Professional Documents

Culture Documents

14 - 10 - 23 Afternoon Test 1 Without Answer

Uploaded by

kkprabhu1122Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

14 - 10 - 23 Afternoon Test 1 Without Answer

Uploaded by

kkprabhu1122Copyright:

Available Formats

Page 1 of 8

Test 1 CBOA Class October 2023

Deposit Policy 2023-24, Term deposit consolidated guidelines (163/23),

NND ( 29,165 & 485 / 23 ), CA Master Circular (496/23) Interest rate on

domestic and NRO deposit (631/23) Interest rate on NRE term deposit

(632/23) & RBI master directions on Deposits updated till 16th Sep 2022

(last update) New SB Products. (Contains 81 questions)

1. Which is not correct with Regard to SB Account? 1)Political Parties registered with

Election Commission of India under the election symbols Act 1968 can open SB

account and get interest 2)Banks can open SB account and pay interest for

Companies licensed by the Central Government under Section 8 of Companies Act,

2013 or Section 25 of Companies Act, 1956 or under the corresponding provision in

the Indian Companies Act, 1913 and permitted not to add to their names the word

“Limited‟ or the words “Private Limited‟. 3)PAN card is not considered as a Officially

Valid Document (OVD) for opening SB account. 4)If customer provides OVD

documents which do not contain updated address, updated OVD with current address

to be provided within a period of 3 months a) 1&2 b) 3&4 c) 1 only d) 4 only e) 2 only

2. Which is NOT correct with regard to SB account? a)Minimum deposit and with drawal

is Rs 10 b) Service charges will be collected if number of withdrawal including

alternate channel debit exceed 50 per half year c) Canara Basic Savings Bank Deposit

Account (BSBD) is a fully KYC complaint account d)Prisoner in jail can open Small

SB deposit Account e)A foreign national who has come to India for employment can

open a domestic SB deposit account

3. Which one of the following is a correct guidelines? a) Foreign Student who has come

to India can open NRO SB b) Foreign tourist visiting India can open NRO SB c) A

resident Indian married a foreign national and the foreign national has come to India

for permanent Stay and this foreign national can open a normal domestic SB account

d) a& b are correct e) a to c all are correct

4. For borrowers, whose OD/OCC exposure from the banking system is less than -- cro,

there is no restriction on opening of current accounts by banks, subject to obtaining

an undertaking from such borrowers that they shall inform the bank, as and when the

credit facilities availed by them from the banking system reaches---

5. If a NRE Term deposits matures and proceeds are unpaid, the amount left unclaimed

with the Bank shall attract interest from the date of maturity till the date of payment

or reinvestment at a) the contracted rate of interest on the matured deposit or SB

interest which ever is less b) rate of interest as applicable to SB account c) The

contracted interest of the matured term deposit e) None of these

6. If a term deposit matures on a holiday which one is correct with regard to payment of interest

for the holiday? 1) Simple interest shall be paid at the originally contracted rate on the original

principal deposit amount for the Holiday in respect of Fixed Deposit 2) In case of reinvestment

of Term deposits and recurring deposits, simple interest shall be paid at the originally

contracted rate for the holiday on the maturity value 3) For all types of deposits

SB interest prevailing on the date of maturity will be paid for the holiday on the principal

amount 4) No interest will be paid for the holiday. A) 1 only b) 2 only c) 1 & 2 d)3 only

With Best Wishes from L Jagennath

Page 2 of 8

7. HO Cir 767/22 gives the SB interest rates for various slabs wef 21.12.22. What is the

minimum and maximum interest rate for SB deposit in our bank? 2.90% and 4%

8. Which is not correct with regard to penalty for pre closure of domestic term deposit as

per HO Cir 631/23 1) A penalty of 1.00% shall be levied for premature closure, part

withdrawal, premature extension of Domestic & NRO term deposits of less than Rs.2

Crore that are accepted /renewed on or after 12.03.2019 excluding that of employees

/ ex employees 2) A penalty of 1.00% is waived in case of premature closure/part

withdrawal/ premature extension of Domestic/NRO CALLABLE term deposit of Rs. 2

Crore & above that are accepted/renewed on or after 12.03.2019. 3) A penalty of

1.00% is applicable on Term Deposits under Capital Gains Account Scheme-1988,

which are prematurely converted/withdrawn/closed, irrespective of the size of the

deposit amount. 4) No interest will be payable on Domestic/NRO term deposits

prematurely closed/prematurely extended before completion of 7th day from the date

of Opening 5 ) Penal cut is waived for NRO deposits that are prematurely closed for

the purpose of reinvestment in NRE term deposit. a) 1 to 5 all b) 1 to 5 None c) 1 &

5 d) 5

9. How many slabs are there in domestic and NRO term deposit int rate as per HO Cir

631/23?

