Professional Documents

Culture Documents

Valuation Index Group

Uploaded by

baongan230620030 ratings0% found this document useful (0 votes)

5 views2 pagesOriginal Title

20

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views2 pagesValuation Index Group

Uploaded by

baongan23062003Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

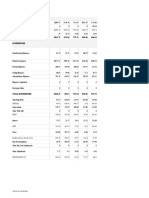

Financial

2020 2021 2022

index - PLC

Valuation index group

Earnings per share for the last VND 1,829.78 2,159.40 1,447.54

Book value of shares (BVPS) VND 15,551.06 16,999.24 15,206.47

Market price to earnings ratio ( Time 15.85 19.17 15.54

Market price to book value inde Time 1.86 2.44 1.48

Market price to net revenue ind Time 0.42 0.49 0.21

Dividend yield % 9 first twelfth

Beta Time 0.56 0.85 1.2

Enterprise value over profit be Time 11.92 15.5 11.29

Enterprise value over profit be Time

Profit index group

Gross profit margin % 16.97 13.61 12.69

EBIT margin % 5.28 4.24 3.13

EBITDA margin % 7.04 5.81 4.32

Rate of return on net revenue % 2.64 2.54 1.36

Return on average equity (RO % 11.47 13.27 8.99

Average long-term return on ca % 21.62 21.81 20.63

Return on average assets (RO % 3.23 3.66 2.48

Growth index group

Net revenue growth % -8.95 22.47 25.23

Gross profit growth % 13.2 -1.73 16.71

Pre-tax profit growth % 2.47 16.2 -16.5

Growth in profit after tax of p % 1.84 18.01 -32.97

Growth in total assets % 5.32 2.68 -4.28

Long-term debt growth % -64.98 -97.19 346.87

Liabilities growth % 9.64 0.26 -1.79

Equity growth % -4.94 9.31 -10.55

Charter capital growth %

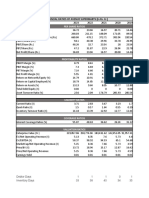

Liquidity index group

Cash payout ratio Time 0.21 0.11 0.16

Quick ratio Time 0.74 0.73 0.67

Quick ratio (Excluding inventor Time 0.34 0.31 0.23

Current ratio (short term) Time 1.04 1.1 1.09

Ability to pay interest Time 2.79 4.12 3.17

Performance index group

Customer receivable turnover Ring 3.54 4.38 5.23

Average customer collection ti Day 103.11 83.42 69.82

Inventory turnover Ring 4.59 5.19 5.61

Average inventory period Day 79.59 70.37 65.09

Supplier payable turnover Ring 3.49 3.85 4.84

Average customer payment tim Day 104.61 94.92 75.38

Fixed asset turnover (Efficiency Ring 6.81 8.09 11

Total asset turnover (Efficiency Ring 1.22 1.44 1.82

Equity turnover Ring 4.35 5.22 6.61

Financial Leverage index group

Ratio of Current Debt to Total Li % 98.79 99.97 99.85

Debt to Total Assets Ratio % 40.09 32.08 38.32

Debt to Total Assets Ratio % 73.28 71.55 73.41

Ratio of Equity to Total Assets % 26.72 28.45 26.59

Current Debt to Equity Ratio % 270.91 251.42 275.7

Debt to Equity Ratio % 150.01 112.75 144.14

Debt to Equity Ratio % 274.22 251.51 276.13

Cash Flow index group

Ratio of operating cash flow to % 8.59 4.77 -4.37

Ability to pay short-term debt f % 14.16 9.48 -11.1

Ability to pay short-term debt f % 8.33 -9.31 5.15

Accrual Ratio (Balanced Accou % -17.29

Accrual Ratio (Cash Flow Meth % -6.1

Cash flow from operating activit % 10.25 6.78 -8.13

Cash flow from operating activit % 38.35 23.84 -30.59

Cash flow from operating activit % 268.72 154.4 -200.27

Ability to pay debt from operati % 13.99 9.48 -11.08

Cash flow from operating activi VND 5,964.09 4,052.86 -4,652.13

Cost Structure

Cost of goods sold/Net revenu % 83.03 86.39 87.31

Selling expenses/Net revenue % 9.42 7.9 7.09

Business management costs/N % 3.64 2.73 1.67

Interest expense/Net revenue % 1.89 1.03 0.99

Short-term Asset Structure

Short-term assets/Total assets % 75.51 78.35 79.77

Cash/Short-term assets % 19.67 9.94 14.92

Short-term financial investment % 12.94 18.44 5.93

Short-term receivables/Short-t % 36.69 37.24 38.85

Inventory/Current Assets % 29.32 32.96 38.84

Other short-term assets/Curren % 1.37 1.42 1.47

Long-term Asset Structure

Long-term assets/Total assets % 24.49 21.65 20.23

Fixed assets/Total assets % 18.71 16.96 16.12

Tangible fixed assets/Fixed as % 99.51 99.57 99.48

Financial leased assets/Fixed % 0

Intangible assets/Fixed assets % 0.49 0.43 0.52

XDCBDD/Fixed assets % 5.93 3.78 5.01

You might also like

- Albermarle Financial ModelDocument38 pagesAlbermarle Financial ModelParas AroraNo ratings yet

