Professional Documents

Culture Documents

Claim Relevent Documents

Uploaded by

Pankaj GuptaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Claim Relevent Documents

Uploaded by

Pankaj GuptaCopyright:

Available Formats

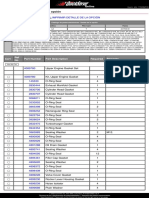

For Commercial vehicles Date : 16.10.

21

1. Duly filled claim Form ( Insured sign & company rubber stamp affixed (if insured is in

the name of company)

2. Insurance Claim Intimation Letter

3. Insurance Paper

4. Satisfaction Voucher – If Cashless

5. Repairer estimate Copy with stamp

6. Registration Certificate

7. Driving License

8. Tax token

9. Fitness Certificate ( Valid for 2 years for new vehicles and then it has to renewed every year)

10. Permit Copy ( If GVW more than 3000 kgs ) ( National & State ) ( Permit is valid for 5 years )

11. Authorization ( For National Permit ) Authorisation is valid for 1 year and has to be renewed

yearly

12. No of occupant in the vehicle at the time of accident

13. Nature and Weight of Goods Carried ( For Goods Carrying Vehicle )

14. Purpose of use of vehicle at the time of Accident

15. Any TP Injury and Property Damages

16. Any GDE/FIR Reported to police

17. Vehicle Was Loaded or Empty at the time of Accident ( If Loaded the Load Challan Required )

Invoice copy of Goods carried & Lorry Receipt ( LR ) Showing Consignment Details

18. Any Spot Photos

19. Company may ask for additional documents and /or clarification/Information if any,

depending on the requirement of the claim.

20. Cashless facility will be arranged if required documents are in order.

Special Cases

21. If in vehicle loaded Hazardous Item ( Then Required permit & Hazardous DL )

22. Trip Sheet ( For Passenger Carrying Vehicle ) – Showing List of all passenger in the board

For Motor Commercial Vehicle Carrying Hazardous Goods / chemicals

23. Driver Training For Handling Hazardous Goods – certificate From Govt. Authorisation

Training Institute

24. Driving License With Hazardous Endorsement ( Valid For One Year )

25. Permit/License to Carry Hazardous /Uncontrolled Goods

Documents Required After Repair to Vehicle And at the Time of Claim Settlement

Original Bills/ Tax Invoices for Repairs – With Seal & Sign of Garage

Bill / Receipt For Towing Charges If Any

Money Receipt ( For Insured Payment ) - With Seal & Sign of Garage

For Claims above Rs. 1 Lakh – Insured Pan Card , Aadhar Card or Any Other Address Proof

Documents Required For Compulsory Personal Accident ( CPA ) Personal Accident (

PA ) Claim Under Motor Insurance Third Party Section

Death Certificate

Post Mortem Report

Disability Certificate with Injury Report

Details of Hospitalization with Details of Treatment

FIR/ Police Punchnama Report

Police Final Report / Charge Sheet

Legal Heir Certificate/ Succession Certificate

Above all Things taken from https://www.policyfactory.in/

For Private Car

1. Duly filled claim Form ( Insured sign & company rubber stamp affixed (if insured is in

the name of company)

2. Insurance Claim Intimation Letter

3. Insurance Paper

4. Satisfaction Voucher – If Cashless

5. Repairer estimate Copy with stamp

6. Registration Certificate

7. Driving License

8. Tax token

9. Towing Bill

10. Repairer Bill With Seal and Sign ( Original / Copy )

11. Payment Confirmation ( Repairer/ Insured) If insured Money receipt Required

For Two Wheeler

1. Duly filled claim Form ( Insured sign & company rubber stamp affixed (if insured is in

the name of company)

2. Insurance Claim Intimation Letter

3. Insurance Paper

4. Satisfaction Voucher – If Cashless

5. Repairer estimate Copy with stamp

6. Registration Certificate

7. Driving License

8. Tax token.

9. Towing Bill

10. Repairer Bill With Seal and Sign ( Original / Copy )

11. Payment Confirmation ( Repairer/ Insured) If insured Money receipt Required

You might also like

- Kubota l185 l235 l245 l275 l285 l295 l305 l345 l355 Shop ManualDocument63 pagesKubota l185 l235 l245 l275 l285 l295 l305 l345 l355 Shop ManualMarinaNo ratings yet

