Professional Documents

Culture Documents

Osotspa Public Company Limited: Q4'18 and FY18 Management Discussion & Analysis

Uploaded by

Echo WackoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Osotspa Public Company Limited: Q4'18 and FY18 Management Discussion & Analysis

Uploaded by

Echo WackoCopyright:

Available Formats

Osotspa Public Company Limited

Q4’18 and FY18 Management Discussion & Analysis 27 February 2019

Financial Highlights

- Q4’18 Net profit* was at THB 789 million, +269.6% YoY. 2018 Net profit* was at THB 3,005 million, +6.1% YoY.

2018 Net profit* margin was at 12.0%, compared to 11.2% in 2017.

- 2018 Domestic Beverage including C-Vitt & Calpis grew 2.7% YoY. Total Personal care continued its momentum with

11.5% growth YoY, with 42.8% growth in CLM markets. International business grew 1.5% at constant FX rate, driven

by Myanmar growth.

- Overall Revenue from sales was at THB 24,297 million, or -2.9% YoY, driven by Unicharm distribution agreement

termination, and 33.7% dropped in OEM sales of glass bottles due to planned furnace repair in early 2018.

- OSP energy drink market share was at 54%. Q4’18 M150 market share was at 37.9% increase by 90bps QOQ. C-Vitt

took over leadership position in functional drink market, with Q4’18 market share of 25.0%, leaving 290bps gap to

the 2nd player.

- Fitness First project delivered more than THB 700 million cost/expenses saving in 2018, which drove Q4’18 Gross

margin to 34.5%, +270bps QoQ.

*Net Profit = Net Profit attributable to owners of the parent

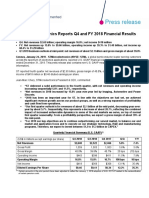

Financial Performance for Q4’18 and FY18

Income Statement Summary

Unit: THB millions Q4'18 Q4'17 % YoY 2018 2017 % YoY

Total revenues 6,519 6,418 1.6% 24,971 25,340 -1.5%

Total revenues from sales 6,333 6,364 -0.5% 24,297 25,027 -2.9%

Beverages 4,690 4,829 -2.9% 18,575 18,975 -2.1%

Personal Care 675 611 10.4% 2,452 2,195 11.7%

Supply Chain Services 911 859 6.0% 3,063 3,645 -16.0%

Other Segments 57 65 -12.2% 207 211 -1.9%

Total other income 186 54 248.3% 674 313 115.0%

Gross profit 2,186 2,082 5.0% 7,883 8,262 -4.6%

SG&A 1,336 1,700 -21.4% 4,947 5,033 -1.7%

Selling and distribution expenses 903 914 -1.2% 3,498 3,384 3.3%

Administrative expenses 434 786 -44.9% 1,449 1,649 -12.1%

EBIT 1,073 472 127.4% 3,803 3,722 2.2%

EBITDA 1,342 736 82.4% 4,875 4,778 2.0%

Profit for the period from discontinued 0 -22 -100.0% 27 40 -34.1%

operation, net of tax

Profit for the period 796 238 234.3% 3,062 2,939 4.2%

Profit attributable to owners of the parent 789 214 268.7% 3,005 2,834 6.1%

Key Ratios (%)

Gross profit margin 34.5% 32.7% 1.8% 32.4% 33.0% -0.6%

SG&A to net sales ratio 21.1% 26.7% -5.6% 20.4% 20.1% 0.3%

EBIT margin 16.5% 7.4% 9.1% 15.2% 14.7% 0.5%

EBITDA margin 20.6% 11.5% 9.1% 19.5% 18.9% 0.6%

Net profit margin for the period 12.2% 3.7% 8.5% 12.3% 11.6% 0.7%

Net profit margin attributable to the 12.1% 3.3% 8.8% 12.0% 11.2% 0.9%

owners of the parent

In September 2018, the Company completed divestment of Interactive Communications – a subsidiary of the group - and booked

gain on sales of investment of THB 12.3 million before tax. As the Company completely divested out of the media business, this

transaction has led to the classification in the Company’s income statement in Q3’18 by taking out all related items in the financial

statement and combined them into one line below corporate tax expense called “Profit for the period from discontinued operation,

net of tax” (See Note 7 to our interim financial statements for the three-month and for the nine-month periods ended 30

September 2018 for more details).

In November 2018, the Company disposed White group PCL, whose businesses comprise of industrial chemicals trading, rental

property and maintenance services. The Company booked a net marginal gains from divestment, as equity gain/loss from White

Group performance were recorded on a quarterly basis.

Q4’18 and 2018 Management Discussion & Analysis Page 1/7

Osotspa Public Company Limited

Q4’18 and FY18 Management Discussion & Analysis 27 February 2019

Financial Performance Summary for Q4’18 vs. Q4’17

The Company reported Q4’18 total revenues from sales of THB 6,333 million, slightly drop by 0.5% YoY (or THB -31 million).

