Professional Documents

Culture Documents

Pending Declaration Format

Pending Declaration Format

Uploaded by

rashiramesh31Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pending Declaration Format

Pending Declaration Format

Uploaded by

rashiramesh31Copyright:

Available Formats

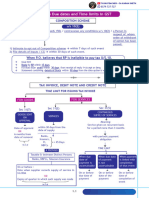

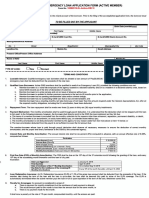

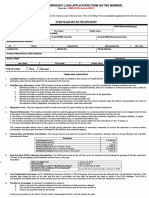

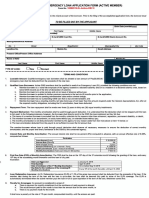

DECLARATION FOR THE DODUMENTS DUE FOR SUBMISSION AFTER PROOF

SUBMISSION 1 st CUT OFF DATE

Employee Code: Name: Location:

Given below are the details of documents which fall due after the proof submission 1 st cut off date,

but are payable before the financial year-end 2023-24. Please consider these as commitment to give me the tax

benefit in the current financial 2023-24.

Rent Receipts - Due

Sl. No Payment Date Amount

Month

1

2

3

Children Tuition

Attached Last Year

Sl. No Fees - Due Month (Only Name of the Child Due Date Amount

Receipt Copy (Yes/No)

Recurring Investments)

1

2

3

Mutual Fund – Due Attached Last Year

Sl. No Month (Only Recurring Folio No. Due Date Amount

Receipt Copy (Yes/No)

Investments)

1

2

3

Life insurance Attached Last

Sl. No Premium/Unit Policy No. Due Date Amount Year Receipt

Linked - Due Month Copy (Yes/No)

1

2

3

4

5

Attached Last

80D Medical

Sl. No Policy No. Due Date Amount Year Receipt

Insurance – Due Month

Copy (Yes/No)

1

2

Benefit would be extended only on submission for any existing premium falling due after the proof 1 st cut off date.

Employee Declaration

I hereby declare that the information provided above is true and correct and will be solely responsible for any

situation arising out of non-payment and submission of the above on or before March 2024 payroll.

Signature: Date:

You might also like

- SITXHRM003 Assessment 2 - ProjectDocument25 pagesSITXHRM003 Assessment 2 - ProjectAndy Lee100% (3)

- Self-Declaration For Claiming Housing Loan Principal & Interest Benefit 1Document1 pageSelf-Declaration For Claiming Housing Loan Principal & Interest Benefit 1NAGARAJ M O100% (6)

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Overview of Ethiopian Manufacturing SectorDocument86 pagesOverview of Ethiopian Manufacturing Sectorgabisa0% (1)

- Future Payment Declaration - FY 2022-23Document2 pagesFuture Payment Declaration - FY 2022-23kiran kurellaNo ratings yet

- Annexure IV Future Investment DeclarationDocument2 pagesAnnexure IV Future Investment DeclarationBhooma Shayan100% (1)

- ApplicationDocument3 pagesApplicationGursharanjit SinghNo ratings yet

- Investment Proof Submission Form23 24Document6 pagesInvestment Proof Submission Form23 24Bindu madhaviNo ratings yet

- Key Points For Investment Proof Submission 2016-2017 Deadline and Mode of SubmissionDocument13 pagesKey Points For Investment Proof Submission 2016-2017 Deadline and Mode of SubmissionAjay TiwariNo ratings yet

- Average Due DateDocument19 pagesAverage Due DatePriyanshuNo ratings yet

- 61807bos50279 cp6 U4Document23 pages61807bos50279 cp6 U4Vishvanath VishvanathNo ratings yet

- What Is A Prepayment?: PrepaymentsDocument3 pagesWhat Is A Prepayment?: PrepaymentsHuy VuNo ratings yet

- Form H Leave Card For EmployeesDocument3 pagesForm H Leave Card For EmployeesBalakrishna HNo ratings yet

