Professional Documents

Culture Documents

GST Tally Q

Uploaded by

babitasingh.ys0 ratings0% found this document useful (0 votes)

342 views3 pagesOriginal Title

gst tally q

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

342 views3 pagesGST Tally Q

Uploaded by

babitasingh.ysCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

B.COM.

(H) I Semester – MOCK EXAM: 2023

Part C: Computerized Accounting System

Duration: 1 hour Max. Marks: 20

University Roll No: .

Name of the Student:

The company details are as follows;

i. Name- University Roll No

ii. Address: Your Address, Your Phone & Mobile No., Your Email ID

iii. Email Id: yourname@gmail.com

iv. Currency Symbol: Rs.

Enter the following transactions of the Company in Tally and show various reports

The business is a registered organization for GST with an office in Delhi.

GSTIN : 07DUUPK9284D7Z5

All purchase and sales transactions of goods, Payment to creditors, and receipt from debtors are

done through BOB Bank

Any other payment and receipt is done through AXIS Bank

Skip date while passing voucher entries.

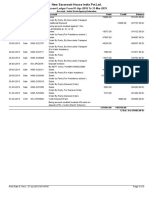

Balance Sheet as at 31-3-2022

Liabilities Amount Assets Amount

Capital 2100000 Land 800000

Reserves 750000 Machinery 430000

Profit and Loss Account 380000 Investment 200000

Debentures 800000 Stock 2038750

Loan from Promoters 250000 Debtors 227000

Provision for tax 300000 Bills Receivables 70000

Bills Payable 620150 BOB Bank 900000

Sundry Creditors 175600 AXIS Bank 750000

Salaries outstanding 45000 Cash in Hand 35000

Rent Outstanding 30000

Total 5450750 Total 5450750

The company deals in the following stocks:

Name of the Items Group GST Rate Quantity Rate (Rs) Opening Stock

(%) Value

Cotton Shirt Shirt 650 pcs. 1100 715000

Woolen Shirt Shirt 12 550 pcs. 1275 701250

Terrycot Shirt Shirt 150 pcs. 2100 315000

Cotton Trouser Trouser 250 pcs. 850 212500

Woolen Trouser Trouser 12 100 pcs. 450 45000

Terrycot Trouser Trouser 100 pcs. 500 50000

Total 2038750

The list of company debtors and creditors is as follows:

Debtors Balance Creditors Balance

Due payable

ZARA 79000 SARA 35000

Ram 62000 PALAK 20500

RADHA 45000 ANKITA 65500

SHYAM 41000 JOY 54600

Total 227000 Total 175600

Record the following transactions

S.No. Transaction Item Quantity Amount

1 Purchase from SARA. She is a registered supplier Terrycot 150 90000

from Goa. GSTIN: 30GGGGG1314R6Z1 Trouser

2 Sale to ZARA. She is a registered supplier from Woolen 60 336000

Delhi. GSTIN: 07DUUPK9284D5Z1 Trouser

3 Sale to RADHA. She is a registered supplier Woolen Shirt 100 400000

fromDelhi. GSTIN: 07DUUPK9284D5Z2

4 Paid money to SARA in full settlement for the transaction at sr. no. 1 above 86000

5 Received from ZARA Rs 332000 in full settlement for their current transaction at sr.

no. 2 above

6 Paid to ANKITA in Full Settlement 62500

7 Purchase from PALAK. She is a registered Terrycot Shirt 100 160000

supplierfrom Goa. GSTIN:

30GGGGG1314R6Z2

8 Purchase from SARA. She is a registered supplier Woolen 110 77000

from Goa. GSTIN: 30GGGGG1314R6Z1 Trouser

9 Sale to Ram (Trade discount 10% on listprice). Cotton Shirt 110 pcs. List Price Rs.

He is a registered supplier from Delhi. 2500/- each

GSTIN: 07DUUPK9284D5Z3

10 Purchased Machinery at the beginning of the year 70000

11 Purchased Land from MN Ltd for Rs. 11, 00,000. to pay this the company borrowed from

bank a loan of Rs. 6,00,000 and issued fully paid unsecured debenture of Rs. 5,00,000 to XY

Ltd.

