Professional Documents

Culture Documents

Title Ii Chapter Ii

Uploaded by

Mae CarpilaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Title Ii Chapter Ii

Uploaded by

Mae CarpilaCopyright:

Available Formats

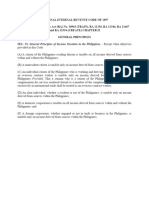

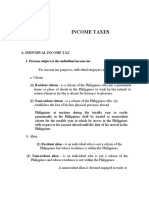

TITLE II

TAX ON INCOME

(As Last Amended by RA No. 10653) [5]

CHAPTER II - GENERAL PRINCIPLES

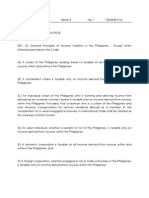

SEC. 23. General Principles of Income (E) A domestic corporation is taxable on all

Taxation in the Philippines. - Except when income derived from sources within and

otherwise provided in this Code: without the Philippines; and

(A) A citizen of the Philippines residing (F) A foreign corporation, whether engaged

therein is taxable on all income derived from or not in trade or business in the Philippines,

sources within and without the Philippines; is taxable only on income derived from

sources within the Philippines.

(B) A nonresident citizen is taxable only on

income derived from sources within the

Philippines;

(C) An individual citizen of the Philippines

who is working and deriving income from

abroad as an overseas contract worker is

taxable only on income derived from

sources within the Philippines: Provided,

That a seaman who is a citizen of the

Philippines and who receives compensation

for services rendered abroad as a member of

the complement of a vessel engaged

exclusively in international trade shall be

treated as an overseas contract worker;

(D) An alien individual, whether a resident

or not of the Philippines, is taxable only on

income derived from sources within the

Philippines;

Page 1 of 1

You might also like

- GENERAL PRINCIPLES As Per Tax Code Sec. 23Document1 pageGENERAL PRINCIPLES As Per Tax Code Sec. 232022107419No ratings yet

- SEC. 23. General Principles of Income Taxation in The Philippines. - Except WhenDocument11 pagesSEC. 23. General Principles of Income Taxation in The Philippines. - Except WhenMiguel BerguNo ratings yet

- Overview TaxDocument1 pageOverview TaxSherry Mae MalabagoNo ratings yet

- Tax Code: Partnerships' Are Partnerships Formed by Persons For TheDocument10 pagesTax Code: Partnerships' Are Partnerships Formed by Persons For Thegabriel omliNo ratings yet

- CH09B Income and Business TaxationDocument20 pagesCH09B Income and Business TaxationArt MelancholiaNo ratings yet

- TAX - Income Tax On IndividualsDocument10 pagesTAX - Income Tax On Individualsall about seventeenNo ratings yet

- Income Taxes: 1. Persons Subject To The Individual Income TaxDocument5 pagesIncome Taxes: 1. Persons Subject To The Individual Income TaxJerome Eziekel Posada PanaliganNo ratings yet

- Income Tax On Individuals - Ust PDFDocument15 pagesIncome Tax On Individuals - Ust PDFKana Lou Cassandra Besana100% (1)

- Present Income Tax SystemDocument57 pagesPresent Income Tax SystemCharm Ferrer100% (1)

- Income Tax On IndividualsDocument7 pagesIncome Tax On IndividualsThe man with a Square stacheNo ratings yet

- Memory-Aid-Taxation San Beda 2001Document24 pagesMemory-Aid-Taxation San Beda 2001jurisNo ratings yet

- Tax 2 TSNDocument38 pagesTax 2 TSNCamille EveNo ratings yet

- Individual Taxpayers Handouts and ProblemsDocument15 pagesIndividual Taxpayers Handouts and ProblemsLovely De CastroNo ratings yet

- Income TaxDocument7 pagesIncome TaxDhang Cerilo AparenteNo ratings yet

- Income Tax On Individuals PDFDocument20 pagesIncome Tax On Individuals PDFKaren Joy MagsayoNo ratings yet

- Assignment No. 4Document7 pagesAssignment No. 4HannahPauleneDimaanoNo ratings yet

- Income Taxation NotesDocument15 pagesIncome Taxation NotesJustin Andre SiguanNo ratings yet

- IBAÑEZ Present Income Tax SystemDocument74 pagesIBAÑEZ Present Income Tax SystemJasmine Montero-GaribayNo ratings yet

- Income Tax Prelims.Document13 pagesIncome Tax Prelims.Amber Lavarias BernabeNo ratings yet

- Income Taxation TableDocument11 pagesIncome Taxation TableRomela Eleria GasesNo ratings yet

