Professional Documents

Culture Documents

Transfer Tax

Uploaded by

darlene floresCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Transfer Tax

Uploaded by

darlene floresCopyright:

Available Formats

TAX “Innovating

TRANSFER TAXATION Educational

Services”

KHEEN V. BATINGAL

REVIEW NOTES

I. INTRODUCTION TO TRANSFER TAXATION

a. Concept of transfer and types of transfers

i. Concept – Transfers refers to any transmission of property from

one person to another.

ii. Types of transfers:

1. Bilateral transfers – transmission of property for

consideration. (Onerous transactions or exchanges).

2. Unilateral transfers – transmission of property by a

person without consideration. (Gratuitous transactions or

transfers).

a. Donation – gratuitous transfer of property from a

living donor to a donee

b. Succession – gratuitous transfer of property

from a deceased person upon death to his/her

heirs

3. Complex transfers – transfers for less than full and

adequate consideration.

Exception: A sale, exchange, or other transfer made in

the ordinary course of business shall be considered as

made for an adequate and full consideration.

iii. Types of transfer taxes

1. Donor’s tax – tax on donation (donation inter vivos)

2. Estate tax – tax on succession (donation mortis causa)

iv. Basis of transfer taxation

1. Tax evasion or minimization theory

2. Tax recoupment theory

3. Benefit received theory

4. State partnership theory

5. Wealth redistribution theory

6. Ability to pay theory

b. General rule in transfer taxation

i. Classification of transfer taxpayers

1. Resident citizens, resident aliens, and non-resident

citizens – subject to tax on all transfers of properties

regardless of their location

www.certsedu.tech Agamata CERTS Online CPA Review 1

TAX TRANSFER TAXATION

2. Non-resident aliens – taxable only on properties

transferred with situs within the Philippines

ii. Test of classification for juridical persons

1. Residency – fixed or principal place of business

2. Citizenship – incorporation test

iii. Situs of properties – important for non-resident aliens and

computation of tax credit for foreign taxes paid. The following

properties are considered located in the Philippines:

1. Franchise exercisable in the Philippines

2. Shares, obligations, or bonds issued by any corporation

or sociedad anonima organized or constituted in the

Philippines in accordance with its laws

3. Shares, obligations, or bonds issued by any foreign

corporation 85% of the business of which is located in

the Philippines

4. Shares, obligations, or bonds issued by any foreign

corporation if such shares, obligations, or bonds have

acquired business situs in the Philippines

5. Shares or rights in any partnership, business or industry

established in the Philippines

6. Any personal property, whether tangible or intangible,

located in the Philippines

iv. Reciprocity rule on non-resident aliens – intangible personal

properties of non-resident aliens (NRAs) are exempt from

Philippine transfer tax if the country in which such NRA is a

citizen and resident also exempts the intangible personal

properties of Filipino non-residents therein from transfer taxes

v. Timing of valuation of transfers

1. Donation inter vivos – valued at the date of perfection

of the donation

2. Donation mortis causa – valued at the date of death

vi. Classifying donation as inter vivos or mortis causa

1. Donation mortis causa:

a. Transfers in contemplation of death

b. Transfers intended to take effect upon death

2. Donation inter vivos:

a. Motives associated with life

b. Transfers intended to take effect during the

lifetime of the donor

www.certsedu.tech Agamata CERTS Online CPA Review 2

TAX TRANSFER TAXATION

c. Non-taxable transfers

i. Void transfers – those that are prohibited by law or those that

do not conform to legal requirements for their validity

ii. Quasi-transfers – transmissions of property which do not

involve transfer of ownership

iii. Incomplete transfers – transmission or delivery of properties

from one person to another, but ownership is not transferred at

the point of delivery

1. Conditional transfers

2. Revocable transfers

3. Transfer in contemplation of death

4. Transfers with reservation of title to property until death

d. Completion of incomplete transfers (point of taxability)

i. Completed inter vivos

1. Conditional transfers

a. fulfillment of the condition by the transferee

b. waiver of the same by the transferor

2. Revocable transfers

a. waiver by the transferor to exercise his right of

revocation

b. the lapse of his reserved right to revoke

ii. Completed mortis causa

1. Transfers in contemplation of death & transfers with

reservation of title to property until death –

completed by the death of the decedent

2. Conditional transfers & revocable transfers – pre-

terminated by the death of the decedent

e. Complex incomplete transfers

i. Valuation rules

1. Donation inter vivos – fair value at the date of

completion of transaction less the consideration given

2. Donation mortis causa – fair value at the date of death

less consideration given at the date of transfer

ii. Test of taxability

1. The incomplete transfer must have been paid for less

than full and adequate consideration at the date of

delivery of the property

2. The property must not have decrease in value less than

the consideration paid at the completion of the transfer

www.certsedu.tech Agamata CERTS Online CPA Review 3

TAX TRANSFER TAXATION

II. ESTATE TAX

a. Principles, concepts involving estate taxation

i. Concept of succession and its types

1. Concept of succession – Succession is a mode of

acquisition by virtue of which the property, rights, and

obligations to the extent of the value of the inheritance,

of a person are transmitted through his death to another

or others either by his will or by operation of law. (Article

774, Civil Code)

2. Types of succession

a. Testate. Voluntary or testamentary – A

succession carried out according to the wishes

of the testator expressed in a will executed in

the form prescribed by law.

b. Intestate, involuntary or legal – A succession

with an invalid will or without a will, thus giving

rise to a succession by operation of law.

c. Mixed – A succession which is effected partly by

will and partly by operation of law.

ii. Concept and types of will

1. Concept – An act whereby a person is permitted, with

the formalities prescribed by law, to control to a certain

degree the disposition of this estate, to take effect after

his death. (Article 783, Ibid)

2. Types of will

a. Holographic will – A will which is entirely

written, dated, and signed by the hand of the

testator himself, without the need of witnesses.

b. Notarial, ordinary or attested will – One which

is executed in accordance with the formalities

prescribed by the new civil code.

c. Codicil – A supplement or addition to a will,

made after the execution of a will and annexed

to be taken as a part thereof, by which

disposition made in the original will is explained,

added to, or altered.

iii. Nature of succession

1. Succession is gratuitous transmission of property from a

deceased person in favor of his successors.

2. Succession involves only the net properties of the

decedent.

www.certsedu.tech Agamata CERTS Online CPA Review 4

TAX TRANSFER TAXATION

iv. Elements of succession

1. Decedent – the person who dies and whose properties,

rights and obligations are transmitted. A decedent who

left a will is called a testator.

2. Estate – the properties, rights and obligations which are

the subject matter of the succession.

3. Heirs/successors – the person to whom the properties,

rights and obligations of the decedent will pass. They are

also known as the beneficiaries.

v. Types of heirs

1. Compulsory heirs – they are entitled to their share in

the estate, with or without a will, unless validly

disinherited or has repudiated his/her share in the

inheritance. Decedents can disinherit an heir on certain

grounds allowable by law, and similarly, heirs can

repudiate their share in the inheritance of the decedent.

a. Primary heirs – legitimate children and

descendants

b. Secondary heirs – legitimate/illegitimate

parents and ascendants

c. Concurring heirs – widow/widower and

illegitimate descendants

2. Voluntary hers – they inherit only if their names are

provided in the will.

vi. Portions of estate for testamentary successions:

1. Legitime – the portion of the testator’s property which

could not be disposed of freely because the law has

reserved it for the compulsory heirs.

2. Free portion – the part of the whole estate which the

testator could dispose of freely through written will

irrespective of his relationship to the recipient.

vii. Intestate succession – in default of testamentary succession,

the following heirs in their order of priority shall be entitled to

claim the inheritance left by the decedent:

1. Concurring heirs and,

a. Descendants, or in their default,

b. Ascendants

2. Relatives in the collateral line up to fifth (5 th) degree of

consanguinity

3. State

www.certsedu.tech Agamata CERTS Online CPA Review 5

TAX TRANSFER TAXATION

viii. Other persons in succession

1. Legatee – a person whom gifts of personal property is

given by virtue of a will

2. Devisee – a person whom gifts of real property is given

by virtue of a will

3. Executors – a person named by the decedent who shall

carry out the provisions of his will

4. Administrators – a person appointed by the court to

manage the distribution of the estate of the decedent

ix. Estate Taxation

Estate taxation pertains to the taxation of the gratuitous transfer

of properties of the decedent to the heirs upon the decedent’s

death.

Estate taxation is governed by the law in force at the time of the

decedent’s death.

x. Estate tax

1. Definition – an excise tax imposed upon the privilege of

transmitting property at the time of death and on the

privilege that a person is given in controlling to a certain

extent the disposition of his property to take effect upon

death. Estate tax laws rest in their essence upon the

principle that death is the generating source from which

the taxing power takes it being, and that it is the power

to transmit or the transmission from the death to the

living on which the tax is more immediately based.

(Lorenzo vs. Posadas, 64 Phil. 353)

2. Nature of estate tax – it is not a tax on property

because their imposition does not rest upon general

ownership but rather, they are privilege tax since they

are imposed on the act of passing ownership of property.

3. Characteristics of estate tax

a. It is a transfer tax

b. It is an ad valorem tax

c. It is a national tax

d. It is a general tax

e. It is a direct tax

f. It is an excise tax

www.certsedu.tech Agamata CERTS Online CPA Review 6

TAX TRANSFER TAXATION

4. Requisites for imposition of estate tax

a. Death of decedent

b. Successor is alive at the time of decedent’s

death

c. Successor is not disqualified to inherit

5. Purpose and object of estate tax

a. To generate additional revenue for the

government

b. To compensate the government for the

protection given to the decedent that enabled

him to prosper and accumulate wealth

c. Remove the disparity in the tax treatment of a

sale and transfer by death

6. Theories on the purposes of estate tax

a. Benefits-protection

b. Privilege or state-partnership

c. Ability to pay

d. Redistribution of wealth

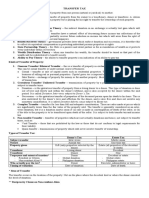

xi. Estate Tax Model

Gross estate XXX,XXX

Less: Deductions from gross estate XXX,XXX

Net taxable estate XXX,XXX

b. Transfers which may be considered donation mortis causa

i. Transfers in contemplation of death

ii. Transfers intended to take effect upon death

iii. Conditional transfers and revocable transfers which are pre-

terminated by the death of the decedent

c. Classification of decedents

i. Resident citizen, non-resident citizen and resident alien

decedents – taxable on properties located within or outside the

Philippines

ii. Non-resident alien decedents – taxable only on properties

located in the Philippines, except intangible personal property

when the reciprocity rules apply

d. Gross estate

i. Concept of gross estate

Residents NRA without NRA with

or citizens reciprocity reciprocity

Property location Within Outside Within Outside Within Outside

www.certsedu.tech Agamata CERTS Online CPA Review 7

TAX TRANSFER TAXATION

Real properties ✓ ✓ ✓ X ✓ X

Personal properties

- Tangible ✓ ✓ ✓ X ✓ X

- Intangible ✓ ✓ ✓ X X X

ii. Gross estate formula

Inventory of properties at the point of death XXX,XXX

Less: Exempt transfers

Properties not owned XXX,XXX

Properties owned but excluded by law XXX,XXX XXX,XXX

Inventory of taxable present properties XXX,XXX

Add: Taxable transfers XXX,XXX

Gross estate XXX,XXX

iii. Exempt transfers

1. Transfers of properties not owned by the decedent

a. Merger of the usufruct in the owner of the naked

title

b. The transmission or delivery of the inheritance

or legacy by the fiduciary heir or legatee to the

fideicommissary

c. The transmission from the first heir, legatee, or

donee in favor or another beneficiary, in

accordance with the desire of the predecessor

d. Proceeds of irrevocable life insurance policy

payable to beneficiary other than the estate,

executor or administrator

e. Properties held in trust by the decedent

f. Separate properties of the surviving spouse of

the decedent

g. Transfer by way of bona fide sales

2. Properties owned but excluded by law from estate

tax

a. Proceeds of group insurance taken out by a

company for employees

b. Proceeds of GSIS policy or benefits from GSIS

c. Accruals from SSS

d. United States Veterans Administration (USVA)

benefits

e. War damage payments

f. All bequests, devises, legacies or transfers to

social welfare, cultural and charitable

institutions, no part of net income of which

www.certsedu.tech Agamata CERTS Online CPA Review 8

TAX TRANSFER TAXATION

inured to the benefit of any individual; provided,

however, that not more than 30% of the said

bequest, devises, legacies or transfers shall be

used by such institutions for administration

purposes

g. Acquisitions and/or transfers expressly declared

as non-taxable by law

iv. Taxable transfers

1. Transfers in contemplation of death

a. Transfers of property to take effect in

possession or enjoyment after death

b. Transfer or property with retention of possession

or enjoyment or right over income of the

property until death

c. Transfer of property with retention of the right to

designate, alone or in conjunction with any

person, the person who shall enjoy the property

and the income therefrom

2. Revocable transfers, including conditional transfers

3. Transfer with retention or reservation of certain rights

4. Transfers under the general power of appointment

v. Composition of gross estate

1. Properties, movable or immovable, tangible or intangible

2. Decedent’s interest on properties

3. Proceeds of life insurance:

a. designated as revocable to any heir

b. regardless of designation, if the beneficiary is

the estate, administrator or executor

4. Taxable transfers

vi. Valuation of the gross estate

1. General valuation rules

a. Fair value at the time of death

b. Fair value set by laws and revenue regulations

c. In default of any laws and revenue regulations,

fair value according to GAAP

d. Encumbrances and decreases in values after

death are ignored

www.certsedu.tech Agamata CERTS Online CPA Review 9

TAX TRANSFER TAXATION

2. Specific valuation rules – all at the date of death of the

decedent

Property Valuation

Real properties Higher between Zonal value or Assessed value

Preferred shares Par value

Unlisted common Book value (unadjusted)

shares

Listed common Arithmetic mean between highest & lower quotation

shares

Usufruct and Present value with interest rate and period approved by Secretary of

annuities Finance, upon recommendation by the Insurance Commissioner

Newly purchased Purchase price (Secondhand value if not newly acquired)

property

Pawned Grossing up pawn value by loan-to-value ratio

properties

Financial Face amount plus accrued interests

instruments

Foreign currency Prevailing exchange rate

vii. Composition of gross estate for married decedents

1. Exclusive properties of the decedent

2. Conjugal/common properties of the spouse

viii. Common types of property regimes

1. Absolute separation of property (ASP)

2. Conjugal partnership of gains (CGP)

3. Absolute community of property (ACP)

4. Local customs

ix. Applicable property regime in default of an agreement

1. Marriages celebrated before August 3, 1988 – Conjugal

partnership of gains

2. Marriages celebrated on or after August 3, 1988 –

Absolute Community of Property

x. Conjugal partnership of gains

Before marriage During marriage

Husband’s property Exclusive

Wife’s property Exclusive

Properties acquired by inheritance & donation Exclusive

during marriage

Other properties acquired during marriage Conjugal

www.certsedu.tech Agamata CERTS Online CPA Review 10

TAX TRANSFER TAXATION

Income from exclusive properties Conjugal

Income from conjugal properties Conjugal

xi. Absolute community of properties

Before marriage During marriage

Husband’s property Community

Wife’s property Community

Property from previous Exclusive

marriage

Properties acquired by inheritance & donation Exclusive

during marriage

Properties of personal exclusive use of either Exclusive

spouse, except jewelry

Other properties acquired during marriage Community

Income from exclusive properties Exclusive

Income from community properties Community

xii. Acquisition of exempt properties – included as exclusive or

common properties of the spouses but shall be excluded in the

computation of the gross estate

e. Deductions from gross estate

i. Concepts and principles of deductions

1. Concept of deductions – refers to amount, which are

subject to limitations by the Tax Code, which either

actually reduces the estate or in a form of incentives

provided, to determine the net taxable estate.

Conjugal/

Exclusive Communal Total

Gross Estate XXX,XXX XXX,XXX XXX,XXX

Less: Ordinary deductions XXX,XXX XXX,XXX XXX,XXX

Estate after Ordinary Deductions XXX,XXX XXX,XXX XXX,XXX

Less: Special deductions XXX,XXX

Net Estate XXX,XXX

Less: Share of the Surviving Spouse x½ XXX,XXX

Net Taxable Estate XXX,XXX

2. Principles of deductions

a. The substantiation rule – items of deduction

must be supported with either documentary

evidence or legal basis to establish their validity

b. Matching principle – proper classification and

categorization of deduction.

www.certsedu.tech Agamata CERTS Online CPA Review 11

TAX TRANSFER TAXATION

c. “No double claim” rule – items of deduction

shall not be claimed simultaneously under

several deduction categories

d. Default presumption on ordinary deduction –

in cases of married decedents, ordinary

deductions are presumed to be against the

common properties unless proven to be an

exclusive property of either spouse

e. Qualified deductions for Nonresident aliens –

No deduction shall be allowed in case of a non-

resident alien decedent, unless the executor,

administrator, or anyone of the heirs, includes in

the return the value at the time of the decedent’s

death that part of his gross estate not situated in

the Philippines

3. Classification of deductions

a. Ordinary deductions – generally those items

that diminish the amount of inheritance, except

for “property previously taxed” which is a

deduction incentive

b. Special deductions – generally those that are

deduction incentives, thus will result only to the

reduction of the net taxable estate, but not to

diminish the amount of inheritance

c. Share of the surviving spouse – interest of the

surviving spouse in the net conjugal or

communal properties of the spouses.

ii. Ordinary deductions

1. Losses, Indebtedness and Taxes (LIT)

a. Losses

i. Concept – These pertain to losses of

properties of the estate during the

settlement of the estate.

ii. Requisites for deductibility:

1. Loss must be a sustained

casualty loss

2. The loss must occur during the

settlement of the estate up to

the deadline of the estate tax

return

www.certsedu.tech Agamata CERTS Online CPA Review 12

TAX TRANSFER TAXATION

3. The loss must not be

concurrently claimed in the

income tax return

iii. Claims against insolvent persons

(Bad debts) – a form of loss but is

presented as a separate item of

deduction in the tax return.

iv. Classification of Losses – classified

based on the “Property classification

Rule.”

b. Claims against the estate (Indebtedness)

i. Concept – The word “claims” as used in

the statute is generally construed to

mean debts or demands of a pecuniary

nature which could have been reduced

to simple money judgments (RAMO 1-

80).

ii. Requisites of deductibility of claims

against the estate:

1. The liability represents a

personal obligation of the

deceased existing at the time of

his death except unpaid medical

expenses

2. The liability was contracted in

good faith and for adequate and

full consideration in money or

money’s worth

3. The claim must be a debt or

claim which is valid in law and

enforceable in court

4. The indebtedness must not

have been condoned by the

creditor or the action to collect

from the decedent must not

have prescribed

www.certsedu.tech Agamata CERTS Online CPA Review 13

TAX TRANSFER TAXATION

iii. Classification Rules:

1. Family benefit rule – if the

obligation was contracted or

incurred for the benefit of the

family, the claim shall be

classified as deduction against

common property.

2. Property classification rule –

if the family benefit rule is

inapplicable, the claims follow

the classification of the relevant

property.

iv. Special rules on certain claims

against the estate:

1. Unpaid mortgage – this

includes mortgage upon, or any

indebtedness, with respect to

property where the value of the

decedent’s interest therein,

undiminished by such mortgage

or indebtedness, is included in

gross estate.

2. Unpaid taxes – this include

national internal revenue taxes

which have accrued as of the

death of the decedent and

which were unpaid as of the

time of death.

3. Accommodation loan –

presented as a receivable in the

gross estate and is presented

as a deduction.

v. Substantiation Requirements:

1. Simple loan and advances

a. The debt instrument

must be duly notarized

at the time the

indebtedness was

incurred, except for

loans granted by

financial institutions

where notarization is

not part of the business

www.certsedu.tech Agamata CERTS Online CPA Review 14

TAX TRANSFER TAXATION

practice/policy of the

financial institution-

lender

b. A duly notarized

Certification from the

creditor as to the unpaid

balance of the debt,

including interest as of

the time of death

c. Proof of financial

capacity of the creditor

to lend the amount at

the time the loan was

granted, as well as its

latest audited balance

sheet with a detailed

schedule of its

receivable showing the

unpaid balance of the

decedent debtor

d. A statement under oath

executed by the

administrator or

executor of the estate

reflecting the disposition

of the proceeds of the

loan if said loan was

contracted within three

(3) years prior to the

death of the decedent

2. Purchase of goods or

services

a. Pertinent documents

evidencing the

purchase of goods or

services as duly

acknowledged,

executed, and signed

by the decedent and the

creditor, such as:

i. Sale of goods –

sales invoice/

delivery receipt

www.certsedu.tech Agamata CERTS Online CPA Review 15

TAX TRANSFER TAXATION

ii. Sale of services

– contract for

the services

agreed to be

rendered

b. Statement of account

given by the creditor as

duly received by the

decedent-debtor

c. Duly notarized

Certification from the

creditor as to the unpaid

balance of the debt

including interest as of

the time of death

d. Certified true copy of

the latest audited

balance sheet of the

creditor with a detailed

schedule of its

receivable showing the

unpaid balance of the

decedent-debtor

3. Where the settlement is made

through the Court in a testate or

intestate proceeding, pertinent

documents filed with the Court

evidencing the claims against

the estate, and the Court Order

approving the said claims, if

already issued, in addition to the

documents mentioned in the

preceding paragraphs

c. Rule on claimable losses, indebtedness and

taxes:

i. Residents or citizens – claimable in full

ii. Nonresident aliens – claimable pro

rata, if gross estate not situated in the

Philippines is also disclosed or reported

in the estate tax return, otherwise, not

deductible

www.certsedu.tech Agamata CERTS Online CPA Review 16

TAX TRANSFER TAXATION

Philippine gross estate

x Losses, indebtedness, & taxes = Claimable LIT

World gross estate

2. Transfers for Public Use – includes the amount of all

bequests, legacies, devises or transfer to or for the use

of the Government of the Republic of the Philippines, or

any political subdivision thereof, for the exclusive public

purposes.

3. Property Previously Taxed (Vanishing Deductions)

a. Concept – Vanishing deduction is an incentive

available to the estate who received certain

properties through gratuitous transfer, which

was previously subjected to transfer tax, within a

short period

b. Requisites of vanishing deduction:

i. The present decedent must have died

within FIVE (5) years from date of

acquisition of property by gratuitous

transfer

ii. The property with respect to which the

deduction is claimed must have been

part of the gross estate SITUATED IN

THE PHILIPPINES of the prior decedent

or taxable gift of the donor

iii. The property must be identified as the

same property received from prior

decedent or donor or the one received

in exchange thereof

iv. The taxes on the transmission from

previous donor or decedent of such

property must have been finally

determined and paid

v. No vanishing deduction on the property

or the property in exchange thereof was

allowed to the prior estate

c. Steps in computing for vanishing deduction:

i. Determine the initial value (lower of

FMV at date of previous transfer & FMV

at date of death of current decedent)

www.certsedu.tech Agamata CERTS Online CPA Review 17

TAX TRANSFER TAXATION

ii. Determine the initial basis

Initial value P xxx,xxx

Less: Indebtedness

assumed and paid

before death xxx,xxx

Initial basis P xxx,xxx

iii. Determine the final basis

Initial basis P xxx,xxx

Less:

(Initial basis/Gross estate)

x (LIT + TPU) xxx,xxx

Final basis P xxx,xxx

iv. Determine the vanishing deduction

Final basis P xxx,xxx

Vanishing percentage xx%

Vanishing deduction P xxx,xxx

100% - within 1 year;

80% - within 2 years;

60% - within 3 years;

40% - within 4 years;

20% - within 5 years

iii. Special deductions

1. Family home

a. Concept – Family home deduction refers to the

value of the family home, which includes the

dwelling house, and the land on which it is

situated, where the decedent and/or members of

his family reside, which is claimable as an

incentive by the Tax Code

b. Requisites for deduction of family home

i. The family home must be the actual

residential home of the decedent and

his family at the time of his death, as

certified by the Barangay Captain of the

locality where the family home is

situated;

ii. The total value of the family home must

be included as part of the gross estate

of the decedent; and,

iii. The allowable deduction must not

exceed the lowest among the current

fair market value of the family home as

declared or included in gross estate, or

www.certsedu.tech Agamata CERTS Online CPA Review 18

TAX TRANSFER TAXATION

the extent of the decedent’s interest

therein, or P10,000,000.

iv. Claimable only by married decedents

and single decedents who are heads of

their families

2. Standard deduction – a deduction incentive allowable

to the estate without the need of substantiation. A

standard deduction of P5,000,000 shall be allowed to

resident and citizen decedents and P500,000 for non-

resident alien decedents, which both shall be claimed in

full against the gross estate.

3. Benefits under RA No. 4917 – NIRC provides that any

amount received by the heirs from the decedent’s

employer as a consequence of the death of the

decedent-employee in accordance with RA No. 4917 is

allowed as a deduction provided that the amount of the

separation benefit is included as part of the gross estate

of the decedent. (NOTE: Benefit under RA No. 4917

shall be totally exempt from tax)

iv. Share of surviving spouse – one-half of the net conjugal or

community properties of the spouses.

Basis – After deducting the allowable deductions appertaining to

the conjugal or community properties included in the gross

estate, the share of the surviving spouse must be removed to

ensure that only the decedent’s interest in the estate is taxed

(RR No. 2-2003).

v. Rules on claimable deductions per decedent classifications

Residents or Non-resident

Citizens Aliens

Ordinary deductions

Losses Yes

Claims against the estate Yes Pro-rated

Indebtedness Yes Amount

Taxes Yes

Transfer for public use Yes Yes

Vanishing deductions Yes Yes

Special deductions

Family home Yes No

Standard deductions P5,000,000 P500,000

www.certsedu.tech Agamata CERTS Online CPA Review 19

TAX TRANSFER TAXATION

Benefits under RA 4917 Yes No

Share of the surviving spouse Yes Yes

f. Net estate and net taxable estate

i. Determination of the net taxable estate

1. Step 1: Enumerate all the items of inclusion in the gross

estate of the decedent

2. Step 2: Determine the classification of the decedent

(whether resident/citizen or non-resident alien and

whether single or married)

3. Step 3: Classify the items of gross estate into its situs

classification per country (if applicable) and property

regime classification (whether paraphernal, capital or

common/conjugal)

4. Step 4: Enumerate all the items of deduction from gross

estate and classify them accordingly per situs and

property regime classification

5. Step 5: Compute the net taxable estate

ii. Determination of the net estate per country

1. Residents/citizens (for tax credit purposes):

a. Rule on ordinary deductions – classification

rule shall be followed

b. Rule on special deductions:

i. Family home – Within the Philippines

ii. Standard deduction – pro-rated based

on gross estate

2. Non-resident alien (for determination of net

Philippine estate):

a. LIT – pro-rated based on gross estate

b. Other ordinary deductions – property

classification rule shall be followed

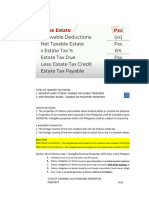

g. Tax due and tax credits, if applicable

i. Determination of tax due

Multiply by the net taxable estate by 6% to determine the total

estate tax due.

ii. Determination of foreign tax credit

1. Available only to the estate of resident and citizen

decedents

2. The tax credit is the lower between the actual foreign

estate tax paid or the ratio of the tax due from the foreign

sourced net estate over the total (world) net estate

www.certsedu.tech Agamata CERTS Online CPA Review 20

TAX TRANSFER TAXATION

3. For multiple foreign countries, the lower of actual estate

tax and the foregoing limit for each country is determined

first. The final foreign tax credit shall be the lower of the

total of the tax credit allowable per country and the world

estate tax credit limit.

Foreign net taxable estate

x Philippine estate tax due

World net taxable estate

Total foreign net taxable estate

x Philippine estate tax due

World net taxable estate

h. Tax return preparation and filing and tax payments

i. Mode of filing of tax returns

1. Manual filing system

2. e-BIR Forms

3. Electronic Filing and Payment System (eFPS)

ii. Venue and time of filing of tax returns

1. Venue of filing

a. For resident decedents – the administrator or

executor shall register the estate of the

decedent and secure a new TIN therefor from

the RDO where the decedent is domiciled at the

date of his death

b. For non-resident decedents – whether non-

resident citizen or alien with executor or

administrator in the Philippines, the estate tax

return shall be filed and a new TIN shall be

secured from the RDO where such executor or

administrator is registered. If he is not

registered, the return shall be filed and new TIN

shall be secured from the RDO having

jurisdiction of his legal residence.

2. Where to file the estate tax returns?

a. Accredited agent bank

b. Revenue district office

c. Collection agent

d. Duly authorized treasurer of the city or

municipality in which the decedent or

administrator was domiciled at the time of his

death

e. Office of the commissioner, if the administrator

or executor has no legal residence in the

Philippines

www.certsedu.tech Agamata CERTS Online CPA Review 21

TAX TRANSFER TAXATION

3. Deadline of filing the estate tax return – shall be filed

within one year after the date of death

4. Extension of filing – The commissioner is authorized to

grant, in meritorious cases, a reasonable extension not

exceeding 30 days for filing the return

iii. Payment of estate tax due

1. General rule – shall be paid at the time the return is filed

following the rule, “pay as you file.”

2. Insufficiency of cash to pay tax – if there is difficulty in

paying the tax, the same may be settled by:

a. Installment payment

b. Partial disposition of estate

iv. Installment payment of estate tax

1. Installment payment – may be paid within two years

without the imposition of interest or civil penalties

Subject to approval of the CIR, the estate tax may be

paid as follows:

a. 24 monthly installments

b. 8 quarterly payments

c. 4 semi-annual payments

d. 2 annual payments

In case of lapse of two years without payment of the

entire tax due, the remaining cash balance thereof shall

be due and demandable subject to the applicable

penalties and interest reckoned from the prescribed

deadline for filing the return and payment of tax

2. Partial disposition – a written request which shall be

approved by the BIR, together with a notarized

undertaking that the proceeds thereof shall be

exclusively used for the payment of estate tax due, for

the partial disposition of properties of the estate to be

conveyed for cash consideration in settlement of the

estate tax due.

In case of a failure to pay the total estate tax due out

from the proceeds of said disposition, the estate tax due

shall be immediately due and demandable subject to the

applicable penalties and interest reckoned from the

prescribed deadline of filing of the return.

www.certsedu.tech Agamata CERTS Online CPA Review 22

TAX TRANSFER TAXATION

v. Extension of time – When the Commissioner finds that the

payment on the due date of the estate tax or of any part thereof

would impose undue hardship upon the estate or any of the

heirs, he may extend the time for payment of such tax or any

part thereof not to exceed five (5) years, in case the estate is

settled through the courts, or two (2) years in case the estate is

settled extrajudicially.

In such case, the amount in respect of which the extension is

granted shall be paid on or before the date of the expiration of

the period of the extension, and the running of the Statute of

Limitations for assessment shall be suspended for the period of

any such extension.

Where the taxes are assessed by reason of negligence,

intentional disregard of rules and regulations, or fraud on the part

of the taxpayer, no extension will be granted by the

Commissioner.

If an extension is granted, the Commissioner may require the

executor, or administrator, or beneficiary, as the case may be, to

furnish a bond in such amount, not exceeding double the amount

of the tax and with such sureties as the Commissioner deems

necessary, conditioned upon the payment of the said tax in

accordance with the terms of the extension.

vi. Liability for payment of the estate tax – The estate tax shall

be paid by the executor or administrator before delivery to any

heir of his distributive share of the estate. Where there are two or

more executors or administrators, all of them shall be severally

liable for the payment of tax.

The executor or administrator of an estate has the primary

obligation to pay the estate tax but the heir or beneficiary has

subsidiary liability for the payment of that portion of the estate

which his distributive share bears to the value of the total net

estate. The extent of his liability, however, shall in no case

exceeds the value of his share in the inheritance.

vii. Discharge of executor or administrator from personal

liability – The executor or administrator shall make a written

application for the Commissioner of the amount of the estate tax

and discharge from personal liability. The executor or

administrator, upon payment of the amount of which he is

notified, shall be discharged from personal liability for any

www.certsedu.tech Agamata CERTS Online CPA Review 23

TAX TRANSFER TAXATION

deficiency in the tax thereafter found to be due and shall be

entitled to a receipt in writing showing such discharge.

No judge shall authorize the executor or judicial administrator to

deliver a distributive share to any party interested in the estate

unless a certification from the Commissioner that the estate has

been paid is shown.

If, after the payment of the estate tax, new obligations of the

decedent shall appear, and the persons interested shall have

satisfied them by order of the court, they shall have a right to the

restitution of the proportional part of the tax paid.

viii. Payment of tax antecedent to the transfer of shares, bonds

or rights – There shall not be transferred to any new owner in

the books of any corporation, sociedad anonima, partnership,

business, or industry organized or established in the Philippines

any share, obligation, bond or right by way of gift inter vivos or

mortis causa, legacy or inheritance, unless a certification from

the Commissioner that the estate taxes due thereon have been

paid is shown.

If a bank has knowledge of the death of a person, who

maintained a bank deposit account alone, or jointly with another,

it shall allow any withdrawal from the said deposit account,

subject to a final withholding tax of six percent (6%). For this

purpose, all withdrawal slips shall contain a statement to the

effect that all of the joint depositors are still living at the time of

withdrawal by any one of the joint depositors and such statement

shall be under oath by the said depositors.

ix. Accomplishing of tax returns and forms – BIR Form 1801

Estate Tax Return (January 2018)

The executor, administrator or any of the heirs shall file in

duplicate an estate tax return under oath, setting forth the

following:

1. Value of gross estate at the point of death or, in the case

of non-resident alien, that part of his gross estate

situated in the Philippines

2. The deductions allowed from gross estate

3. Supplemental data which may be necessary to establish

the correct tax

www.certsedu.tech Agamata CERTS Online CPA Review 24

TAX TRANSFER TAXATION

x. Attachments to the tax return – CPA Certification – where the

value of the gross estate exceeds P5,000,000, the return shall

be accompanied by a statement certified by a Certified Public

Accountant.

Contents of the statement:

1. Itemized assets of the decedent with their corresponding

gross value at the time of death or, in the case of a non-

resident decedent, that part of his gross estate situated

in the Philippines

2. Itemized deductions from gross estate

3. The amount of tax due whether paid or still due and

outstanding

i. Compliance requirements

i. Registration/application for TIN

1. BIR Form 1901 Application for Registration for Self-

Employed (Single Proprietor/Professional), Mixed

Income Individuals, Non-Resident Alien Engaged in

Trade/Business, Estate and Trust –

registration/application for TIN of estate undergoing

judicial settlement

2. BIR Form 1904 Application for Registration for One-Time

Taxpayer and Person registering under E.O. 98 –

registration/application for TIN shall be made before

payment of the tax due applicable for extrajudicial

settlement of the estate

ii. Estate tax amnesty act

1. Coverage – There is hereby authorized and granted a

tax amnesty, hereinafter called Estate Tax Amnesty,

which shall cover the estate of decedents who died on or

before December 31, 2017, with or without assessments

duly issued therefor, whose estate taxes have remained

unpaid or have accrued as of December 31, 2017:

Provided, however, That the Estate Tax Amnesty hereby

authorized and granted shall not cover in the exceptions.

2. Entitlement – Except for the exceptions, the estate may

enjoy the immunities and privileges of the Estate Tax

Amnesty and pay an estate amnesty tax at the rate of six

percent (6%) based on the decedent’s total net estate at

the time of death: Provided, That if an estate tax return

was previously filed with the Bureau of Internal Revenue,

the estate tax rate of six percent (6%) shall be based on

www.certsedu.tech Agamata CERTS Online CPA Review 25

TAX TRANSFER TAXATION

net undeclared estate. The provisions of the National

Internal Revenue Code of 1997, as amended, or the

applicable estate tax laws prevailing at the time of death

of the decedent, on valuation, manner of computation,

and other related matters shall apply suppletorily, at the

time of the entitlement: Provided, further, That if the

allowable deductions applicable at the time of death of

the decedent exceed the value of the gross estate, the

heirs, executors, or administrators may avail of the

benefits of tax amnesty under Title II of this Act, and pay

the minimum estate amnesty tax of Five thousand pesos

(₱5,000).

3. Availment – The executor or administrator of the estate,

or if there is no executor or administrator appointed, the

legal heirs, transferees or beneficiaries, who wish to

avail of the Estate Tax Amnesty shall, within two (2)

years from the effectivity of the Implementing Rules and

Regulations of this Act, file with the Revenue District

Office of the Bureau of Internal Revenue, which has

jurisdiction over the last residence of the decedent, a

sworn Estate Tax Amnesty Return, in such forms as may

be prescribed in the Implementing Rules and

Regulations. The payment of the amnesty tax shall be

made at the time the Return is filed: Provided, That for

nonresident decedents, the Estate Tax Amnesty Return

shall be filed and the corresponding amnesty tax be paid

at Revenue District Office No. 39, or any other Revenue

District Office which shall be indicated in the

Implementing Rules and Regulations:

Provided, further, That the appropriate Revenue District

Officer shall issue and endorse an acceptance payment

form, in such form as may be prescribed in the

Implementing Rules and Regulations of this Act for the

authorized agent bank, or in the absence thereof, the

revenue collection agent or municipal treasurer

concerned, to accept the tax amnesty payment. Proof of

settlement of the estate, whether judicial or extrajudicial,

shall likewise be attached to said Return in order to

verify the mode of transfer and the proper recipients:

Provided, finally, That the availment of the Estate Tax

Amnesty and the issuance of the corresponding

Acceptance Payment Form do not imply any admission

www.certsedu.tech Agamata CERTS Online CPA Review 26

TAX TRANSFER TAXATION

of criminal, civil or administrative liability on the part of

the availing estate.

4. Immunities and Privileges – Estates covered by the

Estate Tax Amnesty, which have fully complied with all

the conditions set forth, including the payment of the

estate amnesty tax shall be immune from the payment of

all estate taxes, as well as any increments and additions

thereto, arising from the failure to pay any and all estate

taxes for taxable year 2017 and prior years, and from all

appurtenant civil, criminal, and administrative cases and

penalties under the National Internal Revenue Code of

1997, as amended.

Without prejudice to compliance with applicable laws on

succession as a mode of transfer, the Bureau of Internal

Revenue, in coordination with the applicable regulatory

agencies, shall set up a system enabling the transfer of

title over properties to heirs and/or beneficiaries and

cash withdrawals from the bank accounts of the

decedent, when applicable.

Upon full compliance with all the conditions set forth in

this Title and payment of the corresponding estate

amnesty tax, the tax amnesty granted under this Title

shall become final and irrevocable.

5. Exceptions – The Estate Tax Amnesty shall not extend

to estate tax cases which shall have become final and

executory and to properties involved in cases pending in

appropriate courts:

a. Falling under the jurisdiction of the Presidential

Commission on Good Government;

b. Involving unexplained or unlawfully acquired

wealth under Republic Act No. 3019, otherwise

known as the Anti-Graft and Corrupt Practices

Act, and Republic Act No. 7080 or An Act

Defining and Penalizing the Crime of Plunder;

c. Involving violations of Republic Act No. 9160,

otherwise known as the Anti-Money Laundering

Act, as amended;

d. Involving tax evasion and other criminal offenses

under Chapter II of Title X of the National

Internal Revenue Code of 1997, as amended;

and

www.certsedu.tech Agamata CERTS Online CPA Review 27

TAX TRANSFER TAXATION

e. Involving felonies of frauds, illegal exactions and

transactions, and malversation of public funds

and property under Chapters III and IV of Title

VII of the Revised Penal Code.

j. Tax implications of transactions applying the tax rules and

regulations, and sound tax planning strategies within legal and

ethical bounds to efficiently manage tax liabilities

III. DONOR’S TAX

a. Principles, concepts involving donor’s taxation

i. Concept of donation – an act of liberality whereby a person

disposes gratuitously of a thing or a right in favor of another who

accepts it. (Article 725, New Civil Code)

ii. Essential and formal requisites of donation

1. Essential elements of donation

a. Capacity of the donor

b. Donative intent, in cases of direct gift

c. Acceptance by the donee

d. Delivery, whether actual or constructive, of the

subject matter of the gift

2. Formal requisites of donation

a. Tangible personal property

i. Value not exceeding P5,000.00 – oral

(or in writing) with simultaneous delivery

ii. Value exceeding P5,000.00 – in writing

b. Intangible personal property – public document

c. Real (immovable) property – public document.

The acceptance of the donation may be made in

the same deed of donation or in a separate

public instrument but shall not take effect unless

it is done during the lifetime of the donor.

iii. Concept and nature of donor’s tax

1. Concept of donor’s tax – a tax on the privilege to

transmit property between two or more persons who are

living at the time of the donation. The tax shall apply

whether the transfer is in trust or otherwise, whether the

gift is direct or indirect.

2. Nature of donor’s tax

a. Privilege tax

b. Annual tax

www.certsedu.tech Agamata CERTS Online CPA Review 28

TAX TRANSFER TAXATION

c. Ad valorem tax

d. National tax

e. General revenue tax

f. Proportional tax

iv. Rationale of donor’s taxation

1. To supplement the estate tax

2. To supplement the capital gains tax

3. To recoup the reduced income taxes due to splitting of

capital

v. Exempt donations

1. Exempt Donations under NIRC & Special Laws

a. Aquaculture Department of the Southeast Asian

Fisheries Development Center (Sec. 2, P.D. No.

292)

b. Aurora Pacific Economic Zone and Freeport

Authority (Sec. 7, R.A. No. 10083)

c. Development Academy of the Philippines (Sec.

12, P.D. No. 205)

d. Girl Scouts of the Philippines (Sec. 11, R.A. No.

10073)

e. Integrated Bar of the Philippines (Sec. 3, P.D.

No. 181)

f. International Rice Research Institute (Art. 5(2),

P.D. No. 1620)

g. National Commission for Culture and the Arts

(Sec, 35, R.A. No. 10066)

h. National Social Action Council (Sec. 4, P.D. No.

294)

i. National Water Quality Management Fund (Sec.

9, R.A. No. 9275)

j. People’s Television Network, Incorporated (Sec.

15, R.A. No. 10390)

k. People’s Survival Fund (Sec. 13, R.A. No.

10174)

l. Philippine-American Cultural Foundation (Sec.

4, P.D. No. 3062)

m. Philippine Normal University (Sec. 7, R.A. No.

9647)

n. Philippine Investors Commission (Sec. 9, R.A.

No. 3850)

o. Philippine Red Cross (Sec. 5, R.A. No. 10072)

p. Ramon Magsaysay Award Foundation (Sec. 2,

R.A. No. 3676)

www.certsedu.tech Agamata CERTS Online CPA Review 29

TAX TRANSFER TAXATION

q. Rural Farm School (Sec. 14, R.A. No. 10618)

r. Task Force on Human Settlements (Sec.

3(b)(8). E.O. No. 419)

s. Tubbataha Reefs Natural Park (Sec. 17, R.A.

No. 10067)

t. University of the Philippines (Sec. 25, R.A. No.

9500)

2. Donations for Election Campaign – any contribution in

cash or in kind to any candidate, political party, or

coalition of parties for campaign purposes shall be

governed by the Election Code, as amended. These

donations must be reported to the Commission on

Elections to be exempted from donor’s tax.

3. Transfer for Insufficient Consideration involving

Real Properties classified as Capital Assets – the

sale, exchange and other disposition of real property

classified as capital asset is subject to a capital gains tax

of 6% based on fair value or gross selling price,

whichever is higher

4. General Renunciation of Inheritance – occurs when

an heir or the surviving spouse renounces his or her

share in the hereditary estate of a decedent in favor or

no particular coheir. A general renunciation is a

repudiation of inheritance which cannot be imputed as a

donation.

5. Donation with Reserved Powers (Incomplete

Transfers)

a. Conditional donation

b. Revocable transfers

6. Donation to the Government for Public Use

7. Donation to Accredited Non-Profit Institution

a. Concept – gifts in favor of an educational and or

charitable, religious, cultural or social welfare

corporation, institution, accredited

nongovernment organization, trust, or

philanthropic organization or institution are

exempt from donor’s tax (Sec. 101 (A)(3),

NIRC).

www.certsedu.tech Agamata CERTS Online CPA Review 30

TAX TRANSFER TAXATION

b. Requisites for exemption

i. Not more than 30% of said gift shall be

used by such donee for administrative

purposes

ii. The donee entity must be organized as

a non-stock entity

iii. The donee entity does not pay dividends

iv. The donee entity’s board of trustees

earns no compensation

v. The donee entity must devote all its

income, donations, subsidies, or other

forms of philanthropy to the

accomplishment and promotion of its

purposes enumerated in its Articles of

Incorporation.

c. Accrediting agencies

i. Department of Social Welfare and

Development (DSWD) – for charitable

and or social welfare organizations,

foundations and associations including

but not limited to those engaged in

youth, children, women, family, disabled

persons, older persons, welfare and

development

ii. Department of Science and Technology

(DOST) – for research and other

scientific activities

iii. Philippine Sports Commission (PSC) –

for sports development

iv. National Council for Culture and Arts

(NCCA) – for cultural activities

v. Commission on Higher Education

(CHEd) – for educational activities

d. Gratuitous donations to associations –

associations do not qualify as exempt donee

institutions under Sec. 101 (A)(3) of the NIRC.

Hence, endowments or gifts received by

associations are not exempt from donor’s tax. All

donations to associations for tax purposes must

be covered by a donor’s tax return. (RMC 53-

2013)

www.certsedu.tech Agamata CERTS Online CPA Review 31

TAX TRANSFER TAXATION

e. Onerous donations to associations – not in

the nature of an endowment or donation. They

are in the concept of a fee or price in exchange

for the performance of a service, use of

property, or delivery of an object. (RMC 53-

2013)

8. Quasi-Transfers – involve delivery of property to

another person but will never result in transfer of

ownership thereto.

a. Merger of the usufruct in the owner of the naked

title during the lifetime of the usufructuary

b. The transmission or delivery of the inheritance

or legacy by the fiduciary heir or legatee to the

fideicommissary during the lifetime of the

fiduciary heir

c. The transmission from the first heir, legatee, or

donee during his lifetime in favor of another

beneficiary, in accordance with the desire of the

predecessor

9. Void Donations – invalid donations—include those

prohibited by law and those with defects in their

execution.

a. Prohibited donation under the Civil Code:

i. Donation between spouses, except

moderate gifts

ii. Donations between persons who were

guilty of adultery or concubinage at the

time of donation

iii. Donations between persons found guilty

of the same criminal offense, in

consideration thereof

iv. Donations to a public officer or his wife,

descendants, or ascendants by reason

of his office

v. Donations to incapacitated persons

vi. Donations of future property

b. Donation with defects at execution

i. Donation by person who has no legal

title to the property donated

ii. Oral or written donation of real property

or intangible personal property

iii. Donation refused by the donee

www.certsedu.tech Agamata CERTS Online CPA Review 32

TAX TRANSFER TAXATION

10. Foreign Donations of Non-Resident Alien Donors

11. Donations of Property Exempt under Reciprocity –

the reciprocity rule—no tax shall be imposed with

respect to intangible personal property donations of NRA

donors if:

a. The donor at the time of the donation was a

citizen and resident of a foreign country which at

the time of his death or donation did not impose

a transfer tax of any character in respect of

intangible personal property of citizens of the

Philippines not residing therein.

b. The laws of the foreign country of which the

donor was a citizen and resident at the time of

donation allows a similar exemption from

transfer tax of every character in respect of

intangible personal property of citizens of the

Philippines not residing therein.

vi. Taxable donations – donations that do not qualify among those

exemption criteria are subject to tax.

b. Transfers which may be considered a donation

i. Direct Gift

ii. Gift through Creation of a Trust

iii. Condonation of Debt

iv. Specific Renunciation of Inheritance

v. Renunciation by the Surviving Spouse of his/her Share in the

Conjugal Partnership or Absolute Community after the

Dissolution of the Marriage in favor of the Heirs of the Deceased

Spouse or any Other Person/s

vi. Transfer for Insufficient Consideration (Except Real Properties

classified as Capital Assets)

c. Classification of donors

i. Natural persons

1. Taxable on global donations

a. Resident citizen

b. Nonresident citizen

c. Resident alien

2. Taxable on Philippine donations, subject to reciprocity

rule

a. Nonresident alien

www.certsedu.tech Agamata CERTS Online CPA Review 33

TAX TRANSFER TAXATION

ii. Juridical persons

1. Taxable on global donations

a. Domestic corporation

b. Resident foreign corporation

2. Taxable on Philippine donations, subject to reciprocity

rule

a. Nonresident foreign corporation

d. Net gifts/donations

i. Donor’s tax rate and structure

1. Donor’s tax model – first donation of the year

Net gift PXXX,XXX

Less: Exempt gift 250,000

Net gift subject to donor’s tax XXX,XXX

Multiply by: Donor’s tax rate 6%

Donor’s tax XXX,XXX

Less: Tax credits XXX,XXX

Donor’s tax due/payable XXX,XXX

2. Donor’s tax model – subsequent donations during

the year

Current net gift PXXX,XXX

Prior net gifts XXX,XXX

Total net gifts XXX,XXX

Less: Exempt gift 250,000

Net gift subject to donor’s tax XXX,XXX

Multiply by: Donor’s tax rate 6%

Donor’s tax XXX,XXX

Less: Tax credits XXX,XXX

Donor’s tax due/payable XXX,XXX

ii. Gross gifts

1. Components of gross gift

Residents or NRA without NRA with

Citizens reciprocity reciprocity

Property location Within Without Within Without Within Without

Real properties X X

Tangible personal properties X X

Intangible personal properties X X X

2. Properties considered as located in the Philippines

a. Franchise which must be exercised in the

Philippines

www.certsedu.tech Agamata CERTS Online CPA Review 34

TAX TRANSFER TAXATION

b. Share, obligations, or bonds issued by any

corporation or sociedad anonima organized or

constituted in the Philippines in accordance with

its laws.

c. Share, obligations, or bonds issued by any

foreign corporation eighty-five per centum (85%)

of the business of which is located in the

Philippines.

d. Shares, obligations, or bonds which have

acquired business situs in the Philippines.

e. Shares or rights in any partnership, business or

industry established in the Philippines.

f. Any personal property, whether tangible or

intangible, located in the Philippines.

3. Encumbrances on the property – mortgage, real

property tax, and unpaid loans thereto which are to be

transferred to, or to be assumed by, the donee shall

NOT BE DEDUCTED from the value of the Gross Gift.

These shall be reported as ‘deduction against gross gift,’

that is items in gross gift shall be presented in gross

amounts, free from deductions and diminutions.

4. Valuation of gross gifts

a. Real properties – higher between zonal value

and assessed value

b. Personal properties – fair market value

c. Preferred shares – par value

d. Unlisted common shares – book value

(unadjusted)

e. Listed common shares – arithmetic mean

between highest and lowest quotation

f. Usufruct and annuities – present value with

interest rate and period approved by Secretary

of Finance, upon recommendation by the

Insurance Commissioner

g. Newly purchased property – purchase price

(secondhand value if not newly acquired)

h. Pawned properties – grossing up pawn value by

loan-to-value ratio

i. Financial instruments – face amounts plus

accrued interests

j. Foreign currency – prevailing exchange rate

www.certsedu.tech Agamata CERTS Online CPA Review 35

TAX TRANSFER TAXATION

5. Timing of valuation – at the point of completion or

perfection of the donation, which is perfected upon

acceptance of the donee. In conditional donations, the

donation is completed and perfected upon satisfaction

by the donee of the terms of donation or upon waiver by

the donor of the conditions.

6. Donation of common properties – husband and wife

are considered as separate and distinct taxpayers for

purposes of the donor’s tax. Donation of conjugal or

community property by the spouses is deemed ½ made

by the husband and ½ made by the wife.

However, if what was donated is a conjugal or

community property and only the husband signed the

deed of donation, there is only one donor for donor’s tax

purposes, without prejudice to the right of the wife to

question the validity of the donation without her consent

pursuant to the pertinent provisions of the Civil Code of

the Philippines and the Family Code of the Philippines.

iii. Deductions from gross gifts

1. Obligations assumed by the donee

2. Donations to national government and its political

subdivisions

3. Donations in favor of educational, charitable, religious,

cultural and social welfare institution – see exempt

donations

4. Diminution of gift as specified by the donor – not exempt

from donor’s tax but deducted for purposes of future

taxability upon consummation of the subsequent

donation/transfer to the eventual donee.

iv. Net gift and net taxable gift

1. Step 1: Enumerate all the items of inclusion in the gross

gift of the donor in a particular date

2. Step 2: Determine the classification of the donor

(whether resident/citizen or non-resident alien and

whether single or married)

3. Step 3: Classify the items of gross gift into its situs

classification per country (if applicable)

4. Step 4: Enumerate all the items of deduction from gross

gift and classify them accordingly per situs

5. Step 5: Compute the net taxable gift

www.certsedu.tech Agamata CERTS Online CPA Review 36

TAX TRANSFER TAXATION

v. Determination of net gift per country – property classification

rule shall be observed in classifying deductions against gross gift

e. Tax due and tax credits, if applicable

i. Determination of tax due – multiply the net gift subject to

donor’s tax by 6% in order to determine the tax due

ii. Determination of foreign tax credit

1. Available only to the donations made by resident and

citizen donors

2. The tax credit is the lower between the actual foreign

donor’s tax paid or the ratio of the tax due from the

foreign sourced net gift over the total (world) net gift

3. For multiple foreign countries, the lower of actual donor’s

tax and the foregoing limit for each country is determined

first. The final foreign tax credit shall be the lower of the

total of the tax credit allowable per country and the world

donor’s tax credit limit.

Foreign net taxable gift

x Philippine donor’s tax due

World net taxable gift

Total foreign net taxable gift

x Philippine donor’s tax due

World net taxable gift

f. Tax return preparation and filing and tax payments

i. Mode of filing of tax returns

1. Manual filing system

2. e-BIR Forms

3. Electronic Filing and Payment System (eFPS)

ii. Venue and time of filing of tax returns

1. Venue of filing

ANY PERSON making a donation (whether direct or

indirect), unless the donation is specifically exempt

under the NIRC or other special laws, is required, for

every donation, to accomplish under oath a donor’s tax

return in duplicate.

Unless the Commissioner otherwise permits, the return

shall be filed where the donor is domiciled at the time of

the transfer, or if there be no legal residence in the

Philippines, with the Office of the Commissioner.

www.certsedu.tech Agamata CERTS Online CPA Review 37

TAX TRANSFER TAXATION

In the case of gifts made by a non-resident, the return

may be filed with the Philippine Embassy or Consulate in

the country where he is domiciled at the time of the

transfer, or directly with the Office of the Commissioner.

2. Where to file the donor’s tax returns?

a. Accredited agent bank

b. Revenue district office

c. Collection agent

d. Office of the commissioner, if the donor has no

legal residence in the Philippines

e. Philippine embassy or consulate in the country

where the donor is domiciled at the time of

transfer

3. Deadline of filing the donor’s tax return – The donor’s

tax return shall be filed within THIRTY (30) DAYS after

the date the gift is made or completed.

4. Notice of donation by a donor engaged in business –

In order to be exempt from donor’s tax and to claim full

deduction of the donation given to qualified-donee

institutions duly accredited, the donor engaged in

business shall give a notice of donation on every

donation worth at least FIFTY THOUSAND PESOS

(P50,000) to the Revenue District Office (RDO) which

has jurisdiction over his place of business within thirty

(30) days after receipt of the qualified donee institution’s

duly issued Certificate of Donation, which shall be

attached to the said Notice of Donation, stating that not

more than thirty percent (30%) of the said donation/gifts

for the taxable year shall be used by such accredited

non-stock, non-profit corporation/NGO institution for

administration purposes.

iii. Payment of donor’s tax due – pay as you file

iv. Accomplishing of tax returns and forms – BIR Form 1800

Donor’s Tax Return

Any person making a donation shall accomplish under oath a

donor’s tax return which shall set forth:

1. Each gift made during the calendar year which is to be

included in gifts;

www.certsedu.tech Agamata CERTS Online CPA Review 38

TAX TRANSFER TAXATION

2. The deductions claimed and allowable;

3. Any previous net gifts made during the same calendar

year;

4. The name of the donee; and,

5. Such further information as the Commissioner may

require.

v. Attachments to the tax return – formal documents evidencing

the donation made and the acceptance made by the donee.

Common documents include Deed of Donation and Deed of

Acceptance of Donation or Certificate of Donation.

g. Compliance requirements

i. Registration/application for TIN

1. BIR Form 1901 Application for Registration for Self-

Employed (Single Proprietor/Professional), Mixed

Income Individuals, Non-Resident Alien Engaged in

Trade/Business, Estate and Trust –

registration/application for TIN of donor undergoing who

is expected to exercise subsequent donation or may

perform other taxable acts subject to internal revenue

taxes

2. BIR Form 1904 Application for Registration for One-Time

Taxpayer and Person registering under E.O. 98 –

registration/application for TIN shall be made before

payment of the tax due applicable for one-time taxpayer

or any taxpayer who does not expect to engage in

another taxable transaction in the near future

h. Tax implications of transactions applying the tax rules and

regulations, and sound tax planning strategies within legal and

ethical bounds to efficiently manage tax liabilities

www.certsedu.tech Agamata CERTS Online CPA Review 39

You might also like

- Resident Citizen Resident Alien Non-Resident Citizen: 10k Transfer Element 5k ExchangeDocument5 pagesResident Citizen Resident Alien Non-Resident Citizen: 10k Transfer Element 5k ExchangeLilliane EstrellaNo ratings yet

- Securitized Real Estate and 1031 ExchangesFrom EverandSecuritized Real Estate and 1031 ExchangesNo ratings yet

- Estate Tax - Is The Tax On The Right To Transmit Property at Death and On Certain Transfers Which Are Made by Law The Equivalent ofDocument4 pagesEstate Tax - Is The Tax On The Right To Transmit Property at Death and On Certain Transfers Which Are Made by Law The Equivalent ofAlliah SomidoNo ratings yet

- Tax-2-Recits Estate Tax Donors TaxDocument5 pagesTax-2-Recits Estate Tax Donors TaxEmmanuel MabolocNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- ET2Document5 pagesET2Mary Joy CabilNo ratings yet

- TAX Tax Law 2Document158 pagesTAX Tax Law 2iamtikalonNo ratings yet

- M1 - Introduction To Transfer Taxaion - Students'Document20 pagesM1 - Introduction To Transfer Taxaion - Students'micaella pasionNo ratings yet

- M1 Introduction To Transfer Taxaion Students PDFDocument20 pagesM1 Introduction To Transfer Taxaion Students PDFTokis SabaNo ratings yet

- Transfer and Business TaxationDocument4 pagesTransfer and Business TaxationKhai Supleo PabelicoNo ratings yet

- TRANSFER TAXES ReviewerDocument5 pagesTRANSFER TAXES ReviewerChreazel RemigioNo ratings yet

- Estate Tax Guide: Gross Estate, Property Rules, and Tax CalculationDocument2 pagesEstate Tax Guide: Gross Estate, Property Rules, and Tax CalculationJustz LimNo ratings yet

- Estate TaxationDocument4 pagesEstate TaxationThe Brain Dump PHNo ratings yet

- Gross Estate InclusionDocument4 pagesGross Estate InclusionAlaineNo ratings yet

- Tax Reviewer 3 TRANSFER TAXDocument6 pagesTax Reviewer 3 TRANSFER TAXAlliahDataNo ratings yet

- Bustax - Estate and Donor's TaxDocument4 pagesBustax - Estate and Donor's TaxPhoebe LunaNo ratings yet

- Bus Trax Mids ReviewerDocument6 pagesBus Trax Mids ReviewerjaculofranzNo ratings yet

- Prelims ReviewerDocument78 pagesPrelims ReviewerAndrea IvanneNo ratings yet

- Taxation II Estate Tax RateDocument78 pagesTaxation II Estate Tax RateAndrea IvanneNo ratings yet

- First Exam Transcript Taxation Law Ii: Title Iii Estate and Donor'S TaxDocument15 pagesFirst Exam Transcript Taxation Law Ii: Title Iii Estate and Donor'S TaxAure ReidNo ratings yet

- Module 1 - Transfer and Business Taxation - v.1Document30 pagesModule 1 - Transfer and Business Taxation - v.1John Vincent ManuelNo ratings yet

- TAX-101 (Estate Tax)Document11 pagesTAX-101 (Estate Tax)Edith DalidaNo ratings yet

- Transfer TaxDocument60 pagesTransfer Taxandrei jim100% (6)

- TSU-CBA Mid-Year 2021 Taxation NotesDocument3 pagesTSU-CBA Mid-Year 2021 Taxation NotesMark Lawrence YusiNo ratings yet

- TaxII Week3Document7 pagesTaxII Week3Julia San JoseNo ratings yet

- Assignment in Tax 102 What Is Transfer?Document5 pagesAssignment in Tax 102 What Is Transfer?JenniferFajutnaoArcosNo ratings yet

- Estate Tax NotesDocument11 pagesEstate Tax NotesClaire Araneta AlcozeroNo ratings yet

- Enhancement Estate Tax2Document35 pagesEnhancement Estate Tax2Kathleen Tabasa ManuelNo ratings yet

- Review Notes on Estate and Gift TaxationDocument44 pagesReview Notes on Estate and Gift TaxationadsleeNo ratings yet

- 10 - Intro To Transfer TaxationDocument4 pages10 - Intro To Transfer TaxationALLYSON BURAGANo ratings yet

- Material 11 Estate TaxDocument20 pagesMaterial 11 Estate Taxnodnel salonNo ratings yet

- CPAR Estate Tax (Batch 89) HandoutDocument18 pagesCPAR Estate Tax (Batch 89) HandoutlllllNo ratings yet

- 4m 2018 Tax 1 Reviewtransfer Tax Vat Remedies and CtaDocument57 pages4m 2018 Tax 1 Reviewtransfer Tax Vat Remedies and CtaArah Mae BonillaNo ratings yet

- Transfer Tax ContinuationDocument6 pagesTransfer Tax ContinuationSenianna HaleNo ratings yet

- Tax2 Premid PDFDocument18 pagesTax2 Premid PDFJoben CuencaNo ratings yet

- Estate Tax and Some Exempt TransfersDocument3 pagesEstate Tax and Some Exempt TransfersfcnrrsNo ratings yet

- Estate TaxDocument10 pagesEstate Taxrandomlungs121223No ratings yet

- Estate and Donation Tax OverviewDocument20 pagesEstate and Donation Tax Overviewjunnace jopsonNo ratings yet

- Estate Taxation NotesDocument39 pagesEstate Taxation NotesJovel LayasanNo ratings yet

- Finals Transfer Tax RPTDocument159 pagesFinals Transfer Tax RPTMary Luz Ebes100% (1)

- Tax Lectures TranscribeDocument29 pagesTax Lectures TranscribeNeri DelfinNo ratings yet