Professional Documents

Culture Documents

Income - Tax - Rates - Thresholds - and - Exemption - 2003 - 2022

Uploaded by

Derrick WalkerOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income - Tax - Rates - Thresholds - and - Exemption - 2003 - 2022

Uploaded by

Derrick WalkerCopyright:

Available Formats

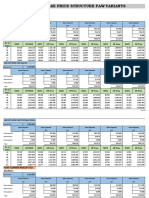

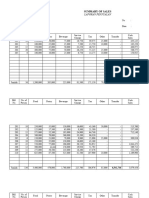

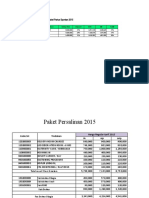

INCOME TAX RATES, THRESHOLDS AND EXEMPTIONS 2003-2022

YEAR OF 2003/4 2005 2006/7 2008 2009 2010 * 2011/12 2013/14 2015 2016** 2017** 2018-22**

ASSESSMENT

RATE OF 25% 25% 25% 25% 25% 25%, 27.5% 25% 25% 25% 25% & 25% & 25% &

INCOME TAX & 35% 30% 30% 30%

INDIVIDUAL 120,432 144,768 193,440 196,872 270,504 441,168 441,168 507,312 557,232 796,536 1,375,140 1,500,096

THRESHOLD

OTHER

EXEMPTIONS:

INDIVIDUALS 120,432 144,768 193,440 196,872 270,504 441,168 441,168 507,312 557,232 796,536 1,375,140 1,500,096

OVER 65 but not

a Pensioner

AGE RELIEF 45,000 45,000 45,000 45,000 62,500 80,000 80,000 80,000 80,000 80,000 80,000 80,000

165,432 189,768 238,440 241,872 333,004 521,168 521,168 587,312 637,232 876,616 1,455,140 1,580,096

PENSIONERS 120,432 144,768 193,440 196,872 270,504 441,168 441,168 507,312 557,232 796,536 1,375,140 1,500,096

UNDER 65

PENSIONERS' 45,000 45,000 45,000 45,000 62,500 80,000 80,000 80,000 80,000 80,000 80,000 80,000

RELIEF

165,432 189,768 238,440 241,872 333,004 521,168 521,168 587,312 637,232 876,616 1,455,140 1,580,096

PENSIONERS 120,432 144,768 193,440 196,872 270,504 441,168 441,168 507,312 557,232 796,536 1,375,140 1,500,096

OVER 65

AGE RELIEF 45,000 45,000 45,000 45,000 62,500 80,000 80,000 80,000 80,000 80,000 80,000 80,000

PENSIONERS' 45,000 45,000 45,000 45,000 62,500 80,000 80,000 80,000 80,000 80,000 80,000 80,000

RELIEF

210,432 234,768 283,440 286,872 395,504 601,168 601,168 667,312 717,232 956,536 1,535,140 1,660,096

NOTE: *Year of Assessment 2010- income tax rates applicable to statutory income above the threshold up to 5,000,000 (25%), $5,000,001-$10,000,000 (27.5%), $10,000,001 and over (35%)

** Years of Assessment 2016 and onwards, statutory income above the threshold up to $6,000,000 (25%), Income in excess of $6,000,000 yearly and $500,000 monthly (30%)

“Statutory Income” is Gross Income less all allowable deductions and exemption

“Individual threshold” is the portion of statutory income on which no tax is paid

For further information contact: 888-TAX-HELP (888-829-4357) or visit us on: Email:taxhelp@taj.gov.jm I website:www.jamaicatax.gov.jm I Facebook:www.facebook.com/jamaicatax I Twitter:@jamaicatax

You might also like

- Rekapitulasi Bulanan Puskesmas Jatirokeh Feb-18Document4 pagesRekapitulasi Bulanan Puskesmas Jatirokeh Feb-18puskesmas jatirokehNo ratings yet

- Invest MaximiserDocument301 pagesInvest MaximiseradarshsinghNo ratings yet

- Premium Chart New India Floater Mediclaim PolicyDocument1 pagePremium Chart New India Floater Mediclaim PolicyDeepan ManojNo ratings yet

- ABL Shareholding Pattern As of December 31 2015Document2 pagesABL Shareholding Pattern As of December 31 2015ARquam JamaliNo ratings yet