- Candlestick Chart PatternsDocument60 pagesCandlestick Chart Patternskrunal solanki100% (3)

- Fintech in Africa 1675424459Document207 pagesFintech in Africa 1675424459Serge Kanga100% (1)

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachFrom EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachRating: 3 out of 5 stars3/5 (3)

- Finance Tata Chemicals LTDDocument5 pagesFinance Tata Chemicals LTDzombeeeeNo ratings yet

- NISM Series VIII - Equity Derivatives Certification Examination Workbook - May 2023Document204 pagesNISM Series VIII - Equity Derivatives Certification Examination Workbook - May 2023kamali varNo ratings yet

- Bank Statement Summary for Ms. Prodduturi SrilekhaDocument15 pagesBank Statement Summary for Ms. Prodduturi SrilekhaSrilekha ProdduturiNo ratings yet

- Ratios FinDocument30 pagesRatios Fingaurav sahuNo ratings yet

- Ratios FinDocument16 pagesRatios Fingaurav sahuNo ratings yet

- Ratios FinancialDocument16 pagesRatios Financialgaurav sahuNo ratings yet

- Investment Valuation Ratios Over 5 YearsDocument16 pagesInvestment Valuation Ratios Over 5 Yearsgaurav sahuNo ratings yet

- Marico RatiosDocument8 pagesMarico RatiosAmarnath DixitNo ratings yet

- Investment Valuation Ratios TableDocument4 pagesInvestment Valuation Ratios Tablehoney08priya1No ratings yet

- RanbaxyDocument2 pagesRanbaxyamit_sachdevaNo ratings yet

- Key Financial Ratios of Bharat Heavy Electricals - in Rs. Cr.Document6 pagesKey Financial Ratios of Bharat Heavy Electricals - in Rs. Cr.Virangad SinghNo ratings yet

- Ankita CFDocument3 pagesAnkita CFRahul YadavNo ratings yet

- NestleDocument4 pagesNestleNikita GulguleNo ratings yet

- VietstockFinance VPG Bao-Cao-Tai-Chinh CSTC 20230824-091458Document7 pagesVietstockFinance VPG Bao-Cao-Tai-Chinh CSTC 20230824-091458thaiNo ratings yet

- Ratios Micro TilDocument1 pageRatios Micro TilVeronica BaileyNo ratings yet

- Shinansh TiwariDocument11 pagesShinansh TiwariAnuj VermaNo ratings yet

- State Bank of India: Key Financial Ratios - in Rs. Cr.Document4 pagesState Bank of India: Key Financial Ratios - in Rs. Cr.zubairkhan7No ratings yet

- Equity Share Data HDFC Bank Mar-20 SBI Mar-19 HDFC Bank/ SBIDocument8 pagesEquity Share Data HDFC Bank Mar-20 SBI Mar-19 HDFC Bank/ SBIAkshaya LakshminarasimhanNo ratings yet

- Project Work FinanceDocument18 pagesProject Work Financeaqsarana ranaNo ratings yet

- Financial Ratios Over 5 YearsDocument2 pagesFinancial Ratios Over 5 YearsKishan KeshavNo ratings yet

- Previous Years : L&T Finance Holding SDocument6 pagesPrevious Years : L&T Finance Holding Srahul gargNo ratings yet

- Annual Accounts 2021Document11 pagesAnnual Accounts 2021Shehzad QureshiNo ratings yet

- RatiosDocument2 pagesRatiosnishantNo ratings yet

- Working Excel - BASFDocument3 pagesWorking Excel - BASFVikin JainNo ratings yet

- Financial Ratios Analysis of Company from 2018-2021Document12 pagesFinancial Ratios Analysis of Company from 2018-2021AkshitNo ratings yet

- Financial Ratios of Federal BankDocument35 pagesFinancial Ratios of Federal BankVivek RanjanNo ratings yet

