Professional Documents

Culture Documents

349 - NTC 4Q18 Earnings Report

Uploaded by

tkanojia12Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

349 - NTC 4Q18 Earnings Report

Uploaded by

tkanojia12Copyright:

Available Formats

Press Release

Nanya Technology Reports Results for the Fourth Quarter 2018

and Year 2018

January 15th, 2019 – Nanya Technology Corporation, (TWSE: 2408), today

announced its results of operations for the Fourth quarter, ended December 31st, 2018.

Nanya’s quarterly sales revenue was NT$ 16,958 million, 30.4 percent decreased

compared to the third quarter, 2018. Average selling prices (ASP) decreased by low teens

percent; bit shipment decreased by low twentys percent in the fourth quarter.

Gross profit of the quarter was NT$ 8,972 million, gross margin was 52.9 percent, a 6.0

percentage points decrease compared with previous quarter. Operating Income of the

quarter was NT$ 7,092 million, operating margin was 41.8 percent. Operating margin

decreased 9.2 percentage points compared with last quarter. Non-operating income of the

quarter was NT$ 894 million primary from interest income and foreign exchange gain. The

Company had net profit of NT$ 7,953 million, with net margin of 46.9 percent, a 5.9

percentage points decrease compared with previous quarter. Earnings per share (EPS) of

NT$ 2.57 in the fourth quarter (the earnings per share calculations are based on weighted

average outstanding shares of 3,090 million). Book value per share was NT$ 54.01 at the

fourth quarter end.

The annual sales revenue was NT$ 84,722 million in 2018, 54.3 percent increase

compared to previous year’s. In year 2018, the sales volume increased by mid-thirtys

percent, the average selling price increased by mid-teens percent year-over-year. Gross

Profit of the year was NT$ 46,616 million, gross margin was 55.0 percent. Operating

income in year 2018 was NT$ 39,355 million, operating margin was 46.5 percent. The

year recognized non-operating income NT$ 2,230million, mainly from interest income and

foreign exchange gain. Income tax expense was NT$ 2,224 million. The net income

attributable to Nanya Technology shareholders of NT$ 39,362 million, with net margin of

46.5 percent, NT$ 12.80 earnings per share (the earnings per share calculations are based

on weighted average outstanding shares of 3,074 million). All numbers are unaudited.

January 15, 2019 Nanya Technology Page 1 of 4

Press Release

In 2019, the company plans to enhance its position in server market and launch

advanced Low Power DRAM products. In response to conservative market conditions,

2018 capital expenditure (Capex) has trimmed down to NT$20.4 billion. 2019 Capex plan

will be further reduced.

Nanya Technology share repurchase plan expired on January 11, 2019. In phase-I,

the Company repurchased 20 million shares of common stock, with a total amount of

NT$1,147 million. Phase-I is for employees’ stock options program. In phase-II, the

Company repurchased 50 million shares of common stock, with a total amount reached

NT$2,666 million. Phase-II of repurchase is for safeguarding shareholders' interests.

The aggregate shares of repurchase were booked as treasury stock, which accounts for

2.26% of the total number of outstanding shares.

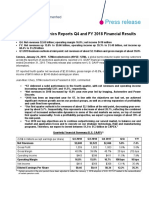

Q4 2018 Consolidated Income Statement

Q4'18 Q3'18 Q4'17

QoQ YoY

Amount in Million NT$,

Unaudited Audited Audited

except for EPS

Net Sales 16,958 100% 24,375 100% -30.4% 16,769 100% 1.1%

Gross Profit (Loss)

Gross Margin(%)

8,972 52.9% 14,366 58.9% -37.5% 8,318 49.6% 7.9%

Operating Income (Loss)

7,092 41.8% 12,434 51.0% -43.0% 6,526 38.9% 8.7%

Operating Margin(%)

EBITDA*

EBITDA Margin (%)

10,217 60.2% 15,487 63.5% -34.0% 9,407 56.1% 8.6%

Non-operating Income

(Exp.)

