0% found this document useful (0 votes)

425 views79 pagesNarrative Report

The document discusses the Philippine national budget process. It begins with budget preparation, where government agencies submit estimates that are reviewed and consolidated into the President's Budget. This is submitted to Congress. Congress then deliberates on the budget through committee hearings and plenary sessions in both the House and Senate to pass the General Appropriations Act. Funds are then executed by agencies and their use is accounted for.

Uploaded by

Jerald Kim VasquezCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

425 views79 pagesNarrative Report

The document discusses the Philippine national budget process. It begins with budget preparation, where government agencies submit estimates that are reviewed and consolidated into the President's Budget. This is submitted to Congress. Congress then deliberates on the budget through committee hearings and plenary sessions in both the House and Senate to pass the General Appropriations Act. Funds are then executed by agencies and their use is accounted for.

Uploaded by

Jerald Kim VasquezCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

- Introduction and Philippine National Budget: Provides an introduction to the Philippine National Budget, explaining its importance and the legal framework governing it.

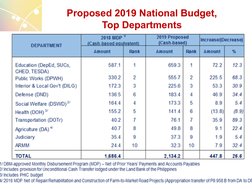

- Proposed 2019 Budget Details: Outlines the proposed 2019 national budget, focusing on department allocations and comparative data.

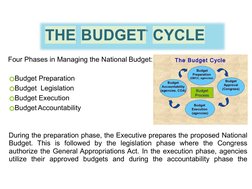

- Budget Cycle: Explains the phases of the budget cycle including preparation, legislation, execution, and accountability.

- Budget Call Phases: Describes the different phases that occur during the Budget Call, focusing on each stage's purpose and key activities.

- School Finance and Assistance: Discusses the sections of the law related to school finance, including funding sources and government assistance programs.

- Financial Management Objective: Describes the financial management objectives set by DepEd for improved governance and transparency.

- Organizational Structure: Provides an overview of the organizational hierarchies and structures within the DepEd management system.

- Division Office Accounting Unit: Explores the accounting unit within the Division Office, detailing the responsibilities and roles of each subsection.

- References: Lists the references used throughout the document, providing sources for further reading and validation.