Professional Documents

Culture Documents

Cheg - 22 Jan 2024 at 11.14

Uploaded by

fayyasin99Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cheg - 22 Jan 2024 at 11.14

Uploaded by

fayyasin99Copyright:

Available Formats

Search

Step 1 Analyze and Journalize the transactions for April.

Apr. 1 The following assets were received from Kelly Pitney in exchange for common stock: cash,

$13,100; accounts receivable, $3,000; supplies, $1,400; and office equipment, $12,500. There were

no liabilities received.

Apr. 1 Paid three months’ rent on a lease rental contract, $4,800.

Apr. 2 Paid the premiums on property and casualty insurance policies, $1,800.

Apr. 4 Received cash from clients as an advance payment for services to be provided and

recorded it as unearned fees, $5,000.

Apr. 5 Purchased additional office equipment on account from Office Station Co., $2,000.

Apr. 6 Received cash from clients on account, $1,800.

Apr. 10 Paid cash for a newspaper advertisement, $120.

Apr. 12 Paid Office Station Co. for part of the debt incurred on April 5, $1,200.

Apr. 12 Recorded services provided on account for the period April 1 – 12, $4,200.

Apr. 14 Paid part-time receptionist for two weeks’ salary, $750.

Apr. 17 Recorded cash from cash clients for fees earned during the period April 1 – 16,

$6,250.

Apr. 18 Paid cash for supplies, $800.

Apr. 20 Recorded services provided on account for the period April; 13 – 20, $2,100.

Apr. 24 Recorded cash from cash clients for fees earned for the period April 17 – 24, $3,850.

Apr. 26. Received cash from clients on account, $5,600.

Apr. 27 Paid part-time receptionist for two weeks’ salary, $750.

Apr. 29 Paid telephone bill for April, $130.

Apr. 30 Paid electricity bill for April, $200.

Apr. 30 Recorded cash from cash clients for fees earned for the period April 25 – 30, $3,050.

Apr. 30 Recorded services provided on account for the remainder of April, $1,500.

Apr 30 Paid dividends, $6,000.

Step 2 Post transactions to the ledger.

Step 3 Prepare an unadjusted trial balance.

Step 4 Assemble and analyze adjustment data.

a. Insurance expired during April is $300.

b. Supplies on hand on April 30 are $1,350.

c. Depreciation on office equipment for April is $330.

d. Accrued receptionist salary on April 30 is $120.

e. Rent expired during April is $1,600.

f. Unearned fees on April 30 are $2,500.

Step 5 Prepare an optional end-of-period spreadsheet.

Step 6 Journalize and post the adjusting entries.

Step 7 Prepare an adjusted trial balance.

Step 8 Prepare the !nancial statements.

Step 9 Journalized and post the closing entries.

Step 10 Prepare a post-closing trial balance.

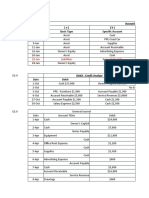

Kelly Consulting

End-of-Period Spreadsheet

For the Month Ended April 30, 2016

Unadjusted Adjusted

Income Balance

Trial Balance Adjustments Trial Balance

Statement Sheet

DR CR DR CR DR CR DR CR DR CR

Cash

Accounts

Receivable

Supplies

Prepaid Rent

Prepaid Insurance

Office Equipment

Accumulated

Depreciation

Accounts Payable

Salaries Payable

Unearned Fees

Common Stock

Dividends

Fees Earned

Salary Expense

Rent Expense

Supplies Expense

Depreciation

Expense

Insurance

Expense

Miscellaneous

Expense

There are 2 steps to solve this one.

Expert-verified Share

1st step All steps Answer only

Step 1

The question asked was to analyze and journalize the transactions for April. This involves

examining each "nancial event that occurred during April and recording them in the

company's accounting records using journal entries.

Explanation:

Initially, summarize the business activities for April and note how they impact the

company's accounts.

Step 2

Apr. 1 : Assets received from Kelly Pitney for common stock:

Debit: Cash $13, 100

Debit: Accounts Receivable $3, 000

Debit: Supplies $1, 400

Debit: Office Equipment$12, 500

Credit: Common Stock (for the total of assets received)

Apr. 1 : Paid three months’ rent on a simple rental contract:

Date Account Dr Cr

Prepaid Rent $4,800

Cash $4,800

Apr. 2 :Paid premiums on property and casualty insurance policies:

Date Account Dr Cr

Prepaid Insurance $1,800

Cash $1,800

Apr. 4 : Received cash from customers as an advance payment for services to be provided:

Date Account Dr Cr

Cash $5,000

Unearned Fees $5,000

Apr. 5 : purchased additional office equipment on account from Officе Station Co.

Date Account Dr Cr

Office Equipment $2,000

Accounts Payable $2,000

Apr. 6:Received cash from clients on account:

Date Account Dr Cr

Cash $1,800

Accounts Receivable $1,800

Apr. 10 : Paid cash for a newspapеr advertisement:

Date Account Dr Cr

Advertising Expense $120

Cash $120

Apr. 12 : Paid Officе Station Co. for part of the debt incurred on April 5:

Date Account Dr Cr

Accounts Payable $1,200

Cash $1,200

Apr. 12 : Recorded services provided on account for April 1–12:

Date Account Dr Cr

Accounts Receivable $4,200

Service Revenue $4,200

Apr. 14 : Paid part-timе rеcеptionist for two weeks’ salary:

Date Account Dr Cr

Salary Expense $750

Cash $750

Apr. 17 :Recorded cash from cash customers for fees earned during April 1–16:

Date Account Dr Cr

Cash $6,250

Service Revenue $6,250

Apr. 18 : Paid cash for supplies:

Date Account Dr Cr

Supplies $800

Cash $800

Apr. 20 :Recorded services provided on account for April 13–20:

Date Account Dr Cr

Accounts Receivable $2,100

Service Revenue $2,100

Apr. 24 : Recorded cash from cash customers for fees earned during April 17–24:

Date Account Dr Cr

Cash $3,850

Service Revenue $3,850

Apr. 26 : Received cash from clients on account:

Date Account Dr Cr

Cash $5,600

Accounts Receivable $5,600

Apr. 27 : Paid part-timе rеcеptionist for two weeks’ salary:

Date Account Dr Cr

Salary Expense $750

Cash $750

Apr. 29 : Paid telephone bill for April:

Date Account Dr Cr

Telephone Expense $130

Cash $130

Apr. 30 :Paid electricity bill for April:

Date Account Dr Cr

Electricity Expense $200

Cash $200

Apr. 30 :Recorded cash from cash customers for fees earned during April 25–30:

Date Account Dr Cr

Cash $3,050

Service Revenue $3,050

Apr. 30 : Recorded services provided on account for the remainder of April:

Date Account Dr Cr

Accounts Receivable $1,500

Service Revenue $1,500

Apr. 30 :Paid dividends:

Date Account Dr Cr

Dividends $6,000

Cash $6,000

Explanation:

These journal entries re#ect the transactions for April.

Answer

Total transactions for April:

Total Dеbits = $56, 670

Total Crеdits = $56, 670

Was this solution helpful?

What would you like to do next?

Send my question to an expert

Academic Integrity / Feedback / Help Center / Manage Subscription

Cookie Notice Your Privacy Choices Do Not Sell My Info General Policies Privacy Policy

Honor Code IP Rights

© 2003-2024 Chegg Inc. All rights reserved.

