Professional Documents

Culture Documents

W2 Export

Uploaded by

enderjosOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

W2 Export

Uploaded by

enderjosCopyright:

Available Formats

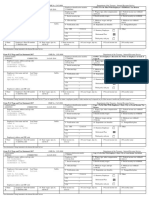

Copy B To Be Filed With Employee's OMB No. Copy 2 To Be Filed With Employee's State, OMB No.

FEDERAL Tax Return 2018 1545-0008

City, or Local Income Tax Return

2018 1545-0008

a Employee's soc sec no 1 Wages, tips, other comp. 2 Federal income tax withheld a Employee's soc sec no 1 Wages, tips, other comp. 2 Federal income tax withheld

15482.58 372.24 15482.58 372.24

xxx-xx-1476 xxx-xx-1476

3 Social security wages 4 Social security tax withheld 3 Social security wages 4 Social security tax withheld

b Employer ID number 15692.58 972.92 b Employer ID number 15692.58 972.92

5 Medicare wages and tips 6 Medicare tax withheld 5 Medicare wages and tips 6 Medicare tax withheld

93-6000508 93-6000508

15692.58 227.57 15692.58 227.57

c Employer's name, address, and zip code c Employer's name, address, and zip code

JACKSON COUNTY SCHOOL DISTRICT #6 JACKSON COUNTY SCHOOL DISTRICT #6

300 ASH STREET 300 ASH STREET

CENTRAL POINT OR 97502 CENTRAL POINT OR 97502

d Control number d Control number

HI11476 HI11476

e Employee's first name and initial Last name e Employee's first name and initial Last name

TONIA J HILL TONIA J HILL

570 BACHAND CIRCLE 570 BACHAND CIRCLE

CENTRAL POINT OR 97502 CENTRAL POINT OR 97502

f Employee's address and zip code f Employee's address and zip code

7 Social security tips 8 Allocated tips 9 Advance EIC payment 7 Social security tips 8 Allocated tips 9 Advance EIC payment

10 Dependent care benefits 11 Nonqualified plans 12a Code See inst. for box 12 10 Dependent care benefits 11 Nonqualified plans 12a Code See inst. for box 12

0.00 E 210.00 0.00 E 210.00

13 Statutory employee 14 Other 12b Code 13 Statutory employee 14 Other 12b Code

385.02 ER 403B MATCH 385.02 ER 403B MATCH

Retirement plan 8.27 ORSTTWH 12c Code Retirement plan 8.27 ORSTTWH 12c Code

X 274.43 OSEA DUES X 274.43 OSEA DUES

Third-party sick pay 12d Code Third-party sick pay 12d Code

OR 0503336-8 15482.58 795.89 OR 0503336-8 15482.58 795.89

15 State Emplr.'s state I.D. # 16 State wages, tips, etc. 17 State income tax 15 State Emplr.'s state I.D. # 16 State wages, tips, etc. 17 State income tax

18 Local wages, tips, etc. 19 Local income tax 20 Locality name 18 Local wages, tips, etc. 19 Local income tax 20 Locality name

0.00

Form W-2 Wage and Tax Statement 41-1628061 Dept. of the Treasury -- IRS Form W-2 Wage and Tax Statement 41-1628061 Dept. of the Treasury -- IRS

This information is being furnished to the Internal Revenue Service.

Copy C For EMPLOYEE'S RECORDS OMB No. Copy 2 To Be Filed With Employee's State, OMB No.

(See Notice to Employee on back of copy B.) 2018 1545-0008

City, or Local Income Tax Return 2018 1545-0008

a Employee's soc sec no 1 Wages, tips, other comp. 2 Federal income tax withheld a Employee's soc sec no 1 Wages, tips, other comp. 2 Federal income tax withheld

15482.58 372.24 15482.58 372.24

xxx-xx-1476 3 Social security wages 4 Social security tax withheld xxx-xx-1476 3 Social security wages 4 Social security tax withheld

b Employer ID number 15692.58 972.92 b Employer ID number 15692.58 972.92

5 Medicare wages and tips 6 Medicare tax withheld 5 Medicare wages and tips 6 Medicare tax withheld

93-6000508 93-6000508

15692.58 227.57 15692.58 227.57

c Employer's name, address, and zip code c Employer's name, address, and zip code

JACKSON COUNTY SCHOOL DISTRICT #6 JACKSON COUNTY SCHOOL DISTRICT #6

300 ASH STREET 300 ASH STREET

CENTRAL POINT OR 97502 CENTRAL POINT OR 97502

d Control number d Control number

HI11476 HI11476

e Employee's name, address, and zip code e Employee's name, address, and zip code