- NOC-APPLICATIONDocument3 pagesNOC-APPLICATIONWynette Winny Williams100% (7)

- Deutz Engine Sl4640 Sl4840 Sl5640 Sl6640 Skid Loader Parts ManualDocument8 pagesDeutz Engine Sl4640 Sl4840 Sl5640 Sl6640 Skid Loader Parts Manualirma100% (44)

- Isuzu Truck Fault Codes List PDFDocument1 pageIsuzu Truck Fault Codes List PDFel_ectro83% (6)

- Morrow Project Light Vehicle XR-311Document1 pageMorrow Project Light Vehicle XR-311DDTWilson100% (1)

- RTA FormDocument14 pagesRTA Formsayed69No ratings yet

- Motor Insurance Claim FormDocument2 pagesMotor Insurance Claim FormKancharla Naveen Reddy0% (1)

- Steam Engine Muncaster-06Document4 pagesSteam Engine Muncaster-06Алексей МоисеевNo ratings yet

- Manual CessnaDocument74 pagesManual CessnaoscarNo ratings yet

- Motor Claim FormDocument3 pagesMotor Claim FormYCMOUNo ratings yet

- 1APIPCDocument217 pages1APIPCmarioNo ratings yet

- 0000002-Spot Survey ReportDocument9 pages0000002-Spot Survey ReportPankaj GuptaNo ratings yet

- CentrifugalandAxialCompressorControlInstructorsGuide 1Document133 pagesCentrifugalandAxialCompressorControlInstructorsGuide 1Abelio TavaresNo ratings yet

- Register your vehicle onlineDocument2 pagesRegister your vehicle onlineLachlanNo ratings yet

- Motor Claim FormDocument3 pagesMotor Claim FormjavednjavedNo ratings yet

- Toyota Pallet Trucks 8HBW30, 8HBE30, 8HBE40, 8HBC30, 8HBC40, 8TB50 Service ManualDocument46 pagesToyota Pallet Trucks 8HBW30, 8HBE30, 8HBE40, 8HBC30, 8HBC40, 8TB50 Service ManualОлег Складремонт75% (4)

- Toyota BT Traigo 9FBMK20T-35T Chapter 10 (Body and Frame) Service TrainingDocument8 pagesToyota BT Traigo 9FBMK20T-35T Chapter 10 (Body and Frame) Service TrainingDennis SteinbuschNo ratings yet

- Operation Manual for Diesel Engine Model 6MD27.5CHDocument73 pagesOperation Manual for Diesel Engine Model 6MD27.5CHFahmi WahyudheeNo ratings yet

- Question 1bDocument14 pagesQuestion 1bPankaj GuptaNo ratings yet

- Guide For Principles and Practice of Insurance and Survey & Loss AssessmentDocument18 pagesGuide For Principles and Practice of Insurance and Survey & Loss AssessmentPankaj Gupta0% (1)

- Guide For Principles and Practice of Insurance and Survey & Loss AssessmentDocument18 pagesGuide For Principles and Practice of Insurance and Survey & Loss AssessmentPankaj Gupta0% (1)

- Motor Claim FormDocument4 pagesMotor Claim FormAnsh SharmaNo ratings yet

- Delhi Rto Information On Vehicle RegistrationDocument8 pagesDelhi Rto Information On Vehicle Registrationabhishek.mishrajiNo ratings yet

- Form 20Document5 pagesForm 20virginvimalNo ratings yet

- Shriram Claim FormDocument2 pagesShriram Claim FormvrevatienterprisesNo ratings yet

- Q A For LL ExamDocument12 pagesQ A For LL ExamSri SaiNo ratings yet

- Declaration by Owner: Letter of UndertakingDocument2 pagesDeclaration by Owner: Letter of UndertakingpagaqNo ratings yet

- RC Transfer in HaryanaDocument7 pagesRC Transfer in HaryanaRajesh UpadhyayNo ratings yet

- Register Vehicle FormDocument4 pagesRegister Vehicle FormJSmth SmithNo ratings yet

- CafDocument3 pagesCafRamasubramanian KRNo ratings yet

- Sbi Claim FormDocument4 pagesSbi Claim FormvrevatienterprisesNo ratings yet

- Form 2 - Siddharth Pankaj Mishra: Particulars To Be Furnished by The ApplicantDocument3 pagesForm 2 - Siddharth Pankaj Mishra: Particulars To Be Furnished by The ApplicantSid MishraNo ratings yet

