Professional Documents

Culture Documents

$value

Uploaded by

Muzi Myeza0 ratings0% found this document useful (0 votes)

14 views1 pageignition switch

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentignition switch

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views1 page$value

Uploaded by

Muzi Myezaignition switch

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Core Administration

Pub Safety EMS

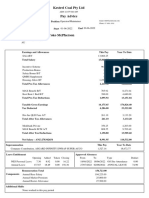

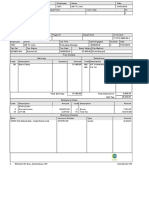

Surname Initials Identity No. Employee No Pay Date

Mashilo BM 930930****086 30096426/10019633 27 Sep 2022

Designation Cost Center Payment Method Payslip No

Fire Fighter /EMT 55527570 - D3 Central Fire EFT Payment 7

Bank Name Branch Code Account Number Carried Over Leave Expiry Date

Capitec Bank Limited 470010 139514**** 0

Pension Fund Ref No Bank Name (Bond) Account No (Bond) Compulsory Leave Expiry Date

30096426 170305 8003184**** 13 30 Sep 2022

Medical Aid Ref No Rate of Pay Entry into Service Non-Compulsory Leave Expiry Date

558754470 165.94 01 Oct 2016 12 31 Dec 9999

Medical Aid Dependents Tax Ref No Tax Period Long Service Leave Expiry Date

Adult: 00 Child: 00 052416**** 2023 0

Earnings Fringe Benefits

Code Description Units/Hours Month Amount Description Amount

1010 Basic Salary 0.00 27,655.22 Bonus Provision (PAYE) 3,072.80

2EM1 EMS Shift Overtime 1.5 12.00 2,986.92

2PH2 Public Holiday Hrs @ 2.00 12.00 August 2022 3,882.96

2SBN Sunday Bon HrsN-Shft @1.5 24.00 August 2022 5,824.56

3040 Housing Subsidy 1.00 1,011.77

3065 High Risk Allowance 0.00 500.00 Employer Contributions*

3096 Night Shift Allowance 10% 0.00 2,765.52 Description Amount

UIF ER Contribution 177.12

Bargaining Council ER 10.80

LA Health Medical (ER) 1,876.20

E-Joburg Funeral (ER) 50.33

E-Joburg RetrFund(ER) 4,927.61

Gross Earnings: 44,626.95

Total Remuneration Package

(Employer Contribution included)*

Unpaid Leave

Deductions

Description Units/Hours Amount

Code Description Units/Hours Month Amount

0.00

/260 Total Tax 0.00 10,718.98

/320 UIF EE Contribution 0.00 177.12

68N5 IMATU Union 0.00 80.00

68N9 Bargaining Council EE 0.00 10.80

Outstanding Contractual Obligations

6I17 IMATU Old Mutual Group Sc 1.00 1,608.35

Description Amount

7B30 Bond Installment 1 0.00 6,000.00

0.00

8ME9 LA Health Medical Scheme 0.00 1,250.80

8RE1 E-Joburg RetrFund 0.00 2,074.14

Tax Statistical Data

Description Amount

Taxable Earnings 304,812.07

3699 Gross Remuneration 351,498.64

3605 Ann Payment Taxable 20,488.94

3607 Overtime 76,320.00

4001 PF EE Contribution 13,830.06

4472 PF ER Contribution 32,856.51

4005 MA EE Contribution 8,755.60

4474/4493 MA ER Contri. 13,133.40

Tax 62,317.66

Total Deductions 21,920.19

Nett Salary 22,706.76

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Paystub 202303Document1 pagePaystub 202303carinaNo ratings yet

- MARETLWA PAYSLIPDocument1 pageMARETLWA PAYSLIPmoonyung602No ratings yet

- July 08Document1 pageJuly 08anon-99145No ratings yet

- Net Pay 3,146.54Document1 pageNet Pay 3,146.54Meii MeiiNo ratings yet

- Your-Pay-Advice-for-Pay-Ending-30-06-2022Document2 pagesYour-Pay-Advice-for-Pay-Ending-30-06-2022iqbal.shahid0374No ratings yet

- Payslip details for Laxman Chandrakanth ChavanDocument2 pagesPayslip details for Laxman Chandrakanth Chavanlaxman lucky100% (2)

- BR 000188920231009Document1 pageBR 000188920231009Mintu MathewNo ratings yet

- Payslip SummaryDocument2 pagesPayslip SummaryVyas Keshini100% (1)

- Pay Details: Earnings Deductions Code Description Quantity Amount Code Description AmountDocument1 pagePay Details: Earnings Deductions Code Description Quantity Amount Code Description AmountVee-kay Vicky KatekaniNo ratings yet

- Afaan OromooDocument1 pageAfaan Oromoookashkemal2No ratings yet

- Payslip To Print 04 29 2017 PDFDocument1 pagePayslip To Print 04 29 2017 PDFDoraNo ratings yet

- Payslip-03_10_2023Document1 pagePayslip-03_10_2023wireNo ratings yet

- Your-Pay-Advice-for-Pay-Ending-30-09-2022Document2 pagesYour-Pay-Advice-for-Pay-Ending-30-09-2022iqbal.shahid0374No ratings yet

- Sheila Mae Platon: Company AIG Shared Services - Business Processing, IncDocument1 pageSheila Mae Platon: Company AIG Shared Services - Business Processing, IncHazel Ann AgacerNo ratings yet

