Professional Documents

Culture Documents

Diskusi After UTS - 5I - Mutia Maulida - 2102015028 - Consolidation With Loss On Intercompany Sale

Uploaded by

Nova AnggrainiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Diskusi After UTS - 5I - Mutia Maulida - 2102015028 - Consolidation With Loss On Intercompany Sale

Uploaded by

Nova AnggrainiCopyright:

Available Formats

NIM 2102015028

NAMA : MUTIA MAULIDA

KELAS : 5I – AKUNTANSI S1

MATA KULIAH : AKUNTANSI KEUANGAN LANJUTAN I

DISCUSSION

“CONSOLIDATION WITH LOSS ON INTERCOMPANY

SALE”

Assume that a machine was sold on January 1, 20x1. Other inform is as follows:

- Selling Price : $20.000

- Remaining useful life : 5 Years

- Ownership : Pop Corporation 90%, Son Corporation 10%

- Pop's book value of machine : $ 30.000

- Unrealized Loss : $10.000

To record sale of Machinery:

Pop’s book on January 1,

20x1

Cash $20.000

Loss On Sale of Machinery $10.000

Machinery $30.000

To record purchase of

Machinery: Son’s book on

January 1, 20x1

Machinery $20.000

Cash $20.000

To record depreciation for one year in Son’s

book Depreciation Expense $10.000

Accumulated Depreciation $10.000

If Son’s net income for 20x1 is $200.000 and there are no other intercompany transactions, Pop

records its income from Son as follows:

Investment in Son $188.000

Investment in Son $188.000

To record income for 20x1 determined as follows:

Equity in Son’s income ($200,000 * 90%) $180.000

Add: Unrealized loss on machine $ 10.000

Less: Piecemeal recognition of loss ($10,000, 5 years) ($ 2.000)

$188.000

20x1

a. To eliminate unrealized intercompany loss on downstream

sale: Machinery $10.000

Loss On Sale of Machinery $10.000

b. Accumulated depreciation $2.000

Depreciation expense $2.000

c. Income from Son $188.000

Investment in Son $188.000

d. To record Noncontrolling income for one year

($200.000*10%): Noncontrolling interest share $20.000

Noncontrolling interest $20.000

e. To eliminate reciprocal investment and equity accounts and to establish beginning

noncontrolling interest:

Equity of Son January 1, 20x1 $500.000

Investment in Son $450.000

Noncontrolling interest Jan 1, 20x1 $ 50.000

20x2

a Machinery (A) $ 10.000

Depreciation expense (E, SE) $ 2.000

Accumulated depreciation (A) $ 4.000

Investment in Son (A) $ 8.000

To eliminate the effects of intercompany sale at a loss

b Accumulated depreciation (A) $ 2.000

Depreciation expense (E, SE) $ 2.000

c Income from Son (R, +SE) $ 178.000

Investment in Son (+A) $ 178.000

To record income for 20x2 determined as follows:

Equity in Son’s income ($200,000 * 90%) $ 180.000

Less: Realize loss on machine $ (10.000)

Add: Unrealized loss on machine $ 10.000

Less: Piecemeal recognition of loss ($10,000, 5 years) $ (2.000)

$ 178.000

d Noncontrolling interest share (SE) $ 20.000

Noncontrolling interest (SE) $ 20.000

To record Noncontrolling income for one year ($200.000*10%)

