Professional Documents

Culture Documents

Bir Ruling No. Vat-419-2022 - Peza Vat and Non Vat Hmo

Uploaded by

Johnallen Marilla0 ratings0% found this document useful (0 votes)

12 views7 pagesOriginal Title

BIR RULING NO. VAT-419-2022_PEZA VAT AND NON VAT HMO

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views7 pagesBir Ruling No. Vat-419-2022 - Peza Vat and Non Vat Hmo

Uploaded by

Johnallen MarillaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 7

October 17, 2022

BIR RULING NO. VAT-419-2022

Sections 108 (A) and 311 the Tax Code;

Section 4.180-3 of RR No. 16-2005, as amended;

Section 5, Rule 18 of IRR of RA No. 11534

Insurance Commission

1071 United Nations Avenue

Manila

Attention: Dennis B. Funa

Insurance Commissioner

Gentlemen :

This refers to your request for clarification whether: (1) the health

maintenance organization ("HMO") plans acquired by business export

enterprises ("REEs") registered with any Investment Promotion Agency

("IPA") is subject to twelve percent (12%) Value-Added Tax ("VAT"); and (2)

if yes, such VAT is based only on the payment representing compensation

for services of HMOs.

As represented, prior to the effectivity of the Corporate Recovery and

Tax Incentives for Enterprises ("CREATE") Act, 1 HMO plans acquired by

REEs were exempt from twelve percent (12%) VAT; that upon issuance of

Revenue Regulations No. 21-2021, 2 these HMO plans are now subject to

twelve percent (12%) VAT; and that in the case of Medicard Philippines v.

Commissioner of Internal Revenue , 3 the Supreme Court ruled that the

twelve percent (12%) VAT is based on the total payment representing

compensation for services of HMOs.

In reply, please be informed as follows:

HMO plans acquired by

REEs are subject to zero

percent (0%) VAT

Section 311 of the Tax Code 4 reads as follows:

"SEC. 311. Investments Prior to the Effectivity of This Act. —

Registered business enterprises with incentives granted prior to the

effectivity of this Act 5 shall be subject to the following rules:

(A) Registered business enterprises whose projects or activities

were granted only an income tax holiday prior to the effectivity of this

Act shall be allowed to continue with the availment of the income tax

holiday for the remaining period of the income tax holiday as specified

in the terms and conditions of their registration: Provided, That for

those that have granted the income tax holiday but have not yet

availed of the incentive upon the effectivity of this Act, they may use

the income tax holiday for the period specified in the terms and

conditions of their registration.

CD Technologies Asia, Inc. © 2022 cdasiaonline.com

(B) Registered business enterprises, whose projects or activities

were granted an income tax holiday prior to the effectivity of this Act

and that are entitled to the five percent (5%) tax on gross income

earned incentive after the income tax holiday, shall be allowed to avail

of the five percent (5%) tax on gross income earned incentive based on

Subsection (C); and

(C) Registered business enterprises currently availing of the five

percent (5%) tax on gross income earned granted prior to the

effectivity of this Act shall be allowed to continue availing the said

incentive at the rate of five percent (5%) for ten (10) years."

(Underscoring supplied)

Also, Rule 18 of the amended IRR of CREATE Law 6 states:

"RULE 18. Investments prior to the effectivity of the Act

xxx xxx xxx

SECTION 5. Non-income related tax incentives. — All

registered export and domestic market enterprises that will continue to

avail of their existing tax incentives subject to Sections 1, 2 and 3 of

this Rule, may continue to enjoy the duty exemption, VAT exemption

on importation, and VAT zero-rating on local purchases as provided in

their respective IPA registrations; provided, that the duty exemption,

VAT-exemption on importation, and VAT zero-rating on local purchases

shall only apply to goods and services directly attributable to and

exclusively used in the registered project or activity of said registered

export enterprises located inside the ecozones and freeports until the

expiration of the transitory period; provided, further, that importation

of capital equipment, spare parts, and accessories by existing export

enterprises and domestic market enterprises registered with the BOI

prior to the effectivity of the act shall continue to be subject to duty

exemption for a period of five (5) years from date of registration."