- Form 28 NOC ApplicationDocument2 pagesForm 28 NOC ApplicationAshish GulatiNo ratings yet

- General InsuranceDocument4 pagesGeneral InsuranceNAKSHA007100% (1)

- Claim Underwriting Guide LineDocument7 pagesClaim Underwriting Guide LineDhin Mohammed MorshedNo ratings yet

- Procedure For Re-Registration of (PVT.) Vehicle:: Form 60Document2 pagesProcedure For Re-Registration of (PVT.) Vehicle:: Form 60Abhishek ChaturvediNo ratings yet

- Traffic Act Form XiDocument2 pagesTraffic Act Form Xiuntoni100% (2)

- To Be Filled at The Time of Applying For Permanent LicenceDocument2 pagesTo Be Filled at The Time of Applying For Permanent Licencejogender kumarNo ratings yet

- Cancel Vehicle Ship RegistrationDocument2 pagesCancel Vehicle Ship RegistrationPiter WijayaNo ratings yet

- Claim Form For Motor Vehicle: Information About InsuredDocument2 pagesClaim Form For Motor Vehicle: Information About Insurednaveen chauhanNo ratings yet

- Audi ABC Courtesy Car AgreementDocument3 pagesAudi ABC Courtesy Car AgreementManishNo ratings yet

- F3523 CFDDocument2 pagesF3523 CFDAdam Scott MillerNo ratings yet

- LBU F VL MR9 VehicleTransferDocument6 pagesLBU F VL MR9 VehicleTransferYhr YhNo ratings yet

- Importer Terms and Agreement Form Rev01Document7 pagesImporter Terms and Agreement Form Rev01Simbi PierreNo ratings yet

- DD 1Document2 pagesDD 1Rebecca CooperNo ratings yet

- LBU F VL MR9 VehicleTransferDocument6 pagesLBU F VL MR9 VehicleTransferChristopher RusliNo ratings yet

- Form 28Document3 pagesForm 28naresh singlaNo ratings yet

- LBU F VL MR9 Vehicle TransferDocument6 pagesLBU F VL MR9 Vehicle TransferGordon Bruce100% (1)

- Form of Application For Registration of A Motor VehicleDocument4 pagesForm of Application For Registration of A Motor VehicleAnant BhardwajNo ratings yet

- E0864V17 SDApplicationForMotorVehicleTitle&RegistrationDocument2 pagesE0864V17 SDApplicationForMotorVehicleTitle&RegistrationVladimir Olvera EstévezNo ratings yet

- Motor Claim Form Reliance General InsuranceDocument4 pagesMotor Claim Form Reliance General InsurancePraveen VanamaliNo ratings yet

- New LicenceDocument5 pagesNew LicenceSharath ChandraNo ratings yet

- Registration of Ownership TranferDocument6 pagesRegistration of Ownership TranferIronHeart MulaaferNo ratings yet

- Vehicle Registration Transfer Application: Information SheetDocument5 pagesVehicle Registration Transfer Application: Information SheetMatt CarltonNo ratings yet

- Req+Form New+CPCDocument2 pagesReq+Form New+CPCKathryna ZamosaNo ratings yet

- Registration FormDocument4 pagesRegistration FormGKGKGOKUL07No ratings yet

- Application for NOC transferDocument2 pagesApplication for NOC transferKumardasNsNo ratings yet

- Deputy Controller, Legal Metrology, Odisha BhubaneswarDocument6 pagesDeputy Controller, Legal Metrology, Odisha Bhubaneswarthe creationNo ratings yet

- Haulage Proposal Form: Please Complete Using Block CapitalsDocument2 pagesHaulage Proposal Form: Please Complete Using Block CapitalsOlajide DINo ratings yet

- Form 1 13093Document3 pagesForm 1 13093Abhishek KalyankarNo ratings yet

- New LicenceDocument5 pagesNew LicenceSagarChedeNo ratings yet

- Form 28 (SEE RULES 54,58 (1), (3) AND (4) ) Application and Grant of No Objection CertificateDocument2 pagesForm 28 (SEE RULES 54,58 (1), (3) AND (4) ) Application and Grant of No Objection CertificateRajesh NaiduNo ratings yet

