Professional Documents

Culture Documents

GSTR 1

GSTR 1

Uploaded by

photolabjsdOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GSTR 1

GSTR 1

Uploaded by

photolabjsdCopyright:

Available Formats

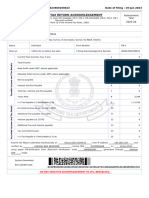

Om Bagodia 3701

GSTR-1

1-Apr-23 to 31-Mar-24

Page 1

GST Registration : 07GGGGG1314R9Z6

Status : Not Signed

Particulars Voucher

Count

Total Vouchers 24

Included in Return

Not Relevant for This Return 16

Uncertain Transactions (Corrections needed) 8

Particulars Vch Count Taxable IGST CGST SGST/ Cess Tax Invoice

(Summary) Amount UTGST Amount Amount

Return View

B2B Invoices - 4A, 4B, 4C, 6B,

6C

Taxable Sales

Reverse Charge Supplies

B2C (Large) Invoices - 5A, 5B

Exports Invoices - 6A

Credit or Debit Notes (Registered)

- 9B

Credit or Debit Notes (

Unregistered) - 9B

Amended B2B Invoices - 9A

Amended B2C (Large) Invoices -

9A

Amended Exports Invoices - 9A

Amended Credit or Debit Notes (

Registered) - 9C

Amended Credit or Debit Notes (

Unregistered) - 9C

B2C (Small) Invoices - 7

Nil Rated Invoices - 8A, 8B, 8C,

8D

Amendment B2C (Small) Invoices

- 10

Tax Liability (Advances Received)

- 11A(1), 11A(2)

Adjustment of Advances - 11B(1),

11B(2)

Amended Tax Liability (Advances

Received) - 11A

Amendment of Adjusted

Advances - 11B

HSN Summary - 12

Document Summary - 13

Total

You might also like

- GSTR 3BDocument1 pageGSTR 3B169 Vishal DabiNo ratings yet

- GSTR 3BDocument2 pagesGSTR 3Bbhoomika.shah0624No ratings yet

- Summery GSTR 1Document1 pageSummery GSTR 1khodiyarfurniture3No ratings yet

- GST 3 BDocument1 pageGST 3 BSwetha KarthickNo ratings yet

- Anand Steel GSTR1 AugustDocument1 pageAnand Steel GSTR1 AugustNikita VarshneyNo ratings yet

- Shree Suleshvari EnterpriseDocument4 pagesShree Suleshvari EnterpriseDIVISION4 MAHESANANo ratings yet

- Invoice Copy 1Document1 pageInvoice Copy 1vrrav7694No ratings yet

- Biswajit Man. ItrDocument2 pagesBiswajit Man. Itralisahamat022No ratings yet

- Patanjali Arogya Kendra 2018-19Document5 pagesPatanjali Arogya Kendra 2018-19tuensangnagaland2018No ratings yet

- Medicine BillDocument1 pageMedicine BillShivam VermaNo ratings yet

- Statistics BookDocument1 pageStatistics BookChatna PuraniNo ratings yet

- GST Healthcheck Sample Report v1Document148 pagesGST Healthcheck Sample Report v1Gauravkumar KateNo ratings yet

- Participating in Return Tables 512 No Direct Implication in Return Tables 0Document2 pagesParticipating in Return Tables 512 No Direct Implication in Return Tables 0ROHIT SHARMA DEHRADUNNo ratings yet

- Screenshot 2019-12-23 at 17.59.49Document1 pageScreenshot 2019-12-23 at 17.59.49Sunil SoniNo ratings yet

- Return: Sections List Forms ListDocument11 pagesReturn: Sections List Forms Listgvramani51233No ratings yet

- GSTR 3BDocument2 pagesGSTR 3BShruti RastogiNo ratings yet

- SGCNTT1223258732Document1 pageSGCNTT1223258732Helen BlackNo ratings yet

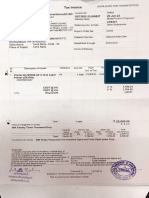

- Tax Invoice: Rebel Enterprise 1325/18-19 4-Jan-2019Document2 pagesTax Invoice: Rebel Enterprise 1325/18-19 4-Jan-2019HARDIK PATELNo ratings yet

- TaxesDocument2 pagesTaxesRameshNadarNo ratings yet

- Combinepdf 2Document4 pagesCombinepdf 2Kisan LendeNo ratings yet

- Gupta SportsDocument1 pageGupta Sportsdevildude1699No ratings yet

- Tax Invoice: Gstin Drug Licence NoDocument1 pageTax Invoice: Gstin Drug Licence NoSachin ChauhanNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Qusai KHNo ratings yet

- Tax Invoice (12-038)Document1 pageTax Invoice (12-038)Julie Libiano Green Kraft Pte LtdNo ratings yet

- DR R K Sharma 13 FebDocument1 pageDR R K Sharma 13 FebVinay SharmaNo ratings yet

- Original For Recipient Duplicate For Transporter Triplicate For SupplierDocument1 pageOriginal For Recipient Duplicate For Transporter Triplicate For SupplierKarthik TNo ratings yet

