Professional Documents

Culture Documents

Guidelines-Issue of Electricity Tax Exemption

Uploaded by

Sanjay Kumar Ranjan0 ratings0% found this document useful (0 votes)

2 views2 pagesED

Original Title

GUIDELINES-ISSUE OF ELECTRICITY TAX EXEMPTION

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentED

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views2 pagesGuidelines-Issue of Electricity Tax Exemption

Uploaded by

Sanjay Kumar RanjanED

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

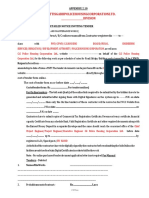

GUIDELINES FOR ISSUE OF ELECTRICITY TAX / DUTY

EXEMPTION CERIFICATE UNDER 2009-14 INDUSTRIAL POLICY.

15.0 EXEMPTION FROM PAYMENT OF ELECTRICITY TAX / DUTY UNDER

2009-14 INDUSTRIAL POLICY.

100% Exemption of electricity tax / duty shall be available to new

micro and small manufacturing enterprises only for the initial period

of 5 years, 4 years and 3 years in Zone-1, Zone-2 and Zone-3

respectively from the date of commencement of commercial

production. This exemption is not applicable for existing enterprises

going in for expansion, diversification and modernization program.

The Energy Department has also issued the Government Order No.

EN/50/EBS/2009 Bangalore dtd: 28.6.2009.

15.1 Documents to be furnished for claiming the Electricity Duty Exemption

Certificate..

a) Application on letterhead / plain paper

b) E M Part – I

c) First Sale Invoice

d) Land documents

e) ESCOMs power sanction letter and service letter with

R.R. No. and date.

f) Copies of the 1st and latest electricity bill with receipt.

15.2 Scrutiny of claim

After verifying the application of the enterprise and satisfying

genuiness of the facts, electricity tax / duty exemption certificate in

the prescribed format as in Annexure-44 shall be issued to the

eligible industrial enterprises by the Joint Director, District

Industries Centre. This exemption certificate shall be forwarded to the

enterprise with an advice to approach the concerned ESCOM for

obtaining exemption from payment of electricity tax/duty.

ANNEXURE - 44

FORMAT FOR ISSUE OF CERTIFICATE FOR CLAIMING ELECTRICITY TAX /

DUTIES EXEMPTION (Under 2009-14 Policy).

No...................................... Office of the

................

....................................

Date:

CERTIFICATE

Sub: Exemption of Electricity Tax / Duty to M/s. ------ ----

--------

Ref: 1.G.O.No. CI 223 SI 2008 dd: 28.2.2009.

2.Energy Department Order No. EN/50/EBS/2009

Bangalore dtd: 29.6.2009.

*******

This is to certify that M/s................................................is a

new micro / small manufacturing enterprises registered vide

No.....................dated for manufacture of .................................with the

Department of Industries and Commerce.

The Enterprise is located at Zone 1 / 2 / 3 as specified in the

Government Order cited at ref (1) above.

The enterprise has started commercial production on

..................as evidenced from the First Invoice / Bill

No......dated:............ issued by the enterprise.

The enterprise is entitled to avail the exemption from payment of

electricity tax / duty from the date of commencement of commercial

production i.e....................for a period of...........year as per the

G.O.Order cited at ref (1) and (2) above.

Joint Director (ID)

District Industries

Centre,

......................Districts.

You might also like

- Coping With Institutional Order Flow Zicklin School of Business Financial Markets SeriesDocument208 pagesCoping With Institutional Order Flow Zicklin School of Business Financial Markets SeriesRavi Varakala100% (5)

- City of Boerne Building RequirementsDocument20 pagesCity of Boerne Building Requirementsurfriend77No ratings yet

- New Connection Application FormDocument3 pagesNew Connection Application FormVivek PaliwalNo ratings yet

- Tender DocumentDocument282 pagesTender DocumentChrisNo ratings yet

- Revised Advisory For Undertaking by RE Developers For Waiver - 05!10!2019Document4 pagesRevised Advisory For Undertaking by RE Developers For Waiver - 05!10!2019Purnendu ChaubeyNo ratings yet

