Professional Documents

Culture Documents

Form No. 7: Notice of Demand Under Section 156 of The Income-Tax Act, 1961

Uploaded by

Yashwant SahaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form No. 7: Notice of Demand Under Section 156 of The Income-Tax Act, 1961

Uploaded by

Yashwant SahaCopyright:

Available Formats

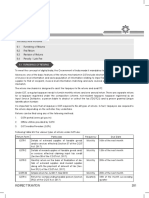

FORM NO.

7

[See rule 15]

Notice of demand under section 156 of the Income-tax Act, 1961

To

Status

PAN

1. This is to give you notice that for the assessment year sum of Rs. ,details of which are

given on the reverse, has been determined to be payable by you.

2. The amount should be paid to the Manager, authorised bank/State Bank of India/Reserve Bank of India at

within 30 days of the service of this notice. The previous approval of the Joint Commissioner of Income-tax

has been obtained for allowing a period of less than 30 days for the payment of the above sum. A challan is

enclosed for the purpose of Payment.

3. If you do not pay the amount within the period specified above, you shall be liable to pay simple interest at

one per cent for every month or part of a month from the date commencing after end of the period aforesaid in

accordance with section 220(2).

4. If you do not pay the amount of the tax within the period specified above, penalty (which may be as much

as the amount of tax in arrear) may be imposed upon you after giving you a reasonable opportunity of being

heard in accordance with section 221.

5. If you do not pay the amount within the period specified above, proceedings for the recovery thereof will be

taken in accordance with sections 222 to 227, 229 and 232 of the Income-tax Act, 1961.

6. If you intend to appeal against the assessment/fine/penalty, you may present an appeal under Part A of

Chapter XX of the Income-tax Act, 1961, to the Commissioner of Income-tax (Appeals)

within thirty days of the receipt of this notice, in Form No. 35, duly stamped and verified as laid down in that

form.

7. The amount has become due as a result of the order of the Joint Commissioner of Income-tax/Commissioner

of Income-tax (Appeals)/Chief Commissioner or Commissioner of Income-tax under section

of the Income-tax Act, 1961. If you intend to appeal against the aforesaid order, you may present an appeal

under Part B of Chapter XX of the said Act to the Income-tax Appellate Tribunal within sixty

days of the receipt of that order, in Form No. 36, duly stamped and verified as laid down in that form.

Place

Date Assessing Officer

Address

Notes :

1. Delete inappropriate paragraphs and words.

2. If you wish to pay the amount by cheque, the cheque should be drawn in favour of the Manager,

authorised bank/State Bank of India/Reserve Bank of India.

3. If you intend to seek extension of time for payment of the amount or propose to make the payment by

instalments, the application for such extension or, as the case may be, permission to pay by instalments,

should be made to the Assessing Officer before the expiry of the period specified in paragraph 2. Any

request received after the expiry of the said period will not be entertained in view of the specific

provisions of section 220(3).

[ITR62;7,1]

Printed from www.incometaxindia.gov.in Page 1 of 1

You might also like

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Form No. 2 Notice of Demand: NotesDocument1 pageForm No. 2 Notice of Demand: NotesYashu GoelNo ratings yet

- ITC Reversal Due To Non-Payment Within 180 DaysDocument2 pagesITC Reversal Due To Non-Payment Within 180 DaysRajdev AssociatesNo ratings yet

- Demand NoticeDocument1 pageDemand NoticeManuNo ratings yet

- Circular No.60Document4 pagesCircular No.60Hr legaladviserNo ratings yet

- 180 Days ITC Reversal On Non-Payment of Consideration – A Dilemma For Taxpayer - Taxguru - inDocument9 pages180 Days ITC Reversal On Non-Payment of Consideration – A Dilemma For Taxpayer - Taxguru - inkvmkinNo ratings yet

