Professional Documents

Culture Documents

w2 hh83UtqU4WlQsBEvVnOT

Uploaded by

Dutchavelli5thOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

w2 hh83UtqU4WlQsBEvVnOT

Uploaded by

Dutchavelli5thCopyright:

Available Formats

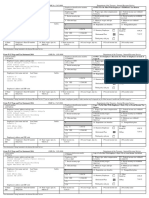

a: Employees Social Security Number

OMB No.1545-0008

b Employers Identification Number (EIN) 1 Wages, tips, other compensation 2 Federal Income tax withheld

120,000.00 19527.5

с Employers Name, Address and Zip code 3 Social security wages 4 Social Security tax withheld

JOHN DOE 120,000.00 7440

123 ABC AVE

5 Medicare Wages and tips 6 Medicare tax withheld

LETTERS, NY 12345

120,000.00 1740

7 Social security tips 8 Allocated tips

d Control Number 9 10 Dependet care benefits

e Employers Name, Address and Zip codes 11 Nonqualified Plans 12a

ABC COMPANY

ALPHABET, NY 12345

13 Statutory Retirement Third-party 12b

employee plan sick pay

14 Others 12c

12d

15 State Employers State ID number 16 State, Wages, tips etc 17 State income tax 18 Local wages, tips etc 19 Local income tax 20 Locality name

NY 123456789 120,000.00 6695.09

From

W-2 Wage and Tax 2023 Department of the Treasury -- Internal Revenue System

For Privacy Act and Paperwork Reduction Act Notice,

Statements see separate instructions

Copy D -- For Employer

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- W2 PreviewDocument1 pageW2 Previewmrs merle westonNo ratings yet

- 20212Document2 pages20212carriemccabeNo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax ReturnJoshua WagonerNo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument5 pagesCopy B-To Be Filed With Employee's FEDERAL Tax ReturnKyle im taken by cailey hand Hand100% (1)

- 0070-0070L268 0000000193 - MICHIG: Copy C, For Employee's RecordsDocument2 pages0070-0070L268 0000000193 - MICHIG: Copy C, For Employee's RecordsDeepika RajasekarNo ratings yet

- W2 Taco BellDocument3 pagesW2 Taco BellJuan Diego Velandia DuarteNo ratings yet

- TAXES w2 REGAL HospitalityDocument2 pagesTAXES w2 REGAL Hospitalityoskar_herrera2012No ratings yet

- W2 W2taxdocument 2023Document3 pagesW2 W2taxdocument 2023sywwvpdnp7No ratings yet

- W 2Document3 pagesW 2Bar ChenNo ratings yet

- W21225760934 0 PDFDocument2 pagesW21225760934 0 PDFAnonymous czHLQeLPB4No ratings yet

- Paredes Abreu - W2 2021Document1 pageParedes Abreu - W2 2021Sarah ParedesNo ratings yet

- Act ch10 l04 EnglishDocument7 pagesAct ch10 l04 EnglishLinds Rivera50% (2)

- R SwieratDocument2 pagesR SwieratDe Gen G.No ratings yet

- Wage and Tax StatementDocument4 pagesWage and Tax StatementRich1781No ratings yet

- 5058.00 5058.00 CA CA 65.88 65.88: Notice To EmployeeDocument2 pages5058.00 5058.00 CA CA 65.88 65.88: Notice To EmployeeWenn RamírezNo ratings yet

- Psav Encore Global W-2Document5 pagesPsav Encore Global W-2Vincent NewsonNo ratings yet

- W2 ExportDocument1 pageW2 ExportenderjosNo ratings yet

- Print PreviewDocument4 pagesPrint PreviewDerrin Lee100% (1)

- OMB No. 1545-0008 OMB No. 1545-0008Document2 pagesOMB No. 1545-0008 OMB No. 1545-0008Robert Taylor50% (2)

- PPDocument2 pagesPPSNG RYKNo ratings yet

- Wage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnDocument7 pagesWage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnLovely HeartNo ratings yet

- Dennis w2Document5 pagesDennis w2Dennis GieselmanNo ratings yet

- Omb No. 1545-0008 Omb No. 1545-0008Document2 pagesOmb No. 1545-0008 Omb No. 1545-0008Luke NyeNo ratings yet

- Ui#menu W2Document1 pageUi#menu W2lisa rugeNo ratings yet

- TWC LIS01 LIS - B AU20161205 P: Aqeel Haider 1 Maple Ave APT. #106 Patchogue, Ny 11772Document2 pagesTWC LIS01 LIS - B AU20161205 P: Aqeel Haider 1 Maple Ave APT. #106 Patchogue, Ny 11772sana shahidNo ratings yet

