Professional Documents

Culture Documents

Download

Uploaded by

rocketsound005Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Download

Uploaded by

rocketsound005Copyright:

Available Formats

Management’s Discussion and Analysis

For the operating results of 2Q2018

Global Green Chemicals Public Company Limited

Global Green Chemicals Public Company Limited

Executive Summary

In 2Q2018, Domestic palm oil production has increased as well as in other countries, consequence

to lower Crude Palm Oil (CPO) prices and Crude Palm Kernel Oil (CPKO) prices than that of 2Q2017. Under

these circumstances, the government has maintained B7 mandate in this quarter, comparing to the mandate

of B5 and pushed to B7 on May 8th, 2017. For Natural Fatty Alcohols (FA) market, in 2Q2018, Natural FA price

was being more competitive to Synthetic FA price and supply of Natural FA was a bit dwindled due to few

producers in China cut their production.

From above reasons, GGC had Methyl Ester (ME) sales volume of 90,100 tons, increased by 4,221

tons or up by 5% yoy, and FA sales volume of 30,209 tons, grew higher by 2,566 tons or up 9% yoy.

The company revenue were posted of THB 4,236 million in 2Q2018, decreased by THB 590 million or

down 12% yoy because the products price were soft following CPO and CPKO price. Consequently, the

company reported EBITDA of THB 137 million (down 40% yoy) because FA EBITDA margin was decreased

from lower Market P2F margin. However, the company recognized profit of THB 27 million from investments

in the Thai Ethoxylate Company Limited (TEX) which producing Fatty Alcohol Ethoxylate (Derivative product of

FA), and was also benefited from the THB depreciation from 31.2 THB/USD in Apr 2018 to 33.2 THB/USD in

Jun 2018 (depreciated by 6%). Consequently, the company posted net profit exclude extraordinary item for

the period of THB 67 million, decreased by 6% yoy.

As the company disclosed NEWS to SET about the issues in the procurement process of raw

materials on 29 Jun 2018 and 31 Jul 2018, the company recorded expenses from raw materials derogation

amounting to THB 2,004 million and tax income from deferred tax assets from such provision amounting to

THB 84 million. As a result the company had net loss for 2Q/2018 for THB 1,853 million.

As of 30 Jun 2018, The company has total assets of THB 12,842 million which comprised of cash

and short-term investment amounted to THB 4,038 million; with total liabilities of THB 3,762 million; and total

equities of THB 9,080 million. In this regard, The Company is still in a strong financial position with low Debt to

Equity ratio and high current ratio.

Management’s Discussion and Analysis | 2

Global Green Chemicals Public Company Limited

Operating Performance

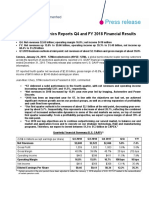

Exhibit 1 : Consolidated Company’s Performance

UNIT: M THB 2Q2018 2Q2017 % yoy 1Q2018 % qoq 6M/2018 6M/2017 % yoy

Sales Revenue 4,236 4,826 -12% 4,631 -9% 8,867 9,073 -2%

EBITDA 137 228 -40% 211 -35% 348 540 -36%

EBITDA Margin (%) 3.2% 4.7% -1.5% 4.6% -1.4% 3.9% 6.0% -2.1%

Stock Gain/(Loss) & NRV -149 -425 -65% -233 -36% -382 -458 -17%

Adjusted EBITDA(1) 286 653 -56% 444 -36% 730 998 -27%

Adjusted EBITDA Margin (%) 6.8% 13.5% -6.7% 9.6% -2.8% 8.2% 11.0% -2.8%

Net Profit ex. Extra item 67 71 -6% 64 5% 131 216 -39%

Extra item net of tax(2) -1,920 -1,920

Net Profit -1,853 71 -2710% 64 -2995% -1,789 216 -928%

EPS (THB/share) -1.81 0.08 -2363% 0.06 -3117% -1.75 0.26 -773%

Note : (1) Adjusted EBITDA refers to EBITDA excluding impact of Stock Gain/(Loss) and NRV

(2) Extra items were expenses from raw materials derogation amounting to THB 2,004 million net of tax income from deferred tax assets amounting

to THB 84 million.

Exhibit 2 : Sales Revenue and Adjusted EBITDA breakdown by business unit comparison of 2Q2018 vs. 2Q2017 vs. 1Q2018 vs.

