Professional Documents

Culture Documents

Bills On Fiscal Regime For The Mining Industry - Table

Uploaded by

Jade Lorenzo0 ratings0% found this document useful (0 votes)

4 views1 pageThis document summarizes different bills proposing amendments to the Philippine Mining Act of 1995 regarding royalty fees for various types of mining operations. It outlines proposals for metallic and non-metallic mining operations both inside and outside of mineral reservations, including rates for large-scale versus small-scale operations and those applying fixed percentages or margin-based percentages of gross output. The Mines and Geosciences Bureau's position supports retaining the 5% royalty for operations within mineral reservations and imposing rates of 1-5% for operations outside reservations depending on the type of mineral and scale of operations.

Original Description:

Original Title

Bills on Fiscal Regime for the Mining Industry_Table

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes different bills proposing amendments to the Philippine Mining Act of 1995 regarding royalty fees for various types of mining operations. It outlines proposals for metallic and non-metallic mining operations both inside and outside of mineral reservations, including rates for large-scale versus small-scale operations and those applying fixed percentages or margin-based percentages of gross output. The Mines and Geosciences Bureau's position supports retaining the 5% royalty for operations within mineral reservations and imposing rates of 1-5% for operations outside reservations depending on the type of mineral and scale of operations.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pageBills On Fiscal Regime For The Mining Industry - Table

Uploaded by

Jade LorenzoThis document summarizes different bills proposing amendments to the Philippine Mining Act of 1995 regarding royalty fees for various types of mining operations. It outlines proposals for metallic and non-metallic mining operations both inside and outside of mineral reservations, including rates for large-scale versus small-scale operations and those applying fixed percentages or margin-based percentages of gross output. The Mines and Geosciences Bureau's position supports retaining the 5% royalty for operations within mineral reservations and imposing rates of 1-5% for operations outside reservations depending on the type of mineral and scale of operations.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Republic Act No.

HB 8400 SB 1979 HB 6135 HB 373 Position of the MGB

7942 - MINING Author: Suansing, et.al Author: Sotto Author: Suansing, et.al Author: Salceda

ACT OF 1995

Royalty Fee of 5% Large-scale Metallic Mining outside Large-scale Metallic Mining Large-scale Metallic Mining

of the market Mineral Reservations – Margin- outside Mineral Reservations outside Mineral Retention of the 5% royalty

value of the gross based royalty of 1-5% – Margin-based royalty of 1- Reservations – Margin- payment of mineral

output of the Metallic and Non-metallic 5% based royalty of 1-5% extracted within mineral

minerals / Large-scale Metallic Mining within mining operations within Large-scale Metallic Mining Large-scale Metallic Mining reservations based on the

mineral products Mineral Reservations – 3% of the Mineral Reservations, within Mineral Reservations - within Mineral Reservations market value of the gross

extracted or gross output of the minerals or whether large-scale or 3% of the gross output of the - 3% of the gross output of output

produced from mineral products extracted or small-scale minerals or mineral products the minerals or mineral

mineral produced by the mining operations, 5% of the gross output of extracted or produced by the products extracted or

reservations exclusive of all other taxes the minerals or mineral mining operations, exclusive produced by the mining

exclusive of all products extracted or of all other taxes operations, exclusive of all Imposition of 3% royalty

other taxes produced by the mining other taxes payment for metallic

(Section 13 of Large-scale Non-Metallic Mining operations, exclusive of all minerals outside mineral

DAO 2010-21) outside Mineral Reservations - other taxes reservations based on the

Margin-based royalty of 1-5% market value of the gross

Large-scale Non-Metallic Mining output

outside Mineral Reservations - 3% of

the gross output of the minerals or

mineral products extracted or

produced by the mining operations, Metallic and Non-metallic Imposition of 1% royalty

exclusive of all other taxes mining operations outside payment for non-metallic

Mineral Reservations, minerals inside or outside

Small-Scale Metallic Mining within or whether large-scale or Small-Scale Metallic Mining Small-Scale Metallic Mining mineral reservations based

outside Mineral Reservations - 1/10 small-scale – Operations - 1/10 of 1% of Operations - 1/10 of 1% of on the market value of the

of 1% of gross output gross output gross output gross output.

