Professional Documents

Culture Documents

Payslip For The Month of May 2023

Payslip For The Month of May 2023

Uploaded by

kumarsandeep838383Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Payslip For The Month of May 2023

Payslip For The Month of May 2023

Uploaded by

kumarsandeep838383Copyright:

Available Formats

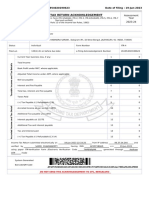

Salary Payslip for the Month of May-2023

Pay Period 01.05.2023 to 31.05.2023 HCL Technologies Ltd Luck

ABHISHEK KUMAR SHARMA

Employee ID : 51950407 Bank Name & Account No : ICICI BANK LTD 353201502326

Person ID : 51950407 Location (CWL) : Lucknow SEZ-IT01-Unit 8-4F

Designation : ASSOCIATE- BFS Department : HCL DPO VBS-VBS BFS-BFS-B

DOJ / Gender : 28.05.2023 / Male Band : E0

PAN No : KXRPS4236J Days worked in month : 30.00

PF // Pension No* : HIL EPF Trust-GN/GGN/5572/500542 LWP Current/Previous Month : 0.00/0.00

UAN No : 101394279941 Sabbatical Leave Current/Previous Mon : 0.00/0.00

Standard Monthly Salary INR Earnings INR Deductions INR

Basic Salary 13,000.00 Basic Salary 13,000.00 CF PF Monthly 201.00

HRA 3,778.00 Arr. Basic Salary 1,677.42 Ee ESI contribution 143.00

Advance Statuatory Bonus 2,158.00 HRA 3,778.00 Ee PF contribution 1,560.00

Arr. HRA 487.48

Advance Statuatory Bonus 2,158.00

Arr.Advance Statuatory Bo 278.45

Total Standard Salary 18,936.00 Gross Earnings 21,379.35 Gross Deductions 1,904.00

Net Pay 19,475.35

Income Tax Computation

Exemption U/S 10 Projected / Actual Taxable Salary Contribution under Chapter VI A Monthly Tax Deduction

Taxable Income till Pr. Month 0.00 Provident Fund 15,801.00

Current Mth Taxable income 21,379.35 Voluntary PF 0.00

Projected Standard Salary 170,424.00 June'23 0.00

Taxable Ann Perks 0.00 July'23 0.00

NPS ER contribution 0.00 August'23 0.00

Gross Salary 191,803.35 September'23 0.00

Standard Deduction 50,000.00

October'23 0.00

Exemption U/S 10 0.00

Tax on Employment (Prof. Tax) 0.00 November'23 0.00

Income under Head Salary 141,803.00 December'23 0.00

Interest on House Property 0.00

Gross Total Income 141,803.00

Agg of Chapter VI 15,801.00

Total Income 126,002.00

Tax on Total Income 0.00

Tax Credit 0.00

Health and Education cess 0.00

Tax payable 0.00

Tax deducted so far 0.00

Balance Tax 0.00 Total 15,801.00 Total 0.00

*This is a computer generated payslip and doesn't require signature or any company seal. All one time payments like PB,taxable LTA,variable pay etc will be subject to one time tax deduction at your applicable tax slab

*The current month pay slip has got generated after consideration of payroll input i.e. compensation letter, flexi declaration, one-timer payment input provided and approved transfers till 24th of this month.

*Refer PF statement in ESS (My HCL) for Pension No. Page 1 of 1

You might also like

- Understanding Homeland SecurityDocument61 pagesUnderstanding Homeland Securityjessica.taylor65596% (45)

- LAW240 NotesDocument21 pagesLAW240 NotesTengku Acher100% (2)

- Salary Slip For 30000 Per Month in IndiaDocument1 pageSalary Slip For 30000 Per Month in IndiaKurakula RamaNo ratings yet

- PDF - 933662320220722.pdf ITR 22-23Document1 pagePDF - 933662320220722.pdf ITR 22-23smpNo ratings yet

- PDF 192659360280722Document1 pagePDF 192659360280722MILTON MOHANTYNo ratings yet

- Andrew Jackson EssayDocument5 pagesAndrew Jackson Essayjulie_noble_1No ratings yet

- Account STMT XX2127 19122023Document7 pagesAccount STMT XX2127 19122023Subramania YuvaraajNo ratings yet

- 2122 ItrDocument1 page2122 ItrAjay PratapNo ratings yet

- HDFC BANK (India)Document4 pagesHDFC BANK (India)deliceplacementiNo ratings yet

- PDF 254872900180623Document1 pagePDF 254872900180623Sachin KumarNo ratings yet

- PDF 293196870250623Document1 pagePDF 293196870250623nagesh valunjNo ratings yet

- Nishar ItrDocument1 pageNishar ItrE-Ticket 40 RTNo ratings yet

- ACK - KIIPK2548R - 2021-22 - 110330000060423 ItrDocument1 pageACK - KIIPK2548R - 2021-22 - 110330000060423 Itrkhan sa bnNo ratings yet