- Delta Life Insurance Co. Ltd. Overeseas Mediclaim Policy: PLAN - A (For Visiting Countries Excluding USA & Canada)Document1 pageDelta Life Insurance Co. Ltd. Overeseas Mediclaim Policy: PLAN - A (For Visiting Countries Excluding USA & Canada)i sumonNo ratings yet

- Profit & Loss StatementDocument16 pagesProfit & Loss StatementtaolaNo ratings yet

- Reporte Neto A Pagar-20211130142441Document4 pagesReporte Neto A Pagar-20211130142441Yessica RamirezNo ratings yet

- 972 Jeevan Umang Additional BIDocument4 pages972 Jeevan Umang Additional BIAmit GokhaleNo ratings yet

- Book 1Document5 pagesBook 1HarisCasteeloPartIINo ratings yet

- Car PricesDocument47 pagesCar PricesMajoo SonsNo ratings yet

- Kindly Change The GREEN Cells Only Kindly Change The GREEN Cells OnlyDocument14 pagesKindly Change The GREEN Cells Only Kindly Change The GREEN Cells OnlyKannammal SampathkumarNo ratings yet

- How To Budget, Save and Invest MoneyDocument18 pagesHow To Budget, Save and Invest MoneyAkramNo ratings yet

- How To Retire Before 30 - Ankur WarikooDocument7 pagesHow To Retire Before 30 - Ankur WarikooJAYA BALDEV DasNo ratings yet

- Ganar Management Services PVT LTD: Fixed Monthly SipDocument1 pageGanar Management Services PVT LTD: Fixed Monthly Sipchiranjeevi kNo ratings yet

- 037 Rutvi Porwal IMDocument2 pages037 Rutvi Porwal IMRutvi PorwalNo ratings yet

- WASTAGE Analysis: K.P.K Steel HattarDocument3 pagesWASTAGE Analysis: K.P.K Steel HattarDanish RazaNo ratings yet

- Leveling Dragon Mania LegendsDocument22 pagesLeveling Dragon Mania LegendsWendi SurdinalNo ratings yet

- Makauno Co.: Semi-Monthly Payroll August 1-15, 2020Document11 pagesMakauno Co.: Semi-Monthly Payroll August 1-15, 2020Chincel G. ANINo ratings yet

- Jadual+bayaran+bulanan+normal+ (Kas+3 00) +pri+&+seDocument1 pageJadual+bayaran+bulanan+normal+ (Kas+3 00) +pri+&+seTaqi DinNo ratings yet

- Финансовая модель СтартапаDocument107 pagesФинансовая модель СтартапаЧудо НяниNo ratings yet

- New JourneyDocument6 pagesNew JourneyEstmarg EstmargNo ratings yet

- Comparitive Financial Statement of Reliance Industries For Last 5 YearsDocument33 pagesComparitive Financial Statement of Reliance Industries For Last 5 YearsPushkraj TalwadkarNo ratings yet

- Copy of Document Sales Journal (1) (1) 1603Document11 pagesCopy of Document Sales Journal (1) (1) 1603Muhammad isaNo ratings yet

- CH Anexo Cierre Enero 24Document60 pagesCH Anexo Cierre Enero 24J'esus S'tNo ratings yet

- ASBF Calculator 2016 Final VersionDocument12 pagesASBF Calculator 2016 Final VersionMizulIkhsanMazlanNo ratings yet

- Rekap BcaDocument4 pagesRekap BcaManyol RFJNo ratings yet

- Set For Life 10pay Sales Illustration: Celebrate LivingDocument11 pagesSet For Life 10pay Sales Illustration: Celebrate LivingJane NavarezNo ratings yet

- Taller EcopetrolDocument61 pagesTaller EcopetrolIvan Camilo CORTES GONZALEZNo ratings yet

- ID Year Cash and Cash Equivalent ReceivablesDocument12 pagesID Year Cash and Cash Equivalent ReceivablesHuma HussainNo ratings yet

- ASB Calculator Advance Lite 2016 V7Document17 pagesASB Calculator Advance Lite 2016 V7Ahmad FarisNo ratings yet

- Shareholding Pattern 2018Document3 pagesShareholding Pattern 2018NazimEhsanMalikNo ratings yet

- Profit & Loss Forecast SummaryDocument44 pagesProfit & Loss Forecast SummaryJarvis100% (5)

- Kindly Change The GREEN Cells Only Kindly Change The GREEN Cells OnlyDocument14 pagesKindly Change The GREEN Cells Only Kindly Change The GREEN Cells Onlyfaizahamed111No ratings yet