- Complete Guide On Revocation of Cancellation of GST Registration (As Per Latest Notification) - Taxguru - inDocument3 pagesComplete Guide On Revocation of Cancellation of GST Registration (As Per Latest Notification) - Taxguru - insuraj shekhawatNo ratings yet

- GST Amdts Part 2Document5 pagesGST Amdts Part 2amankhurana0910No ratings yet

- Final Mou Corssreferencing Press ReleaseDocument6 pagesFinal Mou Corssreferencing Press ReleaseSripal JainNo ratings yet

- Provision Related To Advance Payment of TaxDocument8 pagesProvision Related To Advance Payment of TaxBISHWAJIT DEBNATHNo ratings yet

- Ref: GSTN: Sub: Reply To Your Notice For Payment of Interest Period: July'2017 To Nov'2018Document4 pagesRef: GSTN: Sub: Reply To Your Notice For Payment of Interest Period: July'2017 To Nov'2018Nikhil JainNo ratings yet

- Cir 188 20 2022 CGSTDocument4 pagesCir 188 20 2022 CGSTAtanu Kumar SenNo ratings yet

- Cir 174 06 2022 CGSTDocument5 pagesCir 174 06 2022 CGSTNM JHANWAR & ASSOCIATESNo ratings yet

- For Indiabulls Housing Finance LimitedDocument1 pageFor Indiabulls Housing Finance LimitedWild RaacNo ratings yet

- Analysis of 10 Important Changes in GST From 1st October 2022 - Taxguru - in PDFDocument4 pagesAnalysis of 10 Important Changes in GST From 1st October 2022 - Taxguru - in PDFPawan AswaniNo ratings yet

- Zxyzvyyyyy 1223Document1 pageZxyzvyyyyy 1223VIGNESHNo ratings yet

- Refund of GSTDocument2 pagesRefund of GST76-Gunika MahindraNo ratings yet

- AllotDocument6 pagesAllotn.shinde333No ratings yet

- Circular No.59Document6 pagesCircular No.59Hr legaladviserNo ratings yet

- Revenue Memorandum Order No. 014-16: April 4, 2016 April 4, 2016Document2 pagesRevenue Memorandum Order No. 014-16: April 4, 2016 April 4, 2016Milane Anne CunananNo ratings yet

- Interest CertificateDocument1 pageInterest CertificateSuvajit ChakrabartyNo ratings yet

- ALO WAIVER-finalDocument14 pagesALO WAIVER-finalJasper Alon100% (1)

- Paper-18 Supplementary 180221Document109 pagesPaper-18 Supplementary 180221Srihari SrinivasNo ratings yet

- CIR vs. Systems Technology InstituteDocument2 pagesCIR vs. Systems Technology InstituteMaria100% (3)

- HHLHYE00424239 Provisional (2019-2020)Document1 pageHHLHYE00424239 Provisional (2019-2020)sanjeevNo ratings yet

- Provisional Certificate 2018-2019Document1 pageProvisional Certificate 2018-2019RohanNo ratings yet

- AACCK3258R - Demand Notice Us 156 - 1052866885 (1) - 16052023Document1 pageAACCK3258R - Demand Notice Us 156 - 1052866885 (1) - 16052023Hitesh DhingraNo ratings yet

- Demand and RecoveryDocument9 pagesDemand and RecoverySaumya AllapartiNo ratings yet

- Gstr3a Za180322024284wDocument1 pageGstr3a Za180322024284wIMRADUL HUSSAINNo ratings yet

- ITcertificateDocument1 pageITcertificateV N CharyNo ratings yet

- STAY OF DEMAND Under Income TaxDocument2 pagesSTAY OF DEMAND Under Income TaxChitsimran Singh0% (1)

- Refund Forms For Centre and StateDocument20 pagesRefund Forms For Centre and StateShail MehtaNo ratings yet

- Tax LawDocument32 pagesTax Lawgilbert213No ratings yet

- DocumentDocument1 pageDocumentkalyan0% (1)

