Professional Documents

Culture Documents

The Financial Waves STU - 20210723

The Financial Waves STU - 20210723

Uploaded by

sandeep.tiwari1687Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Financial Waves STU - 20210723

The Financial Waves STU - 20210723

Uploaded by

sandeep.tiwari1687Copyright:

Available Formats

July 23, 2021

Bottom Line: Nifty witnessed V shaped recovery along with Gap up opening. The trend remains in the

consolidation range of 15620-15920 levels.

Latest Webinar – Nifty Neo Wave with OI and Volume Profile on YouTube channel @KyalAshish.

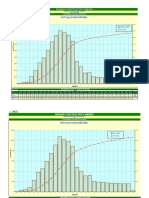

Nifty Daily chart:

NIFTY - Daily 22-07-2021 Open 15736.6, Hi 15834.8, Lo 15726.4, Close 15824 (1.2%) EMA1(Close,50) = 15,560.60

16,000

15,824

e

g 15,560.6

15,500

15,000

e

14,500

c f 14,000

f 13,500

d 13,000

12,500

c a

g 12,000

c e 11,500

b

Copyright, July 2021

f Waves Strategy Advisors

a 11,000

www.wavesstrategy.com

g d

55 Days Time Cycle

x

e b d 10,500

x

c

10,000

Jul Aug Sep Oct Nov Dec 2021 Feb Mar Apr May Jun Jul

f NIFTY - RSI(14) = 54.56

70

d

b 54.556

30

Created with AmiBroker - adv anced charting and technical analy sis sof tware. http://www.amibroker.com

1 www.wavesstrategy.com Mob: +919920422202

helpdesk@wavesstrategy.com Tel: +91 22 28831358

The Financial Waves Short term Update – July 23, 2021

Nifty 60 mins chart:

Wave analysis:

Nifty continued to trade with high volatility. First we saw breakout above 15900-15910 zone but then fell

sharply which took out the support of 15630 levels. Nevertheless, on a closing basis it managed to protect

this support level in Tuesday’s session. In yesterday’s session, it had a massive Gap up opening of almost

100 points post which it sustained above the same and continued to move higher for the rest of the day. By

end of the day, it managed to close with the huge gain of 191 points. From last few weeks, Nifty is hardly

trading in the range of 300-350 points however moves within this range is so powerful that one can be driven

by emotions and hence keeping a risk management is necessary.

It is always better to look at the Bank Nifty structure to understand the overall trend. In the last session

Bank Nifty too had strong Gap up opening similar to the Nifty however in the second half, it erased most of

the gains and closed at day’s low. Nifty closed near days high whereas Bank Nifty closed at day’s low. This

indicates that it is going to be crucial from hereon that how bank nifty is performing. Apart from this, sector

wise, Smallcap50 and Midcap50 continues to be under bull’s radar and gained 1.36% and 1.13% respectively.

IT, Media, Metal and Realty were the star performer. At the same time, India VIX came under pressure and

lost -9.99%.

On the daily chart, prices showed ‘V shaped’ recovery from the lower Bollinger Bands and formed bullish

candlestick pattern which has given close above prior bars high. Thereby, daily bias has reversed on upside.

Now on downside 15730 should act as crucial support.

Nifty reversed after closing above 15620 on previous day thereby managing to protect the weekly low on

closing basis so far. The fall was sharp towards 15630 levels but given the equal fast reversal on upside it

seems that the market will be stuck in a range for now and it is best to get clarity either for a close above

15920 or below 15620 levels. The sharp fall and sharp rise can result into a consolidation mode for now.

Recent price action suggest that both Bulls and Bears are getting trapped on either side and the trending

move is still awaited.

On 60 mins chart, we are showing the alternate possibility since past few days that after wave a the entire

2 www.wavesstrategy.com Mob: +919920422202

helpdesk@wavesstrategy.com Tel: +91 22 28831358

The Financial Waves Short term Update – July 23, 2021

sideways grinding was only wave b and now wave c on upside can start. However, this scenario will become

preferred once we see a decisive breakout above 15920 levels. On the other hand any move back below

15620 will keep the existing counts intact. Next 2 to 3 days will further confirm and a trending move is due

to emerge soon.