Small-Scale Non-Metallic Mining a. 3% on the 1st 3 years

within or outside Mineral

Reservations - 1/10 of 1% of gross b. 4% on the 4th year

output

Margin-based windfall profits tax on c. 5% on the 5th year and Margin-based windfall profits Margin-based windfall

income from mining operations thereafter tax gained profits tax on income from

before corporate income tax - 1% to from mining operations - 1% mining operations before

10% for each taxable year to 10% for each taxable year corporate income tax - 1% to

10% for each taxable year

You might also like

- Zambian Tax SystemDocument3 pagesZambian Tax SystemFanuel NjobvuNo ratings yet

- Sector Overview 3 2. National Mineral Policy 4 3. Summary of Fiscal Regime. 5Document46 pagesSector Overview 3 2. National Mineral Policy 4 3. Summary of Fiscal Regime. 5harishaleemNo ratings yet

- Rio - Tube CP 2015Document16 pagesRio - Tube CP 2015Ioannis ZNo ratings yet

- DRAFT - Indonesia Mining Report Development in - IndonesiaDocument19 pagesDRAFT - Indonesia Mining Report Development in - Indonesiapaul styNo ratings yet

- Lab 1Document6 pagesLab 1Gwen Ibarra SuaybaguioNo ratings yet

- 2010 Minerals Yearbook: ZimbabweDocument9 pages2010 Minerals Yearbook: ZimbabweffgfgfgffgNo ratings yet

- CERA PresentationDocument16 pagesCERA PresentationParaZzzitNo ratings yet

- Salazar Corporate Presentation Q3 2013 March 2014Document52 pagesSalazar Corporate Presentation Q3 2013 March 2014kaiselkNo ratings yet

- Briefing 050608 4Document133 pagesBriefing 050608 4Richard J WinstanleyNo ratings yet

- Mineral Profile Ev Region 2018Document17 pagesMineral Profile Ev Region 2018John Vincent Galleto PajigarNo ratings yet

- AssgfgDocument34 pagesAssgfgashe zinabNo ratings yet

- Kadaster Perpajakan PBB Sektor Pertambangan PPt-Tamer-25120701Document23 pagesKadaster Perpajakan PBB Sektor Pertambangan PPt-Tamer-25120701Wichi LuthfinaNo ratings yet

- ENS 201 Paper (Mining Issues in The Philippines) - Naungayan, Marianne Jane E PDFDocument16 pagesENS 201 Paper (Mining Issues in The Philippines) - Naungayan, Marianne Jane E PDFMarianne Jane NaungayanNo ratings yet

- Golden Triangle Report March2016Document12 pagesGolden Triangle Report March2016Yash ladkeNo ratings yet

- Sintering PlantDocument24 pagesSintering PlantB R Manikyala Rao100% (1)

- Mining Facts and FiguresDocument1 pageMining Facts and FiguresAnatheaAcabanNo ratings yet

- Exito en Farallon 2010 Mar 31Document2 pagesExito en Farallon 2010 Mar 31Juan AnesNo ratings yet

- 7 - Case Study - MoraesDocument24 pages7 - Case Study - MoraesGeorgi Mitkov SavovNo ratings yet

- Myb3 2011 AgDocument11 pagesMyb3 2011 AgLaraba MohamedNo ratings yet

- Comparison Bet. Ftaa & MpsaDocument10 pagesComparison Bet. Ftaa & Mpsacriselkate100% (1)

- Small Scale Mining in NamibiaDocument11 pagesSmall Scale Mining in NamibiaFrans RumbleNo ratings yet