- Expenses Under Section 43B (H) - Taxguru - inDocument4 pagesExpenses Under Section 43B (H) - Taxguru - inanascrrNo ratings yet

- Demand & RecoveryDocument24 pagesDemand & Recoverygeegostral chhabraNo ratings yet

- What Is Advance Payment of TaxDocument11 pagesWhat Is Advance Payment of TaxPrakhar KesharNo ratings yet

- Alabang Vs MuntinlupaDocument2 pagesAlabang Vs MuntinlupaLauriz EsquivelNo ratings yet

- To Whomsoever It May Concern Provisional Interest CertificateDocument1 pageTo Whomsoever It May Concern Provisional Interest CertificateSHOBHRAJ MEENA0% (1)

- en Banc - Alabang Supermarket v. City of MuntinlupaDocument2 pagesen Banc - Alabang Supermarket v. City of MuntinlupaPaul Joshua SubaNo ratings yet

- Circular Refund 137 7 2020Document3 pagesCircular Refund 137 7 2020Shirish JainNo ratings yet

- Labor LawDocument29 pagesLabor LawmissyaliNo ratings yet

- Article On Assessment and AuditDocument33 pagesArticle On Assessment and Auditmks895525No ratings yet

- Unit 5 GSTDocument3 pagesUnit 5 GSTNishu KatiyarNo ratings yet

- Cir VS Philamlife InsuranceDocument5 pagesCir VS Philamlife InsuranceLyka PascuaNo ratings yet

- Sec 194 N - Declaration of Filing of Income Tax ReturnDocument2 pagesSec 194 N - Declaration of Filing of Income Tax ReturnSahithyaNo ratings yet

- CERTIFICATE For Claiming Deduction Under Section 24 (B) & 80C (2) (Xviii) of INCOME TAX ACT, 1961Document1 pageCERTIFICATE For Claiming Deduction Under Section 24 (B) & 80C (2) (Xviii) of INCOME TAX ACT, 1961Raman SharmaNo ratings yet

- TN Computer AdvanceDocument19 pagesTN Computer Advancerajkumar_k_99No ratings yet

- ESIC On Bonus, Overtime, Leave EncashmentDocument3 pagesESIC On Bonus, Overtime, Leave Encashmentharshil.rmlNo ratings yet

- Corp - ITRDocument40 pagesCorp - ITRMiguel CasimNo ratings yet

- NI Act BookDocument9 pagesNI Act Booksameerscribd31No ratings yet

- New TDS Provisions: Rmaconsultancy - in +91-9672372075 Office@rmaconsultancy - inDocument7 pagesNew TDS Provisions: Rmaconsultancy - in +91-9672372075 Office@rmaconsultancy - inCA Ranjan MehtaNo ratings yet

- Ramesh Kamyal JudgementDocument19 pagesRamesh Kamyal JudgementAvantika singh RajawatNo ratings yet

- Tax Doctrines in Dimaampao CasesDocument3 pagesTax Doctrines in Dimaampao CasesDiane UyNo ratings yet

- Relief Us80Document4 pagesRelief Us80Rajesh KumarNo ratings yet

- DEPOSITSDocument12 pagesDEPOSITSmybest friendNo ratings yet

- Do You Know GST I March 2021 I Ranjan MehtaDocument15 pagesDo You Know GST I March 2021 I Ranjan MehtaCA Ranjan MehtaNo ratings yet

- Amendments For NOV 21: Amendment in 1 Min Series Available On InstagramDocument32 pagesAmendments For NOV 21: Amendment in 1 Min Series Available On InstagramAakriti SinghalNo ratings yet

- Union Budget 2023 For NGOsDocument7 pagesUnion Budget 2023 For NGOsGOODS AND SERVICES TAXNo ratings yet

- Standardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument11 pagesStandardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiamonikaNo ratings yet

