Professional Documents

Culture Documents

Tybms Sem5 RM Nov19

Tybms Sem5 RM Nov19

Uploaded by

Kritika SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tybms Sem5 RM Nov19

Tybms Sem5 RM Nov19

Uploaded by

Kritika SinghCopyright:

Available Formats

, ' pape""y;'l3,Li.T':;:ry";II.T::l*.

r""'

I

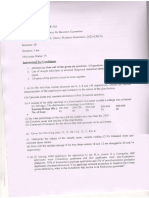

Marks: 75

Time: 2.30 Hrs

NOTE: 1'Q1 is comPulsory

2. Q2 to Q5 having internal oPtions

3. rig;;;io *re Jignt indicate

full marks' i,l,,,Ilt^l

+. Stit" Your assumPtions clearlY oL\

or false (any 8) \1, .

Q1.A State whether the following statements are true N:\*" r--

-"; )

i. Beta measures volatility or risk . ^ tund has exceeded the exp'ectations

and

ii. tf Jensen,s Atp;;i;;;ritir" , it reflects that the Mutual

and vice versa

oriperform"d it-'" tututtt"t porlfolio a firm'

tu" titt itp""1 tn3 fytyrl cash flows of

iii. Transaction exposure in Exchange

th" is eligible to buv or sell the underlying asset

iv. Exercise price is a price at wh]gh "pti";;;;;. an asset's tu*ot be predicted using the

ift" iatl"

v. ApT is an asset pricing model based ",, 'ftat "iu'n

relationship bttrit;; ttat asset ad many common risk factors

Operational Management

vi. The third line of Defense includes stakeholder to the organization

vii. An end user of the project's outcom€

;;;;;i;;1;fual

ifo*t i" tfr" holder if it were exercised immediately

viii. At the money Option leads to negatiu.'#fr (potential impact)

't one dimensional assessment

ix. Enterprise nirt lunug.ment has people in the organtzatron

of different

x. Risk Measur.,r."i i, ihe coilective responsibility

a El$atchgg folqy

Call and Put

ffiTranslation

ffig. traded @eentwoparties

(08)

the Risk Management Process

- -' A) Define the term Risk? Explain

o ?)

and Techniq*?*

(07)

ejE*plain Arbitrage theory

(08)

C)CalculatetheexpectedreturnsandStandarddeviationofStockAandStockB

i-fn motinn of stock A and itock B under the ible states of nature

I ne rollo D 6A' Return'B'

State ofNature ProbabilitY

5% 0%

0,10

1

1nO/^ 8%

) 0.30

18%

0.50 15%

) 20% 26%

4 0.1u (07)

Dtftfitffidtn Risk Register

Page 1 of2

76575

6AF53323CCA72AA 1 656 1 3485FA002989

Paper / Subject Code: 46015 / Finance:Risk Management

- '' :'' ": ' Risk and the three lines of Defense (08)

" 'q3) A) Exglain

B) Explain the challenges of Risk assurance in an organization (07)

'r oR

C).Calculate Beta for each of the following two securities from the given information (15)

Year A.Ltd(%) B.Ltd (%) Market Portfolio (%)

1 10 t4 12

2 6 2 5

3 t3 19 18

4 -4 -12 -8

5 13 11 10

6 t4 t9 t6

a

7 4 J 7

8 l8 20 15

9 24 23 30

10 22 16 25

(08)

Q.4) A) What are the good practice principles for risk assurance?

B) Define Stakeholder and explain the types of project stakeholders (07)

C) Explain the powers, functions and duties of IRDA (08)

D) What is Actuaries? Explain the role, duties and obligations of Actuaries (07)

Q.5) A) Suppose an insurer estimates that an insurance contract exposure has the

following loss

distribution: (08)

Loss (in Rs.) Probability

20.00,000 0.003

9,00,000 0.010

2,00,000 0,050

50,000 0.847

Assume that administrative expenJes; which are paid irn$gdiately, equal 20Yo of the expected claim cost.

Furtheiasiume'ihattt i, type of policy requires a profit loading equal to I l% of the expected claim cost.