In short, Nifty continues to flirt near the important resistance and support areas which is keeping trend in

a consolidation. Till we do not see resumption of trend on either side, it is better to adopt range bound

strategy.

AXIS BANK daily chart:

AXISBANK - Daily 22-07-2021 Open 750.1, Hi 758.5, Lo 741, Close 747.15 (0.2%) EMA(Close,60) = 738.44

(e)

800

(g)

750

747.15

738.437

(c) (f) 700

650

(a)

(x) (x)

(d) 600

Copyright, July 2021

(b) Waves Strategy Advisors

www.wavesstrategy.com 550

b

500

450

a

400

c

(x)

Oct Nov Dec 2021 Feb Mar Apr May Jun Jul

AXISBANK - RSI(14) = 47.36

70

47.3553

30

Created with AmiBroker - adv anced charting and technical analy sis sof tware. http://www.amibroker.com

3 www.wavesstrategy.com Mob: +919920422202

helpdesk@wavesstrategy.com Tel: +91 22 28831358

The Financial Waves Short term Update – July 23, 2021

AXISBANK 60 mins chart:

AXISBANK - Hourly 22-07-2021 04:29:59 PM Open 747.15, Hi 747.15, Lo 747.15, Close

e 762.325

780

761.625

761.625

c 756.5 760

749.75

b 747.15

747.15740

a

d

d

720

700

Copyright, July 2021

f Waves Strategy Advisors 680

b

c www.wavesstrategy.com

660

640

g

e

(x) 620

May Jun Jul

AXISBANK - RSI(14) = 40.01

70

40.0098

30

Created with AmiBroker - adv anced charting and technical analy sis sof tware. http://www.amibroker.com

Wave analysis:

Axis Bank rally recently fizzled out near 775 levels and post that showed severe fall towards 740 levels in

last few sessions. This has brought back prices near to swing support area and it will be important to see if

this support holds or not.

As shown on the daily chart, there is high possibility that in the mid of April 2021 prices completed minor

wave (x) and post that third standard correction looks to be forming Neutral Triangle Pattern. The

completion of this pattern will be confirmed once we see faster move below 720 levels. RSI which gauges

the momentum is showing breakdown from the Head and Shoulder pattern is not a good sign over near term.

In the previous session closed near the trendline support and also near the 60 EMA support. Prices formed a

Doji like candle with long wicks on both sides of the candle indicating indecision over the trend direction.

As shown on hourly chart, minute wave f of Diametric pattern is currently ongoing on downside. We can see

RSI is already near the oversold levels and price is approaching the trendline support. A break above the

ichimoku cloud along with 760 level would indicate that wave f is in place and wave g has started on the

upside.

In short, Axis Bank is at extremely crucial juncture. Break above 760 can take prices towards 775 level

whereas any close below 740 will weaken the stock further towards 720 levels.

4 www.wavesstrategy.com Mob: +919920422202

helpdesk@wavesstrategy.com Tel: +91 22 28831358

The Financial Waves Short term Update – July 23, 2021

Muthoot Finance Daily chart:

MUTHOOTFIN - Daily 22-07-2021 Open 1539.95, Hi 1612, Lo 1532, Close 1606.4 (5.4%) Tenkan-sen (Conversion Line)

1,650

1,606.4

1,606.4

1,600

1,563

(iii) 1,550

1,529.2

1,500

(i) (iv) 1,450

1,436.8

(v)

X 1,400

(c)

(b)

1,350

(d) 1,335.5

(iii) (a) 1,335.5

1,300

1,250

(a) (i)

(f)

1,200

1,150

(ii)

Y

1,100

(c) (ii)

(e) (b)

1,050

(iv) Copyright, July 2021

Waves Strategy Advisors

www.wavesstrategy.com 1,000

(g)

W

950

MUTHOOTFIN - RSI(14) = 65.26

70

65.2619

(ii)