TONIA J HILL TONIA J HILL

570 BACHAND CIRCLE 570 BACHAND CIRCLE

CENTRAL POINT OR 97502 CENTRAL POINT OR 97502

f Employee's address and zip code f Employee's address and zip code

7 Social security tips 8 Allocated tips 9 Advance EIC payment 7 Social security tips 8 Allocated tips 9 Advance EIC payment

10 Dependent care benefits 11 Nonqualified plans 12a Code See inst. for box 12 10 Dependent care benefits 11 Nonqualified plans 12a Code See inst. for box 12

0.00 E 210.00 0.00 E 210.00

13 Statutory employee 14 Other 12b Code 13 Statutory employee 14 Other 12b Code

385.02 ER 403B MATCH 385.02 ER 403B MATCH

Retirement plan 8.27 ORSTTWH 12c Code Retirement plan 8.27 ORSTTWH 12c Code

X 274.43 OSEA DUES X 274.43 OSEA DUES

Third-party sick pay 12d Code Third-party sick pay 12d Code

OR 0503336-8 15482.58 795.89 OR 0503336-8 15482.58 795.89

15 State Emplr.'s state I.D. # 16 State wages, tips, etc. 17 State income tax 15 State Emplr.'s state I.D. # 16 State wages, tips, etc. 17 State income tax

18 Local wages, tips, etc. 19 Local income tax 20 Locality name 18 Local wages, tips, etc. 19 Local income tax 20 Locality name

Form W-2 Wage and Tax Statement 41-1628061 Dept. of the Treasury -- IRS Form W-2 Wage and Tax Statement 41-1628061 Dept. of the Treasury -- IRS

ActiveReports

This information is being Evaluation.

furnished to the IRS. Copyright

If you are required to file a tax2002-2006 (c) Data

return, a negligence Dynamics, Ltd. All Rights Reserved.

iVisions.rptPRW24Up

penalty/other sanction may be imposed on you if this income is taxable and you fail to report it.

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- W2 Taco BellDocument3 pagesW2 Taco BellJuan Diego Velandia DuarteNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- OMB No. 1545-0008 OMB No. 1545-0008Document2 pagesOMB No. 1545-0008 OMB No. 1545-0008Robert Taylor50% (2)

- PricewaterhouseCoopers' Guide to the New Tax RulesFrom EverandPricewaterhouseCoopers' Guide to the New Tax RulesNo ratings yet

- 5058.00 5058.00 CA CA 65.88 65.88: Notice To EmployeeDocument2 pages5058.00 5058.00 CA CA 65.88 65.88: Notice To EmployeeWenn RamírezNo ratings yet

- 20 TR 08894502584200889450Document2 pages20 TR 08894502584200889450Josh JasperNo ratings yet

- 20212Document2 pages20212carriemccabeNo ratings yet

- PDF 1Document1 pagePDF 1manolo IamanditaNo ratings yet

- Omb No. 1545-0008 Omb No. 1545-0008Document2 pagesOmb No. 1545-0008 Omb No. 1545-0008Luke NyeNo ratings yet

- 21 Il 00126975270200012690Document2 pages21 Il 00126975270200012690harryNo ratings yet

- W2 W2taxdocument 2023Document3 pagesW2 W2taxdocument 2023sywwvpdnp7No ratings yet

- Or Wcomp 0.72 or Wcomp 0.72Document1 pageOr Wcomp 0.72 or Wcomp 0.72aaronNo ratings yet

- Return Postage Guaranteed: Employee Reference Copy Wage and Tax StatementDocument2 pagesReturn Postage Guaranteed: Employee Reference Copy Wage and Tax StatementEvelin De NunezNo ratings yet

- 016506 Atla_adn SplashDocument1 page016506 Atla_adn Splashnatali jimenezNo ratings yet

- IRS Form W-2 tax filing informationDocument2 pagesIRS Form W-2 tax filing informationSNG RYKNo ratings yet

- Wage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnDocument7 pagesWage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnLovely HeartNo ratings yet

- W 2Document3 pagesW 2Bar ChenNo ratings yet

- Copy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnDocument1 pageCopy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnmaliktaimoorsurahNo ratings yet

- Devin J Simon 2004 MOHAWK RD APT. 321 Pueblo, Co 81001: Employer Use Only Corp. DeptDocument2 pagesDevin J Simon 2004 MOHAWK RD APT. 321 Pueblo, Co 81001: Employer Use Only Corp. DeptemtteachNo ratings yet

- Evans W-2sDocument2 pagesEvans W-2sAlmaNo ratings yet

- Gwmain RDocument1 pageGwmain Rfznq9n4rkrNo ratings yet

- 779 Ihh 403 H 6754020242226102101202Document2 pages779 Ihh 403 H 6754020242226102101202elena.69.mxNo ratings yet

