Professional Documents

Culture Documents

811 - GST Invoice - XXXXXXX86830 - 27220124049XXXXX - 1

Uploaded by

cryptocasper223Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

811 - GST Invoice - XXXXXXX86830 - 27220124049XXXXX - 1

Uploaded by

cryptocasper223Copyright:

Available Formats

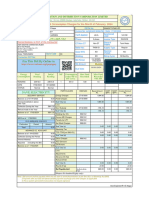

Tax Invoice

Details of Receiver(Billed To) Original for Recipient

N SUNITHA VENKATESH State :KARNATAKA

# 244/7 13TH CROSS State Code :29

2ND MAIN GSTIN :

BANGALORE NORTH POS :29 - KARNATAKA

., KARNATAKA, 560079

Details of Service Provider

DBS BANK INDIA LIMITED State :MAHARASHTRA

Ground, 1st,16th,18th, 19th Floors State Code :27

Express Towers, Nariman Point GSTIN :27AAGCD5838A1ZT

Mumbai,Maharashtra

400 021

SAC/HSN Code : 997119 Customer ID :22858528

SAC Description : Other financial services except -

investment banking insurance services Account ID :881027886830

and pension services

Service Description : IGST MAB Fee GST FOR MAB NON-MAINT

FEE

Invoice Date

Total Invoice

Abatements

Invoice No.

Trans.Ref.

IGST Rate

IGST Amt

Discount

Charges

Taxable

Value*

SI.No.

Value

No.

1 2722012404927465 24-01-2022 S51046562-4 175.00 0 175.00 18.00% 31.50

206.50

Total Invoice Value (In Figure) Rs. 206.50

Total Invoice Value (In Words) Rupees Two Hundred Six And Fifty Paise Only

Remarks:-

* Tax Payable on Reverse Charge Basis: No

* Notional values in case of Fx conversion

-

-

-

-

For SME / Corporate Customers Contact center details: Signature

Call Center Number : 1800 103 6500

Email: businesscarein@dbs.com

For Savings/Digi bank Customers Contact center details:

Digitally signed by INDIA GST

Call Center number : 1800 209 4555 / 1800 103 9897 / 044-66854555

Date: 2022.02.14 18:08:46 SGT

Email: customercareindia@dbs.com

Reason: PDF Sign

Location: MUMBAI

Disclaimer: Please check this invoice carefully. Unless we receive a notification of any discrepancy or inaccuracy with respect to this invoice

within 45 days from the date of receipt of this invoice, it shall be considered as conclusive and binding on you. If you need any additional

details or clarifications related to transactions or any other information in the invoice, please contact your Relationship Manager or contact

person at DBS Bank.

You might also like

- SNGPL - Web BillDocument2 pagesSNGPL - Web BillMuhammad Irfan100% (1)

- Retail Invoice: Other Details of SupplierDocument1 pageRetail Invoice: Other Details of SupplierPubali Deb BurmanNo ratings yet

- SNPL Nokhaiz Bill PDFDocument6 pagesSNPL Nokhaiz Bill PDFUmar Irshad ChaudharyNo ratings yet

- Barangay Micro Business Enterprise (Bmbe) Act: 13284-TOPIC 3Document16 pagesBarangay Micro Business Enterprise (Bmbe) Act: 13284-TOPIC 3kim cheNo ratings yet

- Commentary For Academic Writing For Graduate StudentsDocument123 pagesCommentary For Academic Writing For Graduate StudentsJakler Nichele100% (1)

- TAX87 16 Local Preferential With Answers PDFDocument5 pagesTAX87 16 Local Preferential With Answers PDFJohn Carlo CruzNo ratings yet

- Income Tax Payment Procedures in TanzaniaDocument3 pagesIncome Tax Payment Procedures in Tanzaniashadakilambo100% (1)

- Credit Note: (Original For Recipient)Document2 pagesCredit Note: (Original For Recipient)CA ASHISH JAINNo ratings yet

- InvoiceDocument1 pageInvoiceMAKZYS khanNo ratings yet

- Rri RudramDocument3 pagesRri RudramAnirban BanerjeeNo ratings yet

- Credit Note: (Original For Recipient)Document2 pagesCredit Note: (Original For Recipient)Puneet DabasNo ratings yet

- AIR INDIA GST InvoiceDocument4 pagesAIR INDIA GST InvoiceKanchan Singh0% (1)

- 15-Mar-2019 CL PDFDocument3 pages15-Mar-2019 CL PDFDarshanNo ratings yet

- Analytics CloudDocument1 pageAnalytics CloudAbhijit SarkarNo ratings yet

- Bill DetailDocument1 pageBill DetailJagadeesan ManogaranNo ratings yet

- Retail Invoice: Other Details of SupplierDocument1 pageRetail Invoice: Other Details of SupplierPubali Deb BurmanNo ratings yet

