Professional Documents

Culture Documents

Corporate Briefing Notes - ABL

Uploaded by

Abdullah CheemaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporate Briefing Notes - ABL

Uploaded by

Abdullah CheemaCopyright:

Available Formats

CORPORATE BRIEFING NOTES

December 21, 2023

, 22 2021

Sector Allied Bank Limited (ABL) 22

COMMERCIAL Allied Bank reported a consolidated net mark-up and

BANKS interest income of PKR 80.66 Bn in 9MCY23, up 78% from

PKR 45.44 Bn in SPLY.

Chase Research

research@chasesecurities.com Non markup and interest income was recorded at PKR 17.6

+92-21-35293054-60 Bn in 9MCY23 representing 5% growth when compared to

PKR 16.8 Bn in 9MCY22.

As a result, consolidated gross income surged 58% to PKR

Symbol: ABL

98.2 Bn in 9MCY23 from PKR 62.3 Bn in SPLY.

Current Price: PKR 82.11

Market Cap (PKR bn): 94.02

Total Shares (mn): 1,145.07 Operating costs in the period increased 25% to PKR 37.3 Bn

Free Float (mn): 114.51 in 9MCY23 from PKR 29.9 Bn in 9MCY22. This was driven

52 Week High: PKR 91.00

52 Week Low: PKR 61.03

primarily by a 34% increase in other operating costs

alongside a 12% increase in human resource costs.

In 9MCY23, Allied Bank recorded consolidated profit before

tax of PKR 58.5 Bn. This is 77% more than PKR 33.1 Bn in

9MCY22. Similarly, taxation costs for the company went

from PKR 20.5 Bn in 9MCY22 to PKR 29.4 Bn in 9MCY23, an

increase of 44%.

The bank reported consolidated profit after tax of PKR 29 Bn

in 9MCY23, surging 130% from PKR 12.6 Bn in 9MCY22.

The bank has also seen its total assets rise 1% from PKR 2.253

Tn as of Dec’22 to PKR 2.266 Tn as of Sep’23. Net assets grew

18% from PKR 130 Bn on Dec’22 to PKR 153 Bn on Sep’23.

Allied Bank has also seen 19% growth in Tier 1 equity from

PKR 125 Bn at the end of CY22 to PKR 148 Bn at the end of

3QCY23. Additionally, total equity was up 18% in the same

period from PKR 130 Bn to PKR 153 Bn.

Allied Bank saw its return on assets rise to 1.7% as of Sep’23

against 1% as of Dec’22. Similarly, a growth in return on tier 1

equity was seen from 18.4% to 28.6% in the same time

period.

+92 213 529 3054-60 www.chasesecurities.com research@chasesecurities.com Page 1 of 3

Briefing Notes

December 21, 2023

The Bank’s capital adequacy ratio stands at 22.61% as of

Sep’23 showing a rise from 19.74% as of Dec’22.

The bank has opened 21 conventional branches and 25

Islamic banking windows bringing the total to 1474 and 160

respectively. It has also added 42 new ATMs bringing the

total in its network to 1569.

As of September 30, 2023, the bank has also opened 1.15 Mn

new accounts to bring its total to over 7.61 Mn.

Allied Bank has also launched an industry first Allied

Freelancer Account to cater to a greater number of

customers. Additionally, Allied bank is continuing to work to

expand its e-commerce payment alliances with leading

merchants.

Going forward Allied bank expects a 1-4% reduction in the

SBP policy rate over the next year as inflation cools. It also

does not expect an unusual rise in NPLs.

+92 213 529 3054-60 www.chasesecurities.com research@chasesecurities.com Page 2 of 3