6M/2018 vs. 6M/2017 (mil ion THB)

Management’s Discussion and Analysis | 3

Global Green Chemicals Public Company Limited

Market Overview by business

Methyl Ester (ME or B100)

Exhibit 3: Product and Feedstock Prices

Average Price 2Q2018 2Q2017 % yoy 1Q2018 % qoq 6M/2018 6M/2017 % yoy

B100 (THB/litre)(1) 25.03 29.74 -16% 24.66 2% 24.85 31.97 -22%

B100 (THB/kg.) (2) 28.94 34.38 -16% 28.51 2% 28.73 36.96 -22%

CPO (THB/kg.)(3) 20.78 25.84 -20% 20.34 2% 20.56 28.31 -27%

EPPO P2F (THB/kg)(4) 5.13 4.95 4% 5.14 0% 5.13 5.06 1%

Biodiesel Mandate B7 B5, B7 B7 B7 B5, B7

Note : (1) Reference Price of EPPO

(2) Conversion ratio: 0.865 Tons = 1,000 Liters

(3) Reference Price of DIT

(4) Market ME Price - Mixed Feedstock according to EPPO's B100 formula

An average of the 2Q2018 CPO (CPO-DIT) price was at 20.78 THB/kg, being lower than 2Q2017

CPO price by 5.06 THB/kg or down 20% yoy. This was led by domestic palm oil inventory surplus more than

400,000 tons in 2Q2018, while, in the past, Thailand used to have an average palm oil inventory level of

200,000 - 250,000 tons. For ME domestic demand in 2Q2018, it is estimated approximately at 339,000 tons,

increased by 21,000 tons or up 7% yoy, which was resulted from mandate of B7 that has been applied since

May 8th, 2017. As CPO price dropped in 2Q2018, ME price was reported at 28.94 THB/kg, decreased by 5.44

THB/kg or down 16% yoy.

On qoq basis, CPO price in 2Q2018 was improved by 0.44 THB/kg to 20.78 THB/kg. As a result, ME

price in 2Q2018 was at 28.94 THB/kg, increased by 0.43 THB/kg. On the demand side, ME domestic demand

in 2Q2018 declined by 36,000 tons or 10% qoq to 339,000 tons from 1Q2018’s, mainly due to lower diesel

consumption from transportation sector in rainy season.

In 2Q2018, EPPO P2F (the difference between EPPO ME price and mixed feedstock prices) was a bit

increased by 0.18 THB/kg yoy due to higher Methanol price which is a part of ME EPPO Price formula. On the

qoq basis, EPPO P2F was flat.

For 6M/2018 vs. 6M/2017, CPO price was declined due to increasing of palm production and stock,

EPPO P2F was also increased due to higher of Methanol price.

Management’s Discussion and Analysis | 4

Global Green Chemicals Public Company Limited

Fatty Alcohols

Exhibit 4 : Products and Feedstocks’ prices

Average Price

2Q2018 2Q2017 % yoy 1Q2018 % qoq 6M/2018 6M/2017 % yoy

(USD per ton)

Natural FA(1)

- Short Chain 3,845 3,318 16% 3,618 6% 3,731 3,264 14%

- Mid Cut 1,402 1,802 -22% 1,796 -22% 1,599 2,154 -26%

- Long Chain 1,310 1,336 -2% 1,271 3% 1,291 1,389 -7%

Average Natural FA (2) 1,570 1,783 -12% 1,784 -12% 1,677 2,013 -17%

CPKO (3) 921 999 -8% 1,138 -19% 1,029 1,258 -18%

FA Market P2F 465 584 -20% 419 11% 442 504 -12%

Note : (1) Reference Price of ICIS

(2) Average price of Fatty Alcohols with production proportion: Short Chain 8% Mid Cut 62% and Long Chain 30%

(3) Reference Price of Malaysian Palm Oil Board (MPOB)

CPKO MPOB price in 2Q2018 was at 921 USD/ton, decreased by 78 USD/ton or 8% yoy and

decreased by 217 USD/ton or 19% qoq. This was due to the fact that palm oil production was flooded into

market after El nino effect elapsed, which consequence to the continuous growth of palm oil inventory.

Furthermore, some countries have raised import duties for palm oil which have diminished market demand.

Natural FA demand improved from 2Q2017, mainly due to downward pricing trend of Natural FA to

be lower than Synthetic FA because of downward pricing trend of CPKO. In addition, Natural FA supply was

a bit tight because few producers in China reduced their utilization due to CPKO price volatility. Whereas, the

demand in this quarter was higher qoq, primarily after the low seasonal demand from Chinese New Year.

FA Market P2F in 2Q2018 was at 465 USD/ton, decreased by 119 USD/ton or 20% yoy because

CPKO price in Q2/2017 was sharply drop while Natural FA price was slower declined than CPKO. Comparing

to 1Q2018, Market P2F of FA was improved by 46 USD/ton or up 11% qoq, attributable to the supply and

demand situation.

For 6M/2018 vs. 6M/2017, CPKO price was declined due to increasing of palm production and stock

and, FA Market P2F was also declined.