(Underscoring supplied)

Prescinding from the above-cited provisions, it is clear that registered

business enterprises may continue to avail of the income tax incentives

granted to them before the effectivity of the CREATE Law ( i.e., income tax

holiday ("ITH"), five percent (5%) tax on gross income earned incentive

after the ITH). However, the income tax incentives may only be availed

within the transitory period (For ITH, the remaining period of the ITH as

specified in the terms and conditions of their registration; For 5% gross

income tax, for ten (10) years from the effectivity of the CREATE Law or until

April 11, 2031). 7

When it comes to the non-income tax incentives such as the VAT zero-

rating, it bears stressing that Section 5, Rule 18 of the amended IRR of

CREATE Law expressly states that the VAT zero-rating on local purchases

incentive shall only apply to goods and services directly attributable to and

exclusively used in the registered project or activity of the export enterprises

until the expiration of the transitory period. 8 Hence, while it is true that an

REE may still avail of the VAT zero rating, the same is limited only to goods

and services directly attributable to and exclusively used in the registered

project or activity of said export enterprises.

CD Technologies Asia, Inc. © 2022 cdasiaonline.com

Section 5, Rule 2 of the amended IRR provides what constitutes

"directly and exclusively used in its registered project or activity," to wit:

"Rule 2

Tax and Duty Incentives

SECTION 5. Value-Added Tax (VAT) Zero-Rating and Exemption. —

xxx

The direct and exclusive use for the registered project or activity refers

t o raw materials, inventories, supplies, equipment, goods, packaging

materials, services, including provision of basic infrastructure, utilities,

and maintenance, repair and overhaul of equipment, and other

expenditures directly attributable to the registered project or

activity without which the registered project or activity cannot be

carried out; provided, that the VAT zero-rating on local purchases shall

be granted upon the endorsement of the concerned IPA, in addition to

the documentary requirements of the BIR." (Underscoring supplied)

For this purpose, under Questions No. 13 and 14 of Revenue

Memorandum Circular ("RMC") No. 24-2022, 9 the Bureau clarified the

phrase "direct and exclusive use," to wit:

"Q13: What is meant by direct and exclusive use in the registered

project or activity?

A13: Direct and exclusive use in the registered project or activity refers

to raw materials, supplies, equipment, goods, packaging materials,

services, including provision of basic infrastructure, utilities, and

maintenance, repair and overhaul of equipment, and other

expenditures directly attributable to the registered project or

activity without which the registered project or activity cannot be

carried out."

xxx xxx xxx

Q14: What cost items fall under the "other expenditures" in the

preceding question?

A14: These are costs that are indispensable to the project or activity,

i.e., without which, the project or activity cannot proceed, and these

include expenses that are necessary or required to be incurred

depending on the nature of the registered project or activity of the

export enterprise." (Emphasis and underscoring supplied)

Based on the afore-quoted provisions, purchases of goods and services

include the expenditures that are/will be directly and exclusively used in or

attributable to the registered project or activity, without which the registered

project or activity cannot be carried out. These are expenses that are

indispensable to the project or activity, without which, the same cannot be

carried out.

In the case of HMO plans acquired by REEs for employees directly

involved in the operations of their registered projects or activities and

forming part of their compensation package, the same can be considered

necessary expenses since providing health benefits is not only an

indispensable tool for building a competitive workforce but also ensures

continuous and smooth operation of the registered project or activity by

CD Technologies Asia, Inc. © 2022 cdasiaonline.com

having a healthy workforce. Considering the foregoing, it is our opinion, as

we hereby rule, that HMO related expenses are considered expenses directly

and exclusively used in the registered business or activity of REEs, hence,

subject to zero percent (0%) VAT. It must be emphasized, however, that the

VAT zero-rating shall not extend to HMO plans procured for employees'

dependents, as well as HMO plans for employees NOT directly involved in

the operations of the registered projects or activities of the REEs. For this

purpose, REEs shall be mandated to submit a report as may be prescribed

by the appropriate office of the BIR National Office to ensure that only HMO

expenses for qualified employees are given VAT zero rating.

The 12% VAT is computed

based on gross receipts

excluding those amounts

earmarked for third party

beneficiaries.