Briefing Notes

December 21, 2023

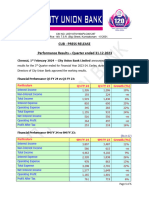

PKR'Mn 9MCY23 9MCY22 YoY 3QCY23 3QCY22 YoY

Mark-up/interest revenue 264,046 147,560 79% 95,144 59,987 59%

Mark-up/interest expense 183,385 102,121 80% 65,130 42,058 55%

Net mark-up/interest income 80,661 45,438 78% 30,013 17,930 67%

Total non-mark-up/interest income 17,611 16,830 5% 5,425 5,841 -7%

- Fee, commission and brokerage income 8,519 6,502 31% 2,979 2,238 33%

- Dividend income 2,716 2,058 32% 1,000 674 48%

- Income from dealing in foreign

currencies 5,781 7,142 -19% 1,421 2,846 -50%

- Gain/(loss) on sale of securities 531 1,050 -49% -10 37 -127%

- Other income 64 78 -18% 35 46 -24%

Total Revenue 98,272 62,268 58% 35,439 23,771 49%

Total provisions -2,532 697 -463% 211 -53 -498%

- Provision against non-performing loans

and advances -1,227 551 -323% 234 -50 -568%

- Provision against off-balance sheet

obligations -354 53 -768% -22 -15 47%

- Provision for diminution in the value of -

investments -958 6 16067% -4 9 -144%

- Bad debts written off directly 6 86 -93% 3 3 0%

Administrative expense 35,807 28,886 24% 12,130 10,373 17%

Other charges 267 280 -5% 109 65 68%

Workers welfare fund 1,209 695 74% 468 270 73%

Profit before tax 58,457 33,103 77% 22,943 13,010 76%

Taxation 29,425 20,460 44% 11,548 7,193 61%

Effective Tax Rate 50% 62% 50% 55%

Profit after tax 29,031 12,643 130% 11,395 5,817 96%

EPS 25.35 11.04 130% 9.95 5.08 96%

Important Disclosures

Disclaimer:

This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for

information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or

solicitation or any offer to buy. While reasonable care has been taken to ensure that the information

contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes

no representation as to its accuracy or completeness and it should not be relied upon as such. From time

to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws,

have a position, or otherwise be interested in any transaction, in any securities directly or indirectly

subject of this report Chase Securities as a firm may have business relationships, including investment

banking relationships with the companies referred to in this report This report is provided only for the

information of professional advisers who are expected to make their own investment decisions without

undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or

indirect consequential loss arising from any use of this report or its contents At the same time, it should

be noted that investments in capital markets are also subject to market risks This report may not be

reproduced, distributed or published by any recipient for any purpose.

+92 213 529 3054-60 www.chasesecurities.com research@chasesecurities.com Page 3 of 3

You might also like

- Corporate Briefing Notes - ZILDocument3 pagesCorporate Briefing Notes - ZILAbdullah CheemaNo ratings yet

- Corporate Briefing Notes - HMBDocument5 pagesCorporate Briefing Notes - HMBAbdullah CheemaNo ratings yet

- Study Material PPT 2022-23Document541 pagesStudy Material PPT 2022-23nigam kumar jhaNo ratings yet

- Bajaj Finance q2 Investor Presentation Fy23pdfDocument66 pagesBajaj Finance q2 Investor Presentation Fy23pdfsachin kumarNo ratings yet

- Investor Presentation Q2 FY24Document48 pagesInvestor Presentation Q2 FY24kush.kumawat.pgdm25No ratings yet

- CUB - Press Release - Dec2023Document5 pagesCUB - Press Release - Dec2023thiyagu.sensibulNo ratings yet

- 1.7. FABSecurities Lowerexpensesonadvertisementandpromotionaloffersboostedprofit Oct 13 2023Document5 pages1.7. FABSecurities Lowerexpensesonadvertisementandpromotionaloffersboostedprofit Oct 13 2023robynxjNo ratings yet

- Press Release: Bank of Baroda Announces Financial Results For The Quarter Ended 30 September 2022Document4 pagesPress Release: Bank of Baroda Announces Financial Results For The Quarter Ended 30 September 2022Mahesh DhalNo ratings yet

- Icici Q3fy24Document74 pagesIcici Q3fy2422mba141No ratings yet

- Golden Tree Annual 2023 ENDocument146 pagesGolden Tree Annual 2023 ENsteveNo ratings yet

- National Stock Exchange of India Ltd. BSE LTD.: Saligrama Mohan Kumar Adithya JainDocument40 pagesNational Stock Exchange of India Ltd. BSE LTD.: Saligrama Mohan Kumar Adithya JainJ&J ChannelNo ratings yet

- MNSO Second Quarter 2022 Results - VFDocument9 pagesMNSO Second Quarter 2022 Results - VFNazihah FareezNo ratings yet

- 4 Q23 Management ReportDocument7 pages4 Q23 Management Reportk33_hon87No ratings yet