- New India Floater Mediclaim Policy Premium ChartDocument2 pagesNew India Floater Mediclaim Policy Premium ChartSnehaAnilSurveNo ratings yet

- Paket Partus Spontan - Rev - NN - 29082015Document10 pagesPaket Partus Spontan - Rev - NN - 29082015Donald KumendongNo ratings yet

- Extensive Budget Set UpDocument1 pageExtensive Budget Set Uporientalhospitality100% (1)

- NSCMP - Rate ChartDocument2 pagesNSCMP - Rate ChartNeelam WaghNo ratings yet

- 1684 - Hemal K Patel - 845 - 600000Document6 pages1684 - Hemal K Patel - 845 - 600000jdchandrapal4980No ratings yet

- Certified Salary ScheduleFY2009Document1 pageCertified Salary ScheduleFY2009lhiltyNo ratings yet

- PS BalancesDocument8 pagesPS BalancesSha RonNo ratings yet

- Süt Üreti̇m - V1Document2 pagesSüt Üreti̇m - V1Gokhan TosunNo ratings yet

- Financial Goal Planning - Ankur WarikooDocument8 pagesFinancial Goal Planning - Ankur WarikooVNo ratings yet

- SPP Standard Quotation.Document1 pageSPP Standard Quotation.ChimzMughoghoNo ratings yet

- NSCMP - Rate Chart With GSTDocument2 pagesNSCMP - Rate Chart With GSTNeelam WaghNo ratings yet

- F&a Cash Collection Report For October 2022Document5 pagesF&a Cash Collection Report For October 2022Esther AkpanNo ratings yet

- Cash CollectionsDocument3 pagesCash CollectionsHabtamu TesfayeNo ratings yet

- Time Is Our Friend: The Power of Compounding Tabel Ialpha-10% Invested End of Year AGE Amount BalanceDocument8 pagesTime Is Our Friend: The Power of Compounding Tabel Ialpha-10% Invested End of Year AGE Amount Balancebp3tki PontianakNo ratings yet

- Savings Simulation TemplateDocument9 pagesSavings Simulation TemplateSubramanian GnanaguruNo ratings yet

- Enter Your Monthly Saving AmountDocument17 pagesEnter Your Monthly Saving AmountHarish ChandNo ratings yet

- Hire Purchase Price Structure Toyota Variants: ManualDocument9 pagesHire Purchase Price Structure Toyota Variants: ManualomiNo ratings yet

- Super Agent 10 Years Projections For ProspectDocument104 pagesSuper Agent 10 Years Projections For ProspectBABAN JUNIORNo ratings yet

- Or Rate Chart Excluding STDocument2 pagesOr Rate Chart Excluding STRatzNo ratings yet

- Home Financing-I Repayment Schedule (Normal) : Instalments For Completed / Under Construction / RefinancingDocument1 pageHome Financing-I Repayment Schedule (Normal) : Instalments For Completed / Under Construction / RefinancingMila AnnNo ratings yet

- Home+Financing i+Instalment+TableDocument1 pageHome+Financing i+Instalment+TableSyafi'ah BakaruddinNo ratings yet

- Inpatient Rates: Inpatient Premium Per Shared Limit Per Family Limit M (Per Person Rate) M+1 M+2 M+3 M+4 M+5 ExtraDocument5 pagesInpatient Rates: Inpatient Premium Per Shared Limit Per Family Limit M (Per Person Rate) M+1 M+2 M+3 M+4 M+5 ExtraGurvinder Mann Singh PradhanNo ratings yet

- Current AssetsDocument24 pagesCurrent AssetsArienNo ratings yet

- HDFC Scheme Calculation 2024-01-20Document4 pagesHDFC Scheme Calculation 2024-01-20pankaj_97No ratings yet

- FIRE CalculatorDocument6 pagesFIRE CalculatorAbhijit BhowmickNo ratings yet

- Gasbill 9162144733 202304 20230415124452Document1 pageGasbill 9162144733 202304 20230415124452Aamir Ali SeelroNo ratings yet

- Sesi 1 GaleriaDocument31 pagesSesi 1 GaleriafannysuwandiNo ratings yet

- Case StudyDocument2 pagesCase StudyDiana Mariz CarlosNo ratings yet

- Hidelink Men Formal Brown Genuine Leather Wallet: Grand Total 356.00Document3 pagesHidelink Men Formal Brown Genuine Leather Wallet: Grand Total 356.00Siva ReddyNo ratings yet

