0% found this document useful (0 votes)

194 views3 pagesChan Accounting Financial Report 20CY

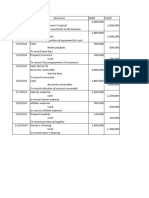

The statement of financial position shows that as of December 31, 20CY, Chan Accounting Firm had total assets of ₱1,599,000 consisting of current assets such as cash, accounts receivable, and prepaid rent. Total liabilities included accounts payable and notes payable. Owner's equity included capital contributions from C. Chan and retained earnings. The income statement shows the firm had professional fee revenues of ₱495,000 for the year and net income of ₱379,000 after expenses such as salaries, utilities, representation, and permits & licenses.

Uploaded by

Irishjosane AgorCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

194 views3 pagesChan Accounting Financial Report 20CY

The statement of financial position shows that as of December 31, 20CY, Chan Accounting Firm had total assets of ₱1,599,000 consisting of current assets such as cash, accounts receivable, and prepaid rent. Total liabilities included accounts payable and notes payable. Owner's equity included capital contributions from C. Chan and retained earnings. The income statement shows the firm had professional fee revenues of ₱495,000 for the year and net income of ₱379,000 after expenses such as salaries, utilities, representation, and permits & licenses.

Uploaded by

Irishjosane AgorCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd