Professional Documents

Culture Documents

J Corp Accounting Finance - 2009 - Dickins - Bridging The Expectations Gap

Uploaded by

Mahmoud magedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

J Corp Accounting Finance - 2009 - Dickins - Bridging The Expectations Gap

Uploaded by

Mahmoud magedCopyright:

Available Formats

JCAF-21-1_20547.

qxd 9/26/09 6:15 AM Page 51

e ar

at r

ticl

u

e

fe

Bridging the Expectations Gap

Denise Dickins and Julia L. Higgs

R

egulators and reasons. First, a lack of

others first The term expectations gap describes the differ- understanding between

began immortal- ence between investors’ ideas of a financial state- the public and auditors

izing the term expec- ment audit and what standards actually require. has long been consid-

tations gap in the Despite many changes in auditing standards, ered a source of litiga-

1970s (e.g., American investors still misunderstand the auditor’s report. tion risk. Research indi-

Institute of Certified © 2009 Wiley Periodicals, Inc.

cates that jury pools

Public Accountants have very different

[AICPA], 1977; expectations of audi-

Liggio, 1974) as a way tors’ roles than auditors

to describe the difference current auditing standards be do (Frank, Lowe, & Smith,

between financial statement clarified in the auditor’s report 2001). These business risks of

users’ ideas of a financial state- (Advisory Committee on the audit firms are necessarily

ment audit and what auditing Department of the Auditing passed onto clients in the form

standards require in a financial Profession, 2008). of higher audit fees. Further, the

statement audit. Thirty years, an confidence of the capital mar-

untold number of new auditing CLARIFYING WHAT kets in the assurance role of the

standards, and at least a dozen AUDITORS DO auditor is undermined when the

accounting scandals later, we role of the auditor is poorly

still appear to be no closer to Unfortunately, the communi- understood. This is perhaps

closing the gap. cation tool that the profession especially true in the case of

Recent efforts to close the uses to describe a financial state- fraudulent financial reporting.

gap include the Public Company ment audit is three paragraphs The auditor’s responsibility for

Accounting Oversight Board’s long and a little under 250 words. the detection of fraud continues

(PCAOB’s) recently issued In this article, we attempt to bet- to be one of the biggest contrib-

Auditing Standard (AS) No. 6, ter clarify what auditors do. In utors to the expectation gap.

Evaluating the Consistency of audits of the largest corporations, In this article, we identify

Financial Statements, intended backing up those 250 words issues that we believe—and

to improve communication when entails fees of millions of dollars others have reported—contribute

financial statements are restated and thousands of hours of profes- to the gap between financial

(PCAOB, 2008), and the Sub- sional labor.1 We hope by better statement users’ beliefs and

committee on Firm Structure explaining the auditing standards auditors’ processes (e.g.,

and Finances of the Treasury that underlie the meaning of the McEnroe & Martens, 2001). We

Advisory Committee on the auditor’s report that we can help discuss these issues in the con-

Auditor Profession’s final rec- reduce the expectations gap. text of the auditors’ communi-

ommendation that the auditor’s Explaining the role of the cations tool, the auditor’s

role in detecting fraud under audit is important for several report. Topics covered include:

© 2009 Wiley Periodicals, Inc.

Published online in Wiley InterScience (www.interscience.wiley.com).

DOI 10.1002/jcaf.20547 51

JCAF-21-1_20547.qxd 9/26/09 6:15 AM Page 52

10970053, 2009, 1, Downloaded from https://onlinelibrary.wiley.com/doi/10.1002/jcaf.20547 by Mahmoud Ali - Egyptian National Sti. Network (Enstinet) , Wiley Online Library on [28/05/2023]. See the Terms and Conditions (https://onlinelibrary.wiley.com/terms-and-conditions) on Wiley Online Library for rules of use; OA articles are governed by the applicable Creative Commons License

52 The Journal of Corporate Accounting & Finance / November/December 2009

what is meant by an unqualified Because of the events culminating 2007), supersedes AS 2, An

opinion; what is the auditor’s in the signing of the Sarbanes- Audit of Internal Control Over

responsibility for the detection Oxley Act of 2002 (SOX), the Financial Reporting Performed

of fraud; how does an auditor profession was deemed to be in Conjunction With an Audit of

determine materiality; what is incapable of self-regulation with Financial Statements (PCAOB,

meant by a financial statement respect to setting auditing stan- 2004), and requires that auditors

restatement; when does an audi- dards and monitoring the quality of publicly traded companies

tor issue a going-concern opin- of auditors of publicly-traded report on the financial state-

ion; what does it mean when a companies, so the PCAOB was ments and on the effectiveness

company reports a material created. The PCAOB’s primary of internal control over financial

weakness in internal control; and functions are standard setting reporting. Internal control over

how does a review of quarterly and the registration and inspec- financial reporting is any

financial data differ from an tion of auditors of publicly process or procedure considered

audit of the annual financial traded companies.3 Thus, the necessary to ensure that external

statements? ASB now sets auditing standards financial reports are accurate,

for audits of privately held com- complete, and timely. As an

THE AUDITOR’S panies, and the PCAOB sets example, the timely preparation

COMMUNICATION TOOL: THE auditing standards for audits of and review of bank reconcilia-

AUDITOR’S REPORT public companies.4 The tions is necessary to ensure that

PCAOB’s rules of auditing are the amounts reported as “cash” in

The auditor is limited in called Auditing Standards the financial statements are valid

what may be communicated to (ASs).5 SASs 1 to 100 were and, hence, part of a company’s

readers of financial statements to adopted by the PCAOB as system of internal control over

his or her report. As the financial reporting. On the

report is required to be other hand, the recruitment

standardized, the auditor The AICPA and the PCAOB carefully of sales personnel is a

has limited ability to mod- vet the standard wording of the process that likely has little

ify or to provide additional direct impact on the finan-

explanation about the con- auditor’s report to communicate to cial statements and therefore

duct of the audit or the readers what responsibility the audi- is not a part of a company’s

judgment that is part of the tor takes for the audit of the finan- system of internal control

auditing process. These over financial reporting.

judgments include an cial statements. These required tests of

assessment of materiality, internal controls for large

an assessment of going publicly traded companies

concern, a determination of may magnify the expecta-

the existence of errors and fraud, “Interim Standards”; thus, audits tion gap for small public compa-

and a determination of whether of privately held and publicly nies and for privately held com-

internal control violations meet traded companies are identical in panies,7 as readers of audit

the criteria of being material many ways. Since 2002, the reports of privately held compa-

weaknesses, among other things. ASB has adopted 16 additional nies generally believe that audi-

The AICPA and the PCAOB SASs and the PCAOB has tors do a lot more testing of

carefully vet the standard word- adopted six ASs, some of which internal controls than is required

ing of the auditor’s report to modify Interim Standards. All (McEnroe & Martens, 2001).

communicate to readers what ASs must be approved by the For audits where AS 5 is not

responsibility the auditor takes SEC prior to becoming law for mandated, the auditing standards

for the audit of the financial publicly traded companies.6 only require that the auditor gain

statements. Auditors of privately held and document their understand-

Until 2002, auditing stan- companies generally only report ing of the system of internal

dards were set by the Auditing on the financial statements. AS control in order to assess the risk

Standards Board (ASB) of the 5, An Audit of Internal Control of material misstatement in the

AICPA. Standards set by the Over Financial Reporting That financial statements, whether

ASB are called Statements of Is Integrated with An Audit of due to error or fraud. Only if the

Auditing Standards (SASs).2 Financial Statements (PCAOB, auditor determines that it is more

DOI 10.1002/jcaf © 2009 Wiley Periodicals, Inc.

JCAF-21-1_20547.qxd 9/26/09 6:15 AM Page 53

10970053, 2009, 1, Downloaded from https://onlinelibrary.wiley.com/doi/10.1002/jcaf.20547 by Mahmoud Ali - Egyptian National Sti. Network (Enstinet) , Wiley Online Library on [28/05/2023]. See the Terms and Conditions (https://onlinelibrary.wiley.com/terms-and-conditions) on Wiley Online Library for rules of use; OA articles are governed by the applicable Creative Commons License

The Journal of Corporate Accounting & Finance / November/December 2009 53

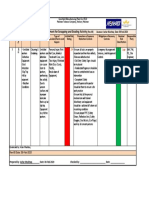

effective and efficient to rely on The basic, unqualified report company and period covered by

internal controls is testing of on the financial statements the financial statements) and

internal controls required. If the includes three paragraphs. The affirms that the financial state-

auditor believes that either (1) it language attempts to clearly ments are the responsibility of

is more efficient to only perform communicate some things that management, while the auditors’

tests of details and analytical historically have contributed to responsibility is the expression

review to support his or her the gap between readers of of an opinion on the financial

report on the financial state- financial statements and audi- statements. The report’s

ments or (2) that a company’s tors. The standard unqualified emphasis on management’s

system of internal control is not opinion without modification is responsibility for the financial

sufficiently effective to ensure presented in Exhibit 1. It has statements is intended as a

that if material errors or fraud three standard paragraphs: intro- reminder that management has

occur, they will be detected in a ductory, scope, and opinion. primary responsibility for the

timely manner, the auditor would detection of error and irregulari-

likely opt to place no reliance on Introductory Paragraph ties (fraud) in the financial

a company’s system of internal statements.

control. In such instances, no The introductory paragraph One of the largest sources

testing of internal controls is describes which financial state- of the expectations gap is the

required. Further, if the auditor ments are audited (i.e., name of auditor’s responsibility for the

concludes the company’s system

of internal control is inadequate,

this conclusion is not required to

be documented or reported in the Exhibit 1

auditor’s report on financial

statements. The auditor’s report

on the financial statements Independent Auditor’s Report

makes no representation about

the quality or effectiveness of We have audited the accompanying consolidated statements of financial

internal controls. position of ABC Company as of December 31, 2XXX and 2XXX, and the

related consolidated statements of operations, shareholders’ equity, and

UNQUALIFIED REPORTS cash flows for each of the three years in the period ended December 31,

2XXX. These financial statements are the responsibility of the Company’s

There are four types of management. Our responsibility is to express an opinion on these finan-

reports that an auditor may issue cial statements based on our audits.

on the financial statements:

unqualified, qualified, adverse, We conducted our audits in accordance with auditing standards generally

and disclaimer. As the Securities accepted in the United States (or standards of the PCAOB). Those standards

and Exchange Commission (SEC)

require that we plan and perform the audit to obtain reasonable assurance

will not accept the last three types

of auditor’s reports—which basi- about whether the financial statements are free of material misstatement.

cally say that the auditor either An audit includes examining, on a test basis, evidence supporting the

believes that the financial state- amounts and disclosures in the financial statements. An audit also includes

ments are not presented in accor- assessing the accounting principles used and significant estimates made by

dance with generally accepted management, as well as evaluating the overall financial statement presenta-

accounting principles (GAAP) or tion. We believe that our audits provide a reasonable basis for our opinion.

the auditor was unable to com-

plete all of the procedures neces- In our opinion, the consolidated financial statements referred to above

sary to be able to form an opinion present fairly, in all material respects, the financial position of ABC Com-

about the fairness of the financial pany of December 31, 2XXX and 2XXX, and the results of their opera-

statements—we focus our discus- tions and their cash flows for each of the three years in the period

sion on the various types of ended December 31, 2XXX, in conformity with accounting principles

unqualified reports typically generally accepted in the United States of America.

accompanying financial state-

ments filed with the SEC.

© 2009 Wiley Periodicals, Inc. DOI 10.1002/jcaf

JCAF-21-1_20547.qxd 9/26/09 6:15 AM Page 54

10970053, 2009, 1, Downloaded from https://onlinelibrary.wiley.com/doi/10.1002/jcaf.20547 by Mahmoud Ali - Egyptian National Sti. Network (Enstinet) , Wiley Online Library on [28/05/2023]. See the Terms and Conditions (https://onlinelibrary.wiley.com/terms-and-conditions) on Wiley Online Library for rules of use; OA articles are governed by the applicable Creative Commons License

54 The Journal of Corporate Accounting & Finance / November/December 2009

detection of fraud. Over the accounting information that, in must also consider qualitative

years, the AICPA has made sev- the light of surrounding circum- factors such as the impact of

eral attempts to bridge the expec- stances, makes it probable that the changes in the financial state-

tation between what the public judgment of a reasonable person ments on debt compliance, and

perceives an auditor’s responsi- relying on the information would the company’s ability to meet

bility is for the detection of fraud have been changed or influenced analysts’ expectations. SAB 99

and what auditors are actually by the omission or misstatement.” reminds auditors that adjustments

able to do in the context of the AU 312A describes the qualities to the financial statements that

detection of financial statement of a reasonable person that would change earnings per share by a

fraud. The AICPA’s most recent be relying on financial statements penny may be considered mate-

attempt is SAS 99 (AICPA, and presumes that readers of rial, as they could translate to bil-

2002a). This standard, written in financial statements “(1) have an lions of dollars in changes in a

conjunction with the Association appropriate knowledge of busi- company’s market capitalization.

of Certified Fraud Examiners, is ness and economic activities and Materiality and risk are closely

unique among auditing standards. accounting and a willingness to tied together in the auditor’s

In addition to audit requirements, study the information in the judgment process.

it has an appendix to help audi- financial statements with an While it would be nice to

tors identify fraud risk factors appropriate diligence; (2) under- have a bright-line measure of

and also has an appendix to assist stand that financial statements are materiality—and while as a

management in developing fraud- prepared and audited to levels of practical matter auditors fre-

prevention programs. quently start their evalua-

Under SAS 99, man- tion of materiality using

agement and those charged Under SAS 99, management and those measures like a percentage

with governance are charged with governance are responsi- of net income, revenues, or

responsible for setting the assets—ultimately, materi-

proper tone, creating and ble for setting the proper tone, creat- ality comes down to the

maintaining a culture of ing and maintaining a culture of judgment of the auditor.

honesty and high ethical The following example

standards, and establishing

honesty and high ethical standards, serves to highlight the

appropriate controls to pre- and establishing appropriate controls exchange between quantita-

vent, deter, and detect to prevent, deter, and detect fraud. tive and qualitative assess-

fraud (paragraph 4). Audi- ments of materiality.

tors have a responsibility to Suppose a company has

plan and perform the audit $10 million in income and

to obtain reasonable assurance materiality; (3) recognize the the auditor sets a materiality

about whether the financial state- uncertainties inherent in the threshold at 5 percent of income.

ments are free of material mis- measurement of amounts based The auditor can tolerate a mis-

statement whether due to error on the use of estimates, judgment, statement in income up to

(unintentional misstatements) or and the consideration of future $500,000. Suppose the company

fraud (intentional misrepresenta- events; and (4) make appropriate underestimated the allowance for

tions) (paragraph 12). As might economic decisions on the basis bad debts by $350,000, which

be expected, intent is often diffi- of the information in the financial caused net accounts receivable to

cult to prove. Nevertheless, the statements.” be overstated by the same amount.

audit must include audit tests For public companies, the This overstatement caused the

designed to detect both. The SEC further clarified the concept current ratio to be higher, which

auditor must conclude whether or under Staff Accounting Bulletin in turn caused the company to

not the financial statements are (SAB) No. 99, Materiality (SEC, meet a debt covenant it would

free of material errors and fraud. 1999). SAB 99 requires that the have otherwise missed. Although

Materiality is described in auditor consider both quantitative the $350,000 is within the materi-

AU Section 312A (AICPA, 1983) and qualitative factors when ality guidelines, the $350,000

and references the FASB Con- determining materiality. This would be considered a material

cepts Statement 2 (FASB, 1980) means that materiality judgments error because it would mean the

definition: “the magnitude of an may not solely be based on difference between meeting and

omission or misstatement of thresholds of financial data. They not meeting the debt covenants.

DOI 10.1002/jcaf © 2009 Wiley Periodicals, Inc.

JCAF-21-1_20547.qxd 9/26/09 6:15 AM Page 55

10970053, 2009, 1, Downloaded from https://onlinelibrary.wiley.com/doi/10.1002/jcaf.20547 by Mahmoud Ali - Egyptian National Sti. Network (Enstinet) , Wiley Online Library on [28/05/2023]. See the Terms and Conditions (https://onlinelibrary.wiley.com/terms-and-conditions) on Wiley Online Library for rules of use; OA articles are governed by the applicable Creative Commons License

The Journal of Corporate Accounting & Finance / November/December 2009 55

The auditor will evaluate fraudulent financial reporting assurance” regarding whether the

some high-risk aspects of the has to be understood through the financial statements are free of

engagement such as related-party lens of risk-based auditing in material misstatements resulting

transactions or transactions which audit effort is concentrated from errors or fraud. What the

involving management with lower where risk of misstatement is auditor’s report implicitly states

materiality thresholds than mis- perceived to be highest. When is that the financial statements

statements due to errors. For the auditor plans the audit, he or may still contain immaterial mis-

example, even if the auditor has she identifies the financial state- statements arising from error or

established an initial definition of ment items with the highest risk fraud. This paragraph of the

materiality of $500,000, a of material misstatement by auditor’s report also points out

$50,000 loan to the CEO would jointly considering the areas that the auditor relies on sam-

be considered material because where controls are weakest and pling, implying that sampling

loans to CEOs, regardless of size, where the account is inherently error (i.e., the risk that a sam-

are not allowed under the law risky.8 The auditor then concen- ple’s characteristics are not rep-

(SOX Section 402a). Although trates the audit effort on these resentative of a population)

regular audits are not designed to higher-risk areas. SAS 99 specif- could arise as part of the audit

find immaterial frauds, if they are ically requires that the auditor process. Finally, although finan-

detected as part of the audit they consider how the financial state- cial statements are based on

must be reported to management ments might be misstated due to numerical amounts, the report

and the audit committee of the misstatements of revenues, the points out to readers that imbed-

board of directors. ded in those numbers are a

In looking for material number of estimates.9 Col-

fraud, the auditor will Despite auditors’ efforts, it is still lectively, these statements

design tests to look for likely that immaterial instances of communicate to the reader

both misappropriation of fraud will go undetected, such as that auditing the financial

assets and fraudulent finan- statements is not an exact

cial reporting. SAS 99 employee theft of inventory. Further, process, that the audit is

requires that the auditor despite excellent audit planning and designed only to provide

identify (through brain- reasonable assurance that

storming, analytical proce- execution, when perpetrated by collu- the financial statements are

dures, and discussions with sion or management override of not materially misstated,

management and the board controls, fraud is difficult to detect. and that given the number

of directors) and document of estimates included in the

fraud risks. The audit plan financial statements (i.e.,

must address plans to man- the allowance for doubtful

age the identified fraud risks in most common type of fraudulent accounts), the financial state-

the conduct of the audit through financial reporting. ments are likely not free of mis-

additional testing. Each member Despite auditors’ efforts, it statements. What financial state-

of the team is reminded to main- is still likely that immaterial ment users are left with is

tain a mental attitude of profes- instances of fraud will go unde- limited assurance that if discov-

sional skepticism, which, when tected, such as employee theft of ered by the auditor, material

properly used, can significantly inventory. Further, despite excel- adjustments will be reflected in

add to the overall judgment qual- lent audit planning and execution, the financial statements.

ity of the audit process. when perpetrated by collusion or Today with the stronger

As a practical matter, for management override of controls, rules of corporate governance in

publicly traded companies, it is fraud is difficult to detect. place as a result of SOX, how

not likely that the most common material audit adjustments are

fraudulent transaction—theft of Scope Paragraph handled is different from the

cash or other assets—will rise to past. All adjustments that meet

a level of materiality such that it The second, or scope, para- the auditor’s level of materiality,

would be detected by the auditor. graph describes the nature of an whether or not recorded by the

More likely, material fraud will audit and its limitations. The company, must be discussed

occur through fraudulent finan- report emphasizes that the audi- with the audit committee. If the

cial reporting. The detection of tor is giving only “reasonable adjustment was discovered by

© 2009 Wiley Periodicals, Inc. DOI 10.1002/jcaf

JCAF-21-1_20547.qxd 9/26/09 6:15 AM Page 56

10970053, 2009, 1, Downloaded from https://onlinelibrary.wiley.com/doi/10.1002/jcaf.20547 by Mahmoud Ali - Egyptian National Sti. Network (Enstinet) , Wiley Online Library on [28/05/2023]. See the Terms and Conditions (https://onlinelibrary.wiley.com/terms-and-conditions) on Wiley Online Library for rules of use; OA articles are governed by the applicable Creative Commons License

56 The Journal of Corporate Accounting & Finance / November/December 2009

the auditor, not by management the board of directors, and the statements can assume that the

as a part of the company’s sys- auditor all potentially face severe financial statements are presented

tem of internal control, the audi- criminal, reputational, and finan- on a consistent basis (same

tor must decide whether the cial consequences. GAAP, same reporting structure),

company has a material weak- unless the auditor states other-

ness in internal control over Opinion Paragraph wise. The auditing standards go

financial reporting. Material into some amount of detail as to

weaknesses are reported in the The third, or opinion, para- what is meant by consistency.

auditor’s Report on the Effective- graph includes the auditor’s con- First, consistency is concerned

ness on Internal Control over clusion about whether the finan- with how a company reports from

Financial Reporting, which we cial statements present fairly the year to year. It is not related to

discuss later. financial position and results of the concept of comparability,

If the company disagrees operations of the company. Again which relates how Company A

with the auditor’s proposed the language emphasizes that the is compared to Company B.

adjustment to the financial state- financial statements present Consistency modifications will

ments, there are other considera- fairly, in all material respects. only be present in the report if

tions. Most importantly, the audi- In certain circumstances, the they materially impact the

tor must make a determination auditor’s report may be modified, financial statements.

about whether the unrecorded yet still be considered unqualified. An important type of consis-

adjustment rises to the level tency modification is a

of making the financial change in the application of

statements materially mis- GAAP such as the change

leading. If so deemed, the

SAS 99 requires that the auditor from straight-line to accel-

auditor would be required to continuously update the fraud risk erated depreciation for

qualify his or her report. As associated with an audit, making property and equipment, or

previously mentioned, since the change from first-in,

the SEC will not allow a adjustments for things like the first-out (FIFO) to last-in,

publicly traded company to company’s posture on aggressive first-out (LIFO) accounting

file a qualified report, the for the cost of inventories.

auditor’s only other alterna-

accounting positions. These types of changes are

tive would be to withdraw considered voluntary. On

from the engagement.10 The the other hand, the adoption

other determination that the audi- The two most frequent modifica- of a newly implemented account-

tor must make when clients tions are when prior financial ing principle, like the adoption of

refuse to record the auditor’s pro- statements have been changed as SFAS 123R (FASB, 2004), which

posed adjustments is whether a result of a company adopting a requires the expensing of stock

management (and the board) are new accounting standard, or options, would be considered an

intentionally (fraudulently) trying changing from one generally involuntary change.

to misrepresent the company’s accepted accounting principle to Prior to the adoption of

financial results or financial posi- another generally accepted SFAS 154 (FASB, 2005), when

tion. Again, if this is deemed to accounting principle; and when companies changed their

be the case, the auditor is likely the auditor wants to emphasize accounting principles, the effect

to withdraw from the engage- a matter like the risk that the of the change was reflected in

ment. SAS 99 requires that the company may be unable to the financial statements as a

auditor continuously update the continue as a going concern. cumulative effect in the income

fraud risk associated with an statement in the year of adop-

audit, making adjustments for COMMUNICATING ABOUT tion. Cumulative effects of

things like the company’s posture CONSISTENCY accounting changes were pre-

on aggressive accounting posi- sented below income from con-

tions. The cost of failing to adjust Communicating about con- tinuing operations, but above net

the financial statements, if those sistency is important enough that income. SFAS 154 now requires

financial statements are later it is included in one of the ten companies, absent any require-

found to be materially mislead- generally accepted auditing stan- ment to do otherwise, to revise

ing, is substantial. Management, dards (GAAS). Users of financial the financial statements for all

DOI 10.1002/jcaf © 2009 Wiley Periodicals, Inc.