Section 108 (A) of the Tax Code provides that twelve percent (12%)

VAT shall be imposed upon the gross receipts derived from the sale of

services and defines "gross receipts" as the total amount of money or its

equivalent actually or constructively received for the services performed or

to be performed for another person, to wit:

"SEC. 108. Value-Added Tax on Sale of Services and Use or Lease of

Properties. —

(A) Rate and Base of Tax. — There shall be levied, assessed and

collected, a value-added tax equivalent to twelve percent (12%) of

gross receipts derived from the sale or exchange of services, including

the use or lease of properties.

xxx xxx xxx

The term 'gross receipts' means the total amount of money or its

equivalent representing the contract price, compensation, service fee,

rental or royalty, including the amount charged for materials supplied

with the services and deposits and advanced payments actually or

constructively received during the taxable quarter for the services

performed or to be performed for another person, excluding value-

added tax." (Underscoring supplied)

In relation thereto, Sections 4.180-3 and 4.180-4 of Revenue

Regulations ("RR") No. 16-2005, 10 as amended by RR No. 4-2007 11 further

explains that the term "gross receipts" excludes those amounts which are

earmarked for payment to unrelated third party, to wit:

"SECTION 4.108-3. Definitions and Specific Rules on Selected Services.

—

xxx xxx xxx

(k) Health Maintenance Organizations (HMOs) are entities,

organized in accordance with the provisions of the Corporation Code of

the Philippines and licensed by the appropriate government agency,

which arranges for coverage or designated managed care services

needed by plan holders/members for fixed prepaid membership fees

and for a specified period of time.

CD Technologies Asia, Inc. © 2022 cdasiaonline.com

HMO's gross receipts shall be the total amount of money or its

equivalent representing the service fee actually or constructively

received during the taxable period for the services performed or to be

performed for another person, excluding the value-added tax. The

compensation for their services representing their service fee, is

presumed to be the total amount received as enrollment fee from their

members plus other charges received.

SEC. 4.108-4. Definition of Gross Receipts. — 'Gross receipts' refers

to the total amount of money or its equivalent representing the

contract price, compensation, service fee, rental or royalty, including

the amount charged for materials supplied with the services and

deposits applied as payments for services rendered and advance

payments actually or constructively received during the taxable period

for the services performed or to be performed for another person,

excluding the VAT, except those amounts earmarked for payment

to unrelated third (3rd) party or received as reimbursement for

advance payment on behalf of another which do not redound

to the benefit of the payor." (Emphasis and underscoring supplied)

Thus, it is clear that those earmarked for payment to unrelated third

party/ies shall be excluded from the "gross receipts." For this purpose, a

payment is a payment to a third party if the same is made to settle an

obligation of another person ( i.e., customer or client, to the said third party,

which obligation is evidenced by the sales invoice/official receipt issued by

said third party to the obligor/debtor such as the customer or client of the

payor of the obligation.

Exemption from VAT of amounts earmarked for third party is not novel

in the Philippines. In RMC No. 39-2007, 12 it was provided that salaries of the

guards received by a security agency from its customers/clients and are

earmarked and segregated for the said guards do not form part of the

security agency's gross income or taxable gross receipts, to wit:

"It is now well settled that only receipts which is subject to a taxpayer's

unfettered command and which he is free to enjoy at his own option is

taxed to him as his income whether he sees fit to enjoy it or not.

(Corliss v. Bowers, 281 U.S. 376). In view of the clear language of the

law and its implementing regulations placing the primary obligation on

the Client to pay the salaries of the security guards coupled with the

requirement that the monies received by the Security Agency

representing salaries shall be earmarked and segregated for the said

guards, the amount paid by the Client representing the salaries of the

security guards will not form part of the Security Agency's gross

income, and neither will it form part of its taxable gross receipts when

actually or constructively received. This peculiarity obviously places the

Security Agency on a tax situation different from other service

providers." (Underscoring supplied)

In the recent case of Medicard Philippines, Inc. v. Commissioner of

Internal Revenue , 13 the Supreme Court ruled that the amounts earmarked

and eventually paid to the medical service providers do not form part of

gross receipts for VAT purposes.

Such being the case, this Office hereby rules that the 12% VAT is

CD Technologies Asia, Inc. © 2022 cdasiaonline.com

computed based on gross receipts excluding those amounts earmarked for

payment to unrelated third party in accordance with RR No. 16-2005, as

amended.

This ruling is issued on the basis of the foregoing facts as represented.

However, if upon investigation it shall be disclosed that the facts are

different, then this ruling shall be considered null and void.

Very truly yours,

(SGD.) LILIA CATRIS GUILLERMO

Commissioner of Internal Revenue

Footnotes

1. Republic Act No. 11534, An Act Reforming the Corporate Income Tax and

Incentives System, Amending for the Purpose Sections 20, 22, 25, 27, 28,

29, 34, 40, 57, 109, 116, 204 and 290 of the National Internal Revenue Code

of 1997, as Amended, and Creating Therein New Title XIII, and for Other

Purposes, March 26, 2021.