- Vehicle Damage or Theft-Contract# 14496Document2 pagesVehicle Damage or Theft-Contract# 14496activedeenNo ratings yet

- Form 31: Application For Transfer of Ownership in The Name of The Person Succeeding To The Possession of The VehicleDocument2 pagesForm 31: Application For Transfer of Ownership in The Name of The Person Succeeding To The Possession of The VehiclemohamedNo ratings yet

- Conditions To Rent A CarDocument3 pagesConditions To Rent A CarMarie BalberanNo ratings yet

- Auto InsuranceDocument5 pagesAuto InsuranceAkshay AggarwalNo ratings yet

- ia-2021.01.20-16.22-NTI Commercial Motor Claim FormDocument4 pagesia-2021.01.20-16.22-NTI Commercial Motor Claim FormJennifer McPhersonNo ratings yet

- MV Registration VehicleDocument3 pagesMV Registration VehicleKhak UsNo ratings yet

- 30532b07-b685-4965-9aa3-6bcb1f9e9247Document3 pages30532b07-b685-4965-9aa3-6bcb1f9e9247mdiftikharhussain019No ratings yet

- Declaration by Owner: Letter of UndertakingDocument2 pagesDeclaration by Owner: Letter of UndertakingHer MayNo ratings yet

- Motor Odpt Claims Document ChecklistDocument2 pagesMotor Odpt Claims Document ChecklistRAJA DURGA RAONo ratings yet

- The Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsFrom EverandThe Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsNo ratings yet

- Rat Bite CircularDocument1 pageRat Bite CircularPankaj GuptaNo ratings yet

- Introduction To Hull ClaimsDocument68 pagesIntroduction To Hull ClaimsPankaj GuptaNo ratings yet

- Body Parts Remove & Refit Labor Schedule - Tier 4Document4 pagesBody Parts Remove & Refit Labor Schedule - Tier 4ADHAR SHARMANo ratings yet

- Body Parts Remove & Refit Labor Schedule - Tier 4Document4 pagesBody Parts Remove & Refit Labor Schedule - Tier 4ADHAR SHARMANo ratings yet

- GLOSTERDocument2 pagesGLOSTERPankaj GuptaNo ratings yet

- 39 - Wallet Insurance PolicyDocument21 pages39 - Wallet Insurance PolicyPankaj GuptaNo ratings yet

- Ramnad Ragu Splendour Renewal 202223Document2 pagesRamnad Ragu Splendour Renewal 202223vimka eximsNo ratings yet

- Ev ZSDocument2 pagesEv ZSPankaj GuptaNo ratings yet

- Complete Health Insurance Brochure PDFDocument16 pagesComplete Health Insurance Brochure PDFjohnnokiaNo ratings yet

- A2 - Painting ScheduleDocument1 pageA2 - Painting SchedulePankaj GuptaNo ratings yet

- Surveyor Portal PartwiseDocument32 pagesSurveyor Portal PartwisePankaj GuptaNo ratings yet

- ICICI Lombard Health Insurance iHealth Plan BrochureDocument5 pagesICICI Lombard Health Insurance iHealth Plan BrochurePankaj GuptaNo ratings yet

- 39 - Wallet Insurance PolicyDocument21 pages39 - Wallet Insurance PolicyPankaj GuptaNo ratings yet

- Complete Health Insurance BrochureDocument21 pagesComplete Health Insurance BrochurePankaj GuptaNo ratings yet

- Complete Health Insurance BrochureDocument21 pagesComplete Health Insurance BrochurePankaj GuptaNo ratings yet

- English Health Claim Form L1Document5 pagesEnglish Health Claim Form L1Gaurav TharejaNo ratings yet

- Introduction To General Insurance: Chapter - 1Document4 pagesIntroduction To General Insurance: Chapter - 1Pankaj GuptaNo ratings yet

- Group Health Insurance Customer Information Sheet: ICICI Lombard General Insurance Company LimitedDocument29 pagesGroup Health Insurance Customer Information Sheet: ICICI Lombard General Insurance Company LimitedPankaj GuptaNo ratings yet

- TNSCERT - Basic Automobile Engineering - Thoery English Medium - 20.5.18 PDFDocument248 pagesTNSCERT - Basic Automobile Engineering - Thoery English Medium - 20.5.18 PDFjai_selvaNo ratings yet