894 5.3% 438 1.8% 103.9% 15,457 92.2%

Income Tax Benefit (Exp.) -33 -0.2% 0 0% -17 -0.1%

Net Income (Loss)

7,953 46.9% 12,872 52.8% -38.2% 21,971 131.0% -63.8%

Net Margin (%)

Earnings Per Share 2.57** 4.15 7.42

Book Value Per Share 54.01*** 51.52 44.54

* EBITDA = Operating income + Depreciation & Amortization Expenses

** EPS is based on weighted average outstanding shares of 3,090M

*** BVPS is calculated based on 3,053M outstanding shares after deduction of treasury stocks

January 15, 2019 Nanya Technology Page 2 of 4

Press Release

2018 Consolidated Income Statement

Y2018 Y2017

Unaudited & Audited & YoY

Amount: Million NT$

Consolidated Consolidated

Net Sales 84,722 100.0% 54,918 100.0% 54.3%

Cost of Goods Sold 38,106 45.0% 30,250 55.1%

Gross Margin 46,616 55.0% 24,668 44.9% 89.0%

SG&A Expenses 2,373 2.8% 2,203 4.0%

R&D Expenses 4,887 5.8% 3,673 6.7%

Operating Income 39,355 46.5% 18,791 34.2% 109.4%

Non-operating Income (Exp.) 2,230 2.6% 23,039 42.0%

Income before Tax 41,586 49.1% 41,831 76.2% -0.6%

Income Tax Benefit (Expense) -2,224 -2.6% -1,536 -2.8%

Net Income 39,361 46.5% 40,295 73.4%

Net Income attributable to

-1 0.0% 13 0.0%

noncontrolling interests

Net Income attributable to NTC 39,362 46.5% 40,282 73.3% -2.3%

EPS(NT$) 12.80 14.36

Note : The earnings per share calculations are based on weighted average outstanding shares of 3,074

million

Disclaimer

This press release contains forward-looking statements. These statements relate to future events or our future

financial performance. These statements are only predictions. Actual events or results may differ materially.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we

cannot guarantee future results, levels of activity, performance or achievements. Moreover, neither we nor

any other person assumes responsibility for the accuracy and completeness of the forward-looking

statements. We undertake no duty to update any of the forward-looking statements after the date of this press

release to conform such statements to actual results or to changes in our expectations.

Readers are also urged to carefully review and consider the various disclosures made by us which attempt to

advise interested parties of the factors which affect our business.

About Nanya

Nanya Technology Corporation (“NTC”), a member of the Formosa Plastics Group, provides key

components DRAM to electronic industry, focusing on research and development, design,

manufacturing, and sales of consumer and Low Power DRAM products. In addition, NTC continues

to enlarge its share of high value-added DRAM market, increases manufacturing efficiency, and

strengthens product quality and customer services in respond to market demand. NTC’s common

stock is traded on the Taiwan Stock Exchange Corporation (TWSE) under the symbol 2408. For

more information, please visit http://www.nanya.com.

January 15, 2019 Nanya Technology Page 3 of 4

Press Release

Contact persons:

Spokesman:

Dr. Pei-Ing Lee, President

Deputy Spokesman:

Joseph Wu, Vice President TEL: 886-2-29045858 x1009, josephwu@ntc.com.tw

Press Contact

Sandra Liu, Investor Relations & Public Relations TEL: 886-2-29045858 x 1066,

sandraliu@ntc.com.tw

January 15, 2019 Nanya Technology Page 4 of 4

You might also like

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachFrom EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachRating: 3 out of 5 stars3/5 (3)

- NTC 4Q17 Earnings ReportDocument4 pagesNTC 4Q17 Earnings ReportJuhie GuptaNo ratings yet

- Pvatepla q3 2023 enDocument14 pagesPvatepla q3 2023 enrogercabreNo ratings yet

- 2023.11.14 Sea Third Quarter 2023 ResultsDocument16 pages2023.11.14 Sea Third Quarter 2023 Resultssk9721616No ratings yet

- Osotspa Public Company Limited: Q4'18 and FY18 Management Discussion & AnalysisDocument7 pagesOsotspa Public Company Limited: Q4'18 and FY18 Management Discussion & AnalysisEcho WackoNo ratings yet

- Alpha-Win: Company Research ReportDocument6 pagesAlpha-Win: Company Research Reportchoiand1No ratings yet

