Professional Documents

Culture Documents

Path To Compliance Nov

Uploaded by

Vishwanath HollaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Path To Compliance Nov

Uploaded by

Vishwanath HollaCopyright:

Available Formats

• Stock of Goods

• Transportation of Goods Q9. Some useful tips for taxpayers

• Other documents as may be prescribed

• Conduct timely reconciliation of records

• Compare e-Way Bills with respect to data in GSTR-1

Q6. What is the indicative list of documents, other than as available on

• Compare GSTR-3B Returns filed, with GSTR-2B and GSTR-1, and

GSTN, required to be furnished by the taxpayer?

ensure that all data matches

The Taxpayer will be required to furnish: • To have clear understanding of the provisions of CGST Act and

• Copies of Balance Sheet, Profit & Loss Accounts with all complete Rules made thereunder

schedules • Timely filing of GSTR-9/9C return (whichever is applicable)

• Annual returns submitted to the Registrar of Companies

GST AUDIT

• Income Tax Returns along with the Annexures and Income Tax Q10. What are the Audit findings?

audit report, if any, under Section 44AB of the Income-tax Act,

On conclusion of an Audit, the officer will inform the taxable person

1961

within 30 days:

PATH TO COMPLIANCE

• Directors/Auditors Report

• Findings in FORM ADT-02

• Cost audit report, if any, under Section 148 of the Companies Act,

• Reason thereof

2013

• Form 26 AS If the audit results in the detection of unpaid/short paid tax or wrong (Updated as on November 2023)

• Details of Anti-Evasion/ Preventive/ DGGSTI cases booked, if any refund or wrong input tax credit availed, and the amount indicated by

and copy of SCN issued thereof the auditor is not paid by the taxpayers, then demand and recovery

• Copy of VAT annual return actions will be initiated as per law.

• List of major input supplies with specific mention of HSN Code and

applicable rate of GST

The taxable person will be also required to provide necessary facility

and give information /assistance for timely completion of audit.

Q7. What is the purpose of Audit under GST? Please scan for download

GST

To verify the correctness of – Audit

• Turnover declared

• Taxes assessed & paid

• Refund claimed

• Input Tax Credit availed, and

• To assess compliance with the provisions of the GST Acts or the

rules made thereunder

Q8. What are the frequent issues detected during audit?

Follow us on:

• Non-payment/ short payment of Tax

• Wrong classification of Goods/Services

• Short/Excess payment of Tax due to improper calculation/

accounting

• Collecting Tax from the customers but not paying the same to the @cbic_india @cbicindia

Government

• Wrong availment of ITC on ineligible document

• Tax not paid on advance in case of services

• Reverse Charge Mechanism liability @cbic @cbicindia

Directorate General of Taxpayer Services

CENTRAL BOARD OF INDIRECT TAXES & CUSTOMS

@CBIC INDIA www.cbic.gov.in

GST Holds the Key The GST Audit Process • Fewer Hassles: With thorough audits, the chances of disputes and

legal proceedings decrease significantly.

In a revolutionary step, Goods and Services Tax (GST) was The GST Audit process includes the following steps:

introduced to unite India’s markets and simplify the complex • The auditee is formally notified of an upcoming audit through the GST Audit is not only for reconciliation of tax liability and payment

web of State and Central Taxation Laws. GST paved the way to prescribed format (FORM GST ADT-01) at least 15 working days thereof, but it also encompasses the verification of compliance with

a uniform structure in taxation of goods and services across the prior to the conduct of audit. the provisions of the GST laws by a registered person and educating the

nation, ensuring uniformity in terms of taxable event, tax rates, • FORM GST ADT-01 also enlists the documents and data to be taxpayers to be more complaint with the law and procedure.

point of levy, provisions for registration, return filing, tax payment, submitted to the Auditor for a preliminary review. A period of 15

refunds, audit, adjudication, appeals etc. days is prescribed for submission of the documents.