The reasons for total revenues decline were 1) Lower OEM businesses, especially OEM bottles sales (-33.7%), 2) unfavorable FX

impact on our international business and 3) Lower Cambodia beverage sales. While Q4’18 Domestic Beverages and C-Vitt and

Calpis grew by 6.5% and domestic Personal Care showed 7.2% growth.

Beverages Segment

Domestic beverages sales were at THB 3,837 million or THB 59 million higher than Q4’17 (or +1.6% YoY) while

international beverages business declined by 15.6%, from FX impact and unfavorable Cambodia performance. At

constant FX, our international business showed stable growth. As a result, total revenues from sales of Beverages

segment booked at 4,690 million, decreased by THB 139 million (or -2.9% YoY) in Q4’18. However, when combining

C-Vitt and Calpis (reported under Supply Chain Services) with domestic beverages sales, Thailand’s beverages portfolio

grew by 6.5% YoY.

Domestic market: M-150 grew by 1.4%. Chalarm continued its strong momentum after the newly launched Black

Galingale variant in August 2018 where sales grew +17.2% YoY. Som In-Sum growth remained strong (+37.8% YoY).

Overseas markets: Total revenues from sales showed at THB 853 million in Q4’18, declined by THB 198 million (or -

18.9% YoY), due to FX impact and weaker sales in Cambodia. Myanmar sales at constant FX grew double digits.

Personal Care Segment

Total Personal Care revenues increased by THB 64 million (or +10.4% YoY) to THB 675 million, mainly from

international sales with a favorable growth of 40.3% YoY. Domestic sales increased by 7.2% YoY driven by the

momentum of new products launched in previous quarter (Q3’18), on top with Twelve Plus campaign with BNK48 (Girl

Group) in Q4’18. Q4’18 growth was affected from high last year base from successful launch of Babi Mild White Sakura

in October 2017.

Supply Chain Services Segment

C-Vitt drove the segment growth with its strong Q4’18 revenue increase by 111.2% YoY. After the capacity and

distribution expansion in Q2’18, C-Vitt is now a number one brand in functional drink market with market share of

23.3% in Q3’18, and improve to 25.0% in Q4’18, according to Nielsen. On the other hands, OEM sales were -34.2%

YoY. Overall supply chain services segment revenues booked at THB 911 million, increase THB 52 million (or +6.0%)

YoY.

Q4’18 the Company’s gross margin improved to 34.5% or +270bps QoQ. Gross profit increased by THB 105 million YoY (or

5.0%) to THB 2,186 million in Q4’18. The big improvement was resulted from Fitness First (cost saving project), which drove

the overall costs down.

The Company’s total SG&A decreased by THB 363 million or -21.4% YoY to THB 1,336 million in Q4’18 which mostly due to the

absence of various non-recurring expenses booked under administrative expenses in Q4’17 (e.g. provision for Kenya court case,

expenses related to company’s reorganization). Selling and distribution expenses declined by -1.2% YoY as well as slightly lower

advertising and promotional spending as a percentage to sales. In addition, administrative expenses declined by -44.9% YoY in

Q4’18 due to last year’s various extra expenses aforementioned.

The Company Q4’18 reported profit for the period was THB 796 million (+234.3% YoY) and the profit attributable to owners of

the parent was THB 789 million (+269.6% YoY).

Financial Performance Summary for 2018 vs. 2017

2018 Domestic Beverage sales including C-Vitt & Calpis** grew by 2.7%. Total Personal Care showed 11.7%, driven by growth

from international businesses in CLM (+42.8% YoY). Total revenue from sales reported at THB 24,297 million, decline by 2.9%

YoY, mostly driven by Unicharm distribution agreement termination since Mar 2017. Taking out the effect of Unicharm absence,

2018 normalized revenues declined by 0.7%, due to lower OEM sales (-31.5% YoY), unfavorable performance in Cambodia and

FX impact on overall international businesses. However, at constant FX, our international business showed positive growth.

Beverages Segment

2018 Total revenues from sales of Beverages segment booked THB 18,575 million, declined by THB 400 million YoY

(or -2.1%). However, Domestic Osotspa’s beverage sales, including C-Vitt and Calpis**, grew 2.7% YoY. C-Vitt itself

grew by +74.6% YoY after capacity and distribution expansion in mid-2018.

** C-Vitt & Calpis are included in Supply Chain Services segment

Q4’18 and 2018 Management Discussion & Analysis Page 2/7

Osotspa Public Company Limited

Q4’18 and FY18 Management Discussion & Analysis 27 February 2019

The success of our small brands with herbal benefits help stabilizing overall domestic sales. A success of Som In-sum

repositioning in late 2017 has continued to grow the sales contribution in 2018 by 109.1% YoY. Moreover, the recently

launched Chalarm Black Galingale in August 2018 also turned Chalarm sales to near breakeven (-0.7% YoY in 2018,

improved from -15% YoY pre-launch to +18.0% YoY post launch of Chalarm Black Galingale). Also, M-Presso (NPD

launched in February 2018) contributed to the Beverages sales this year.