e Equity of Son January 1, 20x2 (SE) $ 550.000

Investment in Son (A) $ 495.000

$ 762.000Noncontrolling interest Jan 1, 20x2 (SE) $ 55.000

To eliminate reciprocal investment and equity accounts and to establish

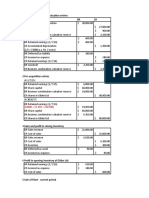

20x2: Years sale of Machinery Adjusment and Elimination Consolidated

Pop 90% Son Db Cr Statement

Income statemen

Income From son $ 178.000 c $ 178.000

Depreciation Expense $ 10.000 a $ 2.000 b $ 2.000 $ 10.000

Non controling intrest Share d $ 20.000 $ 20.000

balance sheet Machinery $ 20.000 a $ 10.000 $ 30.000

Accumulated depreciation $ 20.000 a $ 4.000 $ 22.000

b $ 2.000

$ 681.000 c $ 178.000

Investment in son

e $ 495.000

a $ 8.000

Equity of son - Januari 1 e $ 550.000

$ 550.000

Noncontroling intrest d $ 20.000 $ 75.000

e $ 55.000

20x3

a Machinery (A) $ 10.000

Depreciation expense (E, SE) $ 2.000

Accumulated depreciation (A) $ 6.000

Investment in Son (A) $ 6.000

To eliminate the effects of intercompany sale at a loss

b Accumulated depreciation (A) $ 2.000

Depreciation expense (E, SE) $ 2.000

c Income from Son (R, +SE) $ 178.000

Investment in Son (+A) $ 178.000

To record income for 20x1 determined as follows:

Equity in Son’s income ($200,000 * 90%) $ 180.000

Less: Realize loss on machine $ (10.000)

Add: Unrealized loss on machine $ 10.000

Less: Piecemeal recognition of loss ($10,000, 5 years) $ (2.000)

$ 178.000

d Noncontrolling interest share (SE) $ 20.000

Noncontrolling interest (SE) $ 20.000

To record Noncontrolling income for one year ($200.000*10%)

e Equity of Son January 1, 20x3 (SE) $ 600.000

Investment in Son (A) $ 540.000

$ 812.000Noncontrolling interest Jan 1, 20x3 (SE) $ 60.000

To eliminate reciprocal investment and equity accounts and to establish

20x3: Years sale of Machinery Adjusment and Elimination Consolidated

Pop 90% Son Db Cr Statement

Income statemen

Income From son $ 178.000 c $ 178.000

Depreciation Expense $ 10.000 a $ 2.000 b $ 2.000 $ 10.000

Non controling intrest Share d $ 20.000 $ 20.000

balance sheet Machinery $ 20.000 a $ 10.000 $ 30.000

Accumulated depreciation $ 20.000 a $ 6.000 $ 24.000

b $ 2.000

$ 724.000 c $ 178.000

Investment in son

e $ 540.000

a $ 6.000

Equity of son - Januari 1 e $ 600.000

$ 600.000

Noncontroling interest d $ 20.000 $ 80.000

e $ 60.000

20x4

a Machinery (A) $ 10.000

Depreciation expense (E, SE) $ 2.000

Accumulated depreciation (A) $ 8.000

Investment in Son (A) $ 4.000

To eliminate the effects of intercompany sale at a loss

b Accumulated depreciation (A) $ 2.000

Depreciation expense (E, SE) $ 2.000

c Income from Son (R, +SE) $ 178.000

Investment in Son (+A) $ 178.000

To record income for 20x1 determined as follows:

Equity in Son’s income ($200,000 * 90%) $ 180.000

Less: Realize loss on machine $ (10.000)

Add: Unrealized loss on machine $ 10.000

Less: Piecemeal recognition of loss ($10,000, 5 years) $ (2.000)

$ 178.000

d Noncontrolling interest share (SE) $ 20.000

Noncontrolling interest (SE) $ 20.000

To record Noncontrolling income for one year ($200.000*10%)

e Equity of Son January 1, 20x4 (SE) $ 650.000

Investment in Son (A) $ 585.000

$ 862.000Noncontrolling interest Jan 1, 20x4 (SE) $ 65.000

To eliminate reciprocal investment and equity accounts and to establish

20x4: Yers sale of Machinery Adjusment and Elimination Consolidated

Pop 90% Son Db Cr Statement

Income statemen

Income From son $ 178.000 c $ 178.000

Depreciation Expense $ 10.000 a $ 2.000 b $ 2.000 $ 10.000

Non controling intrest Share d $ 20.000 $ 20.000

balance sheet Machinery $ 20.000 a $ 10.000 $ 30.000

Accumulated depreciation $ 20.000 a $ 8.000 $ 26.000

b $ 2.000

$ 767.000 c $ 178.000

Investment in son

e $ 585.000

a $ 4.000

Equity of son - Januari 1 e $ 650.000

$ 650.000

Noncontroling interest d $ 20.000 $ 85.000

e $ 65.000

20x5

a Machinery (A) $ 10.000

Depreciation expense (E, SE) $ 2.000

Accumulated depreciation (A) $ 10.000

Investment in Son (A) $ 2.000

To eliminate the effects of intercompany sale at a loss

b Accumulated depreciation (A) $ 2.000

Depreciation expense (E, SE) $ 2.000

c Income from Son (R, +SE) $ 178.000

Investment in Son (+A) $ 178.000

To record income for 20x1 determined as follows:

Equity in Son’s income ($200,000 * 90%) $ 180.000

Less: Realize loss on machine $ (10.000)

Add: Unrealized loss on machine $ 10.000

Less: Piecemeal recognition of loss ($10,000, 5 years) $ (2.000)

$ 178.000

d Noncontrolling interest share (SE) $ 20.000

Noncontrolling interest (SE) $ 20.000

To record Noncontrolling income for one year ($200.000*10%)

e Equity of Son January 1, 20x5 (SE) $ 700.000

Investment in Son (A) $ 630.000

Noncontrolling interest Jan 1, 20x5 (SE) $ 70.000 $ 912.000

To eliminate reciprocal investment and equity accounts and to establish beginning

20x5: Years sale of Machinery Adjusment and Elimination Consolidated

Pop 90% Son Db Cr Statement

Income statemen

Income From son $ 178.000 b $ 178.000

Depreciation Expense $ 10.000 a $ 2.000 b $ 2.000 $ 8.000

Non controling intrest Share c $ 20.000 $ 20.000

balance sheet Machinery $ 20.000 a $ 10.000 $ 30.000

Accumulated depreciation $ 20.000 a $ 10.000 $ 28.000

$ 2.000

Investment in son $ 810.000 c $ 178.000

e $ 630.000

a $ 2.000

Equity of son - Januari 1 d $ 700.000

$ 700.000

Noncontroling interest d $ 20.000 $ 90.000

e $ 70.000

the following investment and equity balances—and changes in them—as additional assumptions:

Investment in 90% of the 100% of the

Son 90% Equity of Son Equity of Son

December 31, 20x0 $ 450.000 $ 450.000 $ 500.000

Income 20x1 $ 188.000 $ 45.000 $ 50.000

December 31, 20x1 $ 638.000 $ 495.000 $ 550.000

Income 20x2 $ 178.000 $ 45.000 $ 50.000

December 31, 20x2 $ 816.000 $ 540.000 $ 600.000

Income 20x3 $ 178.000 $ 45.000 $ 50.000

December 31, 20x3 $ 994.000 $ 585.000 $ 650.000

Income 20x4 $ 178.000 $ 45.000 $ 50.000

December 31, 20x4 $ 1.172.000 $ 630.000 $ 700.000

Income 20x5 $ 178.000 $ 45.000 $ 50.000

$ 1.350.000 $ 675.000 $ 750.000

You might also like

- Quiz 17Document2 pagesQuiz 17warning urgentNo ratings yet

- Financial Statements Meaning and CharacteristicsDocument64 pagesFinancial Statements Meaning and CharacteristicsAbhishek Sinha100% (1)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Cash Management 11012018Document41 pagesCash Management 11012018narunsankarNo ratings yet

- Budget Summary Report1Document4 pagesBudget Summary Report1MarvvvNo ratings yet

- Financial and Managerial Accounting 15th Edition Warren Solutions ManualDocument35 pagesFinancial and Managerial Accounting 15th Edition Warren Solutions Manualjordancaldwellwjwu100% (24)

- Preliminary ComputationsDocument3 pagesPreliminary ComputationsFarrell DmNo ratings yet

- EvalsDocument11 pagesEvalsPaul Adriel Balmes50% (2)

- Tugas Minggu 7 Akl Nama: Hidayani Puteri NIM: 20043136Document8 pagesTugas Minggu 7 Akl Nama: Hidayani Puteri NIM: 20043136Hidayani Puteri100% (1)

- F7 SolutionsDocument15 pagesF7 Solutionsnoor ul anumNo ratings yet

- Business Plan On Hand Made ItemsDocument42 pagesBusiness Plan On Hand Made ItemsShery Hashmi90% (60)