FAQs on Audit under Section

GST Audit: Navigating the Maze • The audit will officially commence when the auditor accepts the

65 of the CGST Act, 2017

documents submitted by the auditee or initiates verification of

Audit under GST is an important compliance verification tool to the business premises, whichever is later.

measure the level of compliance of a taxpayer in the light of the • During the audit, the authorized officer may request access to Q1. What is Audit under CGST?

provisions of the CGST Act, 2017 and the Rules made there under. verify the books of accounts or other necessary documents. • An Audit under CGST involves the examination of records, returns,

The whole edifice of GST eco-system is built on Self-assessment/self- Auditee/taxpayer’s cooperation is crucial for a timely completion and documents related to Input Tax Credit (ITC) and Refunds. Its

compliance by GST Taxpayers. It is aimed to bring transparency, deter of audit. purpose is to validate tax payments and compliance by the taxpayers.

tax evasion, and guide towards compliance accuracy in businesses. • On completion of the audit verification, Auditee/taxpayer receives

GST Audit in Action the preliminary findings, and his views/comments are recorded to Q2. Which records, returns and other documents are examined during

finalize the observations. Audit by departmental officers?

GST Audit is mandated to do a meticulous scrutiny of taxpayer’s • On finalization of observations, the results are sent to the

transactions to validate the accuracy of the reported GST liability. The Auditee/taxpayer in the form of Final Audit Report (Form GST • Documents which are maintained by the registered person, or

activity of Audit by the department is to, ADT-02) within 30 days. • Documents furnished by the registered person under GST or any

• The Auditee/taxpayer is given the option to make the payment other law for the time being in force

• examine the records, returns and other documents maintained

or furnished by the taxpayer of tax short paid / not paid with waiver of show cause notice. The

final audit findings are informed to the Auditee/taxpayer within Q3. Where can Audit of a taxpayer be conducted?

• verify the correctness of turnover declared, taxes paid, refund

claimed, and input tax credit availed, and 30 days along with his rights and obligations and the reasons for Audit of records can be carried out either at the jurisdictional office

• assess taxpayer’s compliance with the provisions of the CGST such findings. premises of the tax authority (desk-based audit) or the business premises

Act, 2017 and the Rules made there-under. • The entire audit process is to be completed within 3 months of the taxpayer as decided by the jurisdictional Commissioner CGST, Audit.

from the date of commencement, with the provision of further

Principles of GST Audit Desk-based audit is mandated for small category taxpayers as a trade

6-month extension if necessary.

facilitation measure.

• Risk-Based Selection: The audit process begins with Risk-based • The Auditee/taxpayer is not required to provide most of the digital

selection of taxpayers to be audited. The primary objective of information, as this data is already available with the department.

Q4. What are the timelines prescribed for Audit?

GST Audit is to translate the identified risk parameters into a • Audits verification may be conducted at the place of business of

meaningful review and an Audit Plan to ensure efficiency; the registered taxpayer or at the office of the authorized officer.

• A notice is sent to the auditee at least 15 days prior to Audit. (ADT-01)

• Systematized and Comprehensive: GST Audits follow a • The emphasis of the audit is on trade facilitation and providing

• The entire audit process is to be completed within 3 months from the

methodical and all-encompassing approach, ensuring a non-intrusive environment to taxpayers.

date of commencement of the audit.

meaningful and efficient audit;

Benefits of Audit to Taxpayers • The jurisdictional Commissioner CGST, Audit can extend the audit

• Technique based on materiality: Degree of scrutiny and

period for a further 6 months with reasons recorded in writing.

application of an audit tool is applied depending upon the Participating in GST Audits offers several benefits for the tax compliant

identified nature of risk factors; auditee:

Q5. What documents are required to be furnished by the auditee for

• Record Every Detail: Proper recording of all checks and findings • Enhanced Compliance: Taxpayer gain a better understanding of Audit?

made during the entire audit; tax laws and procedures, making compliance smoother.

• Exploring the Uncharted: Identify the unexplored compliance The Auditee is required to submit the following documents for the Audit:

• Precision in Returns: Taxpayer’s GST returns and Self-assessments

verification parameters; • Inward and outward supply of Goods & Services or both

are prepared accurately, with a sharper focus on correctness and

• Educating Taxpayers: Taxpayers are educated for tax awareness • Goods Produced or Manufactured

completeness.

and better compliance. • Input Tax Credit availed

• Improved Accounting: Audits can help taxpayers in spotting and

• Output Tax Payable & Paid

rectifying deficiencies in your accounting and internal control

systems.