- DR Reddy RatiosDocument6 pagesDR Reddy RatiosRezwan KhanNo ratings yet

- Mehran Sugar Mills - Six Years Financial Review at A GlanceDocument3 pagesMehran Sugar Mills - Six Years Financial Review at A GlanceUmair ChandaNo ratings yet

- Key Financial Ratios of NTPC: - in Rs. Cr.Document3 pagesKey Financial Ratios of NTPC: - in Rs. Cr.Vaibhav KundalwalNo ratings yet

- Balaji TelefilmsDocument23 pagesBalaji TelefilmsShraddha TiwariNo ratings yet

- Excel Brittaniya 2Document3 pagesExcel Brittaniya 2Adnan LakdawalaNo ratings yet

- MaricoDocument13 pagesMaricoRitesh KhobragadeNo ratings yet

- Financial Ratios of AbbotDocument1 pageFinancial Ratios of AbbotAhmad RazaNo ratings yet

- Reliance GuriDocument2 pagesReliance GurigurasisNo ratings yet

- Project of Tata MotorsDocument7 pagesProject of Tata MotorsRaj KiranNo ratings yet

- Tata Motors: Previous YearsDocument5 pagesTata Motors: Previous YearsHarsh BansalNo ratings yet

- Ratio Analysis Compares Liquidity, Efficiency, Leverage and Profitability of HUL and ITCDocument2 pagesRatio Analysis Compares Liquidity, Efficiency, Leverage and Profitability of HUL and ITCSuryakantNo ratings yet

- Financial Management Report FPT Corporation: Hanoi University Faculty of Management and TourismDocument18 pagesFinancial Management Report FPT Corporation: Hanoi University Faculty of Management and TourismPham Thuy HuyenNo ratings yet

- Eq+ RS /Eq+RS+Dbt K 9.14 Equity Portion 0.62 Debt Portion 0.38Document17 pagesEq+ RS /Eq+RS+Dbt K 9.14 Equity Portion 0.62 Debt Portion 0.38sandipandas2004No ratings yet

- Axis RatioDocument5 pagesAxis RatiopradipsinhNo ratings yet

- MarutiDocument2 pagesMarutiVishal BhanushaliNo ratings yet

- Praj Industries Ltd. - Research Center Balance Sheet AnalysisDocument19 pagesPraj Industries Ltd. - Research Center Balance Sheet AnalysisnehaNo ratings yet

- Gul Ahmad Textiles LimitedDocument3 pagesGul Ahmad Textiles LimitedmadihaNo ratings yet

- Total Capital and Liabilities: Asian Paints Kansai NerolacDocument7 pagesTotal Capital and Liabilities: Asian Paints Kansai Nerolacpreet100% (1)

- Nerolac - On Ratio - SolvedDocument6 pagesNerolac - On Ratio - Solvedricha krishnaNo ratings yet

- Punjab National Bank: BSE: 532461 - NSE: PNB - ISIN: INE160A01014 - Banks - Public SectorDocument7 pagesPunjab National Bank: BSE: 532461 - NSE: PNB - ISIN: INE160A01014 - Banks - Public Sectorsheph_157No ratings yet

- Consolidated Balance Sheet and Financial Ratios of Shri Dinesh MillsDocument12 pagesConsolidated Balance Sheet and Financial Ratios of Shri Dinesh MillsSurbhi KambojNo ratings yet

- Ratios andDocument1 pageRatios andankit sharmaNo ratings yet

- Per Share Ratios: Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05Document4 pagesPer Share Ratios: Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05alihayatNo ratings yet

- Reliance Industries LTD (RIL IN) - GrowthDocument8 pagesReliance Industries LTD (RIL IN) - GrowthMayank kapoorNo ratings yet

- Excel financial ratios Canara BankDocument12 pagesExcel financial ratios Canara Bankkapish1014No ratings yet

- Future RetailDocument15 pagesFuture RetailVaibhav SaithNo ratings yet

- Kapco LTD: For The Year Ended 2007Document10 pagesKapco LTD: For The Year Ended 2007Zeeshan AdeelNo ratings yet

- Fuji Foods Limited (Formerly Noon Pakistan Limited) Was IncorporatedDocument4 pagesFuji Foods Limited (Formerly Noon Pakistan Limited) Was IncorporatedALI SHER HaidriNo ratings yet

- Key Financial Ratios of Shree CementsDocument2 pagesKey Financial Ratios of Shree CementsTrollNo ratings yet

- Tata Motors Financial Analysis Case StudyDocument6 pagesTata Motors Financial Analysis Case StudySoumendra RoyNo ratings yet

