Professional Documents

Culture Documents

Business Data Analysis Financial Forecasting

Uploaded by

Md Robin HossainOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Data Analysis Financial Forecasting

Uploaded by

Md Robin HossainCopyright:

Available Formats

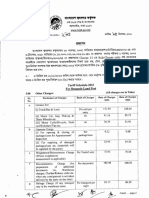

Subject: Invitation to the Online Certificate Course on ‘Business Data Analysis & Financial Forecasting’,

jointly with Daffodil International University (DIU).

Dear Sir/Madam,

We have the pleasure to inform you that DCCI Business Institute (DBI) is offering 3 months long Online

Certificate Course on ‘Business Data Analysis & Financial Forecasting’, scheduled to be held on June-

August 2022, jointly with Daffodil International University (DIU). Total ten (10) sessions each 3 hours will be

held on Friday from 3.00 pm - 6.00 pm in 3 months through Zoom online platform.

Topics overview in brief: The course aims at providing a framework for business data analysis and

financial forecasting using financial statements data using MS Excel. The course focuses on business data

analysis and forecasting tools and explains how financial analysis can create value in well-functioning

markets. In doing so, MS Excel module will cover the basic to advance financial modeling tools and

techniques and later part will be focus on the business analysis and financial forecasting tools and

techniques to make better analysis of businesses.

Objective: Upon completion of this course, participants will able to know the basic to advanced excel

tools & techniques, process reported financial statements to obtain an appropriate basis for business

analysis and forecasting, apply financial ratio analysis to bring out the story that the financial statements

tell, analyze the businesses qualitatively, interpret financial statements, make judgments about earnings

quality, and uncover hidden assets and liabilities, apply the most common valuation models, complete the

valuation of the firms, use analysis and valuation to challenge the assumptions inherent in the market

price.

Who Can Attend: Top Management, Managers, Assistant Managers and Executive of organization,

Financial Analysts, Inventors in Capital Markets, Accountant, Entrepreneurs, Students and those who are

interested in Business Data Analysis & Forecasting.

Facilitators: Highly qualified, professionally trained, reputed and experienced resource persons in the related

areas, having ample theoretical and practical knowledge from home and abroad, with current information, has

been invited to conduct respective sessions.

Fee: Tk. 12,000/- payable in favour of ‘Dhaka Chamber of Commerce & Industry’ by Cash/ Pay Order/

Cheque/ EFT. It could also be paid through bKash merchant number 01766018659 (Payment) with bKash

charge. Fee includes cost of tuition, course materials, exams & certificate and excludes VAT & Tax.

Discount: 10% for (one option applicable): (i) DCCI Members; (ii) Women participants; (iii) Students

(pursuing his/her undergraduation & postgraduation); (iv) DIU Alumni; (v) Three (3) or more participants

from one organization.

Admission Procedure: For admission log on to https://forms.gle/1BSKZw2uZqQkBk3m9 Admission would

be confirmed to candidates on payment of course fee. Admission Deadline: 9th June 2022.

Certification: On successful completion participants will get certificate signed by the President, DCCI and the

Pro Vice Chancellor, DIU. For further information, please contact to DBI, Cell # 01777-364474/ 01913745062

& Tel: 9552562 Ext. 137/124/281; E-mail: dbi@dhakachamber.com , amit@dhakachamber.com

We would appreciate if you could kindly participate and/or nominate concerned official(s) from your esteemed

organization to this prestigious Course.

Thanking you,

Yours Sincerely,

Md. Joynal Abdin

Executive Secretary, DCCI

Contact: DBI, Dhaka Chamber Building (11th floor), 65-66 Motijheel C/A, Dhaka

Phone: 9552562 (Hunting) Ext. 137/124/281, Mobile: 01777364474 & 01913745062, Fax: 9560830

E-mail: dbi@dhakachamber.com, Website: www.dcci-dbi.edu.bd, facebook.com/dcci.dbi

Online Certificate Course on

‘Business Data Analysis & Financial Forecasting’

Jointly Organized by DBI & DIU

Session: June-August 2022

Batch: 1st Batch

Module and Topics

Module Details

Module 01:

Understanding • The Basic Accounting Statements (Balance Sheet, Income statement and

Financial Cash Flow Statements);

Statements & The • Asset Measurement and Valuation;

Framework for • Measuring Financing Mix;

Business Analysis • Measuring Earnings and Profitability.