From aforementioned, Domestic sales contribution remained stable at THB 14,902 million (THB 65.0 million lower than

2017, or -0.4% YoY). The Company has maintained its energy drink market share at 54.0% in 2018 as per mid-term

strategy guidance, according to Nielsen.

However, our international business showed a decline in revenue by THB 335 million YoY (or -8.4%) to THB 3,673

million in 2018, driven by FX impact and weaker sales in Cambodia. Myanmar sales at constant FX grew double digits.

Personal Care Segment

Total revenues from sales of Personal Care segment improved by THB 257 million YoY (or +11.7%) to THB 2,452

million in 2018 driven by sales from Babi Mild (+13.5% YoY to THB 1,637 million in 2018) as well as Twelve Plus

(+10.1% YoY to THB 705 million in 2018). Domestic sales for personal care grew +8.5% to THB 2,165 million in 2018

driven by both Babi Mild (+10.1% YoY) and Twelve Plus (+7.4% YoY). We believe both brands will continue to reap

out benefit from being more focus (after SKU rationalization), having margin accretive new products launches and a

cautious and active evaluation of advertising and promotional spending. In overseas markets, total revenue from sales

improved by THB 86 million YoY (or +42.8%) to THB 287 million.

Supply Chain Services Segment

Total revenues from sales of Supply Chain Services decreased by THB 582 million YoY (or -16.0%) to THB 3,063 million

in 2018 driven mostly by revenue decline from termination of Unicharm’s distribution business (THB -579 million YoY)

in March 2017 and also from lower revenue from sales of OEM products (-31.5% YoY) especially OEM bottle sales

(-33.7% YoY) which dropped from major maintenance of a furnace in Ayutthaya. Meanwhile, sales from C-Vitt has

continued to outperform last year especially after completed capacity expansion in mid-2018 (+74.6% YoY in 2018).

The Company’s gross profit was THB 7,883 million in 2018. Overall gross profit margin for the Company was 32.4% (compared

with 33.0%). Fitness first (cost saving projects) helps mitigating cost imcrease impact in 1) higher listing fees for new product

launches in both beverage and personal care, 2) key material cost increase, particularly cullet costs in 1H18, and natural gas

price increase, and 3) higher conversion costs from lower OEM sales.

The Company’s total SG&A decreased by THB 86 million YoY (or -1.7%) to THB 4,947 million. Administrative expenses was

lower by THB 200 million (-12.1% YoY) from lower personal costs and one-time item in Q4’17, i.e. provision for Kenya court

case. However, the company invested more on A&P to support new product launch and relunches in both beverages and personal

care. Lastly, Our R&D spending increase by 44% YoY to THB 54 million in 2018.

In 2018, the Company booked THB 158 million gain on disposal of investment, mainly in our media businesses and White group.

The Company reported profit for the period of THB 3,062 million (+4.2% YoY). Net profit* of THB 3,005 million (+6.1% YoY),

or net profit* margin of 12.0%

2019 Business outlook

Osotspa 2019 strategy and revenues growth target are consistent with mid-term strategy guidance, which the Company expect

revenues to grow mid-single digit. The company plan to launch 2-4 innovations in beverages portfolio, particularly focus on

functional drink. Domestic energy drink focuses remain with our core brand, M150, and small brands with herbal benefits. Som

In-sum and Chalarm Black Galingale will be further strengthen. For functional drink, C-Vitt remains a key driver, on top with new

product launches. Regarding Personal Care, our two key brands, Babi Mild and Twelve Plus, will be further strengthen, on top

with new pillar launches in facial and skin care segments. CLM remain our key markets outside Thailand. Myanmar is the main

market, where key jobs to be done are to further strengthen our core brands, namely Shark Myanmar and M150, and implement

new route-to-market model. Our new manufacturing facility is expected to be completed by the end of 2019, and Osotspa will

be able to fully capture manufacturing margin afterward. Moreover, the company expect to turnaround our OEM sales, particularly

OEM beverage sales after the completion of furnace repair in Q2 2018.

On profitability side, the Company continues to put our best effort on margin improvement program through Fitness First Project.

2019 benefits will come from continuation of 2018 Fitness First program, and new lighter weight bottles, warehouse and

distribution optimization, packaging optimization and more on product formulations optimization. The company expect

improvement in beverage gross margin, particularly from cost efficiency through key material cost stabilization and conversion

*Net Profit = Net Profit attributable to owners of the parent

Q4’18 and 2018 Management Discussion & Analysis Page 3/7

Osotspa Public Company Limited

Q4’18 and FY18 Management Discussion & Analysis 27 February 2019

cost improvement after commissioning of new glass plant at The Siam Glass Ayutthaya (SGA2), which expect to start

commissioning in mid-2019. Personal Care gross margin improvement will be driven by premiumization and mix transition. 2019

overall profitability target are in-line with our mid-term business plan.

