Professional Documents

Culture Documents

ABALLE InmgtAcctg3Exer6

Uploaded by

Gammy AballeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ABALLE InmgtAcctg3Exer6

Uploaded by

Gammy AballeCopyright:

Available Formats

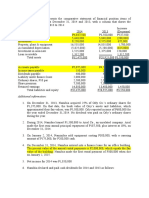

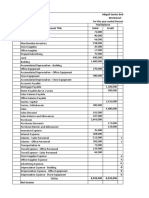

Cashflow

Operating

OPER. Profit for the year

INVEST. Noncash finance costs, finance cost paid P25,000

FINAN Noncash tax expense, income tax paid P190,000

Depreciation of property, plant, and equipmen

Impairment loss

Amortization of intangibles

Gain on sale of equipment

Increase in trade and other receivables

Decrease in inventories

Increase in trade payables, including unrealized foreign exchange loss of P1,000 charged to other expenses

Increase in current and long-term benefit payable

Proceeds from the sale of equipment

Purchase of equipment

Payment of finance lease liability

Repayment of borrowings

Dividends paid

CASH FLOW FROM OPERATIONS

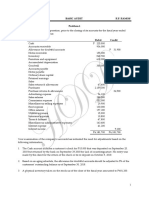

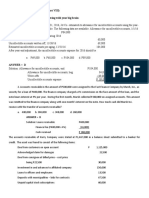

380,000 Profit for the year

1,000 Noncash tax expense, income tax paid P190,000

79,000 Depreciation of property, plant, and equipmen

270,000 Impairment loss

30,000 Amortization of intangibles

2,000 Gain on sale of equipment

60,000 Increase in trade and other receivables

10,000 Decrease in inventories

9,000 Increase in trade payables, including unrealized foreign exchange loss of P1,000 charged to ot

ged to other expenses 11,000 Increase in current and long-term benefit payable

3,000 Noncash finance costs, finance cost paid P25,000

100,000 CASH FLOW FROM INVESTING

485,000

19,000 Purchase of equipment

100,000 Proceeds from the sale of equipment

150,000

CASH FLOW FROM FINANCING

Payment of finance lease liability

Repayment of borrowings

Dividends paid

380,000

79,000

270,000

30,000

2,000

-60,000

-10,000

9,000

ge loss of P1,000 charged to other expenses 11,000

3,000

1,000

715,000

485,000

-100,000

385,000

19,000

100,000

150,000

269,000

You might also like

- Bharat Chemicals Ltd. SolnDocument4 pagesBharat Chemicals Ltd. SolnJayash KaushalNo ratings yet

- Bharat Chemical CaseDocument5 pagesBharat Chemical CaseambitiousfirkinNo ratings yet

- For The Year Ended December 31, 2020: Rcs Consultancy CorporationDocument11 pagesFor The Year Ended December 31, 2020: Rcs Consultancy CorporationYzzabel Denise L. TolentinoNo ratings yet

- RECRUITMENT AND SELECTION in HDFC BANK PDFDocument81 pagesRECRUITMENT AND SELECTION in HDFC BANK PDFapura desai100% (1)

- Invoice No 797044331767Document1 pageInvoice No 797044331767Hafizul RahmanNo ratings yet

- Laboratory Exercise 1 - Intermediate Accounting 3Document1 pageLaboratory Exercise 1 - Intermediate Accounting 3Zeniah LouiseNo ratings yet

- Prctice SetDocument9 pagesPrctice SetAdam CuencaNo ratings yet

- Fabm2 Statement of Comprehensive Income Practice Problems Answer KeyDocument3 pagesFabm2 Statement of Comprehensive Income Practice Problems Answer KeyMounicha Ambayec0% (1)

- Fabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyDocument3 pagesFabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyMounicha Ambayec100% (4)

- Unadjusted Trial Balance Adjusting Journal Entries Account Debit Credit Debit CreditDocument5 pagesUnadjusted Trial Balance Adjusting Journal Entries Account Debit Credit Debit CreditChristine RepuldaNo ratings yet

- Additional InformationDocument6 pagesAdditional InformationBabylyn NavarroNo ratings yet

- Ap-Problems - 2015Document20 pagesAp-Problems - 2015jayson100% (1)

- CFAS 16 and 18Document2 pagesCFAS 16 and 18Cath OquialdaNo ratings yet

- DagohoyDocument6 pagesDagohoylinkin soyNo ratings yet

- E - CAsh Flow Question Meath With Solution and WorkingsDocument5 pagesE - CAsh Flow Question Meath With Solution and Workingschalah DeriNo ratings yet

- Trial BalanceDocument4 pagesTrial BalanceRonnie Lloyd JavierNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial Position Account Titles Debit Credit Debit Credit Debit Credit Debit CreditDocument2 pagesTrial Balance Adjustments Profit or Loss Financial Position Account Titles Debit Credit Debit Credit Debit Credit Debit CreditVencint LaranNo ratings yet