30

Aug Sep Oct Nov Dec 2021 Feb Mar Apr May Jun Jul

Created with AmiBroker - adv anced charting and technical analy sis sof tware. http://www.amibroker.com

5 www.wavesstrategy.com Mob: +919920422202

helpdesk@wavesstrategy.com Tel: +91 22 28831358

The Financial Waves Short term Update – July 23, 2021

Muthoot Finance 60 mins chart:

MUTHOOTFIN - Hourly 22-07-2021 04:29:59 PM Open 1606.4, Hi 1606.4, Lo 1606.4, Close 1606.4 (0.1%) SAR(0.02,0.2) = 1,551.22

1,650

1,606.4

1,600

i

(iii)

iii

v 1,551.22

1,550

ii

1,500

(iv) 1,450

iv

1,400

1,350

Copyright, July 2021

i Waves Strategy Advisors

1,300

www.wavesstrategy.com

f

1,250

(i)

ii

1,200

1,150

(ii)

g

Y 1,100

(ii)

19 26 May 10 17 24 31Jun 7 14 21 28 Jul 5 12 19

MUTHOOTFIN - RSI(14) = 68.88

70

68.8802

30

Created with AmiBroker - adv anced charting and technical analy sis sof tware. http://www.amibroker.com

Wave analysis:

We have continued to maintain bullish stand on Muthoot finance based on Elliott wave structure. It is one

of the stocks which has been outperforming the overall market and has continued to move higher.

On the daily chart, in the mid of April 2021 prices completed intermediate wave (ii) and since then

intermediate wave (iii) is ongoing. This wave (iii) has lot to cover on upside and hence medium term

investors should stay invested as long as 1440 is intact on downside. RSI also relieved its overbought state

and has created further space on upside which is a positive sign. We can see that it has continued to sustain

above conversion and base line of the Ichimoku Clouds which indicates that momentum remains strong on

upside.

On 60 min chart, we have been witnessing subdivision among minute wave (v) which is extending now as

per equality with minute wave (i). From hereon buy on dips strategy will persist as long as 1550 is intact on

downside. On upside it can move towards 1650 level where immediate target is placed as per recent

structure.

In short, view for Muthoot finance remains bullish. Accumulate in the range of 1600-1590 with 1550 as

support and target towards 1650 can be expected.

6 www.wavesstrategy.com Mob: +919920422202

helpdesk@wavesstrategy.com Tel: +91 22 28831358

The Financial Waves Short term Update – July 23, 2021

RELIGARE Daily chart:

7 www.wavesstrategy.com Mob: +919920422202

helpdesk@wavesstrategy.com Tel: +91 22 28831358

The Financial Waves Short term Update – July 23, 2021

RELIGARE 60 mins chart:

Wave analysis:

Bull market has continued in Smallcap and Midcap stocks. RELIGARE is one of the stock which bottomed out

near 16 level in the mid of March 2020 and since then prices have increased multifold and trading near 160

levels. In the previous session it closed with a massive gain of 9.98%. Other broking stocks like MOTILALOFS,

JMFINANCIL were up by 2-4%.

On the daily chart, stock has continued to maintain higher high higher low structure. In the entire month of

June 2021 it retraced around 38.2% of the prior up move and recent rise has taken out the previous peak

which suggest that uptrend has resumed. Now on downside zone of 145-140 will act as an immediate support

zone. As per channeling technique, it is likely to head higher towards 190-195 levels. We have shown ADX

indicator which gives an indication if the stock is trending or in a trading range. The adx of this stock is 42.4

giving an indication of a trending market. The reading above 25 means strong directional strength.

On the hourly chart, 20 periods Exponential Moving Average is acting as a brilliant support line. This suggest

that one should be in the direction of the ongoing trend as far as this line is protected and any pullback

towards the same should be utilized as buying opportunity. Closest support is placed at 150.

In short, trend for this stock is positive. Use dips towards 158-156 as a buying opportunity for a move towards

175-180 levels as long as 150 holds on the downside.