The company also explores new markets entry for beverage products, where Vietnam and China are in our interests. The studies

were kick off and progress as planed in both countries. Moreover, the company sees potential in growing vending machine

channel, where potential partner has been identified and the company expect to close the deal within 2019.

Financial Position

Balance Sheet Balance Sheet Breakdown

Unit: THB million 23,456

4,601

552

15,198 12,641

6,288

11,092 18,303

10,816

8,910

666

3,439

As at As at

31 Dec 2017 31 Dec 2018

Current assets Non-current assets

Current liabilities Non-current liabilities

Shareholders' equity

As of 31 December 2018, the Company had total assets of THB 23,456 million, increase of THB 8,259 million (or +54.3%) from

31 December 2017. Cash and cash equivalents increased by THB 4,110 million driven by cash generated from operations (see

cash flow analysis). IPO proceeds were partly invested in short and long term debt securities resulting in THB 3,422 million

increase in other current assets and and THB 1,386 million increase in long term investments. (see more details in financial

statement note 6).

As of 31 December 2018, the Company had total liabilities of THB 5,153 million, a decrease of THB 6,605 million (or -56.2%)

from 31 December 2017 primarily from net repayment in short-term loans of THB 6,082 million by using IPO proceeds, lower

trade and other payables of THB 207 million, and a decline in liabilities classified as held for sale (THB 394 million) post-divestment

of Future Group.

As of 31 December 2018, the Company had total shareholders’ equity of THB 18,303 million, an increase of THB 14,864 million

from 31 December 2017 which were driven by 2018 consolidated profit attributable to owners of the parent of THB 3,005 million

combined with an increase in paid-up capital and share premium of THB 14,621 million and was partly offset by dividend

payments of THB 2,742 million paid to the owners of the Company in 2018.

Q4’18 and 2018 Management Discussion & Analysis Page 4/7

Osotspa Public Company Limited

Q4’18 and FY18 Management Discussion & Analysis 27 February 2019

Cash Flow

Unit: THB millions

5,703 (5,287)

82 4,486

3,612

376

Beginning Net cash Net cash Net cash Cash and Ending

cash and from from used in cash cash and

cash operating financing investing equivalents cash

equivalents activities activities activities classified equivalents

(31 Dec as non- (31 Dec

2017) current 2018)

assets held

for sale

As of 31 December 2018, the Company had cash and cash equivalents of THB 4,486 million, increased by THB 4,110 million from

31 December 2017. The Company had cash flows from operating activities of THB 3,612 million. Net cash from financing activities

increased by THB 5,703 million from IPO proceeds of THB 14,723 million, offsetting by loans repayment of THB 6,095 million

and total dividends payment of THB 2,809 million (including dividend paid to non-controlling interests). The Company’s cash

outflow from investing activities were mainly for PPE acquisition of THB 1,255 million, leasehold rights acquisition at OSP Myanmar

of THB 364 million and investment in debt securities of THB 5,192 million, however, offset by THB 1,456 million cash inflow from

proceeds from disposal of subsidiaries and associates.

Q4’18 and 2018 Management Discussion & Analysis Page 5/7

Osotspa Public Company Limited

Q4’18 and FY18 Management Discussion & Analysis 27 February 2019

Financial Ratio Analysis

4Q18 4Q17 2018 2017

Profitability Ratios

Operating gross profit margin (%) 34.5 32.7 32.4 33.0

Operating EBITDA margin (%) 20.6 11.5 19.5 18.9

Net profit margin for the period (%) 12.2 3.7 12.3 11.6

Net profit margin attributable to owners of the parent (%) 12.1 3.3 12.0 11.2

Return on equity (%) - trailing 28.2 72.1 28.2 72.1

Return on assets (%) - trailing 15.8 18.5 15.8 18.5

Efficiency Ratios

Number of days of inventory 35 38 36 37

Collection period (days) 42 43 45 51

Accounts payable days 43 40 43 41

Other Ratios

Current ratio (times) 2.75 0.57 2.75 0.57

Total debt to equity (times) 0.28 3.42 0.28 3.42

The company’s operating gross profit margins was 34.5% in Q4’18 compared to 32.7% in Q4’17. SG&A to net sales ratios of

21.1% in Q4’18 compared with 26.7% in Q4’17, the Company’s EBITDA increased from 11.5% in Q4’17 to 20.6% in Q4’18 and

net profit margins improved from 3.3% in Q4’17 to 12.1% in Q4’18. Last year, the company booked THB 132 million DTL for

sale of Future Group in Q4’17.

Q4’18 cash cycle of 34 days, compared with 41 days in Q4’17, came from lower inventory, and better cash collection.

High current ratio at 2.75 times, as the company has high cash and current investments from IPO proceeds.

As a result, debt to equity ratio drop to 0.28 times.