- Stmicro - Q4-Fy2018 PR - FinalDocument12 pagesStmicro - Q4-Fy2018 PR - Finalakshay kumarNo ratings yet

- 2023.05.16 Sea First Quarter 2023 ResultsDocument17 pages2023.05.16 Sea First Quarter 2023 ResultsPrincess DueñasNo ratings yet

- Annual Report Wirecard 2018 PDFDocument233 pagesAnnual Report Wirecard 2018 PDFBlanche RyNo ratings yet

- Hemas Holdings PLC (HHL SL: LKR 69.00) : BRS Quarterly Results Snapshot - Q4 FY 19Document4 pagesHemas Holdings PLC (HHL SL: LKR 69.00) : BRS Quarterly Results Snapshot - Q4 FY 19Sudheera IndrajithNo ratings yet

- Tsla q3Document26 pagesTsla q3Simon AlvarezNo ratings yet

- Micron Technology, Inc. Reports Results For The Fourth Quarter and Full Year of Fiscal 2023Document7 pagesMicron Technology, Inc. Reports Results For The Fourth Quarter and Full Year of Fiscal 2023CNY CentralNo ratings yet

- Financial Results Briefing Material For FY2019: April 1, 2018 To March 31, 2019Document30 pagesFinancial Results Briefing Material For FY2019: April 1, 2018 To March 31, 2019choiand1No ratings yet

- Earnings ReleaseDocument5 pagesEarnings Releaseamira alyNo ratings yet

- Pag BankDocument22 pagesPag Bankandre.torresNo ratings yet

- Alicorp Earnings Report 3Q23 EN VFDocument23 pagesAlicorp Earnings Report 3Q23 EN VFADRIAN ANIBAL ENCISO ARKNo ratings yet

- KFin Technologies - Flash Note - 12 Dec 23Document6 pagesKFin Technologies - Flash Note - 12 Dec 23palakNo ratings yet

- 4Q 2018 Match Group Earnings ReleaseDocument11 pages4Q 2018 Match Group Earnings ReleaseDIanaNo ratings yet

- Earnings Release 4Q18: Rumo 4Q18 and 2018 HighlightsDocument16 pagesEarnings Release 4Q18: Rumo 4Q18 and 2018 HighlightsADVFNNo ratings yet

- UAE Equity Research: First Look Note - 3Q22Document5 pagesUAE Equity Research: First Look Note - 3Q22xen101No ratings yet

- 2022 Annual Financial Report EDocument94 pages2022 Annual Financial Report EKashav KaseraNo ratings yet

- Target Corporation Reports Third Quarter EarningsDocument12 pagesTarget Corporation Reports Third Quarter EarningsRafael BorgesNo ratings yet

- Nestle Holdings Inc Financial Statements 2020Document72 pagesNestle Holdings Inc Financial Statements 2020Michael ScottNo ratings yet

- 2023 Annual Financial Report EDocument94 pages2023 Annual Financial Report Ehimanshuchikiboy05No ratings yet

- StoneCo ER 2Q23Document28 pagesStoneCo ER 2Q23Andre TorresNo ratings yet

- Inancial Highlights Inancial Highlights Inancial Highlights Inancial HighlightsDocument28 pagesInancial Highlights Inancial Highlights Inancial Highlights Inancial HighlightsN2OMNo ratings yet

- Analysis For The Profit Margin For SAIF POWERTEC LIMITEDDocument20 pagesAnalysis For The Profit Margin For SAIF POWERTEC LIMITEDAameer ShahansahNo ratings yet

- 4 Q23 Management ReportDocument7 pages4 Q23 Management Reportk33_hon87No ratings yet

- Earnings Release - 01.30.2023 FINALDocument20 pagesEarnings Release - 01.30.2023 FINALDuangjitr WongNo ratings yet

- UAE Equity Research - Agthia Group 4Q22 - First Look NoteDocument5 pagesUAE Equity Research - Agthia Group 4Q22 - First Look Notexen101No ratings yet

- IT Industry Q3FY09Document4 pagesIT Industry Q3FY09ca.deepaktiwariNo ratings yet

- Angiodynamics $ANGO FY19Q3 Earnings PresentationDocument8 pagesAngiodynamics $ANGO FY19Q3 Earnings PresentationMedtechy Medical SalesNo ratings yet

