Professional Documents

Culture Documents

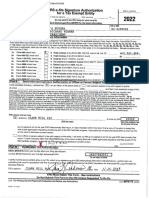

Form 8879-C

Uploaded by

ankit goenkaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 8879-C

Uploaded by

ankit goenkaCopyright:

Available Formats

Form 8879-CORP E-file Authorization for Corporations

For calendar year 2022, or tax year beginning , 2022, ending

(December 2022) Use for efile authorizations for Form 1120, 1120-F or 1120S. OMB No. 1545-0123

Do not send to the IRS. Keep for your records.

Department of the Treasury

Internal Revenue Service Go to www.irs.gov/Form8879CORP for the latest information.

Name of corporation Employer identification number

Aeries Technology Inc 47-4253439

Part I Information (Whole dollars only)

1 mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

Total income (Form 1120, line 11) 3,185,434. 1

2 mmmmmmmmmmmmmmmmmmmmmmmmmmm

Total income (Form 1120-F, Section II, line 11) 2

3 mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

Total income (loss) (Form 1120-S, line 6)

Declaration and Signature Authorization of Officer. Be sure to get a copy of the corporation's return.

3

Part II

Under penalties of perjury, I declare that I am an officer of the above corporation and that I have examined a copy of the corporation's

electronic income tax return and accompanying schedules and statements, and to the best of my knowledge and belief, they are

true, correct, and complete. I further declare that the amounts in Part I above are the amounts shown on the copy of the corporation's

electronic income tax return. I consent to allow my electronic return originator (ERO), transmitter, or intermediate service provider to

send the corporation's return to the IRS and to receive from the IRS (a) an acknowledgment of receipt or reason for rejection of the

transmission, (b) the reason for any delay in processing the return or refund, and (c) the date of any refund. If applicable, I authorize

the U.S. Treasury and its designated Financial Agent to initiate an electronic funds withdrawal (direct debit) entry to the financial

institution account indicated in the tax preparation software for payment of the corporation's federal taxes owed on this return, and

the financial institution to debit the entry to this account. To revoke a payment, I must contact the U.S. Treasury Financial Agent at

1-888-353-4537 no later than 2 business days prior to the payment (settlement) date. I also authorize the financial institutions involved

in the processing of the electronic payment of taxes to receive confidential information necessary to answer inquiries and resolve

issues related to the payment. I have selected a personal identification number (PIN) as my signature for the corporation's electronic

income tax return and, if applicable, the corporation's consent to electronic funds withdrawal.

Officer's PIN: check one box only

X I authorize KNAV Advisory Inc F/K/A KNAV P.A. to enter my PIN 8 6 2 8 6 as my signature

ERO firm name do not enter all zeros

on the corporation's electronically filed income tax return.

As an officer of the corporation, I will enter my PIN as my signature on the corporation's electronically filed income tax

return.

Officer's signature Date Title Head of A/cs & Fin

Part III Certification and Authentication

ERO's EFIN/PIN. Enter your six-digit EFIN followed by your five-digit self-selected PIN. 6 7 0 8 2 4 2 0 2 7 5

do not enter all zeros

I certify that the above numeric entry is my PIN, which is my signature on the electronically filed income tax return for the corporation

indicated above. I confirm that I am submitting this return in accordance with the requirements of Pub. 3112, IRS e-file Application

and Participation, and Pub. 4163, Modernized e-File (MeF) Information for Authorized IRS e-file Providers for Business Returns.

ERO's signature Date

ERO Must Retain This Form - See Instructions

Do Not Submit This Form to the IRS Unless Requested To Do So

For Paperwork Reduction Act Notice, see instructions. Form 8879-CORP (12-2022)

JSA

2C3302 1.000

6164LQ 636L 10/11/2023 01:54:52 V22-7.2F Aeries 9

You might also like

- Capstone Research Paper - Ferrari 2015 Initial Public OfferingDocument9 pagesCapstone Research Paper - Ferrari 2015 Initial Public OfferingJames A. Whitten0% (1)

- Anderson, Elle 2019 Federal Tax ReturnDocument13 pagesAnderson, Elle 2019 Federal Tax ReturnElle Anderson100% (2)

- Amtrak Weighs Acela Financing OptionsDocument32 pagesAmtrak Weighs Acela Financing OptionsAngela Thornton67% (3)

- Case Study 1 - Strategic HR Integration at The Walt Disney CompanyDocument2 pagesCase Study 1 - Strategic HR Integration at The Walt Disney CompanyTrần Thanh HuyềnNo ratings yet

- 2019 Tax ReturnDocument13 pages2019 Tax ReturnTbahajBayanNo ratings yet

- Editable IRS Form 8879 For 2017-2018Document2 pagesEditable IRS Form 8879 For 2017-2018PDFstockNo ratings yet

- PPG Asian Paints PVT LTD: Indian Institute of Management Tiruchirappalli Post Graduate Programme in Business ManagementDocument15 pagesPPG Asian Paints PVT LTD: Indian Institute of Management Tiruchirappalli Post Graduate Programme in Business ManagementMohanapriya JayakumarNo ratings yet

- Narnia IncDocument3 pagesNarnia Incdiah permata sariNo ratings yet

- US Internal Revenue Service: f8879c - 2003Document2 pagesUS Internal Revenue Service: f8879c - 2003IRSNo ratings yet

- US Internal Revenue Service: f8879s - 2003Document2 pagesUS Internal Revenue Service: f8879s - 2003IRSNo ratings yet

- US Internal Revenue Service: f8879c - 2004Document2 pagesUS Internal Revenue Service: f8879c - 2004IRSNo ratings yet

- Laura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyDocument144 pagesLaura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyGabe KaminskyNo ratings yet

- 10 17 22 NPJJ LLC 8879 E-File Authorization 2021-Signed-CertificateDocument2 pages10 17 22 NPJJ LLC 8879 E-File Authorization 2021-Signed-CertificatejimNo ratings yet

- US Internal Revenue Service: F8879eo - 2003Document2 pagesUS Internal Revenue Service: F8879eo - 2003IRSNo ratings yet

- 398 2019 ArchiveTaxReturnDocument10 pages398 2019 ArchiveTaxReturnjimmy naranjoNo ratings yet

- US Internal Revenue Service: f8879b AccessibleDocument2 pagesUS Internal Revenue Service: f8879b AccessibleIRSNo ratings yet

- 2019 CorporateDocument32 pages2019 Corporateapi-167637329No ratings yet

- US Internal Revenue Service: f8879s - 2004Document2 pagesUS Internal Revenue Service: f8879s - 2004IRSNo ratings yet

- 2013 - Form 990Document30 pages2013 - Form 990Fred MednickNo ratings yet

- Acos0950 21i FCDocument22 pagesAcos0950 21i FCAna Acosta MezaNo ratings yet

- Rs Accounting and Tax Services Inc 10 Fairway Drive Suite 201A Deerfield Beach, FL 33441 (888) 341-2429Document17 pagesRs Accounting and Tax Services Inc 10 Fairway Drive Suite 201A Deerfield Beach, FL 33441 (888) 341-2429Moysés Isper NetoNo ratings yet

- CLR 2020 Tax ReturnDocument14 pagesCLR 2020 Tax ReturnAlexander Barno AlexNo ratings yet

- 2014 Alabama Possible 990Document39 pages2014 Alabama Possible 990Alabama PossibleNo ratings yet

- RTMF 990Document49 pagesRTMF 990Craig MaugerNo ratings yet

- Patricia Gonzalez Naranjo XXX XX 9179 2021 01-15-091525Document16 pagesPatricia Gonzalez Naranjo XXX XX 9179 2021 01-15-091525Maria Valentina Neira GonzalezNo ratings yet

- 2020 Tax ReturnDocument16 pages2020 Tax ReturnTbahajBayan100% (1)

- US Internal Revenue Service: f8453c AccessibleDocument2 pagesUS Internal Revenue Service: f8453c AccessibleIRSNo ratings yet

- IRS E-File Signature Authorization For Form 1041: Employer Identification NumberDocument2 pagesIRS E-File Signature Authorization For Form 1041: Employer Identification NumberJerry MandorNo ratings yet

- 1099k Document ExampleDocument65 pages1099k Document ExamplemuchromadhooniNo ratings yet

- 2023 Tax Return: Prepared ByDocument11 pages2023 Tax Return: Prepared ByopreciousekugbereNo ratings yet

- Intertech Fluid Power 2019Document38 pagesIntertech Fluid Power 2019Sue StevenNo ratings yet