JCAF-21-1_20547.qxd 9/26/09 6:15 AM Page 57

10970053, 2009, 1, Downloaded from https://onlinelibrary.wiley.com/doi/10.1002/jcaf.20547 by Mahmoud Ali - Egyptian National Sti. Network (Enstinet) , Wiley Online Library on [28/05/2023]. See the Terms and Conditions (https://onlinelibrary.wiley.com/terms-and-conditions) on Wiley Online Library for rules of use; OA articles are governed by the applicable Creative Commons License

The Journal of Corporate Accounting & Finance / November/December 2009 57

prior periods to reflect the ple, or changes from another gen- amount of latitude in deciding

period-specific effects of apply- erally accepted accounting princi- whether to discuss something that

ing the new accounting princi- ple, the auditor’s report must he believes the reader of the

ple. In other words, the historical include an explanatory paragraph financial statement should pay

financial statements are now similar to the following: particular attention to, such as,

restated. When these types of when there exists an unusual

retrospective adjustments were As discussed in Note X to amount of litigation risk, asset-

made, auditors modified their the financial statements, realization uncertainties, extrac-

reports to alert the reader that the company has changed tive industries uncertainties, con-

the financial statements had (or elected to change) tingent liabilities, and

been restated. As might be its method of accounting related-party transactions (Butler,

expected, there was likely some for ABC in YEAR due to Leone, & Willenborg, 2004). By

confusion among readers of the adoption of Account- far the most common matter that

auditors’ reports as to whether ing Pronouncement (if auditors emphasize is the risk that

restatements were “bad,” result- applicable). a company may be unable to con-

ing from corrections or errors, or tinue as a going concern. Audit

were the result of changing or On the other hand, if the Analytics reported that in 2006,

adopting new accounting stan- financial statements have been 16.6 percent (2,318) of auditor

dards. The ability to distin- reports of publicly traded

guish the type of change companies included para-

giving rise to restated graphs emphasizing going-

financial statements is

When the auditor believes that there concern issues.

important, as research has is substantial doubt that a company The financial statements

generally found that while will fail in less than one full year are prepared under the

the market does not react assumption that the com-

to changes in accounting from the date of the financial state- pany will continue into the

methods with no economic ments, AU 341 requires that the foreseeable future, based on

effects (e.g., Dawson, Neu- the idea that an entity will

pert, & Stickney, 1980;

auditor include an explanatory para- be a going concern. This

Vigeland, 1981), the mar- graph in his or her report emphasiz- means that the company’s

ket does react negatively ing this uncertainty. assets will be realized and

when financial statements its liabilities will be settled

are restated due to previ- in the normal course of

ously unidentified errors business. Contrast this with

and irregularities (Hribar & a company that is going out

Jenkins, 2004). restated due to a previously of business and must liquidate its

In an effort to help reduce undisclosed error, resulting from assets and settle its liabilities

this confusion and, again, narrow either errors or fraud, the within a short time frame. Obvi-

the expectations gap, Auditing explanatory paragraph would ously, the value that the company

Standard 6 was submitted by the read as follows: can be expected to receive for its

PCAOB and approved by the assets, and the amounts that credi-

SEC in 2008. It addresses when As discussed in Note X tors may be willing to take in

and how auditors’ reports are to to the financial state- exchange for settlement of debts,

be modified for consistency when ments, the YEAR finan- most likely will be less. In

public companies adopt new cial statements have accounting jargon, we call this the

accounting standards. It requires been restated to correct a difference between reporting

that the language in the auditor’s misstatement. assets and liabilities on a going

report distinguish between concern versus a liquidation basis.

retroactive changes resulting The other frequently

from changes in or adoptions of observed modification to the AN ERRONEOUS BELIEF

accounting principles, and unqualified auditor’s report

restatements resulting from cor- occurs when the auditor wants to When the auditor believes

rection of errors. If a company emphasize a matter. This is an that there is substantial doubt

adopts a new accounting princi- area where the auditor has a fair that a company will fail in less

© 2009 Wiley Periodicals, Inc. DOI 10.1002/jcaf

JCAF-21-1_20547.qxd 9/26/09 6:15 AM Page 58

10970053, 2009, 1, Downloaded from https://onlinelibrary.wiley.com/doi/10.1002/jcaf.20547 by Mahmoud Ali - Egyptian National Sti. Network (Enstinet) , Wiley Online Library on [28/05/2023]. See the Terms and Conditions (https://onlinelibrary.wiley.com/terms-and-conditions) on Wiley Online Library for rules of use; OA articles are governed by the applicable Creative Commons License

58 The Journal of Corporate Accounting & Finance / November/December 2009

than one full year from the date opinion is self-fulfilling, because accepted accounting principles.11

of the financial statements, AU suppliers may be less willing to The rules as originally drafted

341 requires that the auditor extend credit. Research has under AS 2 were broad and

include an explanatory para- demonstrated that the going- lacked direct guidance on the

graph in his or her report concern opinion is informative. sufficiency of controls and

emphasizing this uncertainty The market reacts negatively to related tests of controls. In 2007,

(AICPA, 1988a). According to going-concern opinions, and for AS 5 was issued to supersede

McEnroe and Martens (2001), companies declaring bankruptcy, AS 2, in part to reduce confu-

investors erroneously believe the market’s reaction to a bank- sion and better direct controls

that in the absence of a going- ruptcy announcement is less nega- testing.

concern opinion, the business tive when the company previously Managers (CEOs and CFOs)

will likely succeed. This popular had a going-concern opinion (e.g., of large publicly traded compa-

opinion is contrary to explicit Firth, 1978; Holder-Webb & nies must attest to the adequacy

language in AU 341 (p. 622), Wilkins, 2000). Unfortunately, of a company’s system of inter-

which states that “the absence of auditors have historically not nal control over financial report-

reference to substantial doubt in been very good at predicting ing. In case there was previously

an auditor’s report should not be when companies will be unable any confusion regarding the

viewed as providing assurance as to survive at least one full year party responsible for establish-

to an entity’s ability to continue (e.g., Menon & Schwartz, 1986), ing, maintaining, and evaluating

as a going concern.” a company’s system of

The auditor bases the internal controls, SOX pro-

going concern assessment SOX Section 404 and related SEC vides that managers now

considering both financial rules describe internal control over explicitly state that they

matters (e.g., reporting net have primary responsibil-

losses or negative cash financial reporting as processes and ity. Auditors make an

flows, or violating of debt procedures designed to provide rea- independent evaluation

covenants) and operational sonable assurance for the reliability of of internal controls.

matters (e.g., financial dis- Two forms of the audi-

tress of a major supplier or financial reporting and the prepara- tor’s report are proscribed:

customer, labor difficul- tion of financial statements for exter- unqualified and adverse.12

ties) known as of the date Unqualified reports con-

of the auditor’s report; and nal purposes in accordance with gen- clude that the system of

not all of which may be erally accepted accounting principles. internal control over finan-

apparent to the reader of cial reporting is operating

the financial statements. effectively, in all material

The assessment of going respects, as of the date of

concern also considers manage- perhaps because relevant infor- the balance sheet. An adverse

ment’s plans for overcoming any mation becomes known after the report indicates the presence of

concerns that the auditor has date of the auditor’s report. one or more, or a combination

identified (e.g., ability to cut of, controls is not operating

costs, obtain new financing, dis- The Auditor’s Report on effectively, and as a result a

pose of assets). Internal Control Over material misstatement of the

Ultimately, the assessment of Financial Reporting financial statements may occur

whether management’s plans can and go undetected. Typical mate-

be successful is a matter of judg- SOX Section 404 and related rial weaknesses include failure

ment. The decision of whether or SEC rules describe internal con- to follow generally accepted

not to issue a going-concern trol over financial reporting as accounting principles (e.g.,

opinion is difficult. On one processes and procedures recording the cost of a lease that

hand, failing to emphasize designed to provide reasonable includes a rent abatement period

going-concern issues exposes the assurance for the reliability of over the period of the payments

auditor to litigation risk if the financial reporting and the rather than over the full term of

client ultimately fails. On the preparation of financial state- the lease), and insufficient or

other hand, some believe that the ments for external purposes in improperly trained accounting

issuance of a going-concern accordance with generally personnel. The reporting of

DOI 10.1002/jcaf © 2009 Wiley Periodicals, Inc.