- Abul Kalam Bhangi ItrDocument2 pagesAbul Kalam Bhangi Itralisahamat022No ratings yet

- Payment Advice SwathiFoods Wipro-20230619-20230621Document3 pagesPayment Advice SwathiFoods Wipro-20230619-20230621spraju1947No ratings yet

- Wa0001.Document1 pageWa0001.Rinku TyagiNo ratings yet

- VP 06DBJ4LK InvoicesDocument2 pagesVP 06DBJ4LK Invoicesjalpa daveNo ratings yet

- As 40825 0 01012023 31012023 1852076Document1 pageAs 40825 0 01012023 31012023 1852076Nasir MansoorNo ratings yet

- Tally Final 3BDocument2 pagesTally Final 3BNikhilNo ratings yet

- Payment Advice SwathiSugarcaneJuice Qualcomm-20230619-20230621Document3 pagesPayment Advice SwathiSugarcaneJuice Qualcomm-20230619-20230621spraju1947No ratings yet

- Wmcustomer 15420324 KLI CustomerInvoiceDocument1 pageWmcustomer 15420324 KLI CustomerInvoiceVamsi Pavan Kumar SankaNo ratings yet

- Draft Audit Report XIVDocument11 pagesDraft Audit Report XIVTradingideas2456No ratings yet

- PDF 260623500190623Document1 pagePDF 260623500190623Harsha R BNo ratings yet

- Tax Invoice: Gstin Drug Licence NoDocument1 pageTax Invoice: Gstin Drug Licence NoRohit BansalNo ratings yet

- Goods & Service Tax (GST) - User DashboardDocument2 pagesGoods & Service Tax (GST) - User Dashboardkasim shekNo ratings yet

- Tax Invoice: Gstin PAN Drug Licence NoDocument1 pageTax Invoice: Gstin PAN Drug Licence Nochunawalahanif997No ratings yet

- 23bch021 (Dilkhush Kumar) GSTR-3BDocument2 pages23bch021 (Dilkhush Kumar) GSTR-3Bpr91127810No ratings yet

- 16935489879006780ASO2Document1 page16935489879006780ASO2chethangowdacg15No ratings yet

- Tax Invoice: Gstin Drug Licence NoDocument1 pageTax Invoice: Gstin Drug Licence Nopranay dasNo ratings yet

- Gstin: 08cympg9536p1z9 BG01189: Amichand Saini (11885729)Document2 pagesGstin: 08cympg9536p1z9 BG01189: Amichand Saini (11885729)Subhash SainiNo ratings yet

- List of Services 2Document18 pagesList of Services 2L.P. SinghNo ratings yet

- 1 - Tax Invoice - K05042-23-24 - SignedDocument2 pages1 - Tax Invoice - K05042-23-24 - SignedmanojNo ratings yet

- Amd2-1168 21.03.2024Document1 pageAmd2-1168 21.03.2024khushbu GajjarNo ratings yet

- OD328794065321107200Document4 pagesOD328794065321107200vikasrsgarg2No ratings yet

- PDF 923744260220722Document1 pagePDF 923744260220722Ashish SinghNo ratings yet

- Jay GSTR-1: Included in HSN/SAC Summary 0 Incomplete HSN/SAC Information (To Be Provided) 1Document2 pagesJay GSTR-1: Included in HSN/SAC Summary 0 Incomplete HSN/SAC Information (To Be Provided) 1Vikas SharmaNo ratings yet

- Adobe Scan Jul 28, 2022Document1 pageAdobe Scan Jul 28, 2022Palani KumarNo ratings yet

- ASG-23-0XXXX - Alam Industries & Export (Azizul)Document1 pageASG-23-0XXXX - Alam Industries & Export (Azizul)speeddemonmahfuj04No ratings yet

- Ankur JainDocument34 pagesAnkur Jainorganic.machliNo ratings yet

- It RajeshDocument2 pagesIt RajeshMegha AaradhyaNo ratings yet

- Q1 Financials 2018 (IFRS) FinalDocument44 pagesQ1 Financials 2018 (IFRS) FinalMicaNo ratings yet

- Tax Invoice: Authorised SignatoryDocument1 pageTax Invoice: Authorised SignatoryArchana MalooNo ratings yet

- Physicswallah Pvt. LTD.: Tax InvoiceDocument1 pagePhysicswallah Pvt. LTD.: Tax InvoiceRaghav AgarwalNo ratings yet

- GSTR2B 06alzps2257h2zf 072022 24092022Document7 pagesGSTR2B 06alzps2257h2zf 072022 24092022Robin JoseNo ratings yet

- MAC Jan-2022 Pending InvDocument1 pageMAC Jan-2022 Pending InvSree ganapathy Facilitation servicesNo ratings yet

- InvoiceDocument1 pageInvoiceawanish639No ratings yet

- Trial BalDocument2 pagesTrial BalphotolabjsdNo ratings yet

- Profit and LossDocument1 pageProfit and LossphotolabjsdNo ratings yet

- Cash BookDocument1 pageCash BookphotolabjsdNo ratings yet

- Tally Practical FileDocument1 pageTally Practical FilephotolabjsdNo ratings yet

- BSheetDocument1 pageBSheetphotolabjsdNo ratings yet