Professional Documents

Culture Documents

Nvidia 2023 - Financial State Analysis

Uploaded by

Francesco Moscogiuri0 ratings0% found this document useful (0 votes)

13 views3 pagesCopyright

© © All Rights Reserved

Available Formats

ODS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as ODS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views3 pagesNvidia 2023 - Financial State Analysis

Uploaded by

Francesco MoscogiuriCopyright:

© All Rights Reserved

Available Formats

Download as ODS, PDF, TXT or read online from Scribd

You are on page 1of 3

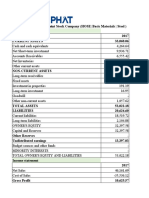

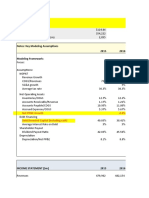

FINANCIAL STATE ANALYSIS **Insert the data in the singles boxes, then the result will

Short-Term Solvency Ratios

Current ratio 1.209213354

Quick ratio 2.729544416

Cash ratio 0.516379704

Long-Term Solvency Ratios

Total debt ratio 0.463333495

Debt-equity ratio 0.439029908

Equity multiplier 1.863354599

Times interest earned ratio //

Cash coverage ratio //

Asset Management Ratios

Inventory turnover 2.251986819

Days’ sales in inventory 162.0791014

Receivables turnover 1.964030872

Days’ sales in receivables 185.8422926

Total asset turnover 0.654994901

Profitability Ratios

Profit margin 0.161933714

Return on assets 0.106065757

Return on equity 0.197638116

Market Value Ratios

EPS //

PE ratio //

Market-to-book ratio //

s boxes, then the result will appear immediately**

Summarized Statement of Income

Revenue 26.974

Cost of goods sold 11.618

Operating income 4.224

Less: 11.132

Depreciation

Other expenses

Income from continuing operations before income taxes 4.181

Summarized Statement of Income

Income taxes 187

Income from continuing operations 4.224

Income from discontinued operations, net of taxes 4.181

Net income 4.368

Summarized Statement of Financial Position

Assets

Current Assets

Cash and cash equivalent 3.389

Trade and other receivables 13.734

Inventories 5.159

Other current Assets 791

Total current Assets 23.073

Non-current Assets 18.109

Total assets 41.182

Liabilities

Current liabilities

Trade payable 5.313

Other current liabilities (shirt-term debit) 1.25

Total current liabilities 6.563

Long term debt 9.703

Other non-current liabilities 903.913

Total liabilities 19.081

Equity 22.101

Retained Earnings 10.171

Total liabilities and equity 41.182

You might also like

- Honda Motors CH 3Document6 pagesHonda Motors CH 3Craft DealNo ratings yet

- MRF Financial 2020 c1l7ccvgt4Document12 pagesMRF Financial 2020 c1l7ccvgt4KUNAL MEHTANo ratings yet

- wilconDocument29 pageswilcon2206158No ratings yet

- Britannia Industries Ltd. (India) : SourceDocument6 pagesBritannia Industries Ltd. (India) : SourceDivyagarapatiNo ratings yet

- Wal-Mart Financials For 2010 MetricsDocument4 pagesWal-Mart Financials For 2010 MetricsGhost FreyNo ratings yet

- FM Assignment (Shilpa Kathuroju-48)Document37 pagesFM Assignment (Shilpa Kathuroju-48)shilpaNo ratings yet

- Ratio Analysis Berger Asian PaintsDocument11 pagesRatio Analysis Berger Asian PaintsHEM BANSALNo ratings yet

- Income Statement AnalysisDocument33 pagesIncome Statement AnalysisSimarpreetNo ratings yet

- Shiksha: Non-Current AssetsDocument4 pagesShiksha: Non-Current AssetsdebojyotiNo ratings yet

- Class 3Document17 pagesClass 3Julio PanduroNo ratings yet

- WSP Financial Analysis V1.4Document68 pagesWSP Financial Analysis V1.4maruthimallepalliNo ratings yet