- Unit - 4 Average Due Date: Learning OutcomesDocument22 pagesUnit - 4 Average Due Date: Learning OutcomesDisha SrivastavaNo ratings yet

- Unit 6: Average Due Date: Learning OutcomesDocument21 pagesUnit 6: Average Due Date: Learning OutcomesSreelakshmiMinnalaNo ratings yet

- Unit 6: Average Due Date: Learning OutcomesDocument21 pagesUnit 6: Average Due Date: Learning OutcomesAshish SultaniaNo ratings yet

- Retirement LoanDocument4 pagesRetirement LoanGerald GalsimNo ratings yet

- Certificate of Creditable Tax Withheld at Source: For Bir Use Only BCS/ Item: BIR Form NoDocument4 pagesCertificate of Creditable Tax Withheld at Source: For Bir Use Only BCS/ Item: BIR Form NoJasper Evonne Paredes QuezaNo ratings yet

- Declaration - For - Due Date After Cut Off DateDocument1 pageDeclaration - For - Due Date After Cut Off DateJitender MadanNo ratings yet

- RC ColaDocument2 pagesRC ColaMi MiNo ratings yet

- Collateral Order Form 2021Document2 pagesCollateral Order Form 2021Assaadkanso KansoNo ratings yet

- PL - NO. Name: Corporate Id: Pan No. Mob - No.: Savings Declaration (Other Than Through Salary)Document3 pagesPL - NO. Name: Corporate Id: Pan No. Mob - No.: Savings Declaration (Other Than Through Salary)TA ED,SafetyNo ratings yet

- Future Payment Declaration FormDocument1 pageFuture Payment Declaration Formmadhur0006No ratings yet

- BIR 2307 For BR#0000000 Referreral Partners Inc - P 571.43Document1 pageBIR 2307 For BR#0000000 Referreral Partners Inc - P 571.43KASHMIR PONSARANNo ratings yet

- 5-Guidelines For Submitting Tax Proofs For 2022-23Document6 pages5-Guidelines For Submitting Tax Proofs For 2022-23Damodar VasistaNo ratings yet

- 2307 Jan 2018 ENCS v3Document2 pages2307 Jan 2018 ENCS v3Analyn DomingoNo ratings yet

- Future Payment DeclarationDocument2 pagesFuture Payment Declarationsubbuece1No ratings yet

- ATI - Guidelines For Investment Proof Submission 2022-2023 V1.0Document8 pagesATI - Guidelines For Investment Proof Submission 2022-2023 V1.0arunNo ratings yet

- Circular CGST 131 NewDocument5 pagesCircular CGST 131 NewSanjeev BorgohainNo ratings yet

- F 1127Document2 pagesF 1127IRSNo ratings yet

- Atr 14541220Document2 pagesAtr 14541220camurthykarumuriNo ratings yet

- V167 - Life Policy Transaction Form - Multi-PurposeDocument2 pagesV167 - Life Policy Transaction Form - Multi-PurposeKathryn RaskinNo ratings yet

- Withholding Tax Alert: Key Points To NoteDocument3 pagesWithholding Tax Alert: Key Points To NotemusaNo ratings yet

- 2307 Jan 2018 ENCS v3Document13 pages2307 Jan 2018 ENCS v3chatNo ratings yet

- Payment Approval FormDocument1 pagePayment Approval FormMaleki B0% (1)

- In-Scope Services & Sla: Service Listing Covered Within Scope Description of Service Covered Within Scope Slas, If AnyDocument5 pagesIn-Scope Services & Sla: Service Listing Covered Within Scope Description of Service Covered Within Scope Slas, If AnyNarayanan VenkatachalamNo ratings yet

- Family Financial QuestionnaireDocument4 pagesFamily Financial QuestionnaireAngela Miles Dizon0% (1)

- RoamDocument2 pagesRoamdivine mercyNo ratings yet

- 2307 Jan 2018 ENCS v3Document4 pages2307 Jan 2018 ENCS v3Jasmin Sheryl Fortin-CastroNo ratings yet