- Time Series Stata CommandDocument4 pagesTime Series Stata CommandSamia NasreenNo ratings yet

- TKF Xlpe Ms PVC SWB PVC Dca enDocument3 pagesTKF Xlpe Ms PVC SWB PVC Dca enSrimathi VijayakumarNo ratings yet

- De Romero Vs CA DigestDocument1 pageDe Romero Vs CA DigestmansikiaboNo ratings yet

- HeikinAshi CandleStick Formulae For MetaStockDocument5 pagesHeikinAshi CandleStick Formulae For MetaStockKhaled Hammad AhmedNo ratings yet

- Chapter 6Document5 pagesChapter 6Nermine LimemeNo ratings yet

- Segment Reporting, Decentralization, and The Balanced Scorecard Problem 1Document3 pagesSegment Reporting, Decentralization, and The Balanced Scorecard Problem 1Jessa Mae LavadoNo ratings yet

- Accounting Entries Under GSTDocument3 pagesAccounting Entries Under GSTAshish RaiNo ratings yet

- Basics of International TradeDocument20 pagesBasics of International TradeMuhdin Muhammedhussen100% (1)

- Business Proposal SVG BankDocument11 pagesBusiness Proposal SVG BankMd Sazzad KhanNo ratings yet

- Lecture 4 - Competitors and Competition Part II - 5SSMN933Document29 pagesLecture 4 - Competitors and Competition Part II - 5SSMN933Slippy GNo ratings yet

- Grade 8 Progress Test: Info@amslink - Edu.vnDocument4 pagesGrade 8 Progress Test: Info@amslink - Edu.vnNhung HoangNo ratings yet

- Go Global or Not FINALDocument8 pagesGo Global or Not FINALKavitha MarappanNo ratings yet

- CBoe Options Expiration Calendar 2019Document1 pageCBoe Options Expiration Calendar 2019Xay Tonus100% (1)

- Kaldor Model - Group 3Document12 pagesKaldor Model - Group 3Dairy Of PeaceNo ratings yet

- Applied Statistics in Business and Economics 5th Edition Doane Solutions Manual 1Document25 pagesApplied Statistics in Business and Economics 5th Edition Doane Solutions Manual 1michelle100% (35)

- Measures of Central TendencyDocument9 pagesMeasures of Central TendencyVignesh CNo ratings yet

- جدول سيولة الخزينة وفق النظام المحاسبي المالي الجديد رؤية تحليلية ديناميكية للمؤسسات الاقتصادية الجزائرية the Statement of Cash Flows According to the New Financial Accounting System a Dynamic Analytical Vision of AlgDocument14 pagesجدول سيولة الخزينة وفق النظام المحاسبي المالي الجديد رؤية تحليلية ديناميكية للمؤسسات الاقتصادية الجزائرية the Statement of Cash Flows According to the New Financial Accounting System a Dynamic Analytical Vision of AlgbdelbatoulNo ratings yet

- 19-3995 Rev2 SPX - Mixer Quotation For Ramani Investment LTD TanzaniaDocument8 pages19-3995 Rev2 SPX - Mixer Quotation For Ramani Investment LTD TanzaniaPhillip PhiriNo ratings yet

- Chapter 5Document1 pageChapter 5abcNo ratings yet

- Foreign Trade Statistics OF Bangladesh 2019-20: Volume-lIDocument164 pagesForeign Trade Statistics OF Bangladesh 2019-20: Volume-lITafsir MahmoodNo ratings yet

- Report Population Projection 2019 PDFDocument268 pagesReport Population Projection 2019 PDFRishi SinghNo ratings yet

- Mining Legislation and Mineral Development in ZambiaDocument35 pagesMining Legislation and Mineral Development in ZambiaNathan MwewaNo ratings yet

- CAPE Accounting 2006 U2 P1Document12 pagesCAPE Accounting 2006 U2 P1Pettal BartlettNo ratings yet

- Returnable Transport Packaging (RTP)Document15 pagesReturnable Transport Packaging (RTP)maniNo ratings yet

- 08-Instruction Manual Fan UnitDocument20 pages08-Instruction Manual Fan Unitvodoley634No ratings yet

- Draft Construction AgreementDocument9 pagesDraft Construction AgreementJoshua James ReyesNo ratings yet