JCAF-21-1_20547.qxd 9/26/09 6:15 AM Page 59

10970053, 2009, 1, Downloaded from https://onlinelibrary.wiley.com/doi/10.1002/jcaf.20547 by Mahmoud Ali - Egyptian National Sti. Network (Enstinet) , Wiley Online Library on [28/05/2023]. See the Terms and Conditions (https://onlinelibrary.wiley.com/terms-and-conditions) on Wiley Online Library for rules of use; OA articles are governed by the applicable Creative Commons License

The Journal of Corporate Accounting & Finance / November/December 2009 59

material weaknesses in internal that a company had no material requires that credit checks be

control is discussed. weaknesses during the year. In performed for all customers to

companies’ quarterly reports, whom credit in excess of $10,000

INTERNAL CONTROL managers are required to report is extended. This process is

REPORTING on any identified material weak- intended to reduce the company’s

nesses and any significant credit risk and acts as a control to

Early evidence suggests that changes in internal control. If ensure that accounts receivable

financial markets’ interest in weaknesses are identified as part are stated at their net realizable

internal control reporting is neg- of the company’s own processes value. A comparison of the

ligible. For example, Cheng, Ho, and controls, and are remediated accounts receivable trial balances

and Tian (2006) find that com- prior to the end of the year, audi- and credit checks identifies three

panies generally suffer signifi- tors may conclude that the com- customers with receivable bal-

cant negative abnormal market pany’s system of internal control ances in excess of $10,000 for

returns when material weak- is effective, and that as of the whom credit checks were not

nesses are announced; however, end of the year, there are no performed. Company A has total

the negative market reaction is material weaknesses impacting receivables of $50,000, total

mitigated for companies with the company’s ability to produce assets of $200,000, and net

complex business structures, and report its financial results. income of $100,000. Company B

suggesting the possibility that The absence of reported has total receivables of $500 mil-

the market expects such compa- material weaknesses also does lion, total assets of $2 billion, and

nies to have weaker inter- net income of $100 million.

nal controls. Ogneva, In the case of Company A,

Raghunandan, and Subra- It is important to note that the the failure of the internal

manyam (2005) report that control is most likely con-

the cost of capital of com- absence of material weaknesses sidered a material weak-

panies reporting material reported in connection with a com- ness. In the case of Com-

weaknesses is only margin- pany B, it would likely be

ally higher than that of pany’s annual financial statements considered a significant

companies without material does not mean that a company deficiency. As is obvious

weaknesses; and such dif- had no material weaknesses during from this example,

ferences disappear after whether a breech in inter-

controlling for economic the year. nal control is characterized

characteristics of compa- as a significant deficiency

nies disclosing material or a material weakness is

weaknesses. not mean there are no significant largely a matter of judgment.

As of the date of this writ- deficiencies in internal control. Different auditors may come to

ing, companies with less than AS 2 defines a significant different conclusions based upon

$75 million market capitalization deficiency as a condition in the their judgment of the likelihood

are not yet required to evaluate design or operation of an internal that the control deficiency would

and report on their systems of control that results in a more result in a material misstatement

internal control over financial than remote likelihood that a of the company’s financial

reporting. This is somewhat more than inconsequential mis- statements.

ironic given that research to date statement of a company’s financial

suggests that smaller companies statements will occur and go REDEFINING “MATERIAL

(measured as market capitaliza- undetected on a timely basis. In WEAKNESS”

tion, among other ways) are other words, all material weak-

more likely to report material nesses are significant deficien- In addition to attempting to

weaknesses in internal control cies, but a significant deficiency reduce confusion and ease the

(e.g., Ge & McVay, 2005). need not be a material weakness. cost (both in terms of manpower

It is important to note that The following example is and dollars) of compliance with

the absence of material weak- intended to illustrate the differ- Section 404, AS 5 redefines the

nesses reported in connection ence between a material weak- term material weakness. Prior to

with a company’s annual finan- ness in internal control and a sig- AS 5, a material weakness in

cial statements does not mean nificant deficiency. A company internal control was defined as a

© 2009 Wiley Periodicals, Inc. DOI 10.1002/jcaf

JCAF-21-1_20547.qxd 9/26/09 6:15 AM Page 60

10970053, 2009, 1, Downloaded from https://onlinelibrary.wiley.com/doi/10.1002/jcaf.20547 by Mahmoud Ali - Egyptian National Sti. Network (Enstinet) , Wiley Online Library on [28/05/2023]. See the Terms and Conditions (https://onlinelibrary.wiley.com/terms-and-conditions) on Wiley Online Library for rules of use; OA articles are governed by the applicable Creative Commons License

60 The Journal of Corporate Accounting & Finance / November/December 2009

control deficiency that resulted in required to be reviewed by an financial statement restatements,

a more than remote likelihood that accountant prior to being filed going-concern opinions, material

a material misstatement of the with the SEC. Unlike an audi- weaknesses in internal control,

financial statements could occur tor’s report, the SEC generally and how a review of interim

and go undetected on a timely does not require that the accoun- financial statements differs

basis. AS 5 changed the “more tant’s review report accompany from an audit. Deepening users’

than remote likelihood” criteria the interim financial statements. understandings of these topics

to a “reasonable possibility.” This lack of explicit reporting reduces investor risk and

Although the change is subtle, may create confusion regarding enhances market efficiency

the threshold for a control defi- the level of assurance provided by reducing information

ciency rising to the level of a by the accountant. asymmetry.

reportable material weakness has Most importantly, the objec-

been raised. tive of a review is not to express NOTES

AS 5 also coins the term an an opinion on the fairness of the

integrated audit to describe an financial statements. Instead, the 1. According to data from Audit Analytics,

audit that jointly considers the auditor performs analytical pro- in 2006, 94 companies had audit fees of

over $20 million, and 2,796 companies

results of testing of the effective- cedures (e.g., ratio analysis and exceeded $1 million.

ness of a company’s system of trend analysis), makes inquiries 2. These can be found at www.aicpa.org.

internal control over financial of managers, reads the financial The codification of SASs is arranged by

reporting (i.e., SOX 404 proce- statements, and considers the codification section number, which per-

dures), and the nature, extent, results of prior audits as a basis tains to topic areas. For example, Audit

Reports is Codification Section AU 508.

and timing of audit tests of for communicating whether he 3. As of January 2009, auditors of nonpub-

details and analytical review pro- or she is aware of any material lic broker-dealers are required to register

cedures. In its early inspections modifications necessary to con- with the PCAOB. See http://www.pcaob.

of post-SOX audits, the PCAOB form with GAAP. A review does org/News_and_Events/News/2009/01-07.

found that auditors tended to not contemplate tests of transac- aspx, accessed February 26, 2009.

4. The Government Accountability Office

treat the tests of internal controls tions through inspection or con- sets auditing standards for audits of state

conducted to comply with SOX firmation, or other procedures and local governments and for entities

Section 404 and AS 2 as sepa- typically performed in the course that fall under the Single Audit Act

rate from the “regular” audit of an audit. A review is not (those that receive certain amounts of

(PCAOB, 2005). AS 5 specifi- designed to provide any level of federal financial assistance). These stan-

dards are found in what has commonly

cally addresses the need to inte- assurance with respect to inter- been called “The Yellow Book.” A

grate the audit and attempts to nal controls. So what reliance fourth entity that sets auditing standards

reduce the inefficiencies that can users place on interim is the International Auditing and Assur-

may arise from conducting an financial statements? Only that, ance Standards Board.

audit in this manner. based on these procedures, 5. Auditing standards can be found at

http://www.pcaob.org.

accountants are not aware of any 6. Our discussion does not cover foreign

Reviews of Interim Financial material adjustments necessary registrants or companies that trade on

Information to make the statements conform U.S. stock exchanges as American

with GAAP. Depository Receipts. We do not attempt

SAS 100, Interim Financial to describe expectations gap issues

related to non-U.S.-based generally

Information (AICPA, 2002b), CLOSING THE GAP accepted auditing standards.

describes the requirements that 7. Currently only companies with market

the auditor must follow when a In this article, we attempted capitalizations of more than $75 million

company produces and distrib- to reduce the gap between finan- are required to provide reports on inter-

utes for public use financial cial statement users’ expecta- nal control over financial reporting.