2. December 3, 2021.

3. G.R. No. 222743, April 5, 2017.

4. As amended by Section 16 of CREATE Law.

5. The term "Act" refers to the CREATE Law.

6. Circularizing Amendments to the IRR of Title XIII of R.A. No. 8424 (NIRC of 1997),

as Amended by R.A. No. 11543 (CREATE Act), Revenue Memorandum

Circular No. 120-2021, December 13, 2021.

7. The CREATE was signed into law on March 26, 2021. It was published on March

27, 2021 and took effect on April 11, 2021; Revenue Memorandum Circular

No. 38-2022, April 6, 2022.

8. Section 5, Rule 18 of the amended CREATE IRR.

9. Clarifying Issues Relative to Revenue Regulations (RR) No. 21-2021

Implementing the Amendments to the Value-Added Tax (VAT) Zero Rating

Provisions under Sections 106 and 108 of the National Internal Revenue Code

of 1997 (Tax Code), in Relation to Sections 294 (e) and 295 (D), Title XIII of

the Tax Code, Introduced by Republic Act (R.A.) No. 11534 (CREATE Act), and

Section 5, Rule 2 and Section 5, Rule 18 of the CREATE Act Implementing

Rules and Regulations (CREATE IRR), February 23, 2022.

10. Consolidated Value-Added Tax Regulations of 2005, September 1, 2005.

11. Amending Certain Provisions of Revenue Regulations No. 16-2005, as

Amended, Otherwise Known as the Consolidated Value-Added Tax

Regulations of 2005, February 7, 2007.

12. Clarifying the Income Tax and VAT Treatment of Agency Fees/Gross Receipts of

Security Agencies Including the Withholding of Taxes Due thereon

(addressed to all Security Agencies, their Clients, Internal Revenue Officers

and Others Concerned), January 22, 2007.

CD Technologies Asia, Inc. © 2022 cdasiaonline.com

13. Medicard Philippines, Inc. v. Commissioner of Internal Revenue, G.R. No.

222743, April 5, 2017; C.T.A. Case No. 9175, October 28, 2021.

CD Technologies Asia, Inc. © 2022 cdasiaonline.com

You might also like

- Tax Provisions for FTZ, Infrastructure & Backward AreasDocument22 pagesTax Provisions for FTZ, Infrastructure & Backward Areaspadum chetry86% (7)

- CREATE-IRR 5nov DTIDOFPOGO-transitoryDocument3 pagesCREATE-IRR 5nov DTIDOFPOGO-transitorygraceNo ratings yet

- Preferential Taxation - Magumpara, AliahDocument8 pagesPreferential Taxation - Magumpara, AliahAliah MagumparaNo ratings yet

- Preferential Tax Incentives for Registered EnterprisesDocument8 pagesPreferential Tax Incentives for Registered EnterprisesAliah MagumparaNo ratings yet

- RR 3-2023 Digest FINALDocument4 pagesRR 3-2023 Digest FINALAkld D LerioNo ratings yet

- Prepared By: Leyla B. Malijan J19-65663Document31 pagesPrepared By: Leyla B. Malijan J19-65663leyla malijanNo ratings yet

- Project PlanningDocument6 pagesProject PlanningIPS & Co.No ratings yet

- 01 Law1993Document17 pages01 Law1993GgoudNo ratings yet

- Assignment On: SECTION 80 IA Subject: Project Management Professor: Marathe Sir Submitted By: GROUP 5Document9 pagesAssignment On: SECTION 80 IA Subject: Project Management Professor: Marathe Sir Submitted By: GROUP 5sourbh_brahmaNo ratings yet

- Regional Operating Headquarters TaxDocument3 pagesRegional Operating Headquarters TaxutaknghenyoNo ratings yet

- Code of Fiscal BenefitsDocument19 pagesCode of Fiscal Benefitsantonior70No ratings yet

- Misc Sections For Exams March 2022Document11 pagesMisc Sections For Exams March 2022Daniyal AhmedNo ratings yet

- In Brief: Recent DevelopmentsDocument7 pagesIn Brief: Recent DevelopmentsScar IceNo ratings yet

