Professional Documents

Culture Documents

Export - Duty - Rate - Oct 2022

Export - Duty - Rate - Oct 2022

Uploaded by

Muhammad Faisal0 ratings0% found this document useful (0 votes)

7 views1 pageThis notification sets the value of crude palm oil under the Customs Act 1967 for the period of October 1st to 31st, 2022 at RM4,033.51 per tonne. It also provides the export duty rates on crude palm oil based on the market price per tonne, ranging from 0% for prices below RM2,250 to a maximum of 8% for prices above RM3,450. The export duty rates have been effective since January 1st, 2020 according to the Malaysian Royal Customs Department.

Original Description:

Malaysia export duty

Original Title

10. EXPORT_DUTY_RATE_OCT 2022

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis notification sets the value of crude palm oil under the Customs Act 1967 for the period of October 1st to 31st, 2022 at RM4,033.51 per tonne. It also provides the export duty rates on crude palm oil based on the market price per tonne, ranging from 0% for prices below RM2,250 to a maximum of 8% for prices above RM3,450. The export duty rates have been effective since January 1st, 2020 according to the Malaysian Royal Customs Department.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 pageExport - Duty - Rate - Oct 2022

Export - Duty - Rate - Oct 2022

Uploaded by

Muhammad FaisalThis notification sets the value of crude palm oil under the Customs Act 1967 for the period of October 1st to 31st, 2022 at RM4,033.51 per tonne. It also provides the export duty rates on crude palm oil based on the market price per tonne, ranging from 0% for prices below RM2,250 to a maximum of 8% for prices above RM3,450. The export duty rates have been effective since January 1st, 2020 according to the Malaysian Royal Customs Department.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

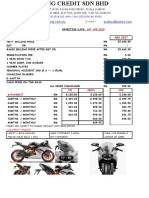

CUSTOMS ACT 1967

NOTIFICATION OF VALUES OF CRUDE PALM OIL

UNDER SECTION 12

This Notification has effect for the period from

01 October 2022 to 31 October 2022

Schedule

(1) (2) (3)

Dutiable goods Subheading Value per tonne

Crude Palm Oil 1511.10 0000 RM 4,033.51

CPO EXPORT DUTY RATE*

CPO MARKET PRICE EXPORT DUTY

(FOB RM/TONNE) (%)

< RM2,250.00 NIL

RM2,250 – RM2,400 3.0

RM2,401 – RM2,550 4.5

RM2,551 – RM2,700 5.0

RM2,701 – RM2,850 5.5

RM2,851 – RM3,000 6.0

RM3,001 – RM3,150 6.5

RM3,151 – RM3,300 7.0

RM3,301 – RM3,450 7.5

> RM3,450.00 8.0

Note: * - Effective from 1st January 2020

Source: Malaysian Royal Customs Department

You might also like

- Fin320 Simulation 2020 JulyDocument40 pagesFin320 Simulation 2020 JulyMohd Azmezanshah Bin Sezwan100% (1)

- c20.2022 - Rubber & Op Wage RateDocument3 pagesc20.2022 - Rubber & Op Wage RateMohd SaadNo ratings yet

- Bombay Metal Exchange LTD.: Sub: Benchmark - Copper Billet Prices Effective From 16 March, 2021Document1 pageBombay Metal Exchange LTD.: Sub: Benchmark - Copper Billet Prices Effective From 16 March, 2021hemant kadlagNo ratings yet

- Mashin TaxDocument6 pagesMashin TaxSharavkhorol ErdenebayarNo ratings yet

- 03 Export Duty Rate Mac 2022Document1 page03 Export Duty Rate Mac 2022gunturpputraNo ratings yet

- Taxation On The Malaysia Palm Oil SectorDocument2 pagesTaxation On The Malaysia Palm Oil SectorSantosNo ratings yet

- Prepare Qotation For ShipmentDocument2 pagesPrepare Qotation For ShipmentRoshan MuralyNo ratings yet

- Investment Performance 2022Document8 pagesInvestment Performance 2022Atim TimNo ratings yet

- KTM 690 R Duke 2015 Abs GSTDocument2 pagesKTM 690 R Duke 2015 Abs GSTzaim nur hakimNo ratings yet

- IndexDocument1 pageIndexPui Yuk YeanNo ratings yet

- Exercise 3 - Updated 020615Document2 pagesExercise 3 - Updated 020615ikhwanstorageNo ratings yet

- Net Rate 220121Document3 pagesNet Rate 220121Am BornNo ratings yet

- Net Rate 040121Document3 pagesNet Rate 040121Am BornNo ratings yet

- Fiarlocks LTD: Invoice and Packing ListDocument1 pageFiarlocks LTD: Invoice and Packing ListDeelaka DheeraratneNo ratings yet

- Z800 Package 2Document1 pageZ800 Package 2a.khairNo ratings yet

- CASH FLOW ConventionalDocument17 pagesCASH FLOW ConventionalHazim ZakariaNo ratings yet

- 10 FlooringDocument191 pages10 FlooringAli shahzadNo ratings yet

- Rumus Perhitungan PajakDocument4 pagesRumus Perhitungan Pajaknisa hamzahNo ratings yet

- Jurnal Anggaran Dan Keuangan Negara Indonesia (AKURASI)Document25 pagesJurnal Anggaran Dan Keuangan Negara Indonesia (AKURASI)AfriyaniNo ratings yet

- Hotel's Room RateDocument9 pagesHotel's Room RatebeeanaclarissaNo ratings yet

- Orange Geometric Line Service InvoiceDocument1 pageOrange Geometric Line Service Invoiceqmar gNo ratings yet