Q4’18 and 2018 Management Discussion & Analysis Page 6/7

Osotspa Public Company Limited

Q4’18 and FY18 Management Discussion & Analysis 27 February 2019

APPENDIX: Ratio & Formula

Profitability Ratios

Gross profit margin (%) = (Total revenues from sales – Total cost of sales of goods) / Total revenues from sales

SG&A to net sales ratio (%) = (Selling and distribution expenses + Administrative expenses) / Total revenues from sales

EBIT margin (%) = (Profit before income tax expense + Finance Cost) / Total revenues

EBITDA margin (%) = (Profit before income tax expense + Finance Cost + Depreciation and Amortization) / Total revenues

Net profit margin for the period (%) = Net Profit for the period / Total revenues

Net profit margin attributable to the owner of the parents (%) = Net Profit attributable to owners of the parent / Total revenues

Return on equity (%) = Profit for the period / Avg. total equity

Return on assets (%) = Profit for the period / Avg. total assets

Liquidity Ratio

Current ratio (times) = Total current assets / Total current liabilities

Efficiency Ratios

Number of days of inventory = Avg. inventory / (Cost of sales of goods / Number of days in the period1)

Collection period (days) = Avg. trade account receivables before allowance for doubtful account / (Total revenue from sales /

Number of days in the period1)

Accounts payable days = Ending account payables / (Cost of sales of goods / Number of days in the period1)

Leverage Ratios

Debt to equity (times) = Total liabilities / Total equity

1

Number of days in the period is defined to have 360 days in a year. For example, 90 days and 180 days should be used for

quarterly and half-year ratio analysis.

Q4’18 and 2018 Management Discussion & Analysis Page 7/7

You might also like

- Hemas Holdings PLC (HHL SL: LKR 69.00) : BRS Quarterly Results Snapshot - Q4 FY 19Document4 pagesHemas Holdings PLC (HHL SL: LKR 69.00) : BRS Quarterly Results Snapshot - Q4 FY 19Sudheera IndrajithNo ratings yet

- Alicorp Earnings Report 3Q23 EN VFDocument23 pagesAlicorp Earnings Report 3Q23 EN VFADRIAN ANIBAL ENCISO ARKNo ratings yet

- Investor Presentation (Company Update)Document24 pagesInvestor Presentation (Company Update)Shyam SunderNo ratings yet

- V-Guard-Industries - Q4 FY21-Results-PresentationDocument17 pagesV-Guard-Industries - Q4 FY21-Results-PresentationanooppattazhyNo ratings yet

- Suzuki Ibf ReportDocument30 pagesSuzuki Ibf ReportSyed Usarim Ali ShahNo ratings yet

- V-Guard Q1 FY20 Earnings Presentation Highlights Strong GrowthDocument21 pagesV-Guard Q1 FY20 Earnings Presentation Highlights Strong GrowthSelva ThanarajNo ratings yet

- 349_NTC 4Q18 Earnings ReportDocument4 pages349_NTC 4Q18 Earnings Reporttkanojia12No ratings yet

- V Guard Industries Q4 Results PresentationDocument23 pagesV Guard Industries Q4 Results PresentationIlyasNo ratings yet

- FSA AssignmentDocument5 pagesFSA AssignmentNaman BishtNo ratings yet

- V Guard Industries Q3 FY22 Results PresentationDocument17 pagesV Guard Industries Q3 FY22 Results PresentationRATHINo ratings yet

- NTC 4Q17 Earnings ReportDocument4 pagesNTC 4Q17 Earnings ReportJuhie GuptaNo ratings yet

- Societe GeneraleDocument23 pagesSociete GeneraleVasiMacoveiNo ratings yet

- Word Note The Body Shop International PLC 2001: An Introduction To Financial ModelingDocument9 pagesWord Note The Body Shop International PLC 2001: An Introduction To Financial Modelingalka murarka100% (2)

- EarningsReleaseQ1 FY19Document5 pagesEarningsReleaseQ1 FY19osama aboualamNo ratings yet

- UAE Equity Research Rates Agthia Group a Buy on Solid Growth OutlookDocument5 pagesUAE Equity Research Rates Agthia Group a Buy on Solid Growth Outlookxen101No ratings yet

- IT Industry Q3FY09Document4 pagesIT Industry Q3FY09ca.deepaktiwariNo ratings yet

- 637957201521149984_Godrej Consumer Products Result Update - Q1FY23Document4 pages637957201521149984_Godrej Consumer Products Result Update - Q1FY23Prity KumariNo ratings yet

- Momo Operating Report 2022 Q4Document5 pagesMomo Operating Report 2022 Q4Harris ChengNo ratings yet

- Annual Report Laporan Tahunan: PT Gudang Garam TBKDocument132 pagesAnnual Report Laporan Tahunan: PT Gudang Garam TBKAnnisa Rosie NirmalaNo ratings yet

- Stmicro - Q4-Fy2018 PR - FinalDocument12 pagesStmicro - Q4-Fy2018 PR - Finalakshay kumarNo ratings yet

