Professional Documents

Culture Documents

The Difference Between Amortization and Depreciation

The Difference Between Amortization and Depreciation

Uploaded by

6042101014Copyright:

Available Formats

You might also like

- Depreciation and AmortizationDocument12 pagesDepreciation and Amortizationabdullahkhattak0076No ratings yet

- AMORTIZATION Vs DEPRICIATIONDocument2 pagesAMORTIZATION Vs DEPRICIATIONhumaidjafriNo ratings yet

- Table of ContentsDocument57 pagesTable of ContentsAbhishek AbhiNo ratings yet

- Depreciation - WikipediaDocument10 pagesDepreciation - Wikipediapuput075No ratings yet

- Accounitng Lec 2Document3 pagesAccounitng Lec 2Fahomeda Rahman SumoniNo ratings yet

- Accounting Concept: Fair Value Matching PrincipleDocument13 pagesAccounting Concept: Fair Value Matching PrincipleJohn ArthurNo ratings yet

- Financial Ratio TutorialDocument41 pagesFinancial Ratio Tutorialabhi2244inNo ratings yet

- Investopedia - Financial Ratio TutorialDocument55 pagesInvestopedia - Financial Ratio TutorialKoh See Hui RoxanneNo ratings yet

- Long Lived Assets L1Document37 pagesLong Lived Assets L1heisenbergNo ratings yet

- FAQs For F&a InterviewsDocument13 pagesFAQs For F&a InterviewsVamsi Chowdary KolliNo ratings yet

- Wa0001.Document3 pagesWa0001.mayoogha1407No ratings yet

- Financial RatioDocument56 pagesFinancial RatioSaran JlNo ratings yet

- How To Analyse Stock Using Simple RatioDocument31 pagesHow To Analyse Stock Using Simple RatioKrishnamoorthy SubramaniamNo ratings yet

- Accountancy 7Document65 pagesAccountancy 7Arif ShaikhNo ratings yet

- DEPRECIATIONDocument6 pagesDEPRECIATIONShivaniNo ratings yet

- Financial RatioDocument69 pagesFinancial RatioSwaroop VarmaNo ratings yet

- Cash and Receivables: Chapter ReviewDocument6 pagesCash and Receivables: Chapter ReviewOmar HosnyNo ratings yet

- Unit - 5 DepreciationDocument19 pagesUnit - 5 DepreciationGeethaNo ratings yet

- 4 - Preparation of Final AccountsDocument6 pages4 - Preparation of Final Accountskeval.dave120812No ratings yet

- Partnership Accounts FormatDocument7 pagesPartnership Accounts FormatJamsheed Rasheed100% (1)

- Accounts Rev NotesDocument13 pagesAccounts Rev NotesAsha SuryavanshiNo ratings yet

- Assets Fair ValueDocument10 pagesAssets Fair ValueArulmani MurugesanNo ratings yet

- Chương 5: So Sánh Tiêu ChíDocument4 pagesChương 5: So Sánh Tiêu ChíNguyễn Thị Minh ThưNo ratings yet

- The Costs and Benefits of Selling On CreditDocument10 pagesThe Costs and Benefits of Selling On CreditFritzRobenickTabernillaNo ratings yet

- Acc Imp Points 2Document10 pagesAcc Imp Points 2AnilisaNo ratings yet

- Acct6293 Intermediate Accounting Odd 2021/2022Document4 pagesAcct6293 Intermediate Accounting Odd 2021/2022Ken SyahNo ratings yet

- Conservation Principle and Balance SheetDocument6 pagesConservation Principle and Balance SheetKumar RajeshNo ratings yet

- Critique Paper On Impairment of AssetsDocument8 pagesCritique Paper On Impairment of AssetsJoshtanco17No ratings yet

- Accounting 0452 Revision Notes For The y PDFDocument48 pagesAccounting 0452 Revision Notes For The y PDFSiddarthNo ratings yet

- Principles Based Versus Rules BasedDocument2 pagesPrinciples Based Versus Rules BasedsreelekhaNo ratings yet

- Accounting 0452 Revision NotesDocument48 pagesAccounting 0452 Revision NotesMasood Ahmad AadamNo ratings yet

- Accounting Concepts and ConventionsDocument4 pagesAccounting Concepts and ConventionssrinugudaNo ratings yet

- Principles and CharacteristicsDocument12 pagesPrinciples and CharacteristicsFloyd DaltonNo ratings yet