- Government Accounting TheoriesDocument6 pagesGovernment Accounting TheoriesHazel Jumaquio100% (7)

- Far Tutor 3Document4 pagesFar Tutor 3Rian RorresNo ratings yet

- Tugas Chapter 6 - Sandra Hanania - 120110180024Document4 pagesTugas Chapter 6 - Sandra Hanania - 120110180024Sandra Hanania PasaribuNo ratings yet

- Assignment Akl Bab 4 (Kel. 7)Document5 pagesAssignment Akl Bab 4 (Kel. 7)Nadiyah ShofwahNo ratings yet

- Aa CH 6Document26 pagesAa CH 6into-the- unknownNo ratings yet

- Tugas AlimDocument3 pagesTugas AlimHappy MichaelNo ratings yet

- 1130 - 89 - Tugas Pribadi Akl Pertemuan 9 Dan 11Document9 pages1130 - 89 - Tugas Pribadi Akl Pertemuan 9 Dan 11Maulana AmriNo ratings yet

- Tugas Aklan TM7Document7 pagesTugas Aklan TM7AdnanNo ratings yet

- Ebook Canadian Income Taxation 2018 2019 21St Edition Buckwold Test Bank Full Chapter PDFDocument36 pagesEbook Canadian Income Taxation 2018 2019 21St Edition Buckwold Test Bank Full Chapter PDFpearlgregoryspx100% (11)

- Canadian Income Taxation 2018 2019 21st Edition Buckwold Test BankDocument38 pagesCanadian Income Taxation 2018 2019 21st Edition Buckwold Test Banklochaphasiawdjits100% (12)

- Lab Pengantar AkuntansiDocument6 pagesLab Pengantar Akuntansirahadatul aishyNo ratings yet

- Akl Week 8Document5 pagesAkl Week 8Rifda AmaliaNo ratings yet

- Tugas 10Document3 pagesTugas 10Reyhan ArioNo ratings yet

- Jawaban Soal Hitungan Bab 4Document16 pagesJawaban Soal Hitungan Bab 4Aheir lessNo ratings yet

- Pindi Yulinar Rosita - Excercise Chapt 5Document32 pagesPindi Yulinar Rosita - Excercise Chapt 5Pindi YulinarNo ratings yet

- Tugas Chapter 4 - Part 2 - 041811333044 - Yefi Nia OpianaDocument4 pagesTugas Chapter 4 - Part 2 - 041811333044 - Yefi Nia OpianaYefinia OpianaNo ratings yet

- Problem 7-3 Akl 2Document3 pagesProblem 7-3 Akl 2andi nanaNo ratings yet

- Akl P4.3 & P4.4Document18 pagesAkl P4.3 & P4.4Dhivena JeonNo ratings yet

- Jay Tesla: ExplanationDocument9 pagesJay Tesla: ExplanationJonathan Cheung100% (1)

- Fundamental Managerial Accounting Concepts 9th Edition Edmonds Solutions ManualDocument16 pagesFundamental Managerial Accounting Concepts 9th Edition Edmonds Solutions Manualeffigiesbuffoonmwve9100% (20)

- Jawaban Modul Pertemuan VI - Transaksi Antar Perusahaan - Persediaan (Upstream)Document5 pagesJawaban Modul Pertemuan VI - Transaksi Antar Perusahaan - Persediaan (Upstream)Mega RefiyaniNo ratings yet

- T1 - IAS 12 - BT1 - KeyDocument3 pagesT1 - IAS 12 - BT1 - KeyKotoru HanoelNo ratings yet

- 1 - Accounting Information Systems Problems With SolutionsDocument22 pages1 - Accounting Information Systems Problems With Solutionsbusiness docNo ratings yet

- S11171641 - Youvashni Shivali Narayan-20.7Document6 pagesS11171641 - Youvashni Shivali Narayan-20.7shivnilNo ratings yet

- Akuntansi Keuangan Lanjutan 2Document6 pagesAkuntansi Keuangan Lanjutan 2Marselinus Aditya Hartanto TjungadiNo ratings yet

