Professional Documents

Culture Documents

ICRRS 11

Uploaded by

Sadia Hossain0 ratings0% found this document useful (0 votes)

2 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views1 pageICRRS 11

Uploaded by

Sadia HossainCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

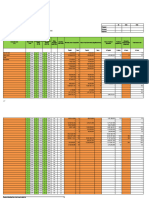

Internal Credit Risk Rating System (Executive

Summary)

File / Reference No: 10000/100/10/1

Borrower Name Audited Total Score 86.8%

Excellent

Group Name (if any) BAT

Industry Name 14. Other Industries

Latest CIB Status Standard

Audit Status Audited

Quantitative Score 83.3%

Excellent

Auditor Name KPMG

Analyst Name, Designations Sadia Hossain

Verifier Name, Designation YL

Date of Analysis 20/10/2023

Qualitative Score 91.9%

Date of Financials 31-12-2022 Excellent

Assessment Criteria: Greater than or equal to 80%= Excellent; 70%-80% = Good; 60% to

70% = Marginal; Less than 60% = Unacceptable

2.0 70% 4,000,000

60%

1.5 3,000,000

50%

40%

1.0 2,000,000

30%

0.5 20% 1,000,000

10%

0.0 0

0%

2019 2020 2021 2019 2020 2021

2019 2020 2021

Debt Equity Debt to Assets Cashflow Coverage

Operating Profit to Operating Assets

Cash Ratio Current Ratio Return on Asset DSCR

LEVERAGE & LIQUIDITY PROFITABILITY COVERAGE

Score Obtained Scale Percentage ICRR

Quantitative Assessments 50 60 83.3% Excellent

A Leverage 10 10 100.0% Excellent

B Liquidity 7 10 70.0% Good

C Profitability 10 10 100.0% Excellent

D Coverage 15 15 100.0% Excellent

E Operational Efficiency 5 10 50.0% Unacceptable

F Earning Quality 3 5 60.0% Marginal

Qualitative Assessments 36.75 40 91.9% Excellent

G Performance behavior 10 10 100.0% Excellent

H Business and Industry Risk 6.75 7 96.4% Excellent

I Management Risk 7 7 100.0% Excellent

J Security Risk 8 11 72.7% Good

K Relationship Risk 3 3 100.0% Excellent

L Compliance Risk 2 2 100.0% Excellent

Aggregate 86.75 100 86.8% Excellent

Signature (Analyst) Signature (Verifier) Signature (Approver)

You might also like

- Fair Value for Financial Reporting: Meeting the New FASB RequirementsFrom EverandFair Value for Financial Reporting: Meeting the New FASB RequirementsNo ratings yet

- Valuing Services in Trade: A Toolkit for Competitiveness DiagnosticsFrom EverandValuing Services in Trade: A Toolkit for Competitiveness DiagnosticsNo ratings yet

- ICRRS 10Document2 pagesICRRS 10Sadia HossainNo ratings yet

- Checklist & Rating Sheet)Document26 pagesChecklist & Rating Sheet)Michel Bryan Semwo0% (1)

- The Warren Buffett Spreadsheet - PreviewDocument350 pagesThe Warren Buffett Spreadsheet - PreviewbysqqqdxNo ratings yet

- 501 - Store Managers Appraisal FormDocument13 pages501 - Store Managers Appraisal FormSyed RashedNo ratings yet

- Santa Barbara County Employees Retirement System Annual Review 2022Document23 pagesSanta Barbara County Employees Retirement System Annual Review 2022giana_magnoliNo ratings yet

- SMEA Quarterly ReportDocument30 pagesSMEA Quarterly ReportRobby Jim Vergara PacisNo ratings yet

- Employee Performance Assessment Form Staff Id: Staff Name:: Key Performance Indicators (Kpis)Document8 pagesEmployee Performance Assessment Form Staff Id: Staff Name:: Key Performance Indicators (Kpis)Victor ImehNo ratings yet

- Analisis Risiko AlkDocument21 pagesAnalisis Risiko AlkAnanda LukmanNo ratings yet

- Fin Model - FinalDocument8 pagesFin Model - FinalMuskan ValbaniNo ratings yet

- LWG-1052 Parte1Document50 pagesLWG-1052 Parte1Gcs11 AmericaNo ratings yet

- Supply Chain Excellence Case StudyDocument25 pagesSupply Chain Excellence Case StudyTrần Văn LựcNo ratings yet

