Professional Documents

Culture Documents

Repayment Schedule

Uploaded by

Charina MiclatOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Repayment Schedule

Uploaded by

Charina MiclatCopyright:

Available Formats

Citibank, N.A.

(Name of Creditor - "the Bank")

DISCLOSURE STATEMENT ON LOAN/CREDIT TRANSACTION

(As Required under R.A. 3765 Truth in Lending Act)

Name of Borrower MS. MENESES JOLLEE Account Number: 0000000007842472396

Address 4171 ROXAS STREET CAPAYA 2 Loan Booking Date: 2023-10-06

Loan Reference No. 2023-10-06-09.31.29.993041

Account Type Personal Loan

1 APPROVED LOAN AMOUNT (Amount to be financed) Php 72,000.00

2 TOTAL INTEREST (See attached computation in Annex A) Php 25,317.95

Interest on your loan is charged starting on the Loan Booking Date, which is the date your loan was approved by the Bank.

3 OTHER BANK CHARGES Php 1,750.00

a. Documentary Stamp Tax (DST) on Loan Php 0.00

b. Insurance Premium -

c. Documentary Stamp Tax (DST) on Insurance -

d. Loan Disbursement Fee 1,750.00

e. Others (Specify) -

4 ANNUAL INTEREST RATE (See attached computation in Annex A)

a. Annual Contractual Rate 21.0%

24.89%

b. Effective Annual Interest Rate

The Annual Contractual Rate is the interest that will be charged on the loan, based on a 360-day period, computed on a monthly basis wherein each

month consists of 30 days (except for the 1st month which is equal to the number of calendar days from the approval date to the next billing date).

In accordance with the Philippine Accounting Standards definition, effective interest rate (EIR) is the rate that exactly discounts estimated future cash flows

through the life of the loan to the net amount of loan proceeds (BSP Circular No. 730, S2011). The EIR includes the monthly interest, the Disbursement

Fee and DST. As such, there will be a variance between Annual Contractual Rate and the Effective Annual Interest Rate.

5 SCHEDULE OF PAYMENTS (See attached Amortization Schedule in Annex A)

a. First Payment Due Date 17 NOV 2023

b. Next Payment Due Date Every 17th of the month

c. Monthly Installment Amounts

Payable in 36 months at Php 4,126.60 for the First Monthly Installment Amount

2,712.61 for the succeeding Monthly Installment Amounts

(no. of payments)

Your first Monthly Installment Amount may be different from your succeeding Monthly Installment Amounts. The interest portion of your first Monthly Installment

Amount is pro-rated based on the number of days from the Loan Booking Date to your next Statement Date. This also includes Other Bank Charges, such as a

Disbursement Fee of P1,750 and Documentary Stamp Tax (DST) of P1.50 per P200 of your loan amount, subject to applicable laws and regulations.

6 ADDITIONAL CHARGES IN CASE CERTAIN STIPULATIONS ARE NOT MET BY THE BORROWER

“Monthly Interest Charge” or “Interest Charge” means the interest, computed using the monthly revolving interest of 2.42%

(“Monthly Interest Rate”), applied on any or all of the following: (1) on any unpaid fees and charges, and (2) on the Total Amount

Due, when my Citi Personal Loan or Citi Salary Loan is in default at 60 days past due, in which case, the Total Amount Due will

Monthly Interest Charge include any unpaid fees and charges, the past due monthly principal installment amounts and the remaining principal balance.

Such interest shall be compounded monthly and will continue to be charged until full payment of Total Amount Due plus accrued

interest.

Monthly Late Charge P500 or 6% of the Overdue Amount, whichever is higher.

Please see the Citi Personal Loan Terms and Conditions at www.citibank.com.ph/loans for the definition of Overdue Amount.

* For Citi Personal Loan only

Closure Handling Fee 4% of the unbilled principal component of the loan that is prepaid.

P1,500 will be charged for every check that is returned or that bounces due to insufficiency of funds, uncollected deposits, stop

Returned Check Fee

payment order, alterations or erasure, among others.

Attorney's Fees & Other Judicial Expenses In case of default in payment, in addition to late and interest charges, the cost of collection and/or attorney's fees and the

litigation and judicial expenses, as applicable.

C E R T I F I E D C O R R E C T:

Citibank, N.A.