Management’s Discussion and Analysis | 5

Global Green Chemicals Public Company Limited

Operating Performance by business unit

Methyl Ester (ME) Business Unit Operating Performance

Exhibit 5 : Keys Operating Performance of ME Business Unit

2Q2018 2Q2017 % yoy 1Q2018 % qoq 6M/2018 6M/2017 % yoy

Utilization (%) (1) 108% 106% 2% 119% -11% 113% 96% 17%

Sales Volume (ton) 90,100 85,879 5% 102,754 -12% 192,854 155,084 24%

Sales Volume (M litre) (2) 104 99 5% 119 -13% 223 179 25%

Sales Revenue (M THB) 2,690 2,903 -7% 2,774 -3% 5,464 5,546 -1%

EBITDA (M THB) 106 65 63% 163 -35% 269 196 37%

EBITDA margin (%) 3.9% 2.2% 1.7% 5.9% -2.0% 4.9% 3.5% 1.4%

Stock G/L & NRV (M THB) -10 -117 -91% -17 -41% -27 -149 -82%

Adjusted EBITDA (M THB)(3) 116 182 -36% 180 -36% 296 345 -14%

Adjusted EBITDA Margin (%) 4.3% 6.3% -2.0% 6.5% -2.2% 5.4% 6.2% -0.8%

Note : (1) Nameplate Capacity 300,000 Tons per year

(2) Conversion ratio: 0.865 Tons = 1,000 Liters

(3) Adjusted EBITDA refers to EBITDA excluding impact of Stock Gain/(Loss) and NRV

Operating performance comparison between 2Q2018 vs. 2Q2017

In 2Q2018, the company reported ME revenue of THB 2,690 million (down 7% yoy) resulting from ME

price drop follow CPO price softness, though the company had higher ME sale volume of 5% yoy due to

biodiesel mandate B7 vs. B5 and B7 in 2Q2017. And as a result of CPO price softness, the company could

source less competitive CPO price, and also had stock loss & NRV of THB 10 million while in 2Q2017 the

company had got stock loss & NRV of THB 117 million due to rapidly declined of CPO price. As a result, the

company reported EBITDA of THB 106 million (up 63% yoy), and had Adjusted EBITDA of THB 116 million

(down 36% yoy).

Operating performance comparison between 2Q2018 vs. 1Q2018

The company’s ME revenue was decreased by 3% qoq, because the company was able to sell ME

sale volume of 90,100 tons which was less than 1Q2018 by 12% mainly due to raining season and no

additional ME sale volume that government asking fuel traders M.7 for collaboration to stock more of ME

inventory. Therefore, the company reported EBITDA of THB 106 million declined by 35% qoq. In addition, the

company recognized lower stock loss & NRV than previous quarter by THB 7 million due to slowing pace of

downward trend of CPO prices. Therefore, the company had Adjusted EBITDA of ME, THB 116 million (down

36% qoq).

Management’s Discussion and Analysis | 6

Global Green Chemicals Public Company Limited

Operating performance comparison between 6M2018 vs. 6M2017

In 6M2018, the company reported ME revenue of THB 5,464 million (down 1% yoy) resulting from ME

price drop follow CPO price softness, though the company had higher ME sale volume of 24% yoy due to

biodiesel mandate B7 vs. B5 and B7 in 6M2017 and the government asking fuel traders M.7 for collaboration

to stock more of ME inventory in 1Q2018. And as a result of CPO price softness, the company could source

less competitive CPO price, and also had got stock loss & NRV of THB 27 million while in 6M2017 the

company had got stock loss & NRV of THB 149 million due to rapidly declined of CPO price. As a result, the

company reported EBITDA of THB 269 million (up 37% yoy), and had Adjusted EBITDA of THB 296 million

(down 14% yoy).

Fatty Alcohol (FA) Business Unit Operating Performance

Exhibit 6 : Keys Operating Performance of FA Business Unit

2Q2018 2Q2017 % yoy 1Q2018 % qoq 6M/2018 6M/2017 % yoy

Utilization (%) 120% 113% 7% 101% 19% 110% 101% 9%

Sales Volume (Ton) 30,209 27,643 9% 24,235 25% 54,444 47,533 15%

Revenue from Sales (M THB) 1,546 1,923 -20% 1,857 -17% 3,403 3,527 -4%

EBITDA (M THB) 31 163 -81% 48 -35% 79 343 -77%

EBITDA margin(%) 2.0% 8.5% -6.5% 2.6% -0.6% 2.3% 9.7% -7.4%

Stock G/L & NRV (M THB) -139 -308 -55% -216 -36% -355 -309 15%

Adjusted EBITDA (M THB)(1) 170 471 -64% 264 -36% 434 652 -33%

Adjusted EBITDA Margin (%) 11.0% 24.5% -13.5% 14.2% -3.2% 12.8% 18.5% -5.7%

Note : (1) Adjusted EBITDA refers to EBITDA excluding impact of Stock Gain/(Loss) and NRV

Operating performance comparison between 2Q2018 vs. 2Q2017

FA revenues recorded THB 1,546 million in 2Q2018 (down 20% yoy), attributed to Natural FA prices drop

follow CPKO price movement though the company was able to sell FA sales volume of 30,209 tons (up 9%

yoy). In addition, the company recorded stock loss & NRV of THB 139 million, pressured by downward trend

of CPKO prices. As a result, EBITDA were recorded at THB 31 million (down 81% yoy), while Adjusted

EBITDA were recorded at THB 170 million (down 64% yoy) which reflected to lower FA Market P2F.