- Duty Exempt Circular PDFDocument5 pagesDuty Exempt Circular PDFroshan21No ratings yet

- Excise Duty Exemption For SolarDocument5 pagesExcise Duty Exemption For SolarMA AhmedNo ratings yet

- Bid DocumentDocument74 pagesBid DocumentShaswat DubeyNo ratings yet

- India Ed OdishaDocument14 pagesIndia Ed OdishaSitaram HansdaNo ratings yet

- Revenue Guidance Understanding Your BillDocument89 pagesRevenue Guidance Understanding Your BillBenny BerniceNo ratings yet

- Electrical CertificateDocument3 pagesElectrical Certificatethobani butheleziNo ratings yet

- Form G-ENDocument3 pagesForm G-ENCurren leeNo ratings yet

- Application For Obtaining Electricity Duty Exemption CertificateDocument3 pagesApplication For Obtaining Electricity Duty Exemption CertificatearvindNo ratings yet

- Solar Net Meetering AppliDocument16 pagesSolar Net Meetering AppliArun P AjithNo ratings yet

- EA Balmer Lawrie KolkataDocument6 pagesEA Balmer Lawrie KolkataNataraj Singh SardarNo ratings yet

- 175-07-2022-GST Manner of Filing Refund of Unutilized ITC On Account of Export of Electricity.Document4 pages175-07-2022-GST Manner of Filing Refund of Unutilized ITC On Account of Export of Electricity.Hr legaladviserNo ratings yet

- Nit FormDocument40 pagesNit FormLokesh ChandrakarNo ratings yet

- Jammu & Kashmir State Electricity Regulatory Commission: Tariff OrderDocument108 pagesJammu & Kashmir State Electricity Regulatory Commission: Tariff OrderBilal AhmadNo ratings yet

- Bid DocumentDocument118 pagesBid DocumentDipesh YadavNo ratings yet

- Civil Work AgreementDocument38 pagesCivil Work AgreementTeddyNo ratings yet

- Tendernotice 1Document116 pagesTendernotice 1Dileep ChintalapatiNo ratings yet

- Application For Electrical Contractor License Category BDocument3 pagesApplication For Electrical Contractor License Category BFaisalNo ratings yet

- Form A-1 - Industrial ConnectionsDocument5 pagesForm A-1 - Industrial Connectionskapil kurhadeNo ratings yet

- M.P. Madhya Kshetra Vidyut Vitaran Co. Ltd. Bhopal: Tender Specification No. Md/Mk/04/786Document75 pagesM.P. Madhya Kshetra Vidyut Vitaran Co. Ltd. Bhopal: Tender Specification No. Md/Mk/04/786Ganga Sharan KataraNo ratings yet

- ALMM LatestDocument3 pagesALMM LatestGaurav PanchalNo ratings yet

- 70MW AC Retender Solar RFP Volume II Final WEBDocument27 pages70MW AC Retender Solar RFP Volume II Final WEBDon Chamini NanayakkaraNo ratings yet

- Meralco vs. CIR (December 6 2010)Document60 pagesMeralco vs. CIR (December 6 2010)Jasreel DomasingNo ratings yet

- 531 Tax Application Cost of Living Rebate Embedded 2023Document1 page531 Tax Application Cost of Living Rebate Embedded 2023micknaylor38No ratings yet

- Chandigarh Suryacon Conf ExemptionsDocument16 pagesChandigarh Suryacon Conf ExemptionsABCDNo ratings yet

- CE Commericial - Instruction Issued On Effecting of Electricity Service Connections in TN - CC by Local AuthorityDocument4 pagesCE Commericial - Instruction Issued On Effecting of Electricity Service Connections in TN - CC by Local AuthorityibookmarkxNo ratings yet

- Comm Cir 136Document2 pagesComm Cir 136chief engineer CommercialNo ratings yet

- Application For An Electrical Contractor's Licence: Instructions For Completing This Form Section 1Document5 pagesApplication For An Electrical Contractor's Licence: Instructions For Completing This Form Section 1Kevin HartleyNo ratings yet