- 779 Ihh 403 H 6754020242226102101202Document2 pages779 Ihh 403 H 6754020242226102101202elena.69.mxNo ratings yet

- Copy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnDocument1 pageCopy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnmaliktaimoorsurahNo ratings yet

- Kenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. DeptDocument2 pagesKenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. Depttaylorizabella1No ratings yet

- Employee W2 2013: Mission Solutions, LLCDocument1 pageEmployee W2 2013: Mission Solutions, LLCJAMES BELLNo ratings yet

- Morehouse Morehouse Daniel Daniel J J: Copy C - For Employee'S RecordsDocument1 pageMorehouse Morehouse Daniel Daniel J J: Copy C - For Employee'S RecordsCorey GarrisNo ratings yet

- Nolasco W2Document2 pagesNolasco W2MARCOS NOLASCONo ratings yet

- Wage and Tax StatementDocument4 pagesWage and Tax StatementMark OasayNo ratings yet

- Resume of Msnetty42Document2 pagesResume of Msnetty42api-25122959No ratings yet

- Procoleman, Tia: Tia Coleman 820 Fotis DR Unit 2 Dekalb, Il 60115Document2 pagesProcoleman, Tia: Tia Coleman 820 Fotis DR Unit 2 Dekalb, Il 60115Myt WovenNo ratings yet

- 20306.87 20306.87 IN IN 637.90 637.90: Notice To EmployeeDocument2 pages20306.87 20306.87 IN IN 637.90 637.90: Notice To EmployeeWillie Davis0% (1)

- PDF 1Document1 pagePDF 1manolo IamanditaNo ratings yet

- Return Postage Guaranteed: Employee Reference Copy Wage and Tax StatementDocument2 pagesReturn Postage Guaranteed: Employee Reference Copy Wage and Tax StatementEvelin De NunezNo ratings yet

- Kenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. DeptDocument2 pagesKenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. Depttaylorizabella1No ratings yet

- Notice To Employee: WWW - Irs.gov/efileDocument2 pagesNotice To Employee: WWW - Irs.gov/efileRODRIGO GRIJALBA CABREJOSNo ratings yet

- Copy 2 To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument2 pagesCopy 2 To Be Filed With Employee's State, City, or Local Income Tax ReturnJim PollockNo ratings yet

- Tax File 2106 Ss FileingDocument5 pagesTax File 2106 Ss FileingWALLAUERNo ratings yet

- Misal RomanoDocument2 pagesMisal RomanoJairo RBNo ratings yet

- Atla - Adn SplashDocument1 pageAtla - Adn Splashnatali jimenezNo ratings yet

- Mona Patel 80 Marlowe CT Somerset, NJ 08873: Wage and Tax Employee Reference Copy StatementDocument3 pagesMona Patel 80 Marlowe CT Somerset, NJ 08873: Wage and Tax Employee Reference Copy StatementManubhai PatelNo ratings yet

- OMB No.1545-0008: DescriptionDocument1 pageOMB No.1545-0008: DescriptionHolanNo ratings yet

- Anil Gupta 2021 w2Document2 pagesAnil Gupta 2021 w2Kawljeet Singh KohliNo ratings yet

- W-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsDocument2 pagesW-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsChantale0% (1)

- 5 MTihh 4271 H 1914120242901191102202Document2 pages5 MTihh 4271 H 1914120242901191102202elena.69.mxNo ratings yet

- Gwmain RDocument1 pageGwmain Rfznq9n4rkrNo ratings yet

- 2020 - PmaDocument2 pages2020 - Pmalaniya rossNo ratings yet

- Timothy W Janssen 4812 LITTLE Fox Court Imperial MO 63052Document2 pagesTimothy W Janssen 4812 LITTLE Fox Court Imperial MO 63052TJ JanssenNo ratings yet

- 2017W2 PDFDocument2 pages2017W2 PDFSeadevil0No ratings yet

- Resume of Vonners2008Document1 pageResume of Vonners2008api-32573385No ratings yet

- Or Wcomp 0.72 or Wcomp 0.72Document1 pageOr Wcomp 0.72 or Wcomp 0.72aaronNo ratings yet

- Sipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Document2 pagesSipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Suesa ThapaliyaNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atDocument1 pageWage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atHenry KilmekNo ratings yet

- 20 TR 08894502584200889450Document2 pages20 TR 08894502584200889450Josh JasperNo ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument9 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerImran SadiqNo ratings yet

- PDF VDocument1 pagePDF VDutchavelli5thNo ratings yet

- PDF VDocument1 pagePDF VDutchavelli5thNo ratings yet

- PDF VDocument1 pagePDF VDutchavelli5thNo ratings yet

- 14k Mailacces, Uhq and PrivateDocument238 pages14k Mailacces, Uhq and PrivateDutchavelli5thNo ratings yet