You might also like

- EFA1 Exercise 2&3 SolutionDocument12 pagesEFA1 Exercise 2&3 SolutionDiep NguyenNo ratings yet

- Accounting AssignmentDocument16 pagesAccounting AssignmentAarya SharmaNo ratings yet

- Accounting Chapter 3Document14 pagesAccounting Chapter 3Huy Nguyễn NgọcNo ratings yet

- Review of Journal Entries, T-Accounts, General Ledger and Trial BalanceDocument9 pagesReview of Journal Entries, T-Accounts, General Ledger and Trial BalanceJasper Briones II100% (1)

- 2.1b Double Entry (Expenses and Incomes)Document14 pages2.1b Double Entry (Expenses and Incomes)cccgNo ratings yet

- Chapter 6Document6 pagesChapter 6Ellen Joy PenieroNo ratings yet

- Weddings R Us IllustrationDocument9 pagesWeddings R Us IllustrationJester Fermalino AquinoNo ratings yet

- Financial Accounting Adjustments and EntriesDocument13 pagesFinancial Accounting Adjustments and EntriesMya B. Walker100% (4)

- B. Williams Week 2 DiscussionDocument3 pagesB. Williams Week 2 DiscussionBernette WilliamsNo ratings yet

- Chapter 2 - Double Entry Book Keeping - PPTMDocument84 pagesChapter 2 - Double Entry Book Keeping - PPTMMahdia Binta KabirNo ratings yet

- Part 3 - AccountingDocument13 pagesPart 3 - AccountingAmr YoussefNo ratings yet

- Exercises AccountingTransactionsDocument4 pagesExercises AccountingTransactionsRuneet Kaur AroraBD21036No ratings yet

- Journal Entries for Accounting AdjustmentsDocument18 pagesJournal Entries for Accounting AdjustmentsJavid BalakishiyevNo ratings yet

- Accounting 101: Facilitator: P. S. RajeshDocument33 pagesAccounting 101: Facilitator: P. S. RajeshBalaVivekNo ratings yet

- Individual AssignementDocument7 pagesIndividual Assignementgemechu67% (3)

- Principles of Accounting Lecture 3Document21 pagesPrinciples of Accounting Lecture 3Masum HossainNo ratings yet

- Accounting LessonsDocument2 pagesAccounting Lessonsmaryam nabaNo ratings yet

- Accounting LessonsDocument2 pagesAccounting Lessonsmaryam nabaNo ratings yet

- Principles of Accounting Lecture 3Document30 pagesPrinciples of Accounting Lecture 3Masum HossainNo ratings yet

- ACCT 2211 Assignment 2Document17 pagesACCT 2211 Assignment 2Tannaz SNo ratings yet

- 2020 AnswerDocument15 pages2020 Answertanjimalomturjo1No ratings yet

- SAMPLE PROBLEMS With SOLUTION Transaction Analysis and Journal EntriesDocument21 pagesSAMPLE PROBLEMS With SOLUTION Transaction Analysis and Journal EntriesRachel OtazaNo ratings yet

- Quiz 4,5,6Document15 pagesQuiz 4,5,6Sundaramani Saran100% (2)

- 1st Assignment - 2023Document15 pages1st Assignment - 2023harmanchahalNo ratings yet

- Chapter 2 Practice KEYDocument17 pagesChapter 2 Practice KEYmartinmuebejayiNo ratings yet

- Topic 3. Recording Business TransactionsDocument35 pagesTopic 3. Recording Business TransactionsHNo ratings yet

- Question A: Adjusting Entries in The Books of G Inc. Adjusting Journal Entries Sr. No. Particulars/Accounts Title Debit $ Credit $Document7 pagesQuestion A: Adjusting Entries in The Books of G Inc. Adjusting Journal Entries Sr. No. Particulars/Accounts Title Debit $ Credit $Talha Iftekhar KhanNo ratings yet

- The Mechanics of Financial: (Continues)Document60 pagesThe Mechanics of Financial: (Continues)Goodluck MartinNo ratings yet

- Accrual Accounting Adjusting Entries Chapter 4Document38 pagesAccrual Accounting Adjusting Entries Chapter 4Kae Abegail GarciaNo ratings yet

