Professional Documents

Culture Documents

Capital Gain On Immovable Property Table

Capital Gain On Immovable Property Table

Uploaded by

Saira KhalilOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Gain On Immovable Property Table

Capital Gain On Immovable Property Table

Uploaded by

Saira KhalilCopyright:

Available Formats

478

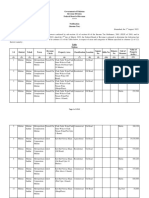

S.No Holding Period Rate of Tax

Open Plots Constructed Flats

Property

(1) (2) (3) (4) (5)

1. Where the holding period 15% 15% 15%

does not exceed one year

2. Where the holding period 12.5% 10% 7.5%

exceeds one year but does

not exceed two years

3. Where the holding period 10% 7.5% 0

exceeds two years but does

not exceed three years

4. Where the holding period 7.5% 5% -

exceeds three years but

does not exceed four years

5. Where the holding period 5% 0 -

exceeds four years but does

not exceed five years

6. Where the holding period 2.5% - -

exceeds five years but does

not exceed six years

7. Where the holding period 0% - -]

exceeds six years

1[Division VIIIA

TAX ON BUILDERS

The rate of tax under section 7C shall be as follows:

(A) Karachi, Lahore (B) Hyderabad, Sukkur, (C) Urban Areas not

and Islamabad Multan, Faisalabad, specified in A and B

Rawalpindi, Gujranwala,

Sahiwal, Peshawar,

Mardan, Abbottabad,

Quetta

For commercial buildings

Rs. 210/ Sq Ft Rs. 210/ Sq Ft Rs. 210/ Sq Ft

For residential buildings

1

Inserted by the Finance Act, 2016.

You might also like

- Vegetron CaseDocument15 pagesVegetron CaseRoshni Patel100% (1)

- Income Tax in PakistanDocument5 pagesIncome Tax in PakistanHamza AminNo ratings yet

- Changes Ty 2023Document4 pagesChanges Ty 2023fizzaNo ratings yet

- Test 2Document3 pagesTest 2Awais ShahidNo ratings yet

- WithholdingRatesCards 2022-2023Document17 pagesWithholdingRatesCards 2022-2023ausafhaider5345No ratings yet

- Tax Card SWHCC 2023-2024Document12 pagesTax Card SWHCC 2023-2024Ayan NoorNo ratings yet

- Interest Rates On Rupee Deposits W.E.F. 26-05-2022: Current Deposits (Domestic/NRO/NRE) ExistingDocument3 pagesInterest Rates On Rupee Deposits W.E.F. 26-05-2022: Current Deposits (Domestic/NRO/NRE) ExistingashishtrueNo ratings yet

- Cho RM 73 2020-21Document1 pageCho RM 73 2020-21Steve WozniakNo ratings yet

- Veg LTDDocument17 pagesVeg LTDkailashNo ratings yet

- The Jammu & Kashmir Bank LTD: AccountDocument5 pagesThe Jammu & Kashmir Bank LTD: AccountĒxçlūsìvē SympãthētìçNo ratings yet

- Administrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008Document3 pagesAdministrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008gmatweakNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsRaghav sharmaNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed Depositssasi 'sNo ratings yet

- Ongc Self Contributory Post Retirement & Death in Service Superannuation Benefit TrustDocument2 pagesOngc Self Contributory Post Retirement & Death in Service Superannuation Benefit TrustDharmender SinghNo ratings yet

- DRDDDDocument12 pagesDRDDDWaqar HussainNo ratings yet

- Rights of BusinessDocument2 pagesRights of BusinessHimanshu MilanNo ratings yet

- ALM PPT-Revised Dr. A NDocument23 pagesALM PPT-Revised Dr. A Nynkamat100% (1)

- Promotion Policy 11 January WAPDADocument28 pagesPromotion Policy 11 January WAPDANigah Hussain100% (1)

- Weekly Report - Operation Support and Compliance Team As of 25 August 2023Document79 pagesWeekly Report - Operation Support and Compliance Team As of 25 August 2023Dea SaskiaNo ratings yet

- Tax Practice TestsDocument81 pagesTax Practice Testsls786580302No ratings yet

- Test 2 CafDocument3 pagesTest 2 CafBrown BoiNo ratings yet

- Msme Rating SheetDocument4 pagesMsme Rating Sheetrajiv559No ratings yet

- f6pkn 2018 Jun QDocument12 pagesf6pkn 2018 Jun QZarnab RazaNo ratings yet

- Interest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresDocument4 pagesInterest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 Croresgolagani praveenkumarNo ratings yet

- Interest Rates On Deposits - Domestic, NRE, NRO - Rs. 2 Crore and AboveDocument5 pagesInterest Rates On Deposits - Domestic, NRE, NRO - Rs. 2 Crore and AboveParasjkohli6659No ratings yet