10. How many slabs are there in NRE term deposit interest rate as per HO Cir 632/23?

11. Which is NOT correct with regard to Non Callable Term deposit as per HO Cir

631/23? A) Minimum amount is above Rs 15 lac b) Can not be accepted from

Individuals and HUF c)Non callable deposit of above Rs 15 lac to less than Rs 2 cro

can be accepted for 46 days and above and for less than 3 years d)Loans against

Non Callable deposit is permissible

12. If branches are desirous to quote rates other than the card rate for Single bulk deposit

of Rs 2 cro and above to less than Rs 10 cro branches to get permission from

a)Integrated Treasury Wing b)S&R Wing c) Respective Circle Offices d) Respective

ROs e) None of these

13. Who is the authority to get a branch designated to accept bulk deposit of Rs 10 cro

and above?

14. In respect of deposits of Rs.--- cro & above, a confirmatory letter in the form of a

“Thanks giving” letter will be sent by the Bank to the beneficiary by Registered

Post/Reputed Courier as well as e-mail and SMS wherever email ID and mobile

number are available, giving necessary details.

15. In case of loan/overdraft facility of Rs.--- Crore and above against the term deposit,

necessary due diligence shall be ensured by the branches.

16. In case of loan/overdraft facility of Rs 1 cro and above and less than than Rs –Rs 10

cro against the term deposit, necessary offsite monitoring should be done at the

BS&IC Section, Circle Office and for loans of Rs 10 cro and above by-------

With Best Wishes from L Jagennath

Page 3 of 8

17. For non deduction of tax at source customers to give 15 G or 15 H along with PAN.

If PAN is not available then which is correct? a) Form 60 to be accepted and TDS need

not be deducted b) Form 60 can be accepted and to be sent to IT department on

line on a quarterly basis c) Proof of having applied for PAN can be accepted TDS

need not accepted. d) None of these

18. Funds can be transferred from the NRO account to the NRE account of the customer

upto a maximum of --- million USD or its equivalent in other currencies in a FY

subject to production of Form 15 CA and form 15 CB by the customer.

19. Which is correct with regard to minimum amount required for opening FCNR deposit?

a) USD 500 b) Euro 500 c) GBP 500 d) AD 500 e) All are correct f) a to c only are

correct

20. The interest ceiling on FCNR (B) deposits and calculation of interest is as per RBI

guidelines and linked to a) LIBOR b) USD rate c) Overnight Alternative Reference

Rate d) None of these

21. Which is not correct with regard to payment of interest on FCNR deposit? a) In case

of FCNR [B] Fixed deposits accepted for a period of exactly one year, simple interest

is payable only on the date of maturity. In other words, in case of such FCNR [B] FDRs

accepted for a period of one year, interest for the entire year [365 or 366 days, as the

case may be] should be computed without any compounding effect and no payment

of interest should be made before completion of one year from the date of investment

b) In case of FCNR [B] Fixed Deposits accepted for more than one year, simple

interest can be paid at intervals of 180 days each and thereafter for remaining number

of days. c) In the case of FCNR (B) Fixed Deposits where the depositor wishes to get

monthly / quarterly interest, the same should be paid at discounted value. D) In case

of FCNR (B) KDR accounts, interest will be paid on maturity with compounding effect

at the interval of 180 days. e) None of these

22. In the case of renewal of Overdue FCNR deposit which is not correct? a) For the

overdue period interest to be paid on RFC SB rate or the contracted FNCR deposit

rate which ever is less and the deposit can not be renewed from the overdue date

irrespective of the overdue period b)If the overdue period is less than 14 days, it can

be renewed from the maturity date & the rate of interest payable shall be the rate of

interest for the period of renewal as prevailing on the date of maturity or on the date

of renewal, whichever is lower c) If the overdue period is more than 14 days simple

interest at RFC SB rate for the respective currency on the date of renewal or the

contracted rate on the matured FCNR deposit which ever is lower d) None of these

23. What is NOT relevant with regard to opening joint NRE and FCNR deposit by NRIs

with Resident Indians? a) Maximum Joint depositors only 4 b) with Close relatives as

defined in Indian Company Act with No I is NRI with Former or Survivor basis c) Money

belonging resident joint account holder can not be credited in this account d)The

resident joint account holder can operate the operative account only under a mandate

given by NRI e) After the death of NRI it becomes a Resident Account. f) all are

relevant

With Best Wishes from L Jagennath

Page 4 of 8

24. Which one of the following is NOT a relevant guidelines for Residents opening Joint

Resident accounts with NRIs? 1)Along with NRI close relative and the resident will be

No I 2) Either or Survivor basis c) For all purposes it is treated as resident account d)

Money belonging to NRI should not be credited to this account e)None of these

25. Additions and deletions of names of depositors are permitted with the consent of all

the depositors provided a) NO I in the original deposit should continue in the new

deposit. b) Any one of the original depositor to continue in the new deposit c) No I in

the old deposit should be NO I in new deposit also d) None of these

26. If FCNR/RFC term deposits remain overdue for a period of ---- years from the date of

maturity of the deposit, at the end of the ---year, branches shall convert the balances

lying in the foreign currency into Indian Rupee at the exchange rate (TT Buying)

prevailing as on that date and place the converted amount in overdue INR deposit. a)

10 and at the end of 10th year b) 3 and at the end of the 3rd year c) 5 and at the end of

the 5th year d) Banks should not covert the deposits into INR with out the consent of

the depositor.

27. In respect of foreign currency denominated deposits like RFC-SB, RFC-CA, or any

other FC deposit with no fixed maturity period, if the deposit remains inoperative for a

period of ------ years, branches shall give three months‟ notice to the depositor at his

last known address and convert the deposit from the foreign currency into Indian

Rupees, at the end of the notice period at the prevailing exchange rate (TT Buying) a)

10 years b) 3 years c) 2 years d) 5 years

28. April 1, 2012, Banks should not make payment of Cheques/Drafts/Pay

Orders/Banker's Cheques bearing that date or any subsequent date, if they are

presented beyond the period of three months from the date of such instrument as per

NI Act. True or False

29. Before classifying an account as inoperative bank to send revival notice to the

customer along with the charges to be debited for those inoperative accounts. If

customer reply to the bank giving reasons for non operating the account branches

should continue classifying the same as an operative account for ---- more year within

which period the account holder may be requested to operate the account. a) Can

not be continued as operative account b) one year c) 2 years d) None of these ]

30. If there is no response to the revival notice and if the balance is less than Rs ----

accounts to be closed.

31. Under the provisions of BR Act the amount to the credit of any account in India with

any bank which has not been operated upon for a period of ten years or any deposit

after maturity or any amount remaining unclaimed for more than ten years shall be

credited Depositors Education Awareness Fund (DEAF), What is the periodicity?

With Best Wishes from L Jagennath

Page 5 of 8

32. Which is NOT correct with regard to accounts of blind persons? 1) Branches to offer

all the banking facilities to the visually challenged persons without any discrimination.

2) Blind persons can issue cheques to third parties also 3) In case a visually impaired

customer makes cash withdrawals at the Bank then the payment must be made in the

presence of another bank employee/ officer without any outsider witness. 4)Outside

witness is required only when the visually impaired customer requests that such

witnesses be present Ans a) 1 to 4 all are not correct b) 2 c) 3 d) 1 to 4 none

33. Capital Gains deposit will attract a penalty of --- for pre closure irrespective of the size

of the deposit. A) 1% b) 2% c) Premature closure not permitted d) None of these.

34. The additional interest for Can Tax Saver for Senior Citizen general public,

employees & Sr Citizen ex employees respectively are a) 0.50%,1%,1.50% b) 0,50%,

1%, 1% c) No additional interest for Can Tax Saver for any category. D) None of these.

35. For Capital Gains account what is the additional interest available for Employees?

A)1% for employees b) 1% for Ex employees c) 1.50% for Sr citizen ex employee d)

All of these e) None of these

36. The additional interest for term deposit payable to the spouse (the spouse is a senior

citizen) of the deceased employee/deceased ex employee is a) 1.50% b) 1% c) As

applicable to general Public d) None of these

37. For Senior citizen domestic term deposit (including RD) for general public the

additional interest rate of 0.50% is provided by Canara Bank only if the deposit is for

--- days and above and the amount should be less than Rs ----. A) 180 days & Rs 2

cro b) Any slab and any amount c) 1 year and less than Rs 2 cro d) Other than the

options given

38. What is the additional interest payable for Senior Citizen ex employee term deposit of

Rs 20 lac accepted for 90 days? A) No additional interest since deposit is less than

180 days b) 1% more than general public c) 1.50% more than general public d) None

of these

39. The minimum period of acceptance of fresh domestic term deposit /NRO deposit of

Rs 2 lac in our bank is a) 7 days b) 15 days c)45 days d) can not be accepted

40. What is the minimum period of renewal of a domestic/NRO deposit of Rs 3 lac in

our bank? a) 7 days b) 15 days c) 46 days d) None of these

41. Maximum number of Joint depositors in Capital Gains deposit (both SB and term

deposit) is a) 4 b) No restriction c) More than 4 permission from MIPD d) None of these

42. Who is the authority to transfer term deposit from one branch to another within the

same city as well as outside the city as per the request of depositor HO Cir 710/23?

43. Who can not open NND account as per HO Cir 165/23? a)Partnership firms b) Clubs

& Associations c)Proprietary Concerns d) Companies e) a to d all

With Best Wishes from L Jagennath

Page 6 of 8

44. What is the minimum fall back wages in all areas if the agent collects the prescribed

amount in a month or in a quarter?

45. As per HO Cir 485/23 how many slabs are there in interest rate for NND?

46. For loans of above Rs 2 cro to depositors against our domestic term deposit the

required margin is 10% and interest rate to be charged to the loan is 1% above the

deposit rate as per HO Cir 621/23. Who is empowered to reduce interest rate for such

loans as per HO Cir 624/23? a) RO Head CAC and above authorities b)GM/CGM CO

CAC and above authorities c) Circle Head CAC and above authorities d) CGM/GM

HO CAC and above authorities

Questions on RBI Master direction on deposits Updated till Sep 2022 (last

updation)

47. The periodicity for crediting SB interest by any bank in India as per RBI guidelines is

a) first day of Calendar quarter b) Quarterly intervals c) 1 st Feb,1st May, 1st Aug and

1st Nov d) quarterly or lesser intervals

48. As per RBI master direction on deposits differential interest rate for SB deposit can be

paid by a bank provided the balance exceeds a) Rs 50 lacs b) Rs 25 lac c) Rs 10 lac

d) Rs 1 lac

49. For calculating interest on SB accounts as per RBI notification banks to take a) daily

product b) daily minimum product c) Monthly minimum product d) Monthly product e)

Minimum balance between 5th to Last day of the month

50. What is the amount of cheque that is mandatory for Positive pay? A) Rs 50,000 &

above b) Rs 5 lac and above c) Rs 10 lac and above d) None of these

51. As per RBI master Circular to earn interest in NRO and domestic term deposit

Minimum tenor of the deposit is ------ and minimum amount is Rs ----. A) 15 days &

Rs 1000 b) 7 days and Rs 5 lac c) 7 days and Rs 1000 d) None of these

52. As per RBI guidelines banks have to necessarily permit premature closure of term

deposit accepted from individuals (single or Joint) if the amount is Rs --- lac and below

a) Rs 2 cro b) Rs 1 cro c) Rs 50 lac d) Rs 5 lac e) Rs 15 lac

53. What is the additional interest that can be offered to the term deposits of Senior Citizen

by any bank in India as per RBI master direction on interest rate on deposits? A)

0.50% b) 1% c) 1.50 d) None of these.

54. To earn interest on NRE term deposit the minimum period is ---, for NRO deposit it is

--- and for FCNR deposit it is--- by any bank in India. A)1 year, 7 days and 1 year b) 1

year, 7 days & 365 days c) Banks discretion d) None of these

55. Which one of the following interest rates are specified by RBI and not left to the

discretion of the banks concerned? A) NRE Savings bank deposit, b) Domestic Term

Deposit c)Domestic SB deposit d) Loans to distressed persons upto Rs 1 lac e) None

of these.

With Best Wishes from L Jagennath

Page 7 of 8

56. As per RBI guidelines interest rate for NRE and NRO deposit (both SB and Term

deposits of similar maturity ) are to be: a) the same that of domestic deposit rates. b)

equal to or more than domestic deposit rate c) equal to or less than domestic deposit

rate d) at the discretion of the bank. C

57. Banks in India have to have same tenor for which type of deposit? a) Domestic b) NRO

c) NRE d) FCNR e) None of these

58. What type of FCNR deposit banks in India can open for NRIs? 1) Current account

under FATCA 2) SB account for Long Term Visa holders of Bangladesh 3) Term

deposit (Fixed and Reinvestment) other than RD 4) Term deposit including RD a) 4

b) 1 to 5 all c) 1 d) 3 e) 1 to 3 all

59. Differential interest rate for NRO/NRE/domestic term deposit can be paid by a bank

(other than RRBs) when the amount is Rs--- and above as per RBI guidelines a)

Above Rs 2 cro b) Rs 2 cro and above c) Above Rs 10 cro d) Rs 10 cro and above

60. As per RBI guidelines bulk deposit for Regional Rural banks means a) Single rupee

term deposit of Rs 2 cro and above b) Single rupee term deposit of Rs 1 cro and above

c) Single rupee term deposit of Rs 15 lac and above d) Single rupee term deposit of

Rs 50 lac and above

61. Form 15G/15H obtained from the customers are to be preserved for how many years?

a) 6 b) 7 c) 5 d) 10

62. Form 60 obtained from customer on 20th OCT 2022. This has to be preserved till

a)20th OCT 2028. b) 19th Oct 2028 c) 20th March 2028 d) 31st March 2029 D

63. What is the amount of term deposit that can be paid in cash? A) Less than Rs 20000

including interest b) up to and inclusive of Rs 20000 including interest c)less than Rs

50000 including interest d) upto and inclusive of Rs 50,000 with interest

64. The above is defined in Sec ---- of --- Act

65. If Sec 269 T is not complied with penalty is the amount paid in cash. This is defined

in --- Sec of --- Act

66. Find out the odd statement: a) All DDs to be issued with Account payee crossing only

b) All DDs of Rs 20,000 and above are to be issued with Account Payee Crossing only

c) Cash DDs can be permitted upto Rs 49,999 excluding commission & GST c) NEFT

for walk in customers to be permitted by accepting cash upto and inclusive of Rs

50,000

67. The deposits of which of the following banks not covered by Deposit Insurance

&Credit Guarantee Corporation of India (DICGC) ? a)All commercial banks including

foreign banks operating in India b) Local area baks c) Regional Rural Banks d)Co

operative banks e)Primary Co operative Societies

With Best Wishes from L Jagennath

Page 8 of 8

68. Which are the deposits not covered by DICGC? 1)Deposits of Foreign Govt 2)

Deposits of Central and State Govts of India 3)Inter bank deposits 4)Deposits of State

Land development Bank a) 1 b) 1 to 4 all c) 3 d) 4

69. Mr A is having a deposit of Rs 5 lac in Canara Bank branch X and another Rs 5 lac in

his name and in his wife name he being No I with branch Y of Canara Bank. He will

get insurance cover for Rs 5 lac only. True or False

70. Mr B is having a reinvest deposit of Rs 4 lac in your branch. The accrued interest date

is Rs 15,000. He wants to know how much of his deposit will be covered under

DICGC?

71. Mr X is having a deposit of Rs 5 lac in his name and another Rs 5 lac in his name in

Bank Y. He wants to know whether both the deposits will be covered under DICGC?

New SB Products

72. What is the Product Code for Canara SB Select? 147

73. What is NOT Correct with regard to Canara SB Select? a) MAB in Metro is Rs 20.000

b) Unlimited free locker operations c) 25 cheque leaves free in a Financial Year d)

NPCI insurance cover is available if one transaction has been done in the last 30 days

with the Rupay Platinum debit card attached to the account e) All options are correct

74. What is the maximum penalty if MAB not maintained by different category of branches

in Canara SB Select? Rs 65

75. What is the product code for Canara SB FCRA? (Foreign Contribution Regulation

Act)

76. Which is Not Correct with regard to Canara SB FCRA? a) Funds to this account to

be credited only from SBI Sansad Marg New Delhi branch. B) No other Credits are

permitted c)Withdrawal of Rs 20,000 and above by account payee cheque, NEFT /

RTGS and DD only d)FCRA registration to be updated in CH 131 e) a to d none

77. When the period of TOD in Canara Premium Pay roll Account, exceeds --- days

documents to be taken.

78. What is the age criteria for opening Canara Premium Payroll Account?

79. For NPCI insurance one Rupay Platinum debit card induced transaction at any PoS

/E-com both intra and inter bank transaction within ---- days prior to the date of

accident including accident date should have taken place in Premium Payroll

accounts.