- Deductions (B) Earnings (A) : Print Date: 03.11.2019, Print Time: 20:51:14Document1 pageDeductions (B) Earnings (A) : Print Date: 03.11.2019, Print Time: 20:51:14Fire SuperstarNo ratings yet

- HR Avenue - Employee Self ServiceDocument1 pageHR Avenue - Employee Self ServiceNurul Aziemah RoslanNo ratings yet

- Amit Dec 2020 PayslipDocument1 pageAmit Dec 2020 PayslipAmit GhangasNo ratings yet

- Private and Confidential: Payslip For PeriodDocument1 pagePrivate and Confidential: Payslip For PeriodYahya Uso YahyaNo ratings yet

- Sal FebDocument2 pagesSal FebHimanshu Sekhar SahuNo ratings yet

- Pay Stub (1) - 11.30.2022Document1 pagePay Stub (1) - 11.30.2022துவேந்தர் சண்முகம்No ratings yet

- Workday1Document1 pageWorkday1raheemtimo1No ratings yet

- Payslip To Print - Report Design 03 06 2023Document1 pagePayslip To Print - Report Design 03 06 2023shani ChahalNo ratings yet

- Ed 9Document2 pagesEd 9Sanjay DuaNo ratings yet

- OCT 2023 UnlockedDocument2 pagesOCT 2023 UnlockedSWADHIN KUMAR SAHOONo ratings yet

- Jul 192017Document1 pageJul 192017Anonymous qqE8o5QNo ratings yet

- 3bdbf6dd-6c71-49c2-a618-4c7251a260cfDocument2 pages3bdbf6dd-6c71-49c2-a618-4c7251a260cfadilsgr0% (1)

- May 2023 Pay SlipDocument2 pagesMay 2023 Pay Slipgomathi7777_33351404No ratings yet

- 383870964-Bigbasket bangaloreDocument1 page383870964-Bigbasket bangalorekreetika kumariNo ratings yet

- Payslip India May - 2023Document2 pagesPayslip India May - 2023RAJESH DNo ratings yet

- Salary slip Conneqt business solutionDocument1 pageSalary slip Conneqt business solutionbittu yoNo ratings yet

- June 2023 PayslipDocument2 pagesJune 2023 Payslipgomathi7777_33351404100% (1)

- Amazon Development Center India Pvt. LTD: Amount in INRDocument1 pageAmazon Development Center India Pvt. LTD: Amount in INRshammas PANo ratings yet

- Salary Slip - June 2022 - UnlockedDocument2 pagesSalary Slip - June 2022 - UnlockedRmillionsque FinserveNo ratings yet

- ING Vysya Life Insurance PayslipDocument1 pageING Vysya Life Insurance PayslipHarsh JasaniNo ratings yet

- 31 Aug 2023Document1 page31 Aug 2023Arun KumarNo ratings yet

- India JUN-2020 ...Document1 pageIndia JUN-2020 ...laxman luckyNo ratings yet

- Payslip 2023 2024 6 200000000029454 IGSLDocument1 pagePayslip 2023 2024 6 200000000029454 IGSLMohit SagarNo ratings yet

- Yejide Porter Recent StubDocument1 pageYejide Porter Recent StubMalinda ShortNo ratings yet

- L00368BI.20231227.85232.0001094215Document1 pageL00368BI.20231227.85232.0001094215Vikas NimbranaNo ratings yet

- Bigbasket SonuDocument1 pageBigbasket SonuSonuNo ratings yet

- Pay Details: 250655 First National Bank - Central Branch Code 62757691160 Current 29,444.07Document1 pagePay Details: 250655 First National Bank - Central Branch Code 62757691160 Current 29,444.07Tyelovuyo Charles JahoNo ratings yet

- Ismail Bin HarithDocument1 pageIsmail Bin HarithNelson LeeNo ratings yet

- Payslip (1)Document1 pagePayslip (1)OnayimisNo ratings yet

- PFIM031007420731072023001Document1 pagePFIM031007420731072023001Angie SekhuniNo ratings yet

- Earnings Deductions MTH - Rate Arrears Total Earned Arrears Total DedDocument1 pageEarnings Deductions MTH - Rate Arrears Total Earned Arrears Total DedShubham GargNo ratings yet

- Salary AdviceDocument1 pageSalary AdviceVee-kay Vicky KatekaniNo ratings yet

- PansDocument1 pagePansVee-kay Vicky KatekaniNo ratings yet

- Https Payroll - Saneforce.info SalaryTemplate ListLoanTemp Vbirds EMP10180&month 10&year Need 2022&st 1&tid 12&org 92&subdiv 0&div 167Document1 pageHttps Payroll - Saneforce.info SalaryTemplate ListLoanTemp Vbirds EMP10180&month 10&year Need 2022&st 1&tid 12&org 92&subdiv 0&div 167Suryakant SinghNo ratings yet

- PDFDocument3 pagesPDFdelmundomarkanthony15No ratings yet

- PayslipDocument1 pagePayslipwala meronNo ratings yet

- PayslipDocument1 pagePayslipRow Dizon0% (3)

- Payslip October 2023Document1 pagePayslip October 2023rajusingh05071992No ratings yet

- PS Jul-23 MPDocument1 pagePS Jul-23 MPmyphotosfetNo ratings yet

- Bigbasket SHOBDocument1 pageBigbasket SHOBSonuNo ratings yet

- Bigbasket SsDocument1 pageBigbasket SsSonuNo ratings yet

- Tata Consultancy Services PayslipDocument2 pagesTata Consultancy Services PayslipRahimaNo ratings yet