- Software Evaluation Copy DO NOT MAIL: E-File Signature AuthorizationDocument64 pagesSoftware Evaluation Copy DO NOT MAIL: E-File Signature AuthorizationZachary White100% (2)

- U.S. Corporation Income Tax Declaration For An IRS E-File ReturnDocument1 pageU.S. Corporation Income Tax Declaration For An IRS E-File ReturnSrinivas GopalanNo ratings yet

- téléchargement (1)Document9 pagestéléchargement (1)Hichem BarkatiNo ratings yet

- Sanogo 2019 TFDocument40 pagesSanogo 2019 TFbassomassi sanogoNo ratings yet

- US Internal Revenue Service: f8453p - 2001Document2 pagesUS Internal Revenue Service: f8453p - 2001IRSNo ratings yet

- 2021 Tax Return Prepared OnlineDocument6 pages2021 Tax Return Prepared OnlineSolomonNo ratings yet

- Mart1552 21i FCDocument23 pagesMart1552 21i FCOlga M.No ratings yet

- US Internal Revenue Service: f8453s - 2003Document2 pagesUS Internal Revenue Service: f8453s - 2003IRSNo ratings yet

- Dixo2460 19i FCDocument32 pagesDixo2460 19i FCHengki Yono100% (1)

- Tax Return - 2018-2019Document30 pagesTax Return - 2018-2019kutner8181No ratings yet

- US Internal Revenue Service: f8878 - 2005Document2 pagesUS Internal Revenue Service: f8878 - 2005IRSNo ratings yet

- 2020 Tax Return: Prepared ByDocument5 pages2020 Tax Return: Prepared ByAdam MasonNo ratings yet

- Cicortflorina 8879Document2 pagesCicortflorina 8879Florin Cicort100% (3)

- Zambrano Tax-Pro & Services 2752 Eagle Canyon DR S Kissimmee, FL 34746 407-334-2907Document15 pagesZambrano Tax-Pro & Services 2752 Eagle Canyon DR S Kissimmee, FL 34746 407-334-2907Yaidhyt PradoNo ratings yet

- 2021 Tax Return: Prepared ByDocument4 pages2021 Tax Return: Prepared ByDennis0% (1)

- 2021 Tax Return: Prepared ByDocument12 pages2021 Tax Return: Prepared ByRobert James100% (1)

- US Internal Revenue Service: f8453s - 2004Document2 pagesUS Internal Revenue Service: f8453s - 2004IRSNo ratings yet

- Goodlett Quail 2019 Form 1065 SC SignedDocument19 pagesGoodlett Quail 2019 Form 1065 SC SignedSue StevenNo ratings yet

- US Internal Revenue Service: f8878 - 2004Document2 pagesUS Internal Revenue Service: f8878 - 2004IRSNo ratings yet

- IRS Form 8879 e-file Signature AuthorizationDocument2 pagesIRS Form 8879 e-file Signature AuthorizationKatia AlvezNo ratings yet

- Exempt Organization Declaration and Signature For Electronic FilingDocument2 pagesExempt Organization Declaration and Signature For Electronic FilingIRSNo ratings yet

- Img 20220411 0006Document1 pageImg 20220411 0006herb flatherNo ratings yet

- Hillside Children's Center, New York 2014 IRS ReportDocument76 pagesHillside Children's Center, New York 2014 IRS ReportBeverly TranNo ratings yet

- .2021 Signature FormsDocument5 pages.2021 Signature FormsASHLEY GRIESEMER100% (2)

- Form PMT ACH Payment 2019: Joyson & Nisha Pekkattil 634-66-1347Document4 pagesForm PMT ACH Payment 2019: Joyson & Nisha Pekkattil 634-66-1347Joy100% (1)

- US Internal Revenue Service: F8878a AccessibleDocument2 pagesUS Internal Revenue Service: F8878a AccessibleIRSNo ratings yet

- US Internal Revenue Service: f8878 - 2002Document2 pagesUS Internal Revenue Service: f8878 - 2002IRSNo ratings yet

- US Internal Revenue Service: F8453ol - 2003Document2 pagesUS Internal Revenue Service: F8453ol - 2003IRSNo ratings yet

- US Internal Revenue Service: F8453ol - 2001Document2 pagesUS Internal Revenue Service: F8453ol - 2001IRSNo ratings yet

- 2022 Amended Tax Return Documents (Operation Vet Fit Inc)Document43 pages2022 Amended Tax Return Documents (Operation Vet Fit Inc)Daniel R. Gaita, MA, LMSWNo ratings yet

