Professional Documents

Culture Documents

Emergency Loan Application Form (Active Member) : Last Name Middle Name

Uploaded by

Karena WahimanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Emergency Loan Application Form (Active Member) : Last Name Middle Name

Uploaded by

Karena WahimanCopyright:

Available Formats

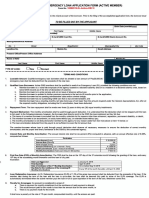

EMERGENCY LOAN APPLICATION FORM (ACTIVE MEMBER)

Form No. 10082019-EL-Active-REV O

GSIS

IMPORTANT: Proceeds of this loan will be credited to the eCard account of the borrower. Prior to the filing of the accomplished application form, the borrower must

read thoroughly the terms and conditions below.

TO BE FILLED OUT BY THE APPLICANT

Name of Applicant Birth Date (mm/dd/yyyy)

Last Name I First Name I Middle Name

I I

GSIS ID No. (any of the ID No. below may be provided)

BP No. E-Card/UMID Card No. E-Card/UMID Bank Account No.

Mailing/Residential Address

No. I Street I Brgy/District I Municipality/City I Zip Code

Landline No.

Present Office/Present Office Address

I Mobile No.

I Email Address

Name of AAO Mobile No.

Last Name I First Name I Middle Name

TYPE OF LOAN: D New D Renewal

••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••

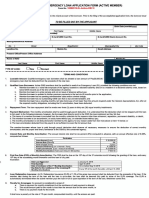

TERMS AND CONDITIONS

1. Loanable Amount: Qualified emergency loan borrowers shall be allowed a loan amount of Php20,000.00. The outstanding balance (OBAL) of the previous

emergency loan shall be deducted from the proceeds of the new loan.

2. Qualified Loan Borrowers: Active GSIS members shall be qualified to avail of an Emergency Loan (EL) provided the following conditions are met:

a. Member-borrower is a bona fide employee of the agency located in a declared calamity area or is a resident of a declared calamity area, based on

latest GSIS records as of the time of declaration of calamity;

b. Member-borrower is in active service and not on leave of absence without pay;

c. Member-borrower is updated in his/her premium payments in the last six (6) months prior to the application;

d. Member-borrower has no pending administrative case and/or criminal charge;

e. Member-borrower has no outstanding GSIS loan that is due and demandable; and

f. Member-borrower has a resulting monthly net take-home pay of not lower than the amount required under the General Appropriations Act, after all

the required monthly obligations, including the EL amortization, have been deducted.

3. Repayment Term: The loan repayment shall be made over three (3) years in thirty-six (36) equal monthly installments.

4. Payment Mechanism: The monthly amortization shall be paid through payroll deduction. It is understood that the deduction shall not be stopped until the loan

is fully paid. In the following instances, however, the borrower shall directly remit to the GSIS the loan instalment as they fall due:

a. The name of a member-borrower is excluded from the monthly collection list for reasons other than retirement, separation, permanent disability, or death;

b. The member-borrower is on secondment, on study leave without pay, or extended leave without pay;

c. The monthly amortization is not deducted and/or remitted by the agency for any reason aside from item 4(b) above or item 10 below; or

d. The loan amortization deducted from the payroll is not sufficient to cover the full amount due.

The member-borrower whose loan is paid through payroll deduction shall observe all necessary measures to ensure the deduction of correct monthly

amortization; and the proper and timely remittance to the GSIS by the concerned agency.

5. Interest Rate and Monthly Amortization: The annual interest rate shall be six percent (6%) computed in advance, with an annual effective rate of 9.88%,

computed as follows:

Particulars

Loan Amount (Loan) P 20,000.00

Interest Rate (Interest) 6%

Term of Loan (Term) 3 years

Amount of Interest (Loan x Interest x Term) P 3,600.00

Total Loan Amount (Loan + Amount of Interest) P 23,600.00

Monthly Amortization (Total Loan Amount I 36 months) P 655.56

6. First Due Date (FDD) of Monthly Amortization: The FDD shall be due on the 1Q1h day of the 3rd calendar month following the granting of the loan, and every

1Qth day of the succeeding month thereafter until the loan is fully paid.

Illustration:

Date Loan Approved January 15, 2019

First Due Date April 10, 2019

Date of remittance of the 1 '' Monthly Amortization On or before May 10, 2019

Due Date for the remittance of the remaining 35

Every 101h of the month thereafter until April 10, 2022

Monthly Amortizations

7. Loan Redemption Insurance: An EL Redemption Insurance (ELRI) of 1.2% of the gross loan amount shall be deducted from the proceeds of the loan. If the

member dies during the term of the loan and the loan is up-to-date, the loan shall be deemed fully paid by virtue of the ELRI coverage. The ELRI is

automatically terminated when the active member pays the loan in full or upon expiration of the term of the loan, whichever comes first.

