extra PractiseDocument20 pagesACC Assignment Questions Extra Practisesikeee.exeNo ratings yet

- Accountancy 12 English Main PDFDocument173 pagesAccountancy 12 English Main PDFAshu SinghNo ratings yet

- Assignment 1567156844 SmsDocument20 pagesAssignment 1567156844 SmsJapneet SidhuNo ratings yet

- 1271 XII Accountancy Study Material Supplementary Material HOTS and VBQ 2014 15 PDFDocument380 pages1271 XII Accountancy Study Material Supplementary Material HOTS and VBQ 2014 15 PDFBalaji TkpNo ratings yet

- Final Account 2020Document30 pagesFinal Account 2020Viransh Coaching ClassesNo ratings yet

- Mba - Iii Sem Mergers & Acquisitions - MF0002 Set - 2Document16 pagesMba - Iii Sem Mergers & Acquisitions - MF0002 Set - 2Dilipk86No ratings yet

- S Y J C Accounts Model Question Paper For Board Exam No 4 2009 - 2010Document6 pagesS Y J C Accounts Model Question Paper For Board Exam No 4 2009 - 2010AMIN BUHARI ABDUL KHADER100% (1)

- Corporate Finance - IDocument43 pagesCorporate Finance - Ivaibhav khuranaNo ratings yet

- Accountancy 12 KVS Study Material 2024Document79 pagesAccountancy 12 KVS Study Material 2024Parth AgrawalNo ratings yet

- Accounting Principles 10th Edition Weygandt Kimmel Chapter 4 and 5Document14 pagesAccounting Principles 10th Edition Weygandt Kimmel Chapter 4 and 5NiizamUddinBhuiyan100% (1)

- Part 1 Partnership BasicDocument11 pagesPart 1 Partnership BasicSagar YadavNo ratings yet

- ACCY901 Accounting Foundations For Professionals: Topic 3 Accrual Accounting and Adjusting EntriesDocument35 pagesACCY901 Accounting Foundations For Professionals: Topic 3 Accrual Accounting and Adjusting Entriesvenkatachalam radhakrishnan100% (1)

- Accounting Imp 100 Q'sDocument159 pagesAccounting Imp 100 Q'sVijayasri KumaravelNo ratings yet

- Changes in A PartnershipDocument18 pagesChanges in A PartnershipHadi HarizNo ratings yet

- Accounting For Partnership - UnaDocument13 pagesAccounting For Partnership - UnaJastine Beltran - PerezNo ratings yet

- Partnership AccountsDocument26 pagesPartnership Accountsoneunique.1unqNo ratings yet

- Cbse Class XII Accountancy Sample Paper 1: Time:3 Hrs Max. Marks: 80Document6 pagesCbse Class XII Accountancy Sample Paper 1: Time:3 Hrs Max. Marks: 80Sukhman DhillonNo ratings yet

- Acct Theory Investments 1 and Cash Spring 2017Document3 pagesAcct Theory Investments 1 and Cash Spring 2017Joshna KNo ratings yet

- Exam Revision - 3 & 4 SolDocument6 pagesExam Revision - 3 & 4 SolNguyễn Minh ĐứcNo ratings yet

- Acounts Papaer II Preliminary Examination 2008 - 09Document5 pagesAcounts Papaer II Preliminary Examination 2008 - 09AMIN BUHARI ABDUL KHADERNo ratings yet

- Accounting For PartnershipDocument15 pagesAccounting For Partnershipnagesh dashNo ratings yet

- Accounting For PartnershipsDocument43 pagesAccounting For PartnershipsAqibNo ratings yet

- 23 PartnershiptheoryDocument10 pages23 PartnershiptheorySanjeev MiglaniNo ratings yet

- AccountancyDocument6 pagesAccountancyManu BabuNo ratings yet

- ACC 412 Specialised Accounting IDocument148 pagesACC 412 Specialised Accounting IStephen YigaNo ratings yet

- Partnership Operations: Accounting Cycle of A PartnershipDocument13 pagesPartnership Operations: Accounting Cycle of A Partnershipred100% (1)

- Fundamentals QuestionsDocument23 pagesFundamentals Questionsdhanvi1259No ratings yet

- Chapter 4: Joint Venture: Rohit AgarwalDocument4 pagesChapter 4: Joint Venture: Rohit Agarwalbcom100% (2)

- Goodwill & PSR Final Revision SPCCDocument43 pagesGoodwill & PSR Final Revision SPCCHeer SirwaniNo ratings yet

- Sample Question Paper IN AccountancyDocument7 pagesSample Question Paper IN AccountancyRahul TyagiNo ratings yet

- FA1 Exercises 2022Document19 pagesFA1 Exercises 2022baothi298No ratings yet

- Concept Map Part FormationDocument4 pagesConcept Map Part FormationSamNo ratings yet

- Class 12 - Quarterly Examination Q FINALDocument11 pagesClass 12 - Quarterly Examination Q FINALsubbuNo ratings yet

- Prepratory Material - AFMDocument39 pagesPrepratory Material - AFMRUTHVIK NETHANo ratings yet

