Professional Documents

Culture Documents

Ch2 How To Identify Support & Resistance Zones

Uploaded by

arifahrose58Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ch2 How To Identify Support & Resistance Zones

Uploaded by

arifahrose58Copyright:

Available Formats

CH 2

HOW TO IDENTIFY

SUPPORT &

RESISTANCE ZONES

SUPPORT RESISTANCE MAJOR TECHNICAL PRINCIPAL RULES FOR DETERMINING The Greater the Speed and

POTENTIAL Extent of the Previous Move,

SUPPORT/RESISTANCE POINTS the More Significant a Support

SUPPORT RESISTANCE 1. A previous high or low is a potential 2. Support reverses its role to resistance on

resistance/support level the way up & down or Resistance Zone Is Likely to

Previous Highs and lows At round numbers Emotional points on a chart represent

Be

- support as “buying (actual or potential) - resistance as “selling(actual or potential)

potential support/resistance levels

sufficient in volume to halt a downtrend in sufficient in volume to satisfy all bids and

prices for an appreciable period hence stop prices from going higher for a time.

- When prices decline, the normal human Support and resistance zones have a habit of

- A support zone represents a concentration - resistance represents a concentration of response is not to take a loss, but to hold on. forming at round numbers.

of demand supply. That way, the pain of actually realizing a loss

can be avoided. This is probably because numbers such as 10,

50, or 100 represent easy psychological points

- As a result, when the price returns to the old upon which traders and investors often base

high, those who bought at that level have their decisions.

great motivation to sell in order to break even.

Figure 5.2 shows a more extended example.

This time, the price found temporary support Figure 5.3, we see the price rally through

at B. C also proves to be a support point, but resistance at B and A (the former support

note that the rallies are reversed at support level). The ensuing decline then finds support

level B. Thus, the second principle is: at A again. Thus, our third principle is:1

In Chart 5.3, probably because of unexpected

bad news, the sugar price experiences three

downside gaps.

Chart 5.1 shows the sugar price for a period

spanning 2002–2003.

Note how previous highs and lows offer good

support/resistance points for future trading.

Unfortunately, there is no way of knowing

whether a particular level will turn out to be

support or resistance, or even whether it will

be a pivotal point at all.

That’s why these are merely intelligent places

for anticipating a temporary reversal. Resort

to other indicators such as oscillators is

therefore required.

You might also like

- Training November - Technical - Support & Resistance (English)Document34 pagesTraining November - Technical - Support & Resistance (English)Maxco CS002No ratings yet

- Training Material On Intraday TradingDocument40 pagesTraining Material On Intraday TradingSavidh ShajuNo ratings yet

- S+R Patterns and BreakoutsDocument9 pagesS+R Patterns and BreakoutsNicola Duke100% (3)

- Day 1 Crypto Technical Analysis ModuleDocument16 pagesDay 1 Crypto Technical Analysis ModuleTomNo ratings yet

- Training Material On Intraday TradingDocument39 pagesTraining Material On Intraday TradingGirisaravanan ThangavelNo ratings yet

- Tonihansen Support and ResistanceDocument54 pagesTonihansen Support and ResistanceBill Neil100% (1)

- Reed Adjustment Guide One PageDocument1 pageReed Adjustment Guide One PageCamillo GrassoNo ratings yet

- Ultrasound Color Mode Artifacts Bioeffects Physics1 - 4perDocument15 pagesUltrasound Color Mode Artifacts Bioeffects Physics1 - 4perstoicea_katalinNo ratings yet

- Entry & Exit StrategyDocument54 pagesEntry & Exit Strategykomijim469No ratings yet

- Ontario Modi Stratify Sydney Scoring Falls Risk ScreenDocument2 pagesOntario Modi Stratify Sydney Scoring Falls Risk ScreenYanmed KasbunNo ratings yet

- CHAPTER 5 - Support and ResistanceDocument25 pagesCHAPTER 5 - Support and ResistanceHirai Gary100% (1)

- V17 C01 008supp PDFDocument9 pagesV17 C01 008supp PDFRenéNo ratings yet

- Two Prime Institutional Investment GuideDocument31 pagesTwo Prime Institutional Investment GuideFabioNo ratings yet

- Report Akreditasi Batch MBT in Branch Batch 124 2024-04-04 08 48 26Document2 pagesReport Akreditasi Batch MBT in Branch Batch 124 2024-04-04 08 48 26Muhammad Agung PratamaNo ratings yet

- How To Trade With Support and ResistanceDocument16 pagesHow To Trade With Support and ResistanceSandeep Reddy100% (2)

- The Support and Resistance ThreadDocument8 pagesThe Support and Resistance Thread严墨No ratings yet

- Listening HabitsDocument3 pagesListening HabitsAhsan AliNo ratings yet

- Log Monitoring Di Boiler Pada PLTUDocument19 pagesLog Monitoring Di Boiler Pada PLTUAris SupraptoNo ratings yet