8. Penalty for Arrearages: An account is considered in arrears if:

a. There is payment for monthly installment but the remittance of said payment is delayed;

b. The actual amount paid for the month is less than the amount due for the same month; or

c. There is no payment made for the month.

It shall incur a penalty at the rate of 1% per month, compounded monthly, until the arrears are paid.

You might also like

- 20200403-Forms-EML Active Fillable PDFDocument2 pages20200403-Forms-EML Active Fillable PDFKarena WahimanNo ratings yet

- Emergency Loan Application Form (Active Member) : Last Name Middle NameDocument2 pagesEmergency Loan Application Form (Active Member) : Last Name Middle NameGian Paula MonghitNo ratings yet

- 20200403-Forms-EML Active FillableDocument2 pages20200403-Forms-EML Active FillableChesca Angel ReyesNo ratings yet

- 20200403-Forms-EML Active Fillable PDFDocument2 pages20200403-Forms-EML Active Fillable PDFBusyMae CabadonNo ratings yet

- Emergency Loan Application Form (Active Member) : Last Name Middle NameDocument2 pagesEmergency Loan Application Form (Active Member) : Last Name Middle NameDeese Marie ZabalaNo ratings yet

- Emergency Loan Application Form (Active Member) : Last Name Middle NameDocument2 pagesEmergency Loan Application Form (Active Member) : Last Name Middle NamePhebe Zhie Zhia CampeñaNo ratings yet

- Emergency Loan Application Form (Active Member) Gsis: To Be Filled Out by The ApplicantDocument2 pagesEmergency Loan Application Form (Active Member) Gsis: To Be Filled Out by The ApplicantChristian de LunaNo ratings yet

- Emergency Loan Application Form (Active Member) : To Be Filled Out by The ApplicantDocument2 pagesEmergency Loan Application Form (Active Member) : To Be Filled Out by The ApplicantRichelle PascorNo ratings yet

- EL Application Form Active MembersDocument2 pagesEL Application Form Active MembersCharles De Saint AmantNo ratings yet

- Emergency Loan (Active Member) Application FormDocument2 pagesEmergency Loan (Active Member) Application FormenzoNo ratings yet

- Emergency Loan (Active Member) Application FormDocument2 pagesEmergency Loan (Active Member) Application FormFermarc Lestajo100% (1)

- Emergency Loan (Active Member) Application FormDocument2 pagesEmergency Loan (Active Member) Application FormJ Espelita CaballedaNo ratings yet

- Codified - Gsis Computer Loan Application Form 09222020 - v1Document2 pagesCodified - Gsis Computer Loan Application Form 09222020 - v1Cloud StrifeNo ratings yet

- GCL-REV 1: RD TH RD THDocument2 pagesGCL-REV 1: RD TH RD THhenryNo ratings yet

- FORMS Emergency - Loan PDFDocument3 pagesFORMS Emergency - Loan PDFUsep ObreroNo ratings yet

- Borrower Must Read Thoroughly The Terms and Conditions BelowDocument3 pagesBorrower Must Read Thoroughly The Terms and Conditions BelowNgirp Alliv TreborNo ratings yet

- Gsis Computer Loan Application Form: To Be Filled Up by The ApplicantDocument2 pagesGsis Computer Loan Application Form: To Be Filled Up by The ApplicantMr. Bates100% (1)

- Loan TermsDocument4 pagesLoan TermsNorman FloresNo ratings yet

- Sudheer Loan Letter PDFDocument7 pagesSudheer Loan Letter PDFmr copy xeroxNo ratings yet

- Repayment ScheduleDocument2 pagesRepayment ScheduleCharina MiclatNo ratings yet

- Welcome LetterDocument3 pagesWelcome LetterDeepak DevasiNo ratings yet

- Emergency Loan (Pensioner) Application Form: 05042020-EL-PEN-REV 1Document2 pagesEmergency Loan (Pensioner) Application Form: 05042020-EL-PEN-REV 1Joel Terrence Gumapon TigoyNo ratings yet

- 2021 Loan Renewal Loan Form 4Document2 pages2021 Loan Renewal Loan Form 4Verly GubimotosNo ratings yet

- NIKKIE MASING CAYATOCLN046190000429256 - LNInfo PDFDocument10 pagesNIKKIE MASING CAYATOCLN046190000429256 - LNInfo PDFNikkie CayatocNo ratings yet