- Acct. Jonathan B. de VeyraDocument17 pagesAcct. Jonathan B. de VeyraAlliah Gianne JacelaNo ratings yet

- Formato EnglishDocument3 pagesFormato EnglishArgenis VaraNo ratings yet

- COPQ WorksheetDocument4 pagesCOPQ WorksheetDhinakaranNo ratings yet

- Kpi Prod - Mar2023 - WeeklyDocument78 pagesKpi Prod - Mar2023 - WeeklyAl - AminNo ratings yet

- Operational Success of Islamic Banking Branches & Windows in BangladeshDocument30 pagesOperational Success of Islamic Banking Branches & Windows in BangladeshFahim RahmanNo ratings yet

- Viden Io Corporate Retail Banking CRB PresentationDocument14 pagesViden Io Corporate Retail Banking CRB PresentationngnquyetNo ratings yet

- Attribute Statistical ReportDocument1 pageAttribute Statistical ReportQuality VenusNo ratings yet

- Incensive Scheme WorkingsDocument5 pagesIncensive Scheme WorkingsvivekNo ratings yet

- Lampiran I Checklist Evaluasi K3L SubcontractorDocument6 pagesLampiran I Checklist Evaluasi K3L SubcontractorSiti PatingkiNo ratings yet

- Calculating Breakeven Point and Capital Structure ImpactDocument3 pagesCalculating Breakeven Point and Capital Structure Impactsultan altamashNo ratings yet

- Template of KRADocument4 pagesTemplate of KRA1qwfegfhngNo ratings yet

- D1.B SamplingDocument7 pagesD1.B SamplingyohannesinagaaNo ratings yet

- Model Content: Input Capital Schedules Capital Expenditures & Depreciation Operational Expenses Revenue CalculationDocument41 pagesModel Content: Input Capital Schedules Capital Expenditures & Depreciation Operational Expenses Revenue Calculationavinash singhNo ratings yet

- Direct Costs Indirect CostsDocument18 pagesDirect Costs Indirect CostsMaiRelotaNo ratings yet

- First Solar Inc. Ratio ComparisonsDocument7 pagesFirst Solar Inc. Ratio ComparisonsSameer ChoudharyNo ratings yet

- Financing Real Estate and Housing: The Indian Perspective: Keki Mistry Managing Director, HDFCDocument20 pagesFinancing Real Estate and Housing: The Indian Perspective: Keki Mistry Managing Director, HDFCsagarstNo ratings yet

- Performance Assessment Trainee 2018Document5 pagesPerformance Assessment Trainee 2018Hammad MalikNo ratings yet

- Vaishali - Officer & Above KPI 2022Document5 pagesVaishali - Officer & Above KPI 2022Deepak JhaNo ratings yet

- Project Work On Financial Management: Prepared By:-Siddharth S. KothariDocument22 pagesProject Work On Financial Management: Prepared By:-Siddharth S. Kotharisunilsims2No ratings yet

- ESG20211220 Partner Evaluation Program - Jan - 2022Document4 pagesESG20211220 Partner Evaluation Program - Jan - 2022Sahil Imran 38No ratings yet

- The Warren Buffett Spreadsheet v16 - PreviewDocument589 pagesThe Warren Buffett Spreadsheet v16 - PreviewNikhil SharmaNo ratings yet

- Performance and Competence For Excellence (PACE) : Form For Grade: E5Document8 pagesPerformance and Competence For Excellence (PACE) : Form For Grade: E5anand26No ratings yet

- Update Business Performances - 030821Document3 pagesUpdate Business Performances - 030821Zainal AlfinzaNo ratings yet

- AUTOMATIC Automated Class RecordDocument18 pagesAUTOMATIC Automated Class Recordlyv caceresNo ratings yet

- Appraisal EmployeeDocument4 pagesAppraisal EmployeeAdi Sutrisno100% (1)

- The Indian Banking Sector, 2017 - Public Policy ChallengesDocument24 pagesThe Indian Banking Sector, 2017 - Public Policy ChallengesvinayNo ratings yet

- FinalDocument3 pagesFinalOsama MuradNo ratings yet

- Discounted Cash Flow Analysis of A Sunflower Oil Refinery Company Tapiwa Madziwa R167779FDocument12 pagesDiscounted Cash Flow Analysis of A Sunflower Oil Refinery Company Tapiwa Madziwa R167779FdreenaNo ratings yet