- 2016 Minerals Yearbook: Zimbabwe (Advance Release)Document10 pages2016 Minerals Yearbook: Zimbabwe (Advance Release)WashingtonChikengezhaNo ratings yet

- 12 Pdac15 TNGGDocument23 pages12 Pdac15 TNGGhamza tariqNo ratings yet

- MEAI - Mining of Minerals Beyond 2020 (Revised)Document11 pagesMEAI - Mining of Minerals Beyond 2020 (Revised)srihari krishNo ratings yet

- MDSW Gujarat03Document13 pagesMDSW Gujarat03miningnova1No ratings yet

- Small Scale Mining LawsDocument29 pagesSmall Scale Mining LawsizaNo ratings yet

- Asm Go2o3532f Assignment 1Document15 pagesAsm Go2o3532f Assignment 1Tinotenda MorganNo ratings yet

- Mineral RoyaltyDocument2 pagesMineral RoyaltyChishiba ChemboNo ratings yet

- Small Scale Mining in ZambiaDocument10 pagesSmall Scale Mining in ZambiaSimi Sichula100% (6)

- Zimbabwe Fact SheetDocument1 pageZimbabwe Fact Sheetvenki4unitedNo ratings yet

- Antamina 2010Document47 pagesAntamina 2010Roberto SalasNo ratings yet

- Procedures Manual MMD Issuance of Otp MoepDocument12 pagesProcedures Manual MMD Issuance of Otp MoepChatz BalagtasNo ratings yet

- Small-Scale Mining and Cleaner Production Issues in ZambiaDocument6 pagesSmall-Scale Mining and Cleaner Production Issues in ZambiaSimi SichulaNo ratings yet

- Philippines As A Developing NationDocument40 pagesPhilippines As A Developing NationKenneth VinoNo ratings yet

- Volume II Non Coal 2014Document156 pagesVolume II Non Coal 2014DGK rajuNo ratings yet

- Oil Industry Future Challenges: by Shri. B.K. BakhshiDocument21 pagesOil Industry Future Challenges: by Shri. B.K. BakhshiGirish1412No ratings yet

- Ferrochrome Smelting PresentationDocument22 pagesFerrochrome Smelting PresentationArchiford TakuraNo ratings yet

- Pa Tax Brief - February 2018Document16 pagesPa Tax Brief - February 2018Teresita TibayanNo ratings yet

- CHWS3DOC20 BunboonDocument19 pagesCHWS3DOC20 BunboonthuanNo ratings yet

- Sustainability Report 2022 Data TablesDocument94 pagesSustainability Report 2022 Data TablesMalefane Cortez TlatlaneNo ratings yet

- Computer and Ugc NetDocument16 pagesComputer and Ugc NetLab DasNo ratings yet

- Joint Venture ProceduresDocument12 pagesJoint Venture Procedureskojo2kgNo ratings yet

- DFR Venmyn RandDocument43 pagesDFR Venmyn RandSreedharBj0% (1)

- EMIS Insight - India Cement Production Report PDFDocument41 pagesEMIS Insight - India Cement Production Report PDFParrNo ratings yet

- Volume-I - (Coal) 2014636129985100886136 PDFDocument153 pagesVolume-I - (Coal) 2014636129985100886136 PDFAzhar KhanNo ratings yet

- 2c Baxter Lbma2005Document4 pages2c Baxter Lbma2005KamogeloGavanistroNtsokoNo ratings yet

- AssumptionDocument1 pageAssumptioniwan dermawanNo ratings yet

- IR-FS-19 Mineral Sands Mining v1.2Document4 pagesIR-FS-19 Mineral Sands Mining v1.2Elves F. CháNo ratings yet

- The Indian Mining Sector: Effects On The Environment & FDI InflowsDocument10 pagesThe Indian Mining Sector: Effects On The Environment & FDI InflowsMehul MandanakaNo ratings yet