- Quarter 30 September, 2023 Vis-À-Vis Quarter 30 September, 2022Document4 pagesQuarter 30 September, 2023 Vis-À-Vis Quarter 30 September, 2022Shubham PandeyNo ratings yet

- Centuryply IP Q1FY24Document30 pagesCenturyply IP Q1FY24Sanjeev GoswamiNo ratings yet

- Benchmark Q1 2023 Earnings Release VFDocument7 pagesBenchmark Q1 2023 Earnings Release VFDavit KhachikyanNo ratings yet

- LadderforLeaders2023 273 PDFDocument699 pagesLadderforLeaders2023 273 PDFsantosh kumarNo ratings yet

- Internal Audit Report - Hippodrome - March 2022Document60 pagesInternal Audit Report - Hippodrome - March 2022Francis DidierNo ratings yet

- Ladder For Leaders 24 2433Document654 pagesLadder For Leaders 24 2433JosephNo ratings yet

- Baf PPT Fy23 Q3Document71 pagesBaf PPT Fy23 Q3Sanjay BhatNo ratings yet

- Adam Gee EquitiesDocument3 pagesAdam Gee Equitiesali ahmadNo ratings yet

- Striving For A Better Tomorrow: Annual Report 2022Document261 pagesStriving For A Better Tomorrow: Annual Report 2022mini mahiNo ratings yet

- Pra Tinjau SahamDocument8 pagesPra Tinjau SahamADE CHANDRANo ratings yet

- Erste Group Posts Net Profit of EUR 235.3 Million in Q1 2020Document4 pagesErste Group Posts Net Profit of EUR 235.3 Million in Q1 2020Neculai CristianNo ratings yet

- EBS041122 enDocument4 pagesEBS041122 enNatalia MuresanNo ratings yet

- 2QFY24 Results PresentationDocument29 pages2QFY24 Results PresentationKushagroDharNo ratings yet

- UAE Equity Research - Agthia Group 4Q22 - First Look NoteDocument5 pagesUAE Equity Research - Agthia Group 4Q22 - First Look Notexen101No ratings yet

- Induslnd Bank: National Stock Exchange of India Ltd. (Symbol: INDUSINDBK)Document49 pagesInduslnd Bank: National Stock Exchange of India Ltd. (Symbol: INDUSINDBK)Ash SiNghNo ratings yet

- Finance M-5Document30 pagesFinance M-5Vrutika ShahNo ratings yet

- ) It'ifi3m, : Bank BarodaDocument5 pages) It'ifi3m, : Bank BarodaKaushal KumarNo ratings yet

- UAE Equity Research: First Look Note - 3Q22Document5 pagesUAE Equity Research: First Look Note - 3Q22xen101No ratings yet

- TLV 20221111164418 2022-Q3-ReportDocument84 pagesTLV 20221111164418 2022-Q3-Reportafrodita99977No ratings yet

- Raising FV Estimate To Php857 On Higher GLO FV: Ayala CorporationDocument7 pagesRaising FV Estimate To Php857 On Higher GLO FV: Ayala CorporationKirby Lanz RosalesNo ratings yet

- ICICI Securities Kotak Bank Q3FY23 Results ReviewDocument21 pagesICICI Securities Kotak Bank Q3FY23 Results ReviewAmey WadajkarNo ratings yet

- Presentation AKR April 23Document24 pagesPresentation AKR April 23muhadiNo ratings yet

- Press Release Bank of Baroda Announces Financial Results For Q3Fy22Document4 pagesPress Release Bank of Baroda Announces Financial Results For Q3Fy22Abhay SinghNo ratings yet

- Investment ThesisDocument5 pagesInvestment Thesisu jNo ratings yet

- Abbey - Mortgage - Bank - PLC - Quarter - 4 - Financial - StatementDocument42 pagesAbbey - Mortgage - Bank - PLC - Quarter - 4 - Financial - StatementCHRIS OGAMBANo ratings yet

- Final Press ReleaseDocument4 pagesFinal Press ReleaseMeghaNo ratings yet

- MAHABANK - Investor Presentation - 17-Oct-22 - TickertapeDocument40 pagesMAHABANK - Investor Presentation - 17-Oct-22 - TickertapeDivy KishorNo ratings yet