- SPE MS Genset Apr 19Document74 pagesSPE MS Genset Apr 19RhizkyNo ratings yet

- Lampiran Hasil Analisis NewDocument4 pagesLampiran Hasil Analisis NewAji PhanonkNo ratings yet

- Excel Graph DataDocument12 pagesExcel Graph DataSamreen malikNo ratings yet

- Bank ManagementDocument14 pagesBank ManagementAreeba MalikNo ratings yet

- p7 Sample-987Document23 pagesp7 Sample-987OctavioNo ratings yet

- Financial Model Example: Hotel Evaluation + M&A: Results Assumptions Loan BalanceDocument14 pagesFinancial Model Example: Hotel Evaluation + M&A: Results Assumptions Loan BalancemotebangNo ratings yet

- 5 Lampiran 6 Hasil Analisa DataDocument5 pages5 Lampiran 6 Hasil Analisa DataRegina Astari PelealuNo ratings yet

- Investor presentation_Jan 2024Document46 pagesInvestor presentation_Jan 2024minhnghia070203No ratings yet

- Supplier Assesment MaxionDocument23 pagesSupplier Assesment Maxionesivaks2000No ratings yet

- Nippon India Low Duration FundDocument1 pageNippon India Low Duration FundYogi173No ratings yet

- Prognosa KM UPT Pulogadung S.D. Semester 1-2021 - 82,63 (Ok)Document7 pagesPrognosa KM UPT Pulogadung S.D. Semester 1-2021 - 82,63 (Ok)Jati PharmaditaNo ratings yet

- Edit Hasil SpssDocument6 pagesEdit Hasil Spssmichael salulinggiNo ratings yet

- RGPPSEZ_Annual Report_2022_ENGDocument149 pagesRGPPSEZ_Annual Report_2022_ENGsteveNo ratings yet

- Analysis of The AlumniDocument10 pagesAnalysis of The AlumnirahulNo ratings yet

- P05 - Stock ValuationDocument8 pagesP05 - Stock ValuationL1588AshishNo ratings yet

- Extra Material On CFDocument127 pagesExtra Material On CFPanosMavrNo ratings yet

- Stybma SFM: Capital Budgeting and Capital RationingDocument10 pagesStybma SFM: Capital Budgeting and Capital Rationing23 Rohit NarNo ratings yet

- Common Stock ValuationDocument10 pagesCommon Stock ValuationDeep AnjarlekarNo ratings yet

- Supplier Pre Qualification AssessmentDocument18 pagesSupplier Pre Qualification AssessmentskystarNo ratings yet

- Icrrs 2Document3 pagesIcrrs 2Sadia HossainNo ratings yet

- AnalysisDocument2 pagesAnalysisSadia HossainNo ratings yet

- Case - It Takes A Village and A Consultant - T&DDocument2 pagesCase - It Takes A Village and A Consultant - T&DSadia HossainNo ratings yet

- Expectancy Theory: Suggests That A Person's Behavior Is Based On 3 FactorsDocument2 pagesExpectancy Theory: Suggests That A Person's Behavior Is Based On 3 FactorsSadia HossainNo ratings yet

- Policy Analysis of Tourism Development in Bangladesh Compared With The Bhutanese PolicyDocument12 pagesPolicy Analysis of Tourism Development in Bangladesh Compared With The Bhutanese PolicySadia HossainNo ratings yet

- Bangladesh Hotel Market Growth PotentialDocument10 pagesBangladesh Hotel Market Growth PotentialashokNo ratings yet

- Chapter-41 Ministry of Civil Aviation and TourismDocument7 pagesChapter-41 Ministry of Civil Aviation and TourismSadia HossainNo ratings yet

- Policy Analysis of Tourism Development in Bangladesh Compared With The Bhutanese PolicyDocument12 pagesPolicy Analysis of Tourism Development in Bangladesh Compared With The Bhutanese PolicySadia HossainNo ratings yet

- Tourism EvalDocument24 pagesTourism EvalSadia HossainNo ratings yet

- Gender Statistrics of Bangladesh 2018Document286 pagesGender Statistrics of Bangladesh 2018Sadia HossainNo ratings yet

- Review of Tourism Policy in BangladeshDocument6 pagesReview of Tourism Policy in BangladeshChowdhury Rubel Al MuhammadNo ratings yet

- Bangladesh Hotel Market Growth PotentialDocument10 pagesBangladesh Hotel Market Growth PotentialashokNo ratings yet