12 Sold all the investment 250000

13 Expenses Paid during the year

1. Outstanding Salaries 15000

2. Rent (Including outstanding) 45000

3. Tax of last year 250000

14 Outstanding to be maintained as on last day

1. Total Salaries 35000

2. Total Rent outstanding 10000

3. Total Provision for Tax 100000

15 Charge Depreciation on Machinery @ 30% p.a.

You are required to:-

1. Create a Folder on desktop with your Exam Roll No.

2. Create a company as per details given above

3. Create appropriate groups and Ledger Accounts.

4. Enter the transactions as given selecting appropriate voucher type.

5. Export the following statements as on 31st March 2023 in PDF format and save it in a Folder.

Day Book

Balance Sheet

Profit and Loss Account

GST Report (GSTR- 3B)

You might also like

- Tally With GSTDocument2 pagesTally With GSTkhushboogrover06100% (1)

- Tally PracticeQuestion 1Document3 pagesTally PracticeQuestion 1Khushi Kumari100% (3)

- Tally Practice QuestionsDocument68 pagesTally Practice Questionspranav tomar100% (1)

- Step by Step Tally Question Practice SBSCDocument69 pagesStep by Step Tally Question Practice SBSCRohit sharmaNo ratings yet

- B - Com - Tally I Sem Exam Set 3Document2 pagesB - Com - Tally I Sem Exam Set 3Vikas100% (1)

- Tally With GST Workshop Jan 2023 QuestionDocument3 pagesTally With GST Workshop Jan 2023 QuestionAryan GuptaNo ratings yet

- Tally TestDocument2 pagesTally TestHK DuggalNo ratings yet

- Tally Practical (B) - 1Document3 pagesTally Practical (B) - 1Bhaavya GuptaNo ratings yet

- Tally ProjectDocument27 pagesTally ProjectSUGANYA THANGAM100% (3)

- Tally - Erp 9 Complete CourseDocument12 pagesTally - Erp 9 Complete CourseMeghaNo ratings yet

- Case Study 3 Tally Prime ExerciseDocument10 pagesCase Study 3 Tally Prime ExerciseBishal SahaNo ratings yet

- Tally PracticeDocument16 pagesTally PracticeArko Banerjee100% (2)

- Tally Record Notes MainDocument20 pagesTally Record Notes MainRemesh A RNo ratings yet

- Tally Practice PaperDocument20 pagesTally Practice PaperAjitesh anand100% (2)

- Payroll Tally Notes With Assignment - SSC STUDYDocument7 pagesPayroll Tally Notes With Assignment - SSC STUDYParminder KaurNo ratings yet

- Practice Assignment For Student (Project 1)Document4 pagesPractice Assignment For Student (Project 1)Saibal Dutta75% (4)

- Solutions JournalDocument50 pagesSolutions JournalAnjali SharmaNo ratings yet

- Tally Accounting EntriesDocument16 pagesTally Accounting EntriesvishnuNo ratings yet

- T.D.S. Assignment: Match The Following:-CASH .. 1,01,950 SBI 37,550Document2 pagesT.D.S. Assignment: Match The Following:-CASH .. 1,01,950 SBI 37,550Reema Kumari100% (2)

- Tally Tutorial Purchase Voucher EntryDocument4 pagesTally Tutorial Purchase Voucher EntryUday PaliNo ratings yet

- Tally Practical QuestionDocument11 pagesTally Practical QuestionNandhini VimalNo ratings yet

- Osmania University B.Com Practical Question Bank on Computerized AccountingDocument19 pagesOsmania University B.Com Practical Question Bank on Computerized AccountingrpraveenkumarreddyNo ratings yet

- Accountancy Practice Questions Journal EntriesDocument4 pagesAccountancy Practice Questions Journal EntriesRitaNo ratings yet

- Tally Questions Batch Wise Entry PDFDocument4 pagesTally Questions Batch Wise Entry PDFAjitesh anand100% (1)

- Solutions to Handout #1 journal entriesDocument8 pagesSolutions to Handout #1 journal entriessimran punjabiNo ratings yet

- JDocument13 pagesJpalash khannaNo ratings yet

- JournalsDocument4 pagesJournalsAkash Srikumar0% (1)

- Tally Questions Zero Value, Billed and Actual Quantity PDFDocument4 pagesTally Questions Zero Value, Billed and Actual Quantity PDFAjitesh anandNo ratings yet

- Assignment No-3Document9 pagesAssignment No-3Ronit gawade100% (1)