- CHAPTER 5 - Support and ResistanceDocument25 pagesCHAPTER 5 - Support and ResistanceNatasha GhazaliNo ratings yet

- DR Manisha Kapse SEPT 2022 (1) .XLSX - TABLE CHO 2Document1 pageDR Manisha Kapse SEPT 2022 (1) .XLSX - TABLE CHO 2mailbot marketingNo ratings yet

- Anchor BoltDocument2 pagesAnchor BoltWidya Prasetya100% (1)

- KSP - Swinger - Trading Process 13feb'22Document24 pagesKSP - Swinger - Trading Process 13feb'22Halimah MahmodNo ratings yet

- Lesson 3 Technical Analysis Part 1Document31 pagesLesson 3 Technical Analysis Part 1marquelNo ratings yet

- Precision TradingDocument37 pagesPrecision TradinggeorgeNo ratings yet

- Risk Assessment LogisticDocument3 pagesRisk Assessment LogisticHasnaoui AsmaaNo ratings yet

- Past Defect History 2021Document10 pagesPast Defect History 2021RahulNo ratings yet

- Supportand ResistanceDocument5 pagesSupportand ResistancePrateek PandeyNo ratings yet

- Forex Market Insight 08 June 2011Document3 pagesForex Market Insight 08 June 2011International Business Times AUNo ratings yet

- Support and Resistance BasicsDocument14 pagesSupport and Resistance Basicskalai selvanNo ratings yet

- Chart PatternsDocument100 pagesChart Patternsmz889367% (3)

- Invoice 01Document1 pageInvoice 01Non AlexanderNo ratings yet

- Lecture 2Document31 pagesLecture 2Andreea MateiNo ratings yet

- Sri Lankan Bank Account ComparisonDocument9 pagesSri Lankan Bank Account ComparisonThusitha DalpathaduNo ratings yet

- Forex Market Insight 03 June 2011Document3 pagesForex Market Insight 03 June 2011International Business Times AUNo ratings yet

- Technically Speaking (PSEi) 31 May 2021-MinDocument1 pageTechnically Speaking (PSEi) 31 May 2021-MinRomel Alvendia ValenciaNo ratings yet

- Ontario Modified Stratify Sydney Scoring Falls Risk ScreenDocument2 pagesOntario Modified Stratify Sydney Scoring Falls Risk ScreenSri WulandariNo ratings yet

- PPEDisposals PM 04 DispTemplateDocument1 pagePPEDisposals PM 04 DispTemplateJosephine LimNo ratings yet

- Class 1Document9 pagesClass 1ErUmangKoyaniNo ratings yet

- Stabilizer - Information 2Document2 pagesStabilizer - Information 2internet.casa149No ratings yet

- Hermes - Level 1-1Document1 pageHermes - Level 1-1Otman DaghmoumiNo ratings yet

- Break and Retest Training FileDocument15 pagesBreak and Retest Training Filenicholas100% (3)

- Trading Hub 2o 1 CompressDocument10 pagesTrading Hub 2o 1 CompressSri sarathNo ratings yet

- Sniper Entries and SwingsDocument3 pagesSniper Entries and SwingsnathanNo ratings yet

- Anima 5th Place Presentation PDFDocument18 pagesAnima 5th Place Presentation PDFJedson VizcaynoNo ratings yet

- Exhibit M - Electrical PlansDocument9 pagesExhibit M - Electrical PlansAdamNo ratings yet

- RA For Firefighting (CS Pipe Prefabrication-Sprinklers - Pressure Test and Flashing Painting-001)Document3 pagesRA For Firefighting (CS Pipe Prefabrication-Sprinklers - Pressure Test and Flashing Painting-001)RAMY ABOU AL DAHABNo ratings yet

- Support and Resistance PresentationDocument35 pagesSupport and Resistance Presentationnafik65299No ratings yet

- Endo Logbook FormsDocument3 pagesEndo Logbook FormsAmethystVonNo ratings yet

- Forex Market Insight 27 May 2011Document3 pagesForex Market Insight 27 May 2011International Business Times AUNo ratings yet

- Rayner Teo - Ultimate Technical Analysis Trading Course 23.12.21Document5 pagesRayner Teo - Ultimate Technical Analysis Trading Course 23.12.21Joy CheungNo ratings yet

- Technical Analyst Perspective by AFA - 100923Document1 pageTechnical Analyst Perspective by AFA - 100923FauzanNo ratings yet

- Income Tax Calculation 2022 2023Document9 pagesIncome Tax Calculation 2022 2023GungamerNo ratings yet

- Architechural Plans REVISED September 24, 2021Document6 pagesArchitechural Plans REVISED September 24, 2021johnNo ratings yet