8 www.wavesstrategy.com Mob: +919920422202

helpdesk@wavesstrategy.com Tel: +91 22 28831358

The Financial Waves Short term Update – July 23, 2021

To Register Contact on +91 9920422202 for more details

9 www.wavesstrategy.com Mob: +919920422202

helpdesk@wavesstrategy.com Tel: +91 22 28831358

The Financial Waves Short term Update – July 23, 2021

Services offered by Waves Strategy Advisors:

Stay ahead at major turning points and think objectively by Subscribing to our Services:

• Equity / Commodity / Currency research reports that are published on daily basis before

market opens

• Intraday / Positional advisory on Equity and Commodity

• Research report and advisory on Currency pairs, Global Market forecasting

• Research on COMEX and LME markets

• Research on NCDEX Agri products

• Multibagger stocks research to create long term portfolio

• Momentum stock research to generate 8% to 10% returns over short term

• Outsourcing Research solutions

• Conduct Educational seminars, Class room training, and Distance learning modules.

Disclosures:

Waves Strategy Advisors (“Firm”) is SEBI registered as a Research Entity in terms of SEBI (Research Analyst) Regulations, 2014.

SEBI Registration number: INH000001097. The Firm, its partners, employees, and associates have not been debarred/ suspended by

SEBI or any other regulatory authority for accessing /dealing in securities market.

The Firm, its partners, employees, and associates including the relatives of the Partners,

• do not hold any financial interest/beneficial ownership of 1% or more in the company subject to research analysis (“Subject

Company”);

• do not have any material conflict of interest with the Subject Company;

• has not received any compensation or monetary benefit of any nature from the Subject Company during the past twelve months;

• has not served as a client, employee, director or officer of the Subject Company;

• has not been engaged in any market making activity for the Subject Company

• has not received any compensation for brokerage services from the subject company in the past twelve months

• have not managed nor co-managed public offering of securities for the subject company in the past twelve months;

• have not received any compensation for investment banking or merchant banking or brokerage services from the subject company

in the past twelve months;

• have not received any compensation for products or services other than investment banking or merchant banking or brokerages

services from the subject company in the past twelve months

• have not received any compensation or other benefits from the subject company or third party in connection with the research report.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. The Firm does not represent/ provide any warranty express or implied to the accuracy, contents or views expressed herein

and investors are advised to independently evaluate the market conditions/risks involved before making any trading or investment

decision. Each recipient of this document should make such investigations as they deemed necessary to arrive at an independent

evaluation of an trading / investment in the securities of the companies referred to in this document (including the merits and risks

involved), and should consult their own advisors to determine the merits and risks of such an investment.

The Firm, its affiliates, directors, partners its proprietary trading and investment businesses may, from time to time, make investment

decisions. The views contained in this document are those of the Firm and the research analyst engaged in preparing the research

report, and the client may or may not subscribe to all the views expressed within and the client has the right and option to not follow

or put reliance on recommendations they are not agreeable to.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Waves Strategy Advisors or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Waves Strategy Advisors has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Waves Strategy Advisors endeavours to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

10 www.wavesstrategy.com Mob: +919920422202

helpdesk@wavesstrategy.com Tel: +91 22 28831358

You might also like

- 2018 Chevrolet Trailering and Towing GuideDocument18 pages2018 Chevrolet Trailering and Towing GuideTetsunari KodaNo ratings yet

- WaddDocument29 pagesWaddReanaldy Ibrahim Masudi PutraNo ratings yet

- Belt Drive LH: Projectionsmeth.1 ISO5456-2Document1 pageBelt Drive LH: Projectionsmeth.1 ISO5456-2Traian SerbanNo ratings yet

- Mccoy Drilling Completions Catalog 2011Document59 pagesMccoy Drilling Completions Catalog 2011IgorCencičNo ratings yet

- Swimming Pool.. A Architectural DrawingsDocument5 pagesSwimming Pool.. A Architectural DrawingsEdward OmondiNo ratings yet

- The Financial Waves STU 20210820Document10 pagesThe Financial Waves STU 20210820shubh vasoyaNo ratings yet