- Presentation Taxation LawsDocument8 pagesPresentation Taxation LawsVineet GuptaNo ratings yet

- ITC FundamentalsDocument114 pagesITC FundamentalsRAUNAQ SHARMANo ratings yet

- S - Viii: Bba - LL.B (Hons) Corporate LawsDocument20 pagesS - Viii: Bba - LL.B (Hons) Corporate LawsSalonee NayakNo ratings yet

- Input Tax Credit-Cp8Document118 pagesInput Tax Credit-Cp8Shipra SonaliNo ratings yet

- ES Ita Rules v2Document50 pagesES Ita Rules v2bacha436No ratings yet

- 76220bos61590 cp7Document208 pages76220bos61590 cp7Sunil KumarNo ratings yet

- 62329bos50452 cp8Document186 pages62329bos50452 cp8Pabitra Kumar PrustyNo ratings yet

- 67767bos54359 cp8 PDFDocument193 pages67767bos54359 cp8 PDFvenuNo ratings yet

- 63974RR 10-2012Document2 pages63974RR 10-2012Anne Margaret Espiritu MomonganNo ratings yet

- Input TAX Credit: Learning OutcomesDocument73 pagesInput TAX Credit: Learning OutcomesRavi kanthNo ratings yet

- As of May 11 - Draft CREATE IRR For DOF WebsiteDocument40 pagesAs of May 11 - Draft CREATE IRR For DOF WebsiteMonica TuttiNo ratings yet

- Departmental Interpretation and Practice Notes No. 7 (Revised)Document33 pagesDepartmental Interpretation and Practice Notes No. 7 (Revised)Difanny KooNo ratings yet

- Highlights On Industrial Enterprise Rules 2078 - 20220509065733Document12 pagesHighlights On Industrial Enterprise Rules 2078 - 20220509065733ca_riturajshahNo ratings yet

- CIR v. Telefunken DigestDocument2 pagesCIR v. Telefunken DigestMariano RentomesNo ratings yet

- 56212rtpfinaloldnov19 p7Document52 pages56212rtpfinaloldnov19 p7naveen kumarNo ratings yet

- Union Budget 2013-14 - Highlights of Direct Tax ProposalsDocument5 pagesUnion Budget 2013-14 - Highlights of Direct Tax Proposalsankit403No ratings yet

- Blocked Credits Under GST Section 17 (5) of CGST ACT, 2017Document8 pagesBlocked Credits Under GST Section 17 (5) of CGST ACT, 2017ajayNo ratings yet

- Tax Holiday in BangladeshDocument7 pagesTax Holiday in BangladeshAulad Hossain100% (2)

- Everything You Need To Know About CREATE Act in The PhilippinesDocument4 pagesEverything You Need To Know About CREATE Act in The PhilippinesMaricrisNo ratings yet

- "Chapter VI Transitory and Miscellaneous ProvisionsDocument2 pages"Chapter VI Transitory and Miscellaneous Provisions0506sheltonNo ratings yet

- Chapter 3-GSTDocument14 pagesChapter 3-GSTPooja D AcharyaNo ratings yet

- Income From Business TaxationDocument19 pagesIncome From Business TaxationArham SheikhNo ratings yet

- Briefing On The Corporate Recovery and Tax Incentives For Enterprise (CREATE) ActDocument56 pagesBriefing On The Corporate Recovery and Tax Incentives For Enterprise (CREATE) ActEdward GanNo ratings yet

- Bir Ruling No. Vat-424-2022 - Philippine Vending To Peza Subject To VatDocument5 pagesBir Ruling No. Vat-424-2022 - Philippine Vending To Peza Subject To VatJohnallen MarillaNo ratings yet

- RMC No. 18-2023v2Document7 pagesRMC No. 18-2023v2Sean AndersonNo ratings yet

- GST Chapter on Input Tax CreditDocument100 pagesGST Chapter on Input Tax CreditAditya ThesiaNo ratings yet

- Input Tax Credit RulesDocument23 pagesInput Tax Credit RulesRAJBIR SINGH TADANo ratings yet

- CIR v. TelefunkenDocument3 pagesCIR v. TelefunkenSophiaFrancescaEspinosaNo ratings yet

- Amendment 2080-2081Document13 pagesAmendment 2080-2081Neeraj GuptaNo ratings yet