Calculate the fair premium

B) What is Reinsurance? State its types (07)

Q.5) Write short notes on (Any three)

(1 s)

a) Risk Exposure Analysis

b) Derivatives

c) Risk Govemance

d) Bancassurance

e) Enterprise Risk Management Matrix

,<* x {< *** * i(* *

7,6sis, Page 2 of 2

6,4F5 33 23 CCA 72 1\Al 65 613 4B5 FA002989

You might also like

- Strategic Analysis of General ElectricDocument6 pagesStrategic Analysis of General ElectricShamim Waheed100% (2)

- Review Capital BudgetingDocument22 pagesReview Capital BudgetingJamesno LumbNo ratings yet

- Process Excellence HandbookDocument107 pagesProcess Excellence Handbookadillawa100% (7)

- CCP Practice Test PDFDocument20 pagesCCP Practice Test PDFSanthosh KannanNo ratings yet

- Topic 8Document44 pagesTopic 86doitNo ratings yet

- Investment and Portfolio Management PQ1 PRELIM EXAMDocument5 pagesInvestment and Portfolio Management PQ1 PRELIM EXAMKayezel Kriss100% (3)

- Forecasting Volatility in the Financial MarketsFrom EverandForecasting Volatility in the Financial MarketsRating: 4 out of 5 stars4/5 (1)

- The Seven Deadly Sins PDFDocument12 pagesThe Seven Deadly Sins PDFshama vidyarthy100% (1)

- 2011 FRM Practice ExamDocument119 pages2011 FRM Practice ExambondbondNo ratings yet

- Chapter 8Document61 pagesChapter 8Mhmad Mokdad100% (4)

- RMC No. 121-2020Document8 pagesRMC No. 121-2020Raine Buenaventura-EleazarNo ratings yet

- Mushroom Project - Part 1Document53 pagesMushroom Project - Part 1Seshadev PandaNo ratings yet

- Container Freight Station (CFS)Document20 pagesContainer Freight Station (CFS)prasanna_lad1133% (3)

- TNT' T Flhilcvt: Cott Hof, L Esitar LleDocument5 pagesTNT' T Flhilcvt: Cott Hof, L Esitar Llecezyyyyyy100% (1)

- Fabv 2018 Board Question Paper Sem 5Document11 pagesFabv 2018 Board Question Paper Sem 5ASHISH NYAUPANENo ratings yet

- Do Not Look Back Risk 1998 FinalDocument4 pagesDo Not Look Back Risk 1998 FinalSowmiya KNo ratings yet

- Errors and Accounting ChangesDocument8 pagesErrors and Accounting ChangesAndrew Benedict PardilloNo ratings yet

- C:a I Iqth. Iri Aidsnli: Tran3formDocument6 pagesC:a I Iqth. Iri Aidsnli: Tran3formJeyakumar NarasingamNo ratings yet

- Software Architecture & Design Patterns T-2 NOV-2019 Sem-I (B.Tech IT)Document1 pageSoftware Architecture & Design Patterns T-2 NOV-2019 Sem-I (B.Tech IT)PranjalNo ratings yet

- Esti. Project CFsDocument3 pagesEsti. Project CFsMinu kumariNo ratings yet

- Econ Art 1Document19 pagesEcon Art 1Misganaw MarewNo ratings yet

- Tybbi Sem5 Ibf Nov19Document2 pagesTybbi Sem5 Ibf Nov19Vishakha VishwakarmaNo ratings yet

- 1 Summer 2016 PDFDocument86 pages1 Summer 2016 PDFVarun sawantNo ratings yet

- (Freory Accounts: Assets Commodities I N-'Rentory Discouni: Gross GrossDocument12 pages(Freory Accounts: Assets Commodities I N-'Rentory Discouni: Gross GrossPhilip CastroNo ratings yet

- Certificate Calitate - SemnatDocument15 pagesCertificate Calitate - SemnatAyush GoyalNo ratings yet

- I' 2' 3. 4. 5, R, 7. B' 9. Equation.: Entity"-To Why ItDocument2 pagesI' 2' 3. 4. 5, R, 7. B' 9. Equation.: Entity"-To Why ItShahid MahmudNo ratings yet

- Sem III Stats - CBCS 2020 (OBE)Document10 pagesSem III Stats - CBCS 2020 (OBE)Jeva AroraNo ratings yet

- Toa 09.15.12Document16 pagesToa 09.15.12Philip CastroNo ratings yet

- RMC No 130-2016 PDFDocument7 pagesRMC No 130-2016 PDFJohny TumaliuanNo ratings yet

- Amul Business ModelDocument8 pagesAmul Business ModelSʜʌʜwʌj HʋsʌɩŋNo ratings yet

- Maths Mark Schem 2006 9164-2Document16 pagesMaths Mark Schem 2006 9164-2Tonderai MayisiriNo ratings yet

- Insulation Resistance TestDocument43 pagesInsulation Resistance TestatchutNo ratings yet

- Vko Recel Mol T Y - S. Ccéf C Ofxl ' Iots: T L - Oj J) .J (5, (Dear Chi Eflust I Ce and Associ at E Justi CesDocument11 pagesVko Recel Mol T Y - S. Ccéf C Ofxl ' Iots: T L - Oj J) .J (5, (Dear Chi Eflust I Ce and Associ at E Justi CesEquality Case FilesNo ratings yet