- Revision Questions - 2 Statement of Cash Flows - SolutionDocument7 pagesRevision Questions - 2 Statement of Cash Flows - SolutionNadjah JNo ratings yet

- Compre Audit Cieloflawless Q PDFDocument3 pagesCompre Audit Cieloflawless Q PDFCarina Mae Valdez ValenciaNo ratings yet

- UntitledDocument5 pagesUntitledm habiburrahman55No ratings yet

- WorkDocument4 pagesWorkhassan KyendoNo ratings yet

- Chapter 9 - Presentation of Fs (Statement of Comprehensive Income)Document2 pagesChapter 9 - Presentation of Fs (Statement of Comprehensive Income)Mark IlanoNo ratings yet

- Cash Flow Statements IIDocument7 pagesCash Flow Statements IIGood VibesNo ratings yet

- Post-Closing Trial BalanceDocument8 pagesPost-Closing Trial BalanceNicole Andrea TuazonNo ratings yet

- Accouncting ProblemDocument3 pagesAccouncting ProblemShaneNo ratings yet

- Start-Up Capital:: Particulars Taka TakaDocument5 pagesStart-Up Capital:: Particulars Taka TakaSahriar EmonNo ratings yet

- AfarDocument29 pagesAfarGONZALES, MICA ANGEL A.No ratings yet

- Answer Sheet Mock Test 23Document5 pagesAnswer Sheet Mock Test 23Nam Nguyễn HoàngNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditDocument2 pagesTrial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditMichelle BabaNo ratings yet

- Retained Earning Opening Balance - Net Income For The Year Ended 2017 2370 Dividend Paid (2,500)Document21 pagesRetained Earning Opening Balance - Net Income For The Year Ended 2017 2370 Dividend Paid (2,500)Umar Razi QasimNo ratings yet

- Chapter 2 - MCDocument12 pagesChapter 2 - MCMiya Crizxen RevibesNo ratings yet

- Pembahasan Kuiz Indirect HoldingsDocument3 pagesPembahasan Kuiz Indirect HoldingsAdara KiranaNo ratings yet

- Yohannes Wibowo - Akuntansi Keuangan Lanjutan I - Akuntansi (E) - Tugas Minggu 5Document5 pagesYohannes Wibowo - Akuntansi Keuangan Lanjutan I - Akuntansi (E) - Tugas Minggu 5YOHANNES WIBOWONo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- GPV & SCF (Assignment)Document16 pagesGPV & SCF (Assignment)Mica Moreen GuillermoNo ratings yet

- Quiz - 4B UpdatesDocument7 pagesQuiz - 4B UpdatesAngelo HilomaNo ratings yet

- Output No. 2 - PAS 1 Instruction: Write Your Answers On Long Bond PapersDocument2 pagesOutput No. 2 - PAS 1 Instruction: Write Your Answers On Long Bond Papersnmdl123No ratings yet

- H.W ch4q7 Acc418Document4 pagesH.W ch4q7 Acc418SARA ALKHODAIRNo ratings yet

- Cash Flow Statement SampleDocument1 pageCash Flow Statement Samplewaqas akramNo ratings yet

- Tutorial Cash FlowDocument18 pagesTutorial Cash FlowmellNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- Accbp100 3rd Exam AnswersDocument8 pagesAccbp100 3rd Exam AnswersAlthea Marie OrtizNo ratings yet

- Profit Tax ClassDocument9 pagesProfit Tax ClassAndreea MateiNo ratings yet

- Perpetual - Adjusted Trial BalanceDocument1 pagePerpetual - Adjusted Trial BalanceJeon Cyrone CuachonNo ratings yet

- Abigail Santos Boutique, Financial Statement For MerchandisingDocument9 pagesAbigail Santos Boutique, Financial Statement For MerchandisingFeiya Liu100% (1)

- FdnacctDocument20 pagesFdnacctvitobautistaNo ratings yet

- Abigail Santos Boutique, Worksheet and Financial Statement For MerchandisingDocument9 pagesAbigail Santos Boutique, Worksheet and Financial Statement For MerchandisingFeiya LiuNo ratings yet

- 03 Activity 1Document1 page03 Activity 1bea santiagoNo ratings yet

- AccountsDocument4 pagesAccountsVencint LaranNo ratings yet

- I. Adjustments Ii. WorksheetDocument11 pagesI. Adjustments Ii. WorksheetDarwyn MendozaNo ratings yet

- Fabm2 First Grading ReviewerDocument3 pagesFabm2 First Grading ReviewerjhomarNo ratings yet

- VELLORE, CHENNAI-632 002: Answer The Following QuestionsDocument5 pagesVELLORE, CHENNAI-632 002: Answer The Following QuestionsJayanthiNo ratings yet

- Sample Problems Cash Flow AnalysisDocument2 pagesSample Problems Cash Flow AnalysisTeresa AlbertoNo ratings yet