80. What is the instant TOD limit permitted for Canara Jeevandhara Platinum?

81. Free Personalised Cheque leaves to Jeevandhara Diamond ----

With Best Wishes from L Jagennath

You might also like

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Recalled MCQs 2021 22Document16 pagesRecalled MCQs 2021 22Ghanshyam KumarNo ratings yet

- Worksheet For Bank Reconciliation - 8 PDFDocument2 pagesWorksheet For Bank Reconciliation - 8 PDFsanele dlaminiNo ratings yet

- Customer StatementDocument5 pagesCustomer StatementDarius Murimi NjeruNo ratings yet

- Chase Bank February Statement SummaryDocument1 pageChase Bank February Statement SummaryAbhishek VNo ratings yet

- 1532 - 2016 01 04 17 59 26 - 1451910566Document56 pages1532 - 2016 01 04 17 59 26 - 1451910566SheenaNo ratings yet

- DEPOSIT ADVICE DETAILSDocument3 pagesDEPOSIT ADVICE DETAILSMurali YNo ratings yet

- Account Number Deposit Amount Interest Rate (%P.A.) Start Date Maturity Date Maturity AmountDocument2 pagesAccount Number Deposit Amount Interest Rate (%P.A.) Start Date Maturity Date Maturity AmountKhushbu NanavatiNo ratings yet

- Model Paper - 4Document7 pagesModel Paper - 4Shiva DubeyNo ratings yet

- Rate of Interest (% P.a.)Document2 pagesRate of Interest (% P.a.)MeeNo ratings yet

- Provisional Tax Saving Fixed Deposit Confirmation AdviceDocument3 pagesProvisional Tax Saving Fixed Deposit Confirmation AdviceKunda MalleshNo ratings yet

- Bank of India Credit Proposal ChecklistDocument12 pagesBank of India Credit Proposal ChecklistshushanNo ratings yet

- Jan 2019 Exam Bank Question SolutionsDocument5 pagesJan 2019 Exam Bank Question Solutionsjitendra singhNo ratings yet

- Promn Exam MCQs 23-01-2022 - 5470497Document17 pagesPromn Exam MCQs 23-01-2022 - 5470497Ghanshyam KumarNo ratings yet

- Miao Huaxian Vs Crane BankDocument12 pagesMiao Huaxian Vs Crane BankAugustine Idoot ObililNo ratings yet

- FOREX Cir1684 12Document12 pagesFOREX Cir1684 12sunilNo ratings yet

- NHPC Application Form DetailsTNC PDFDocument47 pagesNHPC Application Form DetailsTNC PDFHariprasad ManchiNo ratings yet

- Policies Test 2 2022 23Document29 pagesPolicies Test 2 2022 23karshan.dabhi85No ratings yet

- KCC Yeye2012Document19 pagesKCC Yeye2012Aboli GajbhiyeNo ratings yet

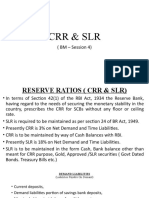

- CRR & SLRDocument19 pagesCRR & SLRBalpreet KaurNo ratings yet

- Mcqs Based On Bank'S Circulars During July, 2021Document8 pagesMcqs Based On Bank'S Circulars During July, 2021Shilpa JhaNo ratings yet

- GCC 2013-14Document7 pagesGCC 2013-14Noble MeshakNo ratings yet

- Knowledge Bank: Fedai RulesDocument10 pagesKnowledge Bank: Fedai RulesRohan Singh100% (1)

- Hand Out On All Types of Star Personal Loan - Updated Upto 25 May 2021Document35 pagesHand Out On All Types of Star Personal Loan - Updated Upto 25 May 2021Amit Manju AgrawalNo ratings yet

- OTS FORMULA Agri Loans Upto 25 Lacs Cir 481 2023 Mobile VersionDocument7 pagesOTS FORMULA Agri Loans Upto 25 Lacs Cir 481 2023 Mobile VersionDigbalaya SamantarayNo ratings yet

- Posb 7. NSC PDFDocument9 pagesPosb 7. NSC PDFbhanupalavarapuNo ratings yet

- Bangladesh Bank: Department of Offsight SupervisionDocument6 pagesBangladesh Bank: Department of Offsight SupervisionArabi HossainNo ratings yet

- HKB 05TechRiskMgmtpolicyPreshipCreditForeignCurrencyDocument25 pagesHKB 05TechRiskMgmtpolicyPreshipCreditForeignCurrencyParamu NatarajanNo ratings yet

- Question Bank On Customer Service: Prepared by SBILD AurangabadDocument22 pagesQuestion Bank On Customer Service: Prepared by SBILD AurangabadsayanNo ratings yet

- DBS Credit Limit Review Consent Form (P.E.T)Document1 pageDBS Credit Limit Review Consent Form (P.E.T)EswaranNo ratings yet

- CRR, SLR Requirements ExplainedDocument4 pagesCRR, SLR Requirements ExplainedBabul YumkhamNo ratings yet

- Trade Certification Level 3 AllDocument8 pagesTrade Certification Level 3 AllRAHUL BISHWASNo ratings yet