- Itr 23-24Document1 pageItr 23-24addy01.0001No ratings yet

- Ack Aalcs4258c 2022-23 448872891271023Document1 pageAck Aalcs4258c 2022-23 448872891271023deepakNo ratings yet

- Acct Statement - XX2832 - 21032024Document9 pagesAcct Statement - XX2832 - 21032024Dhanabal rockNo ratings yet

- Rutansh Final Itr 2022-23 - 2Document1 pageRutansh Final Itr 2022-23 - 2Rutansh JagtapNo ratings yet

- Ack 657377180240723Document1 pageAck 657377180240723SRIYA GADAGOJUNo ratings yet

- Zakiriya ItDocument1 pageZakiriya Itp. r ravichandraNo ratings yet

- Salary Slip S5Document1 pageSalary Slip S5M.B TrickNo ratings yet

- India JUN-2020 ...Document1 pageIndia JUN-2020 ...laxman luckyNo ratings yet

- Form No. 16: Part ADocument7 pagesForm No. 16: Part AMithlesh SharmaNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document3 pagesItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Mohammad AliNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearAEN TRACKNo ratings yet

- S 0 Uy BVWQC LKS7 BZ 3Document15 pagesS 0 Uy BVWQC LKS7 BZ 3Insta LoginNo ratings yet

- PDFReportsDocument6 pagesPDFReportsDeeptimayee SahooNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment Yeartejeswararao ronankiNo ratings yet

- Sunil MewadaDocument1 pageSunil MewadaSteve BurnsNo ratings yet

- R 9 T RZJTMJ CHT 4 VW ZDocument5 pagesR 9 T RZJTMJ CHT 4 VW ZmukulprakashsrivastavaNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearVINAY verma100% (1)

- Paramjeet Kaur 2023-2024Document1 pageParamjeet Kaur 2023-2024thinkpadt480tNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment Yearvikas guptaNo ratings yet

- ACK660988680240723Document1 pageACK660988680240723Harsh JainNo ratings yet

- Ack Ejaps7559m 2022-23 763168490080722Document1 pageAck Ejaps7559m 2022-23 763168490080722Rashi SrivastavaNo ratings yet

- PDF 974069050240722Document1 pagePDF 974069050240722tax advisorNo ratings yet

- Statement of Account: State Bank of IndiaDocument10 pagesStatement of Account: State Bank of IndiaacscomcparandaNo ratings yet

- PDF 169223670270722Document1 pagePDF 169223670270722adhya100% (1)

- MeharwanDocument1 pageMeharwanSteve BurnsNo ratings yet

- Ambire AbhinayaDocument16 pagesAmbire AbhinayaSai CharanNo ratings yet

- ACK544968000190723Document1 pageACK544968000190723hp agencyNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment Yearehsan ahmed0% (1)

- Account Statement From 1 Apr 2021 To 31 Mar 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument12 pagesAccount Statement From 1 Apr 2021 To 31 Mar 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancesanket enterprisesNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurumahesh bhorNo ratings yet

- Statement of Account No:914010046295630 For The Period (From: 01-07-2020 To: 07-10-2020)Document6 pagesStatement of Account No:914010046295630 For The Period (From: 01-07-2020 To: 07-10-2020)santhoshNo ratings yet

- PDF 139527500310723Document1 pagePDF 139527500310723NithinNo ratings yet

- Ack Cdhpa3843f 2022-23 220950670290722Document1 pageAck Cdhpa3843f 2022-23 220950670290722rtaxhelp helpNo ratings yet

- Itr Ay 2022-23Document1 pageItr Ay 2022-23Soumya SwainNo ratings yet

- October 2022: Employee Details Payment & Leave Details Location DetailsDocument1 pageOctober 2022: Employee Details Payment & Leave Details Location DetailsPritam GoswamiNo ratings yet

- JunDocument1 pageJunkallinath nrNo ratings yet

- Ack 137988180310723Document1 pageAck 137988180310723Lakesh kumar padhyNo ratings yet

- Ack 261954020190623Document1 pageAck 261954020190623TANUJ CHAKRABORTYNo ratings yet

- PDF 691846850250723Document1 pagePDF 691846850250723Anish MishraNo ratings yet

- Statement 6590792236 20220613 152347 5Document1 pageStatement 6590792236 20220613 152347 5mohamed arabathNo ratings yet

- PDF 628846520240522Document1 pagePDF 628846520240522Narayana Rao GanapathyNo ratings yet

- Account STMTDocument4 pagesAccount STMTmunafuddin12No ratings yet

- GGGDocument13 pagesGGGDikesh JaiswalNo ratings yet

- Itr 22 23Document1 pageItr 22 23biswa chakrabortyNo ratings yet

- Ack 367661020050723Document1 pageAck 367661020050723Sivaram PopuriNo ratings yet

- PDF 438429930210822Document1 pagePDF 438429930210822peetamber agarwalNo ratings yet