- The Financial Waves STU - 20210722Document11 pagesThe Financial Waves STU - 20210722sandeep.tiwari1687No ratings yet

- A F B C D E: PembantuDocument1 pageA F B C D E: PembantuYudhy NoviantoNo ratings yet

- Proposed Children'S Orphanage To Be Built at Kifaru Njia Panda-Moshi, KilimanjaroDocument4 pagesProposed Children'S Orphanage To Be Built at Kifaru Njia Panda-Moshi, KilimanjaroChille Nchimunya BwalyaNo ratings yet

- CH-CAT-10217126 - MY15 US Trailering Guide - 122215Document15 pagesCH-CAT-10217126 - MY15 US Trailering Guide - 122215Osama HammamNo ratings yet

- 2017 Chevrolet Trailering and Towing GuideDocument17 pages2017 Chevrolet Trailering and Towing GuideHéctor GodoyNo ratings yet

- 18-Tipikal Tower CC and DD, DDR-Layout1Document1 page18-Tipikal Tower CC and DD, DDR-Layout1randi wirdanaNo ratings yet

- GS1496 1 301Document1 pageGS1496 1 301Md ShahinNo ratings yet

- DGTWWSpring2021Engine SpecsAtAGlanceDocument3 pagesDGTWWSpring2021Engine SpecsAtAGlanceMohamed HamdallahNo ratings yet

- B9 2001 Left FootDocument1 pageB9 2001 Left FootneovondorfmamNo ratings yet

- Notes:: Treated Water Transfer PumpDocument1 pageNotes:: Treated Water Transfer PumpjatinNo ratings yet

- Coating Area 189 SQ.M: Spaceera Hanger PlanDocument1 pageCoating Area 189 SQ.M: Spaceera Hanger PlanSrajeshKNo ratings yet

- LightingDocument1 pageLightingJann MarcNo ratings yet

- Final CS, CR, Cu CDDocument1 pageFinal CS, CR, Cu CDfirofiaNo ratings yet

- Daily Market Update - 07.03.2024Document2 pagesDaily Market Update - 07.03.2024Kavindu KamanthaNo ratings yet

- 8015-0151-SC03-22-320-CI-DF-00002 - A OPEN-Layout1Document1 page8015-0151-SC03-22-320-CI-DF-00002 - A OPEN-Layout1valerio losiNo ratings yet

- Wadd ChartDocument39 pagesWadd ChartIlhamNo ratings yet

- B C Location Map Vicinity MapDocument1 pageB C Location Map Vicinity MapJOHN MICHAEL MADLAINGNo ratings yet

- Arabian Construction Company: 18,000 Civil& Buildings Cum. TotalDocument3 pagesArabian Construction Company: 18,000 Civil& Buildings Cum. TotalJule LobresNo ratings yet

- WSR WK26 20230626-0702Document9 pagesWSR WK26 20230626-0702CHRISMAR ZALSOSNo ratings yet

- Floor PlanDocument1 pageFloor PlanKanyika MwangaNo ratings yet

- Lower Trendline Upper Trendline: Jul Jul 2 Jul 3 Jul 4 Jul 5 Jul 8 Jul 9 Jul 10Document1 pageLower Trendline Upper Trendline: Jul Jul 2 Jul 3 Jul 4 Jul 5 Jul 8 Jul 9 Jul 10Haider KHNo ratings yet

- STP LayoutDocument1 pageSTP LayoutSaeful Design-AceNo ratings yet

- STP Layout PlanDocument2 pagesSTP Layout PlanSaeful Design-AceNo ratings yet

- UT1 C TRDR 031 REV D-ModelDocument1 pageUT1 C TRDR 031 REV D-ModelDeep AceNo ratings yet

- Proposed Floor Plan Layout - 240330 - 172110Document1 pageProposed Floor Plan Layout - 240330 - 172110Woody HomeNo ratings yet

- WT5x 11 WT5x 11Document1 pageWT5x 11 WT5x 11JOSE MANUEL ORTIZ ARRIETA LUJANNo ratings yet