8. The audit risk model requires the audi-

statements covering less than a tions of the role of the auditor, tor think about audit risk from the

full year, as when publicly traded and auditors’ procedures under perspective of three components of risk:

companies file quarterly finan- GAAS and standards of the inherent risk, control risk, and detection

cial statements with the SEC on PCAOB. Specifically, we hope risk. Inherent risk cannot be changed by

Form 10-Q. Under Rule 10-01(d) to enhance users’ understanding the action of either the auditor or the

client. Control risk can be reduced if the

of Regulation S-X, interim of unqualified opinions, the client is willing to invest in internal

financial information included in auditor’s responsibility for the controls. The only risk factor under the

Form 10-Q (or Form 10-QSB) is detection of fraud, materiality, control of the auditor is detection risk.

DOI 10.1002/jcaf © 2009 Wiley Periodicals, Inc.

JCAF-21-1_20547.qxd 9/26/09 6:15 AM Page 61

10970053, 2009, 1, Downloaded from https://onlinelibrary.wiley.com/doi/10.1002/jcaf.20547 by Mahmoud Ali - Egyptian National Sti. Network (Enstinet) , Wiley Online Library on [28/05/2023]. See the Terms and Conditions (https://onlinelibrary.wiley.com/terms-and-conditions) on Wiley Online Library for rules of use; OA articles are governed by the applicable Creative Commons License

The Journal of Corporate Accounting & Finance / November/December 2009 61

9. AU Section 342 (AICPA, 1988b) American Institute of Certified Public Hribar, P., & Jenkins, N. (2004). The effect

specifies the procedures for auditing Accountants (AICPA). (2002a). State- of accounting restatements on earnings

accounting estimates. ment on Auditing Standard No. 99: revisions and the estimated cost of capi-

10. Examples of this can be seen in the 8-K, Consideration of fraud in a financial tal. Review of Accounting Studies, 9,

where reasons for auditor terminations statement audit. New York: Author. 337–356.

and resignations must be disclosed. American Institute of Certified Public Liggio, C. D. (1974). The expectation gap:

11. This description is intended to include Accountants (AICPA). (2002b). State- The accountant’s Waterloo. Journal of

the internal controls discussed by AU ment on Auditing Standard No. 100: Contemporary Business, 3(3), 27–44.

319 (AICPA, 1989), the Foreign Corrupt Interim financial information. New McEnroe, J. E., & Martens, S. C. (2001).

Practices Act, and the internal controls York: Author. Auditors’ and investors’ perceptions of

addressed by the Committee of Sponsor- Butler, M., Leone, A. J., & Willenborg, M. the “expectation gap.” Accounting Hori-

ing Organizations (COSO). (2004). An empirical analysis of auditor zons, 15, 345–358.

12. Reports on internal control can also reporting and its association with abnor- Menon, K., & Schwartz, K. (1986, January).

include scope limitations. For example, mal accruals. Journal of Accounting & The auditor’s report for companies fac-

when a company acquires another Economics. 37(2), 139–165. ing bankruptcy. Journal of Commercial

business entity, management may elect Cheng, C. S. A., Ho, J. L. Y., & Tian, F. Bank Lending, pp. 42–52.

to exclude that entity from the evalua- (2006). An empirical analysis of value- Ogneva, M., Raghunandan, K., & Subra-

tion of the effectiveness of the system of relevance of disclosure of material manyam, K. R. (2005). Internal control

internal control (see paragraph B16 of weaknesses under Section 404. Working weakness and cost of equity: Evidence

AS 5). Paper. Retrieved May 18, 2008, from from SOX Section 404 certifications.

http://papers.ssrn.com/sol3/papers.cfm? Presented at the AAA 2006 Financial

abstract_id=877015 Accounting and Reporting Section

REFERENCES Dawson, J. P., Neupert, P. M., & Stickney, C. (FARS) Meeting. Retrieved May 18,

P. (1980). Restating financial statements 2008, from http://ssrn.com/abstract=

Advisory Committee on the Department of for alternative GAAPs: Is it worth the 766104.

the Auditing Profession, Department effort? Financial Analysts Journal, Public Company Accounting Oversight

of the Treasury. (2008, October 6). 36(6), 38–46. Board (PCAOB). (2004). Auditing

Final report of the Advisory Commit- Financial Accounting Standards Board Standard No. 2: An audit of internal

tee on the auditing profession to the (FASB). (1980). Financial Accounting control over financial reporting per-

U.S. Department of the Treasury, Concepts Statement No. 2: Qualitative formed in conjunction with an audit of

Final Report. Retrieved February 17, characteristics of accounting informa- financial statements. Washington, DC:

2008, from http://www.treas.gov/ tion. Norwalk. CT: Author. Author.

offices/domestic-finance/acap/docs/ Financial Accounting Standards Board Public Company Accounting Oversight

final-report.pdf (FASB). (2004). Financial Accounting Board (PCAOB). (2005, November

American Institute of Certified Public Standard No. 123R: Share-based pay- 30). Release No. 2005-023: Report on

Accountants (AICPA). (1977). The ment. Norwalk. CT: Author. the initial implementation of Auditing

Commission on Auditors’ Responsibili- Financial Accounting Standards Board Standard No. 2. Washington, DC:

ties: Report of tentative conclusions. (FASB). (2005). Financial Accounting Author.

New York: Author. Standard No. 154: Accounting changes Public Company Accounting Oversight

American Institute of Certified Public and error corrections. Norwalk. CT: Board (PCAOB). (2007). Auditing

Accountants (AICPA). (1983). AU Sec- Author. Standard No. 5: An audit of internal

tion 312A: Audit risk and materiality in Firth, M. (1978). Qualified audit reports: control over financial reporting that

conducting an audit. New York: Author. Their impact on investment decisions. is integrated with an audit of finan-

American Institute of Certified Public The Accounting Review, 53, 642–650. cial statements. Washington, DC:

Accountants (AICPA). (1988a). AU Frank, K. E,. Lowe, D. J., & Smith, J. K. Author.

Section 341: The auditor’s considera- (2001). The expectations gap: Perceptual Public Company Accounting Oversight

tion of an entity’s ability to continue difference between auditors, jurors and Board (PCAOB). (2008). Auditing

as a going concern. New York: students. Managerial Auditing Journal Standard No. 6: Evaluating the consis-

Author. 16(3), 145–149. tency of financial statements. Washing-

American Institute of Certified Public Ge, W., & McVay, S. E. (2005). The disclo- ton, DC: Author.

Accountants (AICPA). (1988b). AU Sec- sure of material weaknesses in internal Securities and Exchange Commission

tion 342: Auditing accounting estimates. control after the Sarbanes-Oxley Act. (SEC). (1999). Staff Accounting Bul-

New York: Author. Accounting Horizons, 19(3), 137–158. letin No. 99—Materiality. Washington,

American Institute of Certified Public Holder-Webb, L. M., & Wilkins, M. S. DC: Author.

Accountants (AICPA). (1989). AU Sec- (2000). The incremental information Vigeland, R. L. (1981). The market reaction

tion 319: Consideration of internal content of SAS No. 59 going-concern to Statement of Financial Accounting

control in a financial statement audit. opinions. Journal of Accounting Standards No. 2. The Accounting

New York: Author. Research, 38(1), 209–219. Review, 56, 309–325.

© 2009 Wiley Periodicals, Inc. DOI 10.1002/jcaf

JCAF-21-1_20547.qxd 9/26/09 6:15 AM Page 62

10970053, 2009, 1, Downloaded from https://onlinelibrary.wiley.com/doi/10.1002/jcaf.20547 by Mahmoud Ali - Egyptian National Sti. Network (Enstinet) , Wiley Online Library on [28/05/2023]. See the Terms and Conditions (https://onlinelibrary.wiley.com/terms-and-conditions) on Wiley Online Library for rules of use; OA articles are governed by the applicable Creative Commons License

62 The Journal of Corporate Accounting & Finance / November/December 2009

Denise Dickins, PhD, CPA, is an assistant professor at East Carolina University and teaches auditing. She

was formerly a partner with Arthur Andersen and currently serves on the boards of three public companies.

Dr. Dickins has published extensively on auditing topics. Julia L. Higgs, PhD, CPA, is an associate profes-

sor at Florida Atlantic University. She teaches auditing and financial accounting and was formerly an audi-

tor. She is active in the auditing section of the American Accounting Association and has published in

numerous outlets on the topic of auditing.