- Accountancy Project On Trial BalanceDocument13 pagesAccountancy Project On Trial BalanceBiplab Swain67% (3)

- Chap 2 Quiz - BA211Document5 pagesChap 2 Quiz - BA211kenozin272100% (2)

- CH 03Document8 pagesCH 03waresh360% (1)

- Fabm1 Q2 PPT W2Document24 pagesFabm1 Q2 PPT W2esmeraylunaaaNo ratings yet

- Journal Entries Ledger Trial Balance Problem and SolutionDocument7 pagesJournal Entries Ledger Trial Balance Problem and SolutionArgha DuttaNo ratings yet

- Accounting journal entriesDocument12 pagesAccounting journal entriesVALENCIA TORENTHANo ratings yet

- Answer Chapter 1Document5 pagesAnswer Chapter 1Nguyễn Châu Mỹ KiềuNo ratings yet

- Exercise For Chapter 2Document6 pagesExercise For Chapter 2Dĩm MiNo ratings yet

- Kimmel, Weygandt, Kieso: Tools For Business Decision Making, 3rd EdDocument50 pagesKimmel, Weygandt, Kieso: Tools For Business Decision Making, 3rd Edujjval10No ratings yet

- Chapters 4 and 5 The LedgerDocument14 pagesChapters 4 and 5 The LedgerSneha DasNo ratings yet

- Accounting Concepts and PrinciplesDocument30 pagesAccounting Concepts and PrinciplesKristine Lei Del MundoNo ratings yet

- BUSN7008 Week 3 Adjustments - Updated 2023Document33 pagesBUSN7008 Week 3 Adjustments - Updated 2023berfamenNo ratings yet

- CH 02Document4 pagesCH 02flrnciairnNo ratings yet

- Exercise 6: Double Entry Bookkeeping (Level Advanced)Document2 pagesExercise 6: Double Entry Bookkeeping (Level Advanced)Lerry AnnNo ratings yet

- Requirement 1 2 3: ACCT500: Course ProjectDocument18 pagesRequirement 1 2 3: ACCT500: Course Projectsuruth242No ratings yet

- Question No 1: Cash Capital StockDocument6 pagesQuestion No 1: Cash Capital StockBushra NazNo ratings yet

- Account and Finacial AssigmentDocument8 pagesAccount and Finacial Assigmentefrata AlemNo ratings yet

- Las 6Document4 pagesLas 6Venus Abarico Banque-AbenionNo ratings yet

- 5-10 Fa1Document10 pages5-10 Fa1Shahab ShafiNo ratings yet

- Journal Entries: Personal AccountDocument6 pagesJournal Entries: Personal Accountb. animeshNo ratings yet

- Expanded EquationDocument4 pagesExpanded EquationĐinh Hà Phương UyênNo ratings yet

- Fundamentals of ABM1 - Q4 - LAS2 DRAFTDocument10 pagesFundamentals of ABM1 - Q4 - LAS2 DRAFTSitti Halima Amilbahar AdgesNo ratings yet

- 1Document9 pages1Shah Alam Badshah100% (1)

- Continuing Case 4-51 - Cookie Creations FinancialsDocument1 pageContinuing Case 4-51 - Cookie Creations FinancialsTalionNo ratings yet

- Chapter 3 Review Problems With SolutionsDocument13 pagesChapter 3 Review Problems With Solutionsaby251188No ratings yet

- Randy Coburn Opened A Law Office Randy Coburn Attorney atDocument1 pageRandy Coburn Opened A Law Office Randy Coburn Attorney atAmit PandeyNo ratings yet

- Financial AccountingDocument25 pagesFinancial AccountingNguyễn HoànNo ratings yet

- Indonesian Accounting Class Discussion on Solving Accounting Challenge ProblemsDocument34 pagesIndonesian Accounting Class Discussion on Solving Accounting Challenge Problemssuci monalia putriNo ratings yet