- FOR Office USE Only: HDFC Life Sb/Ca/Cc/Sb-Nre/Sb-Nro/OtherDocument2 pagesFOR Office USE Only: HDFC Life Sb/Ca/Cc/Sb-Nre/Sb-Nro/OtherAnithaNo ratings yet

- Application Number APPLICATION FORM For Floating Rate Savings Bonds, 2020 (Taxable)Document6 pagesApplication Number APPLICATION FORM For Floating Rate Savings Bonds, 2020 (Taxable)Vikas AbhyankarNo ratings yet

- Credit Card Authorization FormDocument1 pageCredit Card Authorization Formsheshadri_1999No ratings yet

- WelcomeLetter CDDocument2 pagesWelcomeLetter CDAnirban SahaNo ratings yet

- Social Security System: Terms and Conditions For Salary LoanDocument2 pagesSocial Security System: Terms and Conditions For Salary LoanMichael NavosNo ratings yet

- Consoloan Application Form 4Document3 pagesConsoloan Application Form 4bhon20No ratings yet

- Research Topic 2 1. EMI Laws 2. Bank Laws Relating To Loan and Repayment 3. Rights of The Customer Taking Loan 4. Sarfaesi Act 5. MoratoriumDocument18 pagesResearch Topic 2 1. EMI Laws 2. Bank Laws Relating To Loan and Repayment 3. Rights of The Customer Taking Loan 4. Sarfaesi Act 5. Moratoriumlakshya khandelwalNo ratings yet

- Offer 16124750Document7 pagesOffer 16124750alyssa babylaiNo ratings yet

- CitiBank ApplicationDocument15 pagesCitiBank ApplicationJordan P HunterNo ratings yet

- Promissory Note: Application Number: 13950699 Application Date: 03/30/2022 Borrower's Personal DetailsDocument9 pagesPromissory Note: Application Number: 13950699 Application Date: 03/30/2022 Borrower's Personal DetailsSherryann BenedictoNo ratings yet

- Loan Agreement - MITCDocument6 pagesLoan Agreement - MITCAarti ThdfcNo ratings yet

- Balbheemloan Sanction LetterDocument6 pagesBalbheemloan Sanction LetterVenkatesh DoodamNo ratings yet

- Terms and ConditionsDocument14 pagesTerms and ConditionsPiyush ckNo ratings yet

- Legal Kit - Home Loan: 1. Facility Advice Letter (FAL) 2. Demand Promissory Note 3. Agreement For Home LoanDocument21 pagesLegal Kit - Home Loan: 1. Facility Advice Letter (FAL) 2. Demand Promissory Note 3. Agreement For Home LoanRajNo ratings yet

- NEW LOAN-APPLICATION-FORM November 2021 v2 PDFDocument4 pagesNEW LOAN-APPLICATION-FORM November 2021 v2 PDFjohnson mwauraNo ratings yet

- AC Bajaj Finance - 2Document2 pagesAC Bajaj Finance - 2prsnjt11No ratings yet

- Personal Credit Application Form: Part A: (To Be Completed by The Applicant) 1. 5Document3 pagesPersonal Credit Application Form: Part A: (To Be Completed by The Applicant) 1. 5Nokutenda ChimbeteteNo ratings yet

- SSS Form Salary LoanDocument4 pagesSSS Form Salary LoanMikoy Lacson100% (4)

- FOR Office USE Only: HDFC Life Sb/Ca/Cc/Sb-Nre/Sb-Nro/OtherDocument2 pagesFOR Office USE Only: HDFC Life Sb/Ca/Cc/Sb-Nre/Sb-Nro/OtherVIkashNo ratings yet

- Investment Proof Submission Form23 24Document6 pagesInvestment Proof Submission Form23 24Bindu madhaviNo ratings yet

- Sanctionletter 10045975 29-8-2023 113638Document3 pagesSanctionletter 10045975 29-8-2023 113638greenrootfinancialservicesNo ratings yet

- Clss Affidavit PDF NewDocument2 pagesClss Affidavit PDF NewBalabasker Padmanabhan63% (8)

- KT 1070169204Document4 pagesKT 1070169204shivu patilNo ratings yet

- Bank Authorization (BA) FormDocument4 pagesBank Authorization (BA) FormAilec FinancesNo ratings yet

- Government BusinessDocument17 pagesGovernment BusinessManish AroraNo ratings yet

- New Personal Salary Loan Application: (Last Name) (First Name) (Middle Initial) (Suffix)Document2 pagesNew Personal Salary Loan Application: (Last Name) (First Name) (Middle Initial) (Suffix)En-en FrioNo ratings yet