DOI 10.1002/jcaf © 2009 Wiley Periodicals, Inc.

You might also like

- Towards an XBRL-enabled corporate governance reporting taxonomy.: An empirical study of NYSE-listed Financial InstitutionsFrom EverandTowards an XBRL-enabled corporate governance reporting taxonomy.: An empirical study of NYSE-listed Financial InstitutionsRating: 1 out of 5 stars1/5 (1)

- The Expectation Gap in AuditingDocument9 pagesThe Expectation Gap in AuditingHoài NguyễnNo ratings yet

- Auditor IndependenceDocument21 pagesAuditor IndependenceAastha Mahesh SabooNo ratings yet

- Empirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveFrom EverandEmpirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveNo ratings yet

- 10 Auditing SA 2009 The Audit Expectation Gap in Malaysia Lee Ali Gloeck - 1Document5 pages10 Auditing SA 2009 The Audit Expectation Gap in Malaysia Lee Ali Gloeck - 1T.a. TemesgenNo ratings yet

- Audit II AssignmentDocument10 pagesAudit II AssignmentEric Wong Jun JieNo ratings yet

- Audit Firm Rotation and Audit Quality PDFDocument11 pagesAudit Firm Rotation and Audit Quality PDFbm08smmNo ratings yet

- Its Impact On Profitability A Study of Selected Listed Manufacturing Companies in Sri LankaDocument7 pagesIts Impact On Profitability A Study of Selected Listed Manufacturing Companies in Sri LankaAnnabelle WeeNo ratings yet

- Audit and The Pursuit of Dynamic Repair: Christopher Humphrey, Amanda Sonnerfeldt, Naoko Komori and Emer CurtisDocument28 pagesAudit and The Pursuit of Dynamic Repair: Christopher Humphrey, Amanda Sonnerfeldt, Naoko Komori and Emer Curtisjiahui maNo ratings yet

- The Audit Expectation Gap: An Empirical Study in MalaysiaDocument15 pagesThe Audit Expectation Gap: An Empirical Study in Malaysiaak shNo ratings yet

- All - Audit Expectation Gap - International Evidences - FinalDocument26 pagesAll - Audit Expectation Gap - International Evidences - Finallizasaari100% (2)

- Enhancing Audit Quality in Response to Environmental ChangesDocument23 pagesEnhancing Audit Quality in Response to Environmental ChangesdittaNo ratings yet

- 2.8 Some Developments in The Audit MarketDocument7 pages2.8 Some Developments in The Audit MarketHervenni ClaraNo ratings yet

- Audit StrategyDocument6 pagesAudit StrategyHassan AftabNo ratings yet

- Gaussian CopulaDocument20 pagesGaussian CopulaGustavo Barbeito LacerdaNo ratings yet

- Financial Modelling Risks in Project FinancingDocument21 pagesFinancial Modelling Risks in Project FinancingLay ZhuNo ratings yet

- Badgets All Bad Things Must Come To An EndDocument5 pagesBadgets All Bad Things Must Come To An EndHarry BeachNo ratings yet

- Accounting, Organizations and Society: Christopher Humphrey, Anne Loft, Margaret WoodsDocument16 pagesAccounting, Organizations and Society: Christopher Humphrey, Anne Loft, Margaret Woodskoro bucleNo ratings yet

- Predicting Private Company Failures in Italy Using Financial and Non-Financial InformationDocument15 pagesPredicting Private Company Failures in Italy Using Financial and Non-Financial InformationGaMer LoidNo ratings yet

- 2008 The Determinants of Board Size and CompositionDocument22 pages2008 The Determinants of Board Size and CompositionJuan Camilo GuzmanNo ratings yet

- Audit Firm Rotation and Audit Quality: Evidence From Academic ResearchDocument10 pagesAudit Firm Rotation and Audit Quality: Evidence From Academic ResearchpuspaNo ratings yet

- AAS 2022Document2 pagesAAS 2022Mukunda MukundaNo ratings yet

- File1688 PDFDocument26 pagesFile1688 PDFShahab UdinNo ratings yet

- Are The Audit Profession's Conflicts IrreconcilableDocument15 pagesAre The Audit Profession's Conflicts IrreconcilableChetan ChouguleNo ratings yet

- Audit Expectation Gap - The Trend To Close The Gap in The 21st CenturyDocument16 pagesAudit Expectation Gap - The Trend To Close The Gap in The 21st CenturythoritruongNo ratings yet

- Research QuestionsDocument19 pagesResearch QuestionsRony Rahman100% (1)

- Audit Expectation Gap: Perspectives of Auditors and Audited Account Users Olagunju, AdebayoDocument19 pagesAudit Expectation Gap: Perspectives of Auditors and Audited Account Users Olagunju, AdebayosigiryaNo ratings yet

- Principles of Auditing An Introduction To International Standards On Auditing 3rd Edition Hayes Solutions ManualDocument25 pagesPrinciples of Auditing An Introduction To International Standards On Auditing 3rd Edition Hayes Solutions ManualSherryWalkerozfk98% (56)

- Audit Assurance Assignment Going Concern HighlightedDocument15 pagesAudit Assurance Assignment Going Concern HighlightedAbdullah YousufNo ratings yet

- LO 1-4 - Factors Influencing Accounting Research and Auditing During Financial CrisesDocument2 pagesLO 1-4 - Factors Influencing Accounting Research and Auditing During Financial CrisesSapri JoeriNo ratings yet

- ReportDocument7 pagesReportFroilan BanalNo ratings yet

- Research QuestionsDocument19 pagesResearch QuestionswulandarisaNo ratings yet

- XBRL Mandate Delays Financial Reporting for Firms With Internal Control WeaknessesDocument27 pagesXBRL Mandate Delays Financial Reporting for Firms With Internal Control WeaknessesPablo LunaNo ratings yet

- Financial Education AssociationDocument16 pagesFinancial Education AssociationJulyanto Candra Dwi CahyonoNo ratings yet

- American Accounting AssociationDocument13 pagesAmerican Accounting AssociationRahmat Pasaribu OfficialNo ratings yet

- ExcerptDocument34 pagesExcerptmarcofrfamNo ratings yet

- Can The Expectation Gap Be ReducedDocument7 pagesCan The Expectation Gap Be ReducedAbdulAzeemNo ratings yet

- Financial Statements Introduction GuideDocument60 pagesFinancial Statements Introduction Guide87mbhallaNo ratings yet

- KiTTC - Audit Evidence & TriangulationDocument47 pagesKiTTC - Audit Evidence & TriangulationDung HàNo ratings yet

- De AngeloDocument17 pagesDe AngeloAnnisaAyuLestariNo ratings yet

- Enhancing Perceived and Actual Audit Committee Effectiveness Through Financial Expert Certification - 2010 - 11pDocument11 pagesEnhancing Perceived and Actual Audit Committee Effectiveness Through Financial Expert Certification - 2010 - 11pKhaled Al-SanabaniNo ratings yet

- Working Capital and Current Asset ManagementDocument38 pagesWorking Capital and Current Asset Management2021-SC040 PRANAYSAKHARAMDHANDENo ratings yet

- International Journal of Business and Management Invention (IJBMI)Document7 pagesInternational Journal of Business and Management Invention (IJBMI)inventionjournalsNo ratings yet

- 79d86aa8 1679807526458Document44 pages79d86aa8 1679807526458ankita shreepadNo ratings yet

- Tecplm11129 Webaudit Banks33Document28 pagesTecplm11129 Webaudit Banks33jaysenorinNo ratings yet

- Gold Gronewold Pott IJA2012Document23 pagesGold Gronewold Pott IJA2012Umer PrinceNo ratings yet

- Corporate Governance Implications From The 2008 FiDocument14 pagesCorporate Governance Implications From The 2008 FiTarun SinghNo ratings yet

- Ias 700Document9 pagesIas 700Wa HidNo ratings yet

- Auditors - Changes Are ComingDocument3 pagesAuditors - Changes Are ComingMai RosaupanNo ratings yet

- An Empirical Investigation of Context-Dependent Communications Between Auditors and BankersDocument9 pagesAn Empirical Investigation of Context-Dependent Communications Between Auditors and BankersDianing Ratna WijayaniNo ratings yet