- Compensation Structure of Lanka Bangla S PDFDocument32 pagesCompensation Structure of Lanka Bangla S PDFSadia HossainNo ratings yet

- Meddeal Private Limited: Putting A Price Tag For The BusinessDocument20 pagesMeddeal Private Limited: Putting A Price Tag For The BusinessShivani SinghNo ratings yet

- 1Document3 pages1Flordeliza VidadNo ratings yet

- FARAS COMBINE MARKETING COMPANY PROFILEDocument3 pagesFARAS COMBINE MARKETING COMPANY PROFILEMuhammad Aasim HassanNo ratings yet

- FR111. FFA Solution CMA January 2022 ExaminationDocument5 pagesFR111. FFA Solution CMA January 2022 ExaminationMohammed Javed UddinNo ratings yet

- Important Question For Substantive ProceduresDocument4 pagesImportant Question For Substantive ProceduresMansoor SharifNo ratings yet

- Swot Analysis For Transport Information Action Plan PorDocument19 pagesSwot Analysis For Transport Information Action Plan PorPringgondani YKNo ratings yet

- Cofc Kit 102 110 117 378 - DemoDocument10 pagesCofc Kit 102 110 117 378 - DemoBALAJINo ratings yet

- Jqme 08 2019 0085 AnalyticalDocument17 pagesJqme 08 2019 0085 AnalyticalLucia QuispeNo ratings yet

- Chapter 5 Quiz Project Scope ManagementDocument5 pagesChapter 5 Quiz Project Scope ManagementSeol Han MinNo ratings yet

- Factor Comparison Job Evaluation MethodDocument2 pagesFactor Comparison Job Evaluation MethodWadzanai RinasheNo ratings yet

- Chapter 8: Quality Control: Questions 3 To 5Document12 pagesChapter 8: Quality Control: Questions 3 To 5Janeth NavalesNo ratings yet

- Class 6-Supply Chain Management PDFDocument29 pagesClass 6-Supply Chain Management PDFRajib AliNo ratings yet

- A380 AIRBUS Case & QuestionsDocument4 pagesA380 AIRBUS Case & QuestionskimthaoguyNo ratings yet

- Bharti Axa Alliance Forms Insurance JVDocument12 pagesBharti Axa Alliance Forms Insurance JVNIRJHAR MUKHERJEE (IPM 2016-21 Batch)No ratings yet

- Matrix Organizations AssignmentDocument9 pagesMatrix Organizations AssignmentFairuz Nawfal HamidNo ratings yet

- Project Management PhasesDocument8 pagesProject Management PhasesQasim Javaid BokhariNo ratings yet

- I Introduction To Cost AccountingDocument8 pagesI Introduction To Cost AccountingJoshuaGuerreroNo ratings yet

- Stakeholder EngagementDocument48 pagesStakeholder Engagementhellen muuruNo ratings yet

- Method Statements For Plain Cement ConcreteDocument5 pagesMethod Statements For Plain Cement ConcreteKrm Chari75% (4)

- Change ManagementDocument16 pagesChange ManagementGaurav chaudharyNo ratings yet

- Cif Procedure 0111023Document2 pagesCif Procedure 0111023cv.pelangiadaniNo ratings yet

- ISIR Initial Sample Inspection Report Manual for Quality AssuranceDocument17 pagesISIR Initial Sample Inspection Report Manual for Quality AssuranceGabriel MolinaNo ratings yet

- Engineering Assurance Network Rail 2 of 2Document64 pagesEngineering Assurance Network Rail 2 of 2Venkatesan NarayanaswamyNo ratings yet

- Tsige Final PaperDocument83 pagesTsige Final Papergetahun tesfayeNo ratings yet

- Gaurav KishoreDocument4 pagesGaurav KishoreVikas PundirNo ratings yet

- OSX ManagerialAccounting Ch12 PPTDocument40 pagesOSX ManagerialAccounting Ch12 PPTDiệp ThanhNo ratings yet

- Nestle Sales Officer Trainee JD2Document2 pagesNestle Sales Officer Trainee JD2ajith vNo ratings yet

- Work Method Statement Project KUJ 13 Mei 2022Document3 pagesWork Method Statement Project KUJ 13 Mei 2022datdayne champaNo ratings yet

- Introduction To DDMRP R McphailDocument14 pagesIntroduction To DDMRP R McphailTanvir AhmedNo ratings yet

- Chater 5Document9 pagesChater 5Shania LiwanagNo ratings yet