- AcknowledgmentDocument1 pageAcknowledgmentSatyam MaramNo ratings yet

- Payslip 4 2021Document1 pagePayslip 4 2021Mehraj PashaNo ratings yet

- Acct Statement XX7039 12062023Document34 pagesAcct Statement XX7039 12062023Siyaram MeenaNo ratings yet

- Feb PayslipDocument1 pageFeb Payslipmishra.prashant8948No ratings yet

- Vishal Offer LetterDocument12 pagesVishal Offer Letterkumarsandeep838383No ratings yet

- Statement of Accounts - 193119891Document4 pagesStatement of Accounts - 193119891kumarsandeep838383No ratings yet

- DIGIPL00000003303 SignedDocument23 pagesDIGIPL00000003303 Signedkumarsandeep838383No ratings yet

- InvoiceDocument2 pagesInvoicekumarsandeep838383No ratings yet

- Re Kyc FormDocument1 pageRe Kyc Formkumarsandeep838383No ratings yet

- Key Fact StatementDocument4 pagesKey Fact Statementkumarsandeep838383No ratings yet

- A Project Report On TaxationDocument71 pagesA Project Report On TaxationHveeeeNo ratings yet

- DOP Guidelines AML KYC For MTSS and Forex13112018Document19 pagesDOP Guidelines AML KYC For MTSS and Forex13112018DEBADITYA CHAKRABORTYNo ratings yet

- RMC No 54-2014Document3 pagesRMC No 54-2014lktlawNo ratings yet

- Eu GMP Annex 15 PDFDocument2 pagesEu GMP Annex 15 PDFBrian0% (1)

- GR L-5405Document27 pagesGR L-5405Jani MisterioNo ratings yet

- Brief of Amicus Curiae National Federation of Independent BusinessDocument37 pagesBrief of Amicus Curiae National Federation of Independent BusinessAnonymous mYsvkYwHONo ratings yet

- Introduction To Letter of CreditDocument5 pagesIntroduction To Letter of CreditJara SadarNo ratings yet

- IPC Section 463Document6 pagesIPC Section 463SME 865No ratings yet

- Application For New EnrollmentDocument2 pagesApplication For New EnrollmentHeera KardongNo ratings yet

- Morth Delegation InvoiceDocument1 pageMorth Delegation InvoiceAshu SinghNo ratings yet

- Year Book 2014-15Document135 pagesYear Book 2014-15PRE ContractNo ratings yet

- (08.F.06.d.01) Jovellanos Vs CADocument2 pages(08.F.06.d.01) Jovellanos Vs CADar CoronelNo ratings yet

- Philosophy of Law 2023 1Document115 pagesPhilosophy of Law 2023 1alwaysalwaysfunNo ratings yet

- Tendernotice - 1 - 2020-10-02T083038.744 PDFDocument131 pagesTendernotice - 1 - 2020-10-02T083038.744 PDFPratik GuptaNo ratings yet

- Basic StructureDocument20 pagesBasic Structureshankargo100% (1)

- 16 Heirs of Tan Eng Kee V CaDocument2 pages16 Heirs of Tan Eng Kee V CafullgrinNo ratings yet

- Ministry of Company AffairsDocument12 pagesMinistry of Company AffairsDeepak ChauhanNo ratings yet

- 8 Security Bank and Trust Co. vs. RTC of ManilaDocument5 pages8 Security Bank and Trust Co. vs. RTC of Manilarho wanalNo ratings yet

- Period of Redemption: Agrarian Law L Atty. Capanas L Tanya IbanezDocument8 pagesPeriod of Redemption: Agrarian Law L Atty. Capanas L Tanya IbanezJobelleUySabusayNo ratings yet

- BMBE Form 01 - BMBE Application FormDocument1 pageBMBE Form 01 - BMBE Application FormLenin Rey PolonNo ratings yet

- Attorney Client Engagement Contract Re Antonio Cardinez (2022!12!06 03-24-29 UTC)Document1 pageAttorney Client Engagement Contract Re Antonio Cardinez (2022!12!06 03-24-29 UTC)Jaime GonzalesNo ratings yet

- Order Denying Preliminary Approval of Class Action SettlementDocument6 pagesOrder Denying Preliminary Approval of Class Action Settlementjeff_roberts881No ratings yet

- Youssef 826Document197 pagesYoussef 826Anonymous 5gPyrVCmRoNo ratings yet

- 193.aetna Casualty & Surety Company vs. Pacific Star LineDocument10 pages193.aetna Casualty & Surety Company vs. Pacific Star Linevince005No ratings yet

- Creditors Remedies Under Indian ActDocument8 pagesCreditors Remedies Under Indian ActSameerLalakiya100% (1)

- Plaridel-Surety-GR-183128-Mar-20-2017 Full TextDocument8 pagesPlaridel-Surety-GR-183128-Mar-20-2017 Full TextC SNo ratings yet

- ICT Policies of NamibiaDocument41 pagesICT Policies of NamibiaDaddie InyasisNo ratings yet