- Tally Practical ProblemsDocument13 pagesTally Practical Problemsafreenbanukatchi100% (1)

- Tally Prime Course Cost Center, Order, Price List, BOMDocument12 pagesTally Prime Course Cost Center, Order, Price List, BOMAnkit Singh100% (1)

- Tally Questions Inventry and Bill Wise Entry PDFDocument9 pagesTally Questions Inventry and Bill Wise Entry PDFAjitesh anandNo ratings yet

- Entry of Journal VouchersDocument25 pagesEntry of Journal Vouchersirfanahmed.dba@gmail.com100% (1)

- Sl. No. Date Transaction For April 2021: List of Transaction (Project Based Exercise)Document6 pagesSl. No. Date Transaction For April 2021: List of Transaction (Project Based Exercise)ARYAN INFOTECH0% (1)

- Interest Calculation in Tally Erp9Document9 pagesInterest Calculation in Tally Erp9Michael Wells0% (1)

- Tally Journal EntriesDocument11 pagesTally Journal Entriessainimeenu92% (24)

- Chapter 13Document12 pagesChapter 13palash khannaNo ratings yet

- V1Document10 pagesV1Niranjan ShresthaNo ratings yet

- TallyDocument27 pagesTallyRonak JainNo ratings yet

- Tally ExerciseDocument16 pagesTally ExercisePavanSyamsundarNo ratings yet

- Tally Exam Paper 2018Document2 pagesTally Exam Paper 2018Dilip Bhagat100% (1)

- Tally Questions Interest Calculation and Multiple Currencies PDFDocument7 pagesTally Questions Interest Calculation and Multiple Currencies PDFAjitesh anandNo ratings yet

- TYPES OF ACCOUNTSDocument20 pagesTYPES OF ACCOUNTSVERMA NEERAJ100% (1)

- Tally Assignment No.1Document11 pagesTally Assignment No.1BOOKREADER_NOWNo ratings yet

- Journalize transactions and prepare financial statementsDocument8 pagesJournalize transactions and prepare financial statementsAlok Biswas100% (1)

- Voucher Entry & Practical Problem - TallyDocument7 pagesVoucher Entry & Practical Problem - TallyBackiyalakshmi Venkatraman83% (6)

- Practice Questions of TallyDocument18 pagesPractice Questions of TallyVISHAL100% (2)

- Kapoor Case StudyDocument13 pagesKapoor Case StudyBristi ChoudhuryNo ratings yet

- Tally Prime With GST Example - 01Document4 pagesTally Prime With GST Example - 01Goyal mitraNo ratings yet

- Case Study 1 Tally Prime ExerciseDocument43 pagesCase Study 1 Tally Prime ExerciseRishi bhatiya86% (7)

- Triple Column Cash Book TransactionsDocument6 pagesTriple Column Cash Book Transactionsshahid sjNo ratings yet

- Tally Assignment FINAL 3 MONTHS PDFDocument44 pagesTally Assignment FINAL 3 MONTHS PDFrakesh8roy75% (4)

- Tally With GSTDocument2 pagesTally With GSTRishikaNo ratings yet

- Question No 1 TallyDocument2 pagesQuestion No 1 TallyAnjali Singh50% (2)

- Tally 1Document2 pagesTally 1Anushka TiwariNo ratings yet

- Set 1 & 3 PDFDocument6 pagesSet 1 & 3 PDFCorona VirusNo ratings yet

- Tally Question PaperDocument2 pagesTally Question PaperRAAGHAV GUPTANo ratings yet

- Duration: 1 Hour Max. Marks: 20: Admin@Document2 pagesDuration: 1 Hour Max. Marks: 20: Admin@Narsingh Das AgarwalNo ratings yet

- Company financial recordsDocument3 pagesCompany financial recordsSiya GuptaNo ratings yet

- tally assingmentDocument19 pagestally assingmentTaranNo ratings yet

- Google - Prep4sure - Professional Cloud Network Engineer - Sample.question.2023 Feb 25.by - Adam.80q.vceDocument17 pagesGoogle - Prep4sure - Professional Cloud Network Engineer - Sample.question.2023 Feb 25.by - Adam.80q.vceahme imtiazNo ratings yet

- In The: e HealthDocument29 pagesIn The: e HealthShenaNo ratings yet

- Vic Bulzacchelli CVDocument2 pagesVic Bulzacchelli CVVic BulzacchelliNo ratings yet