- Ui#menu W2Document1 pageUi#menu W2lisa rugeNo ratings yet

- Nolasco W2Document2 pagesNolasco W2MARCOS NOLASCONo ratings yet

- R SwieratDocument2 pagesR SwieratDe Gen G.No ratings yet

- PE7 Ihh 72036 H 1914320215440222104202Document2 pagesPE7 Ihh 72036 H 1914320215440222104202Joali uwuNo ratings yet

- Ioana w2 PDFDocument1 pageIoana w2 PDFBlueberry13KissesNo ratings yet

- Notice To Employee: WWW - Irs.gov/efileDocument2 pagesNotice To Employee: WWW - Irs.gov/efileRODRIGO GRIJALBA CABREJOSNo ratings yet

- 20306.87 20306.87 IN IN 637.90 637.90: Notice To EmployeeDocument2 pages20306.87 20306.87 IN IN 637.90 637.90: Notice To EmployeeWillie Davis0% (1)

- 0070-0070L268 0000000193 - MICHIG: Copy C, For Employee's RecordsDocument2 pages0070-0070L268 0000000193 - MICHIG: Copy C, For Employee's RecordsDeepika RajasekarNo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument5 pagesCopy B-To Be Filed With Employee's FEDERAL Tax ReturnKyle im taken by cailey hand Hand100% (1)

- Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax ReturnJoshua WagonerNo ratings yet

- Sipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Document2 pagesSipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Suesa ThapaliyaNo ratings yet

- Morehouse Morehouse Daniel Daniel J J: Copy C - For Employee'S RecordsDocument1 pageMorehouse Morehouse Daniel Daniel J J: Copy C - For Employee'S RecordsCorey GarrisNo ratings yet

- Filename PDFDocument3 pagesFilename PDFIvette PizarroNo ratings yet

- 2017W2 PDFDocument2 pages2017W2 PDFSeadevil0No ratings yet

- 5 MTihh 4271 H 1914120242901191102202Document2 pages5 MTihh 4271 H 1914120242901191102202elena.69.mxNo ratings yet

- W21225760934 0 PDFDocument2 pagesW21225760934 0 PDFAnonymous czHLQeLPB4No ratings yet

- E Name w2 2021 WithInstructionsDocument3 pagesE Name w2 2021 WithInstructionsKandice ChandlerNo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax Return7cf42b5d98No ratings yet

- 2021 W-2 Earnings SummaryDocument2 pages2021 W-2 Earnings Summaryrachel sanchezNo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturntabithaNo ratings yet

- Jesus A Segovia 8803 Shoemaker LN HUDSON FL 34667-2726: Wage and Tax Employee Reference Copy StatementDocument2 pagesJesus A Segovia 8803 Shoemaker LN HUDSON FL 34667-2726: Wage and Tax Employee Reference Copy Statementcg727841No ratings yet

- W-2 Form Details Employee PayDocument4 pagesW-2 Form Details Employee PayMark OasayNo ratings yet

- DNSP 0000003971Document2 pagesDNSP 0000003971negrapujolsNo ratings yet

- Dan Simon 2016 W2 PDFDocument2 pagesDan Simon 2016 W2 PDFAnonymous ndTTXL80MnNo ratings yet

- TaxForms PDFDocument2 pagesTaxForms PDFLMN214100% (1)

- Timothy W Janssen 4812 LITTLE Fox Court Imperial MO 63052Document2 pagesTimothy W Janssen 4812 LITTLE Fox Court Imperial MO 63052TJ JanssenNo ratings yet

- w2-hh83UtqU4WlQsBEvVnOTDocument1 pagew2-hh83UtqU4WlQsBEvVnOTDutchavelli5thNo ratings yet

- Derrin T Lee's 2017 W-2 from Airport Terminal ServicesDocument4 pagesDerrin T Lee's 2017 W-2 from Airport Terminal ServicesDerrin Lee100% (1)

- W-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsDocument2 pagesW-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsChantale0% (1)

- Wage and Tax StatementDocument4 pagesWage and Tax StatementRich1781No ratings yet

- Statement For 2022-1Document2 pagesStatement For 2022-1Hengki Yono100% (1)

- Wage and Tax Statement Wage and Tax StatementDocument1 pageWage and Tax Statement Wage and Tax StatementFabiola UrgilésNo ratings yet

- W2 Preview titleDocument1 pageW2 Preview titlemrs merle westonNo ratings yet

- Paredes Abreu - W2 2021Document1 pageParedes Abreu - W2 2021Sarah ParedesNo ratings yet

- Resume of Msnetty42Document2 pagesResume of Msnetty42api-25122959No ratings yet

- Act ch10 l04 EnglishDocument7 pagesAct ch10 l04 EnglishLinds Rivera100% (1)

- Copy 2 To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument2 pagesCopy 2 To Be Filed With Employee's State, City, or Local Income Tax ReturnJim PollockNo ratings yet