- Complete Health Insurance BrochureDocument21 pagesComplete Health Insurance BrochurePankaj GuptaNo ratings yet

- No Fault Liability: Section 3: Chapter ThreeDocument5 pagesNo Fault Liability: Section 3: Chapter ThreePankaj GuptaNo ratings yet

- iHEALTH policy detailsDocument22 pagesiHEALTH policy detailsInfo KindlyNo ratings yet

- Time Table 2020-Final - A4Document1 pageTime Table 2020-Final - A4sumedhNo ratings yet

- Extraordinary II - (I) PART II-Section 3-Sub-Section (I) : REGD. NO. D. L.-33004/99Document2 pagesExtraordinary II - (I) PART II-Section 3-Sub-Section (I) : REGD. NO. D. L.-33004/99Pankaj GuptaNo ratings yet

- 55.FLOP - Policy WordingDocument34 pages55.FLOP - Policy Wordingmib_santoshNo ratings yet

- SYKES - QSCP100i X Perkins 404C-2.2 Maintenance Manual - CoatesDocument104 pagesSYKES - QSCP100i X Perkins 404C-2.2 Maintenance Manual - CoatesISRAEL GONZALESNo ratings yet

- Cummins Jgo Emp Superior 4089870Document1 pageCummins Jgo Emp Superior 4089870Alexis SanchezNo ratings yet

- No Faster Prop On The Water: Step 1. Engine/DRIVE Step 2. Installation Kit Step 3. PropellerDocument2 pagesNo Faster Prop On The Water: Step 1. Engine/DRIVE Step 2. Installation Kit Step 3. PropellerjitmarineNo ratings yet

- Starter Motors Buyer's Guide for 246-31 PLGR SeriesDocument8 pagesStarter Motors Buyer's Guide for 246-31 PLGR SeriesJose luis ConsuegraNo ratings yet

- Atlas Copco Rental: 100% Oll-Free Air Compressor Diesel DrivenDocument1 pageAtlas Copco Rental: 100% Oll-Free Air Compressor Diesel DrivenpowermanagerNo ratings yet

- BackfireDocument5 pagesBackfireahmad adelNo ratings yet

- GSX-R1000 (UF/Z/ZUF) L3: Parts CatalogueDocument277 pagesGSX-R1000 (UF/Z/ZUF) L3: Parts CatalogueRea Cleare TampusNo ratings yet

- Failuresinatypicaldrillingmudpump PDFDocument5 pagesFailuresinatypicaldrillingmudpump PDFchemsNo ratings yet

- SKODA Webasto Comfort' Air-Conditioning ControlDocument14 pagesSKODA Webasto Comfort' Air-Conditioning ControlgigipreshNo ratings yet

- Automotive Air Conditioning ThesisDocument8 pagesAutomotive Air Conditioning Thesiscindyturnertorrance100% (2)

- Spare Parts List STORM 15 20180000 XDocument4 pagesSpare Parts List STORM 15 20180000 XFati ZoraNo ratings yet

- 744K Series II (PIN: 1DW744K - CXXXXXX-) 744K Series II (PIN: 1DW744K - DXXXXXX-)Document2 pages744K Series II (PIN: 1DW744K - CXXXXXX-) 744K Series II (PIN: 1DW744K - DXXXXXX-)John GrayNo ratings yet

- Modern Circuit Breakers and Reclosers Free Electrical Engineering Xyz Whitepaper PDFDocument24 pagesModern Circuit Breakers and Reclosers Free Electrical Engineering Xyz Whitepaper PDFm khNo ratings yet

- Manual Bomba Godwin CD100MDocument55 pagesManual Bomba Godwin CD100MLiubka Otaiza67% (3)

- 2800 Series: 2806A-E18TAG3Document2 pages2800 Series: 2806A-E18TAG3Mohammed AfwanNo ratings yet

- AG TransmissionsDocument13 pagesAG Transmissionssunthron somchaiNo ratings yet

- Product DataDocument23 pagesProduct DataAleksandar IlkovskiNo ratings yet

- Team Kit Assembly GuideDocument34 pagesTeam Kit Assembly GuideacaberinNo ratings yet

- Quotation-Automatic Napkin Tissue Production LineDocument7 pagesQuotation-Automatic Napkin Tissue Production LineRAUL lopezNo ratings yet