Professional Documents

Culture Documents

Ratio 2

Ratio 2

Uploaded by

priyopanggahbudiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ratio 2

Ratio 2

Uploaded by

priyopanggahbudiCopyright:

Available Formats

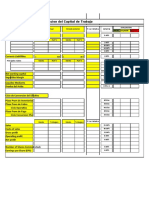

Financial Due Diligence Indicators Scale Criteria Value Score

A Financial Statement

40 A.1 ≥ 2

30 2 > A.1 ≥ 1

A.1 Working Capital Ratio 3,14 40

20 1 > A.1 ≥ 0,5

10 A.1 < 0,5

40 A.2 ≥ 0.8

30 0.8 > A.2 ≥ 0.5

A.2 Cash Flow Coverage Ratio 0,63 30

20 0.5 > A.2 ≥ 0.3

10 A.2 < 0.3

40 A.3 ≥ 10

30 10 > A.3 ≥ 7

A.3 Time Interest Earned Ratio 6,22 20

20 7 > A.3 ≥ 5

10 A.3 < 5

40 A.4 < 40%

30 40% ≤ A.4 < 60%

A.4 Debt to Asset Ratio 21,08% 40

20 60% ≤ A.4 < 80%

10 A.4 ≥ 80%

40 A.5 ≥ 9

30 9 > A.5 ≥ 7

A.5 Account Receivable Turn Over 56,49 40

20 7 > A.5 ≥ 4

10 A.5 < 4

40 A.6 ≥ 10%

30 10% > A.6 ≥ 7%

A.6 Net Profit Margin 17,38% 40

20 7% > A.6 ≥ 5%

10 A.6 < 5%

B Basic Financial Capability

40 B.1 ≥ 1

Working Capital to Min Percentage Project 30 1 > B.1 ≥ 0,7

B.1 0,43 20

Value Ratio 20 0,7 > B.1 ≥ 0,4

10 B.1 < 0,4

You might also like

- 03 SAP Revenue Acc and Reporting WhitePaper 20160513Document28 pages03 SAP Revenue Acc and Reporting WhitePaper 20160513Roger SudatiNo ratings yet

- OR Assignment - Piyush Thakar - PGSM 1935 - 03152020Document11 pagesOR Assignment - Piyush Thakar - PGSM 1935 - 03152020Piyush ThakarNo ratings yet

- Indikator KinerjaDocument17 pagesIndikator KinerjaAnonymous xkeJtpeNo ratings yet

- Contoh Pengisian Form KPIDocument1 pageContoh Pengisian Form KPItri narwantoNo ratings yet

- The Effects of B, C and AC Are Large and Significant.: Problem 6.6 A) Calculation of EffectDocument4 pagesThe Effects of B, C and AC Are Large and Significant.: Problem 6.6 A) Calculation of EffectBablu KumarNo ratings yet

- Uas Komdas Debby Putri P23131117052Document4 pagesUas Komdas Debby Putri P23131117052Debby PutriNo ratings yet

- Qwick Live Video Polices - May 23Document6 pagesQwick Live Video Polices - May 23ddhdbNo ratings yet

- Gradesheet B&CDocument15 pagesGradesheet B&CRajat RanjanNo ratings yet

- Probability of End-Year Portfolio ValueDocument130 pagesProbability of End-Year Portfolio ValueSyed Ameer Ali ShahNo ratings yet

- A6-A7. Ikon Paints Valuation WorkingsDocument3 pagesA6-A7. Ikon Paints Valuation Workingsmohantyrishita2000No ratings yet

- Stiglitz Weiss 1981 Implementation by Kurt HessDocument20 pagesStiglitz Weiss 1981 Implementation by Kurt Hessapi-3763138No ratings yet

- P05 - Stock ValuationDocument8 pagesP05 - Stock ValuationL1588AshishNo ratings yet

- Debt LevelDocument3 pagesDebt Levelsultan altamashNo ratings yet

- Memory Plus Gold For Mas5Document8 pagesMemory Plus Gold For Mas5Ashianna KimNo ratings yet

- Nov 2019 Suggested AnsDocument27 pagesNov 2019 Suggested Ansinter g19No ratings yet

- CAPITAL STRUCTURE Sums OnlinePGDMDocument6 pagesCAPITAL STRUCTURE Sums OnlinePGDMSoumendra RoyNo ratings yet

- Tutorial 3 Question 3 (B) (I) Project A Project BDocument8 pagesTutorial 3 Question 3 (B) (I) Project A Project BChiam ZhiyenNo ratings yet

- Problema 2 3 4Document28 pagesProblema 2 3 4Richard Salcedo ArceNo ratings yet

- Student ID Midterm 1 Midterm 2 Quizzes Assignmetns Class Participation Final Exam 15 15 5 10 5 50Document2 pagesStudent ID Midterm 1 Midterm 2 Quizzes Assignmetns Class Participation Final Exam 15 15 5 10 5 50Abdul Hanan NasirNo ratings yet