- Book 2Document2 pagesBook 2Joyce NoblezaNo ratings yet

- Cash Flows PAS7Document10 pagesCash Flows PAS7Jenyl Mae NobleNo ratings yet

- Financial ManagementDocument9 pagesFinancial Managementkendrapancho9No ratings yet

- Netapp, Inc Com in Dollar US in ThousandsDocument6 pagesNetapp, Inc Com in Dollar US in Thousandsluisa Fernanda PeñaNo ratings yet

- Book 1Document2 pagesBook 1VIRAY, CRISTIAN JAY V.No ratings yet

- Accounting TestDocument4 pagesAccounting Testdinda ardiyaniNo ratings yet

- ASS16 AccountingDocument6 pagesASS16 Accountingvomawew647No ratings yet

- Ifm - 5Document17 pagesIfm - 5Tường LinhNo ratings yet

- Academy ForumIAS Prelims Test 10 Dec 22Document197 pagesAcademy ForumIAS Prelims Test 10 Dec 22Shoukath ShaikNo ratings yet

- Ross Corporate 13e PPT CH21 AccessibleDocument37 pagesRoss Corporate 13e PPT CH21 AccessibleVy Dang PhuongNo ratings yet

- Chapter 7 - 18may 2022Document51 pagesChapter 7 - 18may 2022Hazlina HusseinNo ratings yet

- Ratios Table FormatDocument2 pagesRatios Table FormatAwrangzeb AwrangNo ratings yet

- Geometric GradientDocument20 pagesGeometric GradientDarkie DrakieNo ratings yet

- آليــــات تنشيـط وتطـوير بـورصة الجزائر (الأداء، المعوقات و الحلول)Document20 pagesآليــــات تنشيـط وتطـوير بـورصة الجزائر (الأداء، المعوقات و الحلول)Sea BenNo ratings yet

- BBM 215 - Financial Management IDocument97 pagesBBM 215 - Financial Management Iheseltine tutu100% (1)

- Platni Sistemi Participants ListDocument6 pagesPlatni Sistemi Participants ListKristijan PetrovskiNo ratings yet

- Payment Instruction Form (Pif) : TaclobanDocument1 pagePayment Instruction Form (Pif) : TaclobanEr WinNo ratings yet

- An Analysis On Marketing Communication of American Express Credit Card and It's Competitors in BangladeshDocument49 pagesAn Analysis On Marketing Communication of American Express Credit Card and It's Competitors in Bangladeshmonti_nsuNo ratings yet

- Practice Exam 2020 2.0 in Corporate FinanceDocument5 pagesPractice Exam 2020 2.0 in Corporate FinanceNikolai PriessNo ratings yet

- FINMAN MidtermDocument4 pagesFINMAN MidtermShane CabinganNo ratings yet

- Asian University of Bangladesh: Assignment OnDocument17 pagesAsian University of Bangladesh: Assignment OnMahfuzur RahmanNo ratings yet

- Gold Is Money and Nothing Else 100120Document60 pagesGold Is Money and Nothing Else 100120mengesha abyeNo ratings yet

- Chief Credit Officer, Chief Risk Officer, Head of Distressed AssDocument3 pagesChief Credit Officer, Chief Risk Officer, Head of Distressed Assapi-79240515No ratings yet

- Presentation On Harshad MehtaDocument14 pagesPresentation On Harshad Mehtarupesh_nair14No ratings yet

- Solved Past Papers Income Tax Numericals of ICMAP STAGE IV - (2003 TO 2015)Document45 pagesSolved Past Papers Income Tax Numericals of ICMAP STAGE IV - (2003 TO 2015)muneeb razaNo ratings yet

- What Is Without Recourse?Document1 pageWhat Is Without Recourse?johngaultNo ratings yet

- Quiz VIII - ARDocument3 pagesQuiz VIII - ARBLACKPINKLisaRoseJisooJennieNo ratings yet

- W25421 PDF EngDocument5 pagesW25421 PDF EngAnand RanjanNo ratings yet

- Ia2 (Chapter 7 - Problem 5)Document3 pagesIa2 (Chapter 7 - Problem 5)entienzafatimahNo ratings yet

- Gic Weekly 080124Document14 pagesGic Weekly 080124eldime06No ratings yet

- Spark Strategy - Why Household Savings Have Been Falling in India - Apr'19 - Spark CapitalDocument9 pagesSpark Strategy - Why Household Savings Have Been Falling in India - Apr'19 - Spark CapitalMadhuchanda DeyNo ratings yet

- Employee Pay SlipDocument1 pageEmployee Pay Slippriyankapriyanka90856No ratings yet

- IV. Structured Trade and Commodity Financing: A. IntroductionDocument11 pagesIV. Structured Trade and Commodity Financing: A. Introductionnexus0104464No ratings yet

- S2 PPTDocument12 pagesS2 PPTPUSHKAL AGGARWALNo ratings yet

- Acct Statement - XX9251 - 19012024Document9 pagesAcct Statement - XX9251 - 19012024mw46282No ratings yet