- Sample SheetDocument4 pagesSample SheetMaryam UtutalumNo ratings yet

- Terms and ConditionsDocument4 pagesTerms and ConditionsThatukuru LakshmanNo ratings yet

- ViewPrintRequest AspxDocument3 pagesViewPrintRequest AspxDragana MijajlovicNo ratings yet

- SSS Member Loan ApplicationDocument2 pagesSSS Member Loan ApplicationRj Santos95% (20)

- Yes First Mitc Credit Cards EnglishDocument13 pagesYes First Mitc Credit Cards Englishpriyanka jagtapNo ratings yet

- Vamsi Krishna Loan Sanction Letter 456Document7 pagesVamsi Krishna Loan Sanction Letter 456Venkatesh DoodamNo ratings yet

- Pay-Out Request Form Ver1.1Document2 pagesPay-Out Request Form Ver1.1Mahendra AsawaleNo ratings yet

- BPIMS Credit Card Payment FormDocument2 pagesBPIMS Credit Card Payment Formromel.morales13No ratings yet

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsFrom EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsRating: 5 out of 5 stars5/5 (1)

- Module 4 BookletDocument13 pagesModule 4 BookletKarena WahimanNo ratings yet

- Position and Competency Profile: Rpms Tool For Teacher I-Iii (Proficient Teachers)Document32 pagesPosition and Competency Profile: Rpms Tool For Teacher I-Iii (Proficient Teachers)Devine CagadasNo ratings yet

- Remedial Reading in FilipinoDocument10 pagesRemedial Reading in FilipinoKarena Wahiman100% (3)

- The Building Blocks of Matter - AtomsDocument29 pagesThe Building Blocks of Matter - AtomsROSHAN_25No ratings yet

- SwitzerlandDocument65 pagesSwitzerlandKarena WahimanNo ratings yet

- Action Research Final 2020 CALATRAVADocument3 pagesAction Research Final 2020 CALATRAVAKarena WahimanNo ratings yet

- How Deep Is Your LoveDocument1 pageHow Deep Is Your LoveKarena WahimanNo ratings yet

- FORM 3: LAC Session Report: Region: X Lac Session No.: Venue/Platform of Session: Google MeetDocument3 pagesFORM 3: LAC Session Report: Region: X Lac Session No.: Venue/Platform of Session: Google MeetKarena WahimanNo ratings yet

- Masterlist BOOKSDocument24 pagesMasterlist BOOKSKarena WahimanNo ratings yet

- Inventory and Inspection Report of Unserviceable Property IIRUP Flowchart On The Disposal of Property Waste Materials ReportDocument5 pagesInventory and Inspection Report of Unserviceable Property IIRUP Flowchart On The Disposal of Property Waste Materials ReportLalaLaniba100% (1)

- Sheilou Oath of OfficeDocument1 pageSheilou Oath of OfficeJoan VecillaNo ratings yet

- Electronic Device Borrower Agreement Electronic Device Borrower AgreementDocument1 pageElectronic Device Borrower Agreement Electronic Device Borrower AgreementKarena WahimanNo ratings yet

- DBM-CSC Form No. 1 Position Description FormsDocument4 pagesDBM-CSC Form No. 1 Position Description FormsKarena WahimanNo ratings yet

- CS Form No. 212 Attachment - Work Experience SheetDocument2 pagesCS Form No. 212 Attachment - Work Experience SheetDana Althea Algabre100% (12)

- Republic of The Philippines Position Description Form DBM-CSC Form No. 1Document8 pagesRepublic of The Philippines Position Description Form DBM-CSC Form No. 1Jundell C. DiazNo ratings yet

- AnotherDocument3 pagesAnotherKarena WahimanNo ratings yet

- Bern, Switzerland 1Document3 pagesBern, Switzerland 1Karena WahimanNo ratings yet

- Cover PageDocument1 pageCover PageKarena WahimanNo ratings yet

- CS Form No. 4 Certification of Assumption To Duty - EditedDocument1 pageCS Form No. 4 Certification of Assumption To Duty - EditedKarena Wahiman100% (5)

- Clearance Form: CS Form No. 7 Revised 2018Document1 pageClearance Form: CS Form No. 7 Revised 2018Karena WahimanNo ratings yet

- Effectiveness of Instructional Technology Module For Electropneumatics WithDocument19 pagesEffectiveness of Instructional Technology Module For Electropneumatics WithKarena WahimanNo ratings yet

- You May Have Discovered WHAT You Like Eating HereDocument1 pageYou May Have Discovered WHAT You Like Eating HereKarena WahimanNo ratings yet