- Director Rob Portman February 5, 2007Document8 pagesDirector Rob Portman February 5, 2007losangelesNo ratings yet

- Tabla Frec DatDocument24 pagesTabla Frec DatKAREN ROXANA VILCHEZ CARRILLONo ratings yet

- Krakatau Steel B Case StudyDocument3 pagesKrakatau Steel B Case StudyAndi WibowoNo ratings yet

- CH 05 Loan Amortization - Ready-To-BuildDocument2 pagesCH 05 Loan Amortization - Ready-To-BuildThanh Huyền TrầnNo ratings yet

- Adidas Group Supplier Adidas Group Supplier Adidas Group SupplierDocument6 pagesAdidas Group Supplier Adidas Group Supplier Adidas Group SupplierahmaduggokiNo ratings yet

- Six-Sigma and ReliabilityDocument37 pagesSix-Sigma and Reliabilitypanugantisameer468No ratings yet

- Amount Borrowed Months Annual Int. Rate Monthly PaymentDocument4 pagesAmount Borrowed Months Annual Int. Rate Monthly PaymentNazia Hossain NafisaNo ratings yet

- Kpi Marks SND JulyDocument15 pagesKpi Marks SND JulyVivekNo ratings yet

- Icrrs 11Document1 pageIcrrs 11Sadia HossainNo ratings yet

- Update Business Performances - 030821Document3 pagesUpdate Business Performances - 030821Zainal AlfinzaNo ratings yet

- MSWIL Presentation On Results Q2FY24Document8 pagesMSWIL Presentation On Results Q2FY24apnigyanshaalaaNo ratings yet

- All Values in INR CRDocument1 pageAll Values in INR CRAnushriNo ratings yet

- A3 Risk and Return y CAPMDocument2 pagesA3 Risk and Return y CAPMJose Javier Solivan RiveraNo ratings yet

- PTC Thermistors: EPCOS Sample Kit 2012Document2 pagesPTC Thermistors: EPCOS Sample Kit 2012CezaryCezasNo ratings yet

- Regular Profit Analysis Common Size Profit Analysis: Income Statement Company A Percent Company B Percent RevenueDocument2 pagesRegular Profit Analysis Common Size Profit Analysis: Income Statement Company A Percent Company B Percent RevenueGolamMostafaNo ratings yet

- Corte/elevación ArquitecturaDocument9 pagesCorte/elevación Arquitecturaanayka baezaNo ratings yet

- Lab 2Document3 pagesLab 2Talha Nasir0% (1)

- FM PracticalDocument12 pagesFM PracticalManya RanaNo ratings yet

- Calculation For The 4 Essential MetricsDocument6 pagesCalculation For The 4 Essential MetricsMihai Dragos PostolacheNo ratings yet

- Significance Test - ExampleDocument3 pagesSignificance Test - ExampleMukesh KumarNo ratings yet

- Template - Audit Risk PrioritizationDocument1 pageTemplate - Audit Risk PrioritizationangelicamadscNo ratings yet

- Formato EnglishDocument3 pagesFormato EnglishArgenis VaraNo ratings yet

- Residual Plots For Yield: Normal Probability Plot Versus FitsDocument3 pagesResidual Plots For Yield: Normal Probability Plot Versus FitsBablu KumarNo ratings yet

- Cases Optimal CapitalDocument2 pagesCases Optimal CapitalRiya PandeyNo ratings yet

- Krakatau Steel B Case Study Syndicate 2 2018Document4 pagesKrakatau Steel B Case Study Syndicate 2 2018DenssNo ratings yet

- Definitive Measurement For Gradient Performance WatersDocument2 pagesDefinitive Measurement For Gradient Performance WatersWellerson OliveiraNo ratings yet

- Working Capital Management: Industry AnalysisDocument78 pagesWorking Capital Management: Industry AnalysisSushant SharmaNo ratings yet

- Mod 4 Valuation and ConceptsDocument5 pagesMod 4 Valuation and Conceptsvenice cambryNo ratings yet

- Foreign Owned Businesses 2014 15 Other ServicesDocument1 pageForeign Owned Businesses 2014 15 Other ServicessawicNo ratings yet

- NLP My NotesDocument16 pagesNLP My NotesLương NguyễnNo ratings yet

- Pareto ChartDocument11 pagesPareto ChartStephen SequeiraNo ratings yet

- CgchfkhfitsiyDocument1 pageCgchfkhfitsiyFariza Huacho AchinquipaNo ratings yet

- Eastborne Reality 1Document7 pagesEastborne Reality 1rahulNo ratings yet

- Dividing With A Numberline: Use The Numberline To Solve Each ProblemDocument2 pagesDividing With A Numberline: Use The Numberline To Solve Each ProblemThieu LeNo ratings yet

- FM16 Ch25 Tool KitDocument35 pagesFM16 Ch25 Tool KitAdamNo ratings yet

- The Basics of Capital Budgeting (D. Bañas)Document15 pagesThe Basics of Capital Budgeting (D. Bañas)DAISYBELLE S. BAÑASNo ratings yet