- Bar TaxDocument29 pagesBar TaxMaisie ZabalaNo ratings yet

- Tax CodeDocument1 pageTax CodeVaughn FrancisNo ratings yet

- Taxation Income TaxationDocument73 pagesTaxation Income TaxationB-an Javelosa0% (1)

- Intro To Income Tax and Taxation For IndividualsDocument19 pagesIntro To Income Tax and Taxation For IndividualsvsplanciaNo ratings yet

- TAX Notes AdditionalDocument18 pagesTAX Notes AdditionalJoben Vernan CuencaNo ratings yet

- Report Tax RevDocument10 pagesReport Tax RevMarga ErumNo ratings yet

- Income Tax: Global Income TaxDocument4 pagesIncome Tax: Global Income TaxMichelle Muhrie TablizoNo ratings yet

- Common Questions TaxationDocument5 pagesCommon Questions TaxationChris TineNo ratings yet

- Individual Income TaxDocument9 pagesIndividual Income TaxCharmaine RosalesNo ratings yet

- Lecture Notes Individual TaxationDocument16 pagesLecture Notes Individual Taxationבנדר-עלי אימאם טינגאו בתולהNo ratings yet

- Income Tax - Tax ExemptionDocument1 pageIncome Tax - Tax ExemptionStar RamirezNo ratings yet

- Income Tax On Individuals - REVISED 2022Document141 pagesIncome Tax On Individuals - REVISED 2022rav dano100% (2)

- TAX LAW BALA SA BAR SERIES ExportDocument10 pagesTAX LAW BALA SA BAR SERIES Exportmetrexz17.03No ratings yet

- Person - Orporation: Income TaxDocument138 pagesPerson - Orporation: Income TaxMich FelloneNo ratings yet

- Non-Resident Alien Engaged in Business in The Phil: Income Tax RR2Document8 pagesNon-Resident Alien Engaged in Business in The Phil: Income Tax RR2Jm CruzNo ratings yet

- Nirc As Amended by TrainDocument16 pagesNirc As Amended by TrainKDANo ratings yet

- Resident Alien - Taxed Similarly As A Resident Citizen On IncomesDocument2 pagesResident Alien - Taxed Similarly As A Resident Citizen On IncomesJerome Eziekel Posada PanaliganNo ratings yet

- Unit III A. IndividualsDocument32 pagesUnit III A. IndividualsJay GoNo ratings yet

- Tax 1 MidtermsDocument18 pagesTax 1 MidtermsElaine Yap100% (1)

- ITDocument60 pagesITMo MuNo ratings yet

- Unit III A. IndividualsDocument31 pagesUnit III A. IndividualsBea BernardoNo ratings yet

- Personal Income Taxation 1Document29 pagesPersonal Income Taxation 1Rovic OrdonioNo ratings yet

- Income Tax PresentationDocument22 pagesIncome Tax PresentationItchigo KorusakiNo ratings yet

- Income Taxation For IndividualsDocument60 pagesIncome Taxation For IndividualsFrancis Elaine FortunNo ratings yet

- Tax On IndividualsDocument15 pagesTax On IndividualsMichael SanchezNo ratings yet

- Tax Reviewer by MoiDocument4 pagesTax Reviewer by MoiKenny BesarioNo ratings yet

- Person - Orporation: Income TaxDocument223 pagesPerson - Orporation: Income TaxMich FelloneNo ratings yet

- Income Taxation - LAV Notes122621Document13 pagesIncome Taxation - LAV Notes122621Mil Roilo B EspirituNo ratings yet

- Income Tax 2Document10 pagesIncome Tax 2Blaise VENo ratings yet

- TAX Outline 2 1Document18 pagesTAX Outline 2 1Master GTNo ratings yet

- TAX Outline 2 1Document18 pagesTAX Outline 2 1Master GTNo ratings yet

- Kinds of Taxpayers: Moairah Banielyn Joy B. LaritaDocument28 pagesKinds of Taxpayers: Moairah Banielyn Joy B. LaritaMoairah LaritaNo ratings yet

- Income-Tax OutlineDocument41 pagesIncome-Tax OutlineAnonymous YNTVcDNo ratings yet

- Taxation One CompleteDocument90 pagesTaxation One CompleteCiena MaeNo ratings yet

- Income Taxes For Individuals: ObjectivesDocument15 pagesIncome Taxes For Individuals: ObjectivesChristelle JosonNo ratings yet

- Chapter 2 - Individual TaxpayersDocument2 pagesChapter 2 - Individual TaxpayersAlyza AlmoniaNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)