TIN 000-444-734-000

I acknowledge receipt of a copy of this statement and the Citi Personal Loan Terms and Conditions prior to the consummation of the credit transaction and that I understand

and fully agree to the contents of and to be bound by the said documents. I understand that any alteration made on this form will render the document void.

I understand that the use of unsecured loans such as my Citi Personal Loan as funding / fund sources for Citi's Wealth Management products like investments or insurance is

not allowed. I hereby confirm that these loan proceeds will not be used for Citi's Wealth Management products. In the event that the loan fund has been used for the purposes

prohibited above, Citi will be entitled to do all acts and things it deems necessary to comply with its policies, including but not limited to liquidating my holdings of investments/

insurance at that time. I agree to bear all costs and expenses Citi incurs as a result thereof.

I understand that I may terminate my Citi Personal Loan account by ceasing to use all facilities and services relating to my Citi Personal Loan account, paying all Citi Personal

Loan outstanding balance and such other sums owing to the Bank under the Citi Personal Loan documents, and advising the Bank about my intention to terminate. I

understand that the Bank is entitled to, in its discretion, at any time with reasonable notice to me, terminate my Citi Personal Loan forthwith, and/or to demand immediate

payment of all monies owing in respect of my Citi Personal Loan account, whether or not I am in default of any of my obligations under the Citi Personal Loan documents and

whether or not any Citi Personal Loan outstanding balance is due and owing by me. If my Citi Personal Loan account shall be so terminated by the Bank, I must make

immediate payment of all Citi Personal Loan outstanding balance and such other sums owing to the Bank under this agreement.

(Signature of Borrower over printed name) Date ID Number

NOTICE TO BORROWER: You are entitled to a copy of this document which you shall sign.

This is a computer-generated form and if issued without any alteration, this does not require a signature.

version: November 2020

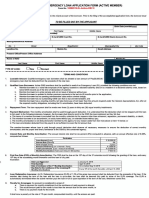

AMORTIZATION SCHEDULE AND

COMPUTATION OF EFFECTIVE ANNUAL INTEREST RATE

DECLINING BALANCE METHOD

(Annex A)