- Man Opa Tax Invoice PDFDocument1 pageMan Opa Tax Invoice PDFpooja padhiNo ratings yet

- Document PDFDocument1 pageDocument PDFArup GhoshNo ratings yet

- InvoiceDocument2 pagesInvoiceFierceNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Padmanabhan RNo ratings yet

- My ESAS - Workflow - RequestDocument1 pageMy ESAS - Workflow - RequestIlove music096No ratings yet

- Washing Machine InvoiceDocument1 pageWashing Machine InvoiceAmeet ParekhNo ratings yet

- SNGPL - Web BillDocument1 pageSNGPL - Web BillRabeea BakhtawerNo ratings yet

- Taco 200716DF00030038Document1 pageTaco 200716DF00030038Frank Edwin VedamNo ratings yet

- (Triplicate For Supplier) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountDocument1 page(Triplicate For Supplier) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountPitoyoNo ratings yet

- Tax Invoice: CIN:U72900DL2020PTC361314 GSTIN: 07AAFCE8193A1ZPDocument1 pageTax Invoice: CIN:U72900DL2020PTC361314 GSTIN: 07AAFCE8193A1ZPAbhijit SarkarNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)satvikNo ratings yet

- JayantDocument2 pagesJayantAnkur KotawadekarNo ratings yet

- GPS 23-02-214Document1 pageGPS 23-02-214Chetan RandhawaNo ratings yet

- Tax Invoice: Raga Coffee CPSDocument1 pageTax Invoice: Raga Coffee CPSAbhijit SarkarNo ratings yet

- Bill DetailDocument1 pageBill DetailsasikumarNo ratings yet

- TataDocument67 pagesTataBhadriNo ratings yet

- Your DetailsDocument2 pagesYour DetailsAveksha RankaNo ratings yet

- Img 20200125 0001 PDFDocument1 pageImg 20200125 0001 PDFballav sarkarNo ratings yet

- BilldetailDocument1 pageBilldetailArun DeppzzNo ratings yet

- Output CGST 14% Output SGST 14% Round Off Fright Charge: 1 Kit Front SuspensionDocument1 pageOutput CGST 14% Output SGST 14% Round Off Fright Charge: 1 Kit Front SuspensionmadhurNo ratings yet

- Swiggy PiDocument1 pageSwiggy Pikashinathvpillai0No ratings yet

- BM2308I002689002Document2 pagesBM2308I002689002Dharmendra KumarNo ratings yet

- Aug 2021 G E Army Peshawar: Cnic No: 12345-6789012-3Document1 pageAug 2021 G E Army Peshawar: Cnic No: 12345-6789012-3Mehtab MalikNo ratings yet

- Feb-20 102072584236Document1 pageFeb-20 102072584236Farhan MalikNo ratings yet

- Isd 00272Document1 pageIsd 00272Hasnain KhanNo ratings yet

- BACKUPDocument3 pagesBACKUPprassananshettyNo ratings yet

- Tax Invoice: AB Cartridge Private LimitedDocument1 pageTax Invoice: AB Cartridge Private LimitedSunil PatelNo ratings yet

- Hariyana LBDocument1 pageHariyana LBSatkar GarmentNo ratings yet

- Bill DetailDocument1 pageBill DetailBUVANA BUVINo ratings yet

- Sold To: Tax InvoiceDocument1 pageSold To: Tax Invoiceমধু্স্মিতা ৰায়No ratings yet

- Taco 0105946082700004Document1 pageTaco 0105946082700004Mohit KukadiaNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherkysydsNo ratings yet

- InvoiceDocument1 pageInvoicesablejanhavi291No ratings yet

- Ka C 23 1380973 PDFDocument5 pagesKa C 23 1380973 PDFHarsh PatelNo ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1Akshay KadamNo ratings yet

- BilldetailDocument1 pageBilldetailRam PriyanNo ratings yet

- Anant Chaitanya Techn0 Lab LLP: SalaltaDocument11 pagesAnant Chaitanya Techn0 Lab LLP: SalaltaGiridhari ChandrabansiNo ratings yet

- Maa Creations: GSTIN: 10ABKFM2255Q1Z1 Tax InvoiceDocument4 pagesMaa Creations: GSTIN: 10ABKFM2255Q1Z1 Tax Invoicesnigdha satyajitNo ratings yet