Operating performance comparison between 2Q2018 vs. 1Q2018

On qoq basis, 2Q2018 FA sales revenues was posted THB 1,546 million (down 17% qoq) attributed

to Natural FA prices drop follow CPKO price movement and lessen of trading good revenue, though the

company was able to sell FA sales volume of 30,209 tons (up 25% yoy). However, the company recognized

Management’s Discussion and Analysis | 7

Global Green Chemicals Public Company Limited

stock loss & NRV of THB 139 million decreased 36% qoq. In summary, the company reported EBITDA of THB

31 million (down 35% qoq) and Adjusted EBITDA of THB 170 million (down 36% qoq).

Operating performance comparison between 6M2018 vs. 6M2017

FA revenues recorded THB 3,403 million in 6M/2018 (down 4% yoy), attributed to Natural FA prices drop

follow CPKO price movement though the company was able to sell FA sales volume of 54,444 tons (up 15%

yoy). In addition, the company recorded stock loss & NRV of THB 355 million (up 15% yoy), pressured by

downward trend of CPKO prices. As a result, EBITDA was recorded at THB 79 million (down 77% yoy), while

Adjusted EBITDA was recorded at THB 434 million (down 33% yoy).

Management’s Discussion and Analysis | 8

Global Green Chemicals Public Company Limited

Consolidated Profit & Loss statement

Exhibit 7 : Consolidated Profit & Loss Statement comparison of 2Q2018, 2Q2017 and 1Q2018

2Q2018 2Q2017 yoy 1Q2018 qoq

MB % MB % MB % MB % MB %

Sale Revenue 4,236 100 4,826 100 (590) (12) 4,631 100 (395) (9)

Feedstock (3,285) (78) (3,540) (73) 255 (7) (3,522) (76) 237 (7)

Net Realizable Value (NRV) 0 - (19) (0) 19 (100) 2 0 (2) (100)

Product to Feed Margin 951 22 1,267 26 (316) (25) 1,111 24 (160) (14)

Variable Costs (485) (11) (421) (9) (64) 15 (495) (11) 10 (2)

Fixed Costs (130) (3) (137) (3) 7 (5) (126) (3) (4) 3

Stock Gain/(Loss) (149) (4) (407) (8) 258 (63) (235) (5) 86 (37)

SG&A (83) (2) (85) (2) 2 (2) (72) (2) (11) 15

Other Income 33 1 11 0 22 200 28 1 5 18

EBITDA 137 3 228 5 (91) (40) 211 5 (74) (35)

Depreciation and Amortization (133) (3) (141) (3) 8 (6) (139) (3) 6 (4)

EBIT 4 0 87 2 (83) (95) 72 2 (68) (94)

Net Financial Costs (8) (0) (15) (0) 7 (47) (5) (0) (3) 60

FX Gain/Loss(1) 44 1 (26) (1) 70 (269) (27) (1) 71 (263)

Share of Profit/(Loss) from investment 27 1 16 0 11 69 20 0 7 35

Income Tax Expenses 0 - 9 0 (9) (100) 4 0 (4) (100)

Net Profit bef extra items 67 2 71 1 (4) (6) 64 1 3 5

Extra item net of tax(2) (1,920) (45) - - (1,920) na. - - (1,920) na.

Net Profit after extra items (1,853) (44) 71 1 (1,924) (2,710) 64 1 (1,917) (2,995)

Notes : (1) Including Gain/(Loss) from FX and Derivatives

(2) Extra items were expenses from raw materials derogation amounting to THB 2,004 million net of tax income from deferred tax assets

amounting to THB 84 million.

Management’s Discussion and Analysis | 9

Global Green Chemicals Public Company Limited

Exhibit 8 : Consolidated Profit & Loss Statement comparison of 6M2018 and 6M2017

6M2018 6M2017 yoy

MB % MB MB % MB

Sale Revenue 8,867 100 9,073 100 (206) (2)

Feedstock (6,807) (77) (6,886) (76) 79 (1)

Net Realizable Value (NRV) 2 0 (19) (0) 21 (111)

Product to Feed Margin 2,062 23 2,168 24 (106) (5)

Variable Costs (980) (11) (776) (9) (204) 26

Fixed Costs (256) (3) (276) (3) 20 (7)

Stock Gain/(Loss) (384) (4) (440) (5) 56 (13)

SG&A (155) (2) (155) (2) - -

Other Income 61 1 21 0 40 190

EBITDA 348 4 540 6 (192) (36)

Depreciation and Amortization (272) (3) (278) (3) 6 (2)

EBIT 76 1 261 3 (185) (71)

Net Financial Costs (13) (0) (37) (0) 24 (65)

FX Gain/Loss(1) 17 0 (51) (1) 68 (133)

Share of Profit/(Loss) from investment 47 1 46 1 1 2

Income Tax Expenses 4 0 (3) (0) 7 (233)

Net Profit bef extra items 131 1 216 2 (85) (39)

Extra item net of tax(2) (1,920) (22) - - (1,920) na.