- Exam Revision - Chapter 3 4Document6 pagesExam Revision - Chapter 3 4Vũ Thị NgoanNo ratings yet

- Fundamantal of Partnership PPT As On 21 12 2020Document50 pagesFundamantal of Partnership PPT As On 21 12 2020jeevan varma100% (1)

- Cbse Sample Papers For Class 12 Accountancy With Solution PDFDocument24 pagesCbse Sample Papers For Class 12 Accountancy With Solution PDFVicky PawarNo ratings yet

- 01 Accounting StatementsDocument4 pages01 Accounting StatementsTijana DoberšekNo ratings yet

- 1 Accounting For Partnership Basic Cionsiderations and FormationDocument83 pages1 Accounting For Partnership Basic Cionsiderations and FormationLheia Micah De CastroNo ratings yet

- Lesson 1 To 5-1Document3 pagesLesson 1 To 5-1Aayush PatelNo ratings yet

- 12 Accountancy Lyp 2018Document34 pages12 Accountancy Lyp 2018Ashish GangwalNo ratings yet

- Roxtec R EMC TransitDocument2 pagesRoxtec R EMC TransitvairavelavanNo ratings yet

- Reservation Agreement 13 04 16Document3 pagesReservation Agreement 13 04 16Snooway Bong Duoble JjNo ratings yet

- 2007 Full SpecbookDocument1,080 pages2007 Full SpecbookGuillermo LuchinNo ratings yet

- Business Studies Report Structure HelpDocument6 pagesBusiness Studies Report Structure HelpSamira.HawliNo ratings yet

- Stop Smoking ConsultingDocument16 pagesStop Smoking ConsultingKazim AdilNo ratings yet

- Accounting Practices of MSMEs in Quezon ProvinceDocument12 pagesAccounting Practices of MSMEs in Quezon ProvinceAMNo ratings yet

- Malunggaling Churros Business PlanDocument10 pagesMalunggaling Churros Business PlanPrincess Elizabeth ArañezNo ratings yet

- 3i's CHAPTER 1 EXAMPLEDocument14 pages3i's CHAPTER 1 EXAMPLEVenj CreagNo ratings yet

- AS NZS ISO 14001-1996 Environmental Management Systems - SpeDocument24 pagesAS NZS ISO 14001-1996 Environmental Management Systems - SpeKrunalNo ratings yet

- Ekasyong Pantahanan at Pangkabuhayan (EPP) : Agriculture Quarter 1 Week 8Document8 pagesEkasyong Pantahanan at Pangkabuhayan (EPP) : Agriculture Quarter 1 Week 8archie v. ninoNo ratings yet

- Managing A Successful Computing ProjectDocument78 pagesManaging A Successful Computing ProjectJunaid FarooqNo ratings yet

- Services Haffmans BrochureDocument6 pagesServices Haffmans BrochureLaura Elianne QuirogaNo ratings yet

- Student Trading Guide - IntroductionDocument39 pagesStudent Trading Guide - IntroductionB.R SinghNo ratings yet

- Healthcare Marketing (Pre Read)Document20 pagesHealthcare Marketing (Pre Read)Himadri MamgainNo ratings yet

- Inventory ModelsDocument9 pagesInventory ModelshavillaNo ratings yet

- MIL CPI IW May 2021 EDocument1 pageMIL CPI IW May 2021 EAmit BharambeNo ratings yet

- Financial Statement 2020-21Document7 pagesFinancial Statement 2020-21celiaNo ratings yet

- Business Law QuizDocument2 pagesBusiness Law QuizDaniyal AliNo ratings yet

- Quest - BourcherDocument24 pagesQuest - BourchercchlouisNo ratings yet

- Social Media MarketingDocument16 pagesSocial Media Marketingiifl data100% (1)

- Journal Entries Module 1Document7 pagesJournal Entries Module 1Jervin Maon Velasco100% (1)

- Pemeriksaan Full Paper Icms-2023 UnrikaDocument7 pagesPemeriksaan Full Paper Icms-2023 UnrikaendtsnackNo ratings yet

- Amul Mission and VisionDocument5 pagesAmul Mission and VisionHarish Phalke100% (2)

- Individual MKT304Document21 pagesIndividual MKT304ducbmhs163293No ratings yet

- Commission and RoyaltiesDocument2 pagesCommission and Royalties08chloe.tanNo ratings yet

- HRBP ManualDocument63 pagesHRBP ManualRAHUL DAM100% (2)

- CW2 Sample 1Document12 pagesCW2 Sample 1MaryamNo ratings yet

- Snapdeal: Risks and Rewards of Celebrity Endorsement: IBS Center For Management ResearchDocument3 pagesSnapdeal: Risks and Rewards of Celebrity Endorsement: IBS Center For Management ResearchNontsikelelo MazibukoNo ratings yet

- UntitledDocument26 pagesUntitledTanvi RAMSEWAKNo ratings yet

- Customer Satisfaction Review of LiteratureDocument2 pagesCustomer Satisfaction Review of LiteratureNishaNo ratings yet