- Accounting A1 Assignment No. 1 11 Nov'10 Thursday: Q1 (A) What Are Capital Expenditures? Give ExamplesDocument4 pagesAccounting A1 Assignment No. 1 11 Nov'10 Thursday: Q1 (A) What Are Capital Expenditures? Give ExamplesIqra'a NadeemNo ratings yet

- Debit and Credit RulesDocument4 pagesDebit and Credit RulesDanica VetuzNo ratings yet

- Stice 18e Ch11 SOL FinalDocument56 pagesStice 18e Ch11 SOL FinalprasetyagrahaNo ratings yet

- ch11 The Balance SheetDocument26 pagesch11 The Balance SheetKurnia Dwi Rachman0% (1)

- L6 DepreciationDocument35 pagesL6 DepreciationVall Halla100% (1)

- Note On End of The YearDocument5 pagesNote On End of The YearojimawilliamsNo ratings yet

- Accounting 0452 Revision Notes For The yDocument48 pagesAccounting 0452 Revision Notes For The ytawanaishe shoniwaNo ratings yet

- Case 8-10Document2 pagesCase 8-10Ā'i Sha0% (1)

- Ch.6 - AR and NRDocument4 pagesCh.6 - AR and NRHamza MahmoudNo ratings yet

- Assignment Liquidity Vs ProfitabilityDocument14 pagesAssignment Liquidity Vs Profitabilityrihan198780% (5)

- The Little Book of Valuation: Cash FlowsDocument5 pagesThe Little Book of Valuation: Cash FlowsSangram PandaNo ratings yet

- 11 Accountancy - Depreciation, Provisions and Reserves - Notes & Video LinkDocument5 pages11 Accountancy - Depreciation, Provisions and Reserves - Notes & Video LinkAmit GuptaNo ratings yet

- Intangible AssetsDocument10 pagesIntangible Assetssamuel debebeNo ratings yet

- 11 Investments in Noncurrent Operating Assets-Utilization and RetirementDocument27 pages11 Investments in Noncurrent Operating Assets-Utilization and RetirementStarilazation KDNo ratings yet

- Financial Management 2Document75 pagesFinancial Management 2Ali ShehbazNo ratings yet

- Debt Ratios: Interest Coverage RatioDocument26 pagesDebt Ratios: Interest Coverage RatioShivashankar KarakalleNo ratings yet

- Full Download Corporate Finance Foundations Global Edition 15th Edition Block Solutions ManualDocument36 pagesFull Download Corporate Finance Foundations Global Edition 15th Edition Block Solutions Manualslodgeghidinc100% (37)

- Sample of Asset-Office Land, Equiptment, Cash, MachinesDocument29 pagesSample of Asset-Office Land, Equiptment, Cash, MachinesMaria Cludet NayveNo ratings yet

- Depreciation: Depreciation Is A Term Used inDocument10 pagesDepreciation: Depreciation Is A Term Used inalbertNo ratings yet

- Publisher Version (Open Access)Document27 pagesPublisher Version (Open Access)Antinolla LonaNo ratings yet

- Lecture-3 DepreciationDocument19 pagesLecture-3 DepreciationMuhammad Aleem nawazNo ratings yet

- ABMF 3174 AssignmentDocument39 pagesABMF 3174 AssignmentRayNo ratings yet

- Depreciation Expense Schedules Explained in Accounting ExamplesDocument8 pagesDepreciation Expense Schedules Explained in Accounting Examplesspb2000No ratings yet

- Expressed As A Percentage of The Value of Revenue or Sales.: Balance Sheet: Reports What The Organization Owns and OwesDocument3 pagesExpressed As A Percentage of The Value of Revenue or Sales.: Balance Sheet: Reports What The Organization Owns and OwesDGNo ratings yet

- Analysis For Cash FlowDocument31 pagesAnalysis For Cash FlowRaja Tejas YerramalliNo ratings yet

The Difference Between Amortization and Depreciation

The Difference Between Amortization and Depreciation

Uploaded by

6042101014Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Difference Between Amortization and Depreciation

The Difference Between Amortization and Depreciation

Uploaded by

6042101014Copyright:

Available Formats

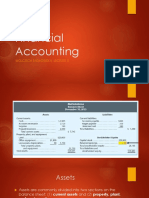

The difference between amortization and

depreciation

April 12, 2021

The key difference between amortization and depreciation is that amortization charges off

the cost of an intangible asset , while depreciation does so for a tangible asset .

Another difference between the two concepts is that amortization is almost always

conducted on a straight-line basis , so that the same amount of amortization is charged to

expense in every reporting period . Conversely, it is more common for depreciation expense

to be recognized on an accelerated basis , so that more depreciation is recognized during

earlier reporting periods than later reporting periods.