- Top 10 Digestive System DiseasesDocument2 pagesTop 10 Digestive System DiseasesKarena WahimanNo ratings yet

- Science 7 Long TestDocument1 pageScience 7 Long TestKarena WahimanNo ratings yet

- Natural ResourcesDocument5 pagesNatural ResourcesKarena WahimanNo ratings yet

- New Form 6Document1 pageNew Form 6Zhēn Ní Fú AteuluzNo ratings yet

- Building PicsDocument5 pagesBuilding PicsKarena WahimanNo ratings yet

- Science 8Document2 pagesScience 8Karena WahimanNo ratings yet

- Statement of Financial Affairs: United States Bankruptcy Court Southern District of New YorkDocument42 pagesStatement of Financial Affairs: United States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- Case Summary (BPI vs. de Coster)Document3 pagesCase Summary (BPI vs. de Coster)Alfredo BentulanNo ratings yet

- FM11 CH 22 Instructors ManualDocument6 pagesFM11 CH 22 Instructors ManualFahad AliNo ratings yet

- Test - B2 Empower Unit 8 Dilemmas - Quizlet 2Document4 pagesTest - B2 Empower Unit 8 Dilemmas - Quizlet 2Guidance Teuku Nyak Arif Fatih Bilingual SchoolNo ratings yet

- Mathematics of Investment - Mr. NogralesDocument55 pagesMathematics of Investment - Mr. NogralesatlasNo ratings yet

- Marston Marble Corporation Is Considering A Merger With TheDocument1 pageMarston Marble Corporation Is Considering A Merger With TheAmit PandeyNo ratings yet

- INGLES II Pag. 148 and 149Document3 pagesINGLES II Pag. 148 and 149Paola Pinedo Garcia100% (1)

- Final Accounts SumDocument2 pagesFinal Accounts SumRohit Aswani25% (4)

- Loan Syndication-Structure, Pricing and Deal MakingDocument30 pagesLoan Syndication-Structure, Pricing and Deal Makingjaya100% (7)

- Government BondDocument28 pagesGovernment BondLotusNuruzzamanNo ratings yet

- CasoDocument2 pagesCasoJosue FrancoNo ratings yet

- Private EquityDocument11 pagesPrivate Equityanurag yadavNo ratings yet

- Vault Guide To The Top Financial Services EmployersDocument385 pagesVault Guide To The Top Financial Services EmployersDerek WangNo ratings yet

- Financial Analysis of Ultratech CementDocument23 pagesFinancial Analysis of Ultratech Cementsanchit1170% (2)

- World Economics: Institute ForDocument17 pagesWorld Economics: Institute ForAndrasNo ratings yet

- Yale University - Financial Market CourseDocument26 pagesYale University - Financial Market CourseNitendo CubeNo ratings yet

- Family BudgetDocument7 pagesFamily BudgetDinesh Hadwale50% (4)

- Module in Business Mathematics: Try To Discover!Document24 pagesModule in Business Mathematics: Try To Discover!Jay Kenneth BaldoNo ratings yet

- Risk Spectrum For BanksDocument5 pagesRisk Spectrum For BanksLý Minh TânNo ratings yet

- This Study Resource WasDocument5 pagesThis Study Resource WasDevia SuswodijoyoNo ratings yet

- Bio-Data of The Promoters / Guarantors: Annexure 1Document41 pagesBio-Data of The Promoters / Guarantors: Annexure 1Anuj NijhonNo ratings yet

- Simple InterestDocument20 pagesSimple InterestEngel QuimsonNo ratings yet

- Accepted For Value Tutorial 2018Document7 pagesAccepted For Value Tutorial 2018Pratus Williams100% (16)

- International FinanceDocument83 pagesInternational Financesamrulezzz100% (1)

- Nicole Reese SBA2Document1 pageNicole Reese SBA2ColeReeseNo ratings yet

- Eurotunnel Case Study: Project FinanceDocument8 pagesEurotunnel Case Study: Project FinanceaboulazharNo ratings yet

- Bonds Valuation Practice ProblemsDocument6 pagesBonds Valuation Practice ProblemsMaria Danielle Fajardo CuysonNo ratings yet

- Payment Return AgreementDocument6 pagesPayment Return AgreementSonica DhankharNo ratings yet

- MT Educare LTD PDFDocument30 pagesMT Educare LTD PDFBhakti ShindeNo ratings yet

- 2007 LCCI Level 2 Series 3 (HK) Model AnswersDocument12 pages2007 LCCI Level 2 Series 3 (HK) Model AnswersChoi Kin Yi Carmen67% (3)