- 1Q2023 Press Release 1 1Document17 pages1Q2023 Press Release 1 1fioreb12No ratings yet

- Balkrishna Industries LTD: Investor Presentation February 2020Document30 pagesBalkrishna Industries LTD: Investor Presentation February 2020PIBM MBA-FINANCENo ratings yet

- Q3'19 Update PDFDocument28 pagesQ3'19 Update PDFSimon AlvarezNo ratings yet

- V-Guard-Industries - Q4 FY21-Results-PresentationDocument17 pagesV-Guard-Industries - Q4 FY21-Results-PresentationanooppattazhyNo ratings yet

- Intel Financial AnalysisDocument2 pagesIntel Financial Analysisbradhillwig6152No ratings yet

- GCC Equity Report: ResearchDocument10 pagesGCC Equity Report: ResearchfahadsiddiquiNo ratings yet

- A1.2 Roic TreeDocument9 pagesA1.2 Roic TreemonemNo ratings yet

- Selecta Group 2021 Annual ReportDocument89 pagesSelecta Group 2021 Annual ReportCarissa May Maloloy-onNo ratings yet

- BOB Analyst Presentation Q4 FY 2019 27052019 PDFDocument77 pagesBOB Analyst Presentation Q4 FY 2019 27052019 PDFSandeep KumarNo ratings yet

- CW 221025015738Document2 pagesCW 221025015738Nundu AntoneyNo ratings yet

- q4 2022 Earnings Press Release and Financial Tables MotorolaDocument23 pagesq4 2022 Earnings Press Release and Financial Tables Motorolaraki090No ratings yet

- Unaudited Results For The Half Year and Second Quarter Results Ended 31 October 2021Document36 pagesUnaudited Results For The Half Year and Second Quarter Results Ended 31 October 2021imsolovelyNo ratings yet

- HCL Technologies Q3FY11 Result UpdateDocument4 pagesHCL Technologies Q3FY11 Result Updaterajarun85No ratings yet

- V Guard Industries Q4 Results PresentationDocument23 pagesV Guard Industries Q4 Results PresentationIlyasNo ratings yet

- Advanc Conference - Call 2q2018 PDFDocument16 pagesAdvanc Conference - Call 2q2018 PDFtat angNo ratings yet

- Signify Third Quarter Results 2022 ReportDocument19 pagesSignify Third Quarter Results 2022 Reportsumanthsumi2023No ratings yet

- RLX 3Q23 PresentationDocument24 pagesRLX 3Q23 PresentationHailong WangNo ratings yet

- Q3 Update TelecosDocument6 pagesQ3 Update Telecosca.deepaktiwariNo ratings yet

- Godrej Consumer Products Result Update - Q1FY23Document4 pagesGodrej Consumer Products Result Update - Q1FY23Prity KumariNo ratings yet

- Q223 EarningsDocument24 pagesQ223 Earningsdinesh suresh KadamNo ratings yet

- Annual Report Wirecard 2018Document245 pagesAnnual Report Wirecard 2018Blanche RyNo ratings yet

- 2020.11.18 PAGS 3Q20 Earnings ReleaseDocument17 pages2020.11.18 PAGS 3Q20 Earnings ReleaseRenan Dantas SantosNo ratings yet

- Financial Information 30 September 2019 - PR 3Q2019 ENGDocument4 pagesFinancial Information 30 September 2019 - PR 3Q2019 ENGApple JuiceNo ratings yet

- Interim Report q3 2023Document26 pagesInterim Report q3 2023jvnshrNo ratings yet

- A1.2 Roic TreeDocument9 pagesA1.2 Roic Treesara_AlQuwaifliNo ratings yet

- Tesla Q4'19 Update LetterDocument26 pagesTesla Q4'19 Update LetterSimon AlvarezNo ratings yet

- SGX Ipo ProcessDocument5 pagesSGX Ipo Processadesuzuki18No ratings yet

- Cash Flows at Warf Computers - Group 5 v.28.09Document8 pagesCash Flows at Warf Computers - Group 5 v.28.09Zero MustafNo ratings yet

- Diagnostic Test: Fundamental of Accounting Business & Management 1Document2 pagesDiagnostic Test: Fundamental of Accounting Business & Management 1Dindin Oromedlav Lorica100% (3)