- Revised Structure of Commission and Remuneration T - 240331 - 195127Document3 pagesRevised Structure of Commission and Remuneration T - 240331 - 195127Study PowerNo ratings yet

- Jean-Raymond Boulle, Titanium Resources GroupDocument30 pagesJean-Raymond Boulle, Titanium Resources Groupinvestorseurope offshore stockbrokersNo ratings yet

- Economics Project ReportDocument7 pagesEconomics Project ReportSnehal JoshiNo ratings yet

- 0 0 06 Jul 2015 1631449471prefeasibilityreportDocument8 pages0 0 06 Jul 2015 1631449471prefeasibilityreportHemant SharmaNo ratings yet

- Chapter-15 Mining: TH THDocument7 pagesChapter-15 Mining: TH THVivek DograNo ratings yet

- Brief Industrial Profile of Dibrugarh District: LR Eso T RsDocument17 pagesBrief Industrial Profile of Dibrugarh District: LR Eso T RsAdi GulatiNo ratings yet

- MagnesiteDocument4 pagesMagnesiteBibek ChatterjeeNo ratings yet

- Sector Minero en El Perú - 2020 - BBVADocument63 pagesSector Minero en El Perú - 2020 - BBVAYensi Urbano CamonesNo ratings yet

- Part 4 - Market EnvironmentDocument25 pagesPart 4 - Market EnvironmentmelNo ratings yet

- DRDGold Jan 2010 PresentationDocument10 pagesDRDGold Jan 2010 PresentationAla BasterNo ratings yet

- Market Research, Global Market for Germanium and Germanium ProductsFrom EverandMarket Research, Global Market for Germanium and Germanium ProductsNo ratings yet

- Getting A Good Deal - Negotiating Extractive Industry Contracts - NotesDocument34 pagesGetting A Good Deal - Negotiating Extractive Industry Contracts - NotesJade LorenzoNo ratings yet

- Climate Change Education - NotesDocument24 pagesClimate Change Education - NotesJade LorenzoNo ratings yet

- G.R. No. 169080Document21 pagesG.R. No. 169080Jade LorenzoNo ratings yet

- Lgu Guiguinto Citizens Charter 2020Document170 pagesLgu Guiguinto Citizens Charter 2020Jade LorenzoNo ratings yet

- UASRet LoaDocument5 pagesUASRet LoaJade LorenzoNo ratings yet

- Dao-2010-21 - IrrDocument147 pagesDao-2010-21 - IrrJade LorenzoNo ratings yet

- Regmy 2020Document1 pageRegmy 2020Jade LorenzoNo ratings yet

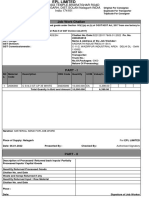

- Job Work Challan: Aadinath Industries (111341) C-11/2, Wazirpur Industrial Area Delhi DL - Delhi 110052Document1 pageJob Work Challan: Aadinath Industries (111341) C-11/2, Wazirpur Industrial Area Delhi DL - Delhi 110052Anshu SinghNo ratings yet

- The P&g-Gillette MergerDocument1 pageThe P&g-Gillette MergerDurgesh YadavNo ratings yet

- Form 05 Cusdec Ro Blank App p1 p2Document3 pagesForm 05 Cusdec Ro Blank App p1 p2chamith.transcoNo ratings yet

- Asian Development BankDocument6 pagesAsian Development Bankneemz1990No ratings yet

- Vietnam Country Report 2022 - A Post-Pandemic Brief Insight Into VietnamDocument6 pagesVietnam Country Report 2022 - A Post-Pandemic Brief Insight Into Vietnamthunguyen.89223020063No ratings yet

- Vission N Mission of SbiDocument19 pagesVission N Mission of Sbianand_lihinarNo ratings yet

- Balance Sheet of JK Tyre and IndustriesDocument4 pagesBalance Sheet of JK Tyre and IndustriesHimanshu MangeNo ratings yet