- Final Exam AccountingDocument7 pagesFinal Exam Accountingshirley franciscoNo ratings yet

- The Following Are The Financial Statements (Along With Common Sized Analysis) of XYZ LTDDocument3 pagesThe Following Are The Financial Statements (Along With Common Sized Analysis) of XYZ LTDDeloresNo ratings yet

- Titan Company Ltd. (India) : SourceDocument6 pagesTitan Company Ltd. (India) : SourceDivyagarapatiNo ratings yet

- Biottech Data:: Part 1: Ratio Analysis: Perform The Following AnalysisDocument1 pageBiottech Data:: Part 1: Ratio Analysis: Perform The Following AnalysisLizza Marie CasidsidNo ratings yet

- Kia Motors Chapter 3Document8 pagesKia Motors Chapter 3Craft Deal100% (1)

- AnalysisDocument14 pagesAnalysisMaryiam HashmiNo ratings yet

- Modern Road Makers P LTD (India) : Emis 14 New Street London, EC2M 4HE, United KingdomDocument3 pagesModern Road Makers P LTD (India) : Emis 14 New Street London, EC2M 4HE, United KingdomLAVISH DHINGRANo ratings yet

- Ratios Analysis and TrendsDocument14 pagesRatios Analysis and TrendsNISHA BANSALNo ratings yet

- Shipping Corp - Comparative StatementDocument3 pagesShipping Corp - Comparative StatementAkshay SinghNo ratings yet

- HPG Finance Statement 1Document25 pagesHPG Finance Statement 1Hoàng Ngọc OanhNo ratings yet

- Balance Sheet Shows Assets, Liabilities and Owner's EquityDocument10 pagesBalance Sheet Shows Assets, Liabilities and Owner's EquityEdiNo ratings yet

- Financial analysis of company revenues and expenses 2017-2018Document9 pagesFinancial analysis of company revenues and expenses 2017-2018mudit mohanNo ratings yet

- Cipla Ltd. (India) : SourceDocument6 pagesCipla Ltd. (India) : SourceDivyagarapatiNo ratings yet

- Ratio Analysis Summary Particulars Mar '17 Mar '18 Mar '19 Revenue Growth Profitability RatiosDocument10 pagesRatio Analysis Summary Particulars Mar '17 Mar '18 Mar '19 Revenue Growth Profitability RatiosKAVYA GUPTANo ratings yet

- Hawkins Cooker LimitedDocument9 pagesHawkins Cooker LimitedShreshtha SinghNo ratings yet

- ALK CH 9Document10 pagesALK CH 9Anisa Margi0% (1)

- Annual Report of Honda AtlasDocument1 pageAnnual Report of Honda AtlaskEBAYNo ratings yet

- Project Work FinanceDocument18 pagesProject Work Financeaqsarana ranaNo ratings yet

- FinShiksha Financials 2017-2015Document4 pagesFinShiksha Financials 2017-2015debojyotiNo ratings yet

- NALCO Balance Sheet and Ratios 2020Document25 pagesNALCO Balance Sheet and Ratios 2020Small Town BandaNo ratings yet

- Financial Management AssignmentDocument5 pagesFinancial Management AssignmentSREEJITH RNo ratings yet

- Consolidated Balance Sheet: Total Non-Current AssetsDocument1 pageConsolidated Balance Sheet: Total Non-Current AssetsAsif Abdul AliNo ratings yet

- Short Term Assets 2018 2017 Change in Amount Differential AmountDocument5 pagesShort Term Assets 2018 2017 Change in Amount Differential Amounthayagreevan vNo ratings yet

- Income StatementDocument4 pagesIncome StatementJudith DelRosario De RoxasNo ratings yet

- Ratio AnalysisDocument15 pagesRatio AnalysisNSTJ HouseNo ratings yet

- Vertical and Trend AnalysisDocument18 pagesVertical and Trend AnalysisAnonymous 8yu6DvANteNo ratings yet