- Andhra Bank 2009-2010Document7 pagesAndhra Bank 2009-2010Don Iz BackNo ratings yet

- Colgate Financial Model SolvedDocument36 pagesColgate Financial Model SolvedSundara MoorthyNo ratings yet

- UAE Equity Research: Agthia Group PJSC Rating Maintained at BUYDocument5 pagesUAE Equity Research: Agthia Group PJSC Rating Maintained at BUYxen101No ratings yet

- 125 1 Final Press Release March 2018Document6 pages125 1 Final Press Release March 2018varun_bhuNo ratings yet

- 2024-Intro Financial Statement Modeling-SpreadsheetsDocument44 pages2024-Intro Financial Statement Modeling-SpreadsheetsBaek AerinNo ratings yet

- Signify Third Quarter Results 2022 ReportDocument19 pagesSignify Third Quarter Results 2022 Reportsumanthsumi2023No ratings yet

- Teleperformance Press Release 2018 Full Year Results VDEFDocument18 pagesTeleperformance Press Release 2018 Full Year Results VDEFahmed abhdaNo ratings yet

- Task 1 BigTech TemplateDocument5 pagesTask 1 BigTech Templatedaniyalansari.8425No ratings yet

- Investment ThesisDocument5 pagesInvestment Thesisu jNo ratings yet

- Financial Model - Colgate Palmolive (Unsolved Template) : Prepared by Dheeraj Vaidya, CFA, FRMDocument35 pagesFinancial Model - Colgate Palmolive (Unsolved Template) : Prepared by Dheeraj Vaidya, CFA, FRMahmad syaifudinNo ratings yet

- Greenply Industries Ltd. - Result Presentation Q2H1 FY 2019Document21 pagesGreenply Industries Ltd. - Result Presentation Q2H1 FY 2019Peter MichaleNo ratings yet

- Press Release 2018 MayDocument4 pagesPress Release 2018 MayJairaj JadhavNo ratings yet

- Bajaj Auto Q4 and FY18 Results Cross Rs 4,000 Cr ProfitDocument4 pagesBajaj Auto Q4 and FY18 Results Cross Rs 4,000 Cr ProfitJairaj JadhavNo ratings yet

- Target FinancialsDocument15 pagesTarget Financialsso_levictorNo ratings yet

- Teejay Lanka PLCDocument17 pagesTeejay Lanka PLCwasanthalalNo ratings yet

- Thaiduong Petrol Joint Stock CompanyDocument15 pagesThaiduong Petrol Joint Stock CompanyMinh PhươngNo ratings yet

- Earnings Release 4Q18: Rumo 4Q18 and 2018 HighlightsDocument16 pagesEarnings Release 4Q18: Rumo 4Q18 and 2018 HighlightsADVFNNo ratings yet

- FIN361Document17 pagesFIN361Mohamed HamedNo ratings yet

- JollibeeDocument4 pagesJollibeeJoyce C.No ratings yet

- 2023.11.14 Sea Third Quarter 2023 ResultsDocument16 pages2023.11.14 Sea Third Quarter 2023 Resultssk9721616No ratings yet

- Kendrion, 2019 Q2Document18 pagesKendrion, 2019 Q2Jasper Laarmans Teixeira de MattosNo ratings yet

- 2023.05.16 Sea First Quarter 2023 ResultsDocument17 pages2023.05.16 Sea First Quarter 2023 ResultsPrincess DueñasNo ratings yet

- Olam Reports 26.6% Growth in Q1 PATMIDocument4 pagesOlam Reports 26.6% Growth in Q1 PATMIashokdb2kNo ratings yet

- Investors - Presentation - 11-02-2021 Low MarginDocument32 pagesInvestors - Presentation - 11-02-2021 Low Marginravi.youNo ratings yet

- A1.2 Roic TreeDocument9 pagesA1.2 Roic TreemonemNo ratings yet

- Olam Reports 2018 PATMI of S$347.8MDocument5 pagesOlam Reports 2018 PATMI of S$347.8MAlezNgNo ratings yet

- ITC detailed analysis strengths weaknesses forecastsDocument14 pagesITC detailed analysis strengths weaknesses forecastsShivang KalraNo ratings yet

- 9M2018 Financial Performance and Strategic UpdateDocument11 pages9M2018 Financial Performance and Strategic UpdateMahkota RambutNo ratings yet

- Nesco LTD - East India Sec PDFDocument7 pagesNesco LTD - East India Sec PDFdarshanmadeNo ratings yet

- Tesla Q4'19 Update LetterDocument26 pagesTesla Q4'19 Update LetterSimon AlvarezNo ratings yet

- Pilipinas Shell Petroleum Corporation (SHLPH)Document2 pagesPilipinas Shell Petroleum Corporation (SHLPH)Jo CadizNo ratings yet

- Nestle Holdings Inc Financial Statements 2020Document72 pagesNestle Holdings Inc Financial Statements 2020Michael ScottNo ratings yet