You might also like

- Audit in GST RegimeDocument2 pagesAudit in GST RegimeKumariNo ratings yet

- Unit 4 GSTDocument13 pagesUnit 4 GSTViral OkNo ratings yet

- Audit Under Fiscal Laws GST AuditDocument4 pagesAudit Under Fiscal Laws GST AuditRanjit BhogesaraNo ratings yet

- Standardised PPT On GST: GST & Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument12 pagesStandardised PPT On GST: GST & Indirect Taxes Committee The Institute of Chartered Accountants of Indiaviji88mbaNo ratings yet

- Unit 4Document16 pagesUnit 4Abhishek Kumar GuptaNo ratings yet

- GST Special Audit ProcedureDocument2 pagesGST Special Audit ProcedureGautamNo ratings yet

- Tax Digest Quaterly Newsletter June 2020 PDFDocument67 pagesTax Digest Quaterly Newsletter June 2020 PDFdpfsopfopsfhopNo ratings yet

- GST Audit - Trans Hindon - 19!05!2018 by CA. Chitresh GuptaDocument38 pagesGST Audit - Trans Hindon - 19!05!2018 by CA. Chitresh GuptaRavigmailNo ratings yet

- GSTV70P4 November 27 December 3 (PG 144) SamplechapterDocument2 pagesGSTV70P4 November 27 December 3 (PG 144) SamplechapterSatyakanth SunkaraNo ratings yet

- 17. Audit Under GST (1)Document12 pages17. Audit Under GST (1)shubhamgaurNo ratings yet

- The Institute of Chartered Accountants of IndiaDocument42 pagesThe Institute of Chartered Accountants of IndiaXpacNo ratings yet

- Eturns: This Chapter Will Equip You ToDocument52 pagesEturns: This Chapter Will Equip You ToShowkat MalikNo ratings yet

- GST - Audit OffencesDocument35 pagesGST - Audit OffencesApurva DharNo ratings yet

- Eturns: After Studying This Chapter, You Will Be Able ToDocument70 pagesEturns: After Studying This Chapter, You Will Be Able ToChandan ganapathi HcNo ratings yet

- Talking Points GSTDocument2 pagesTalking Points GSTvikaskumar1No ratings yet

- India Direct Tax - Changes & ImpactDocument5 pagesIndia Direct Tax - Changes & ImpactPiyush MittalNo ratings yet

- EY Tax Alert: Executive SummaryDocument6 pagesEY Tax Alert: Executive SummaryAjay SinghNo ratings yet

- GST Unit 1 BDocument23 pagesGST Unit 1 BMukul BhatnagarNo ratings yet

- Audit Under GSTDocument11 pagesAudit Under GSTRameshwar FundipalleNo ratings yet

- Session 3, 4 Role of CAG in GST Regim FinalDocument30 pagesSession 3, 4 Role of CAG in GST Regim FinalSuresh Kumar YathirajuNo ratings yet

- Chapter IV: Compliance Audit of GST: 4.1 Lack of Access To DataDocument24 pagesChapter IV: Compliance Audit of GST: 4.1 Lack of Access To DataharshNo ratings yet

- GST Unit 4Document48 pagesGST Unit 4SANSKRITI YADAV 22DM236No ratings yet

- GST Update: Key Announcements from 31st GST Council MeetingDocument29 pagesGST Update: Key Announcements from 31st GST Council MeetingRahul KhandoojaNo ratings yet

- Session 3 & 4 - Input Tax Credit and Cross Utilisation of Taxes FinalDocument42 pagesSession 3 & 4 - Input Tax Credit and Cross Utilisation of Taxes FinalaskNo ratings yet

- 18 GSTDocument1,042 pages18 GSTSwetaNo ratings yet

- GST Audit, Returns and Assessment OverviewDocument53 pagesGST Audit, Returns and Assessment OverviewGAMING WITH MADHURNo ratings yet

- Impact GST Manufacturing SectorDocument21 pagesImpact GST Manufacturing SectorPriyanshi AgarwalNo ratings yet

- Overview of GST Session II and III Final - RTCDocument25 pagesOverview of GST Session II and III Final - RTCSuresh Kumar YathirajuNo ratings yet

- CA Ashish Chaudhary 1Document30 pagesCA Ashish Chaudhary 1sonapakhi nandyNo ratings yet

- Tax Law - Penal ProvisionsDocument23 pagesTax Law - Penal ProvisionsArsalan Ahmad100% (1)

- 2.2016 Syllabus Paper-18 - Jan21 Indirect Tax Laws & Practice Study NotesDocument972 pages2.2016 Syllabus Paper-18 - Jan21 Indirect Tax Laws & Practice Study NotesRadhakrishnaraja RameshNo ratings yet