Account Number 0000000007842472396

Approved Loan Amount Php 72,000.00 Total Interest Php 25,317.95

Annual Contractual Rate 21.0% Disbursement Fee & Loan DST Php 1,750.00

Loan Period / Tenor (in months) 36 Effective Annual Interest Rate 24.89%

Installment Principal Interest Monthly Installment Amount

1 Php 1,452.60 Php 924.00 Php 2,376.60

2 Php 1,478.03 Php 1,234.58 Php 2,712.61

3 Php 1,503.90 Php 1,208.71 Php 2,712.61

4 Php 1,530.21 Php 1,182.40 Php 2,712.61

5 Php 1,556.99 Php 1,155.62 Php 2,712.61

6 Php 1,584.24 Php 1,128.37 Php 2,712.61

7 Php 1,611.96 Php 1,100.65 Php 2,712.61

8 Php 1,640.17 Php 1,072.44 Php 2,712.61

9 Php 1,668.88 Php 1,043.73 Php 2,712.61

10 Php 1,698.08 Php 1,014.53 Php 2,712.61

11 Php 1,727.80 Php 984.81 Php 2,712.61

12 Php 1,758.04 Php 954.57 Php 2,712.61

13 Php 1,788.80 Php 923.81 Php 2,712.61

14 Php 1,820.10 Php 892.51 Php 2,712.61

15 Php 1,851.96 Php 860.65 Php 2,712.61

16 Php 1,884.37 Php 828.24 Php 2,712.61

17 Php 1,917.34 Php 795.27 Php 2,712.61

18 Php 1,950.90 Php 761.71 Php 2,712.61

19 Php 1,985.04 Php 727.57 Php 2,712.61

20 Php 2,019.77 Php 692.84 Php 2,712.61

21 Php 2,055.12 Php 657.49 Php 2,712.61

22 Php 2,091.09 Php 621.52 Php 2,712.61

23 Php 2,127.68 Php 584.93 Php 2,712.61

24 Php 2,164.91 Php 547.70 Php 2,712.61

25 Php 2,202.80 Php 509.81 Php 2,712.61

26 Php 2,241.35 Php 471.26 Php 2,712.61

27 Php 2,280.57 Php 432.04 Php 2,712.61

28 Php 2,320.48 Php 392.13 Php 2,712.61

29 Php 2,361.09 Php 351.52 Php 2,712.61

30 Php 2,402.41 Php 310.20 Php 2,712.61

31 Php 2,444.45 Php 268.16 Php 2,712.61

32 Php 2,487.23 Php 225.38 Php 2,712.61

33 Php 2,530.76 Php 181.85 Php 2,712.61

34 Php 2,575.04 Php 137.57 Php 2,712.61

35 Php 2,620.11 Php 92.50 Php 2,712.61

36 Php 2,665.73 Php 46.88 Php 2,712.61

37 Php 0.00 Php 0.00 Php 0.00

38 Php 0.00 Php 0.00 Php 0.00

39 Php 0.00 Php 0.00 Php 0.00

40 Php 0.00 Php 0.00 Php 0.00

41 Php 0.00 Php 0.00 Php 0.00

42 Php 0.00 Php 0.00 Php 0.00

43 Php 0.00 Php 0.00 Php 0.00

44 Php 0.00 Php 0.00 Php 0.00

45 Php 0.00 Php 0.00 Php 0.00

46 Php 0.00 Php 0.00 Php 0.00

47 Php 0.00 Php 0.00 Php 0.00

48 Php 0.00 Php 0.00 Php 0.00

49 Php 0.00 Php 0.00 Php 0.00

50 Php 0.00 Php 0.00 Php 0.00

51 Php 0.00 Php 0.00 Php 0.00

52 Php 0.00 Php 0.00 Php 0.00

53 Php 0.00 Php 0.00 Php 0.00

54 Php 0.00 Php 0.00 Php 0.00

55 Php 0.00 Php 0.00 Php 0.00

56 Php 0.00 Php 0.00 Php 0.00

57 Php 0.00 Php 0.00 Php 0.00

58 Php 0.00 Php 0.00 Php 0.00

59 Php 0.00 Php 0.00 Php 0.00

60 Php 0.00 Php 0.00 Php 0.00

The first Monthly Installment Amount includes a one-time disbursement fee of P1,750 and your Loan DST, which is computed at P1.50 for every P200.00 of your loan. Please

refer to your copy of the Disclosure Statement for the breakdown of fees applied to your installment loan.

NOTE: In case you missed payment for the Minimum Amount Due of your Citi Personal Loan account for three (3) consecutive months, your account will be considered in

default, the unbilled principal amount of your outstanding loan/s will be billed in full, and your outstanding loan/s will no longer follow the amortization schedule in your

Disclosure Statement. For more details, please refer to your copy of the Citi Personal Loan Terms and Conditions.

You might also like

- Introduction To Freight BrokeringDocument35 pagesIntroduction To Freight BrokeringAtex9100% (3)

- Sudheer Loan Letter PDFDocument7 pagesSudheer Loan Letter PDFmr copy xeroxNo ratings yet

- Sanctionletter 10045975 29-8-2023 113638Document3 pagesSanctionletter 10045975 29-8-2023 113638greenrootfinancialservicesNo ratings yet

- Sample Loan Agreement (Clix)Document8 pagesSample Loan Agreement (Clix)Digi CreditNo ratings yet

- CLSS Affidavit FormDocument2 pagesCLSS Affidavit FormBalabasker Padmanabhan63% (8)

- Mou For SamirDocument6 pagesMou For SamirJohn HudsonNo ratings yet

- 30-Dec-2020-Memorandum To Sebi and Justice BN AgrawalDocument17 pages30-Dec-2020-Memorandum To Sebi and Justice BN AgrawalMoneylife FoundationNo ratings yet

- Electric BillDocument2 pagesElectric BillJagannath PanigrahiNo ratings yet

- Offer 16124750Document7 pagesOffer 16124750alyssa babylaiNo ratings yet

- GCL-REV 1: RD TH RD THDocument2 pagesGCL-REV 1: RD TH RD THhenryNo ratings yet

- AgreementDocument18 pagesAgreementVaishnaviNo ratings yet

- SignatureDocument13 pagesSignatureVee-kay Vicky KatekaniNo ratings yet

- docSanctionLetterForm BL240205040100109Document7 pagesdocSanctionLetterForm BL240205040100109chawllarohitNo ratings yet

- Loan Documentation - 20231215065004Document13 pagesLoan Documentation - 20231215065004souljarsmile7No ratings yet