- Loans & Advances of 2011-12Document8 pagesLoans & Advances of 2011-12Raja PrasadNo ratings yet

- Small Scale Exemption SchemeDocument8 pagesSmall Scale Exemption SchemebakulhariaNo ratings yet

- OSIMO - 2711 - Consent and Application For Direct PVVNL Connection PDFDocument5 pagesOSIMO - 2711 - Consent and Application For Direct PVVNL Connection PDFJayantJhambNo ratings yet

- BESCOMMeter Transfer ProcessDocument6 pagesBESCOMMeter Transfer ProcessAstro BalluNo ratings yet

- ACD-BME-BEE-03 Rev 01 App Form Issuance of Certificate of ComplianceDocument4 pagesACD-BME-BEE-03 Rev 01 App Form Issuance of Certificate of ComplianceRyle PanesNo ratings yet

- Electrical Contractor Licence Grant Application FormDocument17 pagesElectrical Contractor Licence Grant Application FormRahul singh100% (2)

- Annexure 758485965321Document2 pagesAnnexure 758485965321All JunkNo ratings yet

- Coc GuidelinesDocument4 pagesCoc GuidelinesKagiso MokalakeNo ratings yet

- Appendix - Application Form For Allotment of Importer-Exporter Code (Iec) Number and Modification in Particulars of An Existing Iec No. HolderDocument6 pagesAppendix - Application Form For Allotment of Importer-Exporter Code (Iec) Number and Modification in Particulars of An Existing Iec No. Holderaswin_bantuNo ratings yet

- MNREs Clarification On Approved Modeles and Manufacturers SPV ModulesDocument10 pagesMNREs Clarification On Approved Modeles and Manufacturers SPV ModulesMANASVI SHARMANo ratings yet

- Industry Guides: United States Securities and Exchange Commission Washington, D.C. 20549Document36 pagesIndustry Guides: United States Securities and Exchange Commission Washington, D.C. 20549cmollinedoaNo ratings yet

- 611 Pump & Fire HydrentDocument53 pages611 Pump & Fire HydrentBinay K SrivastawaNo ratings yet

- 22-7-20 DISPUTE-2COPY For SCAN - FDocument11 pages22-7-20 DISPUTE-2COPY For SCAN - FArshad MahmoodNo ratings yet

- IOCLtd PODocument6 pagesIOCLtd POSE ElectricalNo ratings yet

- VAOATDocument1 pageVAOATAshoka LonkaNo ratings yet

- 4.wheeling Agreement Third Party SaleDocument11 pages4.wheeling Agreement Third Party SaleNITIN MISHRANo ratings yet

- Application For Electrical Contractor License Category CDocument2 pagesApplication For Electrical Contractor License Category CFaisalNo ratings yet

- J 2019 SCC OnLine NCLT 9640 Veervikrams78 Gmailcom 20220219 193017 1 7Document7 pagesJ 2019 SCC OnLine NCLT 9640 Veervikrams78 Gmailcom 20220219 193017 1 7veer vikramNo ratings yet

- 12.ORDIN NR 12 2015 Regulament Licente EE EngDocument16 pages12.ORDIN NR 12 2015 Regulament Licente EE EngDani Good VibeNo ratings yet

- Request For Quotation: Collective RFQ Number/ Purchase GroupDocument27 pagesRequest For Quotation: Collective RFQ Number/ Purchase GroupQCTS FaridabadNo ratings yet

- Annexure II & III ThermometerDocument4 pagesAnnexure II & III ThermometerChakka ChakkaNo ratings yet

- Detailed NIT (1) PingleshwarDocument22 pagesDetailed NIT (1) PingleshwarVishal MishraNo ratings yet

- GBIDocument6 pagesGBIAnanth VybhavNo ratings yet

- Section I - Instruction To Bidders - Skills CenterDocument19 pagesSection I - Instruction To Bidders - Skills CenterEdo-Abasi EkereNo ratings yet

