Professional Documents

Culture Documents

Capm Info

Capm Info

Uploaded by

Vitthal Sawant.Copyright:

Available Formats

You might also like

- Seaoil Philippines, Incorporated Screening Tool For Management Trainee ApplicantsDocument2 pagesSeaoil Philippines, Incorporated Screening Tool For Management Trainee Applicantsleojay24No ratings yet

- Capital Asset Pricing ModelDocument8 pagesCapital Asset Pricing Modelمحمد حمزہ اسلمNo ratings yet

- Corporate Finance Individual AssignmentDocument9 pagesCorporate Finance Individual AssignmentchabeNo ratings yet

- E4 CAPM Theory Advantages and DisadvantagesDocument6 pagesE4 CAPM Theory Advantages and DisadvantagesTENGKU ANIS TENGKU YUSMANo ratings yet

- Valuation of Securities Including Capital Asset ModelDocument11 pagesValuation of Securities Including Capital Asset Modelmayaverma123pNo ratings yet

- Disadvantage 0f CAPMDocument4 pagesDisadvantage 0f CAPMromanaNo ratings yet

- SAPM Unit-3Document18 pagesSAPM Unit-3Badrinath BhardwajNo ratings yet

- Capm Ta 1Document6 pagesCapm Ta 1Olivier MNo ratings yet

- CAPM: Theory, Advantages, and DisadvantagesDocument9 pagesCAPM: Theory, Advantages, and DisadvantagesMuhammad YahyaNo ratings yet

- Capital Asset Pricing Model - CAPMDocument2 pagesCapital Asset Pricing Model - CAPMSylvia ShirapovaNo ratings yet

- Capital Asset Pricing ModelDocument17 pagesCapital Asset Pricing ModelChrisna Joyce MisaNo ratings yet

- What Is The Capital Asset Pricing ModelDocument1 pageWhat Is The Capital Asset Pricing Modelxin nianNo ratings yet

- Capital Asset Pricing Model ExtraDocument10 pagesCapital Asset Pricing Model ExtraMohamed Hassan ElleithyNo ratings yet

- New DOCX DocumentDocument4 pagesNew DOCX DocumentADITYA JOG YTNo ratings yet

- Capital Asset Pricing ModelDocument13 pagesCapital Asset Pricing ModelkamransNo ratings yet

- Notes MBADocument46 pagesNotes MBAAghora Siva100% (3)

- Topic: Explain CAPM With Assumptions. IntroductionDocument3 pagesTopic: Explain CAPM With Assumptions. Introductiondeepti sharmaNo ratings yet

- Capital Asset Pricing ModelDocument12 pagesCapital Asset Pricing ModelfarahNo ratings yet

- Capital Asset Pricing ModelDocument10 pagesCapital Asset Pricing ModelAdmin RiotNo ratings yet

- Assignment of Security Analysis & Portfolio Management On Capital Asset Pricing ModelDocument6 pagesAssignment of Security Analysis & Portfolio Management On Capital Asset Pricing ModelShubhamNo ratings yet

- AN INTRODUCTION To ASSET PRICING MODELSDocument36 pagesAN INTRODUCTION To ASSET PRICING MODELSLea AndreleiNo ratings yet

- Capital Asset Pricing ModelDocument5 pagesCapital Asset Pricing ModelRajvi SampatNo ratings yet

- Cost of Capital & CAPM - CMA & ACCADocument13 pagesCost of Capital & CAPM - CMA & ACCAMahesh SadhNo ratings yet

- McapmDocument6 pagesMcapmAntonia BogatuNo ratings yet

- Analyzing Capital Asset Pricing Model 294474716Document12 pagesAnalyzing Capital Asset Pricing Model 294474716Simu MatharuNo ratings yet

- Use of A DFA Model To Evaluate Reinsurance Programs: Case StudyDocument30 pagesUse of A DFA Model To Evaluate Reinsurance Programs: Case StudyHesham Alabani100% (2)

- CAPMDocument1 pageCAPMKolariya DheerajNo ratings yet

- Theory CoC and WACCDocument9 pagesTheory CoC and WACCMisky1673No ratings yet

- Certainty Equivalent, Risk Premium and Asset Pricing: Zhiqiang ZhangDocument15 pagesCertainty Equivalent, Risk Premium and Asset Pricing: Zhiqiang ZhangRaj ShravanthiNo ratings yet

- What Is CAPM?: CAPM Formula and CalculationDocument3 pagesWhat Is CAPM?: CAPM Formula and CalculationMillat AfridiNo ratings yet

- Capital Asset Pricing Model ("CAPM")Document3 pagesCapital Asset Pricing Model ("CAPM")Akhil RupaniNo ratings yet

- Capm Advantages and DisadvantagesDocument3 pagesCapm Advantages and DisadvantagesHasanovMirasovičNo ratings yet

- Risk and Return: Underwriting, Investment and Leverage Probability of Surplus Drawdown and Pricing For Underwriting and Investment RiskDocument48 pagesRisk and Return: Underwriting, Investment and Leverage Probability of Surplus Drawdown and Pricing For Underwriting and Investment RiskNebiyu SamuelNo ratings yet

- Acfn 612 Ansewer SheetDocument8 pagesAcfn 612 Ansewer Sheetmubarik awolNo ratings yet

- 8524 UniqueDocument20 pages8524 UniqueMs AimaNo ratings yet

- CAPMDocument2 pagesCAPMСАНЧИР ГанбаатарNo ratings yet

- 06 Cost of CapitalDocument13 pages06 Cost of Capitallawrence.dururuNo ratings yet

- CAPM - Theory, Advantages, and Disadvantages - F9 Financial Management - ACCA Qualification - Students - ACCA GlobalDocument9 pagesCAPM - Theory, Advantages, and Disadvantages - F9 Financial Management - ACCA Qualification - Students - ACCA Globalmagnetbox8No ratings yet

- Introduction To International CAPMDocument7 pagesIntroduction To International CAPMselozok1100% (1)

- Capital Asset Pricing ModelDocument1 pageCapital Asset Pricing ModelVinod MenonNo ratings yet

- Capital Asset Pricing ModelDocument4 pagesCapital Asset Pricing ModelGeorge Ayesa Sembereka Jr.No ratings yet

- E (R) Is Expected Return On Capital Asset R: Security Market LineDocument3 pagesE (R) Is Expected Return On Capital Asset R: Security Market LineAvinash AstyaNo ratings yet

- Definition of 'Capital Asset Pricing Model - CAPM'Document1 pageDefinition of 'Capital Asset Pricing Model - CAPM'Amit TripathiNo ratings yet

- Capital Market TheoryDocument36 pagesCapital Market TheoryNeelam MadarapuNo ratings yet

- Capm + AptDocument10 pagesCapm + AptharoonkhanNo ratings yet

- Financial Concepts: The Optimal Portfolio: Modern Portfolio Theory RiskDocument2 pagesFinancial Concepts: The Optimal Portfolio: Modern Portfolio Theory Riskvenky16021989No ratings yet

- Differentiate Profit Maximization From Wealth MaximizationDocument8 pagesDifferentiate Profit Maximization From Wealth MaximizationRobi MatiNo ratings yet

- Equity Risk Premiums (ERP) : Determinants, Estimation and Implications - The 2012 EditionDocument107 pagesEquity Risk Premiums (ERP) : Determinants, Estimation and Implications - The 2012 EditionTuyết LongNo ratings yet

- What Is The Capital Asset Pricing Model?Document4 pagesWhat Is The Capital Asset Pricing Model?Klester Kim Sauro ZitaNo ratings yet

- 14 Chapter 7Document16 pages14 Chapter 7tarek khanNo ratings yet

- The Capital Asset Pricing ModelDocument43 pagesThe Capital Asset Pricing ModelTajendra ChughNo ratings yet

- Session 5Document17 pagesSession 5maha khanNo ratings yet

- Yukta Jhala Tybaf 16Document5 pagesYukta Jhala Tybaf 16Sameer ChoudharyNo ratings yet

- Capital Asset Pricing ModelDocument6 pagesCapital Asset Pricing ModelkelvinramosNo ratings yet

- Article Review Report On Revised Capital Assets Pricing Model An Improved Model For ForecastingDocument8 pagesArticle Review Report On Revised Capital Assets Pricing Model An Improved Model For ForecastingWorash EngidawNo ratings yet

- Advantages and Disadvantages of Capital ASset Pricing ModelDocument3 pagesAdvantages and Disadvantages of Capital ASset Pricing Modelkvj292001100% (1)

- Fin Market - Chapter 7Document46 pagesFin Market - Chapter 7Arbie DecimioNo ratings yet

- Capital Asset Pricing Model: Make smart investment decisions to build a strong portfolioFrom EverandCapital Asset Pricing Model: Make smart investment decisions to build a strong portfolioRating: 4.5 out of 5 stars4.5/5 (3)

- Capm 2Document1 pageCapm 2Vitthal Sawant.No ratings yet

- 287402-Aushadhi VanaspatiDocument170 pages287402-Aushadhi VanaspatiVitthal Sawant.No ratings yet

- Capm 1Document1 pageCapm 1Vitthal Sawant.No ratings yet

- Assumption of CapmDocument1 pageAssumption of CapmVitthal Sawant.No ratings yet

- Gmail - Requesting For Your Availability For A Motivational Speaking SessionDocument1 pageGmail - Requesting For Your Availability For A Motivational Speaking SessionVitthal Sawant.No ratings yet

- SE Assignment No.1Document20 pagesSE Assignment No.1Vitthal Sawant.No ratings yet

- Rest ClientsDocument2 pagesRest ClientsVitthal Sawant.No ratings yet

- DWM 2Document3 pagesDWM 2Vitthal Sawant.No ratings yet

Capm Info

Capm Info

Uploaded by

Vitthal Sawant.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capm Info

Capm Info

Uploaded by

Vitthal Sawant.Copyright:

Available Formats

Powered by AI

Bing

The Capital Asset Pricing Model (CAPM) is a financial model that describes the relationship between the expected

return and risk of investing in a security. It shows that the expected return on a security is equal to the risk-free

return plus a risk premium, which is based on the beta of that security.

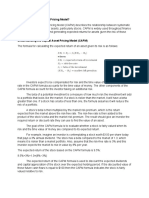

The CAPM formula is used for calculating the expected returns of an asset. It is based on the idea of systematic

risk (otherwise known as non-diversifiable risk) that investors need to be compensated for in the form of a risk

premium. A risk premium is a rate of return greater than the risk-free rate. When investing, investors desire a

higher risk premium when taking on more risky investments.

The CAPM was developed by economist and Nobel Memorial Prize winner William Sharpe in 1990. The model

conveys that the return on investment should equal its cost of capital and that the only way to earn a higher return

is by taking on more risk.

Despite some limitations, such as making unrealistic assumptions and relying on a linear interpretation of risk vs.

return, CAPM is widely used because it allows for easy comparisons of investment alternatives.

You might also like

- Seaoil Philippines, Incorporated Screening Tool For Management Trainee ApplicantsDocument2 pagesSeaoil Philippines, Incorporated Screening Tool For Management Trainee Applicantsleojay24No ratings yet

- Capital Asset Pricing ModelDocument8 pagesCapital Asset Pricing Modelمحمد حمزہ اسلمNo ratings yet

- Corporate Finance Individual AssignmentDocument9 pagesCorporate Finance Individual AssignmentchabeNo ratings yet

- E4 CAPM Theory Advantages and DisadvantagesDocument6 pagesE4 CAPM Theory Advantages and DisadvantagesTENGKU ANIS TENGKU YUSMANo ratings yet

- Valuation of Securities Including Capital Asset ModelDocument11 pagesValuation of Securities Including Capital Asset Modelmayaverma123pNo ratings yet

- Disadvantage 0f CAPMDocument4 pagesDisadvantage 0f CAPMromanaNo ratings yet

- SAPM Unit-3Document18 pagesSAPM Unit-3Badrinath BhardwajNo ratings yet

- Capm Ta 1Document6 pagesCapm Ta 1Olivier MNo ratings yet

- CAPM: Theory, Advantages, and DisadvantagesDocument9 pagesCAPM: Theory, Advantages, and DisadvantagesMuhammad YahyaNo ratings yet

- Capital Asset Pricing Model - CAPMDocument2 pagesCapital Asset Pricing Model - CAPMSylvia ShirapovaNo ratings yet

- Capital Asset Pricing ModelDocument17 pagesCapital Asset Pricing ModelChrisna Joyce MisaNo ratings yet

- What Is The Capital Asset Pricing ModelDocument1 pageWhat Is The Capital Asset Pricing Modelxin nianNo ratings yet

- Capital Asset Pricing Model ExtraDocument10 pagesCapital Asset Pricing Model ExtraMohamed Hassan ElleithyNo ratings yet

- New DOCX DocumentDocument4 pagesNew DOCX DocumentADITYA JOG YTNo ratings yet

- Capital Asset Pricing ModelDocument13 pagesCapital Asset Pricing ModelkamransNo ratings yet

- Notes MBADocument46 pagesNotes MBAAghora Siva100% (3)

- Topic: Explain CAPM With Assumptions. IntroductionDocument3 pagesTopic: Explain CAPM With Assumptions. Introductiondeepti sharmaNo ratings yet

- Capital Asset Pricing ModelDocument12 pagesCapital Asset Pricing ModelfarahNo ratings yet

- Capital Asset Pricing ModelDocument10 pagesCapital Asset Pricing ModelAdmin RiotNo ratings yet

- Assignment of Security Analysis & Portfolio Management On Capital Asset Pricing ModelDocument6 pagesAssignment of Security Analysis & Portfolio Management On Capital Asset Pricing ModelShubhamNo ratings yet

- AN INTRODUCTION To ASSET PRICING MODELSDocument36 pagesAN INTRODUCTION To ASSET PRICING MODELSLea AndreleiNo ratings yet

- Capital Asset Pricing ModelDocument5 pagesCapital Asset Pricing ModelRajvi SampatNo ratings yet

- Cost of Capital & CAPM - CMA & ACCADocument13 pagesCost of Capital & CAPM - CMA & ACCAMahesh SadhNo ratings yet

- McapmDocument6 pagesMcapmAntonia BogatuNo ratings yet

- Analyzing Capital Asset Pricing Model 294474716Document12 pagesAnalyzing Capital Asset Pricing Model 294474716Simu MatharuNo ratings yet

- Use of A DFA Model To Evaluate Reinsurance Programs: Case StudyDocument30 pagesUse of A DFA Model To Evaluate Reinsurance Programs: Case StudyHesham Alabani100% (2)

- CAPMDocument1 pageCAPMKolariya DheerajNo ratings yet

- Theory CoC and WACCDocument9 pagesTheory CoC and WACCMisky1673No ratings yet

- Certainty Equivalent, Risk Premium and Asset Pricing: Zhiqiang ZhangDocument15 pagesCertainty Equivalent, Risk Premium and Asset Pricing: Zhiqiang ZhangRaj ShravanthiNo ratings yet

- What Is CAPM?: CAPM Formula and CalculationDocument3 pagesWhat Is CAPM?: CAPM Formula and CalculationMillat AfridiNo ratings yet

- Capital Asset Pricing Model ("CAPM")Document3 pagesCapital Asset Pricing Model ("CAPM")Akhil RupaniNo ratings yet

- Capm Advantages and DisadvantagesDocument3 pagesCapm Advantages and DisadvantagesHasanovMirasovičNo ratings yet

- Risk and Return: Underwriting, Investment and Leverage Probability of Surplus Drawdown and Pricing For Underwriting and Investment RiskDocument48 pagesRisk and Return: Underwriting, Investment and Leverage Probability of Surplus Drawdown and Pricing For Underwriting and Investment RiskNebiyu SamuelNo ratings yet

- Acfn 612 Ansewer SheetDocument8 pagesAcfn 612 Ansewer Sheetmubarik awolNo ratings yet

- 8524 UniqueDocument20 pages8524 UniqueMs AimaNo ratings yet

- CAPMDocument2 pagesCAPMСАНЧИР ГанбаатарNo ratings yet

- 06 Cost of CapitalDocument13 pages06 Cost of Capitallawrence.dururuNo ratings yet

- CAPM - Theory, Advantages, and Disadvantages - F9 Financial Management - ACCA Qualification - Students - ACCA GlobalDocument9 pagesCAPM - Theory, Advantages, and Disadvantages - F9 Financial Management - ACCA Qualification - Students - ACCA Globalmagnetbox8No ratings yet

- Introduction To International CAPMDocument7 pagesIntroduction To International CAPMselozok1100% (1)

- Capital Asset Pricing ModelDocument1 pageCapital Asset Pricing ModelVinod MenonNo ratings yet

- Capital Asset Pricing ModelDocument4 pagesCapital Asset Pricing ModelGeorge Ayesa Sembereka Jr.No ratings yet

- E (R) Is Expected Return On Capital Asset R: Security Market LineDocument3 pagesE (R) Is Expected Return On Capital Asset R: Security Market LineAvinash AstyaNo ratings yet

- Definition of 'Capital Asset Pricing Model - CAPM'Document1 pageDefinition of 'Capital Asset Pricing Model - CAPM'Amit TripathiNo ratings yet

- Capital Market TheoryDocument36 pagesCapital Market TheoryNeelam MadarapuNo ratings yet

- Capm + AptDocument10 pagesCapm + AptharoonkhanNo ratings yet

- Financial Concepts: The Optimal Portfolio: Modern Portfolio Theory RiskDocument2 pagesFinancial Concepts: The Optimal Portfolio: Modern Portfolio Theory Riskvenky16021989No ratings yet

- Differentiate Profit Maximization From Wealth MaximizationDocument8 pagesDifferentiate Profit Maximization From Wealth MaximizationRobi MatiNo ratings yet

- Equity Risk Premiums (ERP) : Determinants, Estimation and Implications - The 2012 EditionDocument107 pagesEquity Risk Premiums (ERP) : Determinants, Estimation and Implications - The 2012 EditionTuyết LongNo ratings yet

- What Is The Capital Asset Pricing Model?Document4 pagesWhat Is The Capital Asset Pricing Model?Klester Kim Sauro ZitaNo ratings yet

- 14 Chapter 7Document16 pages14 Chapter 7tarek khanNo ratings yet

- The Capital Asset Pricing ModelDocument43 pagesThe Capital Asset Pricing ModelTajendra ChughNo ratings yet

- Session 5Document17 pagesSession 5maha khanNo ratings yet

- Yukta Jhala Tybaf 16Document5 pagesYukta Jhala Tybaf 16Sameer ChoudharyNo ratings yet

- Capital Asset Pricing ModelDocument6 pagesCapital Asset Pricing ModelkelvinramosNo ratings yet

- Article Review Report On Revised Capital Assets Pricing Model An Improved Model For ForecastingDocument8 pagesArticle Review Report On Revised Capital Assets Pricing Model An Improved Model For ForecastingWorash EngidawNo ratings yet

- Advantages and Disadvantages of Capital ASset Pricing ModelDocument3 pagesAdvantages and Disadvantages of Capital ASset Pricing Modelkvj292001100% (1)

- Fin Market - Chapter 7Document46 pagesFin Market - Chapter 7Arbie DecimioNo ratings yet

- Capital Asset Pricing Model: Make smart investment decisions to build a strong portfolioFrom EverandCapital Asset Pricing Model: Make smart investment decisions to build a strong portfolioRating: 4.5 out of 5 stars4.5/5 (3)

- Capm 2Document1 pageCapm 2Vitthal Sawant.No ratings yet

- 287402-Aushadhi VanaspatiDocument170 pages287402-Aushadhi VanaspatiVitthal Sawant.No ratings yet

- Capm 1Document1 pageCapm 1Vitthal Sawant.No ratings yet

- Assumption of CapmDocument1 pageAssumption of CapmVitthal Sawant.No ratings yet

- Gmail - Requesting For Your Availability For A Motivational Speaking SessionDocument1 pageGmail - Requesting For Your Availability For A Motivational Speaking SessionVitthal Sawant.No ratings yet

- SE Assignment No.1Document20 pagesSE Assignment No.1Vitthal Sawant.No ratings yet

- Rest ClientsDocument2 pagesRest ClientsVitthal Sawant.No ratings yet

- DWM 2Document3 pagesDWM 2Vitthal Sawant.No ratings yet