- ITS-R007 - REGISTER FOR EXCISE TAXDocument10 pagesITS-R007 - REGISTER FOR EXCISE TAXsanjay kafleNo ratings yet

- Application For Filing Information Returns Electronically: (Rev. 6-2007) (Please Type Print inDocument2 pagesApplication For Filing Information Returns Electronically: (Rev. 6-2007) (Please Type Print inIRSNo ratings yet

- AIS Reviewer PDFDocument20 pagesAIS Reviewer PDFMayNo ratings yet

- Exercises - Topic 3 (Impairment) (Eng)Document7 pagesExercises - Topic 3 (Impairment) (Eng)Thảo PhạmNo ratings yet

- SD HHML FinalDocument139 pagesSD HHML FinalParas BarbhayaNo ratings yet

- 1.2 B Sheet and Income StatementDocument33 pages1.2 B Sheet and Income Statementtirodkar.sneha13No ratings yet

- SIT Artikel 5Document20 pagesSIT Artikel 5Oxky Setiawan WibisonoNo ratings yet

- Advanced Financial MGMT Notes 1 To 30Document87 pagesAdvanced Financial MGMT Notes 1 To 30Sangeetha K SNo ratings yet

- 14 Sustainable TourismDocument17 pages14 Sustainable TourismIwan Firman WidiyantoNo ratings yet

- 1.1.1 Political StabilityDocument3 pages1.1.1 Political StabilityCuong VUongNo ratings yet

- British Steel Interactive Stock Range GuideDocument86 pagesBritish Steel Interactive Stock Range GuideLee Hing WahNo ratings yet

- GAAP: Generally Accepted Accounting PrinciplesDocument7 pagesGAAP: Generally Accepted Accounting PrinciplesTAI LONGNo ratings yet

- Non-Bank Financial InstitutionsDocument11 pagesNon-Bank Financial InstitutionsCristineNo ratings yet

- Bangladesh Steel Industry - December 2019 PDFDocument19 pagesBangladesh Steel Industry - December 2019 PDFMahmudul Hasan SajibNo ratings yet

- Acctg180 W02 Problems Accounting CycleDocument9 pagesAcctg180 W02 Problems Accounting CycleAniNo ratings yet

- Logistics SsDocument18 pagesLogistics SsCarla Flor LosiñadaNo ratings yet

- Level 1: New Century Mathematics (Second Edition) S3 Question Bank 3A Chapter 3 Percentages (II)Document27 pagesLevel 1: New Century Mathematics (Second Edition) S3 Question Bank 3A Chapter 3 Percentages (II)raydio 4No ratings yet

- Marketing Vocabulary: Term MeaningDocument3 pagesMarketing Vocabulary: Term MeaningSudarmika KomangNo ratings yet

- Enterpreneurship Lec 10Document10 pagesEnterpreneurship Lec 10SaMee KHanNo ratings yet

- Some Costing Questions PDFDocument85 pagesSome Costing Questions PDFHarshit AggarwalNo ratings yet

- LE-TRA - Config Guide For Shipment & Shipment Cost Document - Part IIIDocument20 pagesLE-TRA - Config Guide For Shipment & Shipment Cost Document - Part IIIАвишек СенNo ratings yet

- ECONOMIC APPLICATIONS HANDS-ON EXPERIENCEDocument6 pagesECONOMIC APPLICATIONS HANDS-ON EXPERIENCEPankaj KumarNo ratings yet

- All Project ReportDocument8 pagesAll Project Reportsrin100% (1)

- Difference Between Global Co., International Co., Multinational Co., Transnational Co. and Multidomestic CoDocument4 pagesDifference Between Global Co., International Co., Multinational Co., Transnational Co. and Multidomestic CoNina HooperNo ratings yet

- Accounting Problem B Abeleda (AutoRecovered)Document14 pagesAccounting Problem B Abeleda (AutoRecovered)xjammer100% (2)

- CASO Worldwide Paper CompanyDocument10 pagesCASO Worldwide Paper CompanyJennyfer Andrea Izaziga ParadaNo ratings yet

- Factors Affecting Employee Relations in Banking: A SCB Case StudyDocument51 pagesFactors Affecting Employee Relations in Banking: A SCB Case StudyMBAMBO JAMESNo ratings yet