Professional Documents

Culture Documents

Summary+Document+ +Cost+of+Capital

Summary+Document+ +Cost+of+Capital

Uploaded by

PRASHANT DESHMANEOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Summary+Document+ +Cost+of+Capital

Summary+Document+ +Cost+of+Capital

Uploaded by

PRASHANT DESHMANECopyright:

Available Formats

The cost of debt is the effective interest rate that a company pays on its debts, such as

bonds and loans.

Let’s take a look at the formulas used to calculate the cost of debt:

Debt Issued at Par is given as follows:

Where,

kd = Before-tax cost of debt or the rate of return required by lenders

I = Coupon rate of interest

B0 = Issue price of the bond (debt)

INT = Amount of interest

Debt Issued at Discount or Premium is given as follows:

Where,

kd = Before-tax cost of debt or the rate of return required by lenders

B0 = Value of borrowing or debt or bond/debenture today (Cost of debt)

Bn= Repayment value of debt on maturity

INT = Amount of interest

After-tax Cost of Debt is given as follows:

© Copyright upGrad Education Pvt. Ltd. All rights reserved

After-tax cost of debt = kd (1-T)

A debt covenant is a restriction placed by the lender on the company, which restricts

certain company actions. They are legally binding agreements that are included as part of

the lending contract. Commercial banks use different types of debt covenants to reduce

the risks on their loans. Some examples of debt covenants are listed below.

Violation of Debt Covenants

Under the terms of lending agreement, a financial institution will have potential remedies

if one of the restrictions is violated. The lender could:

© Copyright upGrad Education Pvt. Ltd. All rights reserved

The cost of equity is the compensation that investors demand in exchange for investing

equity in the business. The cost can be further divided into two types.

Cost of Common Share Equity

The cost of equity is calculated by rearranging the dividend discount model.

The formula for the dividend discount model is:

© Copyright upGrad Education Pvt. Ltd. All rights reserved

This formula is rearranged to calculate the cost of equity:

Where,

PE = Share Price

Div1 = Next year’s dividend

re = Cost of equity

g = Dividend growth rate

Cost of Preference Stock Equity

The key difference between common stock and preference stock is that the holders of

preference stock are promised a fixed dividend.

The formula used to calculate preference stock is almost the same as that used for

common stock but with a slight change, as preference shares have a fixed dividend. The

growth rate is 0. So, the formula for cost of equity becomes:

Where,

Pp = Current price of preference shares

Divp = Fixed dividend

rp = Preference stock cost of equity

g = Dividend growth rate

© Copyright upGrad Education Pvt. Ltd. All rights reserved

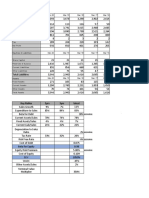

Weighted average cost of capital (WACC) is the average of the cost of debt and the cost of

capital weighted by the proportion of debt and equity. The following three components

are used to calculate the WACC:

● Cost of debt

● Cost of common share equity

● Cost of preference share equity

The formula to calculate WACC is as follows:

Weighted Average Cost of Capital (WACC) = (Cost of Debt × Weightage of Debt) + (Cost

of Equity × Weightage of Equity)

Or

Where,

re × E% = Cost of common equity times the proportion of common equity

rp × P% = Cost of preference equity times the proportion of preference equity

rdt × D% = Effective cost of debt times the proportion of debt

Rwacc = Average cost of capital

The optimal capital mix of a company refers to the best combination of debt and equity

financing that will maximise its value. Given below are the key factors that you need to

consider before finalising the debt to equity ratio for the project.

© Copyright upGrad Education Pvt. Ltd. All rights reserved

Disclaimer: All content and material on the upGrad website is copyrighted material,

belonging to either upGrad or its bona fide contributors, and is purely for the

dissemination of education. You are permitted to access, print, and download extracts

from this site purely for your own education only and on the following basis:

● You can download this document from the website for self-use only.

● Any copies of this document, in part or full, saved to disc or to any other storage

medium, may be used for subsequent, self-viewing purposes or to print an

individual extract or copy for non-commercial personal use only.

● Any further dissemination, distribution, reproduction, and copying of the content

of the document herein, or the uploading thereof on other websites, or use of the

content for any other commercial/unauthorized purposes in any way that could

infringe the intellectual property rights of upGrad or its contributors is strictly

prohibited.