- Book 1Document4 pagesBook 1erdayani amir mohammadNo ratings yet

- Year Oil Palm Planted Area (Hectares) Production of CPO (Tonnes) Exports of Palm Oil (Tonnes)Document8 pagesYear Oil Palm Planted Area (Hectares) Production of CPO (Tonnes) Exports of Palm Oil (Tonnes)Shaeera sulaimanNo ratings yet

- Cost of Doing Business Calculation 2020Document16 pagesCost of Doing Business Calculation 2020harwani3No ratings yet

- 4 Price&RentalIndexH12022Document19 pages4 Price&RentalIndexH12022Suraya NatashaNo ratings yet

- Matrix Project Summary 04.01.23Document2 pagesMatrix Project Summary 04.01.23DDT20F2044 KARTHIK MANIAMNo ratings yet

- Hotel Reko Inn BaruDocument1 pageHotel Reko Inn BaruMohdNorFirdausNo ratings yet

- Expense Report: Purpose: Bengkel Bimbingan Upsr 3.0 Kickoff Name: Muhammad Azfar Bin Ismail Student ID: 21509Document8 pagesExpense Report: Purpose: Bengkel Bimbingan Upsr 3.0 Kickoff Name: Muhammad Azfar Bin Ismail Student ID: 21509azfarNo ratings yet

- KTM RC390 Abs 2015 GST 0Document1 pageKTM RC390 Abs 2015 GST 0zaim nur hakimNo ratings yet

- 14-09-2021. Mr. HussainDocument2 pages14-09-2021. Mr. Hussainengr.shahzaibashfaqNo ratings yet

- Overhead by Raiden Yae MikoDocument25 pagesOverhead by Raiden Yae MikolatomNo ratings yet

- Tender Total-Fajar Baru Contractor Sdn. Bhdr2Document5 pagesTender Total-Fajar Baru Contractor Sdn. Bhdr2Vasanthan PadbanadhanNo ratings yet

- E57888INDocument1 pageE57888INKarFai LeongNo ratings yet

- 2nd Memo AuditDocument3 pages2nd Memo AuditPaul SamuelNo ratings yet

- Net Rate 110121Document3 pagesNet Rate 110121Am BornNo ratings yet

- Costing Sheet WorkingDocument6 pagesCosting Sheet WorkingUsman IjazNo ratings yet

- Bik TableDocument3 pagesBik TableZale EzekielNo ratings yet

- Press Release (PPM) - 27 January 2024Document1 pagePress Release (PPM) - 27 January 2024Le MauricienNo ratings yet

- Built Up Rate Spun PileDocument12 pagesBuilt Up Rate Spun Pilesahila ismailNo ratings yet

- SMS PriceDocument1 pageSMS PriceDeep ShahNo ratings yet

- Kelisa Kak LiyanaDocument2 pagesKelisa Kak Liyanaisa abdullahNo ratings yet

- Petty Cash Sir 231018Document1 pagePetty Cash Sir 231018Nor Hasanah Mohd ZakriNo ratings yet

- 24-QT-Q1-001 - Ain MelakaDocument1 page24-QT-Q1-001 - Ain MelakaNUR AIN KHALIBNo ratings yet

- 1 Bygging India 2 Indure A Our Price With Cement M7.5 M10 B Our Price Without Cement M7.5 M10Document6 pages1 Bygging India 2 Indure A Our Price With Cement M7.5 M10 B Our Price Without Cement M7.5 M10meeraxxx94No ratings yet

- Problem Sheet Agr323Document8 pagesProblem Sheet Agr323ammarsalleh20No ratings yet

- Analisis Finansial Usaha Tani (Bayam)Document12 pagesAnalisis Finansial Usaha Tani (Bayam)Usamah RofiNo ratings yet

- Net Rate 010121Document4 pagesNet Rate 010121Am BornNo ratings yet

- Net Rate 180121Document4 pagesNet Rate 180121Am BornNo ratings yet

- 2022.10.17 AT SEC 17-C Q3 CY2022 Financial and Operating Results and Press Release - SignedDocument2 pages2022.10.17 AT SEC 17-C Q3 CY2022 Financial and Operating Results and Press Release - SignedValiente RandzNo ratings yet

- Mech It Possible: Tax InvoiceDocument1 pageMech It Possible: Tax InvoiceDeepak GovardhaneNo ratings yet

- Z650 Abs 2017Document2 pagesZ650 Abs 2017zaim nur hakimNo ratings yet

- 11-09-2021. Romi Technical ServicesDocument2 pages11-09-2021. Romi Technical Servicesengr.shahzaibashfaqNo ratings yet

- 11-09-2021. Romi Technical ServicesDocument2 pages11-09-2021. Romi Technical Servicesengr.shahzaibashfaqNo ratings yet

- 06 ConcreteDocument179 pages06 ConcreteAli shahzadNo ratings yet

- 2 BR - Tower 108 - Jumeirah Village - Inr 2.46 CR - ReadyDocument4 pages2 BR - Tower 108 - Jumeirah Village - Inr 2.46 CR - ReadyFahad Farooq FareedNo ratings yet

- Quote SampleDocument1 pageQuote SampleNaveen FootyNo ratings yet

- 03.trading Journal by @MNN 2022Document18 pages03.trading Journal by @MNN 2022Mohd Nor NajamudinNo ratings yet

- Lecture 3 RES551 (B) - Conv Technique Case Study 1Document16 pagesLecture 3 RES551 (B) - Conv Technique Case Study 1NURAIN HANIS BINTI ARIFFNo ratings yet