Professional Documents

Culture Documents

Capital Asset Pricing Model

Capital Asset Pricing Model

Uploaded by

Admin Riot0 ratings0% found this document useful (0 votes)

10 views10 pagesThe Capital Asset Pricing Model (CAPM) establishes a linear relationship between the required return on an investment and its risk. CAPM uses an asset's beta, the risk-free rate, and equity risk premium to calculate the expected rate of return for an asset or investment based on its sensitivity to market movements. While CAPM makes some unrealistic assumptions, it remains widely used because it provides a simple way to evaluate investment alternatives and understand portfolio risk and expected returns.

Original Description:

Original Title

Capital+Asset+Pricing+Model

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Capital Asset Pricing Model (CAPM) establishes a linear relationship between the required return on an investment and its risk. CAPM uses an asset's beta, the risk-free rate, and equity risk premium to calculate the expected rate of return for an asset or investment based on its sensitivity to market movements. While CAPM makes some unrealistic assumptions, it remains widely used because it provides a simple way to evaluate investment alternatives and understand portfolio risk and expected returns.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views10 pagesCapital Asset Pricing Model

Capital Asset Pricing Model

Uploaded by

Admin RiotThe Capital Asset Pricing Model (CAPM) establishes a linear relationship between the required return on an investment and its risk. CAPM uses an asset's beta, the risk-free rate, and equity risk premium to calculate the expected rate of return for an asset or investment based on its sensitivity to market movements. While CAPM makes some unrealistic assumptions, it remains widely used because it provides a simple way to evaluate investment alternatives and understand portfolio risk and expected returns.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 10

Capital Asset Pricing Model

Quantitative Finance with Python

What is Capital Asset Pricing Model ?

The Capital Asset Pricing Model (CAPM) describes the relationship between

systematic risk, or the general perils of investing, and expected return for

assets, particularly stocks.

It is a finance model that establishes a linear relationship between the required return on an

investment and risk. The model is based on the relationship between an asset's beta, the

risk free rate and the equity risk premium, or the expected return on the market minus the

risk-free rate.

CAPM evolved as a way to measure this systematic risk. It is widely used

throughout finance for pricing risky securities and generating expected returns

for assets, given the risk of those assets and cost of capital.

What is Capital Asset Pricing Model ?

● The capital asset pricing model - or CAPM - is a financial model that calculates

the expected rate of return for an asset or investment.

● CAPM does this by using the expected return on both the market and a risk-free

asset, and the asset's correlation or sensitivity to the market (beta).

● There are some limitations to the CAPM, such as making unrealistic

assumptions and relying on a linear interpretation of risk vs. return.

● Despite its issues, the CAPM formula is still widely used because it is simple

and allows for easy comparisons of investment alternatives.

● For instance, it is used in conjunction with modern portfolio theory (MPT) to

understand portfolio risk and expected return.

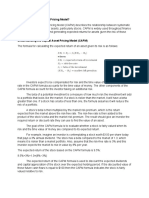

Formula for CAPM

Thank You

You might also like

- Ameri TradeDocument7 pagesAmeri TradexenabNo ratings yet

- Reading 53: Portfolio Risk and Return: Part IIDocument37 pagesReading 53: Portfolio Risk and Return: Part IIAlex PaulNo ratings yet

- CAPMDocument1 pageCAPMKolariya DheerajNo ratings yet

- Arbitrage Pricing Theory, CAPMDocument11 pagesArbitrage Pricing Theory, CAPMMazhar HossainNo ratings yet

- The Capital Asset Pricing ModelDocument5 pagesThe Capital Asset Pricing ModelFaisal KhanNo ratings yet

- Saim Unit 3 & Unit 4 NotesDocument9 pagesSaim Unit 3 & Unit 4 NotesSantosh MaheshwariNo ratings yet

- Benefits and Usage of CapmDocument1 pageBenefits and Usage of CapmPavan H.P.No ratings yet

- Capital Asset Pricing ModelDocument17 pagesCapital Asset Pricing ModelChrisna Joyce MisaNo ratings yet

- Capital Asset Pricing Model - CAPMDocument2 pagesCapital Asset Pricing Model - CAPMSylvia ShirapovaNo ratings yet

- CAPMDocument6 pagesCAPMAbu Bakar ManafNo ratings yet

- Pim Mod-VDocument27 pagesPim Mod-VAkhand RanaNo ratings yet

- Capital Asset Pricing ModelDocument6 pagesCapital Asset Pricing ModelkelvinramosNo ratings yet

- Article Review Report On Revised Capital Assets Pricing Model An Improved Model For ForecastingDocument8 pagesArticle Review Report On Revised Capital Assets Pricing Model An Improved Model For ForecastingWorash EngidawNo ratings yet

- CAPMDocument4 pagesCAPMhamza hamzaNo ratings yet

- CAPM Represented in The SMLDocument3 pagesCAPM Represented in The SMLKarthik KNo ratings yet

- SAPM Unit-3Document18 pagesSAPM Unit-3Badrinath BhardwajNo ratings yet

- Capital Asset Pricing ModelDocument1 pageCapital Asset Pricing ModelVinod MenonNo ratings yet

- RFR CapmDocument23 pagesRFR CapmAline Aprille Capuchino MendezNo ratings yet

- Valuation of Securities Including Capital Asset ModelDocument11 pagesValuation of Securities Including Capital Asset Modelmayaverma123pNo ratings yet

- Capital Market TheoryDocument25 pagesCapital Market Theoryiqra sarfarazNo ratings yet

- Capital Asset Pricing ModelDocument12 pagesCapital Asset Pricing ModelfarahNo ratings yet

- Capital Asset Pricing Model (CAPM)Document25 pagesCapital Asset Pricing Model (CAPM)ktkalai selviNo ratings yet

- E (R) Is Expected Return On Capital Asset R: Security Market LineDocument3 pagesE (R) Is Expected Return On Capital Asset R: Security Market LineAvinash AstyaNo ratings yet

- Assignment#04Document10 pagesAssignment#04irfanhaidersewagNo ratings yet

- Capital Asset Pricing ModelDocument8 pagesCapital Asset Pricing Modelمحمد حمزہ اسلمNo ratings yet

- Capital Asset Pricing Model ExtraDocument10 pagesCapital Asset Pricing Model ExtraMohamed Hassan ElleithyNo ratings yet

- Presentation On CAPMDocument13 pagesPresentation On CAPMmx plNo ratings yet

- Capital Asset Pricing ModelDocument5 pagesCapital Asset Pricing ModelRajvi SampatNo ratings yet

- Cost of Capital & CAPM - CMA & ACCADocument13 pagesCost of Capital & CAPM - CMA & ACCAMahesh SadhNo ratings yet

- C A P M: Apital Sset Ricing OdelDocument14 pagesC A P M: Apital Sset Ricing OdelInvisible CionNo ratings yet

- Analyzing Capital Asset Pricing Model 294474716Document12 pagesAnalyzing Capital Asset Pricing Model 294474716Simu MatharuNo ratings yet

- Reading MaterialDocument3 pagesReading MaterialUday BansalNo ratings yet

- CAPMDocument2 pagesCAPMСАНЧИР ГанбаатарNo ratings yet

- Capm InfoDocument1 pageCapm InfoVitthal Sawant.No ratings yet

- Capital Asset Pricing ModelDocument13 pagesCapital Asset Pricing ModelkamransNo ratings yet

- 8524 UniqueDocument20 pages8524 UniqueMs AimaNo ratings yet

- Disadvantage 0f CAPMDocument4 pagesDisadvantage 0f CAPMromanaNo ratings yet

- CAPM: Theory, Advantages, and DisadvantagesDocument9 pagesCAPM: Theory, Advantages, and DisadvantagesMuhammad YahyaNo ratings yet

- E4 CAPM Theory Advantages and DisadvantagesDocument6 pagesE4 CAPM Theory Advantages and DisadvantagesTENGKU ANIS TENGKU YUSMANo ratings yet

- Portfolio Long Ans QuestionDocument5 pagesPortfolio Long Ans QuestionAurora AcharyaNo ratings yet

- CAPM Approach To Estimating The Cost of Capital - 2023 VersionDocument11 pagesCAPM Approach To Estimating The Cost of Capital - 2023 VersionJeremiah KhongNo ratings yet

- What Is The Capital Asset Pricing Model?Document4 pagesWhat Is The Capital Asset Pricing Model?Klester Kim Sauro ZitaNo ratings yet

- Capm + AptDocument10 pagesCapm + AptharoonkhanNo ratings yet

- Capital Asset Pricing ModelDocument4 pagesCapital Asset Pricing ModelGeorge Ayesa Sembereka Jr.No ratings yet

- Capital Asset Pricing Model IIIDocument8 pagesCapital Asset Pricing Model III27usmanNo ratings yet

- CapmDocument1 pageCapmVivekNo ratings yet

- Yukta Jhala Tybaf 16Document5 pagesYukta Jhala Tybaf 16Sameer ChoudharyNo ratings yet

- DB 2 - Finance and AccountingDocument4 pagesDB 2 - Finance and AccountingNanthaNo ratings yet

- New DOCX DocumentDocument4 pagesNew DOCX DocumentADITYA JOG YTNo ratings yet

- Portfolio Theories1Document17 pagesPortfolio Theories1ayazNo ratings yet

- The Capital Asset Pricing ModelDocument43 pagesThe Capital Asset Pricing ModelTajendra ChughNo ratings yet

- Notes MBADocument46 pagesNotes MBAAghora Siva100% (3)

- Corporate Finance Individual AssignmentDocument9 pagesCorporate Finance Individual AssignmentchabeNo ratings yet

- Capital Asset Pricing ModelDocument8 pagesCapital Asset Pricing ModelJanani RaniNo ratings yet

- Capital Asset Pricing Model ("CAPM")Document3 pagesCapital Asset Pricing Model ("CAPM")Akhil RupaniNo ratings yet

- Literature Review On Capm ModelDocument5 pagesLiterature Review On Capm Modelaflshtabj100% (1)

- The Capital Asset Pricing Model (CAPM)Document22 pagesThe Capital Asset Pricing Model (CAPM)Amritpal Singh PanesarNo ratings yet

- CAPM Notes and Practice QuestionsDocument10 pagesCAPM Notes and Practice QuestionsShaguftaNo ratings yet

- E2 The Capital Asset Pricing Model Part 1Document6 pagesE2 The Capital Asset Pricing Model Part 1TENGKU ANIS TENGKU YUSMANo ratings yet