- NWG PLC q3 ResultsDocument48 pagesNWG PLC q3 ResultsAna LoweNo ratings yet

- AUBANK ConcallAnalysis 19 01 2023 548Document2 pagesAUBANK ConcallAnalysis 19 01 2023 548Muni AwasthiNo ratings yet

- Annual Report SIB 2019-20Document189 pagesAnnual Report SIB 2019-20SREE RAMNo ratings yet

- Fin424 - Final Report - 19104153 - Maliha Tahsin Shafa - Sec-3Document8 pagesFin424 - Final Report - 19104153 - Maliha Tahsin Shafa - Sec-3maliha tahsinNo ratings yet

- Press Release - Q2 TMBDocument9 pagesPress Release - Q2 TMBDhanush Kumar RamanNo ratings yet

- CAE Consolidated Financial - Statements 31-03-2022 EnglishDocument77 pagesCAE Consolidated Financial - Statements 31-03-2022 EnglishMuhammad TohamyNo ratings yet

- Class Question 20 April 2023Document4 pagesClass Question 20 April 2023lesediNo ratings yet

- 04-CityofMati2022 Executive SummaryDocument5 pages04-CityofMati2022 Executive SummaryAlex Grace DiagbelNo ratings yet

- National Stock Exchange of India Limited, BSE LimitedDocument23 pagesNational Stock Exchange of India Limited, BSE LimitedPramod LamkhadeNo ratings yet

- DEME Full Year Results 2023 Press Release - ENGDocument20 pagesDEME Full Year Results 2023 Press Release - ENGKevin ParkerNo ratings yet

- 1QFY23Document14 pages1QFY23Rajendra AvinashNo ratings yet

- Group 1'S Unair's FsaDocument9 pagesGroup 1'S Unair's Fsashy meltedNo ratings yet

- SHri 9M FY22Document27 pagesSHri 9M FY2253crx1fnocNo ratings yet

- Pag BankDocument22 pagesPag Bankandre.torresNo ratings yet

- NBP Quarterly Report - September 2023Document85 pagesNBP Quarterly Report - September 2023ARquam JamaliNo ratings yet

- Sapm 4Document12 pagesSapm 4Sweet tripathiNo ratings yet

- Smart Task 3Document8 pagesSmart Task 3Tushar GuptaNo ratings yet

- Pakistan’s Economy and Trade in the Age of Global Value ChainsFrom EverandPakistan’s Economy and Trade in the Age of Global Value ChainsNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- Chase Weekly Technical Analysis Report (22-April-2024)Document5 pagesChase Weekly Technical Analysis Report (22-April-2024)Abdullah CheemaNo ratings yet

- Pakistan Economy - BOP-1Document3 pagesPakistan Economy - BOP-1Abdullah CheemaNo ratings yet

- Pakistan Autos - December 2023Document3 pagesPakistan Autos - December 2023Abdullah CheemaNo ratings yet

- Daily Company Announcements-19-1Document2 pagesDaily Company Announcements-19-1Abdullah CheemaNo ratings yet

- Macro Monthly - March 2024Document37 pagesMacro Monthly - March 2024Abdullah CheemaNo ratings yet

- Calcorp Ltd-Annual Report 2023Document66 pagesCalcorp Ltd-Annual Report 2023Abdullah CheemaNo ratings yet

- Crescent Cotton MillDocument4 pagesCrescent Cotton MillAbdullah CheemaNo ratings yet

- Assignment of CFDocument5 pagesAssignment of CFAbdullah CheemaNo ratings yet

- Class Wise 1st SeptDocument31 pagesClass Wise 1st SeptAbdullah CheemaNo ratings yet

- Group 9 Abdullah 30, Usman Abid 17Document7 pagesGroup 9 Abdullah 30, Usman Abid 17Abdullah CheemaNo ratings yet

- Second World War Bombing of Chichester: Ken GreenDocument3 pagesSecond World War Bombing of Chichester: Ken GreenMatthew EppyNo ratings yet

- NorwichDocument598 pagesNorwichjonathan_will63No ratings yet

- Animal Health and Livestock Services Act 2055 NepalDocument13 pagesAnimal Health and Livestock Services Act 2055 NepalSuraj SubediNo ratings yet