- Chapter 3Document15 pagesChapter 3clara2300181No ratings yet

- Practices Quizzes About Math 165Document1 pagePractices Quizzes About Math 165fayyasin99No ratings yet

- Michelle M Knoll Can Boys Have Turner Syndrome MoreDocument8 pagesMichelle M Knoll Can Boys Have Turner Syndrome Morefayyasin99No ratings yet

- Husam M Salah Sodium Glucose Cotransporter 2Document10 pagesHusam M Salah Sodium Glucose Cotransporter 2fayyasin99No ratings yet

- Detecting Eggs Condition by Using Pixy Camera Based On Shell-Color FilteringDocument4 pagesDetecting Eggs Condition by Using Pixy Camera Based On Shell-Color Filteringfayyasin99No ratings yet

- Joshua Ehrlich The East India Company and The PoliticsDocument263 pagesJoshua Ehrlich The East India Company and The Politicsfayyasin99No ratings yet

- Step: 1Document1 pageStep: 1fayyasin99No ratings yet

- Eppstein 2013Document21 pagesEppstein 2013fayyasin99No ratings yet

- Kanemitsu 2016Document14 pagesKanemitsu 2016fayyasin99No ratings yet

- SolutionDocument1 pageSolutionfayyasin99No ratings yet

- Step: 1Document1 pageStep: 1fayyasin99No ratings yet

- Rina Dwi Y.S Tk2a 18 Job7Document20 pagesRina Dwi Y.S Tk2a 18 Job7Rina Dwi YunitasariNo ratings yet

- 62c39f2609022 Ferrell 12e PPT ch14Document51 pages62c39f2609022 Ferrell 12e PPT ch14fayyasin99No ratings yet

- Wiley - Essential Mathematics For Economics and Business, 4th Edition - 978!1!118-35829-0Document3 pagesWiley - Essential Mathematics For Economics and Business, 4th Edition - 978!1!118-35829-0fayyasin990% (1)

- Step: 1Document1 pageStep: 1fayyasin99No ratings yet

- Essential Mathematics For Economics and Business / Teresa BradleyDocument1 pageEssential Mathematics For Economics and Business / Teresa Bradleyfayyasin99No ratings yet

- And Cash and Cash A Ntatbeg N Gof 4millionDocument1 pageAnd Cash and Cash A Ntatbeg N Gof 4millionfayyasin99No ratings yet

- Transtutor Yg BetulDocument1 pageTranstutor Yg Betulfayyasin99No ratings yet

- Answer Chegg 10 OktoberDocument3 pagesAnswer Chegg 10 Oktoberfayyasin99No ratings yet

- 62c39f3e39bec Ferrell 12e PPT ch15Document41 pages62c39f3e39bec Ferrell 12e PPT ch15fayyasin99No ratings yet

- 62c39f5663536 Ferrell 12e PPT ch16Document40 pages62c39f5663536 Ferrell 12e PPT ch16fayyasin99No ratings yet

- Review of linguistic anthropology conceptsDocument3 pagesReview of linguistic anthropology conceptsfayyasin99No ratings yet

- Answer Chegg 22 Mei 2023Document1 pageAnswer Chegg 22 Mei 2023fayyasin99No ratings yet

- You Can View The Question in Original Chegg URLDocument1 pageYou Can View The Question in Original Chegg URLfayyasin99No ratings yet

- Bachelor Thesis MaritimeDocument43 pagesBachelor Thesis MaritimeMiriam PedersenNo ratings yet

- English AssignmentDocument79 pagesEnglish AssignmentAnime TubeNo ratings yet

- Faith Surah RefutationDocument9 pagesFaith Surah RefutationKhairul Anuar Mohd IsaNo ratings yet

- Picture DescriptionDocument7 pagesPicture DescriptionAida Mustafina100% (3)

- Channel Emotions into FlowDocument2 pagesChannel Emotions into Flowmaxalves77No ratings yet