Yet another difference between amortization and depreciation is that the calculation of

amortization does not usually incorporate any salvage value , since an intangible asset is not

typically considered to have any resale value once its useful life has expired. Conversely, a

tangible asset may have some salvage value, so this amount is more likely to be included in

a depreciation calculation.

The two concepts also share several similar traits. For example:

Non-cash. Both depreciation and amortization are non-cash expenses - that is, the

company does not suffer a cash reduction when these expenses are recorded.

Reporting. Both depreciation and amortization are treated as reductions from fixed

assets in the balance sheet , and may even be aggregated together for reporting purposes.

Impairment. Both tangible and intangible assets are subject to impairment , which means

that their carrying amounts can be written down . If so, the remaining depreciation or

amortization charges will decline, since there is a smaller remaining balance to offset.

https://www.accountingtools.com/articles/what-is-the-difference-between-amortization-and-

depreciation.html

You might also like

- Depreciation and AmortizationDocument12 pagesDepreciation and Amortizationabdullahkhattak0076No ratings yet

- AMORTIZATION Vs DEPRICIATIONDocument2 pagesAMORTIZATION Vs DEPRICIATIONhumaidjafriNo ratings yet

- Table of ContentsDocument57 pagesTable of ContentsAbhishek AbhiNo ratings yet

- Depreciation - WikipediaDocument10 pagesDepreciation - Wikipediapuput075No ratings yet

- Accounitng Lec 2Document3 pagesAccounitng Lec 2Fahomeda Rahman SumoniNo ratings yet

- Accounting Concept: Fair Value Matching PrincipleDocument13 pagesAccounting Concept: Fair Value Matching PrincipleJohn ArthurNo ratings yet

- Financial Ratio TutorialDocument41 pagesFinancial Ratio Tutorialabhi2244inNo ratings yet

- Investopedia - Financial Ratio TutorialDocument55 pagesInvestopedia - Financial Ratio TutorialKoh See Hui RoxanneNo ratings yet

- Long Lived Assets L1Document37 pagesLong Lived Assets L1heisenbergNo ratings yet

- FAQs For F&a InterviewsDocument13 pagesFAQs For F&a InterviewsVamsi Chowdary KolliNo ratings yet

- Wa0001.Document3 pagesWa0001.mayoogha1407No ratings yet

- Financial RatioDocument56 pagesFinancial RatioSaran JlNo ratings yet

- How To Analyse Stock Using Simple RatioDocument31 pagesHow To Analyse Stock Using Simple RatioKrishnamoorthy SubramaniamNo ratings yet

- Accountancy 7Document65 pagesAccountancy 7Arif ShaikhNo ratings yet

- DEPRECIATIONDocument6 pagesDEPRECIATIONShivaniNo ratings yet

- Financial RatioDocument69 pagesFinancial RatioSwaroop VarmaNo ratings yet

- Cash and Receivables: Chapter ReviewDocument6 pagesCash and Receivables: Chapter ReviewOmar HosnyNo ratings yet

- Unit - 5 DepreciationDocument19 pagesUnit - 5 DepreciationGeethaNo ratings yet

- 4 - Preparation of Final AccountsDocument6 pages4 - Preparation of Final Accountskeval.dave120812No ratings yet

- Partnership Accounts FormatDocument7 pagesPartnership Accounts FormatJamsheed Rasheed100% (1)

- Accounts Rev NotesDocument13 pagesAccounts Rev NotesAsha SuryavanshiNo ratings yet

- Assets Fair ValueDocument10 pagesAssets Fair ValueArulmani MurugesanNo ratings yet

- Chương 5: So Sánh Tiêu ChíDocument4 pagesChương 5: So Sánh Tiêu ChíNguyễn Thị Minh ThưNo ratings yet

- The Costs and Benefits of Selling On CreditDocument10 pagesThe Costs and Benefits of Selling On CreditFritzRobenickTabernillaNo ratings yet

- Acc Imp Points 2Document10 pagesAcc Imp Points 2AnilisaNo ratings yet

- Acct6293 Intermediate Accounting Odd 2021/2022Document4 pagesAcct6293 Intermediate Accounting Odd 2021/2022Ken SyahNo ratings yet

- Conservation Principle and Balance SheetDocument6 pagesConservation Principle and Balance SheetKumar RajeshNo ratings yet

- Critique Paper On Impairment of AssetsDocument8 pagesCritique Paper On Impairment of AssetsJoshtanco17No ratings yet