- Interest Rates On Deposits - Domestic, NRE, NRO - Rs. 2 Crore and AboveDocument5 pagesInterest Rates On Deposits - Domestic, NRE, NRO - Rs. 2 Crore and AboveParasjkohli6659No ratings yet

- Sugar Project QuestionDocument21 pagesSugar Project QuestionHardik ThackerNo ratings yet

- FM RTP, MTP, S.Answer Final FileDocument142 pagesFM RTP, MTP, S.Answer Final Filedeepu deepuNo ratings yet

- Deposits Deposits: IndividualsDocument5 pagesDeposits Deposits: IndividualskaushikNo ratings yet

- Interest Rates On Deposits Above Rs 2 Crs Wef 09082023Document5 pagesInterest Rates On Deposits Above Rs 2 Crs Wef 09082023Mohammed Eidrees RazaNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsV NaveenNo ratings yet

- PNB 250821Document1 pagePNB 250821P K MahatoNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsY_AZNo ratings yet

- Tenure General Public FD Rate Senior Citizens FD RateDocument9 pagesTenure General Public FD Rate Senior Citizens FD Rateisha jsNo ratings yet

- FD Rate Card - Oct 2022Document2 pagesFD Rate Card - Oct 2022Deepak SuyalNo ratings yet

- Yes Bank Interest ChargesDocument3 pagesYes Bank Interest ChargessaiaviNo ratings yet

- Website Disclosure EffectiveDocument3 pagesWebsite Disclosure EffectiveHimanshu MilanNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed Depositssaurav katarukaNo ratings yet

- Combined Summary of Cerc & Sercs Regulations/Tariff Orders: Wind Power ProjectsDocument10 pagesCombined Summary of Cerc & Sercs Regulations/Tariff Orders: Wind Power ProjectsKarthik DhayalanNo ratings yet

- Post Office Savings SchemesDocument5 pagesPost Office Savings SchemeslucknowhubNo ratings yet

- Capital Gain SummaryDocument1 pageCapital Gain SummaryLunasNo ratings yet

- Sanchay: Public Deposit SchemeDocument1 pageSanchay: Public Deposit SchemeShrikant MasulkerNo ratings yet

- Final BU POT Fall 2023Document4 pagesFinal BU POT Fall 2023sohail199aliNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsAkhilesh VijayaKumarNo ratings yet

- UBL Annual Report 2018-140Document1 pageUBL Annual Report 2018-140IFRS LabNo ratings yet

- HBFC PrivitizationDocument6 pagesHBFC PrivitizationMomin IqbalNo ratings yet

- FD Leaflet - A5 - 13 Dec 23Document2 pagesFD Leaflet - A5 - 13 Dec 23Shaily SinhaNo ratings yet

- Interest Rates On Deposits Above Rs 2 Crs Wef 15092022Document5 pagesInterest Rates On Deposits Above Rs 2 Crs Wef 15092022Manish bishnoiNo ratings yet

- Capital Markets - 5/16/2008Document1 pageCapital Markets - 5/16/2008Russell KlusasNo ratings yet

- RevisionInterestRates CircularDocument4 pagesRevisionInterestRates CircularNishantNo ratings yet

- India's No.1 Portfolio Management Services PortalDocument1 pageIndia's No.1 Portfolio Management Services Portalrahul patelNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsspshekarNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsIndranil Roy ChoudhuriNo ratings yet

- Sro India Cy18 Cy19Document13 pagesSro India Cy18 Cy19Amit TanwarNo ratings yet

- FD Interest Rates - Check Latest Fixed Deposit Interest Rates Online - ICICI BankDocument1 pageFD Interest Rates - Check Latest Fixed Deposit Interest Rates Online - ICICI BankdhruvNo ratings yet

- Income Tax CircularDocument6 pagesIncome Tax Circularu19n6735No ratings yet

- Bond Overview 1 PDFDocument6 pagesBond Overview 1 PDFAkash SinghNo ratings yet

- National Saving CenterDocument4 pagesNational Saving CenterMariyam TajamalNo ratings yet

- Direct Imports To Kenya Previously Registered in KenyaDocument3 pagesDirect Imports To Kenya Previously Registered in KenyaisaacNo ratings yet

- MultanDocument1,516 pagesMultanSaira KhalilNo ratings yet

- Chapter 1Document16 pagesChapter 1Saira KhalilNo ratings yet

- Sample Gratuity RulesDocument28 pagesSample Gratuity RulesSaira KhalilNo ratings yet

- Wealth & Wealth Reconciliation StatementDocument3 pagesWealth & Wealth Reconciliation StatementSaira KhalilNo ratings yet