Net Profit after extra items (1,789) (20) 216 2 (2,005) (928)

Notes : (1) Including Gain/(Loss) from FX and Derivatives

(2) Extra items were expenses from raw materials derogation amounting to THB 2,004 million net of tax income from deferred tax assets

amounting to THB 84 million.

Management’s Discussion and Analysis | 10

Global Green Chemicals Public Company Limited

Statement of Financial Position

Exhibit 9 : Consolidated Financial Position as of June 30, 2018 and as of December 31, 2017

Cash and Cash Equivalent Other Liabilities

Interest Bearing Debt

Account Receivable,

Inventory, and other

Current Assets

Shareholders’ Equities

PP&E

Non-current Assets

As of December 31, 2017 As of June 30, 2018

THB 14,535 million THB 12,842 million

Assets

As of Jun 30, 2018, the company had total assets of THB 12,842 million, decreased from Dec 31, 2017

by THB 1,693 million due to reasons as follow:

- a decrease from current assets of THB 1,982 million, which was mainly due to decreasing

of account receivable of THB 579 million as a result of ME and FA Sales volume declined from end of last year

and Natural FA price declined; a decreasing of inventory of THB 1,253 million from expenses from raw

materials derogation;

- an increase of non-current assets of THB 289 million, which was mainly due to increasing of

PP&E value of THB 536 million which came from investment in ME2 project, offsetting by depreciation of PP&E

of THB 235 million.

Liabilities

As of Jun 30, 2018, the company had total liabilities of THB 3,762 million, increased from Dec 31,

2017 by THB 300 million or 9%, mainly attributable to increasing of higher accounts payable and decreasing

of long term loan from financial institution.

Shareholder’s equities

As of Jun 30, 2018, the company had total shareholders’ equities of THB 9,080 million, decreased

from Dec 31, 2017 by THB 1,993 million or 18% due to 6M/2018 net loss.

Management’s Discussion and Analysis | 11

Global Green Chemicals Public Company Limited

Statement of Cash Flows

As of Jun 30, 2018 the company had cash and cash equivalent THB 4,038 million decreased from

Dec 31, 2017 by THB 84 million. The company had cash from operating activities of THB 745 million which

included 1) cash from net profit before extra item of THB 131 million , and other operating activities of THB

607 million which attributable to a decrease from accounts receivable; 2) Cash flow spent for investing

activities of THB 483 million , which was spent on obtaining PP&E for THB 543 million, mainly due to

investment in ME2 project and receiving of dividend from TEX amounting to THB 91 million ; and 3) Cash

Flow spent for financing activities of THB 384 million , which was from annual dividend payment, long-term

loan principal repayment and interest payment.

Key Financial Ratios

Exhibit 10 : Key Financial Ratios comparison of 2Q2018 vs. 2Q2017 vs. 1Q2018

2Q2018 2Q2017 1Q2018

Current ratio(x) 4.0 7.0 7.5

EBITDA to sales revenue(%) 3.2 4.7 4.6

Net profit to sales revenue(%) (43.7) 1.5 1.4

Return on total assets(%) (10.5) 4.6 3.0

Return on equity(%) (14.1) 6.5 4.0

Debt to equity(x) 0.4 0.3 0.3

Interest bearing debt to equity(x) 0.2 0.2 0.2

Interest bearing debt to EBITDA(x) 2.4 2.2 2.3

Notes : Current Ratio(Times) = Current assets divided by current liabilities

EBITDA to sales revenue(%) = EBITDA divided by sales revenue

Net Profit to sales revenue(%) = Net profit divided by sales revenue

Return on total assets(%) = Net profit divided by average total assets

Return on equity(%) = Net profit divided by average equities

attributable to owners of the company

Debt to equity(Times) = Total debt divided by shareholders’ equities

Interest bearing debt to equity(Times) = Interest bearing debt divided by shareholders' equities

Interest bearing debt to EBITDA(Times) = Interest bearing debt divided by EBITDA

Management’s Discussion and Analysis | 12

You might also like

- RJ Analyze A Salary-Based Budget 1 Steven NDocument3 pagesRJ Analyze A Salary-Based Budget 1 Steven Napi-541902866100% (1)