- Accounting Application by Computer (TallyPrime) - BAAC 2205 - HandoutDocument77 pagesAccounting Application by Computer (TallyPrime) - BAAC 2205 - HandoutWijdan Saleem EdwanNo ratings yet

- Diagnostic Quiz On Accounting 2Document9 pagesDiagnostic Quiz On Accounting 2Anne Ford67% (3)

- 5a.capital Gains - Important NoteDocument3 pages5a.capital Gains - Important NoteKansal AbhishekNo ratings yet

- SOUTHWEST AIRWAYS CORPORATION NewDocument8 pagesSOUTHWEST AIRWAYS CORPORATION NewMelrose UretaNo ratings yet

- Unit 6 - Capital Structure and LeverageDocument12 pagesUnit 6 - Capital Structure and LeverageGizaw BelayNo ratings yet

- Lecture Notes On Inventories - 000Document8 pagesLecture Notes On Inventories - 000judel ArielNo ratings yet

- Value at Risk FinalDocument27 pagesValue at Risk FinalAnu BumraNo ratings yet

- Summer Project On Kotak SecuritiesDocument55 pagesSummer Project On Kotak SecuritiesAvinash Singh75% (16)

- Project Report On Demat AccountDocument62 pagesProject Report On Demat AccountPriyanka AgarwalNo ratings yet

- Week 7 Class Exercises (Answers)Document4 pagesWeek 7 Class Exercises (Answers)Chinhoong OngNo ratings yet

- What Is A Shareholder's EquityDocument4 pagesWhat Is A Shareholder's EquityblezylNo ratings yet

- Ifrs Versus GaapDocument25 pagesIfrs Versus GaapNigist Woldeselassie100% (1)

- HK-Listed Heng Fai Enterprises Sells Singapore Properties For S$53.9 Million (HK$328.8 Million) To SGX Catalist-Listed OELDocument2 pagesHK-Listed Heng Fai Enterprises Sells Singapore Properties For S$53.9 Million (HK$328.8 Million) To SGX Catalist-Listed OELWeR1 Consultants Pte LtdNo ratings yet

- Valuation of BondsDocument7 pagesValuation of BondsHannah Louise Gutang PortilloNo ratings yet

- AISM Rules BookDocument7 pagesAISM Rules Bookstyle doseNo ratings yet

- Impact of Corona Virus On Mutual Fund by Sadanand IbitwarDocument14 pagesImpact of Corona Virus On Mutual Fund by Sadanand Ibitwarjai shree ramNo ratings yet

- Tata CorusDocument44 pagesTata Corussunit150% (2)

- The Same As It Would Have Been If The Original Payment Had Been Debited Initially To An Expense AccountDocument37 pagesThe Same As It Would Have Been If The Original Payment Had Been Debited Initially To An Expense AccountNolyne Faith O. VendiolaNo ratings yet

- Investment Emvironment BBA 7th Sem PYCDocument17 pagesInvestment Emvironment BBA 7th Sem PYCDeexyant TimilsinaNo ratings yet

- The Balance Sheet of Poodle Company at The End of PDFDocument1 pageThe Balance Sheet of Poodle Company at The End of PDFCharlotteNo ratings yet

- Cash Flow Calculator CFO SelectionsDocument12 pagesCash Flow Calculator CFO Selections202040336No ratings yet

- Q - Test Far270 Nov 2022 PDFDocument5 pagesQ - Test Far270 Nov 2022 PDFNUR QAMARINANo ratings yet

- Gonzales Week-2Document22 pagesGonzales Week-2Luigi Enderez BalucanNo ratings yet

- Unit IvDocument26 pagesUnit Ivthella deva prasadNo ratings yet

- Di OutlineDocument81 pagesDi OutlineRobert E. BrannNo ratings yet

- IB124 Introduction To Financial Accounting Autumn Term 2020 Seminar QuestionsDocument7 pagesIB124 Introduction To Financial Accounting Autumn Term 2020 Seminar QuestionsS3F1No ratings yet

- Edita's Opertionalization StrategyDocument13 pagesEdita's Opertionalization StrategyMaryNo ratings yet