- Opening of Term DepositDocument8 pagesOpening of Term DepositDeepak RoyNo ratings yet

- 1 Pre-Promotion Training Material 2021 Indian Overseas Bank, Staff CollegeDocument7 pages1 Pre-Promotion Training Material 2021 Indian Overseas Bank, Staff CollegeAman MujeebNo ratings yet

- 1.1 FAQ On Tax Collection at Source (TCS) For Remittance and International Debit Card TransactionsDocument6 pages1.1 FAQ On Tax Collection at Source (TCS) For Remittance and International Debit Card Transactionsspyadav25298No ratings yet

- Session. 4. CRR & SLRDocument15 pagesSession. 4. CRR & SLRArbazuddin shaikNo ratings yet

- CAIIB Elective Paper - International Banking Updates No. No. UpdateDocument7 pagesCAIIB Elective Paper - International Banking Updates No. No. UpdateSelvaraj VillyNo ratings yet

- Multi-Option Question BankDocument36 pagesMulti-Option Question BankPerminder BhandariNo ratings yet

- RBC CP ASSOCIATES STUDY MATERIAL IMPORTANT QUESTIONS FOR EXAMDocument15 pagesRBC CP ASSOCIATES STUDY MATERIAL IMPORTANT QUESTIONS FOR EXAMkhudalNo ratings yet

- Nism Questions-26 GDocument14 pagesNism Questions-26 GabhishekNo ratings yet

- PMJDY Overdraft Scheme Explained in 40 CharactersDocument3 pagesPMJDY Overdraft Scheme Explained in 40 CharactersSreenivasa PaiNo ratings yet

- PMJDY Overdraft FacilityDocument3 pagesPMJDY Overdraft FacilityIftikhar AliNo ratings yet

- State Bank Learning Centre e-gyan Vol 1 Key HighlightsDocument13 pagesState Bank Learning Centre e-gyan Vol 1 Key Highlightsmevrick_guyNo ratings yet

- Cash Reserve Ratio (CRR) & Statutory Liquidity Ratio (SLR) Cash Reserve Ratio (CRR)Document4 pagesCash Reserve Ratio (CRR) & Statutory Liquidity Ratio (SLR) Cash Reserve Ratio (CRR)Sushil KumarNo ratings yet

- Directive No. 15. NRBDocument5 pagesDirective No. 15. NRBManish BhandariNo ratings yet

- Balance Transfer Application Form CorrectDocument1 pageBalance Transfer Application Form CorrectPgcatNo ratings yet

- Post Office Saving SchemesDocument1 pagePost Office Saving SchemesTanuja ShirodkarNo ratings yet

- Muthoot Gold Loan T&ADocument6 pagesMuthoot Gold Loan T&AfinaarthikaNo ratings yet

- Kisan Vikas Patra Scheme: Prepared By: Jagdish Chosala Instructor, PTC VadodaraDocument9 pagesKisan Vikas Patra Scheme: Prepared By: Jagdish Chosala Instructor, PTC Vadodarabhanupalavarapu100% (1)

- Recalled IOB Promotion Questions Covering Banking Regulations, NPA Management, Priority Sector Lending & Foreign ExchangeDocument13 pagesRecalled IOB Promotion Questions Covering Banking Regulations, NPA Management, Priority Sector Lending & Foreign Exchangekannan PNo ratings yet

- PNB Registers 16.7% Growth, Aims Rs 10 Lakh Crore Turnover By2013Document8 pagesPNB Registers 16.7% Growth, Aims Rs 10 Lakh Crore Turnover By2013Anil DhankharNo ratings yet

- Trade Certification Level 2 Exclude ImportsDocument15 pagesTrade Certification Level 2 Exclude ImportsRAHUL BISHWASNo ratings yet

- CRR & SLRDocument3 pagesCRR & SLRSwathy SidharthanNo ratings yet

- RDDocument5 pagesRDAlok Pathak100% (1)

- Ifci Infra Bonds Terms Sept2011Document1 pageIfci Infra Bonds Terms Sept2011navneet1107No ratings yet

- 06 Housing Finance - 2, (S-2) Auto, Personal, Edu LoansDocument40 pages06 Housing Finance - 2, (S-2) Auto, Personal, Edu LoansTarannum Aurora 20DM226No ratings yet

- Govt SchemesDocument49 pagesGovt SchemesArul pratheebNo ratings yet

- Mahindra Finance Fixed Deposit FAQsDocument4 pagesMahindra Finance Fixed Deposit FAQsPoonam ShardaNo ratings yet