- BBA GST UNIT 4Document11 pagesBBA GST UNIT 4darshansah1990No ratings yet

- Returns PDFDocument109 pagesReturns PDFKrishna VamsiNo ratings yet

- 74824bos60500 cp15Document90 pages74824bos60500 cp15soni12c2004No ratings yet

- GST Regime - Panel Discussion With Neel RatanDocument20 pagesGST Regime - Panel Discussion With Neel RatanImtiaz KhanNo ratings yet

- Changes to confiscation and penalty provisions under GSTDocument16 pagesChanges to confiscation and penalty provisions under GSTamitshah2060No ratings yet

- GSTUpdate 05022022Document22 pagesGSTUpdate 05022022prathNo ratings yet

- GST Audit PowerpointDocument62 pagesGST Audit PowerpointBiswakesh PatiNo ratings yet

- GST Audit and Annual Return GuideDocument15 pagesGST Audit and Annual Return Guideyogeshaggarwal09No ratings yet

- Do You Know GST - July 2022Document17 pagesDo You Know GST - July 2022CA Ranjan MehtaNo ratings yet

- CA Roopa NayakDocument40 pagesCA Roopa NayakAayushi AroraNo ratings yet

- Internal Audit Points GSTDocument14 pagesInternal Audit Points GSTAJAY K & ASSOCIATESNo ratings yet

- Tax Law 2 ProjectDocument16 pagesTax Law 2 Projectrelangi jashwanthNo ratings yet

- 0bba0 GSTR 9 Booklet HiregangeDocument113 pages0bba0 GSTR 9 Booklet HiregangeAMIT SHARMANo ratings yet

- Returns in Goods and Services Tax: A Brief OverviewDocument38 pagesReturns in Goods and Services Tax: A Brief OverviewSushant SaxenaNo ratings yet

- Finalisation Account Under GSTDocument20 pagesFinalisation Account Under GSTkbharathNo ratings yet

- Checklist Annual GST Reconciliation 17thoct2023Document9 pagesChecklist Annual GST Reconciliation 17thoct2023cmakartickdasNo ratings yet

- Input Tax Credit: Speaker: Sudhir V SDocument31 pagesInput Tax Credit: Speaker: Sudhir V Smahi_kunkuNo ratings yet

- GST Audit – Types, Objective, Applicability - Taxguru - inDocument3 pagesGST Audit – Types, Objective, Applicability - Taxguru - inAtin KumarNo ratings yet

- GST Seminar Key HighlightsDocument40 pagesGST Seminar Key HighlightsNavneetNo ratings yet

- 2018 Financial Services Banking Industry Vat Awareness SessionDocument65 pages2018 Financial Services Banking Industry Vat Awareness SessionWaqas AtharNo ratings yet

- GST Procedures: April 2022Document15 pagesGST Procedures: April 2022Manada SachdevaNo ratings yet

- BIR Audit ManualDocument89 pagesBIR Audit ManualRivera RwlrNo ratings yet

- CA Vishal Poddar - GST Audit JalgaonDocument40 pagesCA Vishal Poddar - GST Audit JalgaonshahtaralsNo ratings yet

- Revenue Officers Guide to Collection ProceduresDocument165 pagesRevenue Officers Guide to Collection ProceduresMikee Baliguat TanNo ratings yet

- Standardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument11 pagesStandardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiamonikaNo ratings yet

- Revision Notes: For Cs ExecutiveDocument153 pagesRevision Notes: For Cs Executiveekta khatriNo ratings yet

- GSTR 1 - Presentation by GSTN - 30 August 2017Document42 pagesGSTR 1 - Presentation by GSTN - 30 August 2017NitishNo ratings yet

- Chapter 1 - Introduction To GST: Applicability of Utgst ActDocument7 pagesChapter 1 - Introduction To GST: Applicability of Utgst ActSoul of honeyNo ratings yet

- Bangalore Astrology Summit 2022Document4 pagesBangalore Astrology Summit 2022Vishwanath HollaNo ratings yet

- Qrmp-Scheme NovDocument2 pagesQrmp-Scheme NovVishwanath HollaNo ratings yet

- As 000505Document304 pagesAs 000505Vishwanath HollaNo ratings yet

- BCI Accepts Report on LL.B Exam Modes During PandemicDocument3 pagesBCI Accepts Report on LL.B Exam Modes During PandemicvishwaNo ratings yet

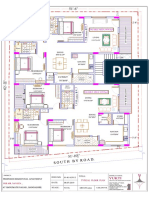

- Typical Floor PlanDocument1 pageTypical Floor PlanVishwanath HollaNo ratings yet

- Bos 45243 Mod 2 CP 4Document45 pagesBos 45243 Mod 2 CP 4sunil mittalNo ratings yet