- POST PRU 14 Revenue Report 13 May 2018Document78 pagesPOST PRU 14 Revenue Report 13 May 2018Mohd. Anis AbdullahNo ratings yet

- Monthly Budget - GrayDocument1 pageMonthly Budget - GrayAgnes Novia JNo ratings yet

- Primer Corte 2024Document1 pagePrimer Corte 2024Franko ChavarriaNo ratings yet

- Pressure Relief Systems 2014 Rev A PDFDocument118 pagesPressure Relief Systems 2014 Rev A PDFgad480100% (1)

- Par NovartisDocument1 pagePar NovartiscyberinteNo ratings yet

- Session 5, Notes On Papers:: A Practitioner's Guide To Arbitrage Pricing TheoryDocument4 pagesSession 5, Notes On Papers:: A Practitioner's Guide To Arbitrage Pricing TheoryRafaelWbNo ratings yet

- Durum Sorulari PDFDocument18 pagesDurum Sorulari PDFGökçen Aslan AydemirNo ratings yet

- View Duplicate Invoice Apple IphoneDocument1 pageView Duplicate Invoice Apple IphoneAnoop JangraNo ratings yet

- Quiz #2 - BreakevenDocument1 pageQuiz #2 - BreakevenNelzen GarayNo ratings yet

- Richard W Ellson ResumeDocument2 pagesRichard W Ellson Resumenrhuron13No ratings yet

- 123 CoffeeDocument29 pages123 CoffeeAubrey RamiloNo ratings yet

- International Financial System: 2.1.1. Role of Financial MarketDocument54 pagesInternational Financial System: 2.1.1. Role of Financial MarketADHITHYA SATHEESANNo ratings yet

- Tutorial Questions Equity 2020-1Document6 pagesTutorial Questions Equity 2020-1Nur Amin Nor AzmiNo ratings yet

- IM Econ 30093 Intl Economics Chapter Three Without ExercisesDocument15 pagesIM Econ 30093 Intl Economics Chapter Three Without ExercisesAru KimNo ratings yet

- Bad 5313 Business Level StrategiesDocument17 pagesBad 5313 Business Level StrategiesAjay KaundalNo ratings yet

- CH 05Document68 pagesCH 05Lê JerryNo ratings yet

- PSU and DisinvestmentDocument40 pagesPSU and DisinvestmentPritesh JainNo ratings yet

- Summary Chapter 7 Bond and Their Valuation: Level of Interest RatesDocument7 pagesSummary Chapter 7 Bond and Their Valuation: Level of Interest RatesmikaelNo ratings yet

- Ongc Report 105Document60 pagesOngc Report 105Manohar Kothinti0% (1)

- Merger Exercises1Document2 pagesMerger Exercises1Kate Crystel reyesNo ratings yet

- ML Changes 1610Document25 pagesML Changes 1610V S Krishna AchantaNo ratings yet

- Hydrocarbon ExplorationDocument5 pagesHydrocarbon Explorationkidilam91No ratings yet

- NegotiatingDocument3 pagesNegotiatinggabboudeh100% (1)

- Parkinmacro4 1300Document16 pagesParkinmacro4 1300Mr. JahirNo ratings yet

- Corporate Finance & International Controlling (BPO) : Home Work 2 On The Balance Sheet and The Important RatiosDocument7 pagesCorporate Finance & International Controlling (BPO) : Home Work 2 On The Balance Sheet and The Important RatiosNitish RawatNo ratings yet

- Exam For Business TaxDocument3 pagesExam For Business TaxJenyll MabborangNo ratings yet

- Stock ValuationDocument3 pagesStock ValuationnishankNo ratings yet

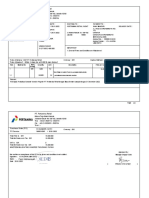

- PT. Pertamina Retail: PO Service Purchase Order (PO)Document2 pagesPT. Pertamina Retail: PO Service Purchase Order (PO)Firman PrimahardhikaNo ratings yet

- Ind As 2 PDFDocument26 pagesInd As 2 PDFmanan3466No ratings yet

- Microeconomics: Dr. Lê Sơn Tùng Vietnam Maritime UniversityDocument45 pagesMicroeconomics: Dr. Lê Sơn Tùng Vietnam Maritime UniversityVũ Việt DũngNo ratings yet

- Bull Whip Effect ASsignmentDocument5 pagesBull Whip Effect ASsignmentSajjad HanifNo ratings yet

- Business Plan FidDocument16 pagesBusiness Plan FidTrisha TinaligaNo ratings yet

- Statement 12312018Document6 pagesStatement 12312018Marcus GreenNo ratings yet

- Berger FinalDocument16 pagesBerger FinalkaleemNo ratings yet

- MA Topic2 Accounting For InventoryDocument25 pagesMA Topic2 Accounting For InventoryHn NguyễnNo ratings yet