• The role of financial reporting in capital markets,

• From business activities to Financial statements,

• From Financial statements to Business Analysis.

Module 02:

Business Analysis • Industry Analysis,

• Degree of actual competition and Potential Competition,

• Relative Bargaining Power in Input and Output Markets, Competitive

Strategy Analysis,

• Sources of Competitive Advantage,

• Achieving and Sustaining Competitive Advantage,

• Corporate Strategy Analysis.

Module 03:

Understanding of Excel

Objects • Introduction to MS Excel Sheet

• Moving along/across MS Excel Sheet

• Entering and Editing Data into Cells

• Naming cells

• Alignment

• Wrap Text & Merging Cells

• Filling Cells

• Sorting & Filtering

• Finding & Selecting

• Hiding Cells and Gridlines

• Naming, Adding, & Deleting Worksheets

• Linking and Referencing inside and across worksheets

• Relative and Absolute Referencing

• Linking Across Different Files

• Row Height & Column Width

• Hiding and Un-hiding Rows and Columns

• Insert Copied Cells

• Operators for Writing Formulas

Module 04:

Customization of

Wordbook/Sheets/Data • Conditional Formatting

• Format as Tables

• Cell Styles

• Number Formatting

• Forcing text to appear on a new line within a cell;

• Trick to input data into multiple cell simultaneously;

• Entering the current date or time into a cell.

• Making Charts & Sparkline

• Freeze Panes

• Go To Special

• Using Hyperlinks

Module 05:

ADVANCE SKILLS ON

EXCEL FUNCTIONS – I Logical Functions in Excel

1. IF and nested IF functions

2. And & Or logics

3. IFERROR.

Statistical Functions

1. Summing and Averaging

2. MIN & MAX

3. Counting numbers, texts and blanks

Text Functions:

1. CONCATENATE

2. PROPER, UPPER, LOWER

3. LEN, LEFT, RIGHT

4. TEXT, TRIM

Module 06: • LOOKUP function

ADVANCE SKILLS ON

EXCEL FUNCTIONS – II • Vertical LOOKUP Function

• Horizontal LOOKUP Functions

• Variations of Date functions

• INDEX Function

• MATCH Function

• SUMIF and SUMIFS

• COUNTIF and COUNTIFS

• Pivot Table

• Pivot Table with Slicer and Pivot Chart.

• Power Pivot.

• Dash Board by using pivot table for quick investment decision.

• Basic concept of Power BI.

Module 07:

Financial Statement Ratio Analysis:

Analysis: Conventional Concept of Ratio Analysis, Significance of Financial Ratio Analysis, and

Approach Comparison of Intra firm, Inter Firm, Industry and Standard, Limitation of Ratio

Analysis, Case study related to Ratio Analysis.

Du-Pont Analysis:

Concept, Situation for Du-Pont Analysis, Three Factors and Five Factors Du-Pont

Analysis.

Sensitivity Analysis:

Concept, Significance of Sensitivity Analysis, Test of Sensitivity of ROE.

Discussion Case:

Financial Ratio Analysis (Ivey)

Module 08:

Financial Statement Vertical Analysis:

Analysis: Contemporary Concept of Vertical Analysis, Significance of Common Size Income Statement,

Approach Common Size Balance Sheet and Income Statement, Limitation of Vertical Analysis.

Case: Milavec Company Horizontal Analysis

Horizontal Analysis:

Concept of Horizontal Analysis, Significance of Horizontal Analysis, Trend

Analysis, Comparative Statement Analysis, Relationship between trend analysis and

ratio analysis. Limitation of Horizontal Analysis.

Case: Milavec Company Horizontal Analysis

Financial Distress Analysis:

Concept, Factors Influencing the Risk of Financial Distress Costs, Indicators of

financial distress, Cause/Attempt of Identifying F. Distress, predicting corporate

bankruptcy: Beaver (1966): Uni-variate Analysis and the Altman’s Z-score model.

Module 09:

Prospective Analysis: Valuation of Equity: Defining Value for Shareholders, The Discounted Valuation

Forecasting & Equity Method, Valuation Using Price Multiples, Dividend Discount Models, Free Cash

Valuation flow to Equity Models, Firm Valuation: Cost of Capital and APV Approaches,

Comparing Valuation Methods, Valuing Private Firms.