- Unit 7: Cultural Studies: Q2e Listening & Speaking 5: Audio ScriptDocument5 pagesUnit 7: Cultural Studies: Q2e Listening & Speaking 5: Audio ScriptLay LylyNo ratings yet

- MKT201 Case Study 03 Group 1Document7 pagesMKT201 Case Study 03 Group 1zarin upamaNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceAshish AgarwalNo ratings yet

- Rain Industries: CMP: INR381 TP: INR480 (+26%) Carbon Prices and Margins Continue To ImproveDocument8 pagesRain Industries: CMP: INR381 TP: INR480 (+26%) Carbon Prices and Margins Continue To ImprovedidwaniasNo ratings yet

- Osotspa Public Company Limited: Q4'18 and FY18 Management Discussion & AnalysisDocument7 pagesOsotspa Public Company Limited: Q4'18 and FY18 Management Discussion & AnalysisEcho WackoNo ratings yet

- Jubilant Life Sciences: CMP: INR596 TP: INR800 (+34%)Document10 pagesJubilant Life Sciences: CMP: INR596 TP: INR800 (+34%)Shashanka HollaNo ratings yet

- Tata Power: CMP: Inr87 TP: INR77 (-11%)Document8 pagesTata Power: CMP: Inr87 TP: INR77 (-11%)Rahul SainiNo ratings yet

- Tata Chemicals by KotakDocument9 pagesTata Chemicals by KotakAshish KudalNo ratings yet

- Ashok Leyland: CMP: INR115 TP: INR134 (+17%)Document10 pagesAshok Leyland: CMP: INR115 TP: INR134 (+17%)Jitendra GaglaniNo ratings yet

- Investor Presentation (Company Update)Document24 pagesInvestor Presentation (Company Update)Shyam SunderNo ratings yet

- Parag Milk Foods: CMP: INR207 TP: INR255 (+23%) BuyDocument10 pagesParag Milk Foods: CMP: INR207 TP: INR255 (+23%) BuyNiravAcharyaNo ratings yet

- PPB Group: 2019: Good Results Amid Challenging EnvironmentDocument4 pagesPPB Group: 2019: Good Results Amid Challenging EnvironmentZhi Ming CheahNo ratings yet

- GSK Pharma: CMP: INR3,239 TP: INR3,130 (-3%)Document10 pagesGSK Pharma: CMP: INR3,239 TP: INR3,130 (-3%)Harshal ShahNo ratings yet

- Global Bio-Chem: (809.HK) Interim Results ReviewDocument4 pagesGlobal Bio-Chem: (809.HK) Interim Results Reviewapi-26443191No ratings yet

- UAE Equity Research: First Look Note - 3Q22Document5 pagesUAE Equity Research: First Look Note - 3Q22xen101No ratings yet

- UAE Equity Research - Agthia Group 4Q22 - First Look NoteDocument5 pagesUAE Equity Research - Agthia Group 4Q22 - First Look Notexen101No ratings yet

- Oil India - 2QFY18 - HDFC Sec-201711140922171564104Document8 pagesOil India - 2QFY18 - HDFC Sec-201711140922171564104Anonymous y3hYf50mTNo ratings yet

- Interim Management StatementDocument16 pagesInterim Management StatementsaxobobNo ratings yet

- Tata Motors (TTMT IN) : Q1FY21 Result UpdateDocument6 pagesTata Motors (TTMT IN) : Q1FY21 Result UpdatewhitenagarNo ratings yet

- EarningsReleaseQ1 FY19Document5 pagesEarningsReleaseQ1 FY19osama aboualamNo ratings yet

- Quarterly Update Q3FY21: Century Plyboards (India) LTDDocument10 pagesQuarterly Update Q3FY21: Century Plyboards (India) LTDMalolanRNo ratings yet

- Current Price (BDT) : BDT 1,010.0Document6 pagesCurrent Price (BDT) : BDT 1,010.0Uzzal AhmedNo ratings yet

- Alicorp Earnings Report 3Q23 EN VFDocument23 pagesAlicorp Earnings Report 3Q23 EN VFADRIAN ANIBAL ENCISO ARKNo ratings yet

- Note For Investment Operation CommitteeDocument4 pagesNote For Investment Operation CommitteeAyushi somaniNo ratings yet

- Hemas Holdings PLC (HHL SL: LKR 69.00) : BRS Quarterly Results Snapshot - Q4 FY 19Document4 pagesHemas Holdings PLC (HHL SL: LKR 69.00) : BRS Quarterly Results Snapshot - Q4 FY 19Sudheera IndrajithNo ratings yet

- RD Release 2Q21 20210810 ENDocument19 pagesRD Release 2Q21 20210810 ENRodrigo FerreiraNo ratings yet

- Volume 8 - October 2022: 16.4% 33% 26% RP 153.15 Bill RP 40.69 Bill 276%Document4 pagesVolume 8 - October 2022: 16.4% 33% 26% RP 153.15 Bill RP 40.69 Bill 276%fielimkarelNo ratings yet