- Bank 1 ICBCDocument24 pagesBank 1 ICBCEnock RutoNo ratings yet

- Balance Sheets and Income Statements For Costco Wholesale Corporation FollowDocument2 pagesBalance Sheets and Income Statements For Costco Wholesale Corporation FollowDavid Rolando García OpazoNo ratings yet

- Coal India Ltd. (India) : SourceDocument6 pagesCoal India Ltd. (India) : SourceDivyagarapatiNo ratings yet

- Ratios Analysis RelaxoDocument9 pagesRatios Analysis RelaxoGaurang GuptaNo ratings yet

- Accounting Assignment QuestionDocument14 pagesAccounting Assignment QuestionsureshdassNo ratings yet

- Session 3 Dr. Reddy Labs (MOH)Document33 pagesSession 3 Dr. Reddy Labs (MOH)Paras PasrichaNo ratings yet

- Group Project - ACCDocument17 pagesGroup Project - ACCLovie GuptaNo ratings yet

- GroupNo04 Assignmet03 YashChavanDocument6 pagesGroupNo04 Assignmet03 YashChavanyashchavan957No ratings yet

- Standalone Financial Statements SummaryDocument6 pagesStandalone Financial Statements SummaryKshitij MaheshwaryNo ratings yet

- San MiguelDocument9 pagesSan MiguelAngel Buitizon100% (1)

- Topic 10-12 Alk (Hitungannya)Document6 pagesTopic 10-12 Alk (Hitungannya)Daffa Permana PutraNo ratings yet

- 11-Year Financial SummaryDocument25 pages11-Year Financial SummaryutsavmehtaNo ratings yet

- ValuationDocument31 pagesValuationAman TaterNo ratings yet

- Section 2 Group 6 FADMDocument77 pagesSection 2 Group 6 FADMRavi KumarNo ratings yet

- GPA (Y) Test Score (X) Month Earnings ExpensesDocument20 pagesGPA (Y) Test Score (X) Month Earnings ExpensesJipin ThomasNo ratings yet

- Maruti Ratios RecapDocument5 pagesMaruti Ratios RecapAnkush PatraNo ratings yet

- FA Ratios AssignmentDocument61 pagesFA Ratios AssignmentShambhavi SinhaNo ratings yet

- ITC standalone balance sheet and profit and loss highlights 2021-22Document7 pagesITC standalone balance sheet and profit and loss highlights 2021-22jhanvi tandonNo ratings yet

- Income Statement - PEPSICODocument11 pagesIncome Statement - PEPSICOAdriana MartinezNo ratings yet

- Daimler Ir Ar2018 Financial TablesDocument28 pagesDaimler Ir Ar2018 Financial TablesAshish PatwardhanNo ratings yet

- Infosys Limited FY2020 ResultsDocument6 pagesInfosys Limited FY2020 ResultsAYUSH SINGLANo ratings yet

- Walmart Valuation ModelDocument179 pagesWalmart Valuation ModelHiếu Nguyễn Minh HoàngNo ratings yet

- THC124 - Lesson 1. The Impacts of TourismDocument50 pagesTHC124 - Lesson 1. The Impacts of TourismAnne Letrondo Bajarias100% (1)

- LUMIX G Camera DMC-G85HDocument9 pagesLUMIX G Camera DMC-G85HnimodisNo ratings yet

- Families of Carbon Compounds: Functional Groups, Intermolecular Forces, & Infrared (IR) SpectrosDocument79 pagesFamilies of Carbon Compounds: Functional Groups, Intermolecular Forces, & Infrared (IR) SpectrosRuryKharismaMuzaqieNo ratings yet

- Haloalkanes and Haloarenes Notes GoodDocument21 pagesHaloalkanes and Haloarenes Notes GoodAnitesh DharamNo ratings yet

- Group ActDocument3 pagesGroup ActRey Visitacion MolinaNo ratings yet

- IM PS Fashion-Business-Digital-Communication-And-Media 3Y Course Pathway MI 04Document7 pagesIM PS Fashion-Business-Digital-Communication-And-Media 3Y Course Pathway MI 04oliwia bujalskaNo ratings yet

- Consumer Notebook Price List For September 2010Document4 pagesConsumer Notebook Price List For September 2010Anand AryaNo ratings yet

- The Impact of Spiritual Intelligence, Gender and Educational Background On Mental Health Among College StudentsDocument22 pagesThe Impact of Spiritual Intelligence, Gender and Educational Background On Mental Health Among College StudentsBabar MairajNo ratings yet

- Carbon Emission and Battery Monitoring SystemDocument17 pagesCarbon Emission and Battery Monitoring SystemIJRASETPublicationsNo ratings yet

- The Whole History of the Earth and LifeDocument2 pagesThe Whole History of the Earth and LifeEdward John Tensuan100% (1)

- Enscape Tutorial GuideDocument27 pagesEnscape Tutorial GuideDoroty CastroNo ratings yet

- Evbox Ultroniq V2: High Power Charging SolutionDocument6 pagesEvbox Ultroniq V2: High Power Charging SolutionGGNo ratings yet

- 02 Lightning Rods and AccessoriesDocument78 pages02 Lightning Rods and Accessoriesmoosuhaib100% (1)

- Using Previous Years AlmanacDocument1 pageUsing Previous Years AlmanacbhabhasunilNo ratings yet

- 1 Catalyst FundamentalsDocument17 pages1 Catalyst FundamentalsSam AnuNo ratings yet

- A Detailed Lesson Plan in (Teaching Science)Document8 pagesA Detailed Lesson Plan in (Teaching Science)Evan Jane Jumamil67% (3)

- XII Class Assignment Programs 2023-24Document8 pagesXII Class Assignment Programs 2023-24Sudhir KumarNo ratings yet

- Pag-IBIG Employer Enrollment FormDocument1 pagePag-IBIG Employer Enrollment FormDarlyn Etang100% (1)

- 10 - (Rahman) The Relationship Between Chest Tube Size and Clinical Outcome in Pleural InfectionDocument8 pages10 - (Rahman) The Relationship Between Chest Tube Size and Clinical Outcome in Pleural InfectionfaisaldanyaniNo ratings yet

- NYC Chocolate Chip Cookies! - Jane's PatisserieDocument2 pagesNYC Chocolate Chip Cookies! - Jane's PatisserieCharmaine IlaoNo ratings yet

- COSMETOLOGY-9 Q1 W3 Mod2Document15 pagesCOSMETOLOGY-9 Q1 W3 Mod2Christian Elliot DuatinNo ratings yet

- Sharp Sharp Cash Register Xe A207 Users Manual 284068Document1 pageSharp Sharp Cash Register Xe A207 Users Manual 284068Zeila CordeiroNo ratings yet

- Titan InvoiceDocument1 pageTitan Invoiceiamdhanush017No ratings yet

- SCMHRD SM-1Document43 pagesSCMHRD SM-1ShivanirahejaNo ratings yet

- Chapter 7 Portfolio Theory: Prepared By: Wael Shams EL-DinDocument21 pagesChapter 7 Portfolio Theory: Prepared By: Wael Shams EL-DinmaheraldamatiNo ratings yet

- New Translation and Deciphering of ChineDocument14 pagesNew Translation and Deciphering of ChineRémyNo ratings yet

- Narrative Report of Landfill VisitDocument3 pagesNarrative Report of Landfill VisitNestor Jan Kenneth P BorromeoNo ratings yet

- DissertationDocument15 pagesDissertationNicole BradyNo ratings yet

- S-H Polarimeter Polartronic-532 Eng - 062015 PDFDocument2 pagesS-H Polarimeter Polartronic-532 Eng - 062015 PDFSuresh KumarNo ratings yet

- National School Building Inventory FormsDocument12 pagesNational School Building Inventory FormsAnonymous w7r911SD91% (11)