- FMID Mid Mock Spring 22Document2 pagesFMID Mid Mock Spring 22Umer FarooqNo ratings yet

- Trade in Information Technology and U.S. Economic Growth Case StudyDocument4 pagesTrade in Information Technology and U.S. Economic Growth Case StudyWibi Sono0% (1)

- "Environmental Kuznets Curve in Thailand: Cointegration and Causality Analysis," by Mohamed Arouri, Muhammad Shahbaz, Rattapon Onchang, Faridul Islam, and Frédéric TeulonDocument23 pages"Environmental Kuznets Curve in Thailand: Cointegration and Causality Analysis," by Mohamed Arouri, Muhammad Shahbaz, Rattapon Onchang, Faridul Islam, and Frédéric TeulonThe International Research Center for Energy and Economic Development (ICEED)No ratings yet

- Info Edge (India) LTD: Tax InvoiceDocument2 pagesInfo Edge (India) LTD: Tax InvoicejayminNo ratings yet

- Taxation CellDocument2 pagesTaxation CellKrung KrungNo ratings yet

- Economic Development and The AmericasDocument32 pagesEconomic Development and The AmericasSureilyValentinEstevezNo ratings yet

- IB PresentaionDocument28 pagesIB PresentaionObk AkashNo ratings yet

- Case Study Assignment Eco415 ( (Macroeconomics)Document2 pagesCase Study Assignment Eco415 ( (Macroeconomics)Dayat HidayatNo ratings yet

- Industrial Policy 1991 PDFDocument17 pagesIndustrial Policy 1991 PDFManisha SinghNo ratings yet

- 11 Task Performance 1Document2 pages11 Task Performance 1Miguel VienesNo ratings yet

- India Is The Second Largest Employment Generator After AgricultureDocument2 pagesIndia Is The Second Largest Employment Generator After AgriculturevikashprabhuNo ratings yet

- Rivne Region Has Significant Investment PotentialDocument2 pagesRivne Region Has Significant Investment PotentialВіка СачукNo ratings yet

- Center in HillDocument4 pagesCenter in Hilljebin boseNo ratings yet

- Markets and Commodity Figures: Currency Cross RatesDocument1 pageMarkets and Commodity Figures: Currency Cross RatesTiso Blackstar GroupNo ratings yet

- Certificate of Balance Standing To The Credit / Debit of PartiesDocument26 pagesCertificate of Balance Standing To The Credit / Debit of PartiesNikhil Visa ServicesNo ratings yet

- Study Questions Non-Tariff Barriers: GSLC Dennes Vansius Gunawan LA24 - 2301849782Document5 pagesStudy Questions Non-Tariff Barriers: GSLC Dennes Vansius Gunawan LA24 - 2301849782marissa002No ratings yet

- 1 Year Assignment S 2019-20: Enrollment Number: 197251690Document3 pages1 Year Assignment S 2019-20: Enrollment Number: 197251690Sinjini DeyNo ratings yet

- Read The Following Case Study Carefully and Answer The Questions Given at The End: Case # 3. ElectroluxDocument3 pagesRead The Following Case Study Carefully and Answer The Questions Given at The End: Case # 3. ElectroluxDarkest DarkNo ratings yet

- Cash Flow StatementDocument2 pagesCash Flow StatementAmolsKordeNo ratings yet

- An Analytical Study of Foreign Direct InvestmentDocument19 pagesAn Analytical Study of Foreign Direct InvestmentNeha SachdevaNo ratings yet

- 31 DECAMBER FromDocument8 pages31 DECAMBER FromMd Rajikul IslamNo ratings yet

- MBF14e Chap05 FX MarketsDocument20 pagesMBF14e Chap05 FX MarketsHaniyah Nadhira100% (1)

- Asian Paints LTD.: International Business Division Presented by Group 1Document20 pagesAsian Paints LTD.: International Business Division Presented by Group 1Divya Prakash SinhaNo ratings yet