- Accounting AndFinancial Management 2015-16Document4 pagesAccounting AndFinancial Management 2015-16Ashish AgarwalNo ratings yet

- 45 Tikrikilla MeghDocument5 pages45 Tikrikilla MeghAtul YadavNo ratings yet

- Paper .Rne: of Tlisclosc Inforlratir:nDocument7 pagesPaper .Rne: of Tlisclosc Inforlratir:nYuh Deff JopNo ratings yet

- Investment Analysis and Portfolio Management: Gareth MylesDocument29 pagesInvestment Analysis and Portfolio Management: Gareth MyleshoalongkiemNo ratings yet

- Techniques For Portfolio MGT TUTORIAL QSNDocument2 pagesTechniques For Portfolio MGT TUTORIAL QSNkelvinyessa906No ratings yet

- MBA/M-l7: Analysis ManagementDocument2 pagesMBA/M-l7: Analysis ManagementGURJARNo ratings yet

- Cape Mob 2012 U1 P1Document8 pagesCape Mob 2012 U1 P1Ronelle VincentNo ratings yet

- 078 Bhadra All QuestionsDocument9 pages078 Bhadra All QuestionsNabin KalauniNo ratings yet

- ,,R/1O, H/T Vflo ('T: "Fib I O,.",-OsureDocument6 pages,,R/1O, H/T Vflo ('T: "Fib I O,.",-OsureZach EdwardsNo ratings yet

- F T I '"". U .: DisclosureDocument4 pagesF T I '"". U .: DisclosureZach EdwardsNo ratings yet

- Ventomatic Instructions & Troubleshooting For Bagging MachineDocument31 pagesVentomatic Instructions & Troubleshooting For Bagging MachineAhmedNo ratings yet

- Ieiuseo@ul"riato - TR 1. .+: Sotk, Co"r"eDocument2 pagesIeiuseo@ul"riato - TR 1. .+: Sotk, Co"r"eHusain PoonawalaNo ratings yet

- Financial Intelligence Center - CompressedDocument22 pagesFinancial Intelligence Center - CompressedAbata BageyuNo ratings yet

- #Ih" ."Rit" It "O : " 'D"ingDocument1 page#Ih" ."Rit" It "O : " 'D"ingJp CombisNo ratings yet

- A147314 PDFDocument116 pagesA147314 PDFEnrique ValenzuelaNo ratings yet

- Project: Bill IsDocument8 pagesProject: Bill IsN.J. PatelNo ratings yet

- Variable Exam 2Document13 pagesVariable Exam 2Claudine Puyao100% (1)

- Chapter 11 Project Risk ManagmentDocument24 pagesChapter 11 Project Risk ManagmentFutaim RashidNo ratings yet

- Risk Analysis in Capital Budgeting PDFDocument33 pagesRisk Analysis in Capital Budgeting PDFkeshav RanaNo ratings yet

- TL M Ry: Distributed: C. Outstanding:....... / C. No - Otsslettersoutstanding:....... ."/.. E. Issuecl:.Document1 pageTL M Ry: Distributed: C. Outstanding:....... / C. No - Otsslettersoutstanding:....... ."/.. E. Issuecl:.Osman BanguraNo ratings yet

- Risk ManagementDocument2 pagesRisk ManagementPavan BasundeNo ratings yet

- Economics: 1. (A) - ' - FT/ U (Xi) T:L) LT (Ii/ ."T-L - . - H Is Tut P: (A, .T 'I - Ldo:) 2.Document2 pagesEconomics: 1. (A) - ' - FT/ U (Xi) T:L) LT (Ii/ ."T-L - . - H Is Tut P: (A, .T 'I - Ldo:) 2.Vikram SharmaNo ratings yet

- RISK AND RATES OF RETURN - Part 2Document14 pagesRISK AND RATES OF RETURN - Part 2Onalenna MdongoNo ratings yet

- Tybcaf Sem-VDocument29 pagesTybcaf Sem-Vkatejagruti3No ratings yet

- Exercise CapmDocument3 pagesExercise Capmputerinayli02No ratings yet

- PM For Bex&bct MergedDocument26 pagesPM For Bex&bct MergedSammanNo ratings yet

- Checklist ForkliftDocument2 pagesChecklist ForkliftPRINGGO ADI SASONGKO, S.TNo ratings yet

- WhatsApp Image 2023-11-21 at 12.21.27 PMDocument2 pagesWhatsApp Image 2023-11-21 at 12.21.27 PMChetan MaretiNo ratings yet

- "Rffu$ffiffi . T:G: Ffir+ /'Document1 page"Rffu$ffiffi . T:G: Ffir+ /'adils440% (1)