- Signature-1Document6 pagesSignature-1Phumi PhumiNo ratings yet

- SBA Loan NoteDocument13 pagesSBA Loan NoteMARC ANDREWS WOLFFNo ratings yet

- Key Fact StatementDocument8 pagesKey Fact StatementनीलNo ratings yet

- Loan Agreement - MITCDocument6 pagesLoan Agreement - MITCAarti ThdfcNo ratings yet

- Emergency Loan Application Form (Active Member) Gsis: To Be Filled Out by The ApplicantDocument2 pagesEmergency Loan Application Form (Active Member) Gsis: To Be Filled Out by The ApplicantChristian de LunaNo ratings yet

- keyFactStatement 1Document8 pageskeyFactStatement 1naga srinuNo ratings yet

- Most Important Document: CustomerDocument8 pagesMost Important Document: CustomermasumsojibNo ratings yet

- Emergency Loan Application Form (Active Member) : To Be Filled Out by The ApplicantDocument2 pagesEmergency Loan Application Form (Active Member) : To Be Filled Out by The ApplicantRichelle PascorNo ratings yet

- Personal Loan Key Facts StatementDocument8 pagesPersonal Loan Key Facts StatementINAM JUNG GUJJARNo ratings yet

- Terms and ConditionsDocument14 pagesTerms and ConditionsKarthik SingamNo ratings yet

- IL masterTnC Single Ibs enDocument10 pagesIL masterTnC Single Ibs enyimo0122No ratings yet

- RHB Personal Financing TermsDocument17 pagesRHB Personal Financing TermsDon LotNo ratings yet

- Sunshine ContractDocument13 pagesSunshine Contractnick wilkinsonNo ratings yet

- Consumer Credit Contract ScheduleDocument10 pagesConsumer Credit Contract ScheduleFarhan MohaimenNo ratings yet

- Loan Sanction Letter C33EFFTDocument10 pagesLoan Sanction Letter C33EFFTNAKSH CREATIONNo ratings yet

- LAP Sanction Letter FixedDocument3 pagesLAP Sanction Letter Fixedpydimukkala SunilNo ratings yet

- MKB95C6539ID102112518Document7 pagesMKB95C6539ID102112518Pankaj singhNo ratings yet

- KT 1070169204Document4 pagesKT 1070169204shivu patilNo ratings yet

- EL Application Form Active MembersDocument2 pagesEL Application Form Active MembersCharles De Saint AmantNo ratings yet

- Balance Conv TandCs Final 1Document12 pagesBalance Conv TandCs Final 1Kareena KapoorNo ratings yet

- Sanction 4Document4 pagesSanction 4ParinithNo ratings yet

- Sanctional Letter 3908838977 2020-01-15 PDFDocument1 pageSanctional Letter 3908838977 2020-01-15 PDFSurendra TagleNo ratings yet

- Terms ConditionsDocument3 pagesTerms ConditionsArdenNo ratings yet

- Loan Sanction_LetterDocument2 pagesLoan Sanction_LetterDaMoN0% (1)

- SALPL AgreementDocument30 pagesSALPL AgreementVipul JainNo ratings yet

- Nagoor SANCTION - LETTER - PSI - AVFSDocument16 pagesNagoor SANCTION - LETTER - PSI - AVFSgudavalli0088No ratings yet

- Mka 37365 e 0 Id 88904221Document6 pagesMka 37365 e 0 Id 88904221ramodela6No ratings yet

- Prev 165896547003461209Document19 pagesPrev 165896547003461209sososolalalaiiNo ratings yet

- Sample Copy of Promissory NoteDocument2 pagesSample Copy of Promissory Notesheila coloradaNo ratings yet

- LBP6030Document4 pagesLBP6030ismadiNo ratings yet

- Balbheemloan Sanction LetterDocument6 pagesBalbheemloan Sanction LetterVenkatesh DoodamNo ratings yet

- Loan Sanction-Letter181240016761170869Document3 pagesLoan Sanction-Letter181240016761170869Sanjay MohapatraNo ratings yet

- Annexure - 1: Mode of RepaymentDocument2 pagesAnnexure - 1: Mode of RepaymentJaggu NitheshNo ratings yet

- 20200403-Forms-EML Active Fillable PDFDocument2 pages20200403-Forms-EML Active Fillable PDFBusyMae CabadonNo ratings yet