● No graphics, images, or photographs from any accompanying text in this document

will be used separately for unauthorized purposes.

● No material in this document will be modified, adapted, or altered in any way.

© Copyright upGrad Education Pvt. Ltd. All rights reserved

● No part of this document or upGrad content may be reproduced or stored on any

other website or included in any public or private electronic retrieval system or

service without upGrad’s prior written permission.

● Any rights not expressly granted in these terms are reserved.

© Copyright upGrad Education Pvt. Ltd. All rights reserved

You might also like

- Nike Case AnalysisDocument9 pagesNike Case AnalysisUyen Thao Dang96% (54)

- IndofoodDocument10 pagesIndofoodzanmatto22No ratings yet

- FinShiksha - Some Common Interview QuestionsDocument12 pagesFinShiksha - Some Common Interview QuestionskaranNo ratings yet

- Technical Interview Questions - IB and S&TDocument5 pagesTechnical Interview Questions - IB and S&TJack JacintoNo ratings yet

- Project Analysis in Chocolate IndustryDocument9 pagesProject Analysis in Chocolate IndustryNeha RathoreNo ratings yet

- Session Summary Valuation of EquityDocument6 pagesSession Summary Valuation of Equityurmila ranaNo ratings yet

- Transcription+Module+Summary Docx+Document4 pagesTranscription+Module+Summary Docx+urmila ranaNo ratings yet

- Lecture 6Document26 pagesLecture 6ceyda.duztasNo ratings yet

- Profitability AnalysisDocument8 pagesProfitability AnalysisSandeep MishraNo ratings yet

- Summary+Document +Profitability+AnalysisDocument8 pagesSummary+Document +Profitability+AnalysisShafa IzwanNo ratings yet

- Quiz Chapter 9 Cheat SheetDocument2 pagesQuiz Chapter 9 Cheat SheetAnonymous wSXoP5aaNo ratings yet

- Summary+Document +Operating+Working+CapitalDocument5 pagesSummary+Document +Operating+Working+CapitalHarsh SinghalNo ratings yet

- Not Meant To Be Read Independently, But Can Be Used To Complement Your Video Watching ExperienceDocument25 pagesNot Meant To Be Read Independently, But Can Be Used To Complement Your Video Watching ExperienceDaveNo ratings yet

- International Financial Management 11 Edition: by Jeff MaduraDocument34 pagesInternational Financial Management 11 Edition: by Jeff Maduraamreena100% (1)

- WK - 5 - Cost of Capital Capital Structure PDFDocument40 pagesWK - 5 - Cost of Capital Capital Structure PDFreginazhaNo ratings yet

- Session Summary Investment DecisionsDocument9 pagesSession Summary Investment Decisionsurmila ranaNo ratings yet

- Financial Management CIA 3 - Report 1 (2Document67 pagesFinancial Management CIA 3 - Report 1 (2anushka guptaNo ratings yet

- Capital Investment Decisions: Cornerstones of Managerial Accounting, 4eDocument17 pagesCapital Investment Decisions: Cornerstones of Managerial Accounting, 4erow rowNo ratings yet

- Summary Sheet - Helpful For Retention For Cost of Capital: Important PointsDocument11 pagesSummary Sheet - Helpful For Retention For Cost of Capital: Important PointsAshutosh BarseNo ratings yet

- COst of Capital Edutap-Rbi SummaryDocument11 pagesCOst of Capital Edutap-Rbi SummaryashishNo ratings yet

- Summary Basics+ofAccountingPrinciplesDocument6 pagesSummary Basics+ofAccountingPrinciplespre.meh21No ratings yet

- International Financial Management 13 Edition: by Jeff MaduraDocument34 pagesInternational Financial Management 13 Edition: by Jeff MaduraAbdulaziz Al-amroNo ratings yet

- Advantages of Ordinary Share CapitalDocument26 pagesAdvantages of Ordinary Share CapitalMoses Bisan DidamNo ratings yet

- Topic 05 - Cost of Capital - BM18275Document6 pagesTopic 05 - Cost of Capital - BM18275ravindu 11111No ratings yet

- 3 Income+statement+and+Balance+Sheet+Document7 pages3 Income+statement+and+Balance+Sheet+Abhinay KumarNo ratings yet

- Cost of Capital - I l7Document23 pagesCost of Capital - I l7Adityaraj PhadnisNo ratings yet

- Cost of Capital: Prof. V. Ramachandran Faculty-SiescomsDocument36 pagesCost of Capital: Prof. V. Ramachandran Faculty-SiescomsManthan KulkarniNo ratings yet

- CH 11Document39 pagesCH 11Najmul Joy100% (1)

- VR - Cost of CapitalDocument36 pagesVR - Cost of CapitalkjohnabrahamNo ratings yet

- Cost of CapitalDocument15 pagesCost of CapitalShainaNo ratings yet

- Cost of Capital: VALMET530Document34 pagesCost of Capital: VALMET530Khim Ziah Velarde BarzanasNo ratings yet

- Weighted Average Cost of CapitalDocument20 pagesWeighted Average Cost of CapitalSamuel NjengaNo ratings yet

- Cost of CapitalDocument12 pagesCost of CapitaltushargkambliNo ratings yet

- Cost of Equity Shares Posted byDocument5 pagesCost of Equity Shares Posted bynafis20No ratings yet

- COST OF CAPITAL SifDocument12 pagesCOST OF CAPITAL SifSardar FaaizNo ratings yet

- Cost of Capital: Concept, Components, Importance, Example, Formula and SignificanceDocument72 pagesCost of Capital: Concept, Components, Importance, Example, Formula and SignificanceRamya GowdaNo ratings yet

- M09 Gitman50803X 14 MF C09Document56 pagesM09 Gitman50803X 14 MF C09Joan MarieNo ratings yet

- COST OF CAPITAL Notes QnsDocument17 pagesCOST OF CAPITAL Notes QnschabeNo ratings yet

- 09 - Chapter 9 Cost of CapitalDocument56 pages09 - Chapter 9 Cost of Capitalhunkie100% (1)

- Cost of Capital Reviewer For Financial Management IDocument56 pagesCost of Capital Reviewer For Financial Management Ikimjoonmyeon22No ratings yet

- Fin440 Chapter 14 v.2Document36 pagesFin440 Chapter 14 v.2Lutfun Nesa AyshaNo ratings yet

- M2+ +Case+Study+ +Summary+DocDocument5 pagesM2+ +Case+Study+ +Summary+DocAradhna PandeyNo ratings yet

- EVA Approach: Calculation of Economic Value Added (EVA)Document4 pagesEVA Approach: Calculation of Economic Value Added (EVA)Lakshmi BaiNo ratings yet

- Consummer and Producer TheoryDocument7 pagesConsummer and Producer TheoryAlpesh KhilariNo ratings yet

- Cost of CapitalDocument54 pagesCost of Capitali_jibran2834No ratings yet

- Unit 2Document5 pagesUnit 2Aditya GuptaNo ratings yet

- CFA Level 1 Corporate Finance E Book - Part 2Document31 pagesCFA Level 1 Corporate Finance E Book - Part 2Zacharia VincentNo ratings yet

- Cost of CapitalDocument55 pagesCost of CapitalSaritasaruNo ratings yet

- Cost of Capital 1Document23 pagesCost of Capital 1shaahmookhanNo ratings yet

- F FM Coc 09.03.22Document19 pagesF FM Coc 09.03.22Yash PokernaNo ratings yet

- Chap 014Document37 pagesChap 014Malak W.No ratings yet

- Session Summary ValuationDocument6 pagesSession Summary Valuationurmila ranaNo ratings yet

- Chapter 3 Cost of CapitalDocument30 pagesChapter 3 Cost of CapitalMELAT ROBELNo ratings yet

- Cost of Capital: Dr. Md. Anwar Ullah, FCMA Southeast UniversityDocument23 pagesCost of Capital: Dr. Md. Anwar Ullah, FCMA Southeast Universityasif rahanNo ratings yet

- Chapter 10 The Cost of CapitalDocument32 pagesChapter 10 The Cost of CapitalSaurabh PandeyNo ratings yet

- Cost of Capital - New (With WACC)Document15 pagesCost of Capital - New (With WACC)Hari chandanaNo ratings yet

- Cost of Capital - To SendDocument44 pagesCost of Capital - To SendTejaswini VashisthaNo ratings yet

- Cost of CapitalDocument27 pagesCost of CapitalShashank PandeyNo ratings yet

- CH 5 Cost of Capital Theory (510139)Document10 pagesCH 5 Cost of Capital Theory (510139)Syeda AtikNo ratings yet

- Session Summary Valuation of EnterpriseDocument10 pagesSession Summary Valuation of Enterpriseurmila ranaNo ratings yet

- Studentschapter 12Document34 pagesStudentschapter 12Bich VietNo ratings yet

- 10 Pdfsam EDITED UOL FM Topic 9 PostedDocument85 pages10 Pdfsam EDITED UOL FM Topic 9 PostedEmily TanNo ratings yet

- Cost of Capital - 103039Document10 pagesCost of Capital - 103039EuniceNo ratings yet

- Tugas Akhir GGRMDocument34 pagesTugas Akhir GGRMFairly 288No ratings yet

- Financial Management IDocument58 pagesFinancial Management Igelango124419No ratings yet

- INSEAD - Master in FinanceDocument25 pagesINSEAD - Master in FinanceJM KoffiNo ratings yet

- 2nd Year English (MCO)Document9 pages2nd Year English (MCO)Kksia AroraNo ratings yet

- 2017-11-16 Independent Expert Report EDocument35 pages2017-11-16 Independent Expert Report EAli Gokhan KocanNo ratings yet

- Beta in FinanceDocument47 pagesBeta in FinanceRitika IsraneyNo ratings yet

- Blcok-4 MCO-7 Unit-2 PDFDocument17 pagesBlcok-4 MCO-7 Unit-2 PDFSoitda BcmNo ratings yet

- Chapter 4 Free Cash Flows To Equity FrimDocument22 pagesChapter 4 Free Cash Flows To Equity FrimMeena MkNo ratings yet

- Project Investment Appraisal ProcessDocument24 pagesProject Investment Appraisal Processsowra vsahaNo ratings yet

- FIN3403 Exam 4 PracticeDocument8 pagesFIN3403 Exam 4 Practicek10924No ratings yet

- Jun 2007 - AnsDocument10 pagesJun 2007 - AnsHubbak KhanNo ratings yet

- Financial ManagementDocument16 pagesFinancial ManagementManish FloraNo ratings yet

- النسب المالية - إنجليزىDocument5 pagesالنسب المالية - إنجليزىMohamed Ahmed YassinNo ratings yet

- Mca - 204 - FM & CFDocument28 pagesMca - 204 - FM & CFjaitripathi26No ratings yet

- Importance of Cost of CapitalDocument2 pagesImportance of Cost of CapitalSigei Leonard100% (2)

- Review Class For Final Exam 2016, For Moodle, With SolutionDocument17 pagesReview Class For Final Exam 2016, For Moodle, With SolutionMaxNo ratings yet

- Ezz Steel Report.eDocument14 pagesEzz Steel Report.eIsrael Sodium JobNo ratings yet

- CIMA F2 Notes 2018 PDFDocument154 pagesCIMA F2 Notes 2018 PDFsolstice567567No ratings yet

- Equity ValuationDocument18 pagesEquity ValuationsharmilaNo ratings yet

- Corporate GovernanceDocument19 pagesCorporate GovernanceNadeem GanaiNo ratings yet

- Capital Structure Decisions in Financial ManagementDocument52 pagesCapital Structure Decisions in Financial ManagementAnkit LakhaniNo ratings yet

- CF2 - Chapter 2 Capital Structure - SVDocument45 pagesCF2 - Chapter 2 Capital Structure - SVleducNo ratings yet

- Financial Management 2: Capital Budgeting Problems and Exercises PART 1 Problems Problem 1Document7 pagesFinancial Management 2: Capital Budgeting Problems and Exercises PART 1 Problems Problem 1Robert RamirezNo ratings yet

- Key Ratios 5yrs 3yrs Latest: Sales Other Income Total Income Total Expenditure Ebit Interest Tax Net ProfitDocument2 pagesKey Ratios 5yrs 3yrs Latest: Sales Other Income Total Income Total Expenditure Ebit Interest Tax Net ProfitmohithNo ratings yet

- CH 14Document16 pagesCH 14جمالعبدالحميدالبرباويNo ratings yet

- Risks and Cost of CapitalDocument8 pagesRisks and Cost of CapitalSarah BalisacanNo ratings yet