- Inhibex 101 Ibc 1040l 1 000000000000828678 Rest of World (GHS) - EnglishDocument19 pagesInhibex 101 Ibc 1040l 1 000000000000828678 Rest of World (GHS) - EnglishPrototypeNo ratings yet

- Love Is The AnswerDocument1 pageLove Is The AnswerGenesis Frances Misa ToledoNo ratings yet

- Page 59 BIR Inclusion Non-IndividualDocument1 pagePage 59 BIR Inclusion Non-IndividualHans LeeNo ratings yet

- PP Vs Cesar Dela Cruz y Libonao Alias Sesi of Zone 3, Macanaya, Aparri, CagayanDocument2 pagesPP Vs Cesar Dela Cruz y Libonao Alias Sesi of Zone 3, Macanaya, Aparri, CagayanAnonymous aDY1FFGNo ratings yet

- Burton Junior Post v. Otto C. Boles, Warden of The West Virginia State Penitentiary, 332 F.2d 738, 4th Cir. (1964)Document11 pagesBurton Junior Post v. Otto C. Boles, Warden of The West Virginia State Penitentiary, 332 F.2d 738, 4th Cir. (1964)Scribd Government DocsNo ratings yet

- Ipc Sem4 Project PDFDocument12 pagesIpc Sem4 Project PDFAmir KhanNo ratings yet

- Plagiarism LectureDocument5 pagesPlagiarism LectureJennifer OestarNo ratings yet

- Invoice: Gross Invoice Total Minus Outstanding AmountDocument2 pagesInvoice: Gross Invoice Total Minus Outstanding AmountIsahaque Ahmed MilonNo ratings yet

- Customer Enrollment Form For HC Consumer Finance Philippines Inc. CustomersDocument3 pagesCustomer Enrollment Form For HC Consumer Finance Philippines Inc. CustomersluckymapanaoNo ratings yet

- Rape Victim - Sentenced To Natural LifeDocument2 pagesRape Victim - Sentenced To Natural LifeLee GaylordNo ratings yet

- 1 SMDocument16 pages1 SMHabiburrahman AlmansurNo ratings yet

- In Re MoralesDocument1 pageIn Re MoralesErnie GultianoNo ratings yet

- Ajio FL0114477630 1564208353305Document2 pagesAjio FL0114477630 1564208353305sravanNo ratings yet

- Business Income 4Document35 pagesBusiness Income 4Nyakuni NobertNo ratings yet

- Prudential Bank Vs IacDocument3 pagesPrudential Bank Vs IacMon CheNo ratings yet

- General Knowledge Questions About SAHABA KARAMDocument6 pagesGeneral Knowledge Questions About SAHABA KARAMEngineer ZaedNo ratings yet

- FILIPINO April 2011 Room Assignments-PagadianDocument5 pagesFILIPINO April 2011 Room Assignments-PagadianproffsgNo ratings yet

- Comptel Convergent Mediation™: Installation GuideDocument12 pagesComptel Convergent Mediation™: Installation Guidejuanete29No ratings yet

- Polycarbonate Sheet Rate AnalysisDocument2 pagesPolycarbonate Sheet Rate AnalysisVenkataramanaiah Puli0% (1)

- 05 - APRILIA P - F3318016 - Tugas TensesDocument4 pages05 - APRILIA P - F3318016 - Tugas TensesSolekNo ratings yet

- 2016 Guidelines For Mayor's PermitDocument2 pages2016 Guidelines For Mayor's PermitPollyNo ratings yet

- LifestoryDocument3 pagesLifestoryNats MagbalonNo ratings yet

- Mcdo RatiosDocument3 pagesMcdo RatiosMykaNo ratings yet

- Insurance Reviewer Notes by Atty. SaclutiDocument12 pagesInsurance Reviewer Notes by Atty. SaclutiGayFleur Cabatit RamosNo ratings yet

- E 1Document7 pagesE 1MD AbdullahNo ratings yet

- National Security - Wikipedia, The Free EncyclopediaDocument7 pagesNational Security - Wikipedia, The Free EncyclopediaRenjith PalakkadNo ratings yet

- Gojek Take Home Test Assessment - Achmad RamlanDocument10 pagesGojek Take Home Test Assessment - Achmad RamlanAnonym AnonNo ratings yet