- 20200403-Forms-EML Active Fillable PDFDocument2 pages20200403-Forms-EML Active Fillable PDFKarena WahimanNo ratings yet

- 20200403-Forms-EML Active FillableDocument2 pages20200403-Forms-EML Active FillableChesca Angel ReyesNo ratings yet

- Emergency Loan Application Form (Active Member) : Last Name Middle NameDocument2 pagesEmergency Loan Application Form (Active Member) : Last Name Middle NameDeese Marie ZabalaNo ratings yet

- Emergency Loan Application Form (Active Member) : Last Name Middle NameDocument2 pagesEmergency Loan Application Form (Active Member) : Last Name Middle NameKarena WahimanNo ratings yet

- Emergency Loan Application Form (Active Member) : Last Name Middle NameDocument2 pagesEmergency Loan Application Form (Active Member) : Last Name Middle NameGian Paula MonghitNo ratings yet

- Loan AgreementMITC - 1705588392880Document24 pagesLoan AgreementMITC - 1705588392880844501abhayNo ratings yet

- Codified - Gsis Computer Loan Application Form 09222020 - v1Document2 pagesCodified - Gsis Computer Loan Application Form 09222020 - v1Cloud StrifeNo ratings yet

- Loan Sanction Letter for Instalment Billing Pay LaterDocument2 pagesLoan Sanction Letter for Instalment Billing Pay LaterSathyan JrNo ratings yet

- Loan TermsDocument4 pagesLoan TermsNorman FloresNo ratings yet

- AgreementDocument11 pagesAgreementManish KumarNo ratings yet

- Term Loan Hong LeongDocument5 pagesTerm Loan Hong LeongYap HSNo ratings yet

- Emergency Loan Application Form (Active Member) : Last Name Middle NameDocument2 pagesEmergency Loan Application Form (Active Member) : Last Name Middle NamePhebe Zhie Zhia CampeñaNo ratings yet

- Terms and ConditionsDocument14 pagesTerms and ConditionsPiyush ckNo ratings yet

- Annexure - 1: Mode of RepaymentDocument2 pagesAnnexure - 1: Mode of RepaymentJyoti SharmaNo ratings yet

- Credit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsFrom EverandCredit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsNo ratings yet

- Capaya 1 DC Masterlist of Children 2023Document8 pagesCapaya 1 DC Masterlist of Children 2023Charina MiclatNo ratings yet

- Camia CDC Weighing 2Document4 pagesCamia CDC Weighing 2Charina MiclatNo ratings yet

- Hids Capaya Weighing 2Document3 pagesHids Capaya Weighing 2Charina MiclatNo ratings yet

- Capaya 1 DC Masterlist of Children 2023Document8 pagesCapaya 1 DC Masterlist of Children 2023Charina MiclatNo ratings yet

- Capaya 1 CDC WeighingDocument4 pagesCapaya 1 CDC WeighingCharina MiclatNo ratings yet

- BSWM Ordinance No Segregation No CollectionDocument10 pagesBSWM Ordinance No Segregation No CollectionCharina Miclat100% (1)

- Soa 0020010207473Document1 pageSoa 0020010207473Mary Joy NobleNo ratings yet

- Soa 0020010059798Document1 pageSoa 0020010059798Charina MiclatNo ratings yet

- Executive Order No 04 s2023Document2 pagesExecutive Order No 04 s2023Charina MiclatNo ratings yet

- Arnoah Prince Dg. MandaniDocument1 pageArnoah Prince Dg. MandaniCharina MiclatNo ratings yet

- Aydy C. BoligorDocument1 pageAydy C. BoligorCharina MiclatNo ratings yet

- SOA SummaryDocument1 pageSOA SummarylayNo ratings yet

- Analiza TiamzonDocument1 pageAnaliza TiamzonCharina MiclatNo ratings yet

- Anthropos Delos SantosDocument1 pageAnthropos Delos SantosCharina MiclatNo ratings yet

