Professional Documents

Culture Documents

Trade Confirmation Report: Account Information

Uploaded by

FelipeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Trade Confirmation Report: Account Information

Uploaded by

FelipeCopyright:

Available Formats

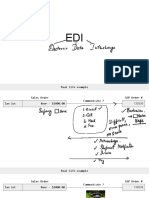

Trade Confirmation Report

September 1, 2023 - October 4, 2023

Help

Interactive Brokers LLC, Two Pickwick Plaza, Greenwich, CT 06830

Account Information

Name Felipe N Silva

Account U11504515

Account Type Individual

Customer Type Individual

Account Capabilities Margin

Base Currency USD

Trades

Order

Acct ID Symbol Trade Date/Time Settle Date Exchange Type Quantity Price Proceeds Comm Fee Code

Type

Stocks

EUR

U11504515 ZPRX 2023-09-25, 03:04:42 2023-09-27 - BUY 11 43.3800 -477.18 -1.29 0.00 LMT O

U11504515 ZPRX 2023-09-25, 03:04:42 2023-09-27 IBIS2 BUY 11 43.3800 -477.18 -1.29 0.00 LMT O

Total ZPRX (Bought) 11 43.3800 -477.18 -1.29 0.00

Total -477.18 -1.29 0.00

Financial Instrument Information

Symbol Description Conid Security ID Listing Exch Multiplier Type Code

Stocks

ZPRX SPDR EUROPE S/C VALUE 184168292 IE00BSPLC298 IBIS2 1 ETF

Order Types

Code Meaning Code (Cont.) Meaning (Cont.)

ALERT Alert PEGMKTVOL Peg Mkt Vol

FUNARI Funari PEGPRMVOL Peg Prim Vol

LIT Limit If Touched PEGSRFVOL Peg Surf Vol

LMT Limit REL Relative

LMTOB Limit Or Better REL2MID Relative Up To Mid

LOC Limit On Close RELSTK Relative To Stock

LWOW Limt With Or Without RFQ Quote Request

Generated: 2023-10-04, 14:51:51 EDT Page: 1

Order Types

Code Meaning Code (Cont.) Meaning (Cont.)

MIDPX Mid Price RPI Retail Price Improve

MIT Market If Touched SNAPMID Snap To Mid point

MKT Market SNAPMKT Snap To Market

MKTPROT Market Protect SNAPREL Snap To Primary

MOC Market On Close STP Stop

MTL Market To Limit STPLMT Stop Limit

PASSVREL, PSVR Passive Relative STPPROT Stop Protect

PEGBENCH Peg Bench TRAIL Trailing Stop

PEGGED Pegged TRAILLIT Trailing Limit If Touched

PEGMID Peg To Mid TRAILLMT Trailing Stop Limit

PEGMID2 Peg To Mid2 TRAILMIT Trailing Market If Touched

PEGMIDVOL Peg Mid Vol VOLAT Volat

PEGMKT Peg To Mkt WOW With Or Without

Codes

Code Meaning Code (Cont.) Meaning (Cont.)

This transaction was executed as part of an IPO in which IB was a member of the selling

A Assignment IPO group and is classified as a Principal trade.

AEx Automatic exercise for dividend-related recommendation. L Ordered by IB (Margin Violation)

AFx AutoFX conversion resulting from trading M Entered manually by IB (Please refer to legal note #2)

B Automatic Buy-in MEx Manual exercise for dividend-related recommendation.

C Closing Trade O Opening Trade

Ca Cancelled P Partial Execution

Part or all of this transaction was executed by the Exchange as a Crossing by IB against an

Co Corrected Trade Pr IB affiliate and is therefore classified as a Principal and not an agency trade

Part or all of this transaction was a Crossing executed as dual agent by IB for two IB

Cx R Dividend Reinvestment

customers

IB acted as dual agent for both the buyer and seller in this transaction. Information

D RI Recurring Investment

regarding the counterparty to this trade will be furnished to you upon your request

IB acted as agent for the fractional share portion of this trade, which was executed by an IB

Ep Resulted from an Expired Position RP affiliate as riskless principal.

IB acted as agent for both the fractional share portion and the whole share portion of this

Ex Exercise RPA trade; the fractional share portion was executed by an IB Affiliate as riskless principal.

FP The fractional portion of this trade was executed against IB or an affiliate. Rb Rebill

The fractional portion of this trade was executed against IB or an affiliate. IB acted as agent SI

FPA This order was solicited by Interactive Brokers

for the whole share portion of this trade.

G Trade in Guaranteed Account Segment SO This order was marked as solicited by your Introducing Broker

Customer designated this trade for shortened settlement and so is subject to execution at

IA The transaction was executed against IB or an affiliate SS prices above the prevailing market

A portion of the order was executed against IB or an affiliate; IB acted as agent on a

IM T Transfer

portion.

Notes/Legal Notes

Notes

1. Most stock exchange transactions settle on the trade date plus two business days. Options, futures and US open-end mutual fund transactions settle on trade date plus one business day. (Some exchanges and other

transaction types may have longer or shorter settlement periods.) Ending settled cash reflects the cash that has actually settled. Execution time will be furnished upon request.

Trade Confirmation Report - September 1, 2023 - October 4, 2023 Page: 2

Notes/Legal Notes

2. Initial and maintenance margin requirements are available within the Account Window of the Trader Workstation.

3. Interactive Brokers LLC receives compensation from fund companies in connection with the purchase and holding of fund shares by customers of Interactive Brokers LLC. Such compensation includes, but is not limited

to, Rule 12b-1 fees that are paid out of the funds assets. The source and amount of any remuneration received by Interactive Brokers LLC in connection with a transaction will be furnished upon written request of the

customer. IB may share a portion of the compensation received from fund companies with your financial advisor or introducing broker, if applicable.

4. Quantities preceded by a "-" sign indicate sell transactions. Other transactions are purchases.

5. IB acts as agent in executing the fractional share portion of your order. In certain circumstances, IB routes the fractional portion of your order to an affiliate, which may execute the fractional portion of the order as

principal. In such circumstances, this is indicated by the codes associated with the trade. If an IB affiliate acts as principal in executing any fractional share portion of your order, the order will be executed at the price

displayed for the opposite side of the NBBO from your order (the offer if you are buying and the bid if you are selling) at the time of execution. If an IB affiliate is acting as riskless principal in connection with filling the

fractional share portion of your order, the affiliate will execute the fractional share portion of your order at the price it receives for the execution of the whole share.

6. In case of partial executions, commissions are charged on the total quantity executed on the original order. The commission is displayed on the first partial execution only.

7. Trade execution times are displayed in Eastern Time.

8. Applicable regulatory fees for your transactions are available on the IB website at www.interactivebrokers.com/en/accounts/fees/exchangeAndRegulatoryFees.php.

9. Additional information about your Forex transactions may be requested, including information required under NFA Rule 2-36(o) about Forex trades in the same currency pair as any Forex transaction you executed in your

IB account. We can provide this information for trades executed within the 15 minutes immediately before and after your trade. This information is available for a period of 6 months after your trade.

Fixed Income Notes

1. Call features for bonds or preferred stocks may affect the yield. For zero coupon, compound interest and multiplier securities, there are no periodic payments and securities may be callable below maturity value without

notice to holder unless registered. For asset-backed securities, the actual yield may vary depending on the speed at which the underlying note is pre-paid. For additional information regarding bond yield, please contact

the IB Help Desk at: help@interactivebrokers.com. If this debt security is unrated by a nationally recognized statistical rating organization, it may pose a high risk of default. You should consult a financial advisor to

determine whether unrated bonds are appropriate for your portfolio in light of your goals and your financial circumstances. Fees charged by bond trading centers are included in the cost of bond transactions.

2. In the case of any transaction in a debt security subject to redemption before maturity, such debt security may be redeemed in whole or in part before maturity and such redemption could affect the yield presented.

Additional information is available upon request.

Legal Notes

1. Please promptly report any inaccuracy or discrepancy in this statement, or in your account. Contact the IB Customer Service Department in writing using the form available on the IB website. You may also contact IB by

phone, but if you report an error by phone, you should re-confirm such oral communication in writing in order to protect your rights, including rights under the Securities Investor Protection Act (SIPA).

Interactive Brokers LLC, www.interactivebrokers.com, 877-442-2757 (U.S.)

Interactive Brokers (UK) (Ltd), www.interactivebrokers.co.uk, 00800-42-276537 (Intl)

Interactive Brokers Canada Inc., www.interactivebrokers.ca, 877-745-4222 (Can.)

2. Unless otherwise noted, Interactive Brokers acted as agent in the execution of the above transactions. For those exchanges where IB is not a direct clearing member or custodian, IB may use one of the following clearing

agents or sub-custodians: Interactive Brokers Australia Pty Limited; Interactive Brokers Canada Inc.; Interactive Brokers Central Europe Zrt.; Interactive Brokers Hong Kong Limited; Interactive Brokers Securities Japan,

Inc.; Interactive Brokers (U.K.) Limited; IBKR Financial Services AG; ABN Amro Clearing Singapore Pte. Ltd.; BBVA Bancomer, S.A.; BNP Securities Services, Milan Branch; BMO Harris Bank N.A.; Citibank Europe plc;

Skandinaviska Enskilda Banken AB (including select branches).

3. IB acts as agent or riskless principal in foreign currency exchange transactions and as riskless principal in spot precious metals transactions. Such transactions are executed against an IB affiliate or a third party, which

acts as principal in such transactions and may have a long or short position and may have profited or lost in connection with the transaction. Foreign currency exchange and spot precious metals transactions executed by

Customer through IB are not regulated or overseen by the SEC or the CFTC.

4. All VWAP trades are effected pursuant to an average price formula based on a reference price provided by a third-party data provider. Additional information and reference prices are available upon request. IB, as agent,

effects VWAP transactions through a market making affiliate, which acts as principal in such transactions and may have a long or short position in the security and may have profited or lost in connection with the

transaction.

5. IB accepts liquidity rebates or other order flow payments from Alternative Trading Systems, market makers and exchanges for certain orders in stocks. IB receives payment for some option orders pursuant to exchange-

mandated marketing fee programs or other arrangements. The source and nature of any compensation received by IB in connection with any transaction is available upon written request of the customer. For further

information, check the IB website and the Order Routing and Payment for Order Flow Disclosure provided when you opened your account and annually or email help@interactivebrokers.com.

6. For security trades, if not already indicated on this statement, information about the time of any transaction and the identity of the counterparty to the transaction will be available upon written request of the customer.

7. For security futures trades, if not already indicated on this statement, information about the time of any transaction, the identity of the counterparty to the transaction, and whether IB is acting as agent or principal, as agent

for the counterparty, as agent for both parties to the contract, or as principal, and if acting as principal, whether the transaction was a block transaction or an exchange for physicals transaction, will be available upon

written request of the customer.

8. Customer is requested to promptly advise Interactive Brokers of any material change in Customers investment objectives.

9. A financial statement of Interactive Brokers LLC is available for your personal inspection at www.interactivebrokers.com or at its offices, or a copy of it will be mailed upon your written request.

10. For trades executed on the ASX market, the ASX 24 market and the Cboe Australia market, this confirmation is issued subject to: (i) the Applicable Laws, the directions, decisions and requirements of the relevant market

operator, the operating rules of the relevant market, the clearing rules and where relevant, the relevant settlement rules, (ii) the customs and usages of the relevant financial market, and (iii) the correction of errors and

omissions. Trades in Cash Market Products (as that term is defined in the relevant ASIC market integrity rules) on ASX market and Cboe Australia are cleared by BNP Paribas, ARBN 149 440 291, AFSL 402467, who is

a participant of ASX Clear Pty Ltd and ASX Settlement Pty Ltd. Trades in Derivative Products on ASX and all products on ASX 24 are cleared by Interactive Brokers Australia (“IBA”) as a participant of ASX Clear Pty Ltd

and ASX Clear (Futures) Pty Ltd. If your transaction was a crossing transaction, IBA may have either acted on behalf of (i) both the buyer and seller of this transaction, or (ii) on behalf of the buyer or seller on one side of

the transaction and acted as Principal on the other side. Under the Corporations Act 2001, where IBA enters into an exchange traded derivative on a customer's behalf, IBA is regarded as having issued the derivative to

the customer.

Trade Confirmation Report - September 1, 2023 - October 4, 2023 Page: 3

Notes/Legal Notes

11. For All Options Trades Executed on the Stock Exchange of Hong Kong ("SEHK"): (a) Options can involve a high degree of risk and may not be suitable for every investor. Investors should ensure they understand those

risks before participating in the options market. (b) All options contracts executed on the SEHK were executed by Interactive Brokers Hong Kong Limited on behalf of Interactive Brokers LLC. (c) In the event of a default

committed by Interactive Brokers LLC resulting in the client suffering any pecuniary loss, the client shall have a right to claim under the Investor Compensation Fund established under the Hong Kong Securities and

Futures Ordinance, subject to the terms of the Investor Compensation Fund from time to time. (d) All Exchange Traded Options Business made for or on behalf of a client shall be subject to the relevant provisions of the

constitution, Rules of The Stock Exchange of Hong Kong Limited ("SEHK Rules"), regulations, the Articles, customs and usages of SEHK, the Options Trading Rules, the Clearing Rules of SEOCH, the CCASS Rules and

the laws of Hong Kong, which shall be binding on both Interactive Brokers LLC and the client.

12. Deposits held away from Interactive Brokers LLC may not qualify under SIPC protection. Also, futures and options on futures are not covered by SIPC.

SIPC Member

Trade Confirmation Report - September 1, 2023 - October 4, 2023 Page: 4

You might also like

- Non Fungible Token (NFT): Delve Into the World of NFTs Crypto Collectibles and How It Might Change Everything?: The Exciting World of Web 3.0: The Future of Internet, #2From EverandNon Fungible Token (NFT): Delve Into the World of NFTs Crypto Collectibles and How It Might Change Everything?: The Exciting World of Web 3.0: The Future of Internet, #2No ratings yet

- VIOP How To Trade in ViopDocument20 pagesVIOP How To Trade in Viopmir danish anwarNo ratings yet

- 2024-04-05 Daily Basket - KLCI1XIDocument1 page2024-04-05 Daily Basket - KLCI1XIseeme55runNo ratings yet

- Comunicaciones AccionesDocument1 pageComunicaciones AccionesPerla YedroNo ratings yet

- MTP For NiftyDocument3 pagesMTP For NiftyAnil KumarNo ratings yet

- Introduction To T24 - Treasury - R10.1Document34 pagesIntroduction To T24 - Treasury - R10.1Gnana Sambandam50% (2)

- ENERGIA AccionesDocument1 pageENERGIA AccionesPerla YedroNo ratings yet

- 2024-04-05 Daily Basket - KLCI2XIDocument1 page2024-04-05 Daily Basket - KLCI2XIseeme55runNo ratings yet

- BitOrb Whitepaper June 2019Document43 pagesBitOrb Whitepaper June 2019Handisaputra LinNo ratings yet

- FastConnectData Specs v2.0Document26 pagesFastConnectData Specs v2.0danhNo ratings yet

- Sample New Fidelity Acnt STMT Pages 12Document1 pageSample New Fidelity Acnt STMT Pages 12Temp 123No ratings yet

- Bienes Raices AccionesDocument1 pageBienes Raices AccionesPerla YedroNo ratings yet

- LT - Pole & Flag Break Out. For NSE - LT by SafeTrader1976 - TradingView IndiaDocument2 pagesLT - Pole & Flag Break Out. For NSE - LT by SafeTrader1976 - TradingView IndiaAbhiNo ratings yet

- Points - 4 v5Document119 pagesPoints - 4 v5m.awaisuohNo ratings yet

- Points - 4 v1Document69 pagesPoints - 4 v1m.awaisuohNo ratings yet

- Explanation Crypto Asset RegulationDocument26 pagesExplanation Crypto Asset RegulationStephen RosholtNo ratings yet

- Indmoney AnnualTaxPnlReport 4YOME82072 31 Mar 2023Document5 pagesIndmoney AnnualTaxPnlReport 4YOME82072 31 Mar 2023royprithvi37No ratings yet

- Visha LDocument2 pagesVisha LUbed QureshiNo ratings yet

- Rikhav Securities LTD.: (Tax Invoice Under Section 31 of GST Act)Document1 pageRikhav Securities LTD.: (Tax Invoice Under Section 31 of GST Act)Dhruv Harshal ShahNo ratings yet

- 02 - Basic Data Warehousing & ArchitecturesDocument51 pages02 - Basic Data Warehousing & ArchitecturesRyanNo ratings yet

- Capital Gains Statement FY 2022-2023Document1 pageCapital Gains Statement FY 2022-2023Santoshkumar BalkundeNo ratings yet

- Product Wise Field Details For OTC DerivativesDocument4 pagesProduct Wise Field Details For OTC DerivativesRavindra PappuNo ratings yet

- Financiero AccionesDocument1 pageFinanciero AccionesPerla YedroNo ratings yet

- Exchange Traded NotesDocument27 pagesExchange Traded Notesthomas.mkaglobalNo ratings yet

- Complaint Investigation-DashboardDocument8 pagesComplaint Investigation-Dashboardkapil vaishnavNo ratings yet

- Fin 0724Document3 pagesFin 0724alcaydediane64No ratings yet

- Common Contract Note Format Across Exchanges - Annexure-IDocument2 pagesCommon Contract Note Format Across Exchanges - Annexure-IShah HiNo ratings yet

- Angel Broking Limited: Contract NoteDocument2 pagesAngel Broking Limited: Contract NoteMUTHYALA NEERAJANo ratings yet

- Salud AccionesDocument1 pageSalud AccionesPerla YedroNo ratings yet

- MATERIA PRIMA AccionesDocument1 pageMATERIA PRIMA AccionesPerla YedroNo ratings yet

- Angel Broking Limited.: Daily Margin Statement For The Day: 23/11/2021Document1 pageAngel Broking Limited.: Daily Margin Statement For The Day: 23/11/2021Pratish kutalNo ratings yet

- Year Month Day Date Exchange Derivative Segment: 2021 January - Mse Interest Rate DerivativesDocument14 pagesYear Month Day Date Exchange Derivative Segment: 2021 January - Mse Interest Rate Derivativesmovie buffNo ratings yet

- Sales Report Format Comparison: A Guide For SuppliersDocument13 pagesSales Report Format Comparison: A Guide For Supplierskazimhld805No ratings yet

- Assignment 2Document6 pagesAssignment 2haha haha0% (1)

- Assignment 2Document6 pagesAssignment 2Umar ZahidNo ratings yet

- Brent Crude Front Month: Main CharacteristicsDocument2 pagesBrent Crude Front Month: Main CharacteristicsPaolo ScafettaNo ratings yet

- Purchase Requisition PDFDocument3 pagesPurchase Requisition PDFKEYBOARD SOMPLAK ProductionNo ratings yet

- Non-Stock DemandDocument2 pagesNon-Stock DemandISO CELLNo ratings yet

- Brokerage Calculator-Zerodha PDFDocument1 pageBrokerage Calculator-Zerodha PDFbasanisujithkumarNo ratings yet

- Indmoney AnnualTaxPnlReport KL9ME2DG71 11 Aug 2023Document4 pagesIndmoney AnnualTaxPnlReport KL9ME2DG71 11 Aug 2023SHIV BALAPURENo ratings yet

- Tecnologia AccionesDocument2 pagesTecnologia AccionesPerla YedroNo ratings yet

- SEBI Risk DisclosureDocument5 pagesSEBI Risk Disclosuregarbage DumpNo ratings yet

- Functional Template E-Invoice Template - 1june2021Document490 pagesFunctional Template E-Invoice Template - 1june2021AkshayNo ratings yet

- Contract Note Cum Tax Invoice: RD1986 Deebak SDocument4 pagesContract Note Cum Tax Invoice: RD1986 Deebak SDeebak SNo ratings yet

- S4 HANA - 2020 - Fiori - All1Document20 pagesS4 HANA - 2020 - Fiori - All1Marcos CovelloNo ratings yet

- BeanFX Boom Et Crash Scalper - Blog Des Traders FXDocument22 pagesBeanFX Boom Et Crash Scalper - Blog Des Traders FXRomi Carter L'impérialNo ratings yet

- Zebu Share and Wealth Managements Private Limited: Name of The ClientDocument1 pageZebu Share and Wealth Managements Private Limited: Name of The ClientMadhanNo ratings yet

- 1.1 Edi PDFDocument61 pages1.1 Edi PDFYasmine ArabNo ratings yet

- Inf Cedear IAM 10mar2022Document2 pagesInf Cedear IAM 10mar2022vdedillon2023No ratings yet

- Mutual Fund (User Manual)Document24 pagesMutual Fund (User Manual)satyagodfatherNo ratings yet

- Tata Power Company Limited Share Price Today, Stock Price, Live NSE News, Quotes, Tips - NSE IndiaDocument2 pagesTata Power Company Limited Share Price Today, Stock Price, Live NSE News, Quotes, Tips - NSE Indiasantanu_1310No ratings yet

- Super Rich StrategyDocument18 pagesSuper Rich StrategyARV PHOTOSNo ratings yet

- Angel One Limited: Daily Margin Statement For The Day: 29/11/2023Document1 pageAngel One Limited: Daily Margin Statement For The Day: 29/11/2023shreyashwankhade19No ratings yet

- CM V132190 18082020 PDFDocument1 pageCM V132190 18082020 PDFvinodNo ratings yet

- Ws 240223Document10 pagesWs 240223Gayeong KimNo ratings yet

- Angel Broking Limited.: Daily Margin Statement For The Day: 18/08/2020Document1 pageAngel Broking Limited.: Daily Margin Statement For The Day: 18/08/2020vinodNo ratings yet

- Capital Market 3Document18 pagesCapital Market 3CancelynshrnpNo ratings yet

- Project LEAP - Purchase Report: Lead Sourcing InformationDocument4 pagesProject LEAP - Purchase Report: Lead Sourcing InformationPavan Singh RajputNo ratings yet

- Axis Equity & Hybrid Common Appl FromDocument4 pagesAxis Equity & Hybrid Common Appl FromAltamash FaridNo ratings yet

- Nvocc List 2023Document69 pagesNvocc List 2023Mannu GoyatNo ratings yet

- Beyond Illusion & Doubt - Bhaktivedanta Vedabase PDFDocument194 pagesBeyond Illusion & Doubt - Bhaktivedanta Vedabase PDFAnikó Guttmann-PappNo ratings yet

- 21-064 Dean Hall Cooling Tower RFPDocument37 pages21-064 Dean Hall Cooling Tower RFPvyshakhNo ratings yet

- Writing Packet 12 1 19Document85 pagesWriting Packet 12 1 19JerryNo ratings yet

- Department of The Treasury IRS Memo For Hieu MattisonDocument2 pagesDepartment of The Treasury IRS Memo For Hieu Mattison9newsNo ratings yet

- Navid Chowdhury IsArguments For Nuclear As Renewable EnergyDocument3 pagesNavid Chowdhury IsArguments For Nuclear As Renewable Energylram70No ratings yet

- Fundamentals of Public PolicyDocument41 pagesFundamentals of Public Policysohini chatterjee100% (1)

- Social Networking Sites Pros and ConsDocument4 pagesSocial Networking Sites Pros and ConsZAHARIAH BINTI MOHD ZAIN KPM-Guru100% (1)

- Eclair-Coupe Paris Basic Book 1952 PatternsDocument25 pagesEclair-Coupe Paris Basic Book 1952 Patternsantoniaher82% (17)

- Bangladeshi Migration To West BengalDocument34 pagesBangladeshi Migration To West BengalAkshat KaulNo ratings yet

- Seven BaptismsDocument21 pagesSeven BaptismsRobert Hargenrater100% (1)

- DevianceDocument13 pagesDevianceEmmanuel Jimenez-Bacud, CSE-Professional,BA-MA Pol SciNo ratings yet

- Roderick Talley Loses No-Knock LawsuitDocument12 pagesRoderick Talley Loses No-Knock LawsuitRuss Racop0% (1)

- Ben SdgeDocument1 pageBen SdgeCandy ValentineNo ratings yet

- Site of The First MassDocument18 pagesSite of The First MassKim Arielle GarciaNo ratings yet

- Syc Ausmat Sept Fee Structure 2019Document1 pageSyc Ausmat Sept Fee Structure 2019SeanNo ratings yet

- Gopher CEO Open Letter To Tampa Bay CommunityDocument2 pagesGopher CEO Open Letter To Tampa Bay CommunityPeter SchorschNo ratings yet

- Order Granting Preliminary Injunction - Drag Story Hour BanDocument53 pagesOrder Granting Preliminary Injunction - Drag Story Hour BanNBC MontanaNo ratings yet

- The Basic Economic Problem Unit 1 - Lesson.2Document13 pagesThe Basic Economic Problem Unit 1 - Lesson.2Aditya SARMA (9CWA)No ratings yet

- GR, 12 (A) Mock Exam (2022 2023) (Al Warith Bin Ka'Ab) ) Marking GuideDocument7 pagesGR, 12 (A) Mock Exam (2022 2023) (Al Warith Bin Ka'Ab) ) Marking Guideاحمد المقباليNo ratings yet

- Cha v. CA 277 SCRA 690Document4 pagesCha v. CA 277 SCRA 690Justine UyNo ratings yet

- ReportsDocument5 pagesReportsapi-536196914No ratings yet

- Parole Objection - Paula Sims B07074Document5 pagesParole Objection - Paula Sims B07074Kavahn MansouriNo ratings yet

- A Review of The Differences and Similarities Between Generic Drugs and Their OriginatorDocument19 pagesA Review of The Differences and Similarities Between Generic Drugs and Their Originatoriabureid7460No ratings yet

- Before: Jane C. HiattDocument5 pagesBefore: Jane C. HiattduobaobearNo ratings yet

- JiBril UsOol ClassDocument375 pagesJiBril UsOol ClassMahmud MahmudiNo ratings yet

- Pengembangan Desa Wisata Berbasis Unggulan Dan Pemberdayaan Masyarakat (Kajian Pengembangan Unggulam Dan Talenta Budaya Masyarakat Karimunjawa Kabupaten Jepara)Document22 pagesPengembangan Desa Wisata Berbasis Unggulan Dan Pemberdayaan Masyarakat (Kajian Pengembangan Unggulam Dan Talenta Budaya Masyarakat Karimunjawa Kabupaten Jepara)armita ameliaNo ratings yet

- Tibet Journal IndexDocument99 pagesTibet Journal Indexninfola100% (2)

- Effect of Independence, Professionalism, Professional Skepticism and Time Budget Pressure On Audit Quality With Moral Reasoning As Moderation VariablesDocument13 pagesEffect of Independence, Professionalism, Professional Skepticism and Time Budget Pressure On Audit Quality With Moral Reasoning As Moderation VariablesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Employee Complains About Falsified Time Records at Marcellus Town Highway DepartmentDocument4 pagesEmployee Complains About Falsified Time Records at Marcellus Town Highway DepartmentCharleyHannaganNo ratings yet