- Magnificent BharatDocument52 pagesMagnificent Bharatrhkolte8881100% (14)

- Jurisprudence Interpretation and General Laws PDFDocument457 pagesJurisprudence Interpretation and General Laws PDFSuriya N KumarNo ratings yet

- Indian Financial System: Leasing and Hire PurchaseDocument26 pagesIndian Financial System: Leasing and Hire PurchaseAjayNo ratings yet

- Application Form Account Opening UBIDocument4 pagesApplication Form Account Opening UBIDba ApsuNo ratings yet

- Traders EdgeDocument5 pagesTraders Edgeartus14100% (1)

- Transaction Statement: Account Number: 1632104000026770 Date: 2023-11-08 Currency: INRDocument5 pagesTransaction Statement: Account Number: 1632104000026770 Date: 2023-11-08 Currency: INRwww.manjsahuNo ratings yet

- Flash Memory Inc Student Spreadsheet SupplementDocument5 pagesFlash Memory Inc Student Spreadsheet Supplementjamn1979No ratings yet

- IC 33 Question PaperDocument12 pagesIC 33 Question PaperSushil MehraNo ratings yet

- A Study On Compariion of Online With Offline Trading in CommoditiesDocument56 pagesA Study On Compariion of Online With Offline Trading in CommoditiesN.MUTHUKUMARAN100% (1)

- Online Request Form For Uco Home LoanDocument2 pagesOnline Request Form For Uco Home Loanbiswajit sarangiNo ratings yet

- Chapter 2 The Accounting EquationDocument15 pagesChapter 2 The Accounting EquationDahlia Fernandez Bt Mohd Farid FernandezNo ratings yet

- Mohan A PDFDocument3 pagesMohan A PDFARK ArbaazNo ratings yet

- How To Renew Your Business Permits in The PhilippinesDocument2 pagesHow To Renew Your Business Permits in The Philippinespat xNo ratings yet

- IIA Company Analysis Project E-Commerce IndustryDocument44 pagesIIA Company Analysis Project E-Commerce IndustryAngira VermaNo ratings yet

- Deed of PartnershipDocument4 pagesDeed of Partnershipsince1978nsNo ratings yet

- Kalyani Investment 5th AGM Report and FinancialsDocument28 pagesKalyani Investment 5th AGM Report and FinancialsmarinedgeNo ratings yet

- Stipulated Order Appointing ReceiverDocument27 pagesStipulated Order Appointing ReceiverDaily TimesNo ratings yet

- Trading Foreign Currencies With ARBYVEST TECHNOLOGY 1Document26 pagesTrading Foreign Currencies With ARBYVEST TECHNOLOGY 1Babatunde AlaaniNo ratings yet

- Final PPT of IndusInd BankDocument14 pagesFinal PPT of IndusInd BanktruptiNo ratings yet

- Internal Audit Procedures ManualDocument11 pagesInternal Audit Procedures ManualLeizza Ni Gui DulaNo ratings yet

- FinancialManagement Mplte ChoiceDocument18 pagesFinancialManagement Mplte ChoiceCrish NaNo ratings yet

- Ac20 Quiz 1 - DGCDocument10 pagesAc20 Quiz 1 - DGCMaricar PinedaNo ratings yet

- Questionnaire For CustomersDocument5 pagesQuestionnaire For CustomersAkhilNo ratings yet

- CL2016 63Document23 pagesCL2016 63Mark Erickson Raspi BalahadiaNo ratings yet

- Capital Balances and Profit DistributionDocument4 pagesCapital Balances and Profit DistributionLorraine Mae RobridoNo ratings yet

- Short AnswerDocument5 pagesShort AnswerblueberryNo ratings yet

- Raghee Horner Daily Trading EdgeDocument53 pagesRaghee Horner Daily Trading Edgepsoonek100% (8)

- Amazon StatementsDocument3 pagesAmazon StatementsJohnny80% (5)

- 2076 - Varias, Aizel Ann B - Module 1Document18 pages2076 - Varias, Aizel Ann B - Module 1Aizel Ann VariasNo ratings yet

- Medical BillDocument27 pagesMedical BillSagarNo ratings yet

- Emba 2014 2015 Exec Mba - OxfordDocument36 pagesEmba 2014 2015 Exec Mba - OxfordAjay DevNo ratings yet

- Letter of AdviceDocument3 pagesLetter of AdviceGreg Wilder100% (13)