- Annalyn HambalaDocument1 pageAnnalyn HambalaCharina MiclatNo ratings yet

- Alejandro TampusDocument1 pageAlejandro TampusCharina MiclatNo ratings yet

- Ana May T. LacsinaDocument1 pageAna May T. LacsinaCharina MiclatNo ratings yet

- Alfonso Niño EslerDocument1 pageAlfonso Niño EslerCharina MiclatNo ratings yet

- Aljon R. Dela CruzDocument1 pageAljon R. Dela CruzCharina MiclatNo ratings yet

- China Mobile SolutionDocument10 pagesChina Mobile Solutionnelsonpapa30% (1)

- ACTG6497 - Midterm Quiz 1 - Attempt ReviewDocument4 pagesACTG6497 - Midterm Quiz 1 - Attempt ReviewKinglaw PilandeNo ratings yet

- M.Mukundhante AbhimukhamDocument7 pagesM.Mukundhante AbhimukhamkanakambariNo ratings yet

- Preparing The Working PaperDocument5 pagesPreparing The Working PaperChriszel Dianne DamasingNo ratings yet

- South Philippines Adventist College: Submitted By: Torres, Arly Kurt Besana, Keyla MaeDocument3 pagesSouth Philippines Adventist College: Submitted By: Torres, Arly Kurt Besana, Keyla MaeArly Kurt TorresNo ratings yet

- Change face value shares documentDocument25 pagesChange face value shares documentParth GargNo ratings yet

- Pay FixationDocument4 pagesPay FixationMayank PrakashNo ratings yet

- Basic MicroeconomicsDocument8 pagesBasic MicroeconomicsJanzen Mark GuetaNo ratings yet

- Position and Competency Profile: Job SummaryDocument20 pagesPosition and Competency Profile: Job Summaryjohnrey_lidresNo ratings yet

- Jean-Louis Tourne PresentationDocument20 pagesJean-Louis Tourne PresentationeatnutesNo ratings yet

- CASE DIGEST Filipinas Colleges Inc Vs TimbangDocument2 pagesCASE DIGEST Filipinas Colleges Inc Vs TimbangErica Dela Cruz50% (2)

- Product InnovationDocument22 pagesProduct InnovationLarry AdenyaNo ratings yet

- Headphone PDFDocument1 pageHeadphone PDFRohan BadeNo ratings yet

- Bir Form 2305Document1 pageBir Form 2305MacneoNo ratings yet

- A Project Report On Insurance As An Investment Tool With Regards To ULIP at ICICI LTDDocument96 pagesA Project Report On Insurance As An Investment Tool With Regards To ULIP at ICICI LTDBabasab Patil (Karrisatte)50% (2)

- Outerwest Recycling Plant 365 04 K W Solar Cell Crowdsale 46de3e4b34Document41 pagesOuterwest Recycling Plant 365 04 K W Solar Cell Crowdsale 46de3e4b34Koya MatsunoNo ratings yet

- Contract of Lease Know All Men by These PresentsDocument3 pagesContract of Lease Know All Men by These PresentsToby RogersNo ratings yet

- Treasury BillsDocument35 pagesTreasury BillsChristine HowellNo ratings yet

- Chapter 3Document93 pagesChapter 3Shifali ShettyNo ratings yet

- Entrepreneurship and Regional Competitiveness: The Role and Progression of PolicyDocument26 pagesEntrepreneurship and Regional Competitiveness: The Role and Progression of PolicyAnonymous q8vCvYNo ratings yet

- BiiserDocument7 pagesBiiserFiras FurkanNo ratings yet

- Application Form For Financial Assistance Under Prime Ministers Employment Generation Programme (Pmegp)Document27 pagesApplication Form For Financial Assistance Under Prime Ministers Employment Generation Programme (Pmegp)Jaldeep KarasaliyaNo ratings yet

- 14 A Study On Women Empowerment Through Self Help Groups in IndiaDocument6 pages14 A Study On Women Empowerment Through Self Help Groups in IndiaPARAMASIVAN CHELLIAH100% (1)

- IJIRSTV2I11198-Analysis of WCM in Steel Industry PDFDocument8 pagesIJIRSTV2I11198-Analysis of WCM in Steel Industry PDFShikha MishraNo ratings yet

- Provisions Of Companies Act 1956Document15 pagesProvisions Of Companies Act 19569986212378No ratings yet

- KeltnerEA Installation Guide V7Document10 pagesKeltnerEA Installation Guide V7Muhammad RizqiNo ratings yet

- MMPC 4 em 2023 24Document22 pagesMMPC 4 em 2023 24Rajni KumariNo ratings yet