- Tax ReturnDocument16 pagesTax ReturnDutchavelli5thNo ratings yet

- Personal LoanDocument16 pagesPersonal LoanDutchavelli5thNo ratings yet

- Ssa 1099 - Ssa 1042s Letter 6 5Document2 pagesSsa 1099 - Ssa 1042s Letter 6 5Dutchavelli5thNo ratings yet

- Editable IRS Form 8879 For 2017-2018Document2 pagesEditable IRS Form 8879 For 2017-2018PDFstockNo ratings yet

- Wage and Tax StatementDocument6 pagesWage and Tax StatementNick RubleNo ratings yet

- 2011 Federal 1040Document2 pages2011 Federal 1040Swati SarangNo ratings yet

- Kia Lopez Form 1040Document2 pagesKia Lopez Form 1040Stephanie RobinsonNo ratings yet

- Criminal Complaint Against Teddy KossofDocument5 pagesCriminal Complaint Against Teddy KossofChicago TribuneNo ratings yet

- Income Tax On Dollar To InrDocument1 pageIncome Tax On Dollar To InrApki mautNo ratings yet

- Barbyq Dire IrsDocument2 pagesBarbyq Dire IrsrolfNo ratings yet

- SamHoustonState Fy 2020Document79 pagesSamHoustonState Fy 2020Matt BrownNo ratings yet

- Form 1040A or 1040Document2 pagesForm 1040A or 1040Vita Volunteers WebmasterNo ratings yet

- Tax Law Research Paper TopicsDocument5 pagesTax Law Research Paper Topicsxfdacdbkf100% (1)

- US Internal Revenue Service: I1099intDocument5 pagesUS Internal Revenue Service: I1099intIRSNo ratings yet

- IRS Form 5405Document2 pagesIRS Form 5405maxcpa100% (1)

- 2019 - Uwm - Ncaa ReportDocument79 pages2019 - Uwm - Ncaa ReportMatt BrownNo ratings yet

- 22-23 Special Circumstance Appeal FormDocument1 page22-23 Special Circumstance Appeal FormAmber GrahamNo ratings yet

- SF ECPAY CountrySpec PDFDocument370 pagesSF ECPAY CountrySpec PDFJoana MataNo ratings yet

- Additional Child Tax Credit: Schedule 8812Document1 pageAdditional Child Tax Credit: Schedule 8812Jack MiguelNo ratings yet

- 2010 ADSO As DGPA Tax ReturnDocument17 pages2010 ADSO As DGPA Tax ReturnDentist The MenaceNo ratings yet

- En 05 10127Document28 pagesEn 05 10127Kevin TalbertNo ratings yet

- TurboTax® Free Edition - Free Tax Filing, Free Taxes Online, Free Tax Return, Free EfileDocument25 pagesTurboTax® Free Edition - Free Tax Filing, Free Taxes Online, Free Tax Return, Free Efilerandy5burton940% (1)

- Non Taxpayer Bill of RightsDocument6 pagesNon Taxpayer Bill of RightsAlbertoNo ratings yet

- Tax Credit One Pager QR-RBCDocument1 pageTax Credit One Pager QR-RBCErick MorenoNo ratings yet

- Legal EncyclopediaDocument292 pagesLegal EncyclopediaprincelegerNo ratings yet

- 9YWwhh55h5384810244629010109102 PDFDocument2 pages9YWwhh55h5384810244629010109102 PDFDave Yerznkyan100% (1)

- Disbur Form Series 100-500, 800 & 801Document12 pagesDisbur Form Series 100-500, 800 & 801Geno GottschallNo ratings yet

- 1.4 IRS Form 1040VDocument1 page1.4 IRS Form 1040VBenne James100% (1)

- 2022 Victor Tamayo YourDocument9 pages2022 Victor Tamayo YourCiber 13100% (3)

- Drivewealth, LLC 97 Main ST 2Nd Floor CHATHAM, NJ 07928: For Your Investing Account With Cash App Investing LLCDocument8 pagesDrivewealth, LLC 97 Main ST 2Nd Floor CHATHAM, NJ 07928: For Your Investing Account With Cash App Investing LLCAdib RashidNo ratings yet

- Center For Science in The Public Interst (CSPI) IRS 990s, 2001-2014Document487 pagesCenter For Science in The Public Interst (CSPI) IRS 990s, 2001-2014Peter M. HeimlichNo ratings yet

- Tides Foundation 2011 990Document128 pagesTides Foundation 2011 990TheSceneOfTheCrimeNo ratings yet

- U.S. Individual Income Tax Return: Filing Status XDocument8 pagesU.S. Individual Income Tax Return: Filing Status XTehone Teketelew100% (2)