- Acccob Activity 5Document26 pagesAcccob Activity 5trishadatuNo ratings yet

- Nur Amaliyah - 041811333032 AKLDocument5 pagesNur Amaliyah - 041811333032 AKLNur AmaliyahNo ratings yet

- Angelo Fernando - 01012190021 - Tugas Akuntansi Menengah 2 - Pertemuan 5Document4 pagesAngelo Fernando - 01012190021 - Tugas Akuntansi Menengah 2 - Pertemuan 5ANGELOXAK202No ratings yet

- Canadian Income Taxation 2017 2018 Canadian 20th Edition Buckwold Test BankDocument13 pagesCanadian Income Taxation 2017 2018 Canadian 20th Edition Buckwold Test Banklovellhebe2v0vn100% (31)

- Accounts Gibson Keller Debit CreditDocument4 pagesAccounts Gibson Keller Debit CreditMcKenzie WNo ratings yet

- Project in Business TaxDocument5 pagesProject in Business TaxJemalyn PiliNo ratings yet

- XLSXDocument10 pagesXLSXezar zacharyNo ratings yet

- P6Document3 pagesP6Jessica HutabaratNo ratings yet

- Tax Homework Chapter 4Document7 pagesTax Homework Chapter 4RosShanique ColebyNo ratings yet

- Assignment 3 ACC 401Document9 pagesAssignment 3 ACC 401ShannonNo ratings yet

- Online Ass Advance Acc NEWDocument6 pagesOnline Ass Advance Acc NEWRara Rarara30No ratings yet

- Entry GDocument2 pagesEntry GMcKenzie WNo ratings yet

- Answers To Extra QuestionsDocument8 pagesAnswers To Extra QuestionsHashani KumarasingheNo ratings yet

- Chapter 5 Solutions To PostDocument43 pagesChapter 5 Solutions To PostJax TellerNo ratings yet

- Consolidated Net Income P 370,000 P 460,000: Illustrative ProblemsDocument11 pagesConsolidated Net Income P 370,000 P 460,000: Illustrative ProblemsKeir GaspanNo ratings yet

- Financial Planing & ForecastingDocument31 pagesFinancial Planing & ForecastingRetno Yuniarsih Marekhan IINo ratings yet

- Consolidation Q76Document4 pagesConsolidation Q76johny SahaNo ratings yet

- GEN4Document7 pagesGEN4Mylene HeragaNo ratings yet

- Materi Lab 5 - Consolidated Techniques and ProceduresDocument7 pagesMateri Lab 5 - Consolidated Techniques and ProceduresrahayuNo ratings yet

- Feed Back Kuis Akl Praktikum (Uts)Document5 pagesFeed Back Kuis Akl Praktikum (Uts)KiwidNo ratings yet

- Name: Nurul Sari NIM: 1101002048 Case 7.1 7.2 7.7: Case 7.1: Investment Center Problems (A)Document4 pagesName: Nurul Sari NIM: 1101002048 Case 7.1 7.2 7.7: Case 7.1: Investment Center Problems (A)Eigha apriliaNo ratings yet

- Intermediate Accounting 1 (Chap 17)Document10 pagesIntermediate Accounting 1 (Chap 17)Natalie Anne Bambico MercadoNo ratings yet

- Chapter 3 - Consolidated Statements: Subsequent To AcquisitionDocument36 pagesChapter 3 - Consolidated Statements: Subsequent To AcquisitionJean De GuzmanNo ratings yet

- Tugas AKL 1 TM 9Document8 pagesTugas AKL 1 TM 9Dila PujiNo ratings yet

- Review of Financial Statements and Its Analysis: Rheena B. Delos Santos BSBA-1A (FM2)Document12 pagesReview of Financial Statements and Its Analysis: Rheena B. Delos Santos BSBA-1A (FM2)RHIAN B.No ratings yet

- MGMT AssignmentDocument79 pagesMGMT AssignmentLuleseged Gebre100% (1)

- Bài tập chương 13Document10 pagesBài tập chương 132021agl12.phamhoangdieumyNo ratings yet