- Question PaperDocument3 pagesQuestion PaperGnana KumarNo ratings yet

- DIA'PHY1-23-Report On Investigations On The Implementation of The Intelligent Transport Monitoring System by M's Joint Stock Company Global SecurityDocument48 pagesDIA'PHY1-23-Report On Investigations On The Implementation of The Intelligent Transport Monitoring System by M's Joint Stock Company Global SecurityEdgar Mugarura100% (1)

- Capital Budgeting TechniquesDocument11 pagesCapital Budgeting TechniquesDip KunduNo ratings yet

- 2018 ICL PaperDocument1 page2018 ICL PaperParitosh MahalNo ratings yet

- MIDTERM EXAMINATION in ENTREPRENEURSHIPDocument3 pagesMIDTERM EXAMINATION in ENTREPRENEURSHIPjafNo ratings yet

- Solved Platinum Inc Has Determined Its Taxable Income As 215 000 BeforeDocument1 pageSolved Platinum Inc Has Determined Its Taxable Income As 215 000 BeforeAnbu jaromiaNo ratings yet

- Chan & Lakonishok 2004 Value and Growth Investing Review and UpdateDocument17 pagesChan & Lakonishok 2004 Value and Growth Investing Review and Updateshiva agrawalNo ratings yet

- Analysis of TSPDL On The Basis of The Various Matrices : Matrices: A D Little, Ge/ Mckinsey/ BCG Product PortfolioDocument13 pagesAnalysis of TSPDL On The Basis of The Various Matrices : Matrices: A D Little, Ge/ Mckinsey/ BCG Product Portfoliolyf4funNo ratings yet

- Discussion Questions For Enterprise Rent-A-CarDocument1 pageDiscussion Questions For Enterprise Rent-A-CarDeepankur Malik100% (1)

- Sarwat 2Document7 pagesSarwat 2Abeer ArifNo ratings yet

- Rift Valley University Chiro Campus: Collega of Business and EconomicsDocument35 pagesRift Valley University Chiro Campus: Collega of Business and EconomicsBobasa S AhmedNo ratings yet

- Itai BrezisDocument14 pagesItai Brezisreintobing55No ratings yet

- Reducing Waiting Time in KFC's Drive Thru: Instructor: Dr. Mohammed BasingabDocument10 pagesReducing Waiting Time in KFC's Drive Thru: Instructor: Dr. Mohammed BasingabMohammad KashifNo ratings yet

- Daily Settlement Price Methodology - Exchange Traded OptionsDocument3 pagesDaily Settlement Price Methodology - Exchange Traded OptionsDiego BittencourtNo ratings yet

- Six Sigma DMAIC Project To Improve The Performance of An Aluminum Die Casting Operation in PortugalDocument26 pagesSix Sigma DMAIC Project To Improve The Performance of An Aluminum Die Casting Operation in PortugalUNITED CADD100% (1)

- Amortization vs. Depreciation - What's The Difference - InvestopediaDocument4 pagesAmortization vs. Depreciation - What's The Difference - InvestopediaBob KaneNo ratings yet

- Caiib Exam Syllabus 2021Document4 pagesCaiib Exam Syllabus 2021senthil kumar nNo ratings yet

- 12 May 2008 The Report by The General Inspection of Societe GeneraleDocument71 pages12 May 2008 The Report by The General Inspection of Societe GeneraleMagdalena NieśpielakNo ratings yet

- Objectives: To Study The Market Mapping of NecktiesDocument4 pagesObjectives: To Study The Market Mapping of NecktiesMahek SisodiaNo ratings yet

- Pas 40 Investment PropertyDocument6 pagesPas 40 Investment PropertyElaiza Jane CruzNo ratings yet

- ML Supernova FinalDocument9 pagesML Supernova Finalsreekuma911100% (1)

- Business Model CanvasDocument2 pagesBusiness Model Canvasrubella zaidNo ratings yet

- Report On Summer Internship Project "Development of Debongo Brand"Document76 pagesReport On Summer Internship Project "Development of Debongo Brand"Hasna HarisNo ratings yet

- Chapter 20 Introduction To System Development and System AnalysisDocument7 pagesChapter 20 Introduction To System Development and System AnalysisAmara PrabasariNo ratings yet

- Cash Flow Projections - TemplateDocument3 pagesCash Flow Projections - TemplateAdrianna LenaNo ratings yet

- Petitioner vs. vs. Respondents Leonardo A. Amores Lauro G. Noel Constancio B. Maglana Ireneo R. Clapano, JRDocument17 pagesPetitioner vs. vs. Respondents Leonardo A. Amores Lauro G. Noel Constancio B. Maglana Ireneo R. Clapano, JRCamshtNo ratings yet

- Loss RatioDocument3 pagesLoss RatiohieutlbkreportNo ratings yet