- Band Theory of Soids5!1!13Document20 pagesBand Theory of Soids5!1!13Ravi Kumar BanalaNo ratings yet

- 2019 AhmadDocument73 pages2019 Ahmadaateka02No ratings yet

- Kawai MP7 Owner's ManualDocument148 pagesKawai MP7 Owner's ManualMiloNo ratings yet

- Philippine Poetry:: It's Form, Language, and SpeechDocument12 pagesPhilippine Poetry:: It's Form, Language, and SpeechRis AsibronNo ratings yet

- Reflection Paper IIDocument1 pageReflection Paper IIHazel Marie Echavez100% (1)

- Media ExercisesDocument24 pagesMedia ExercisesMary SyvakNo ratings yet

- RuelliaDocument21 pagesRuelliabioandreyNo ratings yet

- CDC121 Weekly Schedule Spring 2017 RidDocument5 pagesCDC121 Weekly Schedule Spring 2017 RidAnonymous x1Lu4qE623No ratings yet

- Key Responsibilities On Skill.: Curriculum Vitae PersonalDocument3 pagesKey Responsibilities On Skill.: Curriculum Vitae PersonalLAM NYAWALNo ratings yet

- Body Condition Scoring of Dairy Cattle A Review - 2 PDFDocument8 pagesBody Condition Scoring of Dairy Cattle A Review - 2 PDFfrankyNo ratings yet

- A Meta Analysis of Effectiveness of Interventions To I - 2018 - International JoDocument12 pagesA Meta Analysis of Effectiveness of Interventions To I - 2018 - International JoSansa LauraNo ratings yet

- Well Plug and Abandonment Using HwuDocument1 pageWell Plug and Abandonment Using HwuJuan Pablo CassanelliNo ratings yet

- (已压缩)721 260 PBDocument879 pages(已压缩)721 260 PBflorexxi19No ratings yet

- BTechSyllabus EC PDFDocument140 pagesBTechSyllabus EC PDFHHNo ratings yet

- Structural Analysis of Mn(phen)3(CF3SO3)2 ComplexDocument7 pagesStructural Analysis of Mn(phen)3(CF3SO3)2 ComplexAnonymous 8pSaum8qNo ratings yet

- India's Fertilizer IndustryDocument15 pagesIndia's Fertilizer Industrydevika20No ratings yet

- Three Phase Traffic Theory PDFDocument11 pagesThree Phase Traffic Theory PDFKocic GradnjaNo ratings yet

- Shyness and Social AnxietyDocument22 pagesShyness and Social Anxietybeleanadrian-1No ratings yet

- Public Health Risks of Inadequate Prison HealthcareDocument3 pagesPublic Health Risks of Inadequate Prison HealthcarerickahrensNo ratings yet

- Intensive ReadingDocument3 pagesIntensive ReadingKarina MoraNo ratings yet

- Assurance Question Bank 2013 PDFDocument168 pagesAssurance Question Bank 2013 PDFIan RelacionNo ratings yet

- Pilani MTech SS PDFDocument12 pagesPilani MTech SS PDFonline accountNo ratings yet

- Azzi, R., Fix, D. S. R., Keller, F. S., & Rocha e Silva, M. I. (1964) - Exteroceptive Control of Response Under Delayed Reinforcement. Journal of The Experimental Analysis of Behavior, 7, 159-162.Document4 pagesAzzi, R., Fix, D. S. R., Keller, F. S., & Rocha e Silva, M. I. (1964) - Exteroceptive Control of Response Under Delayed Reinforcement. Journal of The Experimental Analysis of Behavior, 7, 159-162.Isaac CaballeroNo ratings yet

- Civil Engineering Softwares and Their ImplementationsDocument13 pagesCivil Engineering Softwares and Their ImplementationsADITYANo ratings yet

- Why We Can't Stop Obsessing Over CelebritiesDocument2 pagesWhy We Can't Stop Obsessing Over CelebritiesJoseMa AralNo ratings yet