Case: Equity valuation of Company’s by each student

Financial Forecasting:

The technique of Forecasting, Elements of the Detailed Forecast. Meaning,

Significance and Preparation of Pro forma Statements.

Managing Sustainable Growth:

Concept of Sustainable Growth, Balance Growth, Principles of Sustainable Growth,

Sustainable Growth Modeling: Steady–State Model, Changing Model.

Budgetary Control : Meaning, Objectives and Essentials

Module 10:

Case Analysis 2 comprehensive cases will be covered

Final Assessment

ASSESSMENT CRITERIA-

Final examination (100 marks) will be held after completing course; - 50% class attendance is mandatory

for eligibility of Exam; - Pass Marks 50% and will be mentioned ‘With Distinction’ in certificate for

obtaining 75% & above marks.

Contact: DBI, Dhaka Chamber Building (11th floor), 65-66 Motijheel C/A, Dhaka-1000

Phone: 9552562 (Hunting) Ext. 281/137, Mobile: 01777-364474/01913-745062, Fax: 9560830

E-mail: dbi@dhakachamber.com, Website: www.dcci-dbi.edu.bd, facebook.com/dcci.dbi

You might also like

- The Kimball Group Reader: Relentlessly Practical Tools for Data Warehousing and Business Intelligence Remastered CollectionFrom EverandThe Kimball Group Reader: Relentlessly Practical Tools for Data Warehousing and Business Intelligence Remastered CollectionNo ratings yet

- Information Brochure TIGDocument7 pagesInformation Brochure TIGSandipan DuttaNo ratings yet

- Program Content For FM & Additional Certifications-2Document3 pagesProgram Content For FM & Additional Certifications-2Hitisha agrawalNo ratings yet

- Project Details - Indira IIBM & DMTIMS - Common Program - Extended PDFDocument7 pagesProject Details - Indira IIBM & DMTIMS - Common Program - Extended PDFDr. Vishal GhagNo ratings yet

- Lessons 1-2 SlidesDocument9 pagesLessons 1-2 SlideskaNo ratings yet

- Level I:: Advanced Financial Modeler (Afm)Document1 pageLevel I:: Advanced Financial Modeler (Afm)ngagenjot sapedahNo ratings yet

- TWSS 6-Weeks-Full Time Program Brochure PDFDocument27 pagesTWSS 6-Weeks-Full Time Program Brochure PDFEshanMishraNo ratings yet

- MGCR 331 F22 S13 RevisionDocument22 pagesMGCR 331 F22 S13 RevisionGabriel PodolskyNo ratings yet

- Intermediate Financial ModellingDocument95 pagesIntermediate Financial ModellingWilliam WilliamsonNo ratings yet

- Advanced ExcelDocument6 pagesAdvanced ExcelKeith Parker100% (4)

- Udacity Enterprise Syllabus Business Analytics nd098Document13 pagesUdacity Enterprise Syllabus Business Analytics nd098Ibrahim AdamaNo ratings yet

- Business Analytics: Nanodegree Program SyllabusDocument13 pagesBusiness Analytics: Nanodegree Program SyllabusLucas Castro AlvesNo ratings yet

- Financial Modeling CourseDocument20 pagesFinancial Modeling CourseSwati RohtangiNo ratings yet

- FM For Begineers WorkshopDocument43 pagesFM For Begineers WorkshopMiit DholakiaNo ratings yet

- Financial Modelling 1Document291 pagesFinancial Modelling 1muriloveNo ratings yet

- A Z Modelling CourseDocument359 pagesA Z Modelling CourseRishabhNo ratings yet

- Power BI Training BrochureDocument7 pagesPower BI Training BrochurehaiderNo ratings yet

- Data Analytics Essentials Online CourseDocument15 pagesData Analytics Essentials Online Courseinfokabod1No ratings yet

- Power BI Developer: Professional SummaryDocument6 pagesPower BI Developer: Professional Summarysudeepkumar345No ratings yet

- 1 aJH1iF46azb9tzC7GVf9FRqlpbiV1sNDocument52 pages1 aJH1iF46azb9tzC7GVf9FRqlpbiV1sNTebogo WarrenNo ratings yet

- UT-AUSTIN Data-Analytics-Essentials-Online-CourseDocument16 pagesUT-AUSTIN Data-Analytics-Essentials-Online-CourseBakhtiar KhanNo ratings yet

