Professional Documents

Culture Documents

GSTR 3B

Uploaded by

169 Vishal DabiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GSTR 3B

Uploaded by

169 Vishal DabiCopyright:

Available Formats

Vishal/169

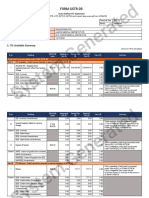

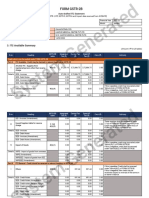

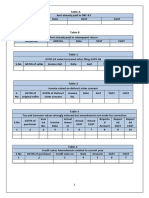

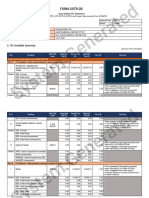

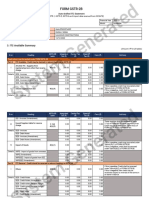

GSTR-3B

1-Apr-23 to 30-Apr-23

Page 1

GST Registration : 07DUUPK9284D7Z5

Status : Not Signed

Particulars Voucher

Count

Total Vouchers 21

Included in Return

Not Relevant for This Return 6

Uncertain Transactions (Corrections needed) 15

Particulars Taxable IGST CGST SGST/ Cess Tax

Amount UTGST Amount

Return View

3.1 Tax on Outward and Reverse

Charge Inward Supplies

3.2 Interstate Supplies

4 Eligible for Input Tax Credit

A. Input Tax Credit Available (either in

part or in full)

B. Input Tax Credit Reversed

C. Net Input Tax Credit Available (A) - (B)

D. Other Details

1. ITC reclaimed which was reversed

under Table 4(B)(2) in earlier tax period

2. Ineligible ITC under section 16(4) and

ITC restricted due to PoS rules

5 Exempt, Nil Rated, and Non-GST

Inward Supplies

6.1 Interest, Late Fee, Penalty and

Others

You might also like

- GSTR2B 20CHSPM6149M1ZS 032023 10062023Document7 pagesGSTR2B 20CHSPM6149M1ZS 032023 10062023laxmi handloommdpNo ratings yet

- Form GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BDocument7 pagesForm GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BAtul VermaNo ratings yet

- GSTR 3BDocument2 pagesGSTR 3Bbhoomika.shah0624No ratings yet

- GSTR 1Document1 pageGSTR 1photolabjsdNo ratings yet

- GST 3 BDocument1 pageGST 3 BSwetha KarthickNo ratings yet

- GSTR 3BDocument2 pagesGSTR 3BShruti RastogiNo ratings yet

- Patanjali Arogya Kendra 2018-19Document5 pagesPatanjali Arogya Kendra 2018-19tuensangnagaland2018No ratings yet

- 23bch021 (Dilkhush Kumar) GSTR-3BDocument2 pages23bch021 (Dilkhush Kumar) GSTR-3Bpr91127810No ratings yet

- Participating in Return Tables 512 No Direct Implication in Return Tables 0Document2 pagesParticipating in Return Tables 512 No Direct Implication in Return Tables 0ROHIT SHARMA DEHRADUNNo ratings yet

- Shree Suleshvari EnterpriseDocument4 pagesShree Suleshvari EnterpriseDIVISION4 MAHESANANo ratings yet

- Bhagwati Traders - (From 1-Apr-2011) : Participating in Return Tables 161 No Direct Implication in Return Tables 0Document4 pagesBhagwati Traders - (From 1-Apr-2011) : Participating in Return Tables 161 No Direct Implication in Return Tables 0mukesh singhal537No ratings yet

- GST Healthcheck Sample Report v1Document148 pagesGST Healthcheck Sample Report v1Gauravkumar KateNo ratings yet

- Form GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BDocument7 pagesForm GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BMaddy GamerNo ratings yet

- GSTR3B 24AHSPS6763P1Z6 012023 SystemGeneratedDocument8 pagesGSTR3B 24AHSPS6763P1Z6 012023 SystemGeneratedsammy shergilNo ratings yet

- Combinepdf 2Document4 pagesCombinepdf 2Kisan LendeNo ratings yet

- Gstr3b 09ehmpm8928j1zf 062021 SystemgeneratedDocument6 pagesGstr3b 09ehmpm8928j1zf 062021 SystemgeneratedAnkur mittalNo ratings yet

- Customs Circular-No-18-2023Document1 pageCustoms Circular-No-18-2023Raja SinghNo ratings yet

- GSTR2B 06alzps2257h2zf 072022 24092022Document7 pagesGSTR2B 06alzps2257h2zf 072022 24092022Robin JoseNo ratings yet

- Form GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1,3.2 and 4 of FORM GSTR-3BDocument6 pagesForm GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1,3.2 and 4 of FORM GSTR-3BMUJAHIDUL ISLAM SHAIKHNo ratings yet

- Form GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1,3.2 and 4 of FORM GSTR-3BDocument6 pagesForm GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1,3.2 and 4 of FORM GSTR-3Bhiteshmohakar15No ratings yet

- Anand Steel GSTR1 AugustDocument1 pageAnand Steel GSTR1 AugustNikita VarshneyNo ratings yet

- GSTR3B 07AALCP1900G1ZN 112022 SystemGeneratedDocument7 pagesGSTR3B 07AALCP1900G1ZN 112022 SystemGeneratedChandan KumarNo ratings yet

- Form GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BDocument7 pagesForm GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3Bgotbaya rNo ratings yet