- BNK 632: International Finance &bankingDocument31 pagesBNK 632: International Finance &bankingShubham SrivastavaNo ratings yet

- IBC Bankruptcy Code QuestionsDocument101 pagesIBC Bankruptcy Code QuestionsRitesh SharmaNo ratings yet

- Ans Test Set 2Document10 pagesAns Test Set 2vinayNo ratings yet

- MCQDocument6 pagesMCQArup Kumar DasNo ratings yet

- HDFC Fixed Deposits Individual Application Form Contact Wealth Advisor Anandaraman at 944-529-6519Document5 pagesHDFC Fixed Deposits Individual Application Form Contact Wealth Advisor Anandaraman at 944-529-6519Mutual Funds Advisor ANANDARAMAN 944-529-6519No ratings yet

- Payment Return AgreementDocument6 pagesPayment Return AgreementSonica DhankharNo ratings yet

- For Confirmations After The First Response IsDocument6 pagesFor Confirmations After The First Response IsRin ZhafiraaNo ratings yet

- Abstract HBL 1Document19 pagesAbstract HBL 1Niaz DinNo ratings yet

- Director Finance in New York NY Resume Charles RebisDocument2 pagesDirector Finance in New York NY Resume Charles RebisCharlesRebisNo ratings yet

- Assignment 1Document2 pagesAssignment 1HANIS HADIRAH BINTI HASHIMNo ratings yet

- Baljinder SinghDocument4 pagesBaljinder SinghsunilNo ratings yet

- Money Banking MGT 411 LecturesDocument148 pagesMoney Banking MGT 411 LecturesshazadNo ratings yet

- Fdocuments - in Project Report of Oscb 11Document41 pagesFdocuments - in Project Report of Oscb 11MANASI MAHARANANo ratings yet

- Frenklin TemlitonDocument12 pagesFrenklin TemlitonShailendra ShuklaNo ratings yet

- Questionnaire For Financial Advosory SurveyDocument2 pagesQuestionnaire For Financial Advosory SurveyharishmnNo ratings yet

- Banking System Case Study 1 Problem DescriptionDocument5 pagesBanking System Case Study 1 Problem DescriptionMeNo ratings yet

- KASB Institute of Technology (PVT.) Ltd. Kasbit KASB Institute of Technology (PVT.) Ltd. Kasbit KASB Institute of Technology (PVT.) Ltd. KasbitDocument2 pagesKASB Institute of Technology (PVT.) Ltd. Kasbit KASB Institute of Technology (PVT.) Ltd. Kasbit KASB Institute of Technology (PVT.) Ltd. KasbitAsadullah KhanNo ratings yet

- SQL PRACTICEDocument4 pagesSQL PRACTICEparmar shyam50% (2)

- D 1 3pdfUserGuide of CBBankCardPortalDocument16 pagesD 1 3pdfUserGuide of CBBankCardPortalbluegyiNo ratings yet

- Factors Affecting Non-Performing Loans: Case Study On Development Bank of Ethiopia Central RegionDocument15 pagesFactors Affecting Non-Performing Loans: Case Study On Development Bank of Ethiopia Central RegionJASH MATHEW67% (3)

- Cooperation Department in BengalDocument1 pageCooperation Department in BengalK Srinivasa MurthyNo ratings yet

- Overview of Indian Capital Markets and Key IndicatorsDocument58 pagesOverview of Indian Capital Markets and Key IndicatorsFarzana SayyedNo ratings yet

- Wa0009.Document34 pagesWa0009.Tejas GaubaNo ratings yet

- Pre-Approved Xpress Credit LoanDocument1 pagePre-Approved Xpress Credit LoanArjunNo ratings yet

- PICG Directors Training Program ListDocument95 pagesPICG Directors Training Program ListFaizan Rasool100% (1)

- Types of Plastic MoneyDocument26 pagesTypes of Plastic MoneyKevin D'Costa100% (1)

- Inter-Acct1Document6 pagesInter-Acct1.No ratings yet

- A Cashless Society in 2018 v7 - DiscDocument105 pagesA Cashless Society in 2018 v7 - DiscAnonymous HsoXPyNo ratings yet

- Pine Labs Q2 ManualDocument10 pagesPine Labs Q2 ManualAli WarsiNo ratings yet

- Financial Services in IndiaDocument3 pagesFinancial Services in IndiamargetNo ratings yet

- Haritha Project ReportDocument37 pagesHaritha Project ReportSarin SayalNo ratings yet