- Form 2307Document12 pagesForm 2307Reycia Vic QuintanaNo ratings yet

- 2307 Jan 2018 ENCS v3Document2 pages2307 Jan 2018 ENCS v3SK GACAO PALO, LEYTENo ratings yet

- Bir Form 2307Document3 pagesBir Form 2307Benjie R. RefilNo ratings yet

- IT Declaration Form 2019-20Document1 pageIT Declaration Form 2019-20KarunaNo ratings yet

- Certificate of Creditable Tax Withheld at SourceDocument36 pagesCertificate of Creditable Tax Withheld at SourceProbinsyana KoNo ratings yet

- 2307 FORM - WITHHOLDING 2021 - VanDocument46 pages2307 FORM - WITHHOLDING 2021 - VanHraid MundNo ratings yet

- US Internal Revenue Service: f433d AccessibleDocument5 pagesUS Internal Revenue Service: f433d AccessibleIRSNo ratings yet

- Bill of SupplyDocument3 pagesBill of SupplyAnas QasmiNo ratings yet

- 2307 Iseco VatDocument18 pages2307 Iseco VatWILBERT QUINTUANo ratings yet

- All The Due Dates and Time Limits in GSTDocument10 pagesAll The Due Dates and Time Limits in GST2d77gp69kzNo ratings yet

- 73210d52 c0bf 4dc4 8ef0 E198125e295dDocument1 page73210d52 c0bf 4dc4 8ef0 E198125e295dGaurav PandeyNo ratings yet

- SSS - Employee - Investment - Declaration - Form12BB - FY 2022-23Document10 pagesSSS - Employee - Investment - Declaration - Form12BB - FY 2022-23gowtham DevNo ratings yet

- General Standing Instruction Order Payment PDFDocument3 pagesGeneral Standing Instruction Order Payment PDFmiriam chewNo ratings yet

- Fabm1 PPT Q2W1Document62 pagesFabm1 PPT Q2W1giselle100% (1)

- Emergency Loan Application Form (Active Member) : Last Name Middle NameDocument2 pagesEmergency Loan Application Form (Active Member) : Last Name Middle NameGian Paula MonghitNo ratings yet

- 20200403-Forms-EML Active Fillable PDFDocument2 pages20200403-Forms-EML Active Fillable PDFKarena WahimanNo ratings yet

- Emergency Loan Application Form (Active Member) : Last Name Middle NameDocument2 pagesEmergency Loan Application Form (Active Member) : Last Name Middle NameKarena WahimanNo ratings yet

- 20200403-Forms-EML Active FillableDocument2 pages20200403-Forms-EML Active FillableChesca Angel ReyesNo ratings yet

- Emergency Loan Application Form (Active Member) : Last Name Middle NameDocument2 pagesEmergency Loan Application Form (Active Member) : Last Name Middle NameDeese Marie ZabalaNo ratings yet

- 20200403-Forms-EML Active Fillable PDFDocument2 pages20200403-Forms-EML Active Fillable PDFBusyMae CabadonNo ratings yet

- Appendix V Family Part Case Information Statement This Form and Attachments Are Confidential Pursuant To Rules 1:38-3 (D) (1) and 5:5-2 (F)Document10 pagesAppendix V Family Part Case Information Statement This Form and Attachments Are Confidential Pursuant To Rules 1:38-3 (D) (1) and 5:5-2 (F)Nard CruzNo ratings yet

- CH 1 Final Copy ADD Theory and Examples 2020-2021Document16 pagesCH 1 Final Copy ADD Theory and Examples 2020-2021Utkarsh SharmaNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- IT Exemption Guidelines 2023-24Document7 pagesIT Exemption Guidelines 2023-24rashiramesh31No ratings yet

- Sap PM TutorialDocument1 pageSap PM Tutorialisha mittalNo ratings yet

- Loss From HPDocument1 pageLoss From HPrashiramesh31No ratings yet

- Rent Receipts FormatDocument1 pageRent Receipts Formatrashiramesh31No ratings yet

- Chapter 8 Training & DevelopmentDocument21 pagesChapter 8 Training & DevelopmentSalman PreeomNo ratings yet