- GSTR3B 21ACGPD6446D2Z5 062023 SystemGeneratedDocument7 pagesGSTR3B 21ACGPD6446D2Z5 062023 SystemGeneratedsamir ranjan dhalNo ratings yet

- Gstr3b 10ckvpk6948n1zc 042023 SystemgeneratedDocument8 pagesGstr3b 10ckvpk6948n1zc 042023 Systemgeneratedharshitkr1805No ratings yet

- Tattvam Advisors GSTR 9 and 9CDocument63 pagesTattvam Advisors GSTR 9 and 9CKunalKumarNo ratings yet

- Participating in Return Tables 212 No Direct Implication in Return Tables 0Document1 pageParticipating in Return Tables 212 No Direct Implication in Return Tables 0Dharmendra RoutNo ratings yet

- GSTR3B 27CHHPP4347K1ZU 032021 SystemGeneratedDocument7 pagesGSTR3B 27CHHPP4347K1ZU 032021 SystemGeneratedShreenath AgarwalNo ratings yet

- 3B Apr To June 21Document2 pages3B Apr To June 21Sachin NandeNo ratings yet

- Form GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BDocument7 pagesForm GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BSankar GaneshNo ratings yet

- Form Gstr-2B: 3. ITC Available SummaryDocument7 pagesForm Gstr-2B: 3. ITC Available SummaryRohit GoyalNo ratings yet

- Gstr3b 19bbspr1755d1z8 062023 SystemgeneratedDocument8 pagesGstr3b 19bbspr1755d1z8 062023 Systemgeneratedb2bservices007No ratings yet

- Form Gstr-2B: 3. ITC Available SummaryDocument7 pagesForm Gstr-2B: 3. ITC Available SummaryRohit GoyalNo ratings yet

- GSTR2B 06alzps2257h2zf 032022 24092022Document7 pagesGSTR2B 06alzps2257h2zf 032022 24092022Robin JoseNo ratings yet

- Gstr3b 20bejps1674a1zv 052023 SystemgeneratedDocument8 pagesGstr3b 20bejps1674a1zv 052023 SystemgeneratedMukund MayankNo ratings yet

- Ram NameDocument2 pagesRam NameStock PsychologistNo ratings yet

- GST Rfd-01 07aabcw4620l1z8 Expwop 202204 FormDocument3 pagesGST Rfd-01 07aabcw4620l1z8 Expwop 202204 FormSANDEEP SINGHNo ratings yet

- Draft Audit Report XIVDocument11 pagesDraft Audit Report XIVTradingideas2456No ratings yet

- GSTR2BQ 23Z6 032024 24042024Document7 pagesGSTR2BQ 23Z6 032024 24042024Neha JainNo ratings yet

- 3BDocument2 pages3BmnenterprisesknpNo ratings yet

- GSTR3B Aug-22Document7 pagesGSTR3B Aug-22HEMANTH kumarNo ratings yet

- GSTR 9 9A CA Mohit SinghalDocument61 pagesGSTR 9 9A CA Mohit SinghalRishav AnandNo ratings yet

- GST RFD-01 - 37AABCJ1299A1ZS - EXPWOP - 201904 - FormDocument3 pagesGST RFD-01 - 37AABCJ1299A1ZS - EXPWOP - 201904 - FormkotisanampudiNo ratings yet

- TablesDocument6 pagesTablesShiva PatwariNo ratings yet

- GSTR ReturnDocument136 pagesGSTR Returnyoyorikee0% (1)

- Document 1Document2 pagesDocument 1gstceraslmNo ratings yet

- Form Gstr-2B: 3. ITC Available SummaryDocument7 pagesForm Gstr-2B: 3. ITC Available SummaryRohit GoyalNo ratings yet

- GSTR3B 33AAKCB0823F1Z5 022023 SystemGenerated PDFDocument8 pagesGSTR3B 33AAKCB0823F1Z5 022023 SystemGenerated PDFBairava MotorsNo ratings yet

- Adobe Scan Jun 10, 2023Document3 pagesAdobe Scan Jun 10, 2023Atharv KumarNo ratings yet

- Asli Pracheen Ravan Samhita PDFDocument2 pagesAsli Pracheen Ravan Samhita PDFgirish SharmaNo ratings yet

- Form GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1,3.2 and 4 of FORM GSTR-3BDocument6 pagesForm GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1,3.2 and 4 of FORM GSTR-3BMUJAHIDUL ISLAM SHAIKHNo ratings yet

- Form Gstr-2B: 3. ITC Available SummaryDocument7 pagesForm Gstr-2B: 3. ITC Available SummaryRohit GoyalNo ratings yet

- Form GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BDocument7 pagesForm GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BArun SasidharanNo ratings yet

- Wa0003.Document3 pagesWa0003.Rishu GiriNo ratings yet

- VP 06DBJ4LK InvoicesDocument2 pagesVP 06DBJ4LK Invoicesjalpa daveNo ratings yet

- Return: Sections List Forms ListDocument11 pagesReturn: Sections List Forms Listgvramani51233No ratings yet

- GSTR2B 06alzps2257h2zf 112020 24092022Document7 pagesGSTR2B 06alzps2257h2zf 112020 24092022Robin JoseNo ratings yet

- Invoice: Page 1 of 2Document2 pagesInvoice: Page 1 of 2Poonam PurohitNo ratings yet

- GSTR 3B NewDocument2 pagesGSTR 3B Newarpit85No ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet