Professional Documents

Culture Documents

BDO Publication

BDO Publication

Uploaded by

Saira KhalilOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BDO Publication

BDO Publication

Uploaded by

Saira KhalilCopyright:

Available Formats

Sindh Trust Bill 2020

Enforced Sindh Trusts Act, 2020 having been passed by the Provincial Assembly

of Sindh on 21st August 2020 and assented to by the Governor of Sindh

on 22nd September 2020.

Repealed Trust Act 1882 (Act No. 2 of 1882).

The provisions of the Trust Act 1882 (Act No. 2 of 1882), are hereby repealed

to the extent of the Province of Sindh.

ESSENTIAL CHANGES

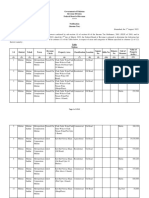

Trust Act 1882 Sindh Trusts Act, 2020

Prior to the implementation of the Sindh All forms of trust after the commencement

Registering Trust Act, 2020, this act registered all of the Sindh Trust Act, 2020 were registered

types of trusts. District-based Sub Registrar under this Act. The registering Authority is the

Authority offices served as the registering authority. government of Sindh Directorate of Industries

(Trust Wing).

There are two kinds of Trust. The first is Public Trust while the second is Private Trust.

Public trusts, such as welfare trusts, are registered to provide societal advantages at large.

Kind of Trust Private trusts, such as Masjids and Madaris, benefit a specific social sect.

Provident Fund and Gratuity Fund Trusts are register under the aforementioned Trust Act.

Register once and remain registered until Register on a recurring basis; annual renewal

Life of Trust the party itself dissolves the registration. is required.

1. Original Trust Deed. 1. Memorandum of Association in the

Documents 2. Original Rules. Form of Schedule-I of Sindh trust

Required 3. Copy of Notarized CNIC. Rules, 2020.

4. Passport-sized photograph. 2. Trust deed [One original and attested

5. Proof of the registered office of copy, original will be returned by the

the trust (Electricity/Sui Gas Bill or registrar after registration]. Each paper

rent agreement, mutation, or any of the trust should be signed by the

other proof). In case of rented author, trustee, and any other person

property, signed NOC is required associated with the trust and attested

from the landlord. by a notary public.

6. Government Challan Fee. 3. Affidavit under schedule II of Sindh

Trust rules, 2020 {Acceptance

certificate by trustee}

4. Attested Copies of CNIC or passport

copies of members of the trust.

5. Proof of the registered office of the

trust (Electricity/Sui Gas Bill or rent

agreement, mutation, or any other

proof). In case of rented property,

signed NOC is required from the

landlord.

6. Affidavit under schedule III of Sindh

Trust rules, 2020 attesting that neither

trust nor a member of the trust is

involved in any criminal activities/

proceedings, etc.

7. Bank Challan of Rs. 10,500/- Credit

to provincial Government under head

of Accounts C-03818.

8. Trust members’ details on schedule IV

of Sindh Trust rules, 2020.

9. Any other document as Director may

require.

The Trust Deed must be registered with Step 1: Submission of Documents with

the Trust Registrar. Trustees must appear draft Trust Deed and Rules.

before the Registrar for physical

Procedure for verification and Bio-Metric together with All documents will be submitted to the

Registration copies of all trustees' ID cards and two government of the Sindh Directorate of

passport-sized pictures of each trustee Industries (Trust Wing).

with Authority must be filed with the original Trust Deed

and a copy of the Rules before the Step 2: Verification.

Registrar. After registering, the Trust must

get a National Tax Number. Sindh Directorate of Industries (Trust Wing)

forward all documents to the Home

Department for verification. The concerned

officers shall report within 14 days of receiving

a request from the director. 14 days is not

applicable in case of any member is a

foreigner and his/her credentials will be

verified through the Embassy of Pakistan in

that country.

Step 3: NOC.

A NOC will be issued by the Home

Department to Trust Sindh Directorate of

Industries (Trust Wing) that all particulars and

trustees are eligible for registration.

Step 4: Payment of Challan and

presenting the Original Trust Deed.

Challan and the original trust deed will be

presented to the Director Trust Sindh

Directorate of Industries (Trust Wing).

Step 5: The registration certificate of the

trust will be issued when

1. Trust/its members are not involved in

the dissemination of hatred, militancy,

money laundering, or threats to

national security and harmony.

2. Members of the trust have submitted

comprehensive personal information,

none of which is forged/falsified.

The certificate issued will adhere to

Schedule-V of the 2020 Sindh Trust rules.

After registering with the Authority, an application for tax exemption approval must be

filed to the Commissioner of Inland Revenue.

Impact of the New Trust Act on registering and following the

rules on time to get the most benefits and avoid sanctions:

The following complication will occur from noncompliance with the Sindh Provincial Trust Act

of 2020:

• The trust will cease to operate;

• Its bank accounts will freeze.

• The trust will be ineligible to get an exemption certificate for non-withholding taxes;

• Penalties and sanctions may be imposed.

Remedy:

• To avoid confusion, companies or banks are required to register their Gratuity Funds

and Provident Funds under the aforementioned laws for their smooth operation and

so that their employees can get their post-retirement benefits.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Capital Gain On Immovable Property TableDocument1 pageCapital Gain On Immovable Property TableSaira KhalilNo ratings yet

- MultanDocument1,516 pagesMultanSaira KhalilNo ratings yet

- Chapter 1Document16 pagesChapter 1Saira KhalilNo ratings yet

- Sample Gratuity RulesDocument28 pagesSample Gratuity RulesSaira KhalilNo ratings yet

- Wealth & Wealth Reconciliation StatementDocument3 pagesWealth & Wealth Reconciliation StatementSaira KhalilNo ratings yet