- JICA AsbuiltDocument1 pageJICA AsbuiltRecto PinedaNo ratings yet

- Warkop Kemang - Bandara Sam Ratulangi Manado: Schematic Design DocumentDocument1 pageWarkop Kemang - Bandara Sam Ratulangi Manado: Schematic Design Documentwarkop kemangNo ratings yet

- I:/3. SUBANG WORKS 2018/5. MATERI UNSUB/2.SM GENAP/1. STRUKTUR KONTRUKSI 2/2. TUGAS BESAR/unsub Teknik - JPGDocument1 pageI:/3. SUBANG WORKS 2018/5. MATERI UNSUB/2.SM GENAP/1. STRUKTUR KONTRUKSI 2/2. TUGAS BESAR/unsub Teknik - JPGFajar bahariNo ratings yet

- SM 10Document1 pageSM 10MUBASHIRNo ratings yet

- AR02-10 - TOWER 6&7 FLOOR PLANS 2ndDocument1 pageAR02-10 - TOWER 6&7 FLOOR PLANS 2ndJay Berlin EsguerraNo ratings yet

- 2300series ViewDocument2 pages2300series ViewEmmanuel Ber SNo ratings yet

- Inventory Management (EOQ)Document30 pagesInventory Management (EOQ)Samina HyderNo ratings yet

- Mntto. InternationalDocument1 pageMntto. InternationalJohn Lucero MuñozNo ratings yet

- Denah KlinikDocument1 pageDenah Klinikfajar putraNo ratings yet

- Grain Valley Analysis Review Meeting (December 2022)Document67 pagesGrain Valley Analysis Review Meeting (December 2022)confluencescribdNo ratings yet

- Site Plan + Luas - 230426 - 223115Document1 pageSite Plan + Luas - 230426 - 223115J.T HalohoNo ratings yet

- Auditorium Lighting Layout - Method, Analysis and DistributionDocument3 pagesAuditorium Lighting Layout - Method, Analysis and DistributionJohn Russel MarananNo ratings yet

- BAL AssignmentDocument1 pageBAL Assignmentroneshia12No ratings yet

- Zte l900 - 8mhz Tizi 8 Sites Trail - 1107Document15 pagesZte l900 - 8mhz Tizi 8 Sites Trail - 1107hamzaNo ratings yet

- Limites Bananal PM FinalDocument1 pageLimites Bananal PM FinalLuiz Fernando de SantanaNo ratings yet

- Second Floor PlanDocument1 pageSecond Floor PlanMark Christian EsguerraNo ratings yet

- ClasemmmDocument1 pageClasemmmAlexa JimenezNo ratings yet

- Layout Lantai 4Document1 pageLayout Lantai 4reshapalepiNo ratings yet

- Sukhani GA With Levels PDFDocument1 pageSukhani GA With Levels PDFHimal KafleNo ratings yet

- KW V1/CB KW: 1:2:4 & Terrazo TileDocument1 pageKW V1/CB KW: 1:2:4 & Terrazo Tilesunder kumawatNo ratings yet

- Section X-X: B C D EDocument1 pageSection X-X: B C D EkukoyigbemigaNo ratings yet

- B9 2001 Right FootDocument1 pageB9 2001 Right FootneovondorfmamNo ratings yet

- Yusuf ChermanDocument1 pageYusuf ChermanYusufNo ratings yet

- 750 UNI 1200 1200 750 UNI 750 UNI 900 900 600 750 UNI: Safety InstructionDocument1 page750 UNI 1200 1200 750 UNI 750 UNI 900 900 600 750 UNI: Safety Instructionfalparslan5265No ratings yet

- RMD Shoring PDFDocument2 pagesRMD Shoring PDFBalaji SubramanianNo ratings yet

- #Contact Company: Revision HistoryDocument1 page#Contact Company: Revision HistoryFRANKLYN SPENCERNo ratings yet

- Denah Loading Dock Skala 1:1000: Jalan DesaDocument1 pageDenah Loading Dock Skala 1:1000: Jalan Desafadia adilaNo ratings yet