- Investor@radico Co inDocument19 pagesInvestor@radico Co inAshwani KesharwaniNo ratings yet

- Tupy Annual Report 2017Document76 pagesTupy Annual Report 2017Rodrigo Lucas IgnacioNo ratings yet

- Q3'19 Update PDFDocument28 pagesQ3'19 Update PDFSimon AlvarezNo ratings yet

- Q4FY23 Financial ResultsDocument21 pagesQ4FY23 Financial ResultsRiya ThakurNo ratings yet

- Olam International Reports Strong Growth in PATMI and EBITDA for FY2016Document6 pagesOlam International Reports Strong Growth in PATMI and EBITDA for FY2016ashokdb2kNo ratings yet

- Guide to Management Accounting CCC (Cash Conversion Cycle) for ManagersFrom EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for ManagersNo ratings yet

- Guide to Management Accounting CCC (Cash Conversion Cycle) for Managers 2020 EditionFrom EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for Managers 2020 EditionNo ratings yet

- Guide to Management Accounting CCC for managers 2020 EditionFrom EverandGuide to Management Accounting CCC for managers 2020 EditionNo ratings yet

- CID 20200103091401206895 1040881 uniROC IpayobDocument6 pagesCID 20200103091401206895 1040881 uniROC IpayobEcho WackoNo ratings yet

- CID 20210320173003021556 989295 uniROC IpayobDocument6 pagesCID 20210320173003021556 989295 uniROC IpayobEcho WackoNo ratings yet

- Helicon TechDocument6 pagesHelicon TechEcho WackoNo ratings yet

- CID 20180829084027169901 1266747 uniROC IpayccDocument6 pagesCID 20180829084027169901 1266747 uniROC IpayccEcho WackoNo ratings yet

- CID 20200103091401206895 1040881 uniROC IpayobDocument6 pagesCID 20200103091401206895 1040881 uniROC IpayobEcho WackoNo ratings yet

- CID 20200101083811881941 599714 uniROC PrepaidDocument6 pagesCID 20200101083811881941 599714 uniROC PrepaidEcho WackoNo ratings yet

- Southern RockDocument6 pagesSouthern RockEcho WackoNo ratings yet

- Malaysian Company ProfileDocument6 pagesMalaysian Company ProfileEcho WackoNo ratings yet

- Piramal Enterprises: Building Scalable Differentiated Pharma BusinessDocument14 pagesPiramal Enterprises: Building Scalable Differentiated Pharma BusinessEcho WackoNo ratings yet

- Practical Challenges in Implementing The BSS Requirements (Regulatory Control of NORM)Document41 pagesPractical Challenges in Implementing The BSS Requirements (Regulatory Control of NORM)Echo WackoNo ratings yet

- PEL Investor Presentation May20180Document93 pagesPEL Investor Presentation May20180Echo WackoNo ratings yet

- Management Discussion & Analysis For The Third Quarter of FY 2020-21Document15 pagesManagement Discussion & Analysis For The Third Quarter of FY 2020-21Echo WackoNo ratings yet

- Malaysian Company ProfileDocument6 pagesMalaysian Company ProfileEcho WackoNo ratings yet

- Ammetlife Insurance Corporate InformationDocument7 pagesAmmetlife Insurance Corporate InformationEcho WackoNo ratings yet

- PMC Buys Isochem - Generics No 334 20171205Document16 pagesPMC Buys Isochem - Generics No 334 20171205Echo WackoNo ratings yet

- Exercise Working ProcuduresDocument4 pagesExercise Working ProcuduresEcho WackoNo ratings yet

- PEL Investor Presentation May20180Document93 pagesPEL Investor Presentation May20180Echo WackoNo ratings yet

- Mergers and Acquisitions in IndiaDocument408 pagesMergers and Acquisitions in IndiaEcho WackoNo ratings yet

- MyCC - Pharma Market ReviewDocument250 pagesMyCC - Pharma Market ReviewEcho WackoNo ratings yet

- Piramal Enterprises Q3FY21: Financial Results & HighlightsDocument4 pagesPiramal Enterprises Q3FY21: Financial Results & HighlightsEcho WackoNo ratings yet

- Gland Pharma LimitedDocument316 pagesGland Pharma LimitedPranav WarneNo ratings yet

- Cambrex - Ebook - 2019 - Part1 (Small Molecules)Document44 pagesCambrex - Ebook - 2019 - Part1 (Small Molecules)Echo WackoNo ratings yet

- Generic Pharmaceutical Industry Yearbook Torreya Feb2016 GphaDocument72 pagesGeneric Pharmaceutical Industry Yearbook Torreya Feb2016 GphaSheltie ForeverNo ratings yet

- Petronas Annual Report 2017 PDFDocument268 pagesPetronas Annual Report 2017 PDFEcho WackoNo ratings yet

- Hiap Huat Ipo PDFDocument581 pagesHiap Huat Ipo PDFEcho WackoNo ratings yet

- Kian Joo Can Factory: Good Things Come in A Long-Term PackageDocument13 pagesKian Joo Can Factory: Good Things Come in A Long-Term PackageEcho WackoNo ratings yet

- Cambrex - Ebook - 2019 - Part2 (Small Molecules)Document75 pagesCambrex - Ebook - 2019 - Part2 (Small Molecules)Echo WackoNo ratings yet

- Indahmilik Harta RM1Juta: Million Ringgit Property DealsDocument173 pagesIndahmilik Harta RM1Juta: Million Ringgit Property DealsEcho WackoNo ratings yet

- Herbalife Nutrition LTD.: United States Securities and Exchange Commission Form 10-KDocument177 pagesHerbalife Nutrition LTD.: United States Securities and Exchange Commission Form 10-KEcho WackoNo ratings yet

- Math Final ProjectDocument6 pagesMath Final Projectapi-247933607No ratings yet

- Jack D. Denton v. First National Bank of Waco, Texas, 765 F.2d 1295, 1st Cir. (1985)Document16 pagesJack D. Denton v. First National Bank of Waco, Texas, 765 F.2d 1295, 1st Cir. (1985)Scribd Government DocsNo ratings yet

- National Textile Corporation Annual ReportDocument186 pagesNational Textile Corporation Annual ReportSimran BohraNo ratings yet

- FX Floor Trader StrategyDocument14 pagesFX Floor Trader StrategyAlvin CardonaNo ratings yet

- CIR V COFA - VAT ExemptionDocument2 pagesCIR V COFA - VAT ExemptionJose MasarateNo ratings yet

- ACCOUNTING FOR INFLATION IN HIGHLY INFLATIONARY COUNTRIESDocument2 pagesACCOUNTING FOR INFLATION IN HIGHLY INFLATIONARY COUNTRIESgandhunkNo ratings yet

- Working Capital Management at Raymond Ltd.Document92 pagesWorking Capital Management at Raymond Ltd.Bhagyesh R Shah67% (6)

- Foundation Chart of AccountsDocument4 pagesFoundation Chart of Accountsbam04No ratings yet

- Finance Chapter 19Document29 pagesFinance Chapter 19courtdubs50% (2)

- Service Corporation International CaseDocument5 pagesService Corporation International CasePeter0% (1)

- Making Capital Investment DecisionsDocument48 pagesMaking Capital Investment DecisionsJerico ClarosNo ratings yet

- Chapter 2. The Time Value of Money: (Section 2.2)Document35 pagesChapter 2. The Time Value of Money: (Section 2.2)Sai Sriram JNo ratings yet

- Financial Accounting: Accounting - Process of Identifying, Measuring, and Communicating EconomicDocument7 pagesFinancial Accounting: Accounting - Process of Identifying, Measuring, and Communicating EconomicKyle Daniel PimentelNo ratings yet

- Risk Management Assignment 3: President University Cikarang UtaraDocument7 pagesRisk Management Assignment 3: President University Cikarang UtaraAlya RamadhaniNo ratings yet

- Transfer and Estate Taxation ExplainedDocument16 pagesTransfer and Estate Taxation ExplainedRizzle RabadillaNo ratings yet

- Quiz 2 Financial Accounting SolutionsDocument5 pagesQuiz 2 Financial Accounting SolutionsScribdTranslationsNo ratings yet

- Startup Financial Planning - PPT DownloadDocument7 pagesStartup Financial Planning - PPT DownloadhomsomNo ratings yet

- Fraud Risk FactorDocument5 pagesFraud Risk FactorShafayet Hossain MollaNo ratings yet

- Handbook of The River Plate 1869Document580 pagesHandbook of The River Plate 1869Alina Silveira100% (1)

- Accounting for investments under the equity methodDocument32 pagesAccounting for investments under the equity methodAmina AbdellaNo ratings yet

- Conclusion of Camel ModelDocument2 pagesConclusion of Camel ModelSanjeev PadhaNo ratings yet

- Aeb SM CH11 1 PDFDocument16 pagesAeb SM CH11 1 PDFAdi SusiloNo ratings yet

- Understanding Macroeconomics and Monetary PoliciesDocument14 pagesUnderstanding Macroeconomics and Monetary PoliciesMia MiatriacNo ratings yet

- AccountsDocument33 pagesAccountsVijayalakxmiNo ratings yet

- Tar MRL Company PDFDocument18 pagesTar MRL Company PDFrishi Kr.No ratings yet

- Ratio AnalysisDocument34 pagesRatio Analysismohitsingh1997No ratings yet

- MAP A University: Dog's WorldDocument27 pagesMAP A University: Dog's WorldJames GoNo ratings yet

- Methods for redemption of public debtDocument2 pagesMethods for redemption of public debtSana NasimNo ratings yet

- Divya ProjectDocument60 pagesDivya ProjectvarunNo ratings yet

- Financial Risk Management (PROJECT)Document72 pagesFinancial Risk Management (PROJECT)Vinayak Halapeti100% (2)