- Bos 45290Document23 pagesBos 45290CA Kashish MittalNo ratings yet

- Excise Law PDFDocument54 pagesExcise Law PDFJay BudhdhabhattiNo ratings yet

- Value Added Tax Act AmendmentsDocument42 pagesValue Added Tax Act AmendmentsJamie ReyesNo ratings yet

- Input Tax Credit-1Document74 pagesInput Tax Credit-1Shaikh HumeraNo ratings yet

- Mat and Amt: Objective of Levying MATDocument17 pagesMat and Amt: Objective of Levying MATSamuel AnthrayoseNo ratings yet

- RBI Notice - CAIIB - ABMDocument13 pagesRBI Notice - CAIIB - ABMSATISHNo ratings yet

- Union Budget 2018-19 proposes key amendments to international tax provisionsDocument4 pagesUnion Budget 2018-19 proposes key amendments to international tax provisionsManoj GuptaNo ratings yet

- 10.mat and AmtDocument17 pages10.mat and AmtShailendra SainwalNo ratings yet

- Input Tax Credit System (Chapter-V) (Sections: 16, 17, 18, 19, 20, 21. (Other Related Sections Linked 39, 41, and 49)Document3 pagesInput Tax Credit System (Chapter-V) (Sections: 16, 17, 18, 19, 20, 21. (Other Related Sections Linked 39, 41, and 49)dinesh kasnNo ratings yet

- Train Law Section 32. Section 107 of The NIRC, As Amended, Is Hereby Further Amended To Read As FollowsDocument2 pagesTrain Law Section 32. Section 107 of The NIRC, As Amended, Is Hereby Further Amended To Read As FollowsReynaldo YuNo ratings yet

- Pay Bonus ActDocument30 pagesPay Bonus ActAaju KausikNo ratings yet

- Unit 3 - ITC-1Document9 pagesUnit 3 - ITC-1Shivani YadavNo ratings yet

- Income Tax Act, 1961 (ITA)Document3 pagesIncome Tax Act, 1961 (ITA)June HaydenNo ratings yet

- General Provisions Scope and Definition of Terms Title: Rule 1Document48 pagesGeneral Provisions Scope and Definition of Terms Title: Rule 1chan.aNo ratings yet

- Mat and Amt: Objective of Levying MATDocument16 pagesMat and Amt: Objective of Levying MATaNo ratings yet

- MAT and AMT ExplainedDocument17 pagesMAT and AMT ExplainedNitin ChoudharyNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Withholding Tax on Wages GuideDocument183 pagesWithholding Tax on Wages GuideJohnallen MarillaNo ratings yet

- BIR RULING NO. 585-19: Hon. Josue S. Gaverza, JRDocument3 pagesBIR RULING NO. 585-19: Hon. Josue S. Gaverza, JRJohnallen MarillaNo ratings yet

- ! - 0815 - C.T.A. Case No. 9058 - Philippine Securities Settlement Corp. v. Commissioner of Internal RevenueDocument67 pages! - 0815 - C.T.A. Case No. 9058 - Philippine Securities Settlement Corp. v. Commissioner of Internal RevenueJohnallen MarillaNo ratings yet

- G.R. No. 225266 - Commissioner of Internal Revenue v. East Asia Utilities CorpDocument16 pagesG.R. No. 225266 - Commissioner of Internal Revenue v. East Asia Utilities CorpJohnallen MarillaNo ratings yet

- The Regalia Group Corporation: BIR RULING (DA-295-08)Document4 pagesThe Regalia Group Corporation: BIR RULING (DA-295-08)Johnallen MarillaNo ratings yet

- Approval of Permit To Use Loose-Leaf BooksDocument3 pagesApproval of Permit To Use Loose-Leaf BooksJohnallen MarillaNo ratings yet

- Bir Ruling No. 071-96 - Conflicting LawsDocument2 pagesBir Ruling No. 071-96 - Conflicting LawsJohnallen MarillaNo ratings yet

- Managing IT Integration Risk in AcquisitionsDocument20 pagesManaging IT Integration Risk in AcquisitionsYurnida PangestutiNo ratings yet

- 1.3 CET 402 Quantity Surveying and ValuationDocument12 pages1.3 CET 402 Quantity Surveying and ValuationOwsu KurianNo ratings yet

- National Income and Price DeterminationDocument3 pagesNational Income and Price Determinationbustiman20No ratings yet

- Pindi Yulinar Rosita - 008201905023 - Assignment 3Document3 pagesPindi Yulinar Rosita - 008201905023 - Assignment 3Pindi YulinarNo ratings yet