- Slovakia 14Document11 pagesSlovakia 14Edvin MusiNo ratings yet

- Form GST ITC 04 NewDocument2 pagesForm GST ITC 04 NewAjay DayalNo ratings yet

- PHD Thesis Topics in Financial ManagementDocument6 pagesPHD Thesis Topics in Financial Managementvsiqooxff100% (2)

- DEPRECIATIONDocument38 pagesDEPRECIATIONJun TiNo ratings yet

- Mcq's Tax ScannerDocument533 pagesMcq's Tax ScannerSajal DixitNo ratings yet

- (Original For Recipient) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountDocument1 page(Original For Recipient) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total Amountmanish kholiyaNo ratings yet

- CIR vs. Primetown Property Group, IncDocument2 pagesCIR vs. Primetown Property Group, IncKeisha Camille OliverosNo ratings yet

- 7Document3 pages7Carlo ParasNo ratings yet

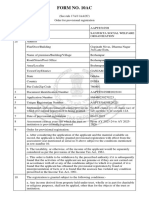

- Form No. 10acDocument2 pagesForm No. 10acAditya NayakNo ratings yet

- XX. CIR vs. Fitness by Design, IncDocument11 pagesXX. CIR vs. Fitness by Design, IncStef OcsalevNo ratings yet

- Property Tax ReceiptDocument1 pageProperty Tax Receiptsayan.official833No ratings yet

- The 2013 Budget SpeechDocument17 pagesThe 2013 Budget SpeechgombakluangNo ratings yet

- Fe Cereñado Obe: #37C Hornbill St. Sitio Veterans, Area 3 Brgy. Bagong Silangan, Quezon CityDocument2 pagesFe Cereñado Obe: #37C Hornbill St. Sitio Veterans, Area 3 Brgy. Bagong Silangan, Quezon CityJoanna PaulaNo ratings yet

- Income Tax Calculator Fy 2020 21 v2Document12 pagesIncome Tax Calculator Fy 2020 21 v2Anonymous Clm40C1No ratings yet

- Sri Lanka Projects ProposalsDocument29 pagesSri Lanka Projects ProposalsUzair Ul GhaniNo ratings yet

- List of Approved Makes: RCC/S - 21Document19 pagesList of Approved Makes: RCC/S - 21Upendra ChariNo ratings yet

- Leach's Tax DictionaryDocument465 pagesLeach's Tax DictionarystNo ratings yet

- Water Report - CostsDocument7 pagesWater Report - CostsEric ReynoldsNo ratings yet

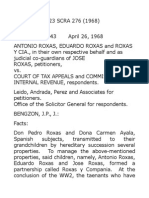

- 16 Roxas V CTA 23 SCRA 276 (1968) - DigestDocument8 pages16 Roxas V CTA 23 SCRA 276 (1968) - DigestKeith Balbin0% (1)

- Unity Foods Excel WorkDocument92 pagesUnity Foods Excel WorkAsra Hamid MalikNo ratings yet

- Instructions For The Form SS-4Document7 pagesInstructions For The Form SS-4Benne James83% (12)

- CIR v. DLSU DigestDocument2 pagesCIR v. DLSU DigestNinya Saquilabon60% (5)

- BRN Annual Report 2013/14Document80 pagesBRN Annual Report 2013/14benmtegaNo ratings yet

- Trust DeedDocument7 pagesTrust DeedSETHUNo ratings yet

- InvoiceDocument1 pageInvoiceShreyas V SNo ratings yet

- MULTIPLEDocument7 pagesMULTIPLEKim EllaNo ratings yet

- Case Digest: Pelizloy v. BenguetDocument13 pagesCase Digest: Pelizloy v. BenguetBruce WayneNo ratings yet

- GEO Technical Firm (TOR)Document14 pagesGEO Technical Firm (TOR)Assam Green InfrastructuresNo ratings yet

- Hotel BookingDocument2 pagesHotel BookingdevbnwNo ratings yet

- Roth IRADocument2 pagesRoth IRAanon_757121No ratings yet