- Pidilite Industries: ReduceDocument9 pagesPidilite Industries: ReduceIS group 7No ratings yet

- JSW Energy: CMP: Inr68 TP: INR73 (+8%) Higher Merchant Rates Drive Strong PerformanceDocument8 pagesJSW Energy: CMP: Inr68 TP: INR73 (+8%) Higher Merchant Rates Drive Strong PerformanceOrlieus GonsalvesNo ratings yet

- Presentation To Investors: First Nine Months 2020 ResultsDocument27 pagesPresentation To Investors: First Nine Months 2020 ResultsMiguel García MirandaNo ratings yet

- Prabhudas Lilladher Apar Industries Q3DY24 Results ReviewDocument7 pagesPrabhudas Lilladher Apar Industries Q3DY24 Results ReviewvenkyniyerNo ratings yet

- Itc 031017Document3 pagesItc 031017Sam SamNo ratings yet

- Mahindra & Mahindra: CMP: INR672 TP: INR810 (+20%)Document14 pagesMahindra & Mahindra: CMP: INR672 TP: INR810 (+20%)Yash DoshiNo ratings yet

- Ril 1qfy23Document12 pagesRil 1qfy23Deepak KhatwaniNo ratings yet

- Rosneft Oil Company ProfileDocument37 pagesRosneft Oil Company ProfileVo Ngoc HoangNo ratings yet

- Institutional Equities: Deepak Nitrite LTDDocument6 pagesInstitutional Equities: Deepak Nitrite LTD4nagNo ratings yet

- Hasil Riset Analis Dari Mandiri SekuritasDocument3 pagesHasil Riset Analis Dari Mandiri SekuritastaufiqNo ratings yet

- Utcem 20211018 Mosl Ru PG012Document12 pagesUtcem 20211018 Mosl Ru PG012Vinayak ChennuriNo ratings yet

- Q2FY24 Post Results Review - SMIFS Institutional ResearchDocument17 pagesQ2FY24 Post Results Review - SMIFS Institutional Researchkrishna_buntyNo ratings yet

- Vinati Organics: AccumulateDocument7 pagesVinati Organics: AccumulateBhaveek OstwalNo ratings yet

- JK Lakshmi Cement 18062019Document6 pagesJK Lakshmi Cement 18062019saran21No ratings yet

- StoneCo ER 2Q23Document28 pagesStoneCo ER 2Q23Andre TorresNo ratings yet

- JM - SailDocument10 pagesJM - SailSanjay PatelNo ratings yet

- Reliance Industries: CMP: INR1,077 TP: INR1,057 (-2%)Document18 pagesReliance Industries: CMP: INR1,077 TP: INR1,057 (-2%)Abhiroop DasNo ratings yet

- MG Group Merck Ar21Document10 pagesMG Group Merck Ar21TEST SENo ratings yet

- Ibn Sina - Financial AnalysisDocument19 pagesIbn Sina - Financial Analysisabdel hameed ibrahimNo ratings yet

- Prabhudas LiladharDocument6 pagesPrabhudas LiladharPreet JainNo ratings yet

- Q1FY23 - Result Update: Future Growth IntactDocument10 pagesQ1FY23 - Result Update: Future Growth IntactResearch ReportsNo ratings yet

- Itc LTD (Itc) : GST Implementation To Aid Volume GrowthDocument12 pagesItc LTD (Itc) : GST Implementation To Aid Volume Growthvalueinvestor123No ratings yet

- Stmicro - Q4-Fy2018 PR - FinalDocument12 pagesStmicro - Q4-Fy2018 PR - Finalakshay kumarNo ratings yet

- Alkyl AminesDocument8 pagesAlkyl AminesSriram RanganathanNo ratings yet

- Sbkuch 1Document8 pagesSbkuch 1vishalpaul31No ratings yet

- Nesco LTD - East India Sec PDFDocument7 pagesNesco LTD - East India Sec PDFdarshanmadeNo ratings yet

- Dolat Capital Market - Vinati Organics - Q2FY20 Result Update - 1Document6 pagesDolat Capital Market - Vinati Organics - Q2FY20 Result Update - 1Bhaveek OstwalNo ratings yet

- Coal India (COAL IN) : Q4FY19 Result UpdateDocument6 pagesCoal India (COAL IN) : Q4FY19 Result Updatesaran21No ratings yet

- Dixon InvestorPresentationJan2022Document12 pagesDixon InvestorPresentationJan2022raguramrNo ratings yet

- Topline Result Review (Feb 23, 2022) MLCFDocument2 pagesTopline Result Review (Feb 23, 2022) MLCFDiljeet KumarNo ratings yet