- Sampath G SAP BO Consultant Mo No: 9849156381 Summary:: Placement Zone Applicant Code: C8730848-A0015014865Document5 pagesSampath G SAP BO Consultant Mo No: 9849156381 Summary:: Placement Zone Applicant Code: C8730848-A0015014865guntha2sampathNo ratings yet

- Business Intelligence Masters Program CurriculumDocument30 pagesBusiness Intelligence Masters Program CurriculumAbdul SamiNo ratings yet

- Course DA-100T00-A: Analyzing Data With Power BI: Audience ProfileDocument10 pagesCourse DA-100T00-A: Analyzing Data With Power BI: Audience ProfileAshutosh ChauhanNo ratings yet

- SpreadsheetDocument8 pagesSpreadsheetSMNo ratings yet

- DA-100 - Analyzing Data With Power BIDocument7 pagesDA-100 - Analyzing Data With Power BInareshbawankarNo ratings yet

- Financial Modeling For Mineral Project - 2022 Course FlyerDocument2 pagesFinancial Modeling For Mineral Project - 2022 Course FlyernuzululNo ratings yet

- 02 - Data Analytics Prefessional CourseDocument16 pages02 - Data Analytics Prefessional CourseSandhya Kuppala100% (1)

- jhgp5tt8 Micro Degree The Credit Analyst Course OutlineDocument9 pagesjhgp5tt8 Micro Degree The Credit Analyst Course Outlinenallafirdos786No ratings yet

- Business Analytics: Nanodegree Program SyllabusDocument12 pagesBusiness Analytics: Nanodegree Program SyllabusSmart BalaNo ratings yet

- Business Intelligence Masters Program CurriculumDocument36 pagesBusiness Intelligence Masters Program CurriculumPawan KurmiNo ratings yet

- Lecture0 INT217Document25 pagesLecture0 INT217Shubham BandhovarNo ratings yet

- Syllabus (AI - ML BlackBelt Plus Program)Document18 pagesSyllabus (AI - ML BlackBelt Plus Program)Vignesh NarasimhanNo ratings yet

- Pes University, Bangalore-85: Management StudiesDocument8 pagesPes University, Bangalore-85: Management StudiesshreeniNo ratings yet

- AnalytixLabs - Visualization & Analytics With Excel-VBA, SQL & TableauDocument16 pagesAnalytixLabs - Visualization & Analytics With Excel-VBA, SQL & TableauLavanya AnandNo ratings yet

- AAshokReddy (4 5) 5.5Document5 pagesAAshokReddy (4 5) 5.5Bali TripNo ratings yet

- Jai FM lAB FILEDocument99 pagesJai FM lAB FILEViraj SareenNo ratings yet

- Mad Ha VanDocument6 pagesMad Ha VanMadhavan13No ratings yet

- IFYP0023 Week 12 Assessment ClinicDocument37 pagesIFYP0023 Week 12 Assessment ClinicWenxinNo ratings yet

- Power BiDocument27 pagesPower BiHasnain Haider 40-FMS/BSPM/F21100% (1)

- Course Outline - OMSDocument5 pagesCourse Outline - OMSKaranNo ratings yet

- Course Outline Financial Modeling PGDMDocument5 pagesCourse Outline Financial Modeling PGDMDisha DahiyaNo ratings yet

- CB2500 Information Management ChecklistDocument8 pagesCB2500 Information Management Checklistsiu chun chanNo ratings yet

- 0.1 Course Outline SYBcom CF II 2022Document5 pages0.1 Course Outline SYBcom CF II 2022Harshit ChauhanNo ratings yet

- Brochure TableauDocument4 pagesBrochure Tableauraji0% (1)

- About Course:: Annexure: 2Document4 pagesAbout Course:: Annexure: 2anuNo ratings yet

- Business Analytics: Nanodegree Program SyllabusDocument12 pagesBusiness Analytics: Nanodegree Program SyllabusXấu Như MaNo ratings yet

- Course Description: Introduction To Data VisualizationDocument2 pagesCourse Description: Introduction To Data VisualizationVaibhav BhatnagarNo ratings yet

- IT-Data and Business AnalysisDocument15 pagesIT-Data and Business AnalysisstallionozoneNo ratings yet

- Investment Banking Institute Brochure - 1Document9 pagesInvestment Banking Institute Brochure - 1MEGNo ratings yet

- SAP BI SyllabusDocument2 pagesSAP BI SyllabusDeepu NyalakantiNo ratings yet

- Week 1lessonDocument24 pagesWeek 1lessoneugenia.borosz88No ratings yet

- Business Analytics MasterDocument19 pagesBusiness Analytics MasterGiang DoNo ratings yet

- A2-R3 SyllabusDocument4 pagesA2-R3 Syllabusapi-3782519No ratings yet

- Advanced ExcelDocument1 pageAdvanced Excelsumeet_ivyNo ratings yet

- Data Warehouse - Dimensional Modelling - Use Case Study: EwalletDocument7 pagesData Warehouse - Dimensional Modelling - Use Case Study: EwalletamritaNo ratings yet

- Data Analytics For Business Professionals SyllabusDocument4 pagesData Analytics For Business Professionals SyllabusLauren GeisNo ratings yet

- Sem IV SybafDocument15 pagesSem IV Sybafalaskhan173No ratings yet

- Enterprise Data Warehousing: Course: BI 7.0 As Application of Netweaver Type: Hands-On TrainingDocument4 pagesEnterprise Data Warehousing: Course: BI 7.0 As Application of Netweaver Type: Hands-On Trainingpooja.sagar05No ratings yet

- FTP2023 Chapter11Document6 pagesFTP2023 Chapter11Md Robin HossainNo ratings yet

- Exportable Fruits and Vegetables List - 180619 - HortexDocument5 pagesExportable Fruits and Vegetables List - 180619 - HortexMd Robin HossainNo ratings yet

- Kiwi ShirtDocument2 pagesKiwi ShirtMd Robin HossainNo ratings yet

- Labels of Polybags Aldi GBIE Shirts and Sholos - 2023!01!27Document9 pagesLabels of Polybags Aldi GBIE Shirts and Sholos - 2023!01!27Md Robin HossainNo ratings yet

- Country-Wise Fruits, Veg, Potato, Flowers, Spices - ExportDocument4 pagesCountry-Wise Fruits, Veg, Potato, Flowers, Spices - ExportMd Robin HossainNo ratings yet

- Land Port ChargesDocument5 pagesLand Port ChargesMd Robin HossainNo ratings yet

- Seminar Paper Shahnewas KabirDocument28 pagesSeminar Paper Shahnewas KabirMd Robin HossainNo ratings yet

- 11 Bangladesh3Document28 pages11 Bangladesh3Md Robin HossainNo ratings yet

- The Life of Imam Jafar Al-SadiqDocument646 pagesThe Life of Imam Jafar Al-SadiqMd Robin HossainNo ratings yet

- Imam Jafar Al-Sadiq039s A Contribution To The SciencesDocument24 pagesImam Jafar Al-Sadiq039s A Contribution To The SciencesMd Robin HossainNo ratings yet

- Bengali Forms Final VersionDocument68 pagesBengali Forms Final VersionMd Robin HossainNo ratings yet

- COMPANY PROFILE PT AISYAH CAHAYA NUSANTARA Aisyahcahaya NusantaraDocument15 pagesCOMPANY PROFILE PT AISYAH CAHAYA NUSANTARA Aisyahcahaya NusantaraMd Robin HossainNo ratings yet

- ROCKanpurFinal 30082018Document98 pagesROCKanpurFinal 30082018Md Robin HossainNo ratings yet

- 3.3 BangladeshDocument25 pages3.3 BangladeshMd Robin HossainNo ratings yet

- Soft ShirtDocument2 pagesSoft ShirtMd Robin HossainNo ratings yet

- 5 Pocket Ponte Rest of All Price Ticket BookingDocument2 pages5 Pocket Ponte Rest of All Price Ticket BookingMd Robin HossainNo ratings yet

- Barlor Top Pos Label-Ad8605180 (U01979), BG8479138 (M61701), Ad8605177 (T46883)Document7 pagesBarlor Top Pos Label-Ad8605180 (U01979), BG8479138 (M61701), Ad8605177 (T46883)Md Robin HossainNo ratings yet

- Top 20 Countries 1617 - 2122Document2 pagesTop 20 Countries 1617 - 2122Md Robin HossainNo ratings yet

- Double Standard 2Document9 pagesDouble Standard 2Md Robin HossainNo ratings yet

- Brochure 03 Tindola Kantola Brinjal (Small) Bitter GourdDocument6 pagesBrochure 03 Tindola Kantola Brinjal (Small) Bitter GourdMd Robin HossainNo ratings yet

- Fabric DefectsDocument49 pagesFabric DefectsMd Robin Hossain100% (1)

- Ar2018ultrajaya PDFDocument205 pagesAr2018ultrajaya PDFAas astrianiNo ratings yet

- Unit 3 Cost of CapitalDocument41 pagesUnit 3 Cost of CapitalVïñü MNNo ratings yet

- Chapter 4 Acctg 1 LessonDocument14 pagesChapter 4 Acctg 1 Lessonizai vitorNo ratings yet

- Chad Wilson'S Rental Property - Accounting EquationDocument5 pagesChad Wilson'S Rental Property - Accounting EquationDella TheodoraNo ratings yet

- Candor Cash Flow ExerciseDocument3 pagesCandor Cash Flow ExerciseMohammed100% (1)

- Answers Lease 1Document10 pagesAnswers Lease 1els emsNo ratings yet

- SM 13Document29 pagesSM 13wtfNo ratings yet

- Financial Statement AnalysisDocument87 pagesFinancial Statement AnalysisShreyaSinglaNo ratings yet

- 2016 Vol 1 CH 9 AnswersDocument3 pages2016 Vol 1 CH 9 Answersma quenaNo ratings yet

- AP 5904Q InvestmentsDocument6 pagesAP 5904Q InvestmentsRhea NograNo ratings yet

- Gazi Ashiqur Rahman ID: 161-11-282Document21 pagesGazi Ashiqur Rahman ID: 161-11-282FahimNo ratings yet

- Includes $2,000 Depreciation Each MonthDocument3 pagesIncludes $2,000 Depreciation Each MonthLynnard Philip Panes100% (1)

- 2022 April FarDocument23 pages2022 April FarXavier Xanders100% (2)

- Bharti Airtel DCFDocument4 pagesBharti Airtel DCFPraveen BhatiaNo ratings yet

- What Are The Practical Challenges in Implementing Ipsas? - Indonesian ExperienceDocument28 pagesWhat Are The Practical Challenges in Implementing Ipsas? - Indonesian ExperienceAdi RamasandiNo ratings yet

- Cost-Volume-Profit (CVP) Analysis: Cmu SPDocument3 pagesCost-Volume-Profit (CVP) Analysis: Cmu SPKuya ANo ratings yet

- DBA 320 Exam DecDocument12 pagesDBA 320 Exam DecMabvuto PhiriNo ratings yet

- Paper - 2: Management Accounting and Financial AnalysisDocument20 pagesPaper - 2: Management Accounting and Financial AnalysisChandana RajasriNo ratings yet

- E8-29 Segmented Income Statement: Conceptual ConnectionDocument5 pagesE8-29 Segmented Income Statement: Conceptual ConnectionDhiva Rianitha Manurung100% (1)

- Basic Concept FileDocument97 pagesBasic Concept FileArsalan AliNo ratings yet

- Institute of Chartered Accountants of PakistanDocument4 pagesInstitute of Chartered Accountants of PakistanAqib SheikhNo ratings yet

- ForewordDocument10 pagesForewordhuihihiNo ratings yet

- Sol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionDocument12 pagesSol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionCharlene Mae MalaluanNo ratings yet

- Fra - Financial Statement Analysis-An IntroducitonDocument23 pagesFra - Financial Statement Analysis-An IntroducitonSakshiNo ratings yet

- JPM MCPDocument11 pagesJPM MCPmmmansfiNo ratings yet

- Practice Problems AcctgDocument10 pagesPractice Problems AcctgRichard ColeNo ratings yet

- Unit 3 - Business Finance - AppendixDocument5 pagesUnit 3 - Business Finance - Appendixmhmir9.95No ratings yet

- Analysis SumsDocument11 pagesAnalysis SumsJessy NairNo ratings yet

- Management Accounting: Instructions To CandidatesDocument3 pagesManagement Accounting: Instructions To CandidatessumanNo ratings yet

- Allianz SE (ALVG - De) Understanding Buy-Back CapabilitiesDocument13 pagesAllianz SE (ALVG - De) Understanding Buy-Back CapabilitiesYang LiNo ratings yet