- Net Metering SopDocument34 pagesNet Metering Sopساحر حسینNo ratings yet

- Bharat Sanchar Nigam Limited: Technical BidDocument20 pagesBharat Sanchar Nigam Limited: Technical Bidmswalia_sikNo ratings yet

- Work Order-T-02-CDocument24 pagesWork Order-T-02-CSUDEEP PAULNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Act on Special Measures for the Deregulation of Corporate ActivitiesFrom EverandAct on Special Measures for the Deregulation of Corporate ActivitiesNo ratings yet

- Sales Flow Chart 2019Document2 pagesSales Flow Chart 2019grace hutallaNo ratings yet

- Hospital Equipments PrecurmentDocument10 pagesHospital Equipments PrecurmentRashid UmerNo ratings yet

- Case Study 1Document6 pagesCase Study 1Narendra VaidyaNo ratings yet

- Sample of Memorandum of Agreement (MOA)Document12 pagesSample of Memorandum of Agreement (MOA)Johanna BelestaNo ratings yet

- SCADocument14 pagesSCANITIN rajputNo ratings yet

- No Shortchanging ActDocument11 pagesNo Shortchanging ActDesiree Ann GamboaNo ratings yet

- Online Shopping PDFDocument4 pagesOnline Shopping PDFkeerthanasubramaniNo ratings yet

- Problem Set 1 SolutionsDocument16 pagesProblem Set 1 SolutionsAhmed SamadNo ratings yet

- Bony IauDocument572 pagesBony IauTommy HectorNo ratings yet

- PriceListHirePurchase Normal6thNov2019Document56 pagesPriceListHirePurchase Normal6thNov2019Jamil AhmedNo ratings yet

- Investor PDFDocument3 pagesInvestor PDFHAFEZ ALINo ratings yet

- Uber Final PPT - Targeting and Positioning MissingDocument14 pagesUber Final PPT - Targeting and Positioning MissingAquarius Anum0% (1)

- Intermediate Accounting 14th Edition Kieso Test BankDocument25 pagesIntermediate Accounting 14th Edition Kieso Test BankReginaGallagherjkrb100% (58)

- Ifrs 5Document2 pagesIfrs 5Foititika.netNo ratings yet

- AspenTech's Solutions For Engineering Design and ConstructionDocument13 pagesAspenTech's Solutions For Engineering Design and Constructionluthfi.kNo ratings yet

- Real Options and Other Topics in Capital BudgetingDocument24 pagesReal Options and Other Topics in Capital BudgetingAJ100% (1)

- SAP InvoiceDocument86 pagesSAP InvoicefatherNo ratings yet

- Customer SQ - Satisfaction - LoyaltyDocument15 pagesCustomer SQ - Satisfaction - LoyaltyjessiephamNo ratings yet

- Resolution No 003 2020 LoanDocument4 pagesResolution No 003 2020 LoanDexter Bernardo Calanoga TignoNo ratings yet

- ACCT1501 MC Bank QuestionsDocument33 pagesACCT1501 MC Bank QuestionsHad0% (2)

- Cab - BLR Airport To Schneider PDFDocument3 pagesCab - BLR Airport To Schneider PDFVinil KumarNo ratings yet

- DBM BudgetDocument85 pagesDBM BudgetGab Pogi100% (1)

- Coin Sort ReportDocument40 pagesCoin Sort ReportvishnuNo ratings yet

- Leonardo Roth, FLDocument2 pagesLeonardo Roth, FLleonardorotharothNo ratings yet

- 1.introduction To Operations Management PDFDocument7 pages1.introduction To Operations Management PDFEmmanuel Okena67% (3)

- Payback PeriodDocument32 pagesPayback Periodarif SazaliNo ratings yet

- VT - DUNS - Human Services 03.06.17 PDFDocument5 pagesVT - DUNS - Human Services 03.06.17 PDFann vom EigenNo ratings yet

- 1st Quarterly Exam Questions - TLE 9Document28 pages1st Quarterly Exam Questions - TLE 9Ronald Maxilom AtibagosNo ratings yet

- Credit Card ConfigurationDocument5 pagesCredit Card ConfigurationdaeyongNo ratings yet