- English Edition - 11 December, 2020, 09:02 PM ISTDocument7 pagesEnglish Edition - 11 December, 2020, 09:02 PM ISTRANAJAY PALNo ratings yet

- Ashok Leyland Kotak 050218Document4 pagesAshok Leyland Kotak 050218suprabhattNo ratings yet

- Reliance Industries: Laggard To LeaderDocument9 pagesReliance Industries: Laggard To LeaderAnonymous y3hYf50mTNo ratings yet

- NPC 100908 RN2Q10Document2 pagesNPC 100908 RN2Q10limml63No ratings yet

- Wipro: CMP: INR243 TP: INR260 (+7%) Largely in Line Lower ETR Drives A Beat in ProfitabilityDocument14 pagesWipro: CMP: INR243 TP: INR260 (+7%) Largely in Line Lower ETR Drives A Beat in ProfitabilityPramod KulkarniNo ratings yet

- Fats & Oils Refining & Blending World Summary: Market Values & Financials by CountryFrom EverandFats & Oils Refining & Blending World Summary: Market Values & Financials by CountryNo ratings yet

- Applied Economics (Prelims)Document12 pagesApplied Economics (Prelims)Amor A. Fuentecilla Jr.No ratings yet

- Case Study - Put OptionsDocument3 pagesCase Study - Put OptionsMartijn ReekNo ratings yet

- En - MB1136 DEFAULT C05 - SchematicDocument5 pagesEn - MB1136 DEFAULT C05 - SchematicAlejandro PazNo ratings yet

- Q - Add or Drop A SegmentDocument1 pageQ - Add or Drop A SegmentIrahq Yarte TorrejosNo ratings yet

- Warren Buffet Powerpoint Presentation PDF FreeDocument7 pagesWarren Buffet Powerpoint Presentation PDF FreeHeeba jeeNo ratings yet

- LET-AP-Practice Test in Social Studies 2Document8 pagesLET-AP-Practice Test in Social Studies 2armand rodriguezNo ratings yet

- Economics 50q Question BankDocument14 pagesEconomics 50q Question Bankhemant rakhechaNo ratings yet

- The Igbo-UkwuDocument10 pagesThe Igbo-UkwuMateus Raynner André100% (1)

- 150Y Markt Broschuere Japan Inhalt RedDocument62 pages150Y Markt Broschuere Japan Inhalt RedDeepak JainNo ratings yet

- Module 9 Quiz-Foreign Exchange Risk Management - Treasury ManagementDocument2 pagesModule 9 Quiz-Foreign Exchange Risk Management - Treasury ManagementAira Denise TecuicoNo ratings yet

- Public Relation Dilemma # 1: Unilever Pakistan in A Self-Created PR CrisisDocument2 pagesPublic Relation Dilemma # 1: Unilever Pakistan in A Self-Created PR Crisiskashifshaikh76No ratings yet

- Vishwas's ProjectDocument71 pagesVishwas's ProjectRAMJI VISHWAKARMANo ratings yet

- Examen A PDFDocument8 pagesExamen A PDFMaria Fernanda Soto OrellanaNo ratings yet

- Monetary Economics AssignmentDocument6 pagesMonetary Economics AssignmentNokutenda Kelvin ChikonzoNo ratings yet

- EM Final Paper Assingment EE GCU S18Document4 pagesEM Final Paper Assingment EE GCU S18KhanNo ratings yet

- Catch Up Review J HD Caug 2015Document3 pagesCatch Up Review J HD Caug 2015Sourabh SinghNo ratings yet

- Belay, S. (2009) - Export-Import Theory, Practices, and Procedures. (2 Ed.) - New York: RoutledgeDocument10 pagesBelay, S. (2009) - Export-Import Theory, Practices, and Procedures. (2 Ed.) - New York: RoutledgejaiderNo ratings yet

- Hacienda LuisitaDocument34 pagesHacienda LuisitaDanica JoyNo ratings yet

- Group Assignment: II. WorkoutDocument5 pagesGroup Assignment: II. Workoutyohannes lemiNo ratings yet

- JSW Steel - WikipediaDocument28 pagesJSW Steel - WikipediaPawan SrivastavaNo ratings yet

- International Trade 3Rd Edition by Robert C Feenstra Full Chapter PDFDocument27 pagesInternational Trade 3Rd Edition by Robert C Feenstra Full Chapter PDFsandra.watkins960100% (65)

- 4.international TradeDocument73 pages4.international TradeDhawal RajNo ratings yet

- Incremental Working Capital RequirementDocument2 pagesIncremental Working Capital RequirementRNo ratings yet

- Broker's InviteDocument1 pageBroker's Invitedelphine cazalsNo ratings yet

- Morris LiquidityblackholesDocument19 pagesMorris LiquidityblackholesOloyede RidwanNo ratings yet

- Economic Drain PRCDocument48 pagesEconomic Drain PRCSubhadip Saha ChowdhuryNo ratings yet