- Account LedgerDocument1 pageAccount LedgerAnurag JainNo ratings yet

- Types of Bank Accounts in IndiaDocument5 pagesTypes of Bank Accounts in IndiaNikita DesaiNo ratings yet

- Online Networking: The Advantage of Facebook To Conduct Business in City of Malolos Integrated School Sto. Rosario Senior High SchoolDocument11 pagesOnline Networking: The Advantage of Facebook To Conduct Business in City of Malolos Integrated School Sto. Rosario Senior High SchoolAshaira MangondayaNo ratings yet

- Wave Accounting Software ReviewDocument10 pagesWave Accounting Software ReviewV ChandriaNo ratings yet

- Travel Forecasting Models ExplainedDocument10 pagesTravel Forecasting Models ExplainedMAHEBOOB PASHANo ratings yet

- Quote-76851-0819-Dai Son Loc-REVISEDDocument2 pagesQuote-76851-0819-Dai Son Loc-REVISEDMajorNo ratings yet

- Social Media Management PortfolioDocument21 pagesSocial Media Management PortfolioSiti FatimahNo ratings yet

- 1-15 A11421 IPP Manual PDFDocument348 pages1-15 A11421 IPP Manual PDFsyunamiNo ratings yet

- Internship Report on Soneri BankDocument37 pagesInternship Report on Soneri BankAnoshKhanNo ratings yet

- Case Study The Smith GroupDocument2 pagesCase Study The Smith Groupminisaggu0% (1)

- Preface: SevenDocument60 pagesPreface: Seven24.Mr.Theutthavy Pms 7/6No ratings yet

- Report On Dena BankDocument23 pagesReport On Dena Bankjit5742No ratings yet

- FreightSmith ReceiptDocument2 pagesFreightSmith ReceiptMena LuisNo ratings yet

- Aditya Birla MinacsDocument9 pagesAditya Birla MinacsLekshmikanth BhagavateeswaranNo ratings yet

- Ebron, Dexter Jan Tago Gomez Bldg.,Fortich ST Sumpong Malaybalay City BUKIDNON, Northern Mindanao PhilippinesDocument3 pagesEbron, Dexter Jan Tago Gomez Bldg.,Fortich ST Sumpong Malaybalay City BUKIDNON, Northern Mindanao PhilippinesJan Karlyle Stefan EbronNo ratings yet

- Single Entry System of Bookkeeping - Features & AdvantagesDocument3 pagesSingle Entry System of Bookkeeping - Features & AdvantagesMumtaz AhmadNo ratings yet

- Vertical Marketing SystemDocument18 pagesVertical Marketing SystemSheram Khan0% (1)

- Unisa Payments Digital BankingDocument10 pagesUnisa Payments Digital BankingThabiso MathobelaNo ratings yet

- Borghese Gallery Guided Tour - Visit Villa Borghese GardensDocument2 pagesBorghese Gallery Guided Tour - Visit Villa Borghese GardensViju HiremathNo ratings yet

- NEW SPP 2021 FEE STRUCTURE On Campus StudentsDocument2 pagesNEW SPP 2021 FEE STRUCTURE On Campus StudentsEdwardNo ratings yet

- Presentation Audit of Acquisition and Payment CycleDocument38 pagesPresentation Audit of Acquisition and Payment CycleSyaffiq UbaidillahNo ratings yet

- IAT-I Question Paper With Solution of 18CS81 Internet of Things May-2022-Dr. Srividya RDocument5 pagesIAT-I Question Paper With Solution of 18CS81 Internet of Things May-2022-Dr. Srividya RSOURAV CHATTERJEE100% (2)

- INV1844199792Document18 pagesINV1844199792MohdDanishNo ratings yet

- Mam Karina Template Periodic 1Document21 pagesMam Karina Template Periodic 1Claudine bea NavarreteNo ratings yet

- Checklist of Supporting Documents 04.25.16Document30 pagesChecklist of Supporting Documents 04.25.16Richelle PascorNo ratings yet

- 3GPP LTE/SAE Specification Series Evolved UTRANDocument3 pages3GPP LTE/SAE Specification Series Evolved UTRANMohit SharmaNo ratings yet

- HabibMetro Mera MustaqbilDocument15 pagesHabibMetro Mera MustaqbilRashid Shah100% (1)