- 03 Serrano v. NLRC, G.R. No. 117040, 27 January 2000 PDFDocument37 pages03 Serrano v. NLRC, G.R. No. 117040, 27 January 2000 PDFAndrei Da JoseNo ratings yet

- CHAPTER4Document34 pagesCHAPTER4Nour NaakhuudeNo ratings yet

- Valiao v. CA G.R. No. 146621 July 30, 2004 Facts: IssueDocument1 pageValiao v. CA G.R. No. 146621 July 30, 2004 Facts: IssueJepz FlojoNo ratings yet

- UK-SPEC Third EditionDocument48 pagesUK-SPEC Third EditionRahul PatelNo ratings yet

- 401k Pension Retirement Interview Questions and Answers 31685Document12 pages401k Pension Retirement Interview Questions and Answers 31685Suresh JadhavNo ratings yet

- Theories of Career ChoiceDocument16 pagesTheories of Career ChoiceAdrianeEstebanNo ratings yet

- Sugeco Employee Handbook Manual - DraftDocument28 pagesSugeco Employee Handbook Manual - Draftapi-555471143No ratings yet

- AssignmentDocument3 pagesAssignmentJevi RuiizNo ratings yet

- Feminism in IndiaDocument29 pagesFeminism in Indiasmily rana100% (2)

- Freelancer Startup GuideDocument15 pagesFreelancer Startup GuideveravsyrNo ratings yet

- PEAM - Measuring Govt EmploymentDocument8 pagesPEAM - Measuring Govt EmploymentKim Roque-AquinoNo ratings yet

- Field ReportDocument17 pagesField Reportshafiru khassimuNo ratings yet

- Introduction To Organisational BehaviourDocument34 pagesIntroduction To Organisational BehaviourStephanie BanksNo ratings yet

- Indian Railways ModernisationDocument29 pagesIndian Railways Modernisationsimonebandrawala9No ratings yet

- BROTHERHOOD LABOR UNITY MOVEMENT OF THE PHILIPPINES V ZAMORADocument3 pagesBROTHERHOOD LABOR UNITY MOVEMENT OF THE PHILIPPINES V ZAMORACZARINA ANN CASTRONo ratings yet

- Counseling InterventionsDocument8 pagesCounseling InterventionsAnkita ShettyNo ratings yet

- Employee Retention StrategiesDocument18 pagesEmployee Retention StrategiesJanardhan ThokchomNo ratings yet

- Project Quantity Surveyor, Hyderabad, India: Job SummaryDocument4 pagesProject Quantity Surveyor, Hyderabad, India: Job Summaryjalluri vemkateshNo ratings yet

- Labor Mariwasa vs. LeogardoDocument9 pagesLabor Mariwasa vs. LeogardomelodyNo ratings yet

- PNOC-EDC V BuenviajeDocument19 pagesPNOC-EDC V BuenviajeCarmela Lucas DietaNo ratings yet

- Ey Future of Pay ReportDocument24 pagesEy Future of Pay Reportmeenal_smNo ratings yet

- The Mistreatment of Filipino Domestic Workers in Kuwait - Chapter I, II, & IIIDocument30 pagesThe Mistreatment of Filipino Domestic Workers in Kuwait - Chapter I, II, & IIIYIGGSNo ratings yet

- Ethics Emp Rights N DisDocument44 pagesEthics Emp Rights N DisMarkNo ratings yet

- Organizational Behaviour Part 2Document14 pagesOrganizational Behaviour Part 2KZ MONTAGENo ratings yet

- Promotions Demotions Transfers Separation Absenteeism and TurnoverDocument23 pagesPromotions Demotions Transfers Separation Absenteeism and Turnoverkaysheph100% (1)

- Dream Jobs PDFDocument3 pagesDream Jobs PDFTânia CarmonarioNo ratings yet

- Groen Sebenza Intern Advert - CapeNature 140113Document4 pagesGroen Sebenza Intern Advert - CapeNature 140113Eve Lawrence MarthinusNo ratings yet