- Challenges of Audit ProfessionDocument8 pagesChallenges of Audit ProfessionEershad Muhammad GunessNo ratings yet

- Auditor Independence Low Balling and Dis PDFDocument15 pagesAuditor Independence Low Balling and Dis PDFKhairur IchsanNo ratings yet

- 2.Coram, P. J., & Wang, L. (2021)Document14 pages2.Coram, P. J., & Wang, L. (2021)dudyNo ratings yet

- Uncover $3.8B Financial FraudDocument39 pagesUncover $3.8B Financial FraudJosé Moura Rodrigues100% (1)

- World Bank'S: Ease of Doing Business IndexDocument23 pagesWorld Bank'S: Ease of Doing Business Indexwakar606No ratings yet

- Project Proposal: Research Methods in Finance and Accounting BFIN730.2Document40 pagesProject Proposal: Research Methods in Finance and Accounting BFIN730.2muhammad bilalNo ratings yet

- 248102Document19 pages248102abdiyooNo ratings yet

- Manage End-User Computing Risks at CCI BankDocument20 pagesManage End-User Computing Risks at CCI Banksujay PaulNo ratings yet

- Auditors' Responsibility for Fraud Detection Over TimeDocument27 pagesAuditors' Responsibility for Fraud Detection Over TimeArtur Wuerges100% (2)

- OST Report 1420145Document27 pagesOST Report 1420145Medha SinghNo ratings yet

- Practicum Report Writing Guidelines - Pom & MotDocument13 pagesPracticum Report Writing Guidelines - Pom & Motsyafiqah jasminNo ratings yet

- Pertemuan 12-Audit SamplingDocument10 pagesPertemuan 12-Audit SamplingWawa LalaNo ratings yet

- Joanna Dela Cruz resume for various job rolesDocument3 pagesJoanna Dela Cruz resume for various job rolesJoanna Dela CruzNo ratings yet

- PCITAL Gardeny - Edifici H2 Planta 2 25003 Lleida - Spain Telf: +34 973 100 801 URD Code: 24/10/2023 24/10/2023Document1 pagePCITAL Gardeny - Edifici H2 Planta 2 25003 Lleida - Spain Telf: +34 973 100 801 URD Code: 24/10/2023 24/10/2023GERMANNo ratings yet

- Deming PDFDocument4 pagesDeming PDFPayal SaxenaNo ratings yet

- Application Form Epsilon DanubeDocument44 pagesApplication Form Epsilon DanubePaul BNo ratings yet

- International Standard: Iteh Standard Preview (Standards - Iteh.ai)Document12 pagesInternational Standard: Iteh Standard Preview (Standards - Iteh.ai)Vanessa TonitoNo ratings yet

- Greinfield Manufacturing Plant For VELO Job Safety Analysis & Risk Assessment for Scrapping and Grading Activity (Rev-00Document1 pageGreinfield Manufacturing Plant For VELO Job Safety Analysis & Risk Assessment for Scrapping and Grading Activity (Rev-00Azhar Mushtaq100% (1)

- Prescribed Format of Cost Sheet (For Imfl and Beer Only)Document3 pagesPrescribed Format of Cost Sheet (For Imfl and Beer Only)sujal_shr21No ratings yet

- Strama Module 9 PDFDocument27 pagesStrama Module 9 PDFLeoan DomingoNo ratings yet

- JD - Human ResourcesDocument2 pagesJD - Human ResourcesSHRESTI ANDENo ratings yet

- C18OB - Review Sheet For Exam: Reading WeekDocument7 pagesC18OB - Review Sheet For Exam: Reading WeekMayookhaNo ratings yet

- QMS Manual IS 9001 2015Document28 pagesQMS Manual IS 9001 2015Parag WadekarNo ratings yet

- 10 Rights of Asset Lifecycle ManagementDocument46 pages10 Rights of Asset Lifecycle ManagementWilson GarciaNo ratings yet

- AAICLAS8131684770729Document10 pagesAAICLAS8131684770729PRAVASH KUMAR SINGHNo ratings yet

- Weekly Journal Week 2: Ms. Fairuze Chowdhury Lecturer Department of BBA in Marketing & International BusinessDocument3 pagesWeekly Journal Week 2: Ms. Fairuze Chowdhury Lecturer Department of BBA in Marketing & International BusinessSky PunkerNo ratings yet

- Impact of Training and Development On The Employee Performance: "A Case Study From Different Banking Sectors of North Punjab"Document1 pageImpact of Training and Development On The Employee Performance: "A Case Study From Different Banking Sectors of North Punjab"Christian Ardy HandokoNo ratings yet

- Company ProfileDocument15 pagesCompany ProfileMichael DavidNo ratings yet

- CIDB L5 LP03 Leadership & Strategy PlanningDocument29 pagesCIDB L5 LP03 Leadership & Strategy PlanningMohd Zailani Mohamad JamalNo ratings yet

- Bid 14Document47 pagesBid 14Jaspergroup 15No ratings yet

- Identifying Major Channel AlternativesDocument19 pagesIdentifying Major Channel AlternativesCarl Joshua TorresNo ratings yet

- Kickstart CVDocument6 pagesKickstart CVTamara RueeggNo ratings yet

- Internal Auditing Role in Corporate GovernanceDocument23 pagesInternal Auditing Role in Corporate GovernanceNor Syahra AjinimNo ratings yet

- Houston Fearless 76 Sales Incentive AnalysisDocument3 pagesHouston Fearless 76 Sales Incentive Analysisdachlevie rizaNo ratings yet

- Material ControlDocument16 pagesMaterial ControlbelladoNo ratings yet

- MB 0042Document30 pagesMB 0042Rehan QuadriNo ratings yet

- Acc 16Document28 pagesAcc 16Erin MalfoyNo ratings yet

- Chapter 5 Scheduling & Tracking Edited 03042014Document40 pagesChapter 5 Scheduling & Tracking Edited 03042014Shafiq KadirNo ratings yet

- Abbas Khalil EEDocument4 pagesAbbas Khalil EEAbas KhalelNo ratings yet

- Business Process Mapping: Improving Customer SatisfactionFrom EverandBusiness Process Mapping: Improving Customer SatisfactionRating: 5 out of 5 stars5/5 (1)

- A Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersFrom EverandA Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersRating: 4.5 out of 5 stars4.5/5 (11)

- GDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekFrom EverandGDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekNo ratings yet

- Electronic Health Records: An Audit and Internal Control GuideFrom EverandElectronic Health Records: An Audit and Internal Control GuideNo ratings yet

- (ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideFrom Everand(ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideRating: 2.5 out of 5 stars2.5/5 (2)

- Audit. Review. Compilation. What's the Difference?From EverandAudit. Review. Compilation. What's the Difference?Rating: 5 out of 5 stars5/5 (1)

- Financial Statement Fraud Casebook: Baking the Ledgers and Cooking the BooksFrom EverandFinancial Statement Fraud Casebook: Baking the Ledgers and Cooking the BooksRating: 4 out of 5 stars4/5 (1)

- The Layman's Guide GDPR Compliance for Small Medium BusinessFrom EverandThe Layman's Guide GDPR Compliance for Small Medium BusinessRating: 5 out of 5 stars5/5 (1)

- GDPR for DevOp(Sec) - The laws, Controls and solutionsFrom EverandGDPR for DevOp(Sec) - The laws, Controls and solutionsRating: 5 out of 5 stars5/5 (1)

- Mastering Internal Audit Fundamentals A Step-by-Step ApproachFrom EverandMastering Internal Audit Fundamentals A Step-by-Step ApproachRating: 4 out of 5 stars4/5 (1)

- Guide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyFrom EverandGuide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyNo ratings yet

- Executive Roadmap to Fraud Prevention and Internal Control: Creating a Culture of ComplianceFrom EverandExecutive Roadmap to Fraud Prevention and Internal Control: Creating a Culture of ComplianceRating: 4 out of 5 stars4/5 (1)

- Scrum Certification: All In One, The Ultimate Guide To Prepare For Scrum Exams And Get Certified. Real Practice Test With Detailed Screenshots, Answers And ExplanationsFrom EverandScrum Certification: All In One, The Ultimate Guide To Prepare For Scrum Exams And Get Certified. Real Practice Test With Detailed Screenshots, Answers And ExplanationsNo ratings yet