- Financial Analysis of PPLDocument12 pagesFinancial Analysis of PPLAamer MansoorNo ratings yet

- TOApr May 23Document24 pagesTOApr May 23buzbonNo ratings yet

- ACC0 20053 - Intermediate Accounting 1 - 2022 Final Departmental ExamDocument41 pagesACC0 20053 - Intermediate Accounting 1 - 2022 Final Departmental ExamNathalie Faye TajaNo ratings yet

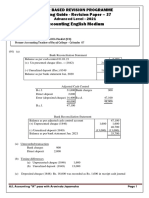

- Accounting English Medium: Paper Based Revision Programme Marking Guide - Revision Paper - 37Document6 pagesAccounting English Medium: Paper Based Revision Programme Marking Guide - Revision Paper - 37Malar SrirengarajahNo ratings yet

- Stanadyne Packaging and Shipping GuidelinesDocument39 pagesStanadyne Packaging and Shipping GuidelinesABDELOUAHEB HAMIDINo ratings yet

- A Project Report ON Production Process AT Katraj Dairy IndustryDocument43 pagesA Project Report ON Production Process AT Katraj Dairy IndustryHařsh Thakkar HťNo ratings yet

- LH 2017 990Document44 pagesLH 2017 990Lazarus_HouseNo ratings yet

- Bahasa Inggris AgendaDocument2 pagesBahasa Inggris AgendaArdian Syahputra ShowNo ratings yet

- How To Get Powerful Testimonials That SellDocument10 pagesHow To Get Powerful Testimonials That SellMobile MentorNo ratings yet

- BHP Group PLCDocument20 pagesBHP Group PLCKishor JhaNo ratings yet

- RCSA Risk Control Self Assessment GuideDocument9 pagesRCSA Risk Control Self Assessment GuideTejendrasinh GohilNo ratings yet

- Set up car showroom business planDocument14 pagesSet up car showroom business planshrish guptaNo ratings yet

- Essentials of Entrepreneurship and Small Business Management 9th Edition Scarborough Test BankDocument20 pagesEssentials of Entrepreneurship and Small Business Management 9th Edition Scarborough Test Banksarahhant7t86100% (23)

- Corporation Code Part 4 - Title IV Powers of A CorporationDocument11 pagesCorporation Code Part 4 - Title IV Powers of A CorporationJynxNo ratings yet

- Loadmasters Customs Services, Inc. v. Glodel Brokerage Corporation, G.R. No. 179446, 10 January 2011, (639 SCRA 69)Document3 pagesLoadmasters Customs Services, Inc. v. Glodel Brokerage Corporation, G.R. No. 179446, 10 January 2011, (639 SCRA 69)Christian Talisay100% (1)

- Literature ReviewDocument2 pagesLiterature ReviewLokesh SharmaNo ratings yet

- Multiple Choice QuestionsDocument9 pagesMultiple Choice Questionskhankhan1No ratings yet

- Legal Form and Ownership SurveyDocument60 pagesLegal Form and Ownership Surveypooja kumariNo ratings yet

- MEDX 58 Total Productive MaintenanceDocument3 pagesMEDX 58 Total Productive Maintenancerajee101No ratings yet

- T1-Phe2035 - Acc1005 Foundations of Finance-Tutorial 7Document11 pagesT1-Phe2035 - Acc1005 Foundations of Finance-Tutorial 7mavisNo ratings yet

- 081 000 Falk Wrapflex Elastomeric Couplings Part Number Guide BrochureDocument4 pages081 000 Falk Wrapflex Elastomeric Couplings Part Number Guide BrochureSmith Jonhatan Moya CarbajalNo ratings yet

- Hi! I'am Paddma Sambhav: Graphic Design Intern - Jan-Mar 2022 2019-2023Document1 pageHi! I'am Paddma Sambhav: Graphic Design Intern - Jan-Mar 2022 2019-2023Tanya rajNo ratings yet

- CostingDocument56 pagesCostingaiko0% (2)

- Literature Review of Marketing StrategyDocument6 pagesLiterature Review of Marketing Strategyea68afje100% (1)

- Field inspection plan for structural steel erectionDocument1 pageField inspection plan for structural steel erectionDelta akathehusky100% (1)

- SAP T-Code FormDocument1 pageSAP T-Code FormSudarshan DawNo ratings yet