- 20340-Kpi Dashboard Powerpoint TemplateDocument1 page20340-Kpi Dashboard Powerpoint TemplateSahar FekryNo ratings yet

- Reactive Dyeing Process: Recommended Salt & Soda RatesDocument1 pageReactive Dyeing Process: Recommended Salt & Soda Rateselçin ekmekçiNo ratings yet

- Supplier Evaluation MatrixDocument1 pageSupplier Evaluation MatrixRanda S JowaNo ratings yet

- Accounting 1Document4 pagesAccounting 1Abdirahman Abdullahi OmarNo ratings yet

- Cambridge International Examinations General Certificate of Education Ordinary Level Principles of Accounts Paper 1 Multiple Choice October/November 2003 1 Hour 15 MinutesDocument12 pagesCambridge International Examinations General Certificate of Education Ordinary Level Principles of Accounts Paper 1 Multiple Choice October/November 2003 1 Hour 15 MinutesMERCY LAWNo ratings yet

- Advanced Financial AccountingDocument4 pagesAdvanced Financial AccountingchuaxinniNo ratings yet

- Tally Vol-1 - April #SKCreative2018Document34 pagesTally Vol-1 - April #SKCreative2018SK CreativeNo ratings yet

- Ifrs 5 Acca AnswersDocument2 pagesIfrs 5 Acca AnswersMonirul Islam MoniirrNo ratings yet

- PurchasesDocument18 pagesPurchasesChibi ChichiwNo ratings yet

- Jio Platforms Limited - 20200331Document38 pagesJio Platforms Limited - 20200331JamesNo ratings yet

- Mov Types Document in SAP MMDocument8 pagesMov Types Document in SAP MMAhmed AlloucheNo ratings yet

- Cash Book ExampleDocument4 pagesCash Book ExampleChirag SatbadreNo ratings yet

- Audited Financial Statements 2020Document37 pagesAudited Financial Statements 2020Tan NguyenNo ratings yet

- Industrial RevolutionDocument7 pagesIndustrial RevolutionShahirah HafitNo ratings yet

- Indofood CBP Sukses Makmur - Bilingual - 31 - Mar - 21Document129 pagesIndofood CBP Sukses Makmur - Bilingual - 31 - Mar - 21NicoleNo ratings yet

- BoardPaper 2019 SolutionsDocument7 pagesBoardPaper 2019 Solutionskartik 011No ratings yet

- Home Office and Branch Accounting Covidproject4accountants Aug 2020 PDFDocument9 pagesHome Office and Branch Accounting Covidproject4accountants Aug 2020 PDFKathrina RoxasNo ratings yet

- PurchaseBook Tapone 2024Document20 pagesPurchaseBook Tapone 2024liezelNo ratings yet

- Adecco Thailand Salary Guide 2009 2010Document32 pagesAdecco Thailand Salary Guide 2009 2010Patchara IPatt KerdsiriNo ratings yet

- M3 Assignment Internal Control Group 9 AUDIT SPECIAL INDUSTRYDocument5 pagesM3 Assignment Internal Control Group 9 AUDIT SPECIAL INDUSTRYReginald ValenciaNo ratings yet

- B291 TMA - Fall - 2023-2024Document3 pagesB291 TMA - Fall - 2023-2024adel.dahbour97No ratings yet

- International Public Sector Accounting Standards (Ipsass) : A Systematic Literature Review and Future Research AgendaDocument24 pagesInternational Public Sector Accounting Standards (Ipsass) : A Systematic Literature Review and Future Research AgendaNiken RindasariNo ratings yet

- How To SubmitDocument23 pagesHow To SubmitVendyNo ratings yet

- Republic of The Philippines Bacolor, Pampanga: ST ST ST ST ST ST ST STDocument2 pagesRepublic of The Philippines Bacolor, Pampanga: ST ST ST ST ST ST ST STNoel CarpioNo ratings yet

- 04 Review Problem - CVP AnalysisDocument3 pages04 Review Problem - CVP AnalysisIzzahIkramIllahi100% (1)

- Pequity Company Purchased 85 of The Common Stock of SequityDocument1 pagePequity Company Purchased 85 of The Common Stock of SequityMuhammad ShahidNo ratings yet

- Aaa Services Problem SampleDocument15 pagesAaa Services Problem SampleCheche AmpoanNo ratings yet

- Purchases, Cash Basis P 2,850,000Document2 pagesPurchases, Cash Basis P 2,850,000Dummy GoogleNo ratings yet

- Gathering and Evaluating EvidenceDocument73 pagesGathering and Evaluating EvidenceHanna BayotNo ratings yet

- Amalgamation and Sale of FirmDocument57 pagesAmalgamation and Sale of FirmShrutika singhNo ratings yet

- Chapter07 - AnswerDocument16 pagesChapter07 - Answerirene_pabello100% (1)

- Skema PSPM 16-17 Aa025Document4 pagesSkema PSPM 16-17 Aa025Dehey KNo ratings yet