- Solution - Problems and Solutions Chap 3Document4 pagesSolution - Problems and Solutions Chap 3Ajeet YadavNo ratings yet

- Topic 3 SolutionsDocument13 pagesTopic 3 SolutionsLiang BochengNo ratings yet

- Caso Glen Mount Furniture CompanyDocument56 pagesCaso Glen Mount Furniture CompanyJanetCruces100% (2)

- Tugas 2Document2 pagesTugas 2Silvia Fudjiyani79No ratings yet

- AccountancyDocument3 pagesAccountancyJil Macasaet50% (2)

- BYDDDocument25 pagesBYDDandre.torresNo ratings yet

- Firm Price Shares Deckers Outdoor Nike Timberland Columbia SportswearDocument9 pagesFirm Price Shares Deckers Outdoor Nike Timberland Columbia SportswearKshitishNo ratings yet

- UEFA Financial Fair Play, Club Toolkit 2013Document110 pagesUEFA Financial Fair Play, Club Toolkit 2013Tifoso BilanciatoNo ratings yet

- AS 24 Discontinuing OperationsDocument10 pagesAS 24 Discontinuing OperationsakulamNo ratings yet

- Anisa Muzaqi 4c Lat 22 Castleman Holdings, IncDocument6 pagesAnisa Muzaqi 4c Lat 22 Castleman Holdings, Incanisa MuzaqiNo ratings yet

- Solutions - Long-Term Construction ContractsDocument19 pagesSolutions - Long-Term Construction Contractskaren perrerasNo ratings yet

- Conservatism in Accounting - Ross L WattsDocument39 pagesConservatism in Accounting - Ross L WattsDekri FirmansyahNo ratings yet

- IFRS 15 Q and ADocument27 pagesIFRS 15 Q and AaliNo ratings yet

- KMF ProjectDocument90 pagesKMF Projectsuh99as67% (3)

- Chapter 10Document55 pagesChapter 10Duong Duc Ngoc (K17 HL)No ratings yet

- ch02 PenmanDocument31 pagesch02 PenmansaminbdNo ratings yet

- Ias 27 KPMGDocument16 pagesIas 27 KPMGAgha AsadNo ratings yet

- Balance Sheet: ASAT31 MARCH, 2017Document2 pagesBalance Sheet: ASAT31 MARCH, 2017Mandeep BatraNo ratings yet

- Management Accounting Tauseef A.Qureshi Assignment No 5 (Budgeting) Problem No 1: (Gulick Company)Document9 pagesManagement Accounting Tauseef A.Qureshi Assignment No 5 (Budgeting) Problem No 1: (Gulick Company)Mustafa ArshadNo ratings yet

- Abm - 12 - Fabm2 - q1 - Clas2 - Prep of Sci - v8 - Rhea Ann NavillaDocument22 pagesAbm - 12 - Fabm2 - q1 - Clas2 - Prep of Sci - v8 - Rhea Ann NavillaKim Yessamin MadarcosNo ratings yet

- Activity No. 4 - Attach Your Activity With The Filename SURNAME - SECTION - ACT#4Document3 pagesActivity No. 4 - Attach Your Activity With The Filename SURNAME - SECTION - ACT#4-st3v3craft-No ratings yet

- CH 3Document63 pagesCH 3fahdmohammed707No ratings yet

- CMA-Unit 5 - Absorbtion Costing, Operation Costing & by Product Costing - 18-19Document23 pagesCMA-Unit 5 - Absorbtion Costing, Operation Costing & by Product Costing - 18-19rohit vermaNo ratings yet

- Investment Accounts: Attempt Wise AnalysisDocument54 pagesInvestment Accounts: Attempt Wise AnalysisJaveedNo ratings yet

- PMBA - Quiz # 6 - SolutionDocument4 pagesPMBA - Quiz # 6 - SolutionAli Shaharyar ShigriNo ratings yet

- Financial Statements For Decision Making: Powerpoint Presentation by Phil Johnson ©2015 John Wiley & Sons Australia LTDDocument30 pagesFinancial Statements For Decision Making: Powerpoint Presentation by Phil Johnson ©2015 John Wiley & Sons Australia LTDShiTheng Love UNo ratings yet