- January ClaimDocument1 pageJanuary Claimtabu 1No ratings yet

- Maple InvoiceDocument1 pageMaple InvoiceJames JoelNo ratings yet

- ICAI Membership FeeDocument1 pageICAI Membership Feeanjalidas91No ratings yet

- GTS10215 Headset Claim InvoiceDocument1 pageGTS10215 Headset Claim InvoiceBalaji ArumugamNo ratings yet

- Ht2329i002681770 2Document4 pagesHt2329i002681770 2Chegg tutorsNo ratings yet

- Bolero Bill JanuaryDocument1 pageBolero Bill JanuaryMAA KALI ENTERPRISESNo ratings yet

- Sales Invoice 308137Document1 pageSales Invoice 308137patmosodera1999No ratings yet

- Sample Copy 3Document1 pageSample Copy 3Random NameNo ratings yet

- SampleDocument1 pageSampleRandom NameNo ratings yet

- Taxation - Direct and IndirectDocument9 pagesTaxation - Direct and IndirectAkshatNo ratings yet

- Delhi Fire Service Rules, 2010Document66 pagesDelhi Fire Service Rules, 2010ChannaNo ratings yet

- Economy DA - MSDI 2019Document99 pagesEconomy DA - MSDI 2019ConnorNo ratings yet

- RMCDocument7 pagesRMCKim TabayocyocNo ratings yet

- Test Bank For Hills Taxation of Individuals and Business Entities 2021 Edition 12th Edition Brian Spilker Benjamin Ayers John Barrick John Robinson Ronald Worsham Connie Weaver Troy LDocument80 pagesTest Bank For Hills Taxation of Individuals and Business Entities 2021 Edition 12th Edition Brian Spilker Benjamin Ayers John Barrick John Robinson Ronald Worsham Connie Weaver Troy LGuadalupe Panek100% (27)

- House Bill 2270: New Sections Are in Boldfaced TypeDocument8 pagesHouse Bill 2270: New Sections Are in Boldfaced TypeSinclair Broadcast Group - EugeneNo ratings yet

- Assessment of Charitable Trusts and Institutions: Peeyush Sharma & Co.Document45 pagesAssessment of Charitable Trusts and Institutions: Peeyush Sharma & Co.Vipul DesaiNo ratings yet

- (CBTP)Document23 pages(CBTP)gudissagabissaNo ratings yet

- Septic Tank and Cistern Tank ComputationDocument12 pagesSeptic Tank and Cistern Tank ComputationkristelleNo ratings yet

- Manual Instructions Surcharge 80EEBDocument11 pagesManual Instructions Surcharge 80EEBSuprasannaPradhanNo ratings yet

- Value Added TaxDocument2 pagesValue Added TaxBon BonsNo ratings yet

- Economy of BahrainDocument2 pagesEconomy of Bahrainocduran42004No ratings yet

- TSF 5108235026014504 R PosDocument3 pagesTSF 5108235026014504 R PosJoy MondalNo ratings yet

- Dividend Decisions Unit 5Document8 pagesDividend Decisions Unit 5md saifNo ratings yet

- G.R. No. L-6355-56 Endencia Vs David 1953Document5 pagesG.R. No. L-6355-56 Endencia Vs David 1953fiNixzzNo ratings yet

- SEBI All InformationDocument297 pagesSEBI All Informationarjun222222No ratings yet

- The Organizational Plan: Teams, Legal Forms, & Strategic AlliancesDocument32 pagesThe Organizational Plan: Teams, Legal Forms, & Strategic Alliancessappz3545448No ratings yet

- Class XII Acc PB HC Mock 2021-22Document15 pagesClass XII Acc PB HC Mock 2021-22Satinder SandhuNo ratings yet

- Capital Gains Tax-1Document61 pagesCapital Gains Tax-1Jieve Licca FanoNo ratings yet

- Lesson PlanDocument2 pagesLesson PlanAguinaldo Geroy JohnNo ratings yet

- Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Document5 pagesFill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"May Joy DepalomaNo ratings yet

- TRAIN LAW FindingsDocument10 pagesTRAIN LAW FindingsHoney Lizette Sunthorn80% (5)

- Ashita VarshneyDocument2 pagesAshita VarshneyThe Cultural CommitteeNo ratings yet

- Roth IRADocument2 pagesRoth IRAanon_757121No ratings yet

- Sri Lanka Accounting Standards Slfrs 02 SHARE-BASED PAYMENT (Revision)Document3 pagesSri Lanka Accounting Standards Slfrs 02 SHARE-BASED PAYMENT (Revision)Dhanushika SamarawickramaNo ratings yet

- Gujarat Cooperative Milk Marketing Federation LimitedDocument4 pagesGujarat Cooperative Milk Marketing Federation LimitedvickyvinNo ratings yet