- Accounting 0452 Revision Notes For The y PDFDocument48 pagesAccounting 0452 Revision Notes For The y PDFSiddarthNo ratings yet

- Principles Based Versus Rules BasedDocument2 pagesPrinciples Based Versus Rules BasedsreelekhaNo ratings yet

- Accounting 0452 Revision NotesDocument48 pagesAccounting 0452 Revision NotesMasood Ahmad AadamNo ratings yet

- Accounting Concepts and ConventionsDocument4 pagesAccounting Concepts and ConventionssrinugudaNo ratings yet

- Principles and CharacteristicsDocument12 pagesPrinciples and CharacteristicsFloyd DaltonNo ratings yet

- Accounting A1 Assignment No. 1 11 Nov'10 Thursday: Q1 (A) What Are Capital Expenditures? Give ExamplesDocument4 pagesAccounting A1 Assignment No. 1 11 Nov'10 Thursday: Q1 (A) What Are Capital Expenditures? Give ExamplesIqra'a NadeemNo ratings yet

- Debit and Credit RulesDocument4 pagesDebit and Credit RulesDanica VetuzNo ratings yet

- Stice 18e Ch11 SOL FinalDocument56 pagesStice 18e Ch11 SOL FinalprasetyagrahaNo ratings yet

- ch11 The Balance SheetDocument26 pagesch11 The Balance SheetKurnia Dwi Rachman0% (1)

- L6 DepreciationDocument35 pagesL6 DepreciationVall Halla100% (1)

- Note On End of The YearDocument5 pagesNote On End of The YearojimawilliamsNo ratings yet

- Accounting 0452 Revision Notes For The yDocument48 pagesAccounting 0452 Revision Notes For The ytawanaishe shoniwaNo ratings yet

- Case 8-10Document2 pagesCase 8-10Ā'i Sha0% (1)

- Ch.6 - AR and NRDocument4 pagesCh.6 - AR and NRHamza MahmoudNo ratings yet

- Assignment Liquidity Vs ProfitabilityDocument14 pagesAssignment Liquidity Vs Profitabilityrihan198780% (5)

- The Little Book of Valuation: Cash FlowsDocument5 pagesThe Little Book of Valuation: Cash FlowsSangram PandaNo ratings yet

- 11 Accountancy - Depreciation, Provisions and Reserves - Notes & Video LinkDocument5 pages11 Accountancy - Depreciation, Provisions and Reserves - Notes & Video LinkAmit GuptaNo ratings yet

- Intangible AssetsDocument10 pagesIntangible Assetssamuel debebeNo ratings yet

- 11 Investments in Noncurrent Operating Assets-Utilization and RetirementDocument27 pages11 Investments in Noncurrent Operating Assets-Utilization and RetirementStarilazation KDNo ratings yet

- Financial Management 2Document75 pagesFinancial Management 2Ali ShehbazNo ratings yet

- Debt Ratios: Interest Coverage RatioDocument26 pagesDebt Ratios: Interest Coverage RatioShivashankar KarakalleNo ratings yet

- Full Download Corporate Finance Foundations Global Edition 15th Edition Block Solutions ManualDocument36 pagesFull Download Corporate Finance Foundations Global Edition 15th Edition Block Solutions Manualslodgeghidinc100% (37)

- Sample of Asset-Office Land, Equiptment, Cash, MachinesDocument29 pagesSample of Asset-Office Land, Equiptment, Cash, MachinesMaria Cludet NayveNo ratings yet

- Depreciation: Depreciation Is A Term Used inDocument10 pagesDepreciation: Depreciation Is A Term Used inalbertNo ratings yet

- Publisher Version (Open Access)Document27 pagesPublisher Version (Open Access)Antinolla LonaNo ratings yet

- Lecture-3 DepreciationDocument19 pagesLecture-3 DepreciationMuhammad Aleem nawazNo ratings yet

- ABMF 3174 AssignmentDocument39 pagesABMF 3174 AssignmentRayNo ratings yet

- Depreciation Expense Schedules Explained in Accounting ExamplesDocument8 pagesDepreciation Expense Schedules Explained in Accounting Examplesspb2000No ratings yet

- Expressed As A Percentage of The Value of Revenue or Sales.: Balance Sheet: Reports What The Organization Owns and OwesDocument3 pagesExpressed As A Percentage of The Value of Revenue or Sales.: Balance Sheet: Reports What The Organization Owns and OwesDGNo ratings yet

- Analysis For Cash FlowDocument31 pagesAnalysis For Cash FlowRaja Tejas YerramalliNo ratings yet