- Key RatiosDocument6 pagesKey RatiosSumeet ChaurasiaNo ratings yet

- Financial Ratios of NHPCDocument2 pagesFinancial Ratios of NHPCsathish kumarNo ratings yet

- Financial Ratios of Zee Entertainment Over 5 YearsDocument2 pagesFinancial Ratios of Zee Entertainment Over 5 Yearssagar naikNo ratings yet

- CCS G4Document14 pagesCCS G4Harshit AroraNo ratings yet

- Financial Markets Institutions and Money 3rd Edition Kidwell Test BankDocument18 pagesFinancial Markets Institutions and Money 3rd Edition Kidwell Test Bankodiledominicmyfmf100% (27)

- Rohit TradeDocument14 pagesRohit Tradearpit200407No ratings yet

- Chapter 5 Setting Menu PriceDocument11 pagesChapter 5 Setting Menu PricemeltinaNo ratings yet

- Business ProposalDocument4 pagesBusiness Proposalzw8cvgxqhxNo ratings yet

- Chapter 6 - FS Analysis (Worksheet)Document6 pagesChapter 6 - FS Analysis (Worksheet)angelapearlrNo ratings yet

- Portfolio ManagementDocument26 pagesPortfolio ManagementNina CruzNo ratings yet

- Summary #17Document2 pagesSummary #17atika suriNo ratings yet

- Errors and Questionable Judgments in Analysts' DCF ModelsDocument37 pagesErrors and Questionable Judgments in Analysts' DCF ModelsSergiu CrisanNo ratings yet

- (Samsung Biologics) 2022 1st Quarter ReportDocument108 pages(Samsung Biologics) 2022 1st Quarter Report林正遠No ratings yet

- Chapter 6 Interest Formulas - Equal Payment Series 3.13 If You Desire To Withdraw The Following Amounts Over The Next Five Years From ADocument4 pagesChapter 6 Interest Formulas - Equal Payment Series 3.13 If You Desire To Withdraw The Following Amounts Over The Next Five Years From ACHEANG HOR PHENGNo ratings yet

- MS-44L (Capital Budgeting With Risks & Returns)Document18 pagesMS-44L (Capital Budgeting With Risks & Returns)juleslovefenNo ratings yet

- Pitch Deck FinalDocument13 pagesPitch Deck FinalShivam GuptaNo ratings yet

- Factiva 20230109 1309Document6 pagesFactiva 20230109 1309david kusumaNo ratings yet

- BAF2202-MANAGEMENT ACCOUNTING I TAKE AWAY CAT - EliotDocument6 pagesBAF2202-MANAGEMENT ACCOUNTING I TAKE AWAY CAT - EliotEliot umugwanezaNo ratings yet

- FV-Lump Sum PV-Lump Sum PV-Different Interest Rates Time To Double A Lump Sum TVM Comparisons Growth Rate FV-Ordinary Annuity FV-Annuity DueDocument10 pagesFV-Lump Sum PV-Lump Sum PV-Different Interest Rates Time To Double A Lump Sum TVM Comparisons Growth Rate FV-Ordinary Annuity FV-Annuity Duehoangyen260803No ratings yet

- Sujan Sir Assignment (MBA)Document18 pagesSujan Sir Assignment (MBA)Habibur RahmanNo ratings yet

- Technical Analysis Modern Perspectives CMT AssociationDocument45 pagesTechnical Analysis Modern Perspectives CMT Associationmonjedgogo0% (1)

- Basics of Financial AnalysisDocument17 pagesBasics of Financial AnalysisRy De VeraNo ratings yet

- GCR Rating Report - Zedcrest Capital LimitedDocument10 pagesGCR Rating Report - Zedcrest Capital LimitedTolulopeNo ratings yet

- Regulation of Financial SystemDocument39 pagesRegulation of Financial SystemRamil ElambayoNo ratings yet

- Financial Management Important QuestionsDocument3 pagesFinancial Management Important QuestionsSaba TaherNo ratings yet

- Group 3 - Business Plan SiswaniagaDocument25 pagesGroup 3 - Business Plan SiswaniagaNatasha TashaNo ratings yet

- Compensation Policy 2020 21Document14 pagesCompensation Policy 2020 21K. NikhilNo ratings yet

- Account TransactionDocument1 pageAccount Transactionblc groupNo ratings yet

- Manage cash flows effectivelyDocument4 pagesManage cash flows effectivelyRehanne M. MarohomNo ratings yet

- KSLU Company Law UNIT 1 AnswersDocument19 pagesKSLU Company Law UNIT 1 AnswersMG MaheshBabuNo ratings yet